Abstract

In developed countries, the degree of socio-economic offers provided to the public is a certain number of times higher than the degree that takes place in the Russian Federation. The degree of innovative energy is even higher, and personal business is more stable. The article discusses the role of public-private partnership as a tool for stimulating innovative and investment work of the state. The subject of the research is a public and private partnership that improves the economic efficiency of investors, enterprises and the government. Special attention is paid to the factors affecting development of the investment system of innovation. The author also presented promising forms of a public and private partnership for infrastructure projects that contribute to cash flows into innovative projects. Based on the study, the author proposed an algorithm for evaluating the effectiveness of the project on the basis of public and private partnerships as tools for stimulating the innovative component of the country. The stages of making a decision on implementation of infrastructure projects through public and private partnerships were described. It allows for a more detailed study of the investment process as well as for identification of the level and possibility of financial risk minimization at each planning stage. The tools reflect the sequence of relations between the government and businesses aimed at developing the innovative economy. The main conclusions on the efficiency of public and private partnership mechanisms were drawn.

Keywords: Public and private partnershipinvestment activities

Introduction

Currently, one of the key and topical issues in the Russian Federation is mechanisms for developing and reviving the real sector of the economy as a basis for the economic growth.

J. Schumpeter said that innovation and an entrepreneurial resource creating demand for innovation and their excessive supply are the main factors of economic development.

Problem Statement

Innovation technologies are implemented in compliance with the economic laws that are characteristic of the innovation market economy. Implementation of innovations (a set of measures for creation, development and dissemination of maximizes the benefits of fresh products, technologies, raw materials, management methods, etc.) and promotes healthy market competition. This is a significant element of the sustained financial recovery of growth.

Research Questions

The purpose of the article is to justify the efficiency of interaction between public authorities and businesses based on the public and private partnership when implementing projects in various sectors.

Financing methods play a decisive role in innovation activities. The efficient financing system is characterized by a high rate of innovation in various sectors as well as a high level of the innovation potential of public and private actors in the innovation sphere.

Purpose of the Study

Thus, the financing system can solve such important tasks as improvement of the conditions for implementing innovative projects, development of the innovative potential and resource base of innovative projects. These tasks can be implemented if there are favourable external conditions (Busch & Givens, 2013).

The factors influencing the investment system of innovation activities are as follows:

- general factors: the priority of public interests; market orientation; continuity of service provision; competition; equality; interdisciplinary communication; international cooperation; science; consistency; focus; continuity of development; unity of educational, scientific and production processes; transparency of operations; involvement of the government in economic activities, etc.;

- organizational factors: informational cooperation; division of responsibilities between structural units; cooperation and division of responsibilities of civil servants and private sector workers; use of scientific methods; structural integrity; dynamic management structure, etc.

The active use of public and private partnership mechanisms can be observed in almost all sectors of the national economy (Kovaleva & Chernov, 2017). Partnership mechanisms are one of the most promising forms of involvement of businesses in national and regional programs (Gorbachevskaya, Nikityuk, & Timchuk, 2018). Public and private partnerships will increase the potential amount of resources required for implementation of the project (Department of Finance and Personnel for Northern Ireland …, 2002), diversify project risks, increase the interest of subjects in its implementation and contribute to expected results.

Research Methods

The research methods are as follows: 1) general research methods: analysis, generalization, analogy and abstraction; 2) empirical research methods: observation, description, comparison; 3) theoretical research methods: idealization and formalization, systematization of scientific knowledge - typologization and classification.

Findings

Currently, a public and private partnership is a basis for innovation activities, the most important tool for improving the efficiency of the national innovation system which stimulates investment, optimal use of material, technical, human and financial resources. This partnership is an institutional and organizational alliance between the government and the private investor created for implementation of social projects and programs in a wide range of industries where resources, advantages and capabilities of each project participant complement each other (Gabdullina, 2012). This can be achieved through diversification of risks and distribution of responsibility between them in accordance with the financial support of the innovative project. This tool accelerates each stage of the life cycle of an innovative project and helps implement it in a shorter time.

The scientific literature considers many options for increasing investment activity for the development of innovative activity. The development of the Russian Federation is based on the economy of a high-tech society, and this is directly related to the course for innovation, modernization and industrialization of the country (Yang, Shieh, Huang, & Tung, 2018). In this context, a consistent change of capital, as the main factor in investing, in its various aggregate forms: material, energy, and informational (Anokhov, 2019), is theoretically grounded. The advantages and disadvantages of existing methods for assessing the investment potential of economic entities are identified and ways to improve them (proteins) are suggested. The choice of types of innovations on which Russia needs to focus in modern conditions (Belikov & Novikova, 2016) is justified; various options for innovative partnerships (Paleev, Chernyaev, Grigorieva, & Moseykin, 2018) are offered. Scientific developments of scientists have the right to use either in the formation of the state innovation policy, or in the presence of investment income in a particular area of sectoral or regional development (Balashova & Popova, 2018).

This partnership distributes functions of the project participants in accordance with the main goals: the government solves the tasks of social and economic development, while businesses increase the efficiency of production and economic activities (Department of Finance and Personnel for Northern Ireland …, 2002). Public risks are distributed between private partners and the government, and interaction of local governments with businesses is strengthened, new forms and mechanisms of management occur, private investment in innovative business projects increases.

A partnership of the government and the private sector can be defined as a legal mechanism for coordinating interests and ensuring equality of the government and businesses within economic projects in order to achieve the goals of public administration. The public and private partnership is a mechanism for coordinating the interests of the government and the private sector. Its main goal is creation and development of innovation activities, development of production and business activities of companies, industries or regions. It has a positive influence on the economic development of the country. The objectives of the private sector are measured by classical indicators of investment activities rather than by the amount of one-moment profit (Federal Act…, 2015). The forms of a public and private partnership depend on the government openness to direct investment and desire to transfer assets (land, infrastructure) to investors or national companies.

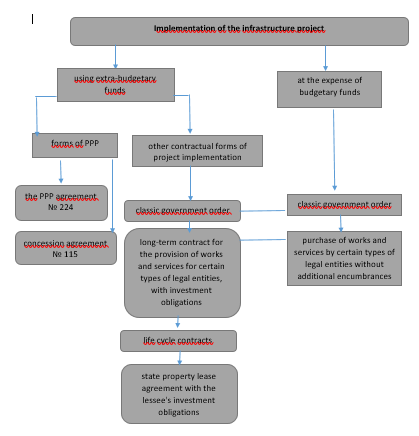

In the Russian Federation, the infrastructure project can be implemented according to the scheme in Figure

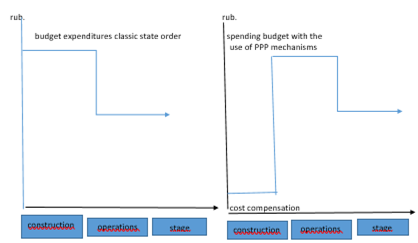

An important advantage of the public and private partnership is participation of private partners at the operation stage, when the return on investment is carried out (Busch & Givens, 2013). The private investor is interested in the quality of the object, its operational characteristics and operating costs. This encourages the investor to use the latest technological achievements to increase the economic efficiency of the project.

Based on the study of practical data, Figure

The infrastructure project can be implemented in two ways:

1. by a public partner (budget financing) – “classical” public order (Essig, Glas, Selviaridis, & Roehrich, 2016).

2. using the mechanisms of a public and private partnership with partial budget reimbursement of costs.

Promising forms of public and private partnerships (life cycle contracts or concession agreements) involve the long-term return on investment which requires the use of modern technologies to improve the economic efficiency. At the planning stage of the infrastructure project, it is necessary to justify the project, predict the return on investment and implement technological achievements.

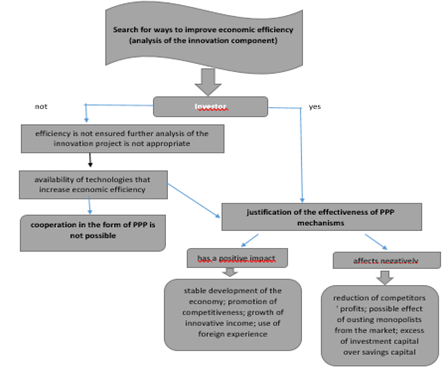

It is advisable to assess the innovative potential of the project in two stages – Figure

The 1st period implies a high-quality evaluation of the public-private partnership plan. At this stage, information about the plan and program for its implementation is intended. Information includes the appropriate main components:

1. Description of the tasks that can be solved by implementing public-private partnership.

2. Information about the partnership object and its leading properties.

3. Goals and results of public-private partnership, ways of their merits.

4. Information about members of the public-private partnership, their leading rights and obligations, and the procedure for interaction.

5. Forms of implementation partnerships.

6. Assessment of preparatory financial performance for the personal section

2 period implies the justification of the innovation plan, which should show that the plan is considered more sympathetic than the classic plans of the municipal section. The following points should be taken into account:

1. certain results that must be achieved during the implementation of the plan. They must be popular and agreed with the parties, and they are also relevant and applicable for measurement and monitoring;

2. technological and other appropriate nuances are fairly measured, meaning that the agreement does not need to be adjusted to meet changing conditions;

3. the personal section contains the best abilities to implement the innovation plan and provide important proposals than the municipal sector;

4. a high degree of competition is assumed when submitting orders for a public-private partnership plan.

Thus, high-quality aspects are considered: personal trader, strategic significance of the plan, flattering public effect, the inability to implement the plan without state assistance, flattering expert decisions.

The novelty of the method of making conclusions is justified by the fact that the Creator systematized flattering and negative aspects that affect the effective formation of public-private partnership in the advanced criteria of the innovative economy.

Conclusion

The development of a rational method for the effective use of public-private partnership devices is considered one of the most important criteria for successful implementation of an innovation plan and the main point that affects the characteristics of its financial, budgetary and financial performance, economic profitability, credit rating of the plan, etc.

Thus, the test of the essence of public-private partnership allows us to draw a conclusion that its leading part is considered to be a contract between the state and the investor. The partnership is crucial for recruiting rivals to the municipal monopoly that provides offers, and for pooling the resources of both partners to satisfy municipal needs. These goals have every chance to be achieved only with a specific level of innovation work. The long-term return on investment in public-private partnerships forces members to plan for the expected benefits and apply modern technologies in the design of the plan.

Acknowledgments

The main condition for the successful formation of an innovative economy is considered to be competitiveness, which can be achieved through the widespread use of the mechanism of public-private partnership. It is considered to be a complex socio-economic phenomenon.

References

- Anokhov, I. V. (2019). Theoretical aspects of investing. The number of individuals involved, the frequency and density of their contacts as a criterion for payback. Historical and Economical Researcch, 20(3), 506–529.

- Balashova, M. A., & Popova, Yu. S. (2018). Innovative development of the Russian economy: an independent path or cooperation. Baikal Research Journal, 9(3).

- Belikov, A. Yu., & Novikova, I. Yu. (2016). Comparative analysis of methods for determining and evaluating the investment potential of an economic entity. Bulletin of the Baikal State University, 26(5), 750–757.

- Busch, N. E., & Givens, A. D. (2013). Achieving resilience in disaster management: The role of public-private partnerships. Journal Strategical Security, 6, 1–19.

- Department of Finance and Personnel for Northern Ireland. (2002). Public Procurement Policy. Belfast, United Kingdom.

- Essig, M., Glas, A.H., Selviaridis, K., & Roehrich, J. K. (2016). Performance-based contracting in business markets. Ind. Marketing Management, 59, 5–11.

- Federal Act of July 01, 2015 No. 224-FZ. (2015). “On the public and private partnership, municipal private partnership in the Russian Federation and amendment of legislative acts of the Russian Federation”. Access from the reference legal system “Consultant”.

- Gabdullina, E. I. (2012). Evaluation of the effectiveness of PPP projects as a mechanism of interaction between government and businesses in the region. Modern problem of science and education, 2.

- Gorbachevskaya, E. Yu., Nikityuk, L. G., & Timchuk, O. G. (2018). The role of e-commerce for the digital economy. Ed. by A.V. Babkin. St. Petersburg (pp. 472–490): Polytech-press.

- Kovaleva, I. V., & Chernov, M. V. (2017). Concept of state regulation of entrepreneurial activity. Bulletin Altai State Agrar. University, 12, 163–167.

- Paleev, D., Chernyaev, M., Grigorieva, E., & Moseykin, Y. (2018). National Peculiarities of Russian Consumers’Perception of Energy-saving Technology. Anais Acad. Bras. Ciênc., 90, 1875–1887.

- Yang, C. -L., Shieh, M. -C., Huang, C. -Y., & Tung, C. -P. (2018). A Derivation of Factors Influencing the Successful Integration of Corporate Volunteers into Public Flood Disaster Inquiry and Notification Systems. Sustainability, 10, 1973.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Timchuk, O. G., & Sokolova, L. G. (2020). Public And Private Partnership As A Tool For Innovation And Investment Stimulation. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 641-647). European Publisher. https://doi.org/10.15405/epsbs.2020.12.83