Abstract

A two-tier banking system is one of the most effective regulatory instruments in the market economy. By changing the amount of money supply, the Central Bank (a regulator) can accelerate the economic growth or, on the contrary, keep it down. The regulator can influence the volume of money supply only if commercial banks follow its orders. The quick response of the bank community is ensured by means of competition. Therefore, the Central Bank does not regulate the behavior of commercial banks using administrative tools. If commercial banks bear unlimited liability for its obligations, it is enough for them to use marginalization opportunities provided by the Central Bank. Thus, they will contribute to the effective use of the most valuable resource of the Central Bank – money. However, failures of a commercial bank may have negative effects on the whole bank system and its efficiency at the most inopportune moment. Therefore, the Central Bank can tighten control over the behavior of a commercial bank by regulating its operations. However, this control does not limit the healthy desire of a commercial bank to make a profit by selling money to wealthy clients. In other words, the Regulator has to make a choice between “efficiency” and “stability” of the banking system. After the crisis of 2014, the Bank of Russia shifted the focus of its activities from the first goal to the second one. This had a negative effect on the efficiency of the Russian bank system.

Keywords: Mortgage amnestymoral riskdistribution effects

Introduction

The modern Russian banking system has existed since 1992, when the first commercial banks were created. At first, the number of private banks exceeded 3.000; now, there are less than 500 banks. The two-tier banking system of Russia was preceded by a single-tier banking system of the USSR. In the USSR, all cash settlements and money supply regulation were carried out by the State Bank of the USSR. In the socialist economy, the money supply regulation was conditional, since both competition and private entrepreneurship (Keynes, 2007) were banned. In fact, the State Bank performed accounting functions and increased money supply only in accordance with government plans. Enterprises were not allowed to independently use their money. Financial control carried out by the State Bank was administrative; there was no indirect regulation through economic incentives.

In the 1990s, Russian commercial banks enriched themselves in the most exotic ways. For several years, the real value of the discount rate was negative. Financial discipline was weak. Customers cheating and deliberate reduction of the bank liquidity was normal. Banks often laundered money obtained in a criminal way (Fedotov, 2015). In 2004, the crisis of non-confidence broke out. After the crisis, the Bank of Russia created the Deposit Insurance Association (DIA) (Hogan & Johnson, 2016; Vernikov, 2018). Financial discipline has steadily tightened, and control of the Central Bank has become strict. In the end, the Regulator began to use administrative tools to influence operations of the commercial banks. Currently, the Russian banking system is immune to market signals emanating from the private sector of the economy.

Problem Statement

The Central Bank needs commercial banks as a tool for influencing the money supply and the economy as a whole. However, this tool will be effective only if commercial banks are free to choose ways to make a profit. Only in this case money will be used efficiently, and the increasing money supply will be transformed into the economic growth. However, if commercial banks are not controlled, the entire financial system of the country can be destroyed due to regular “bank raids”. This encourages the Regulator to maintain control over commercial banks to the detriment of their economic efficiency. It is necessary to look for an optimal balance of “freedom" and “control” (Bogatyreva, Kolmakov, & Kolmakov, 2018).

Research Questions

The Bank of Russia aims to make the banking system of Russia as stable as possible. To this end, the Bank strengthened control over activities of commercial banks by specifying requirements for assets and operations of commercial banks and using direct administrative methods. Russian commercial banks are not free to choose their profit maximization tools. In addition, in case of banking panic, the Bank of Russia will save troubled banks (e.g., Otkrytie and Bin-bank). The Bank of Russia encourages the spread of moral hazard in the banking community (Allen, Carletti, Goldstein, & Leonello, 2015). The largest banks operating in the Russian financial market are state-owned. This means that the rule of unlimited liability is not a restriction for them. According to the theory, the combination of these conditions will decrease the efficiency of the banking system.

Purpose of the Study

The article aims to analyze a set of decisions made by the Bank of Russia for the last several years. These actions of the Regulator decreased the demand of the private sector of the economy. Having lost the opportunity to take on the burden of business risks, commercial banks stopped financing projects that seem to be the most profitable. An increasing number of loan agreements is concentrated in the public sector of the Russian economy, where the return on investment is small.

Research Methods

The system of US commercial banks proved to be a great tool to stimulate economic growth in the middle of the XIX century. Initially the system of commercial banks was not regulated by the government. Banking business relied on the principles of private initiative and unlimited liability (Hansen, 2006). However, in 1908, during the crisis in the trust fund market (Krugman, 2009), it was discovered that activities of banks are influenced by powerful external factors. The most important of them is the banking panic which can destroy the national financial system in a short time. To eliminate the influence of negative factors, administrative regulation of credit institutions, especially banks, was implemented. The purpose of the regulation is to make the banking system “stable”. Stability implies immunity to self-destructive impulses. To achieve this goal, it is necessary to prevent and suppress risky operations of commercial banks.

The downside of administrative regulation is inefficiency of the banking sector as a tool for creating the most valuable resource – money. This is due to weak incentives of the banking sector to search for risky ways to make a profit which may cause excessive bureaucratic control over “disobedient” banks. One more type of distortion of market signals caused by administrative regulation is a moral risk which pushes banks (or their customers) to take risky actions. The basic rule can be formulated as follows: any attempt to limit competition in the financial market deteriorates the quality of the banking system (Rukstad, 1994).

We do not blame the Bank of Russia for the economic failures in last 5–6 years. The Bank is not responsible for the 2014 crisis because the managers of the Bank of Russia abandoned purely market-based methods for regulating the financial market which were used by the Central Banks of developed countries during the recent liquidity crisis (Usoskin, 2017).

Findings

Recently, it became known that the Board of the Bank of Russia is going to allow mortgage borrowers to suspend loan payments. Of course, this rule can be applied only to some debtors who have lost their jobs. This humane rule speaks for the fact that the Bank of Russia has run off the course and is wandering in the archipelago of decisions that are not typical of the monetary regulator in the market economy.

What is the central bank for? It supplies money for the economic development. If the Central Bank is competent to perform this task, the question arises “Has it done everything for the national economy?”. Yes, the Central Bank has done everything it could. Commercial banks engaged in financial operations should help the Central Bank. All the attempts to influence the economy otherwise than through monetary signals are harmful. Commercial bankers have a better qualification than the managers of the Central Bank in the matter of making a profit, and they do not need the advice of the Central Bank. However, it is the desire to control, popular with the Government of Russia, that has seized the managers of the Bank of Russia.

The “amnesty” for borrowers who have lost their jobs is an undisguised attempt to “fix” the impact of the market through bureaucratic intervention. Indeed, in Russia, mortgage lending was implemented more than one decade ago. Borrowers and banks have already experienced two crises and one stagnation, and there was nothing supernatural in the mortgage market. There were no thousands of families expelled from their houses. There were no banks that burst due to the inability of borrowers to pay their debts. The market manages to deal with these problems. We cannot say exactly how the market solves these problems. There are only hypotheses.

The initiative of the Bank of Russia raises several questions. First, how is the regulator going to solve the notorious moral risk issue? How to prevent the negative behavior of people? After all, the Bank of Russia provides debtors with a new guarantee (at the expense of banks). Some borrowers will try to get the financial gain (Bonus). Workers will quit their jobs since the loss of jobs will be partially compensated by the bank. For the same reason, people who have lost their jobs will not search for new ones. Unemployment will increase causing a decrease in GDP. These are the most obvious consequences of the initiative of the Bank of Russia.

The employer and the employee can make a deal: the employee “loses” his job and gets the right to bank compensation continuing to work for the company. It is a kind of an additional tax imposed on commercial banks and transferred to the employer–employee couple. Distribution effects illustrated in Figure

The parameters of the labor market are the salary rate (w) and the number of employees (L). The equilibrium salary rate was initially equal to

The Bonus does not affect the behavior of the employer guided by the rule

As a result, the equilibrium salary rate drops to

Figure

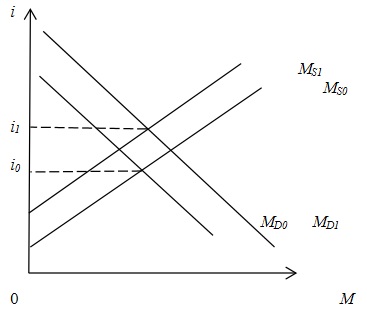

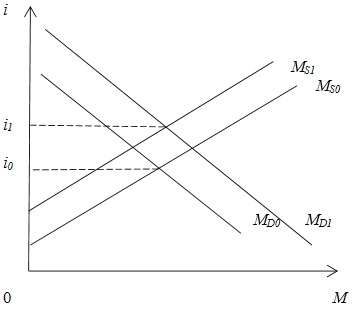

Distributional effects will occur in the credit market. Figure

In Figure

Knowing the nature of Homo economics, it can be argued that the Bonus will cause a targeted flow of resources from one economic agent to another one. Even the insignificant distribution effects lead economic agents away from market goals. Every next administrative innovation might turn out to be the straw that will break the back of the banking market.

The second question to the management of the Bank of Russia can be formulated as follows: “If you really want the Bonus to be an effective tool rather than a populist idea, how are you going to control commercial banks”? The innovation of the Bank of Russia imposes additional restrictions on commercial banks. There is no doubt that commercial banks will try to dodge these restrictions to get competitive advantages. They will sabotage the new initiative of the Bank of Russia. Indeed, the “job loss” criterion is rather vague, it has too many interpretations which will make the sabotage policy quite effective.

In these conditions, the Bank of Russia has to control the commercial banks. The Bank of Russia will not have strict criteria for evaluating operations of commercial banks. Therefore, it has only two solutions. Either the Bank of Russia uses special controllers (option – additional functions of controllers assigned to this bank), or it relies on the judicial decisions. Both options are no good.

Controllers assigned to the banks are not able to keep track of all the parameters of the activities of the commercial bank. Scandalous bank failures when the most valuable assets were taken out from under the very nose of the controllers are a vivid example. Moreover, as the recent bankruptcy of the “Business Systems” bank (DS-Bank) shows, the quis custodiet ipsos custodies fear is relevant for the Russian banking system (Sergeev & Rubnikovich, 2018).

It means that the employees of the Bank of Russia warned the management of the commercial bank about the audit. The unfair management of the commercial bank will try to bribe the controller. Thus, the institution of controllers (authorized representatives) acting on behalf of the Central Bank seems meaningless. Information asymmetry causes abuses (Fedotov, 2018).

Generally speaking, the efficient monitoring of commercial banks is a significant problem for the Bank of Russia. Administrative control is often “blind” which allows commercial banks to implement criminal policies. The law on maximum loan interest rates is a vivid example. Since market interest rates were significantly higher, commercial banks began to use equilibrium (market) interest rates disguising them as “commission” and “insurance” rates. The monitoring of operations of commercial banks is a time-consuming task. Therefore, the Bank of Russia does not do this. It can be seen from the statements of the Bank of Russia which publishes the dynamics of nominal loan interest rates. The field check shows that these data do not include insurance rates. The Bank of Russia does not have any reliable method for detecting violations committed by commercial banks. Although, it could ask any bank employee to conclude a standard credit agreement with a commercial bank to detect the violations. However, the management of the Bank of Russia trusts in formal indicators which show the efficiency of the monetary policy of the Bank of Russia – loan interest rates have reached their historical minimum. The fact that commercial banks violating instructions of the Bank of Russia use the equilibrium interest rate is undoubtedly useful for the economy. The credit market returns to the state when available resources are used in an optimal way. The only significant consequence of these laws (on the maximum loan interest rate) is the legal nihilism of lenders and borrowers. This is exactly the case when "severity of the laws is leveled by optionality of their implementation." It is much more reasonable to cancel the law which is impossible to enforce or not to adopt it at all.

The monitoring based on judicial decisions is ineffective as well. Judicial decisions will support pragmatic decisions (conclusion of a credit agreement under conditions that violate the regulations of the Bank of Russia). In other words, the judicial authorities like the commercial banks will try to circumvent external circumstances.

One more issue is the purpose of administrative regulation that violates the delicate work of a competitive market mechanism. It has negative effects on the distribution and use of limited public resources. Why does the Bank of Russia believe that it can solve economic problems more effectively than the market itself? Why are goals set by the Bank of Russia more important than those set by the market?

The Bank of Russia began to use administrative measures as tools for achieving its goal (Kurgansky, 2016). The decisions on maximum loan interest rates and maximum deposit rates, salvation of the banks “Otkryitie” and BIN-Bank, excessive specification of risks and assets are vivid examples of administrative policies of the Bank of Russia. The Bank of Russia tried to ensure the stability of the Russian banking system. Now, according to the management of the Bank of Russia, this goal has finally been achieved. In any case, all the criteria developed by the Bank of Russia speak for this fact. This success prompted the Bank of Russia to control the banking sector of the economy.

The value of “stability” of the banking system is insignificant. The foreign central banks care and cherish commercial banks and use them as tools for creating money supply. The fierce competition between commercial banks decrease interest rates and makes loans affordable for each household and enterprise. This allows the Central Bank to influence the financial market and the economy as a whole because commercial banks respond to price signals coming from the regulator.

It is hard to imagine why the Bank of Russia has been implementing administrative regulation measures. It might be due to the desire to manage the economy in a manual way. However, the results of this policy are obvious: in Russia, the share of total household debts is only 13% of the GDP. In comparison with the countries that changed planned economic relations by market ones, this value is insignificant after almost one and a half decades of rapid growth of the Russian economy. The management of the Bank of Russia shows concern about a high level of a debt load on Russian households.

According to the Regulator, this is a sign of mass defaults of households. If the forecasts of the Bank of Russia are justified, the banking sector will experience trouble. However, the high level of indebtedness of the private sector of the economy is the most popular topic of the management of central banks around the world (Greenspan, 2008). This concern is unreasonable. For example, the managers of the Bank of Russia associate debt indicators with the amount of incomes. Over the last five years, Russian household incomes have not been growing. Simultaneously with the growing debt load, the market price of assets has been rising. This means that the debt load does not increase. In addition, the share of loan payments in the household budget has not changed since 2013 (2018).

Conclusion

The low share of bank debt in relation to GDP means that the Bank of Russia is not able to use the banking system as an effective tool for regulating the economy. It cannot reduce the loan interest rate. This rate is more than 10 % (for mortgages, it is slightly below 10 %). This is due to high transaction costs and the desire of commercial banks to be profitable. Most of the Russian banks are engaged in consumer lending. High transaction costs and ignorance of products with low profitability are symptoms of monopolism. This disease can be prevented by competition (Bogatyreva et al., 2018). However, Russia is afraid of competition with its “unpredictability” and requirement for highly qualified managers of commercial banks. Interest rates are high while the national economy has been experiencing business depression for the last five years. In this situation, the Bank of Russia can be proud of “stability” of the useless banking system (Bogatyreva et al., 2018).

References

- Allen, F., Carletti, E., Goldstein, I., & Leonello, A. (2015). Moral hazard and government guarantees in the banking industry. Journal of Financial Regulation, 1(1), 30-50.

- Bogatyreva, M., Kolmakov, A., & Kolmakov, M. (2018). Russian banking system: searching for trust. In MATEC Web of Conferences (Vol. 212, p. 08016). EDP Sciences.

- Fedotov, D. Yu. (2015). The impact of the tax system on the shadow economy. Finance and credit, 41(665), 10–21.

- Fedotov, D. Yu. (2018). Analysis of Federal Tax Revenue Forecasts in Russia. Finance and credit, 12(780), 2849–2862.

- Greenspan, A. (2008). The Epoch of Shocks: Problems and Perspectives of the Global Financial System. Moscow: Alpina Busin. Book.

- Hansen, A. (2006). Monetary Theory and Financial Policy. Moscow: Delo.

- Hogan, T., & Johnson, K. (2016). Alternatives to the federal deposit insurance corporation. Independent Review, 20(3), 433–454.

- Keynes, J. M. (2007). The general theory of employment, interest and money. Favorites. Moscow: Eksmo.

- Krugman, P. (2009). Return of the Great Depression? The global crisis through the eyes of a Nobel laureate. Moscow: Eksmo.

- Kurgansky, S. A. (2016). Inflation factors in Russia in 2016. Bulletin of the Irkutsk State Econmy Academy, 26(2), 229–241.

- Rukstad, M. G. (1994). Macroeconomic Decision Making in the World Economy. Text and Cases. Hardcover: The Dryden Press.

- Sergeev, N., & Rubnikovich, O. (2018). The Bank was stolen by a call from the Central Bank. Kommersant, 225.

- Tatarinova, L. V., & Plotnikova, V. A. (2018). Factors that affect the mortgage lending in the Russian Federation. Business. Education Right, 4(45), 208–216.

- Trofimov, E. A., & Trofimova, T. I. (2018). K voprosu o diskriminatsii na ros-siyskom rynke truda [On the issue of discrimination in the Russian labour market]. Bulletin of Baikal State University, 28(3), 419-425.

- Usoskin, V. M. (2017). Money in the national and world economy. Moscow: Magistr.

- Vernikov, A. V. (2018). Misuse of the Institute on the example of Bank Deposit insurance in Russia. Banking, 6, 34–39.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

07 December 2020

Article Doi

eBook ISBN

978-1-80296-095-2

Publisher

European Publisher

Volume

96

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-833

Subjects

Management, human resources, resource efficiency, investment, infrastructure, research and development

Cite this article as:

Bogatyreva, M. V., Tagarov, B. Z., & Kolmakov, M. A. (2020). Transformation of the Bank of Russia Into the USSR State Bank. In A. S. Nechaev, V. I. Bunkovsky, G. M. Beregova, P. A. Lontsikh, & A. S. Bovkun (Eds.), Trends and Innovations in Economic Studies, Science on Baikal Session, vol 96. European Proceedings of Social and Behavioural Sciences (pp. 75-82). European Publisher. https://doi.org/10.15405/epsbs.2020.12.11