Abstract

Upgrading economic relations in the pension system to raise the living standards of Russian citizens remains a relevant problem for present-day Russia. In order to raise living standards of pensioner citizens, the Russian Federation adopted a federal law in 2018: No 350-FZ “On amendment of several legal acts of the Russian Federation for the purposes of assignment and payment of pensions”. It included a 10-year pension reform providing both for a raise of the retirement age and for a gradual transition to a new two-level pension system: state and voluntary. The main reason for the reform is the shortage of resources in the Pension Fund of the Russian Federation. Using a systemic methodological approach and methods of statistical and economic analysis, including horizontal and vertical analysis, the authors assessed the dynamics and structure of income and expenses of the Pension Fund and the number of employed pensioners in Russia. Pensions to individuals were calculated using methods of ratio analysis. Differences in living standards of pensioners in the Far North and other regions of Russia were assessed using comparative analysis. The study showed the reason why Russian pensioners stay employed, presented the procedure of pension payments to individuals, and explained potential ways of improving the pension system. The main idea of the study findings is to explain the need to reform the pension system for the purpose of raising the living standards of pensioner citizens of the Russian Federation.

Keywords: Pension systemindividual pension coefficient (Note: the terms used in this paper are given in accordance with the official English version of the Pension Fund's website: http://wwwpfrfru/en/pens_system/)

Introduction

Economic relations in a pension system play an important part in economic, social, and political life of a state. In the current circumstances, particularly challenging issues arise because of the following:

the trend of falling number of the employed in the Russian economy;

the increasing social and demographic burden per employed person;

the implementation of targeted government programmes for increasing the average life expectancy, for social security, and for healthcare improvement;

the need for efficient use of the Russian Pension Fund.

A lot of researchers study economic relations in pension systems. In particular, they described issues of pension protection establishment (Cipriani & Pascucci, 2020; Clark & Mitchell, 2020; Johnston, Hatem, Carnes, & Kosedag, 2019; Kruchek, 2016; Kyyrä & Pesola, 2020; Rabaté, 2019; Silchuk, 2016a,b; Vidal-Melia, Ventura-Marco, & Pla-Porcel, 2020) pension planning (Batyra, de la Croix, Pierrard, & Sneessens, 2019; de Villiers & Roux, 2019; Horwitz, Klontz, & Zabek, 2019; Kimiyagahlam, Safari, & Mansori, 2019; Kuiate & Noland, 2019); factors affecting pension levels (Bishnu, Guo, & Kumru, 2019; Chen, 2019; Hammer, Spitzer, Vargha, & Istenič, 2020; they identified a link between financial literacy and wealth (Hastings & Mitchell, 2020), regeneration of financial prosperity and life satisfaction of the elderly (Yeo & Lee, 2019).

Besides, modern studies of economic relations in pension systems suggested an original approach of social comparison for the purposes of stimulating saving behaviour in order to increase future savings (Raue, D'Ambrosio & Coughlin, 2020); developed a set of scientific methods and tools for mitigating risks of investing in pension assets (Ali, Fang, Sota, Taylor, & Wang, 2019; McDonald, 2019; Weiss-Cohen, Ayton, & Clacher, 2020), and indentified cause-and-effect relations of falling living standards at retirement (Allais, Leroy, & Mink, 2020; Chen, 2019; Hammer et al., 2020).

Problem Statement

The study problem is to identify inconsistencies in economic relations in the pension system on the basis of scientific methods and tools for the pension system upgrade aimed at raising the living standards of Russian citizens. The problem has a significant socio-economic importance.

Research Questions

The subject is economic relations in the pension system.

Purpose of the Study

The purpose of the study is determined by its relevance. The purpose is to formulate suggestions on how to raise the living standards of Russian pensioner citizens given the reform of economic relations in the pension system.

The following objectives were achieved for the purpose:

- analysis of dynamics and structure of income and expenses of the Pension Fund and the number of employed pensioners in Russia;

- comparative analysis of living standards of pensioners in the Far North and other regions of Russia;

- suggestions for improvement of the pension system.

Research Methods

Reliability of the findings is achieved by the following:

- using factual data (annual Government statistical reports, reports of the Russian Pension Fund, Russian laws and regulations) combined with author’s own study and calculations pertaining to the pension system;

- scientific methodology and methods based on Russian and international experience;

- using practically tested research methods: sampling, grouping, comparison, summary; visualisation using histograms and time series graphs.

The objectives were achieved using the following sequence:

- the first stage included sampling of statistical data from the annual Government statistical reports and reports of the Russian Pension Fund over the last three years;

- the second stage included a horizontal and vertical analysis of the income and expenses of the Russian Pension Fund, federal budget performance, and number of employed pensioners;

- at the third stage, the suggestions for improvement of the pension system were formulated.

Findings

The analysis of income and expenses of the Russian Federation Pension Fund shows positive dynamics throughout the period analysed (Tables

For instance, in 2018 the income amount was 8.220 bn RUB, which is 0.6 % lower than the previous year 2017. In 2017, the total income amount was 8.269.6 bn RUB, which is 0.11 % higher compared with 2016. The Pension Fund expense amount in 2018 also rose by 0.9 %, or 8.505.2 bn RUB, which made the deficit equal to 233.33 bn RUB. The expenses were therefore higher than the income by 3.47 and by 1.31 % in 2017, making it 8.428.7 bn RUB compared with 8.319.5 bn RUB in 2016, which made the Pension Fund deficit equal to 159.1 bn RUB. During 2015–2016, the Pension Fund also had a deficit, and in 2017 the expenses exceeded the income by 1.92 %.

The total percentage of this fund’s income in the gross domestic product (GDP) was 11.6 % in 2015, rising to 11.93 % in 2016 and falling to 11.04 % in 2017. The total percentage of the Pension Fund’s expenses in the GDP was 11.91 % in 2015, 12.02 % in 2016, and 11.25 % in 2017.

Analysing the expense structure of the PRF, three expense categories were identified (Table

The first category includes government pensions and takes up the biggest share in overall expenses, equal to 82.3, 83.2 and 87.1 %, with the growth rate equal to 104.7 % in 2017. The second category includes expenses on public social security, its percentage decreasing from 2015 to 2017. In the reporting year, the social security expenses accounted for 10.1 %, which is 5.5 % lower than in 2016, the decrease rate being 64.7 %. The third category of other expenses accounted for an insignificant share in overall expenses in 2015–2017, equal to 1.9, 1.2 and 2.8 % respectively.

The income structure of the Russian Pension Fund comprises insurance contributions, transfers from the federal budget, and other income (Table

Analysing the PRF income structure, we have to note the growth of the insurance contributions’ share in the overall income of the Pension Fund from 51.9 % in 2014 to 61.5 % in 2016

However, a sizable share of pensions, about 37 % of the Pension Fund’s expenses in 2017, was financed with transfers from the federal budget, which shows a high dependence of the PRF on the federal budget and its income and expense performance. There is an upward trend in the Pension Fund’s income being covered by inter-budget transfers in 2015–2017. The bulk of the PRF budget was funded from Russian Federation commitments: 2.174.3 bn RUB in 2015 and 3.110.4 bn RUB in 2017, as well as pension valorisation: 600.7 bn RUB in 2015 and 685.45 bn RUB in 2017.

Consequently, spending a significant share of the GDP on pension, the Russian pension system generates low pension amounts. For instance, the average work pension was 11.783.29 RUB per month in 2015, 13.132 RUB in 2016, 13.761 RUB in 2017, and 14.184 RUB in 2018.

The main reasons for the current underperformance of the Russian pension system manifesting itself in low pensions for Russian citizens are:

- the significant dependence of the Russian pension system on the federal budget income, which is connected with the significant share of federal budget transfers in PRF income;

- the low collection level of insurance contributions to the PRF from businesses determined by the fact that the nominal rate of insurance contributions to the PRF is 22 % + 10 % of the contribution rate if the employer’s taxable basis exceeds certain values. Given that business revenues and employee incomes shrink in an economic recession and financial downturn, we can suggest lower overall contributions in 2017 and further;

- the absence of efficient government management tools aimed at reducing unreported employment and increasing insurance contributions;

- the negative ratio of those employed and paying pension contributions and those receiving pensions, determined by the adverse demographic conditions. According to Rosstat projections, the number of people of working age will have dropped by 11m by 2030, the number of those older than the working age to rise by 9m. The ratio of the workers having their pension contributions paid to the number of pensioners is declining from 1.5:1 in 2016 to 1.4:1 in 2020, to 1.05:1 in 2030, to 0.97:1 in 2040, to 0.93:1 in 2050. There was a steady rise of the share of the employed in the population structure of the country from 2014 to 2018 simultaneously with an increasing demographic burden on the working-age population. For example, while the demographic burden coefficient was 66.5 % in 2012–2013, 74 % in 2015, and 78.5 % in 2017, its value in 2018 rose to 80.4 %. The increasing number of the elderly is conditioned by the mortality in 2017 lower by 63.573 people compared with 2016 (2018 saw an increase in mortality by 4.570 people) and increased life expectancy in this age group. In 2015, the average life expectancy of Russian citizens reached 71.4 years (65.9 for men and 76.7 for women). In 2016, the indicator increased by another 8.5 months, reaching 72.1 years. The life expectancy of women exceeded 77.3 years, and the life expectancy of men reached 67 years. In 2017, the average life expectancy of Russians was 72.7 years (67.5 for men and 77.6 for women). In 2018, the life expectancy in Russia reached 72.9 years, with men living for 67.7 years, which is 10 years shorter than women, whose life expectancy was 77.8 years (Rosstat, 2019);

- the low retirement age compared with other market economies (55 for women and 60 for men), which was raised starting from 1 January 2019 (60 for women and 65 for men), which, combined with early retirement, leads to a large share of pensioners in the total Russian population.

Apart from that, the condition of pension protection as a result of pension system’s operation is affected by the division of Russian territories into two types: regions of the Far North and other Russian regions.

This cannot but affect the level of pensions.

In the Far North, for instance, the average pension was 3.000 RUB higher than in the other regions, which is due to the level of consumer prices and poverty threshold. Apart from that, all Russian territories see an increase of consumer prices. Pensions can therefore be increased by their annual indexation depending on the inflation rate in the country and consumer price index.

Pension Fund’s performance is also significantly affected by two factors: the rising number of employed pensioners and new pension calculation procedure introduced from 1 January 2015 under the mandatory pension insurance scheme.

The number of employed pensions had shown a steady rise until 2016. In 2014 their number was about 14.8 m people whereas in 2016 the number was 16 m. Because of the cancellation of indexation, the number of employed pensioners significantly decreased to 9.8 m people in 2017 and 9.7 m people in 2018 (20 % of the total number of pensioners).

Studies show that the main reason why pensioners stay employed is the need to raise their living standards in 70 % of cases, with 30 % of them willing to help their children and relatives.

The new pension calculation procedure expressed in points means that an employed pensioner can be assigned no more than three additional points at pension recalculation whereas an unemployed pensioner is assigned points in line with indexation and the inflation rate of the previous year. Russian Prime Minister D. Medvedev issued a directive to the Russian Federation Government to elaborate the matter of restoring pension indexation for employed pensioners, to be resolved in 2020 at earliest. In 2018, the maximum pension increase for an employed pensioner was 261.72 RUB, which is 11.02 % (25.98 RUB) higher than in 2017. In 2017, the recalculation amount was 235.74, which is 5.8 % (12.93 RUB) higher than in 2016. In 2016, the recalculation was equal to 222.81 RUB, which is 4 % (18.42 RUB) higher compared with 2015, when the increase was 214.23.

From 2016 to 2019, regardless of the chosen pension scheme in the pension insurance system, all citizens were only entitled to insurance pension depending on the total amount of insurance contributions. The maximum amount of the individual pension coefficient is therefore the same for any variant of pension structure.

Points depend on the time the person claims the insurance pension upon reaching the retirement age. If an employed person applies later, continuing their employment, each year of the application delay (i.e. refusal to start receiving the pension on time) the insurance pension is increased by a relevant coefficient. For instance, if an employed citizen claims the pension five years after reaching the retirement age, the insurance pension will rise by 36 % and the sum of personal pension coefficients by 45 %. If the claim is made ten years later, the payment will increase by a factor of 2.11 and the sum of personal pension coefficients by a factor of 2.32.

On 1 January 2015, Federal Law No 400-FZ of 28/12/2013 “On insurance pensions” came into effect. In accordance with the law, pensions would be calculated in line with Article 15 of the said Federal Law starting from 1 January 2015 depending on the individual pension coefficient. Pensions in Russia are also governed by the following federal laws: “On state pension protection in the Russian Federation”, “On work pensions in the Russian Federation”, “On funded pension”, and “On the procedure of payment financing from accrued pension funds”.

We will review the procedure of pension payment using two individuals living in the Far North as examples. The first individual is citizen R. who has worked for 30 years, 28 of them in the Far North.

Following an claim of 28 February 2019, citizen R. was assigned an insurance pension starting from 23 March 2019 in accordance with Cl. 10 Part 1 Article 30 of Federal Law No 400-FZ of 28/12/2013 “On insurance pensions” that states that for persons living in the Far North as of 1 January 2002 and having regional salary coefficients, the ratio of average monthly income of the insured person to the average salary in the Russian Federation shall be as follows: no more than 1.4 for persons living in the regions and territories having a regional salary coefficient up to 1.5.

For instance, in accordance with Decree of the State Committee of the USSR Council of Ministers on Labour and Salaries and the Executive Committee of the All-Union Central Trade Union Council No. 380/P-18 of 04/09/1964, in Murmansk, a city considered equivalent to a Far North territory, the centrally-established regional coefficient applied to pensions was 1.4.

Table

The second individual is citizen I. having an average salary of 70K RUB over the recent 7 years as well as two children of age.

Let us assume that I., who has a higher income, and R., who has a lower income, claimed the insurance pension after three and five years respectively (Table

Citizen I. is a woman and therefore entitled to claim the insurance pension at the age of 58. Then the surplus coefficient for late application will be 1.24 for the insurance pension and 1.19 for the fixed pension amount.

In this case the insurance pension amount will be:

116.37 × 1.24 × 87.24 RUB + 4.805.11 RUB × 1.19 + 2.000 = 20.306.81 RUB.

(27.6 % higher than at the age of retirement).

If I. claims the insurance pension at the age of 60, i.e. five years after the retirement age, her insurance pension will be:

116.37 × 1.45 × 87.24 RUB + 4.805.11 RUB × 1.36 + 2.000 = 23.255.83 RUB.

(14.5 % higher than at retirement three years later than the retirement age).

If individual R. claims the insurance pension at the age of 68, i.e. three years after the retirement age, the insurance pension will be:

89.985 × 1.24 × 87.24 RUB + 4.805.11 RUB × 1.19 + 2.000 = 17.452.32 RUB.

(15.5 % higher than at the age of retirement).

If individual R. claims the insurance pension at the age of 70, i.e. five years after the retirement age, his insurance pension will be:

89.985 × 1.45 × 87.24 RUB + 4.805.11 RUB × 1.36 + 2.000 = 19.918.03 RUB.

(14.1 % higher than at retirement three years later than the retirement age).

It is obvious that a significant difference in income during employment does not ensure a similar difference between the pensions paid, i.e. regardless of the relatively high income, the pension amount is not significantly higher than that of the citizen receiving low income throughout his employment history.

An efficient pension system is an important factor of socioeconomic security of a country, including the Russian Federation. The employed want to be sure that their pension will be sufficient for a suitable living standard after they retire. The current demographic situation in Russia is characterised by a low birth rate and high rate of ageing, which leads to an increasing share of employable population and pensioners. If the trend persists, Russia may soon face a situation where the bulk of economically active population will consist of pensioners, with the rate of progressive development of the Russian economy depending on the effective demand of this population category. As a result, an adequate pension system and protection suitable to the need of post-working-age population for high living standards is the main economic security factor in Russia. Currently, two main problems of the pension system are specified: the accelerating growth of the PRF budget deficit and low level of pensions.

The budget deficit problem is solvable by raising the retirement age, the social tension caused by the higher retirement age to be eased with higher pensions.

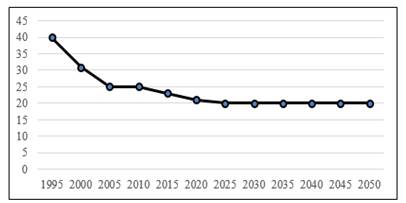

The low level of pensions means a very low replacement rate as a ratio of the average pension to the average salary (Figure

If the government policy aimed at raising financial well-being of pensioners and fighting poverty in that socioeconomic group of population is to accelerate indexation of the main component of the work pension to bring it in line with the poverty threshold as stated in the pension law, the PRF deficit may keep growing. In this case, both the base and insurance components of the work pension will be in the red. In general, the deficit of the distributed pension during its probable further increase is projected to rise to 3.07 % GDP in 2050. The loss in the insurance and base components of the work pension may develop differently.

According to Pension Fund’s forecasts, if the deficit of the base component of the work pension keeps growing steadily from 0.37 to 2.85 % GDP, the deficit of the insurance component is projected to go down slowly to 0.28 % GDP in 2050.

To achieve the pension development objectives and create tools for a functioning pension system, the following measures are therefore suggested:

- raise pension protection of retirement-age persons and eradicate poverty among them;

- develop insurance principles of work pension provision;

- change funding sources of the mandatory pension insurance system;

- create conditions for acquiring pension rights from the insured in a required scope;

- increase the funded component of the pension fund;

- raise the retirement age (threshold);

- establish a system of retraining for people of pre-retirement age;

- establish a system of voluntary private pensions with state insurance guarantees.

Performing these tasks can ensure growth of pensions for pensioners and conditions for suitable pensions for the employed. Consequently, a major objective of the Russian Government is to create a legal framework for functioning of the pension system to ensure more efficient results of the pension reform in Russia.

Of all the suggested measures, raising the retirement age (threshold) is the most substantial and widely discussed in public.

The retirement age varies from country to country, and so do retirement rules and payment principles. There are therefore three main features of a pension system:

1)retirement age;

2)pension amount;

3)ways of pension funding accrual.

The first feature – retirement age – varies in different countries depending on two factors:

socioeconomic situation;

average life expectancy called life expectancy at birth in statistical reporting.

The second feature is the pension amount varying from place to place.

The third feature is pension accrual on the basis of funding done in the following ways:

1)on an individual funding basis;

2)in a distribution system based on a) pension taxes; b) general tax revenues.

The retirement age in the majority of countries varies depending on the gender and average life expectancy.

The highest retirement age, 70 years for both men and women, is in Japan, where the average life expectancy is 82.1 years. In Britain, men retire at 68 and women at 60, the life expectancy being 79 years.

In Denmark, Norway, and Germany, the retirement age is 67 years for everyone, and the average life expectancy is 79 years.

65 years is the age when both men and women retire in the USA, Canada, Spain, and Sweden. The average life expectancy in those countries is about 80 years.

Men in Switzerland, Armenia and Belgium become pensioners at the same age of 65. Yet, the life expectancy in Armenia is 72.7 years, which is significantly shorter than in Switzerland and Belgium, where it is equal to 80.9 and 79.2 years respectively. However, women in Switzerland, Armenia, and Belgium become pensioners at 64, 63, and 62 respectively.

In Italy and France, the retirement age is 67 for men and 65 for women, and the life expectancy is slightly over 80 years.

In Kazakhstan and Lithuania, the retirement age for men is 63 and 62.5 and for women 58 and 58.5 respectively, with the life expectancy being 67.9 years in Kazakhstan and 74.9 years in Lithuania.

In Hungary, the Czech Republic, Azerbaijan, and Moldova, the retirement age for men is 62. Women in Hungary and the Czech Republic become pensioners at the same age whereas in Moldova and Azerbaijan the age is 57. The average life expectancy in Hungary, the Czech Republic, Azerbaijan and Moldova varies between 70.8 and 76.7 years.

Men in Ukraine, Belarus, and Uzbekistan retire at 60, whereas the retirement age of women is 55 and the average life expectancy about 70 years.

The current trend in retirement age variation is that the retirement age started to grow in various countries in 2015–2016, caused by the continuing global crisis and budget deficits in most of the countries.

The retirement age is expected to change in Ukraine, which plans to raise the retirement age to 60 years for women by 2021. In Britain, Poland, Germany, France, and Belgium, citizens will only be entitled to retirement from the age of 67. The USA is also planning to raise the retirement age, from 65 to 69.

According to international experts, there is no optimal retirement age and no ideal pension system.

Britain is an example of a near-perfect pension system. Like in many countries, it has three types of pension protection:

- state pensions;

- occupational pensions;

- private pensions.

Basic state pensions are paid to all British citizens when they reach the retirement age. The pension amounts are fixed, tax-funded, and do not depend on the labour record or other factors. For all pensioners having a certain labour record, there is a different option: occupational pensions depending on the labour record and income. However, a significant amount can be received as a private pension determined by employees themselves. That pension is formed by both the employee and employer.

Participation in private schemes is stimulated with a number of significant tax incentives.

Using various methods of pension funding accrual is typical for pension systems. Combinations of several methods are the most common. All of the systems are based on three methods.

The essence of the first method – individual funding – is that employees, either personally or via their employers, pay part of their income to the Pension Fund, where their old-age pensions are accrued.

The second method is distribution based on pension taxes. It means that employees do not pay their own funds for their pension accrual. Part of their income funds the pensions of the existing pensioners in the current period. Consequently, when they retire, the currently employed will get their own pensions from salaries of employed fellow citizens.

The third method is distribution based on general taxation, where pensions are paid from tax revenues.

The highest monthly pensions, 2.800 USD, are paid to Danish citizens. Citizens of Finland, Norway, Israel, Germany, Spain, and the USA receive from 1,900 to 1.164 USD. Less than 1,000 USD but more than 500 USD is paid to citizens of Switzerland, Sweden, Japan, the UK, France, Canada, and Italy. Pensions from 500 to 100 USD are paid to citizens of Hungary, Poland, China, Bulgaria, Lithuania, Kazakhstan, Azerbaijan, Belarus, and Ukraine. Pensioners in Argentina, Moldova, Uzbekistan, and Georgia receive less than 100 USD a month.

The difference between the highest and lowest pension is therefore 70 times.

Conclusion

The study shows that the PRF budget, which consists of the income and expense components, is formed provided that the income is equal to the expenses. The income and expenses are only related to payment of various work pensions and state social security pensions, excluding other benefits and payments.

The budget expenses depend on the number of pensioners and average pension but do not include pension delivery and payment expenses.

The average pension depends on factors that characterise the number of employed people in the economy, number of pensioners, share of unreported employment, gratuitous transfers from the federal budget, payroll share in the GDP, and effective rate of insurance contributions.

The suggested list of measures towards a better pension system in the Russian Federation is in line with the government policy of transition to a new pension system aimed at using individual funding and creating indexation tools.

The practical importance of this study is connected with using the experience of other countries in raising the retirement age and improving their pension protection and with establishment of a combined pension system based on individual funding and the distribution methods, one of them being based on pension taxes and the other on general taxation.

References

- Ali, Y., Fang, M., Sota, P. A. A., Taylor, S., & Wang, X. (2019). Social security benefit valuation, risk, and optimal retirement. Риски, 7(4), 124.

- Allais, O., Leroy, P., & Mink, J. (2020). Changes in food purchases at retirement in France. Food Policy.

- Batyra, A., de la Croix, D., Pierrard, O., & Sneessens, H. R. (2019). Structural Changes in the Labor Market and the Rise of Early Retirement in France and Germany. German Econmy Review, 20, 38–69.

- Bishnu, M., Guo, N. L., & Kumru, C. S. (2019). Social security with differential mortality. J. of Macroeconomics. Retrieved from:

- Chen, W. (2019). Health and transitions into nonemployment and early retirement among older workers in Canada. Econmy and Human Biology, 35, 193–206.

- Cipriani, G. P., & Pascucci, F. (2020). Pension policies in a model with endogenous fertility. J. of Pension Econ. and Finance, 19, 109–125.

- Clark, R. L., & Mitchell, O. S. (2020). Target Date Defaults in a Public Sector Retirement Saving Plan. Southern Economy Journal, 86, 1133–1149.

- de Villiers, J. U., & Roux, E. -M. (2019). Reframing the Retirement Saving Challenge: Getting to a Sustainable Lifestyle Level. Journal of Financial Counseling and Planning, 30, 277–288.

- Hammer, B., Spitzer, S., Vargha, L., & Istenič, T. (2020). The gender dimension of intergenerational transfers in Europe. Journal of the Econmy of Ageing, 15.

- Hastings, J., & Mitchell, O. S. (2020). How financial literacy and impatience shape retirement wealth and investment behaviors. Journal of Pension Econmy and Finance, 19, 1–20.

- Horwitz, E. J., Klontz, B. T., & Zabek, F. (2019). Participation in and Contribution to Retirement Plans: Results of Three Trials. A Financial Psychol. Interventation for Increasing Employee, 30, 262–276.

- Johnston, K., Hatem, J., Carnes, T., & Kosedag, A. (2019). An empirical evaluation of dynamic vs static withdrawal strategies: It’s a dynamic small world after all. Managerial Finance, 45, 1509–1525.

- Kimiyagahlam, F., Safari, M., & Mansori, S. (2019). Influential Behavioral Factors on Retirement Planning Behavior: The Case of Malaysia. Journal of Financial Counselling and Planning, 30, 244–261.

- Kruchek, I. V. (2016). Social pensions as a type of state pensions from the perspective of social security legislation principles. Tavrichesky Nauchny Obozrevatel, 11(16), 1.

- Kuiate, C., & Noland, T. (2019). Attracting and retaining core competency: a focus on cost stickiness. Journal of Account. and Organizational Change, 15, 678–700.

- Kyyrä, T., & Pesola, H. (2020). Longterm effects of extended unemployment benefits for older workers. Labour Econ., 62.

- McDonald, I. (2019). The Economics of Ageing—What do you Face? Australian Economy Review, 52, 496–506.

- Rabaté, S. (2019). Can I stay or should I go? Mandatory retirement and the labor-force participation of older workers. Journal of Public Econmy, 180.

- Raue, M., D'Ambrosio, L., & Coughlin, J. F. (2020). The The Power of Peers: Prompting Savings Behavior Through Social Comparison. Journal of Behavioral Finance, 21, 1–13.

- Rosstat. (2019). Regions of Russia. Socio-economic indicators. Collected statistics. Moscow: Rosstat, 900 p.

- Silchuk, A. A. (2016a). Efficiency of the system of mandatory pension insurance for an insured person. Vest. State University of Management, 3, 24.

- Silchuk, A. A. (2016b). Strengths and weaknesses of the insurance and funded components in the system of mandatory pension insurance. Ekon. i predprinim., 6, 11.

- Vidal-Melia, C., Ventura-Marco, M., & Pla-Porcel, J. (2020). An NDC approach to helping pensioners cope with the cost of long-term care. Journal of Pension Econ. and Finance, 19, 80–108.

- Weiss-Cohen, L., Ayton, P., & Clacher, I. (2020). Extraneous menu-effects influence financial decisions made by pension trustees. Econmic Letters, 187.

- Yeo, J., & Lee, Y. G. (2019). Understanding the Association Between Perceived Financial Well-Being and Life Satisfaction Among Older Adults: Does Social Capital Play a Role? Journal of Family and Econ. Issues, 40, 592–608.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Skotarenko, O. V., Lyudmila, B. N., Nikolai, V. I., & Yuri, N. Y. (2020). Economic Relations In The Public Pension System By Territory. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 573-585). European Publisher. https://doi.org/10.15405/epsbs.2020.12.75