Abstract

The level of saturation of the economy with money is determined by several significant factors. In particular, it depends on the development trends of the economy, payment discipline and applicable forms of payments. In modern conditions, the money supply as a macroeconomic indicator correlates and affects the formation of supply and demand, fiscal balance and price stability. Monetary aggregates consist of elements characterized by varying degrees of liquidity and affect income, employment, products and other economic parameters. An analysis of real laws and relationships in the sphere of money supply allow us to assess the qualitative and quantitative composition of monetary aggregates that have a significant impact on the processes occurring in the real Russian sector, which, in the end, has applied interest. The article discusses the theoretical and applied aspects of the formation of the money supply, as well as the specifics of monetary aggregates in the current conditions.

Keywords: Money supplymonetary aggregatesmonetary regulation

Introduction

The volume of money supply and the structure of monetary aggregates are significant macroeconomic indicators affecting price volatility, changes in the volume of output of goods and services, as well as employment and inflation. Cash flow and their dynamics are the totality of monetary relations, which are reflected in the country's payment system, which makes it necessary to study the categories of money supply and monetary aggregates.

Problem Statement

Data on macroeconomic indicators, which reflect the parameters of money and money circulation, allow us to talk about the size of the money supply in a specific time period, as well as about changes in the volume of money supply in the country. This, in turn, makes it possible to draw conclusions about economic development trends and make adequate management decisions.

Research Questions

Money supply has an established concept. This question was developed in classical economic theory.

Due to the need to manage and control the amount of money in circulation, one of the areas of research of money and money circulation revealed the need to measure money supply. The problem of measuring money supply has determined the need to introduce the concepts of “narrow” and “broad” money aggregates, which are the “stock” of money in the economy. So, Friedman and Schwartz (1971) focused on money aggregates:

Purpose of the Study

The goal is to assess the money supply and monetary aggregates. The article discusses the theoretical and practical aspects and characteristics of the money supply and monetary aggregates.

Research Methods

The economy of the Soviet period did not include monetary policy in the toolkit of monetary regulation of the economy. The market economy has made adjustments in the sphere of money and money circulation, which introduced the category of “monetary base” in a narrow and broad definition.

The monetary base in a narrow definition is formed from cash and required reserves of credit organizations in the Bank of Russia. Additionally included balances on correspondent and deposit accounts of credit organizations with the Bank of Russia and Bank of Russia bonds form a broad monetary base.

Findings

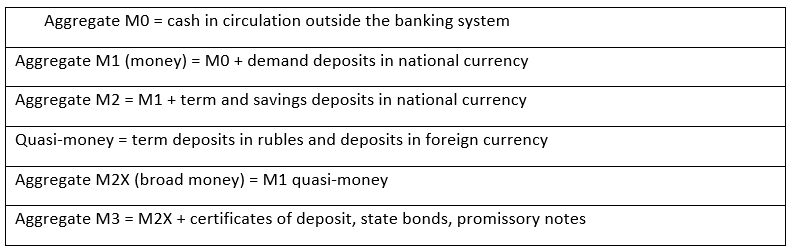

The Bank of Russia, pursuing a monetary policy, began to use monetary aggregates. At the same time, the rules for calculating and analyzing money supply and monetary aggregates according to the methodology of the Bank of Russia determine their sequence from the standpoint of decreasing liquidity, which corresponds to the banking practice of other countries (Golikova & Khokhlenkova, 2000).

As shown in Figure

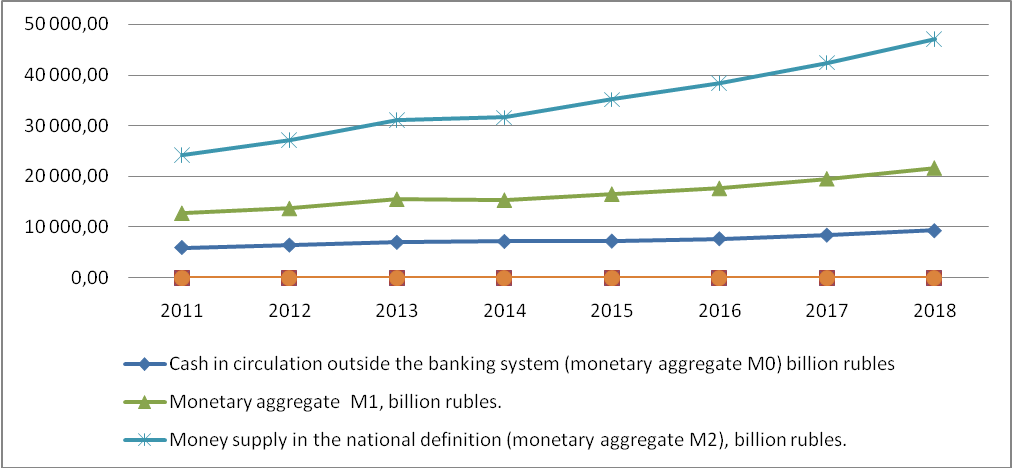

Russian practice of the formation of monetary aggregates for the period 2011–2018 shown in figure

So, according to figure

In general, the

The

The

The

Unlike the

Practice has established that the

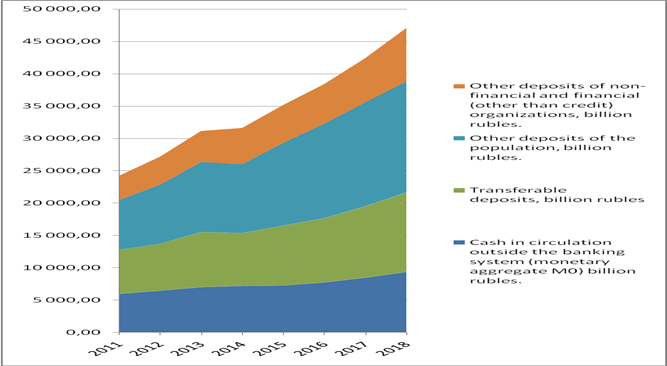

The structure of the money supply in the national definition (monetary aggregate M2) is presented in Figure

Figure

The liquidity of

The

In addition, the active part, which serves the economic turnover, and the passive part, which includes cash accumulations, are distinguished in the money supply. This gradation of quantitative indicators of the money supply forms such statistical indicators as “money” and “quasi-money”. The “money” aggregate is equal to the indicator

The “money” and “quasi-money” aggregates form the “broad money” (

When choosing an object of regulation, it is necessary to take into account the ability of the Central Bank to influence the monetary aggregate and monitor its dynamics. In this case, the monetary aggregate should possess some mandatory properties: dynamics close to the dynamics of the general price level, which allows influencing macroeconomic processes; be easily determined for the possibility of the Central Bank affecting the money supply in circulation; to be accessible to the understanding of economic agents in order to provide them with the opportunity to navigate when developing an economic strategy (Khokhlova & Pakholchenko, 2015; Khokholova, Kretova, Kuznetsova, & Tsaregorodtseva, 2017; Vovseenko, 2018).

The

Conclusion

In Russia, the main monetary aggregate assessing the state of the money supply and representing the object of monetary regulation is indicator

Therefore, an increase in the share of non-cash funds in the banking system has a positive effect on macroeconomic processes and allows monetary authorities to have a greater impact on their dynamics.

Thus, the money supply not only ensures the implementation of payment relations between business entities, but also is an object of regulation of economic activity. The basis of this process is the change in demand for money, the ratio between the components of the money supply, as well as the implementation of monetary policy measures by the Central Bank.

References

- Friedman, M., & Schwartz, A.J. (1971). A monetary history of the United States 1867–1960. Princeton: Publ. by Princeton univer. press.

- Golikova, Yu. S., & Khokhlenkova, M. A. (2000). Bank of Russia: organization of activities: studies. Central Bank of the Russian Federation; Mosk. bank. school. Kn. 1. Moscow: Deca.

- Hayek, F. A. (2007). The Pure Theory of Capital. Chicago.

- Hayek, F. A. (2008). Prices Production and other works. Alabama: Ludwig von Mises Instit.

- Marks, K. (1976). The poverty of Philosophy in Marx-Engels. Collected Works. Vol. 6: Marx and Engels, 1845–1848. New York: Int. Publ.

- Khokhlova, G., & Pakholchenko, V. (2015). Cash Turnover: Construction Models and Progress Prospects. Economic annalis-XXI, 1–29(2), 27–30.

- Khokhlova, G., Kretova, N., & Burov, V. (2019). The problems of investment activity of entrepreneurship and methodological aspects of credit risks assessment. ICRE 2019 IOP Conf. Ser. Mater. Sci. and engineer., 667. Retrieved from: https://.doi:

- Khokholova, G., Kretova, N., Kuznetsova, I., & Tsaregorodtseva, E. (2017). Improvement of financial instruments of innovative activities stimulation Advances in Economics, Business and Management Research. Atlantis press, 38. Retrieved from: https://doi:

- Makarevich, L. M. (2003). In the world of money. Moscow: Tumer.

- Muftahova, O., Nechaev, A., & Antipina, O. (2015). The use of financial and credit tools to minimize the risks in the organization of production. Int. J. of Econ. and Financial Issues, 5(4), 1060–1065.

- Official website of the Bank of Russia. Retrieved from: www. cbr.ru/statistics/macro_itm/dkfs/

- Ricardo, D. (2004). On the principles of political economy and taxation, by Liberty Fund, Inc

- Tayurskaya, O. V., Okladnikova, D. R., & Solodova, N. G. (2018). Investment in the regional economy: challenges and prospects. Proc. of Int. Conf. on Res. Paradigms Transform. in Soc. Sci. “The European Proceedings of Social & Behavioural Sciences” EpSBS 1161–1168.

- Tayurskaya, O. V., Okladnikova, D. R., & Bibarsov, K. R. (2019). Problems of labour market development in remote regions – information society: health, economy and law. Mater. of the Int. sci. and pract. conf. (pp. 313–319). (Network Institute of Continuing Professional Education).

- Thornton, H. (2016). An enquiry into the nature and effects of the paper credit of Great Britain (1802). Creative Media Patners, LLC.

- Tyapkina, M. F., Ilina, E. A., & Mongush, J. D. (2016). The Effect of Innovative Processes on the Cyclical Nature of Economic Development IEJME. Mathem. Ed., 11(6), 1519–1527.

- Vovseenko, E. A. (2018). financial Instruments and Hedging: New Rules of IFRS European. Proc. of Soc. and Behavioural Sci., L. https: //dx.doi.org/

- Usoskin, V. M. (1976). Theory of money. Moscow: Thought.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Kretova, N. V., Ilyashevich, N. P., Kretova, A. А., & Xinshan, L. (2020). Money Supply As An Indicator Of Monetary Regulation. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 368-374). European Publisher. https://doi.org/10.15405/epsbs.2020.12.48