Abstract

The modern conditions show that the effectiveness of monetary regulation is largely determined by the organization of payment relations. The various mechanisms connect payment relations and economic subjects. The institutions of central banks, credit organizations and their branches have a special place in the national payment system. They are not only payers and recipients of money, but also provide cash settlement services to customers and conduct interbank settlements. The purpose of the article is the need to identify the mechanism of the influence of the organization of payment relations on the effectiveness of state regulation of economic activity, in particular, of the monetary policy. As a result, the work focused on the solution of such most important problems as: Firstly, the study of theoretical and methodological aspects of calculating indicators, which characterize the security of economy with cash; Secondly, the identification of trends in underlying macroeconomic indicators; Thirdly, the identification of factors, affecting the organization of payment system and the state of monetary sphere. The authors studied the methods for calculating such indicators as the velocity of money circulation and the coefficient of monetization. In addition, the article reflects the possibility of their use in modern practice of statistical work in the field of money circulation.

Keywords: Payment relationsmoney supplymonetary regulation

Introduction

The combination of various forms and the purposes of payments, their methods, information technology, cash management services and communication systems form the basis of the payment system, in particular, the payment mechanism. Payment relations between economic subjects are implemented by the use of the elements of this mechanism and the service is provided for the reproduction process. The efficiency of the regulation of monetary sphere also depends on it.

The influence of payment relations is ambiguous on the reproduction process in a competitive environment: on the one hand, changes in the payment mechanism stimulate the processes of production, distribution, exchange and consumption, and on the other, the state can limit the economic activity of economic subjects and its regulation. Russia has the stability of payment relations that arises between market subjects in fulfilling settlement obligations. They increase the efficiency of the state regulation of economic activity in order to ensure investment and innovative activity of business subjects.

Problem Statement

The forms of payment have a significant impact on payment relations between participants in the reproduction process and are directly determined by the specific features of a particular settlement mechanism, namely, by using cash or non-cash money, as well as close substitutes for money that can serve as a means of payment. Russia has legislatively established the rules for the functioning of payment system, including the legal regulation of payments and settlements, etc.

For example, cash payments are made by simply transferring money from a payer to a recipient and are governed by national rules for cash transactions. Cashless payments are organized taking into account the national legislation of a country and the characteristics of business turnover, i.e. according to the principles, compliance with which allows timely, reliable and efficient settlements.

The use of money substitutes in the calculations is carried out taking into account contractual relations and regulatory acts that directly or indirectly regulate the possibility of making payments. The economic literature highlights negative and positive features for business and the state. In particular, such calculations have a “non-monetary” form and the lack of instant liquidity, a forced acceptance by economic subjects and high discounts upon secondary circulation. Moreover, they are used throughout Russia, have the potentially unlimited circle of new owners (holders, endorsers) and the presence of the means of payment or offsetting. The presence of monetary surrogates and the various schemes of “settlement” of debt obligations in payment relations is a characteristic phenomenon in countries where there are various “barriers” that reduce the efficiency of economic activities of economic subjects and state regulation. At the same time, the “real” value balance is violated by overpricing. Business and investment activity decreases, cash accumulates in the “shadow” sector of the economy and capital goes abroad. There is the need to study the role of payment relations in the implementation and regulation of economic activity because of the changes in the payment mechanism under the influence of various kinds of factors.

Research Questions

The issues of the study of payment turnover have always been associated with such key parameters of a market economy as price dynamics, employment, ensuring investment activity and economic growth, which is reflected in the works of many scientists.

J.M. Keynes focused on the issues of “liquidity preference” and “effective demand”. He believed that the main tool of state monetary policy is reducing interest rates to increase investment (Keynes, 1936). Monetarists believed that it was more important to control the rate of increase in the amount of money in circulation than the rate of interest. They revealed the importance of the central bank as an “independent financial structure” that exists to “control financial policy and prevent it from becoming the subject of political manipulation” (Friedman, 1996).

The researchers also focused on the analysis of the functional features of money and its transformation as the competitive environment develops (Usoskin, 1976).

In the process of development of commodity production, a payment mechanism was formed, which in practice was the simplest act of sale. Then it became the complex form of exchange, including not only various market subjects.

The process of the development of commodity production formed a payment mechanism, which was the simplest act of sale. Then it became a complex form of exchange, including not only various market entities, but also financial institutions (Pashkus, 1990). Payment relations have their own specifics in crisis conditions, which deform market “signals” and affect economic development (Checheleva, 2003).

At the same time, the effectiveness of economic activity is closely related to the problems of introducing innovations (Folomiev & Geiger, 1997). Increased investment activity has a multiplier effect for introducing innovations in the various sectors of the economy (Tyapkina, Ilina, & Mongush, 2016). In this regard, it is important to form the investment resources to implement innovative projects at the level of Russian regions (Tayurskaya, Okladnikova, & Solodova, 2018). The financial support of Russian innovation activity is characterized by weak business activity of small and medium-sized businesses, insufficient volumes of own investment resources, high risks of borrowing funds and, accordingly, the cost of credit resources (Khokhlova & Okladnikova, 2014). The existing mechanisms of state monetary and tax incentives are not fully able to activate innovation processes. (Khokhlova, Kuznetsova, Kretova, & Tsaregorodtseva, 2017). There is an increasing need to step up government support measures for businesses through the mechanisms of interaction between public and private structures (Tayurskaya, Okladnikova, & Bibarsov, 2019). The study of business risks arising from the implementation of investment projects allows developing ways to reduce them and fulfilling payment obligations (Vovseenko, 2018).

Purpose of the Study

The purpose of the study is to analyze the mechanism of the influence of the organization of payment relations on the economic activity of business subjects. In this regard, it can be assumed that the disclosure of theoretical and methodological aspects, the analysis of trends in fundamental macroeconomic indicators and factors that affect the organization of the payment system and the state of the monetary sector will allow strategic decisions to be made at various levels of management.

Research Methods

The calculation and analysis of monetary indicators is applied. Its results are aimed not only at assessing the state of the money supply and its aggregates, but also at such quantities as the velocity of money circulation and the monetization coefficient, which are closely related to the organization of payments and settlements.

The development of the conceptual and methodological provisions for calculating these indicators is based on the simplified equation of exchange of I. Fisher, which reflects the dependence of the nominal national product and the mass of money in circulation:

where V – velocity of money; P – price level; T – trade volume; М – amount of money in circulation (Fisher, 2001).

The equation shows that there is an inverse relationship between money supply and money velocity: the higher the money velocity, the less money is needed to service transactions.

This indicator is difficult to directly quantify, therefore, indirect methods are used to characterize the intensification of the movement of money when they function as a means of circulation and means of payment. For example, the Russian practice of statistical work using the official methodology has the average annual money supply velocity is calculated as the ratio of nominal GDP to the monetary aggregate

,

where

The calculation of this indicator allows eliminating from the calculation duplicate deductions for writing off funds, and it is advisable to build the practice of statistical work on the value of the cash receipts of all institutional units (Kosoy, 2005). The complexity of the calculations lies in the fact that there are no relevant statistical records. Therefore, we can use the dynamics of this indicator in comparable periods to estimate the pace of the acceleration or deceleration of the velocity of money circulation.

Monetization coefficient is the value of the reverse velocity of money and is determined by the formula:

where K – monetization coefficient; Y – annual national income.

This indicator is used to analyze the degree of cash security of economy. According to statistics from the Bank of Russia, the monetization coefficient can be calculated as the ratio of the average annual value of the money supply

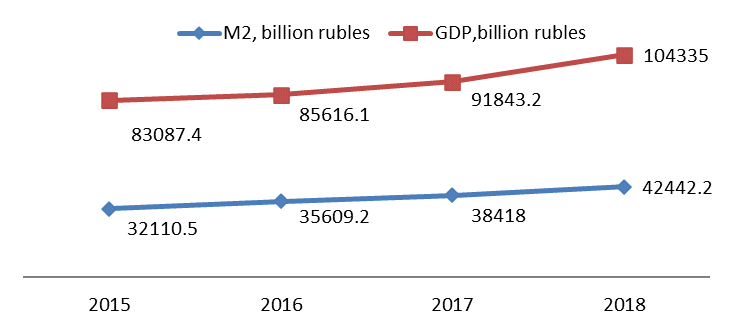

According to the Bank of Russia, the M2 aggregate (money supply in the national definition) for 2018 showed an increase of 11.0 %, for 2017 by 10.5 %. The growth rate of the broad money supply in 2018 was 12.3 %, in 2017 it was 7.4 % (Оfficial site of the Bank of Russia, 2016). The growth of the broad money supply was mainly due to an increase in the volume of ruble deposits of the population and organizations. In particular, household deposits in rubles in 2018 increased by 10.9 %, organizations by 11.5 % (Оfficial site of the Bank of Russia, 2018a). The dynamics of deposits was influenced by the preservation of attractive interest rates. However, due to the depreciation of the ruble against foreign currencies in 2018, the level of “valuation” of deposits increased (Оfficial site of the Bank of Russia, 2018b).

Figure

January 1 2019, this value amounted to 27.2 %, including on deposits of organizations – 35.7 %, on deposits of the population – 20.5 %. For comparison, on January 1, 2018, this value was 25.8 %; 33.4 and 19.9 % respectively (Official site of the Bank of Russia, 2019).

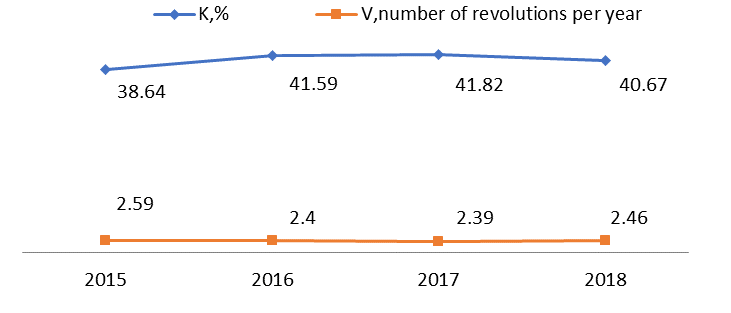

Figure

It is legitimate to use the following model for a more accurate calculation of the monetization coefficient:

where MMS – monetary part of the money supply; MNMS – non-monetary parts of the money supply.

This model shows that the total monetization coefficient K is the sum of the monetary monetization coefficient Km and the coefficient, which can be called the “surrogate monetization” coefficient Knm. The method of calculating the coefficient reflects the scale of the substitution of money by surrogates (Namozov, 2000). At the same time, the non-monetary part of the money supply can be presented in more detail depending on the country’s debt settlement schemes and settlements in the “shadow” sector of the economy.

In recent decades, modern communication technologies are actively developing around the world and electronic payment systems are spreading. The economic literature has a concept of the idea of the impact of private issuance in the form of electronic money on such macroeconomic indicators as the central bank's share premium, money supply and the velocity of money, namely:

it is possible to lose share premium by central banks because of the use of electronic money. In this case, there are two ways to prevent the loss of share premium: the monopolization of the issue of electronic money or an increase in reserve requirements;

the uncontrolled issue of electronic money makes a sharp increase in the money supply and the acceleration of inflation. One of the preventive measures may be linking the value of electronic money emissions to the size of demand deposits and introducing a mandatory reserve in the amount of this issue;

the influence of electronic money on the velocity of the money supply can lead to inflation even without an additional increase in money supply, but the return on the effectiveness of calculations and optimization of economic turnover will be higher than the risk of inflation (Shamraev, 2000).

In turn, an increase in the index of saturation of the economy with money indicates an increase in savings in the banking system and creates conditions for economic growth and investment.

Findings

Summarizing the materials of the study of payment relations and their role in the implementation and regulation of economic activity, we can assume that:

Firstly, the structure of monetary aggregates, the dynamics of the velocity of money and the coefficient of monetization are the most important quantitative indicators of the monetary sphere and the economic activity of business subjects and characterize the state of payment relations;

secondly, practical experience indicates that the countries with a specific payment structure, a significant proportion of which, as a rule, are money surrogates or there are settlements and accumulations of the “shadow” sector of the economy, usually in foreign currencies, have the monetization coefficient several times lower than the countries with developed market relations;

thirdly, the trends in the velocity of money are largely determined by:

the level of credit investments in the economy, for example, the larger the volume of lending, the lower the velocity of money supply;

the share of fixed-term bank deposits in the money supply and settlements in the “shadow” economy, but if growth in savings in the banking system contributes to the creation of credit resources and positively affects the development of the economy, then the "shadow" payment schemes reduce the collection of cash in cash banks, increasing their share in the total mass of means of payment, and reduce tax revenues to the budget;

fourthly, the development of payment electronic technologies contributes to the acceleration of money turnover, which, on the one hand, leads to a reduction in the amount of money invested in calculations, but, on the other hand, to an increase in money supply and inflation.

Conclusion

The competition and dynamism of economic relations in a market environment has led not only to the increase in the number of payments and complication of settlement mechanisms, but also to increased requirements for the speed and reliability of their implementation. It can be assumed that the results of this study can be recommended for the analysis of payment relations, which will contribute to:

achieving a balance between the demand for money and their supply in the economy, ensuring "transparency", improving the efficiency of managing money resources of economic subjects and regulating economic activity;

reducing distribution costs by reducing the need for cash;

the accumulation of temporarily free cash in bank institutions, thereby, on the one hand, reducing inflationary losses on the savings of customers held in bank accounts, on the other hand, increasing the volume of credit resources for investment activities;

transparency and validity of calculations and the effectiveness of counteracting the legalization of proceeds from crime and the financing of terrorism.

References

- Checheleva, T. V. (2003). Effective economic growth: theory and practice. Moscow: Exam.

- Fisher, I. (2001). The purchasing power of money. Moscow: Delo.

- Folomiev, A. N., & Geiger, E. A. (1997). Management of Innovation: Theory and Practice. Moscow: RAGS Publication House.

- Friedman, M. (1996). Quantitative theory of money. Moscow: Elf -press.

- Keynes, J. M. (1936). The General Theory of Employment, Interest and Money (Kindle DX version). Retrieved from: http://cas2.umkc.edu/economics/people/facultypages/kregel/courses/econ645/ winter2011/ generaltheory.pdf

- Khokhlova, G. I., Kuznetsova, I. A., Kretova, N. V., & Tsaregorodtseva, E. Y. (2017). Improvement of financial instruments of innovative activities` stimulation. Proc. of the Int. Conf. on Trends of Technolog. and Innovat. in Econ. and Soc. Studies “Advances in Economics, Business and Management Research”, 38, 304–311.

- Khokhlova, G. I., & Okladnikova, D. R. (2014). Classification of factors as grounds for analysis of innovative-investment activity of small and medium business Middle. East J. of Sci. Res., 20(8), 900–904.

- Kosoy, A. M. (2005). Payment turnover: research and recommendationst. Moscow: Finance and statistics.

- Namozov, O. (2000). On the causes of the monetary deficit in the transition economy. Money and credit, 6, 41–46.

- Official site of Russian Statistic Service. (2017). Retrieved from: www.gks.ru/free_doc/new_site/ vvp/vvp-god/tab1a.xls

- Official site of the Bank of Russia. (2011). Retrieved from: https://cbr.ru/Collection/ Collection/ File/7591/ Bbs1112r.pdf

- Official site of the Bank of Russia. (2016). Retrieved from: https://cbr.ru/Collection/Collection/File/7531/ Bbs1612r.pdf

- Official site of the Bank of Russia. (2018a). Retrieved from: https://www.cbr.ru/collection/collection/file/ 19699/ar_2018.pdf

- Official site of the Bank of Russia. (2018b). Retrieved from: https://cbr.ru/Collection/Collection/File/ 4213/ Bbs1812r.pdf

- Official site of the Bank of Russia. (2019). Retrieved from: https://cbr.ru/Collection/Collection/File/ 25711/ Bbs_1912r.pdf

- Pashkus, Yu. V. (1990). Money: past and present. Leningrad: Publ. house of Leningrad State University.

- Shamraev, A. V. (2000). The monetary component of the payment system: legal and economic approaches. Money and credit, 4, 38–41.

- Tayurskaya, O. V., Okladnikova, D. R., & Bibarsov, K. R. (2019). Support for small businesses in the manufacturing sector: ways to develop and improve efficiency. Econ. and entrepreneurship, 5, 710–715.

- Tayurskaya, O. V., Okladnikova, D. R., & Solodova, N. G. (2018). Investment in the regional economy: challenges and prospects. Proceedings of International Conference on Research Paradigms Transformation in Social Sciences. The Europ, Procee, of Social & Behavioural Sciences EpSBS, L, 1161–1168.

- Tyapkina, M. F., Ilina, E. A., & Mongush, J. D. (2016). The Effect of Innovative Processes on the Cyclical Nature of Economic Development IEJME. Mathematics Education, 11, 1519–1527

- Usoskin, V. M. (1976). Theories of money. Moscow: Thought.

- Vovseenko, E. A. (2018). Financial Instruments and Hedging: New Rules of IFRS. European Proceedings of Social and Behavioural Sciences, L. Retrieved from: https://dx.doi.org/10.15405/epsbs.2018.12

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Khokhlova, G. I., Chernykh, A. G., Khokhlova, A. Y., & Paretsky, I. I. (2020). Payment Relations And Their Impact On The Efficiency Of Economic Activity. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 329-336). European Publisher. https://doi.org/10.15405/epsbs.2020.12.43