Abstract

The relevance of the research is based on a critical shortage of infrastructure of spatial data in order to ensure the process of state cadastral evaluation. For many years has been intensively challenging in the designations of cadastral value in Russia, which is one of the factors of imperfection of the cadastral evaluation system. The article contains analysis of the common problems in the formation of real estate objects list and their characteristics with a view to identifying the cadastral value. This analysis identified that information on quantitative and qualitative property characteristics often contain inaccuracies, errors or non-existent. Thus, the lack or inaccuracy of the information makes it difficult to determine the cadastral value of the real estate objects, since this information is basic to determine the price forming factors in evaluation. The result of the ongoing evaluation depend directly on the availability and reliability of such information. This confirms the need to develop additional methods for collecting, updating and systematizing information about valuation objects, which will allow us to create a populated database of basic information on quantitative, qualitative characteristics that can be used in the process of determining the cadastral value. The development of information resources implies possibilities for extension of the value proposition in determining the cadastral value. Thus, there is a need to improve the information support of the cadastral evaluation system, thereby increasing the reliability of the evaluation results and the budget increase.

Keywords: Evaluationtaxcadastrepropertyvaluefactors

Introduction

The importance of state cadastral evaluation is growing with a development of financial and tax mechanisms. The objective results of the cadastral evaluation contribute to the proper taxation of real estate, and consequently, the sustainability of the formed budget. Meanwhile, the issues in the theory and practice of cadastral evaluation are not well defined, which is confirmed by the works of many scientists (Animica, 2012; Bogachev, 2017; Ivanenko, 2014; Savinykh, 2019; Sternik, Sternik, & Lapko, 2010; Volovich, 2014). This emphasizes the importance and relevance of this direction.

The system of state cadastral evaluation for tax purposes specifies the implementation of the economic management methods, as well as improve effectiveness of real estate usage. Despite the frequent changes in the structure and content of the methodological instructions about determining of the cadastral value, the basis for the formation of a list of objects and collecting data about the value of the property were cadastral information and information about registered rights. To date, the principal source of information about the values of the price-forming factors is the data of the Federal State Registration, Cadastre and Cartography, that is information of a Uniform State Register of Property in semantic and graphical form.

When formulating the list of the evaluation subject, quantitative and qualitative characteristics are indicated. On-call cadastral cards served as a basis for the formation of digital thematic cards and for graphic display price-forming factors. In addition to this data, other sources are used as well as all available in organizations and institutions information funds and databases, address digital plans, digital thematic maps, archives of technical inventory authority, and other sources represented in the information systems.

Despite the fact that the Uniform State Register of Property in our country started operating relatively recently, this register was established by databases force before January 1, 2017 (State Cadastre of Property and Unified State Register of Rights). This combination is aimed at addressing duplication of information, as well as preventing errors. Over the past two decades, the State Information Resource has undergone changes. This concerns not only structure, but also the federal executive authority, general documents.

Problem Statement

At the international level, an important role in the formation of information systems, including cadastral, plays a Bathurst Declaration, signed in 1999 (The Bathurst Declaration…, 1999). In drafting and approving of this Declaration participated forty world’s leading experts from twenty-five developed and developing countries with experience in various fields (geodesy, jurisprudence, economics, evaluation, geography, planning, information technologies, government management, etc.), including experts from six UN agencies and from the World Bank. According to this Declaration, to ensure that solutions of land management resources in accordance with sustainable development, information systems should integrate a wider spectrum of data, information and knowledge. Therefore, information systems of land resources need to be supplemented with variety of data sets, depending on the needs and demands of the society and the state. And besides, this systems should be open and accessible to all interested persons in order to be able to anticipate economic, social, environmental, demographic or other trends.

The Declaration also focuses on the cadastre – the information system, which contains data about plots, including information about rights (limitations, liability). The land cadastre is designed not only for the account the characteristics and legal transactions, but also for the sound land management, as well as for fiscal purposes. Thus, as a one of the main objectives of maintenance of a real estate cadastre, is information gathering for fair taxation.

In many foreign countries, the basis for the formation of an evaluation list of objects and their characteristics provided by the information systems, including cadastral. In each country, general approaches for maintaining information systems have been formed, but they are, however, have some features that manifest themselves at different forms, content, nature or administration level.

Research Questions

Based on the analysis of cadastral registration systems in different countries, it is possible to identify the following common features. In most countries, there is a problem of lack of information about some of the property objects due to illegal use of these objects, or the lack of registered titles to this objects. In this case, limited information on real estate complicates the work of cadastral registration, as well as the calculation of the tax base. The fullness of registers varies greatly regarding the real property characteristics, including with regard to the approach to the definition of real estate. In some countries, the registration of property is carried out in different registers, in which sometimes there is a contradiction in the information about the objects, which complicates the work. The administrating system of property registers is also varied: in some countries the administration of information registers is carried out at one state level, in others – at different levels. In some countries, there are no agreed systems for collecting and processing information on real estate. Nevertheless, there is a sustainable development of cadastral systems in the form of integration of real estate management in the overall system. The main direction of the development of information systems is the creation of relevant databases and the use of automated control methods.

Thus, the modern concept of a cadastre in the world is closely connected with information systems about real estate, and in some cases it is a unified register. The state supports this system, which is designed to accounting physical, legal, economic, and other special documented information about real estate, as well as for fiscal and management purposes. An important element in the process of valuation of real estate is the collection and updating of data contained in such registers.

Purpose of the Study

Formation of a new property tax model based on the cadastral value allows to consider economic and social factors. But only if the cadastral valuation will have objective results in the conditions of market and other information related to the economic characteristics of using real property. It should be noted, that the high quality of information systems helps to stimulate investment in real estate. Including our country holds 35th place in the rating of the World Economic Forum's "Global Competitiveness" (among 190 countries) (Doing Business…, 2019). It plays an important role for the state cadastral valuation, because due to the improvement of the procedure for registration of property, fewer objects remain in the informal sector. But at the same time, we can note the low quality of the basic information about qualitative and quantitative characteristics of real estate objects. Information on the characteristics and price forming factors of the evaluation subject should be carefully analyzed, because there are a number of unresolved problems in this area. It is important, on the one hand, to take into account the experience gained by developed countries, on the other hand, to find effective approaches to solve existing problems in accordance with the characteristics of our country.

Research Methods

Consider the most common problems in forming a list of real estate and their characteristics with a view to identifying the cadastral value.

Firstly, the lack of enshrined real estate object edges. As shown in Table

Along with the lack of information about the location of borders, there are errors and inaccuracies that are widespread in our country and are closely related (Gubanishcheva & Khloptsov, 2017, par. 2, p. 54) (Figure

Secondly, the list of evaluation subjects does not contain information about the land in which the building is located. Further check is required of such linkages, establishing binding buildings to land plots. It is necessary to compare the types of authorized using a land and the appointment of buildings, that are not always comparable. For land plots, it is necessary to monitor the correctness of binding to units of cadastral division, as well as in this case there are inconsistencies too.

Thirdly, verification of the authorized using type of land and the appointment of buildings is a significant element in the formation of cost factors. The main problem that exists today is the multiplicity of authorized using. Therefore, sometimes there is no possibility of establishing a specific type. You should also pay attention to the conformity of the type of authorized using and the actual use of real estate.

Fourth, this is a poor quality of basic information. Many characteristics of objects contain incorrect information or non-existent. Table

Findings

Thus, the lack and inaccuracy of information makes it difficult to determine the cadastral value of real estate. The importance of regulation of information systems for the economic and social development of the country is high, which is confirmed by foreign experience. This area requires special attention from the state and citizens, since information about real estate plays an important role in taxation. The availability of information about real estate is the basis for the formation of price forming factors during the cadastral valuation.

The determination of the cadastral value involves the calculation of the most probable price of the property object at which it available to purchase. The determination of the cadastral value includes the collection of information about values of price forming factors. A modern theoretical and empirical analysis of the influence of factors on the value of real estate is presented in the works of foreign scientists (Davis & Palumbo, 2008; Fischel, 1980; Glaeser & Ward, 2009; Handy & Niemeier, 1997; Huang & Tang, 2012; Kok, Monkkonen, & Quigley, 2014; Kowalski & Paraskevopoulos, 1990).

Our analysis leads to the understanding that in models of mass valuation, it is necessary to take as a basis a higher number of price forming factors - qualitative and quantitative characteristics that affect on cadastral value of a land plot (for example, location of a land plot, availability of communications, infrastructure, environmental externalities, etc.). It should be targeted on the existing foreign experience, choosing the most suitable models for specific situations.

The collection of information on the values of price forming factors plays an important role in determining the objective cadastral value. World practice confirms that the collection of information on real estate is an important aspect for sound evaluation, therefore, in some countries, additional information is provided, including from taxpayers.

Published by the United Nations Human Settlements Program (UN-HABITAT), Real Estate Tax in Europe contains an analysis of information on cadastral and valuation systems (Property Tax…, 2013). For example, modern computer-based mass valuation systems are integrated with the tax administration and geographic information systems (GIS), which provides and facilitates the collection and accounting of taxes.

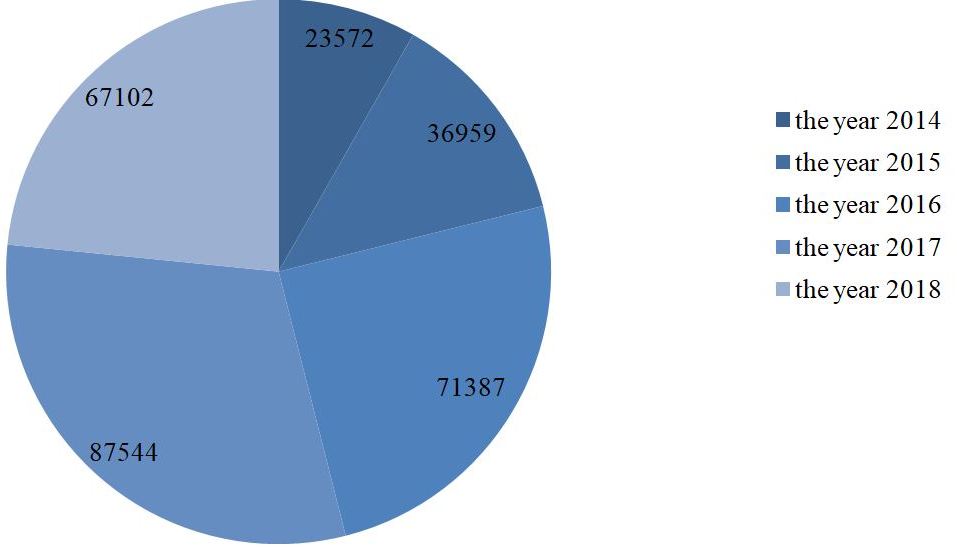

As the analysis showed, information on the quantitative and qualitative characteristics of real estate often contains inaccuracies, errors, or non-exist. The result of evaluation directly depends on the availability and reliability of such information. As practice shows, only a small number of objects has all the necessary information. In this context, already at the initial phase of cadastral valuation, many problems arise. This affects the results of the cadastral valuation, and as a result, the tax base, as there is an active challenging of the cadastral value (Figure

According to the law, it is the responsibility of a budgetary institution to submit available information about real estate to the registration authority. However, accounting for this information at the legislative level is not provided. To date, the entry of information is fixed, for example, through cadastral documents (Figure

Conclusion

The perceived lack on the basis of information received characterizes distorting the results of the cadastral valuation. This confirms the need to develop additional methods for collecting, updating and systematizing information about valuation objects, which will allow us to create a populated database of basic information on quantitative, qualitative characteristics that can be used in the process of determining the cadastral value.

The development of information resources makes it possible to expand the cost factors in determining the cadastral value. Thus, there is a need to improve the information support of the cadastral valuation system, which will increase the reliability of the valuation results and the budget increase.

References

- Animica, P. E. (2012). Real estate taxation: foreign experience and Russian prospects. Finance and credit, 44(524), 28–34. Retrieved from: https://www.fin-izdat.ru/journal/fc/detail.php?ID=53885

- Bogachev, S. V. (2017). Real estate tax. Property relations in the Russian Federation, 4(187), 68–73. Retrieved from: http://www.iovrf.ru/mag.php?id=192

- Davis, M. A., & Palumbo, M. G. (2008). The price of residential land in large US cities. Journal of Urban Economics, 63(1), 352-384.

- Doing Business. The World Bank. (2019). Retrieved from: http://russian.doingbusiness.org/ru/rankings

- Federal State Registration, Cadastre and Cartography. (2020). Retrieved from: https:// rosreestr.ru/

- Fischel, W. A. (1980). Zoning and the exercise of monopoly power: A reevaluation. Journal of Urban Economics, 8(3), 283-293.

- Glaeser, E. L., & Ward, B. A. (2009). The causes and consequences of land use regulation: Evidence from Greater Boston. Journal of urban Economics, 65(3), 265-278.

- Gubanischeva, M. A., & Khloptsov, D. M. (2017). Land acquisition for state or municipal needs: possible ways to improve. Property relations in the Russian Federation, 8(191), 52–61. Retrieved from: http://www.iovrf.ru/mag.php?id=197

- Handy, S. L., & Niemeier, D. A. (1997). Measuring accessibility: an exploration of issues and alternatives. Environment and Planning A, 29(7), 1175–1194.

- Huang, H., & Tang, Y. (2012). Residential land use regulation and the US housing price cycle between 2000 and 2009. Journal of Urban Economics, 71(1), 93-99.

- Ivanenko, D. E. (2014). Aspects of cadastral valuation of real estate: institutional experience of foreign countries. Property relations in the Russian Federation, 1(148), 16–24. Retrieved from: http://www.iovrf.ru/mag.php?id=151

- Kok, N., Monkkonen, P., & Quigley, J. M. (2014). Land use regulations and the value of land and housing: An intra-metropolitan analysis. Journal of Urban Economics, 81, 136-148.

- Kowalski, J. G., & Paraskevopoulos, C. C. (1990). The impact of location on urban industrial land prices. Journal of Urban Economics, 27(1), 16–24.

- Property Tax Regimes in Europe. (2013). UN-HABITAT. Retrieved from: https://oldweb.unhabitat.org/books/property-tax-regimes-in-europe/

- Public Cadastral Map. Federal State Registration, Cadastre and Cartography. (2020). Retrieved from: https://pkk5.rosreestr.ru/

- Savinykh, V. A. (2019). To the problem of the right to update cadastral value. Property relations in the Russian Federation, 6(213), 73–92.

- Sternik, S. G., Sternik, G. M., & Lapko, K. S. (2010). Mass valuation of real estate for tax purposes: problems and solutions. Financial analytics: problem and solution, 12(36), 2–12. Retrieved from: https://www.fin-izdat.ru/journal/fa/detail.php?ID=31453

- The Bathurst Declaration on Land Administration for Sustainable Development. (1999). Retrieved from: http://www.fig.net/resources/publications/figpub/pub21/figpub21.asp

- Volovich, N. V. (2014). Transition to taxation of capital construction objects at their cadastral value. Part 1. Property relations in the Russian Federation, 6(153), 71–89. Retrieved from: http://www.iovrf.ru/mag.php?id=156

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Gubanishcheva, M. A. (2020). Development Of Information Support During The Cadastral Assessing. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 298-305). European Publisher. https://doi.org/10.15405/epsbs.2020.12.39