Abstract

Stable economic development is an urgent problem for all the Russian regions, including Irkutsk oblast. The key indicator evaluating regional economic development is the gross regional product whose factor is the share of food exports. The President set the task to increase the volume of exports of non-commodity goods with high added value, which requires an analysis of new mechanisms for its implementation. Under the sanctions, agricultural producers can increase the volume of produced and processed agricultural products with high added value and organic products, create infrastructure, increase profitability, and help enter new foreign markets. Therefore, public support for export-oriented projects through concessional lending and improving the regulatory framework is required. In order to remove administrative barriers, the availability of public measures and support for exporters and increase the number of exporters and export volumes, a public institute has been created. It allows the interaction with exporters in the field of financial and non-financial support and ministries and departments that deal with the development of foreign economic activities.

Keywords: Agriculturefood exports

Introduction

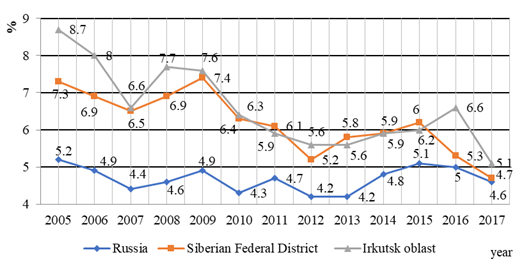

The agricultural sector of Irkutsk oblast makes a significant contribution to the gross regional product, strengthening the regional economy and ensuring the food independence. The agricultural sector produces 5.1 % of the gross regional product, against 4.7 % in the Siberian Federal District and 4.6 % in the Russian Federation. Agriculture interacts with more than 60 sectors and sub-sectors of national economy, purchasing their products or supplying them with its own products, and the agricultural sector is strengthening its position in the foreign market.

Problem Statement

On the one hand, the adequacy and usefulness of food is a measure of the well-being of the nation. On the other hand, food is being used in the political confrontation between systems and states, as evidenced by the sanctions and anti-sanctions on food products. In response to the Western sanctions, Russia imposed a ban on food imports from the US, EU, Norway and other countries (Person Agency). It should be noted that the sanctions have a positive impact on cooperation with other countries, taking them to a new level of development (Nechaev, Zakharov, & Troshina, 2017, p. 550). Agri-food markets have adapted in various ways:

- the meat market – due to the growth of domestic industrial commodity production; the fish market – due to the redistribution in favor of other exporting countries, the increasing domestic production and cheaper meat;

- the market of milk and dairy products – due to the increasing domestic production and strengthening positions of Belarusian producers in the Russian market, where there are risks of further deterioration of the situation for producers;

- the market of fruit and vegetables – due to the increasing household (natural, non-commercial) production and partial switching to other foreign suppliers (Ushachev et al, 2017).

It should be noted that some foreign brands, as well as some Russian companies that imported products to the Russian markets, either left or reduced their share, but there are new domestic producers (the cheese market), and the share of domestic trademark brands in retail chains has increased.

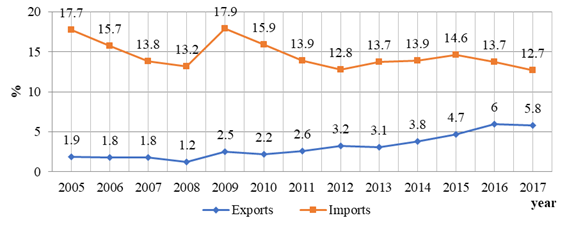

For national agricultural producers, the sanctions contributed to the development of competition and improved quality of products (Kobtseva et al., 2017), which increased the volume of own production for import substitution (Kosinsky, Bondarev, & Bondareva, 2015; Pershukevich, Gritsenko, & Chu, 2016). On the contrary, exports of food products and agricultural raw materials increased from 1.9 % in 2005 to 5.8 % in 2017, which is a positive development trend.

In order to increase the profitability of national agricultural producers (Kundius et al., 2016; Sidorchukova & Ilyashevich, 2008) and the foreign trade turnover, it is necessary to increase the production volume and enter new foreign markets. For this purpose, JSC “Russian Export Center” was created. It aims to interact with exporters in the field of financial and non-financial support.

JSC “REC” created a consulting center developing food export competencies. The center for food export analysis was created under the Ministry of Agriculture of the Russian Federation, and measures aimed to increase the number of foreign markets were implemented. Employees of the Russian agricultural supervision department were trained and new equipment was purchased to ensure compliance with safety requirements of countries importing Russian cereals; diagnostic tests were carried out to obtain the status of the international epizootic Bureau for Infectious Animal Diseases. Systems ensuring safety of agricultural products and food, supervising animal and plant health, and controlling product origin were modernized. Regional sub-brands of agricultural export products were developed.

Research Questions

The decree “On National Goals and Strategic Tasks of Development of the Russian Federation for the period until 2024” aims to achieve target indicators for food exports – 45 billion US dollars by 2024. The agricultural policy, including public support mechanisms are aimed at improving international competitiveness of Russian products in order to ensure their presence in foreign markets (Тyapkina, Mongush, & Ilina, 2019, p. 2).

It is necessary to increase the volume of production and processing of agricultural products with high added value (Pershukevich & Chu, 2015), support export-oriented projects (soft loans, improving the regulatory framework), as well as produce organic products (Petukhova & Shelkovnikov, 2013), which are in increasing demand in foreign markets. It is also necessary to develop an infrastructure.

Purpose of the Study

Along with an analysis of the dynamics of indicators of food exports and imports, the article studies promising external agri-food markets in order to increase the income of agricultural producers.

Research Methods

During the analysis of the development of agricultural exports, the main focus is on the comparison of exported food products of Irkutsk region, the Siberian Federal District and Russia as a whole. Data from the Federal State Statistics Service of the Russian Federation and the Siberian Customs Administration were used.

Findings

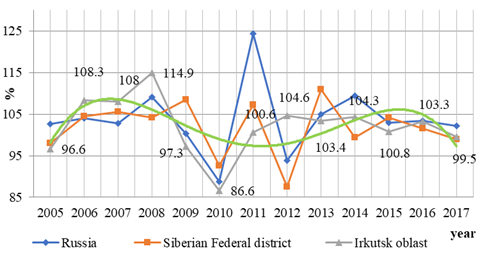

The dynamics of the GDP growth rate in Irkutsk region for 2005–2017 is presented in Figure

Both in the Siberian Federal District and the Russian Federation, the most significant GDP decline in agriculture, hunting and forestry falls on 2010 and 2012, which indicates the impact of the global financial crisis on national and regional economies. In Irkutsk region, a significant decrease was observed in 2010 and 2012 (Figure

In 2017, in the structure of GDP, the share of agriculture, hunting and forestry was 4.6 % (Figure

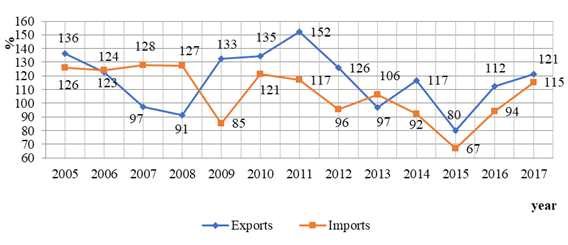

In 2017, the volume of imports of food products and agricultural raw materials decreased by 29.1 % compared to 2012, by 33 % compared to 2013 (Figure

The exports volume increased 4.6 times in 2017 compared to 2005. Since 2016, it increased by 21 % and amounted to 20.7 billion US dollars. The exports of cereals increased by 27.6 % (in 2017, the export price of wheat was $ 191.8 per ton), the share of exports of sunflower, safflower or cottonseed oil and their fractions increased by 29.9 %, white sugar – by 5.4 times, pork – by 1.5 times, poultry – by 42.1 % (Figure

The share of food products and agricultural raw materials in the structure of imports decreased from 17.7 % in 2005 to 12.7 % in 2017 (Figure

Agricultural production is of regional nature, although there is an access to the foreign market (Khokhlova, Kretova, & Burov, 2019, p. 2).

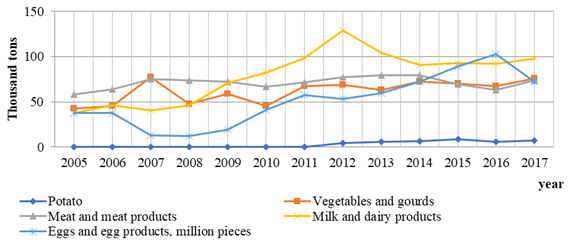

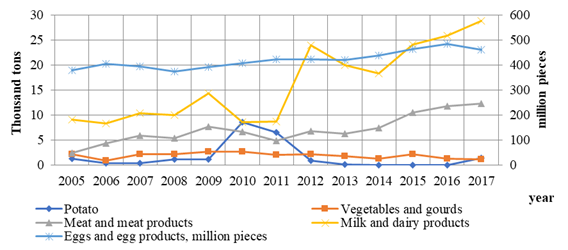

In 2017, 73.6 thousand tons of meat and meat products, 97.5 thousand tons of milk and milk products, and 72.1 million eggs, 7.1 thousand tons of potatoes and 75.9 thousand tons of vegetables were imported to Irkutsk region.

The volume of potato exports decreased up to 1.4 thousand tons (Figure

In 2018, agricultural exports from Irkutsk region increased by 8.8 % compared to 2017 and amounted to 33.8 million US dollars (Table

In 2017, in Russia, the total foreign trade turnover for food products amounted to 49.6 billion dollars, of which Exports took 20.7 billion dollars. The share of mineral products accounted for 60.4 % (an increase by 28 %), the share of machines, equipment, and vehicles was 7.9 % (+ 15 %), food – 5.8 % (+ 21 %) (see table. 01above), wood – 3.3 % (+ 20 %). The share of imported products was 28.9 billion rubles, including 48.6 % of machinery, equipment and vehicles (an increase by 28 %), 17.7 % of chemical products (+ 19 %), 12.7 % of food products (+ 15 %). If the share of exported products is lower than the share of imported products, the ratio is 0.72 and the export growth rate is significantly higher than the import one (compared to 2011, the share of exported products increased by 55 %, and the share of imported products increased by 32 %).

In the Siberian Federal District, the volume of exports is almost equal to the volume of imports. The volume of exports increased 2.4 times compared to 2011, the volume of imports increased by 8 %. In Irkutsk region, exports prevailed over imports until 2017. The ratio ranged from 1.37 to 1.97. In 2017, imports prevailed and annual growth rates were higher (a 2-fold increase compared to 2011). In 2017, the share of exported wood was 42.7 % of the total export volume (Nechaev, Ognev, & Antipina, 2017, p. 554), metals – 28.6 %, fuel and energy products – 26.6 %, of which oil – 25.1 % and coal – 1.5 %. It indicates the focus of Irkutsk region on raw materials. The share of imported chemical products was 56.2 %, the share of imported machinery, equipment, vehicles – 26.5 %, metals – 6.1 %, fuel and energy products – 5.2 %, and food products and agricultural raw materials – 2.9 % (Khokhlova, Kretova, Kuznetsova, & Tsaregorodtseva, 2017, p. 3).

Russian agricultural producers export cattle of dairy and meat breeds, pigs, sheep, goats, horses, poultry to Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Mongolia, Tajikistan, and Uzbekistan. Grains were mainly exported to Azerbaijan, Kazakhstan, Egypt, Turkey, Bangladesh, Nigeria, Saudi Arabia, Sudan, and other countries of Asia and Africa.

Since 2017, the Ministry of Agriculture of the Russian Federation has been providing state support by covering transportation costs as part of the priority project “Exports of agricultural products”.

An increase in the volume of food exports to the level of 45 billion US dollars per year can be ensured by products of the oil and fat industry (+5.4 billion US dollars by 2024); products of the food and processing industry (+5.2 billion US dollars by 2024); fish and seafood (+4.1 billion US dollars by 2024); cereals (+3.9 billion US dollars by 2024); meat and dairy products (+ $ 2.2 billion by 2024); other agricultural products (+2.7 billion US dollars by 2024).

Conclusion

Thus, in order to increase the gross domestic product and profitability of agricultural companies, it is necessary to increase the volume of exports of agricultural products, which will require modern logistics structures aimed at stimulating trading activities, increasing sales of national producers and improving their competitiveness.

References

- Khokhlova, G., Kretova, N., & Burov, V. (2019). The problems of investment activity of entrepreneurship and methodological aspects of credit risks assessment. ICRE 2019 IOP Conference series: materials science and engineering, 667.

- Khokhlova, G., Kretova, N., Kuznetsova, I., & Tsaregorodtseva, E. (2017). Improvement of financial instruments of innovative activities stimulation. Advance in Economy, Business and Management Research, Atlantis press, 38.

- Kobtseva, O. N., Shichiyakh, R. A., Sidorchukova, E. V., Novoselova, N. N., Novoselov, S. N., & Morkovkin, D. E. (2017). Organizational and economic features of import substitution formation and realization in the conditions of spatial restrictions. International Journal of Applied Business and Economical Research, 15(23), 25–35.

- Kosinsky, P. D., Bondarev, N. S., & Bondareva, G. S. (2015). Food provision in the region: theory and practice. Novosibirsk.

- Kundius, V. A., Voronkova, O. Yu., Ivanov, A. V., Glotko, A. V., Galkin, D. G., Svistula, I. A., …, & Norolhozhav, J. (2016). Prospects for the production of environmentally friendly products in the transboundary territories of the Great Altai. Barnaul.

- Nechaev, A. S., Ognev, D. V., & Antipina, O. V. (2017). Analysis of Risk Management in Innovation Activity Process. International Conference on Quality Management, Transp. and Inform. Security, Inform. Technol. (IT and QM and IS) (pp 548-551). (St. Petersburg, Russia, 23–30 Sep).

- Nechaev, A. S., Zakharov, S. V., & Troshina, A. O. (2017). Innovation Risk Minimization and Neutralization Methods. Int. Confe. on Quality Manag., Transp. and Inform. Security, Inform. Technol. (IT and QM and IS) (pp. 552–555). (St. Petersburg, Russia, 23–30 Sep).

- Pershukevich, P. M., & Chu, L. V. (2015). Ensuring food security of the Siberian Federal District. Siberian. Bulletin of Agricultural Science, 5(246), 101–110.

- Pershukevich, P. M., Gritsenko, G. M., & Chu, L. V. (2016). Imports substitution in the cattle meat market of the Siberian Federal District and factors providing it. Achievements of sci. and technol. of the agro-industr. complex, 30(4), 18–22.

- Petukhova, M. S., & Shelkovnikov, S. A. (2013). Evaluation of the food market in Russia. Current issues of socio-econ. development, 5–9.

- Sidorchukova, E. V., & Ilyashevich, N. P. (2008). Ways to increase profitability of milk production in agricultural enterprises of Irkutsk region. Bulletion of Irkutsk State Technical University, 2(34), 74–75.

- Tyapkina, M. F., Vrublevskaya, V. V., & Samarukha, V. I. (2019). Assessment of reproduction of agricultural products. Retrieved from: https://iopscience.iop.org/article/

- Тyapkina, М., Mongush, Y., & Ilina, E. (2019). Cyclical fluctuations of the Russian economy. Retrieved from: https://iopscience.iop.org/article/

- Ushachev, I. G., Paptsov, A. G., Dolgushkin, N. K., Serkov, A. F., Maslova, V. V., & Chekalin, V. S. (2017). Strategic directions for the development of agriculture in Russia in the context of deepening integration in the EAEU. Moscow: RAS.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Tyapkina, M. F., Samarukha, V. I., Vinokurov, G. M., Mongush, J. D., & Vrublevskaya, V. V. (2020). Food Exports: Regional Aspect. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 659-667). European Publisher. https://doi.org/10.15405/epsbs.2020.12.86