Abstract

The article determines the relevance of methods for improving the investment climate in the Russian Federation, defines the concept of the investment climate and its difference from the concept of investment attractiveness, formulates problems of ensuring the favorable investment climate accompanied by the influence of negative political and economic factors. The investment climate was evaluated on the basis of international and national ratings, as well as some macroeconomic indicators. The authors revealed an obvious contradiction between the ranking position of the Russian Federation which takes into account business conditions and between statistical indicators of the level of direct foreign investment and investment in non-financial assets. Based on the assessment, the most attractive macroregions and regions were identified. Summarizing the information, changes in the legal framework were identified. They can intensify investment activities in Russia. In addition, other measures implemented at the federal level to ensure a favorable investment climate and sustainable development of the economy were identified. In conclusion, recommendations for further optimization of the investment climate were formulated: reduction of the administrative pressure on business, simplification of the communication between regulatory and supervisory authorities, municipalities and business; improving quality and accessibility of government support measures; infrastructure improvement, etc.

Keywords: Investment climateformationdevelopmentfactorsperspectives

Introduction

Over the last five years, the economy of the Russian Federation has developed in unfavorable conditions, as a result of which a number of systemic problems have arisen. Their solution is important, but requires an integrated scientific approach. Among these problems are the low dynamics of economic development, a decline in the living standards, high prices and a low income level, unfavorable conditions for the development of small and medium-sized businesses, etc. In addition, as a result of such factors as price instability oil, trade wars and sanctions, the investment climate is unfavorable.

Problem Statement

The favorable investment climate is one of the conditions for ensuring sustainable development of the economy. At the same time, both the attractiveness of economic entities for foreign investors and feasibility and profitability of investment within the country are important. Since in recent years, the influx of foreign investment has been reduced, it is advisable to assess the current state of the investment climate in the Russian Federation, to identify key problems and directions for their solution.

Research Questions

The investment climate is interpreted in different ways in the scientific literature. The authors define the investment climate as a complex factor reflecting the influence of political, economic, social, and legal factors; conditions and development of the investment, capital and labor markets; the aggregate demand and aggregate supply; development of economic sectors, and especially foreign trade (Poluyanov & Golovchanskaya, 2014).

Some authors (Plotkina, Biryukova, & Kovaleva, 2017) consider the investment climate as an element of investment attractiveness, since each of these categories characterizes conditions for investment activities and its effectiveness, noting that without the influence of investment policies on the investment climate, it is impossible to improve attractiveness. However, we consider the investment climate to be a more capacious category. That is, an economic entity (enterprise, industry, region) can be attractive, while functioning in a region, industry or country where the investment climate is unfavorable, and, conversely, the positive investment climate is not a guarantee of high investment attractiveness of the economic entity.

Purpose of the Study

The purpose of the study is to identify key problems of investment climate development in the Russian Federation, assess measures aimed at improving the investment climate and formulate recommendations on development of favorable conditions for investment activities.

Research Methods

The methods used in the study are induction, deduction, comparison, generalization, and analysis.

Findings

Methods for assessing the investment climate of the country as a whole and individual economic entities are diverse. The most popular of them are ranking methods used by the World Bank, the International Institute for Management Development International Institute for Management Development (IMD), the Foreign Investment Advisory Council (FIAC), RAEKS-Anatitika, etc. (Skvortsova & Kondratieva, 2019).

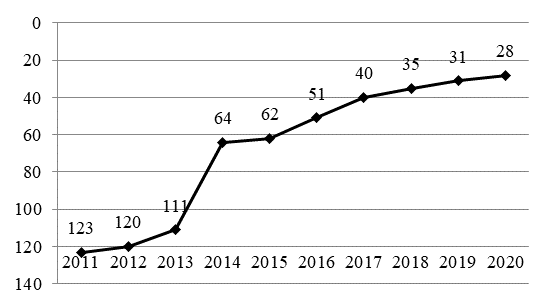

Let us consider the dynamics of Russian positions in the Doing Business World Bank ranking, which takes into account such groups of indicators as registration procedures, procedures for obtaining building permits, connecting to the electricity supply system, property registration procedures, protecting minority investors, taxation policies, international trade, enforcement of contracts and resolution of insolvency. The dynamics of the Russia's ranking over the past 10 years is shown in Figure

As follows from the data presented, since 2011 the position of Russia has a tendency to the sustainable growth, i.e. the investment climate has improved.

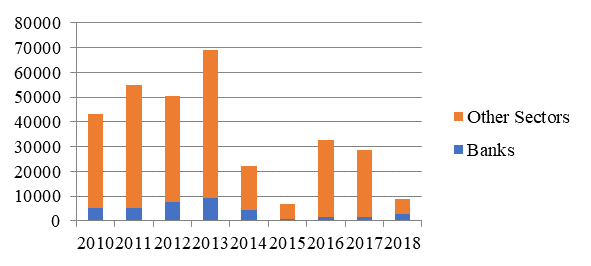

Since any evaluation technique has its advantages and disadvantages, it is not practical to draw conclusions using one indicator. Obviously, the investment climate can be evaluated by the dynamics of investment. Figure

Until 2014, there was an increase in the volume of foreign direct investment in the banking and other sectors. Since 2014, there has been a significant decline in FDI, with the largest decline in 2015. In 2016–2017, there was a slight increase, in 2018 there was a significant decrease in FDI, the investment climate was unfavorable.

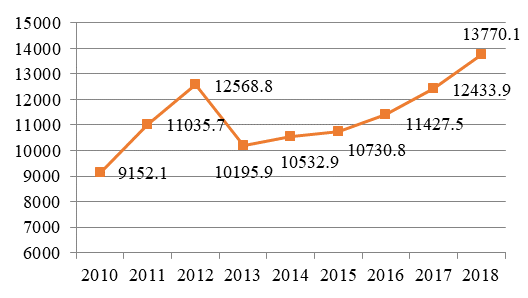

Given that after the imposition of sanctions, the Russian government launched an import substitution policy (Alexandrova & Ryabinnikov, 2019), the current situation is due to investment activities of Russian investors. Let us evaluate the dynamics of investments in non-financial assets in 2010–2018. (Figure

There is no significant increase in the level of financial investments. Undoubtedly, there is a positive trend; however, given the decline in the cost of money, we cannot talk about a significant increase in investment activities.

Despite the improvement of positions among other countries, the level of investment activities in the Russian Federation has decreased – the volume of foreign investment has declined significantly, and a slight increase is not able to level the current negative trend.

The attempts to improve the situation are more targeted than systemic – the Doing Business ranking is based on assessments of simplicity of technical procedures for conducting business and the level of its legal protection. But it does not take into account the monetary, budgetary and legislative policies affecting the economy. Therefore, countries with high positions in the ranking can be extremely far from each other in terms of real investment attractiveness.

At the same time, according to the study by the international auditing company Ernst and Yang (2019) , in Russia the number of FDI-financed projects has changed insignificantly – in 2018, the number of FDI decreased by 11 % (238 projects in 2017), which corresponds to the pan-European trend of a decrease in the total number of projects and a decrease in investment activity due to Brexit and the slowdown in economic growth in Europe. For comparison, in 2010 the number of such projects was 201, in 2014 – 125, in 2015 – 201. With reduced funding, investors do not leave the Russian market, i.e. business conditions are still satisfactory.

The economic development and the investment climate in Russian regions. Yeslukova Maevsky, and Cheberko (2019) assessed the volume of investment attraction in the macroregions. The leader is the Central macroregion. In 2018, it accounted for about 24 % of the total Russian volume. One more attractive region is the Ural-Siberian macro-region (about 17 %). The North-West macro-region (10 %) ranks third followed by the Volga-Kama, Far Eastern and Southern macro-regions. The Volga-Ural macro-region accounts for about 6 % of investment in fixed assets. The indicator of 5 % was observed in the Angara-Yenisei and South Siberian macroregions. The Central Chernozem (4 %), North Caucasian (3 %) and Northern (2 %) macroregions have lower indicators.

With the undisputed leadership of the Central and Ural-Siberian macro-regions, there is a significant gap between them and other macro-regions. Within them, there are regions which account for at least a quarter of the total volume of attracted investments in fixed assets of the macroregion (Yelsukov, Maevsky, & Cheberko, 2019).

The same conclusions can be drawn by examining the results of the National ranking of the investment climate in the Russian regions. This ranking is calculated on 44 indicators in 4 areas: the regulatory environment, business institutions, infrastructure and resources, support for small businesses. Non-ranking indicators are also taken into account. The quality of public services is an indicator of effectiveness of various public services: travel time, number of procedures and satisfaction of entrepreneurs with typical administrative procedures. According to the results of 2019, Moscow, the Republic of Tatarstan, the Tyumen Region, the Kaluga Region and St. Petersburg are leaders.

Thus, the investment climate is not favorable enough – there is a decrease in foreign direct investment, an insignificant increase in domestic investment, significant differences in the level of development of investment infrastructure in the regions, as a result of which the distribution of investment funds is uneven.

Despite the unfavorable situation, federal and regional bodies aim to optimize the investment climate, including in the legislative sphere.

In pursuance of the Decree of the President of the Russian Federation of May 7, 2018 No. 204 “On National Goals and Strategic Tasks of the Development of the Russian Federation for the Period until 2024”, in October 2019, the Prime Minister signed an order "On protection and promotion of investment and development of investment activities in the Russian Federation". Adoption of this act will contribute to the implementation of new technologies, creation of new products, medicines, new professions and specialties.

The law also provides for a new procedure for carrying out investment activities, providing preferences to companies willing to invest in the Russian economy, thereby increasing the number of investors in order to improve the business climate in the country.

Thus, the conditions for doing businessare improving; at the same time, it is necessary to solve systemic problems, such as bureaucratization of procedures, corruption, lack of equal access to government orders and contracts (Khodasevich & Shalamova, 2018), etc.

Conclusion

The investment climate as a set of conditions for carrying out investment activities is not favorable in Russia. It is evident from the dynamics of foreign and national investment volumes. Measures are taken to improve the business environment in order to increase the investment attractiveness of the country and companies. As a result, some positive results have already been achieved.

Given the current situation, further implementation of measures to improve the investment climate is required: protection of rights and legitimate interests of businesses and investment entities; reduction of administrative pressure on business; simplification of the communication between regulatory authorities, municipalities and businesses; tax support measures (reduced tax rates, deductions, tax holidays, etc.); improvement of quality and accessibility of government support measures, quality and accessibility of labor resources; integrated infrastructure development; development of the competitive environment and improvement of the efficiency of companies with public participation; reduction in government participation in competitive markets; financial support for investment activities (lowering the level of equilibrium interest rates, increasing the portfolio of corporate loans and the number of profitable projects by increasing the rate of household savings).

References

- Alexandrova, E. N., & Ryabinnikov, D. V. (2019). Features of implementation of the import substitution policy as a tool to increase economic security of the state. Actual problem of the modern economic, 4, 345.

- Central Bank of the Russian Federation. (2019). Statististik Bulletin of the Bank of Russia, 12(319). Retrieved from: http://www.cbr.ru/collection/collection/file/25711/bbs_1912r.pdf

- Doing Business (2019). Rating of the countries 2020. Retrieved from: https://russian.doingbusiness.org

- Ernst & Young (2019). How to manage investor confidence? Study of investment attractiveness of European countries. Russia. Retrieved from: https://www.ey.com/Publication/vwLUAssets/ey-european-attractiveness-survey-2019-rus/$FILE/ey-european-attractiveness-survey-2019-rus.pdf

- Federal State Statistics Service of the Russian Federation. (2019). Russian statistical yearbook. Retrieved from: https://www.gks.ru/folder/210/document/12994

- Khodasevich, O. N., & Shalamova, E. Yu. (2018). Corruption in the public procurement system. Concept, 3. Retrieved from: https://cyberleninka.ru/article/n/korruptsiya-v-sfere-gosudarstvennyh-zakupok-1

- Plotkina, A. R., Biryukova, L. V., & Kovaleva, M. V. (2017). Assessment of investment attractiveness of the Khabarovsk Territory. Bulletin of Khabarovsk University of Economic and Law, 2, 64.

- Poluyanov, V. P., & Golovchanskaya, M. A. (2014). Organizational and economic mechanism for investing industrial and economic activities of the housing and communal services enterprise. Donetsk: Southeast.

- Skvortsova, G. G., & Kondratieva, O. A. (2019). Modern methods of assessing the country's investment climate: opportunities and disadvantages. Bulletin of Tver State University Series Economic and Managing, 3(47), 25–26.

- Yelsukov, M. Yu., Maevsky, A. V., & Cheberko, E.F. (2019). Investment climate and investment attractiveness of macro-regions of Russia. Managing Consulting, 12, 70–89.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Golovchanskaya, M. A., Rabotkina, S. V., Bolotova, V. V., & Mezentseva, J. R. (2020). Current Trends In The Investment Climate Improvement In The Russian Federation. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 275-280). European Publisher. https://doi.org/10.15405/epsbs.2020.12.36