Abstract

In the conditions of crisis and tough competition, the problems of attracting investments to many regions of the country are quite acute. The leadership of the country and each region pays special attention to the issues of economic growth and investment attractiveness of territories. as a result, many regions are developing successfully by attracting investors, developing priority sectors of the economy, improving the management system, using advanced technologies, etc., however, many regions still have a shortage of financial resources, have a low indicator of investment attractiveness, and cannot achieve the desired economic growth for many objective reasons. There is an urgent need to look for additional ways to attract potential investors (domestic and foreign), to solve issues of increasing the investment attractiveness of each territory, to solve problems of living standards of the population, the development of priority industries, based on the use of domestic and foreign experience. To eliminate negative trends in the development of territories it is necessary, first of all, to identify and assess the negative impact of factors inherent in each region, many factors that reduce the investment attractiveness of regions are quite clear, but there are those that can be determined as a result of analysis and special research methods. The dynamic development of any region today requires the introduction of complex measures, for example, implementation of short-term and long-term development programs, improvement of the territory management mechanism, changes too many bills.

Keywords: Competitioninvestment attractivenessriskseconomic growth

Introduction

In modern conditions, the issues of investment attractiveness in each region of the country are quite acute. Many regions cannot attract investors to implement the planned projects for the development of the territory. One of the problems of dynamic development of many territories is a decrease in investment volumes or their absence. This situation is a consequence of an inefficient system of territory management, as well as the result of the influence of many additional factors. The lack of financial resources, first of all, leads to the failure of many socially significant projects, a decrease in the level of income of the population, as a result, the investment attractiveness of the region and investment activity in general decreases. In order to solve existing problems it is necessary to identify the main reasons for low investment attractiveness of each country to identify priority sectors that can be quickly developed in each region based on the optimal financial investment, to ensure strict control over the use of all the resources invested and control the business projects through the implementation period. One of the problems of development of regions and industries is the lack of effective control. As a result, many business projects and development programs do not give the desired result for dynamic growth in the regions.

Problem Statement

Currently, for the effective development of the country's territories, it is necessary to develop the domestic market, based on the modernization of existing production structures and the production of products that can replace imported goods. This is a fairly complex process, but there is foreign experience, for example, in China, where many existing problems are successfully solved.

According to the authors, an important direction for the development of the domestic market of the country and regions should be:

- real investments in real projects (Bunkovsky, 2002; Loukil, 2016)

- with a specified payback period and the actual volume of products received that can replace imported goods in the maximum volume (without the development of the domestic market, it is impossible to create an investment attractiveness of any region).

Special attention is required in remote regions (Siberia and the far East), where there are significant natural resources, but the low standard of living, undeveloped infrastructure lead to an outflow of population, and therefore an outflow of specialists, which also reduces the investment attractiveness of these regions. The existing problems have a closed circle and are closely interrelated. they can be solved by certain significant development programs at both the federal and regional levels. To create greater attractiveness, a set of measures is necessary, their action must be dynamic and defined by specific deadlines for implementation and determining the magnitude of a specific effect. It is almost impossible to change the process of investment activity in any region of the country if the terms of implementation of the development program are not defined, and there is no strict control over their implementation. We also need a qualitative assessment of the effectiveness of decisions taken and an assessment of possible risks (Bunkovsky, 2012; Kumpilov, 2018; Khokhlova & Okladnikova, 2014).

Research Questions

The main issues for increasing investment activity in any region are: determining priority sectors of the economy for this region, operational implementation of federal and regional development programs based on available financial opportunities, monitoring the use of invested resources, assessing possible risks and determining ways to reduce them. To achieve these goals, it is necessary to use the methods of operational analysis of statistical data, the introduction of effective methods of territory management.

Purpose of the Study

The purpose of the study based on express analysis is to justify measures to encourage regional management and entrepreneurs to actively invest and increase the investment attractiveness of territories.

Research Methods

The methodological basis of this article is a comprehensive approach to the study of organizational and economic phenomena in the field of investment policy and investment activity in the regions.

General scientific methods were used as the main research methods: analysis, synthesis, and comparison.

Findings

Justification for the introduction of additional measures for effective development and investment activity in the regions of the RF

Investment today is an essential tool for the dynamic development, they can be: public, private, industrial, intellectual, foreign (Campbell, 2012; Chepkasov, 2019).

In the RF, 85 regions have been identified and attracting investors to each of them is a significant problem, especially acute problems of investment activity are identified in remote regions. Any region wants to receive foreign investment, but a potential investor first calculates all possible risks and the amount of desired profit, often there is a conflict of interests, which leads to a decrease in the number of investors, the current sanctions also reduce the volume of investment flows, many regions have low investment attractiveness due to their geographical location. According to the Rating Agency (NRA, Rosstat (http://www.ra-national.ru/sites/default/files/analitic_article/IPR-6-06112018.pdf) for 2018, the absolute leaders of the rating are still the two largest megacities - Moscow and St. Petersburg, after them are listed (IC2 group)- Tatarstan, the Moscow region, the Yamalo-Nenets Autonomous district, the Sakhalin region, the Leningrad region, the Belgorod region and the Tyumen region) (Fedorova, 2018).

The group of outsiders in the rating (IC9) – for the last six years includes the republics of the north Caucasus, Tyva and Kalmykia. In 2018 (from 85 regions of Russia):

- 64 regions maintained their positions at the same level,

- 5 regions improved position in the rating,

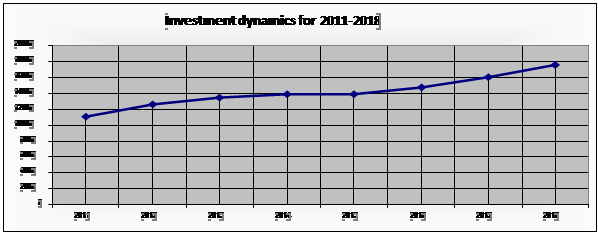

- 16 regions decreased their indicators; however there is a small increase in all regions by 3.2%. Figure

It can be noted that their volumes are growing. However, a noticeable increase occurred only in 2018, also, it is impossible not to point out the fact that the objects of intellectual property receive the smallest amount of investment funds.

In 2018, a significant inflow of investment funds was made:

traditionally, in extraction of minerals,

food industry,

chemical,

agricultural industry.

Unfortunately, there is no inflow to the machine tool industry, textile industry, leather industry, tourism industry, etc., that is, to those industries that are able to develop the domestic market faster and more effectively.

In general, the investment process is progressing at an increasing pace, but this pace should be much higher, given the ongoing sanctions and the low standard of living in many regions. Important factors for a potential investor are:

- development of the legal framework,

- tax system and system of existing benefits,

- human resources potential in the region,

- development of infrastructure facilities,

- availability of natural (raw) resources, etc.

The current crisis trends in the economy negatively affect the number of foreign investors, therefore, it is necessary to attract their own, from neighboring regions of the country, creating the best conditions for them to invest and get the final result.

Many potential investors are put off by the constantly changing system of legislation and the amount of taxes this is an important and negative factor, the value of which should be reduced and create more comfortable conditions for the implementation of many significant investment programs.

Another problem for any investor is the probability of bankruptcy of the company. In this regard it is necessary to develop special force majeure conditions that are convenient for both parties.

In different regions of the country, investment activity has a different level, and the influence of specific factors inherent in each region affects.

For example, a survey conducted in the Chelyabinsk region in 2019 showed:

- investment activities are carried out by 85% of the surveyed enterprises,

- 46% of business leaders noted an increase in investment activity in the region,

- 17% of the surveyed managers indicated its decrease.

In 2020, 37% of managers expect an increase in investment activity,

- 5% predict a decrease in the volume of investments in fixed assets.

In 2019, they assessed their economic situation as:

- “favorable” 17%,

- “satisfactory” 69%.

The improvement of the economic situation in 2019 compared to the previous year was noted by 33% of organizations, 13% of the deterioration.

In 2020, 48% of managers expect an improvement in the economic situation in the organization, 44% do not expect a change in the economic situation in the organization, 6% deterioration, 2% found it difficult to give an answer.

The main source of financing for fixed capital investments in 2019 was the company's own funds (83% indicated this).

For enterprise development

- 20% used loans and borrowings,

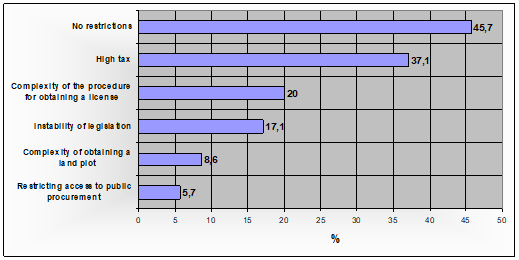

- 8% additional budget funds. The negative factors in business development were identified by business leaders:

- high taxes – 37.1% of respondents, difficulty in obtaining a license- 20%, instability of legislation- 17.1%, difficulty in obtaining a land plot- 8.6%, and 45.7% indicated the absence of any problems (fig.

The conditions for activation of investment activities as a whole, the country is favorable, for example, in the majority of subjects of the RF for investors there are tax benefits on the property and upon the conclusion of the investment agreement with administration of the region (Leningrad, Novgorod, Rostov oblast, etc.). Broad benefits are provided to companies that invest in infrastructure (for example, road construction- Saratov region).

But there are regions where there are no benefits for investment projects (Stavropol territory, the Republic of Bashkortostan, Buryatia, Dagestan, Kalmykia, etc.).

In the Irkutsk region, the main factors that reduce the dynamic development of enterprises, hence their investment activities (according to the statistical survey) are: (Orekhova, 2017)

insufficient demand for manufactured products - indicated 40% of the number of respondents

high taxes - 42%,

the financial deficit,

high interest rates on loans;

lack of qualified personnel.

The rapid analysis shows that many enterprises in priority industries have difficulties:

in search of sales markets,

minimization of costs associated with the purchase of raw materials (or components),

infrastructure and human resource constraints.

It was also found that each region has its own factors that reduce investment attractiveness. One of the reasons that reduce the volume of investment in the real sector of the territory is the lack of an effective mechanism for implementing investment projects. Therefore, it is necessary to change the priorities in choosing investors and to activate private, industrial and intellectual investments throughout the country, especially since private and industrial investments occupy the smallest share of their number. Currently, these investments can activate the development of the domestic market, create additional jobs and reduce the unemployment rate. This reorientation of the investment structure should be the desire and will of the government (Kazarinov, 2012).

It is obvious that with a shortage of foreign investors, today it is necessary to focus on the domestic investor in the face of large companies. Entrepreneurs and individuals, the country's market is also large enough and potential opportunities for investment activity are absent or insignificant only incentive mechanisms for the investor (Rysukhina & Korovin, 2016).

Conclusion

Based on the express analysis, it can be noted, all regions of the country developed differently and have different characteristics of investment activity in the central regions of the figure above, remote regions are developing less rapidly and have rather low indicators of the level of development of industrial production, incomes, security infrastructure, and therefore low investment attractiveness.

To change the prevailing adverse conditions, it is necessary to:

1) Improve legislation on investment issues based on ongoing surveys of business leaders,

2) The main focus should be on the development of the country's domestic market;

3) To implement many investment projects, it is necessary to expand the system of benefits and tax credits.

4) An annual analysis is needed to identify problems in each region, identify the reasons for the decline in investment activity, and promptly develop measures to address them.

5) More actively involve credit organizations to participate in investment projects

6) At the stage of developing business projects, conduct an analysis to identify possible risks and develop measures to reduce them

7) Develop science-intensive high-tech industries more quickly

8) At the heart of development programs, quality control over the use of investment investments is necessary to eliminate situations of inefficient use of invested resources.

To attract foreign investment, create consulting centers and business incubators. The development of advertising is also an integral part of actions aimed at the dynamic development of enterprises and regions of the country (Rysukhina & Korovin, 2016; Tayurskaya, Okladnikova, & Bibarsov, 2019; Tayurskaya, Okladnikova, & Solodova, 2018).

The problem of the domestic economy today is the sluggish pace of development of many industries and the lack of control over the implementation of many tasks, both at the regional and federal levels.

To improve the process of investment activity, it is necessary to cooperate with neighboring regions, develop investment and development programs involving representatives of small and large businesses for the development of the regions where they operate.

The government of the country should also constantly conduct an analysis of the implementation of the adopted development programs. Undoubtedly, it is worth using and promptly implementing successful foreign experience, in particular in China, where special economic zones and quality control over the implementation of any business project have become the basis for effective development, as well as the development of high-tech technologies should become a priority for the development of regions, and actively use all levels of financial investments:

- venture projects,

- reinvestments,

- investments for modernization and diversification of production structures, etc. (Gorbova, 2013; Khohlova, Kuznetsova, Kretova, & Tsaregorodtseva, 2017).

References

- Bunkovsky, V. I. (2002). Economic justification of development of territorial corporate complexes of Siberia. (Doctoral dissertation), Moscow.

- Bunkovsky, V. I. (2012). Creation of a mechanism for attracting direct foreign investment for the development of the mining region of Eastern Siberia Bulletin of the Irkutsk state technical University, 3(62), 150-154.

- Campbell, B. A. (2012). Rethinking sustained competitive advantage from human capital The Academy of Management review: AMR, 37(3), 376-395

- Chepkasov, V. V. (2019). Investments: concept and main types "Scientific and practical electronic journal Alley of Science", 5 (21).

- Fedorova, V. A. (2018). Investment climate of Russia and problems of its improvement "Scientific and practical electronic journal Alley of Science", 9(25), 2.

- Gorbova, I. N. (2013). Regional development problems and ways to solve them in the Russian Federation. Bulletin of state and municipal administration, 1, 107-111.

- Kazarinov, S. Yu. (2012). Possibilities of inflow of foreign investments into the region's economy (on the example of the Irkutsk region) Problems and prospects of economy and management: materials of the international economic forum. science. Conf. (St. Petersburg, April 2012) (pp. 199-201). SPb.: Renome.

- Kumpilov, A. R (2018). Features and factors of development of tourism cluster in the system of investment activity in ragionevolmente research.

- Khokhlova, G. I., & Okladnikova, D. R. (2014). Classification of factors as grounds for analysis of innovative-investment activity of small and medium business Middle. East Journal of Scientific Research 20(8), 900-904.

- Khohlova, G. I, Kuznetsova, I. A., Kretova, N. V., & Tsaregorodtseva E. Y. (2017). Improvement of financial instruments of innovative activities` stimulation. Advances in Economics, Business and Management Research. Proceeding of the International Conference on Trends of Technologies and Innovations in Economic and Social Studies, 38, 304-311.

- Loukil, K. (2016). Foreign direct investment and technological innovation in developing countries. Oradea Journal of Business and Economics, 1(2), 31–40.

- Orekhova, S. V. (2017). Investigation of the modern Russian model of investing in enterprise resources Electronic Scientific and Practical Journal "Synergy", 3(12-2), 266-270

- Rysukhina, D. V., & Korovin, V. E. (2016). Modern issues of improvement of the investment attractiveness of the Russian economy. Young researcher, 8(8), 28-30

- Tayurskaya, O. V., Okladnikova, D. R., & Bibarsov, K. R. (2019). Support for small businesses in the production sector: ways to develop and improve efficiency Economics and entrepreneurship, 5, 710-715.

- Tayurskaya, O. V., Okladnikova, D. R., & Solodova, N. G. (2018). Investment in the regional economy: challenges and prospects. Proceedings of International Conference on Research Paradigms Transformation in Social Sciences. The European Proceedings of Social & Behavioural Sciences EpSBS, 1161-1168.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Tayurskaya, O. V., Okladnikova, D. R., Bibarsov, K. R., & Ogorodnikov, I. A. (2020). Assessment Of Factors Affecting Investment Activity In Regions. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 627-634). European Publisher. https://doi.org/10.15405/epsbs.2020.12.81