Abstract

A necessary condition for the effective functioning of local self-government is the availability of sufficient economic and financial resources. Moreover, as you know, most of the territories in the Russia do not have sufficient funds to solve issues of local importance. The lack of local budget funds to finance the activities of local governments is offset by significant amounts of subsidies, subventions and other types of financial assistance. It is difficult to solve the problems of unbalanced interests without the redistribution of financial assistance in the conditions of high differentiation of the budgetary provision of municipalities and uneven distribution of income-generating property. Achieving financial independence of municipalities and maintaining a sufficient level of fiscal centralization pose new challenges in the field of regional finance management. The article discusses the main approaches to assessing the budgetary independence of territories (municipalities) used in the Russia. The significance of the financial component in the activities of local self-governments is determined. The necessity of a comprehensive analysis of the budgetary independence of municipalities is justified. After analyzing the economic literature, the budget coefficients used to assess the level of budget independence of the territories are studied. An assessment of the budgetary independence of the territories is carried out on the example of one of the cities in the Russia. Problems were found in the field of ensuring the financial independence of local territories in the Russia, insufficiency of own funds to solve issues of local importance and ways to solve them were proposed.

Keywords: Budget coefficientsbudget independenceincomecosts

Introduction

Local self-government is the most important democratic institution in all developed countries. It is a form of self-organization and citizen participation in the development management of the territories in which they live. Russia has experience in the formation and development of local self-government, a new stage of which is associated with the development of a regulatory framework and the adoption of a federal law on the organization of local self-government in the Russian Federation. About a hundred changes and additions were made to the normative act during the validity period. However, the main issues of the functioning of local self-government remain unresolved. First of all, this is the problem of financial independence and the ability of local self-government to solve issues of local importance. (Nechaev & Antipina, 2015). The municipal budget represents the financial basis necessary for the activities of both state authorities and local authorities. The formation and effective management of local budgets is one of the priority areas for the development of the budget system of the Russian Federation in modern economic conditions (Arundel, 2017; Dawson, 2008).

One of the basic principles of the formation and execution of budgets of municipalities is the principle of ensuring the independence of local budgets. It consists, firstly, in the responsibility of local governments to independently ensure the balance of their budgets, as well as the efficient use of budget funds. Secondly, it consists in the independent implementation of the budget process at the local level and in determining the forms and directions of spending of local budgets. Thirdly, it consists in the establishment by local authorities in accordance with the legislation of the Russian Federation on taxes and levies of taxes and fees, the proceeds of which are payable to the local budget (Durham, 2008).

Problem Statement

The presence of a sufficient amount of financial resources ensures that local self-governments achieve high indicators of socio-economic development of municipalities, and also ensures the provision of better municipal services to the population (Koc & Bozdag, 2007). In this regard, it is relevant to consider methods for assessing the financial independence of municipalities.

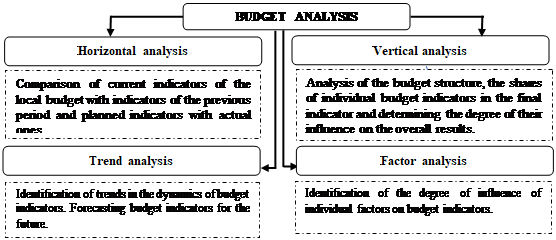

Various approaches can be used for budget analysis, which are presented in Figure

Research Questions

As the main tool for assessing the independence of the federal, regional and local budgets, various budget coefficients are used, which allow us to analyze the budget not only for certain periods of time, but also to compare the characteristics of the budgets of different territories (Salamonsen, 2015).

Based on a generalized analysis of various sources of economic literature in Table

Purpose of the Study

Let us analyze the budget of the municipal formation of the city of Irkutsk, the regional center of the Irkutsk region. This city is the fifth largest city in Siberia with a population of 623.5 thousand at the beginning of 2019. Irkutsk is a large scientific and educational center with over one hundred thousand students. Among the industries there are aircraft, hydropower and food production. Irkutsk is also assigned to the historical settlements of Russia. The historic city center is on the preliminary list of UNESCO World Heritage Sites.

Research Methods

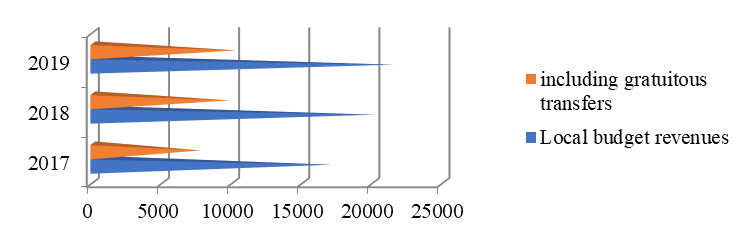

The income structure of the local budget of Irkutsk is presented in Figure

Almost half of the local budget incomes are gratuitous transfers. Moreover, there is a tendency to increase the total income of the municipality for the analyzed period.

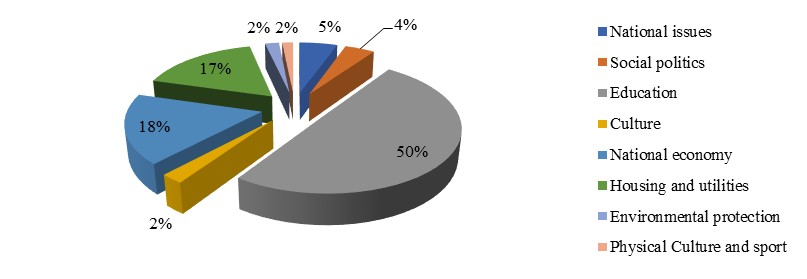

The structure of local budget expenditures in 2019 presented in Figure

In 2019, the social orientation of budget spending was maintained. In general, the share of expenditures aimed at social protection of citizens and the provision of socially significant services in the fields of education, culture and cinematography, healthcare, social policy, physical education and sports, the media, and others was increased.

Findings

The calculation of the coefficients of the local budget of Irkutsk for 2017-2019 is presented in Table

The coefficient of budgetary performance shows that from 26.24 to 32.22 thousand rubles for each time period from 2017 to 2019 falls on each resident in Irkutsk. Compared to 2017 in 2018 there was a significant increase of 4.9 thousand rubles and a decrease in 2019. As a result, we can conclude that 2018 was more favorable compared to the previous and actual year.

The result of calculating the coefficient of budgetary autonomy showed that its value is more than 0.5. This indicates that financial stability is increasing and the level of financial independence of the budget of the municipality is increasing too.

The value of the stability coefficient for the analyzed period is more than 0.5. Thus, we get that the local budget is solvent and liquid.

Calculations of the budget debt coefficient show its average value of about 3 %, which suggests that for the analyzed period no more than 3 % of budget expenditures are not covered by revenues.

The coefficient of budget coverage indicates a budget deficit for the analyzed period, which is a negative factor. To solve this problem, in principle, there are two ways. It is necessary to increase income or reduce costs.

The coefficient of budgetary provision of the population shows the level of budgetary expenditures per inhabitant. A decrease in this indicator by almost five thousand rubles per inhabitant in 2019 indicates a negative trend.

Conclusion

Thus, a complete and reliable assessment of the financial independence of municipalities, the study of conditions for ensuring and eliminating deficiencies in the municipal finance management system are important areas of sustainable socio-economic development of municipalities with the aim of ensuring a decent quality of life for the population based on the implementation of the fiscal budget by local authorities politicians (Weimer & Marin, 2016).

In order to solve the problems of increasing budget independence, it is necessary to increase the budget’s filling with revenues, carry out systematic work to reduce the amount of arrears in payments to the municipal (local) budget, strengthen the control by the administration of revenues and their revenues, and carry out a set of measures aimed at increasing the efficiency of using the municipal property. (Prokopyeva & Nechaev, 2013).

The solution of social problems of the municipal (local) budget depends on the fulfillment of existing expenditure obligations, the prevention of the adoption of new expenditure obligations not secured by revenue sources, and the improvement of social support measures for citizens and the quality of financial management.

Achieving the budgetary independence of the city of Irkutsk and the advisability of maintaining a sufficient level of budgetary centralization pose new challenges in the field of regional finance management. Negative facts include increased aid from budgets of higher levels. The basis of the financial policy of municipal authorities is the principle of independence of local budgets in combination with state financial support.

Acknowledgments

The authors acknowledge receiving support from of Irkutsk National Research Technical University, Irkutsk State Agricultural University named after A. A. Ezhevsky and Bratsk State University. We are responsible for all errors as well as heavy style of the manuscript.

References

- Arundel, A. (2017). Rethinking the effect of risk aversion on the benefits of service innovations in public administration agencies. Research Policy, 46(5), 900-910.

- Dawson, P. J. (2008). Financial development and economic growth in developing countries. Progress in Development Studies, 8(4), 325-331.

- Durham, J. B. (2002). The effects of stock market development on growth and private investment in lower-income countries. Emerging Markets Review, 3(3), 211-232.

- Koc, T., & Bozdag, E. (2017). Measuring the degree of novelty of innovation based on Porter's value chain approach. European Journal of Operational Research, 257(2), 559-567.

- Nechaev, A., & Antipina, O. (2015). Tax stimulation of innovation activities enterprises. Mediterranean Journal of Social Sciences, 6(1 S2), 42.

- Prokopyeva, A. V., & Nechaev, A. S. (2013). Key features of risks of company innovative activities. Middle East Journal of Scientific Research, 17(2), 233-236.

- Salamonsen, K. (2015). The effects of exogenous shocks on the development of regional innovation systems. European Planning Studies, 23(9), 1770-1795.

- Weimer, M., & Marin, L. (2016). The role of law in managing the tension between risk and innovation: introduction to the special issue on regulating new and emerging technologies. European Journal of Risk Regulation, 7(3), 469–474.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Antipina, O. V., Kleymenova, L. V., & Deich, V. Y. (2020). Assessment Of The Budget Independence Of The Territories. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 29-34). European Publisher. https://doi.org/10.15405/epsbs.2020.12.5