Abstract

In modern conditions, the effectiveness of the activities of branches of the Russian economy depends to a large extent on the state. The state influences the country's economy in various areas and sectors through economic policy through a system of financial and credit institutions, ministries and departments. However, the current state of the world economy, and the Russian one in particular, shows the inability of the state to effectively solve complex economic problems. The decline in production in certain sectors, the intensification of inflationary processes and the reduction in investment indicate the imperfection of the mechanism of state regulation of the financial and fiscal system that has developed in Russia. In foreign and Russian scientific literature, effective approaches to regulating the national economy are insufficiently developed by ensuring the interaction of credit, customs, leasing, depreciation, tax, investment mechanisms and the mechanism for applying investment tax credit. In the article we examined the general issues of taxation of enterprises. We identified the problems of taxation in modern economic conditions, proposed ways to solve them.

Keywords: Business entityfixed assetsproduction fundstatetax rateincome tax

Introduction

Tax system presents one of the key levers regulating the financial relations of an enterprise with the state in the conditions of transition to a market economy. It is used to provide the state with the financial support to solve the most acute economic and social problems.

Therefore, an economic entity will pay these taxes anyway (Nechaev & Rasputina, 2020). As we can see, the government is not interested in the process of updating and increasing main production assets, although this process directly affects the increase in revenue of an enterprise, leading to the increase in payments for income and property taxes. It is so because the growth of the enterprises’ main production assets significantly the growth of GDP (gross domestic product) and tax collection due to capacity expansion (Torugsa & Arundel, 2017).

Problem Statement

Through taxes, benefits and financial sanctions, which are an integral part of the tax system, the state affects the economic behaviour of enterprises, while creating equal conditions for all participants in social production. Tax methods for regulating financial and economic relations in the national economy in combination with other economic levers create the necessary prerequisites for the formation and functioning of a single integrated market (Nechaev, Bovkun, & Zakharov, 2017).

An economic entity should apply a developed depreciation policy that takes into account market conditions and focuses on forming a depreciation fund (Ilina & Tyapkina, 2016). The government, for its part, should provide a developed tax policy that makes an economic entity to allocate the depreciation fund for updating fixed assets constantly.

However, there are not any advanced mechanisms which would help to an economic entity to raise fixed assets, but not to spend depreciation charges (Nguyen & Almodóvar, 2018). The government would need to develop a tax policy that allows business entities to upgrade fixed assets using depreciation reserves

Research Questions

In this paragraph we propose to create a methodology taking account of the interests of the state and the economic entity (Tyapkina, Nechaev, & Romanova, 2018).

To advance the method, firstly, we should identify:

Key indicators that may be necessary for depreciation and the value of income tax and property tax (Nechaev, Ognev, & Antipina 2017):

1. Primary (residual) cost of fixed assets

2. Earnings

3. Expenses

4. Amortization amount

5. Tax base possessions

6. Tax base revenue

7. Tax wager revenue

8. Tax wager possessions (Blackburn, 1998).

Income tax

An indicator that has a significant correlation between the growth of main production assets (MPA) and the growth of revenue due to labor productivity increase. This indicator can be:

- Capital productivity (CP) = Earnings / medium annual cost of MPA

The indicator shows how efficient is the use of only the main production assets of an organization. In other words, when the number grows faster (if we compare it to a denominator), the units of revenue in unit of fixed assets increase (Tyapkina & Ilina, 2018).

It is possible only due to the implementation of modern equipment.

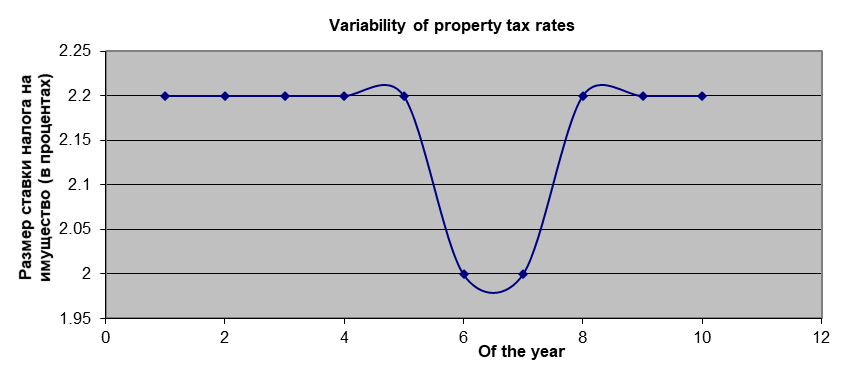

As a result, if the residual value of fixed assets is greater at the end of the tax period than at the beginning of it, this means that the basis to encourage the state to reduce the amount of property tax is proportional to the amount of objects acquired by organizations (Nechaev & Rasputina, 2020).

Purpose of the Study

Stimulators renovating fixed assets

Powerful factors are the following:

Reduced income tax wager with the augmentation of fixed assets. Actions are set by the government.

Let us consider the example, with growing Fo by 5 times (0.25), i.e. Fo = 1.25, decreases by 0.025 (2.5 %) and is equal to 21.5 % (0.215).

One of the real and effective factors is:

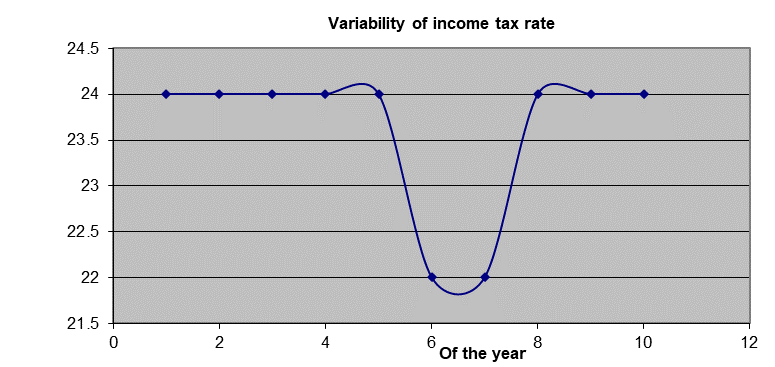

1. Income tax rate reduction during increasing in the capital productivity indicator (CP) in the indicator. The level of this reduction can be set by each state independently.

We can assume that the basic income tax rate () is 20% (0.20) when the CP (MPA) is equal to 1 unit.

The level of increasing in CP by 0.05 points (5%) will be a decrease of by 0.005 points (0.5%).

Thus, if CP is increased by 5 times (0.25 points), that is CP = 1.25 units, will decrease by 0.025 points (2.5%) and it will be 21.5 % (0.215).

These actions and income tax rate might make an economic entity always to have high-tech devices, machinery, etc., which are necessary for its work. This will give opportunities, firstly, to increase revenue (V), and secondly, to increase the depreciation fund that will allow to get the optimal residual value (Ot), and as a result, to pay income tax (NB) at reduced rates (Schymik, 2018).

Research Methods

The computation of the rate of revenue tax variation

The calculation of Fо for the calculating of the rate of income tax:

(1)

Income tax rate calculation (Nt):

(2)

Before tax income calculation (Dt):

(3)

Cost calculation (St):

(4)

where Zt is the production costs amount (excluding amortization).

Calculation of the rate of amortization (At):

(5)

I.e.

(6)

If we assume that Zt includes

Middle annual cost calculation of taxable property:

Where t is equal to 1 quarter:

Where t is equal to 1 year:

(8)

The calculation of the tax total, which must be paid for tax period (a quarter, a half year, 9 months):

Pt = the value of middle anniversary property for tax period * / 4

At the end of the year: (10)

We constructed a mathematical model in order to study the formation trends and formulas’ derivation.

Over the 1st year, the residual value of fixed assets is equal to their initial value, i.e.:

(11)

On the 2nd year (t = 1), the residual cost is equal to the initial cost exclusive of amortization calculated with the help of Ку, i.e.:

(12)

The total of the variation income tax of the 1st year is:

(13)

At t = 2

or

(14)

The model of formation of residual value at t is evident. Combining (1.11), (1.12) and (1.14), we get formula:

(15)

The variation income tax amount is:

(16)

We can calculate the complete amount of adjourned income tax for Q summing up formula by t:

(17)

The conclusion of the formula for the calculation of the variation asset tax.

The calculation of the middle annual cost of fixed assets for 1 quarter, taking into account the formulas (8) and (9):

(18)

The calculation of the middle annual cost of fixed assets for the 1st year,

(19)

Therefore, the final formula for the calculation of variable income and property tax taking into account the formulas (16) and (19) is as follows:

(20)

The most advantageous strategy for the regulation of the residual value and depreciation reserves of fixed assets is the authority of economic entity to perform these activities according to state variational policy (Seoane, 2015).

Using the formulas given above an economic entity can answer the question when (t) or how long the value of the residual value should be optimal for the entity on the basis of tax rates.

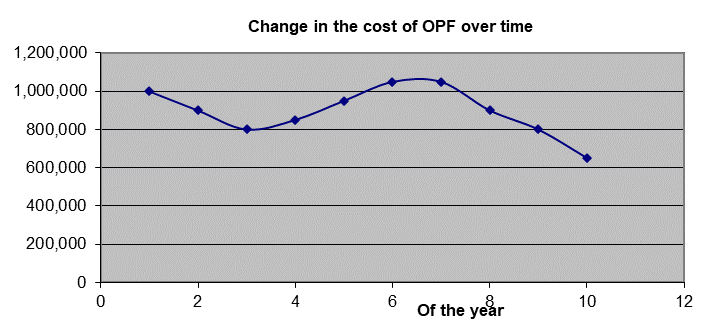

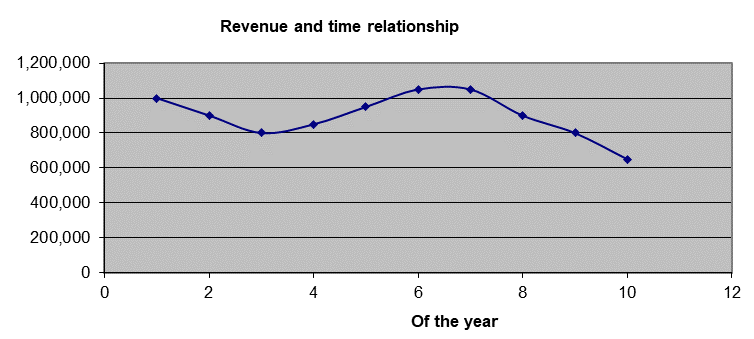

The data presented in Figure

As shown in two tables, the size of income tax should be inextricably connected with residual value of fixed assets and revenue, as well as the tax wager on property should be connected with the residual cost of fixed assets.

Findings

In modern conditions, enterprise management requires a wealth of knowledge in many areas of the economy. Along with management, marketing, accounting and some other areas, the basis of taxation occupy one of the most important places and are an integral part of any enterprise

Conclusion

Skilful management of the tax policy of the enterprise has become one of the main functions of general management. In this regard, the knowledge of the managerial staff of an enterprise of the country's tax system can be a significant advantage for any company. Tax rates, objects of taxation are changing, some benefits are cancelled and new ones are introduced, sources of tax payments are specified. Numerous changes and additions are made to the instructive and methodological material on taxes. All this dramatically increases the flow of information on taxation, which is difficult to keep track of, but must be received in a timely manner. Ignorance of the laws does not exempt from liability for their failure to comply.

Acknowledgments

The authors express their gratitude to of Irkutsk National Research Technical University. The research is supported by state-funded research program.

References

- Blackburn, V. T. Y. H. (1998). Economica, 65, 107–124.

- Ilina, E., & Tyapkina, M. (2016). Enterprise investment attractiveness evaluation method on the base of qualimetry. J. of Appl. Econy Science, 11(2), 302–303.

- Nechaev, A. S., Bovkun, A. S., & Zakharov, S. V. (2017). Innovation Management Characteristics of Industrial Enterprises. Int. Conf. on Quality Management, Transport and Information Security, Information Technologies (IT and QM and IS, 556–559.

- Nechaev, A. S., Ognev, D. V., & Antipina, O. V. (2017). Analysis of Risk Management in Innovation Activity Process. International Conference on Quality Management, Transport and Information Security, Information Technologies (IT and QM and IS), 548–551.

- Nechaev, A. S., & Rasputina, A. V. (2020). Theory of tax variation calculation. IOP Conf. Series: Earth and Environmental Science AGRITECH, 1-7. Retrieved from https://www.researchgate.net/publication/338433808

- Nguyen, Q. T. K., & Almodóvar, P. (2018). Export intensity of foreign subsidiaries of multinational enterprises: The role of trade finance availability. International Business Review, 27(1), 231–245.

- Schymik, J. (2018). Globalization and the evolution of corporate gov-ernance. European Economy Review, 102, 39–61.

- Seoane, F. J. F. (2015). Supporting Innovation Through a Mechanism of Accelerated Depreciation in the Republic of Uzbekistan. Economics World, 3(1-2), 31-46.

- Torugsa, N. A., & Arundel, A. (2017). Rethinking the effect of risk aversion on the benefits of service innovations in public administration agencies. Research Policy, 46(5), 900–910.

- Tyapkina, M., Nechaev, A., & Romanova, T. (2018). Author’s toolkit of the state regulation of the development of leasing. Int. Sci. Conf. “Investment, Con-struction, Real Estate: New Technologies and Special-Purpose Development Priorities” EDP Sciences, France, 212.

- Tyapkina, M. F., & Ilina, E. A. (2018). Assessment of the Reproduction Process of Agri-cultural Enterprises. International Journal of Ecological Economy and Statistic, 39(1), 171–179.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Nechaev, A. S., & Tyapkina, M. F. (2020). Features Of The Tax Component Calculation In The Activities Of Enterprises. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 426-433). European Publisher. https://doi.org/10.15405/epsbs.2020.12.56