Abstract

The article reveals a relationship between the balance of payments of the international investment position regarding changes in the amount of cash foreign currency and the volume of assets due to changes in the residency of the owner of cash foreign currency (resident/non-resident). The structural and dynamic analysis of the international investment position revealed the place of the Russian financial system in the global capital market as an investment partner, and its investment status in the global financial system. The relationship between the balance of payments and the international investment position regarding changes in the amount of cash foreign currency and the volume of assets is indicated. As a result of assessing the structure and dynamics of the international investment position using data from the International Monetary Fund and the Central Bank of Russia, a stable dynamics of the net international investment position, the active use of debt instruments and debt securities, and reverse investment for direct and portfolio investments were revealed. The main impact on the dynamics of Russia's international investment position is made by the government, acting as an intermediary between non-residents, Russian enterprises and commercial banks. The Ministry of Finance of Russia, issuing high-yield debt securities, encourages non-residents and commercial banks to carry out investment lending through the state "leverage", which increases the loan price. The real sector of the Russian economy is becoming dependent on the policies of the Government of Russia.

Keywords: External financial assets and liabilitiespublic “leverage”international investment position

Introduction

The modern economic development of countries requires a financial system. The level of development of the financial system affects the ability of the government to eliminate negative manifestations in the cyclical development of the economy. The financial systems have become cross-border, able to use external financial resources in the form of financial assets and liabilities. To assess the economic relations of the country, the Balance of Payments (BP) is used and the International Investment Position (IIP) is assessed.

An anamnesis of the evolution of the capital market revealed its high dependence on investment activities. In the context of high incentives, it is cheaper for banks to raise equity to meet the endogenous requirements for risk-sensitive capital (Song & Thakor, 2010; Zawadowski, 2013).

If you do not change the structure and flows in the financial system, it will be impossible to ensure economic growth. To increase the efficiency of the Russian financial system, it is necessary to link the assets of the banking system used in the form of investment loans with dynamically growing Smart technologies. To restructure the Russian economy, large-scale financing of the production of a new technological structure is needed (Smirnov, Semenov, Kadyshev, Zakharova, & Perfilova, 2019). The development of Smart technologies requires a high concentration of investments in the initial phase (Smirnov, Semenov, Kadyshev, Zakharova, & Babaeva, 2019), and the banking system should become an instrument of economic development.

Problem Statement

IIP shows the total volume and structure of financial assets (stocks, bonds, real estate, etc.) and the country's obligations to non-residents. The net international investment position (NIIP) is the difference between country's assets and liabilities. NIIP is the stock of external assets minus the stock of external liabilities. NIIP and the stock of non-financial assets of the country are the net national wealth of the economy. IIP, like BP, provides information for assessing the country’s economic relationship with the rest of the world. IIP is a statistical report that displays volumes of external financial assets and liabilities, which are formed as a result of external operations valued at a current market value, and the impact of other factors (write-offs, changes in classification, etc.). The items constituting financial assets and liabilities represent financial claims on non-residents and liabilities to them, assets and liabilities in the form of equity instruments, derivative financial instruments, monetary gold and special drawing rights (SDR).

The concept of IIP coincides with BP, and is also consistent with the concepts of other systems of macroeconomic statistics. All IIP assets and liabilities are valued at market prices. This concept assumes a constant and regular reevaluation of IIP.

NIIP includes foreign assets and liabilities owned by the government, the private sector and its citizens. The country with a positive NIIP is a creditor, while the country with a negative NIIP is a debtor.

The applied NIIP analysis of 65 developed and developing economies using two criteria – consistency with economic fundamentals (NIIP standards in the form of cumulative current account norms) and caution regarding the risk of external crises (NIIP prudential thresholds obtained as an income threshold for per capita), revealed the median NIIP norm – 17 % of GDP, the median for the prudential threshold – 44 % (Turrini & Zeugner, 2019). More open countries with large domestic financial markets tend to attract more foreign assets and liabilities (Lane, 2000).

Research Questions

The subject is the structure and dynamics of Russia's external financial assets and liabilities – International Investment Position (IIP) as part of the Balance of Payments (BP) drawn up on the legislative basis: Federal Laws N 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)” , N 282-ФЗ “On official statistical accounting and the system of state statistics in the Russian Federation”; No. 395-1 “On banks and banking activities”; N 149-ФЗ “On information, information technologies and information protection”; Decree of the Government of the Russian Federation No. 1226 “On Accession of the Russian Federation to the Special IMF Data Dissemination Standard”; Decree of the Government of the Russian Federation No. 671-r “On approval of the federal statistical work plan”. IIP as part of BP makes it possible to determine the place of the Russian financial system in the global capital market as an investment partner, and in the global financial system, to identify the investment status (investor or investment object).

Purpose of the Study

The aim of the study is to determine the structure and dynamics of external financial assets and liabilities of Russia. The article identified a significant relationship between BP and IIP regarding changes in the amount of cash foreign currency, the volume of assets caused by changes in the residency of the owner of cash foreign currency. The research takes into account changes in the value of assets denominated in currencies other than the unit of account in BP and IIP, the effect of the exchange rate on IIP, ruble stocks accumulated by non-residents, etc.

Research Methods

The study uses statistical, cluster, neural network and nonparametric analysis. Statistical analysis is a method of collecting, studying and presenting large amounts of data to identify patterns and trends of phenomena.

Cluster analysis is used as a multidimensional statistical procedure for collecting data on a sample of objects and ordering research objects in homogeneous groups. Cluster analysis is implemented using the SPSS Statistics application package – hierarchical cluster analysis, an average distance between clusters, a squared Euclidean distance.

Neural network analysis through the construction of neural networks is used to identify patterns in phenomena. Neural network analysis is implemented using the SPSS Statistics application package – multilayer perceptron and batch training.

Nonparametric analysis includes descriptive statistics and statistical inference. Nonparametric analysis does not depend on parameters whose interpretation does not depend on the population corresponding to parameterized distributions. Nonparametric analysis is implemented using the SPSS Statistics application package – Kolmogorov’s acceptance criterion with a significance level of 0.05.

Findings

Analysis of IIP changes includes an assessment of the dynamics of growth rates (Rate of Increase, RI) according to the IMF and the Central Bank of Russia.

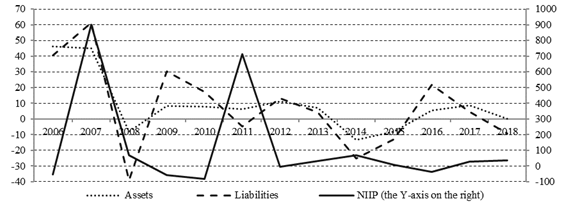

According to the results of the “F-test” (the two-sided probability that the difference between the variances of the arguments of the two arrays is insignificant), a high correlation of RI NIIP with assets was revealed. The median value of RI NIP is many times greater than the dynamics of the assets (Me = 6.80 %) and liabilities (Me = 4.40 %). There is a low median value of the RI of liabilities and their volatility (Ϭ2 = 745.93) in comparison with a change in the RI of assets (Ϭ2 = 323.38). The stable dynamics of RI NIIP is associated with stable RI assets and liabilities (to a lesser extent).

Sources of direct investment in the capital of Russian enterprises are investment funds and debt instruments formed through the deposits of organizations. Non-residents apply reverse investment in government debt securities, which negatively affects opportunities for investment development by the real sector of the economy.

According to the dynamics of the RI component of IIP of Russia, debt instruments, debt securities, corporate deposits, monetary gold, reverse investment in direct and portfolio assets are used.

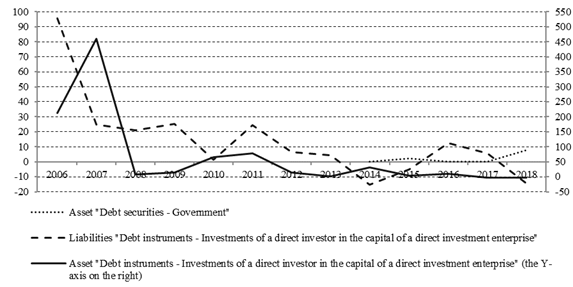

Combining the results of cluster, neural network and nonparametric analysis, the following main components of the IIP of Russia can be distinguished: assets: “Debt instruments – Investments of a direct investor in the capital of a direct investment enterprise” and “Debt securities – Government”; obligations: “Debt instruments – Investments of a direct investor in the capital of a direct investment enterprise”.

RI of the main components reflect the dynamics of IIP of Russia (Figure

In the conditions of decreased efficiency of investment development, the Government is increasing the RI of the asset “Debt Securities – Government”, thereby encouraging non-residents to re-invest, taking away excess investment in the financial sector of the economy. Government intervention in banking through subsidizing bank capital in exchange for the public ownership of banks and direct regulation of lending will increase the risk to the financial system and does not contribute to its development (Deltuvaite & Sineviciene, 2014; Song & Thakor, 2013), With a stable ratio of reserves, an increase in reserves should have expanded loans and deposits and increased the money supply (Kregel, 2009).

To maintain the balance of RI “asset – liabilities” of the component “Debt instruments – Investments of a direct investor in the capital of a direct investment enterprise” in IIP, since 2014, the Russian Government has used assets “Debt securities – Government”, which since 2017, have exceeded assets “Debt instruments – Investments of a direct investor in the capital of a direct investment enterprise” by the RI.

Conclusion

The structural-dynamic analysis of Russian external financial assets and liabilities identified a high correlation of RI NIIP with RI assets of “Investment of the Direct Investor in the Equity of a Direct Investment Enterprise”, “Debt Securities – Government” and “Debt Instruments – Deposits of the Organization, except for the Central Bank”. Sources of direct investment in the equity of Russian enterprises are investment funds and debt instruments formed through the deposits of organizations. The active use of reverse investment in government debt securities by non-residents (portfolio investment) indicates a low efficiency of investment development by the real sector of the economy. By increasing the RI of the asset “Debt Securities – Government”, the Russian Government attracts excess liquidity to the financial sector, which creates risks of losing the balance between RI assets and liabilities. The real sector of the economy becomes dependent on the policy of the Government, which attracts investment resources of non-residents and commercial banks, providing them with stable revenues. Non-residents use the mechanism of return investment in federal loan bonds.

The Russian government is forced to support the RI of the asset “Debt instruments – Investments of a direct investor in the equity of a direct investment enterprise” in order to ensure IIP stability. The Russian financial system falls into the “liquidity trap” due the creation of a large amount of money by the Central Bank that was raised on the assets side of bank balance sheets without any expansion of deposit liabilities, which are loans to businesses.

References

- Deltuvaite, V., & Sineviciene, L. (2014). Research on the Relationship between the Structure of Financial System and Economic Development. Proceedings – Socical and Behavioral Sci.ences, 156, 533–537.

- Kregel, J. (2009). Why don't the bailouts work? Design of a new financial system versus a return to normalcy. Cambridge Journal of Econ.my, 33(4), 653–663.

- Lane, P. R. (2000). International investment positions: a cross-sectional analysis. Journal of International Money and Finance, 19(4), 513–534https://doi.org/10.1016/S0261-5606 (00)00019-X

- Russia International Investment Position: BPM6: Annual. CEIC Data’s Global Database (2019). Retrieved from: https://www.ceicdata.com/en/russia/international-investment-position-bpm6-annual (Accessed: 2019/08/23).

- Smirnov, V., Semenov, V., Kadyshev, E., Zakharova, A., & Babaeva, A. (2019). Management of Employment Promotion Institution In Russia. The European Proceedings of Social & Behavioural Sciences “Social and Cultural Transformations in the Context of Modern Globalism” (SCT 2018). Vol. 134 (pp. 1157–1165).

- Smirnov, V., Semenov, V., Kadyshev, E., Zakharova, A., & Perfilova, E. (2019). Management of Development Efficiency of the Russian Economy. The European Proceedings of Social & Behavioural Sciences “Social and Cultural Transformations in the Context of Modern Globalism” (SCT 2018. Vol. 218 (pp. 1871–1877).

- Song, F., & Thakor, A. (2013). Notes on Development and Political Intervention. The World Bank Econ. Review, 27(3), 491–513.

- Song, F., & Thakor, A. V. (2010). Architecture and the Co‐evolution of Banks and Capital Markets. The Economy Journal, 120(547), 1021–1055.

- Turrini, A., & Zeugner, Z. (2019). Benchmarks for net international investment positions. Journal of International Money and Finance, 95, 149–164.

- Zawadowski, A. (2013). Entangled Financial Systems. The Review of Financial Studies, 26(5), 1291–1323. https://doi.org/10.1093/rfs/hht008

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Smirnov, V. V., Semenov, V. L., Perfilova, E. F., Gorbunova, P. G., & Denisov, G. N. (2020). Movement Of External Financial Assets And Liabilities Of Modern Russia. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 604-611). European Publisher. https://doi.org/10.15405/epsbs.2020.12.78