Abstract

The situation in the market of venture financing is constantly changing as evidenced by the statistics of the use of the venture investment pool. Experienced investors who are reducing their risks prefer advanced start-ups in the middle and late stages of development as well as start-ups in the field of IT development and high technologies. This fact leads to the problem that at the early and seed stages, the investor does not notice a lot of interesting, bright and promising projects. In this regard, it is important to consider some methods aimed at the evaluation of start-ups at different stages of their development. For example, one of these methods is the use of special Internet sites where there are authors of ideas who need money, investors and experts who bring viable interesting projects to investors. Such crowdfunding resources can receive their commissions, while reducing the risk of investors and helping real-life live projects.

Keywords: Start-upcrowd fundingcrowd landing platform

Introduction

Modern investment projects that have narrow innovative specifics cannot logically follow traditional business models and forms of financing. Innovative companies (start-ups) are forced to look for non-standard solutions that would allow them to enter promising markets or segments. Such solutions enable start-ups to grow and develop by minimizing the time, start-up capital requirements and financial calculations.

Problem Statement

In reality, there are great difficulties in making investment decisions on financing start-ups due to the assessment complexity of the projects financial prospects. When a start-up needs its first financial investments, the initiators have nothing but an idea, and often there is not even a promising model, prototype, or other form that the start-up idea could take. Traditional methods of financing are often not available for start-ups due to strict conditions as a result young companies work with crowdfunding platforms, venture funds and "business angels" (Blank & Bustard, 2017, p. 224).

Research Questions

However, even here there are certain difficulties: even 10–15 years ago, venture investors and funds were ready to finance a start-up at the early and even initial stages of its launch. Now, despite the fact that the first generations of tech investors obtain more "free" money, they are less likely to invest it in young start-ups that require time and resources to grow (Bereza & Volodin, 2016, p. 10).

This approach to investing which is carried out at a later stage of the start-up's lifecycle has created some difficulties for entrepreneurs who are looking for investment for their start-up.

Investing in early-stage start-ups follows a "wait-and-see" strategy, despite a major increase in the venture capital pool, funding for early-stage start-ups has declined from 10 percent of the total funding pool in 2017 to 5 percent in 2019 according to Upfront Ventures. Now venture capital investors prefer to invest large amounts in fewer, more sustainable projects instead of widely funding "seed" start-ups (Review of the private equity and venture capital investment market, 2019).

However, those start-ups for which the money is found are associated with angel investors, accelerators, and incubators.

The Harvard business school reports that three-quarters of venture capital projects fail. This is due to a poor understanding of the following issues:

1. The readiness of the market for the proposed idea.

The main reason why start-ups fail is a misinterpretation of market demand which occurs 42 percent of the time.

Therefore, even for a technological start-up where, apart from the idea, there is no calculated financial base, it is necessary to draw up a business plan. This kind of external perspective is crucial to help to see potential blind spots in the market strategy and business model.

2. The need to seek advice.

Consulting support leads to the fact that "supported" start-ups grow three and a half times faster and collect seven times more money than those that are implemented by the initiators of these projects without assistance. Maintaining this type of relationship is one of the most important things for successful capital raising.

3. Planning a start-up with the possibility of scaling.

Start-ups with two or more co-founders usually receive 30 % more investment and show higher growth rates.

It is recommended to set a schedule of goals after determining the start-up's membership. It is generally assumed that various industry frameworks define the life cycle of about 5 years but in the end the payback of the start-up would depend on the attractiveness of the idea.

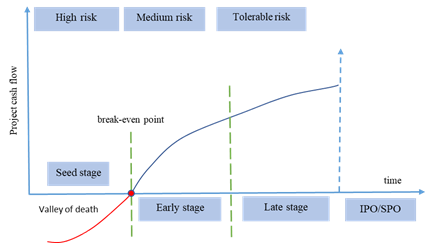

The life cycle of a typical start-up is a "J" curve (Figure

The seed stage lasts until the company reaches the break-even point being in the so-called "valley of death" which is characterized by a high degree of project risk. Reaching the break-even point is typical for the early stage of a start-up with a medium degree of risk while the late stage is characterized by a low degree of risk (Bovkun & Troshina, 2017).

At an early stage, companies form a market for their products and services and begin to make their first profit from their activities.

At a late stage, a start-up is able to meet needs of financing through internal cash flow from operations, bank loans, and private equity funds. At this stage, the company could start preparing for public sales of its shares (Romanova & Korshunov, 2018).

It is considered that achieving the stage of initial public offering (IPO) and a secondary public offering (SPO) to an unlimited number of investors at the auction organized by the owners and founders of the company is not exposed to risks associated with financing start-ups. However, it should be remembered that the external economic environment is quite capable of forcing a sustainable start-up to return to the risk zone (Skvortsova & Kartashova, 2016).

Platform analysts presented a report on the development of the Russian venture market in 2019. Compared to 2018, the venture market growth in the volume of investments was 13% and reached $868.7 million, excluding exits. The average receipt in transactions with mature projects increased 1.6 times to $78.2 million. The most popular by number and second by volume of investments were investments in business software. Almost half of all transactions are non-public because the venture capital market is traditionally undisclosed, many funds do not divulge the size of investments, the authors of the study explain. In general, venture investors prefer to advertise successful exits from assets rather than purchases (Bovkun, Korodyuk, & Arkhipkin, 2018).

The study on the specifics of start-ups financing in Russia determines the following sources of funding that have been formed in the market:

Venture capital funds. Traditionally, preference is given to start-ups in the IT market.

Corporate accelerators, corporations, state-owned companies. For example, the accelerator of Sberbank, MTS, etc.

Business angels. This segment of financing is characterized by lack of publicity (Rodin, 2014 p.104).

Crowd funding which is represented by various crowd-investing or crowd-landing platforms.

The principle of such platforms operation should be viewed in more detail.

The goal of crowd-funding is to raise funds to finance a start-up from voluntary donations of investors. Project initiators, called recipients, present their ideas on special web-based platforms in order to attract investors – from individuals with scanty investments to large corporate investors – everything depends on the type and capabilities of the platform as well as on the goals and scale of a start-up. In turn, donor-investors rely on a certain percentage of the profit or part of their enterprise in proportion to the size of the investment.

The problem with such platforms is that the initiators of a start-up may receive money for obviously unviable projects or do not plan to develop them at all and the owners of the platform simply retain their commissions from the collected money. On the one hand, such actions reduce the attractiveness of crowd-funding in general. On the other hand, they reduce the loyalty of investors to a particular platform.

Purpose of the Study

The purpose of the study is to analyze the financial support for start-ups in Russia.

Research Methods

This study analyzes basic methods that contribute to the development of investments in start-ups.

Findings

The way to increase the effectiveness of such platforms is, first of all, by improving the quality of start-up projects as well as by increasing the number of successful projects. In this regard, in addition to recipients and donor-investors, experts should take part in the activities of the platform. In this case, the efficiency will be increased by selecting and evaluating the best projects.

The process involves the following sequence of actions:

1. The start-up provides information on its activities based on special forms developed in accordance with the methodology of the expert assessment.

2. Experts are real people who have confirmed their qualifications. They assess the analytical part of the project and the possibilities of commercialization of the start-up idea. The owners of the web-based platform along with investors could develop criteria-based requirements to experts in order to receive a confirmation of qualification, resume, portfolio, etc.

3. Based on the conclusion received from the expert community, investors make a decision on investment and determine the amount of the financing share by voting.

In this case, the remuneration of experts should not be forgotten. Platform owners sign a smart contract with experts by which they could agree on the terms of remuneration, for example, to speed up the process, by using tokens – units of accounting for the digital balance of assets of each expert. Payment for experts work is closely linked to cryptocurrency, the principles of using which for many remain something ephemeral and unreliable – this is another task that would need to be solved in the process of joint work of investors, start-ups and experts.

A major advantage of this scheme is the almost complete exclusion of the platform owners’ responsibility towards investors for financing deliberately "false" and unviable projects; in addition, experts will be as motivated as possible for a qualitative assessment of projects, the results of which will affect their rating. In this area, quite often there are projects whose initiators joined the web-based platform with one goal which is to raise money and disappear in an unknown direction.

The second advantage of this scheme could be the case when experts unanimously give positive evaluation of a project which was not initially noticed by the investor due to personal non-financial preferences. Thus, by forming a rating of projects solely based on the expected financial result, experts, on the one hand, help to notice the project, and on the other hand, help the investor to make a decision in accordance with its main goal – to place funds with maximum effectiveness and objectivity.

In addition to initiators-recipients and experts, all types of investors could be drawn to these platforms including "business angels" whose participation in the venture financing process is sometimes difficult to determine.

Conclusion

Despite the difficult financial situation in the world, it is believed that seed funding for start-ups is more likely to live than not to live. Highly specialized areas such as IT development for business and software testing are rapidly developing, and numerous start-ups have very tangible prospects. For example, Headspin, a young company that has launched as a start-up and now allows developers to test and debug their applications in real time, is currently valued at $1.16 billion and is recognized by market participants as a "unicorn" (CB Insights. The Top 20 Reasons Startups Fail, 2014).

In order to improve the process of financing start-ups, it is necessary to solve the issue of the efficiency of start-ups self-positioning. If the trend on reducing funding for young companies at an early stage (the seed stage) stays, there are enough alternative market sources – angel investors, accelerators and venture capitalists that could help promising projects to survive and thrive.

Today the start-up ecosystem is more complex than it was a decade ago but opportunities for entrepreneurs who are willing to learn from experts in an unstable external environment and creative financing alternatives still exist.

References

- Bereza, A. I., & Volodin, R. S. (2016). Trends in the development of Internet startups in Russia. Economy Management Finance, 2, 5–15.

- Blank, S., & Bustard, B. (2017). Startup. Table book of the founder. Moscow: Alpina publucation.

- Bovkun, A. S., Korodyuk, I. S., & Arkhipkin, O. V. (2018). Detection and Analysis of Model Construction of Innovative Development in Russian Regions. The European Proceedings of Social & Behavioural Sciences. (EpSBS), 246–253.

- Bovkun, A. S., & Troshina, A. O. (2017). Classification of innovative activities in universities. Advances in Economics, Business and Management Research (AEBMR). Proc. of the Int. Conf. (pp. 82–86).

- CB Insights. The Top 20 Reasons Startups Fail. (2014). Retrieved from: https://www.cbinsights.com/ research-reports/The-20-Reasons-Startups-Fail.pdf (accessed 30.03.2020).

- Pushkarenko, A. B. (2010). Support for innovative and active enterprises in the regions. ECO, 6, 53–61. Novosibirsk.

- Review of the private equity and venture capital investment market. (2019). Retrieved from: https://ffin.ru/upload/iblock/bc9/bc9ab0cb97c6ca54950e3debb756052e.pdf

- Rodin, E. N. (2014). Analysis of funding sources for startups. Russian entrepreneurship, 5(251), 99–107.

- Romanova, A. O., & Korshunov, V. O. (2018). Startups as a tool for the development of the innovative economy of Russia. Alley of sci., 6(10(26)), 7–10.

- Skvortsova, N. A., & Kartashova, I. A. (2016). Marketing of startups: key points. Economic environment, 3(17), 50–54.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Sobolev, A. S., Konyukhov, V. Y., Druzhinina, T. Y., Zott, R. S., & Mezina, A. A. (2020). Start-Ups Evaluation With The Help Of Web-Based Platforms. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 612-617). European Publisher. https://doi.org/10.15405/epsbs.2020.12.79