Abstract

The banking sector is vital for the economy of every country as it plays the role of managing the country’s financial assets. Financial Technology (fintech) become an important issue in corporate world debate today. FinTech is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. This study examines the nexus of financial technology (technology spending ratios and research and development intensity towards financial performance of commercial bank in Malaysia, Singapore & Thailand. This study used a regression analysis in order to examine the impact of observed variables. The findings shows that there is an impact of technology spending ratios and R& D intensity towards bank performance. However, the outcome varies for each sample data as a different country has its own banking regulations and policies. Consequently, the findings of this study could be used an indicator for the banks to evaluate their investment allocation in technology advancement.

Keywords: Banks performancefinancial technologyfintech investment

Introduction

The banking sector is vital for the economy of every country as it plays the role of managing the country’s financial assets. Traditional banking is characterised by physical decentralisation, with branches scattered around populated areas providing a ubiquitous presence (Jayawardhena & Foley, 2000). However, traditional banking alone is not sufficient to strive through the technology-centred world today. According to Feng and Wu (2018) firms must actively invest in new technology to provide higher quality products, deliver better customer services, boost revenue and cut costs in order to stay competitive in the market. Information technology or widely known as IT is the study or use of systems (especially computers and telecommunications) for storing, retrieving, and sending information (Oxford Dictionary, 2006). Berger (2003) defined IT as innovations in information processing, telecommunications, and related technologies. IT can be categorized generally to software applications and computer hardware. Beccalli (2007) refers to IT investments as the total estimated revenues paid to vendors for IT, hardware, software and IT services. Hitt and Brynjolfsson (1996) explained that IT investments have served to increase firm productivity and consumer value, lowered the entry barriers, eliminated market inefficiencies that enable a firm to maintain monopoly power, and intensified market competition, thereby failing to create any lasting return to the investing firm. However, a potential competitive advantage from IT may be diminished if peer firms make similar investments in IT (Mata et al., 1995).

Hall and Khan (2003) highlighted that technology is not a choice of whether to or not to adopt but rather about when to adopt them. Technologies bring online banking and transactional websites to exist. According to DeYoung et al. (2007), the period in which internet banking is a relatively new phenomenon is in the year-end 1999 through year-end 2001 for banks in the U.S. Since technology and internet in banking was applied for years, banks today need to spend more of their capital on financial technology investment as technology in the market today moves rapidly. Deloitte, a multinational professional services network explains that a step for digital transformation is getting a better handle on data to extract the greatest value from technology investments. Investing in different technologies can maximize value for the firm. Blockchain and financial technology (fintech) have been the type of technologies mostly discussed in the financial industry nowadays. In reality, blockchain existed a few years back even when people are not aware of it. Blockchain and fintech being the technologies that most banks are trying to get their hands on are not the same thing, but they somehow related to each other. Blockchain or usually known as the public ledger is a distributed ledger technology that provides a historical record of all transactions that have taken place across a peer-to-peer network (Boireau, 2018). Blockchain technology connects people from a different geographical location that may not know each other to have the same access to a constantly updated digital ledger that cannot be altered. Michael et al. (2018) defined blockchain as the mechanism that facilitates peer-to-peer transactions without the need for an intermediary or a centralized authority to update and maintain the information generated by the transactions.

Financial institutions started to invest in blockchain technology as blockchain applications are used for financial transactions, as a platform for issuing and trading of equity shares and corporate bonds as well as claiming insurance. This technology brings convenience to both banks and customers. By using blockchain for record-keeping, money transfers and other back-end functions, the transaction costs are reduced, less paper consumed, and more time is being saved. Banks are mostly built on a centralized database and that made them more vulnerable to cyber-attack. As blockchain is not made to be easily modified, any disruption to the certain block in the chain will not affect all the other blocks and thus less harm can occur.

Most traditional banks are collaborating with fintech firms in their operation to deliver the best consumer experiences and to create a stronger entity together. This is one of the examples in fintech investment. Fintech improves the activities in financial services even though it is sometimes seen negatively by financial regulators such as the governments and banks. Fintech refers to an organization where financial services are delivered through a better experience using digital technologies to reduce costs, increase revenue and remove friction (Marous,2018). Fintech investment can be defined as an investment that focuses on technology-driven innovation in financial infrastructure, products, services, and distribution. In developing countries like China and India, 50% of the digitally literate citizens are using at least one fintech product as per E&Y’s report. In Malaysia, several top banks such as Maybank, Hong Leong Bank, RHB Bank, Public Bank and CIMB Bank has already invested hugely in technologies since the past few years.

Lee and Shin (2018) grouped fintech business models into 6 categories namely payment, wealth management, crowdfunding, lending, capital market and insurance services. In the payment business model, one of the examples is mobile payment services which include charging to a phone bill, barcode or QR code and direct mobile payment without using credit card companies. Samsung Pay is one of the digital payment platforms in Malaysia collaborated with Maybank, CIMB, Hong Leong Bank, RHB Bank, Public Bank and a few more banks to offer cashless transactions for users. Alipay, an eWallet payment method partnered up with Maybank, Public Bank and CIMB in Malaysia to serve the eWallet services. Those banks act as the settlement and merchant acquirer bank to facilitate Alipay. Instead of viewing fintech firms as competitors, banks should work together with them to maximize productivity. Shawn Ward, the CEO and Co-Founder of Geezeo, highlighted fintech benefits for banking: fintech improves profitability and enhance performance by improving the health of traditional financial institutions, enhance loan portfolio diversification and fintech partnerships help to secure credit card processing, transferring money and quick processing of loans. Moreover, the technology of cloud where mostly fintech firms are using is another tool in delivering product offers and services specifically tailored to individual customers in real-time. Lee and Shin (2018) discovered that traditional financial institutions are investing in fintech in a variety of ways. First, collaborating with fintechs or technology companies. Second, outsourcing fintech services from fintechs. Third, providing venture capital to fintechs. Fourth, accelerating fintech startups. Fifth, acquiring or buying fintechs and lastly, developing internal fintechs. Technologies bring benefits to financial institutions including banks. The emergence of various new types of technologies encourages banks in investing to win over their competitors in terms of profitability and reach a bigger market. Financial theory suggests that managers should make management decisions that maximise the value of the firm. Thus, this stimulates the interest in examining the impact of financial technology investment on banks performance that might facilitate managers in making the right investment decision.

Problem Statement

Lack of studies on the impact of financial technology investment toward banks in South East Asia especially Malaysia, Thailand and Singapore are one of the reasons this study is being carried out. Most of the past literature focused on South Korea (Huang et al., 2006; Lee et al., 2016). A recent issue in Malaysia is on the safety of online banking account of CIMB Bank. In 2018, two articles dated 18 December by The Edge Markets and 7 December by The Star Online reported that CIMB Click users claimed that their online banking account was hacked. There was an unauthorised transaction where the funds from their accounts had been transferred out to PayPal. CIMB management decided to update their system with the ability to accommodate passwords longer than eight characters and up to 20 characters and added the reCaptcha security measure to mitigate this issue. Investment in strong cybersecurity is really crucial, especially for banks. The cyber intrusion may bring direct and indirect negative effect on banks' image as well as performance.

Referring to the EY Global Banking Report with the title “EY Global Banking Outlook 2018”, 85% of banks cited for a digital transformation program implementation as their 2018’s business priority. They found out that bankers are positive about their ability to improve their financial performance and expects revenue growth in 2018 and in future when a survey with 221 financial institutions across 29 markets was carried out. The business priorities for 2018 of 82% of total banks in developed Asia Pacific markets such as Hong Kong, Australia and Singapore were said to be focusing on developing partnerships with fintech companies, investing in technology to reach customers and to improve risk management. Meanwhile, China, India, Indonesia as well as Malaysia (the emerging Asia-Pacific markets) listed implementing a digital transformation program, gaining efficiencies through technology and enhancing data and cybersecurity as their top priorities. 66% of banks in Malaysia aim to reach digital maturity by the year 2020 by focusing on investing in technology along with their own growth strategies. More than 50% of Malaysia’s banks are also likely to set up partnerships or joint ventures in the core markets.

Bain & Co, a global management consulting firm reported that the percentage of customers using banks’ apps grew from 32% in 2012 to 52% in 2015 and 55% in 2016. With the increase in the number of users, that shows bank customers are starting to accept the change in operation from traditional to digital. Despite the increase in number, World FinTech Report 2018 reported that customers of financial services trusted traditional firms over FinTechs. Thus, technologies can either be good or bad for banks. According to PwC’s survey in 2015 and the first half of 2016, 11% or US$345 million of total venture capital funding in Southeast Asia went into fintech. In Malaysia, 82% of financial institutions see FinTech as a threat to their business, 47% say they have placed FinTech at the heart of their strategy while 22% believe that they may lose more than 20% of their revenues to FinTech companies. While some say fintech and other technology benefits them, others might think otherwise.

Several banks in Malaysia have started investing in technologies especially in financial technologies. Maybank is the first bank to launch a digital wallet, MaybankPay and recently launched Maybank QRPay. Moreover, they are also a partner of Alipay and SamsungPay. Hong Leong in 2016 invested in Artificial Intelligence (AI) with IBM Watson and currently exploring other available technologies such as Augmented and Virtual Reality, Blockchain and Application Program Interfaces. RHB has launched a mortgage app, RHB MyHome and a unique service by name of RHB Rider Service that allows RHB customers to request for a bank’s staff to visit them for account activation and KYC when they opened an account online. However, The Star Online on 15 August 2017 reported that Public Bank partners Alipay to offer mobile wallet services. According to Zhang Dayong, Alipay South-East Asia general manager "this will create opportunities for local merchants to better target a large number of Chinese tourists coming to Malaysia". CIMB Bank has developed CIMB EVA, an Artificial Intelligence virtual assistance that helps CIMB customers with their banking needs. It shows that banks in Malaysia have started to invest in technologies to strive for today's digital world.

There is a lack of research on this topic for the past ten years. Most of the past researches focused mainly on banks and firms in Europe as well as the U.S. The lack of study towards banks in Southeast Asia is one of the factors this study is being carried out, thus this study is being conducted to examine the impact of financial technology investment towards banks performance in Malaysia and Singapore

Insofar, in Malaysia, the relationship study between these two variables is still at the infant stage. Specifically, the research of how financial development influences the environmental pollution is still ongoing. The motivation for this study stems from the desire to explore the links between carbon emissions and financial development.

Research Questions

Given the issues and literature gaps, the research question for this study is

Does investing in financial technology improve the banks' performance?

Purpose of the Study

The objective of this study is

To examine the nexus of financial technology investment towards banks performance across Malaysia, Singapore and Thailand

Research Methods

This study used the secondary data collected from Bursa Malaysia and Thompson Reuters as this study include banks from outside Malaysia. The data that this research will be looking at is the financial statement from nine banks throughout Malaysia, Singapore and Thailand for the duration of 10 years from 2008 until 2017 on a yearly basis. This study examined nine sample banks selected based on their total assets from Malaysia, Singapore and Thailand. The three banks from Malaysia are Maybank, CIMB Bank and Public Bank. Bangkok Bank, Kasikornbank and Krung Thai Bank were selected as the sample banks from Thailand while the banks from Singapore are Developmental Bank of Singapore (DBS), Oversea-Chinese Banking Corporation (OCBC Bank) and United Overseas Bank (UOB). Ten years of financial data of the banks ranging from 2008 to 2017 collected from Bursa Malaysia and Thompson Reuters used in this study. The reason this study choose Thailand and Singapore is that looking at their technological advancement, Malaysia is at par with Thailand, while Singapore is higher in rank.

Hypotheses development

Technology spending ratios

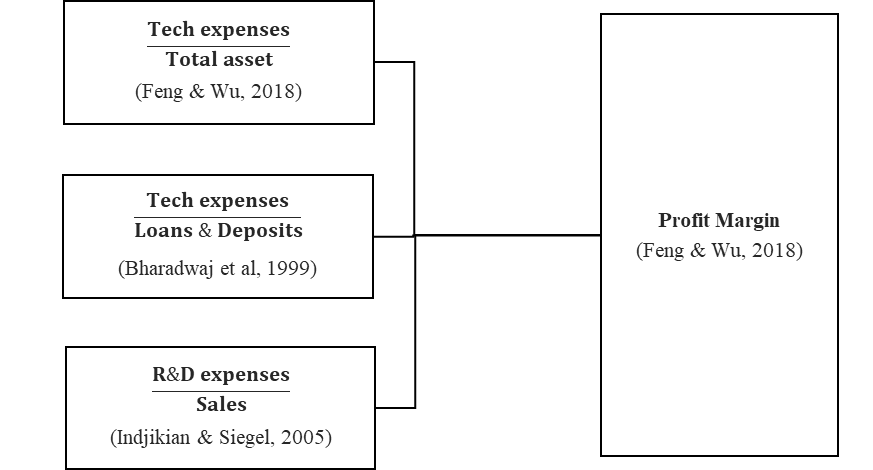

The independent variables used in this study are two technology spending ratios: Tech Expenses/Total Assets and Tech Expenses/Loans & Deposits which was referred to Feng and Wu (2018). The technology expenses (Tech Expenses) include physical technology equipment, software and services (see Figure

R&D Intensity

Spending on R&D ultimately is to increase productivity as well as an organization's saleable output. R&D intensity can be measured by dividing R&D expenses with Sales. Indjikian and Siegel (2005) use technology intensity in their study as independent variables. According to Indjikian and Siegel (2005), it can be indicators for technical change. Shin (2001) uses R&D intensity as one of the variables to look at the impacts on financial performance.

H1 : There is a significant impact of financial technology investment towards banks performance.

Model Equation

Yit = α + β1 TechExp/TA + β2 TechExp/Loans & Deposit + β3 R&D Exp/Sales + Ɛit

Where,

Yit = Dependent Variable (Banks Performance)

α = Constant Value

β1 = Tech Expenses/Total Assets Beta Coefficient

β2 = Tech Expenses/Loans & Deposits Beta Coefficient

β3 = R&D Expenses / Sales Beta Coefficient

Ɛit = Error term

Findings

Table

The beta coefficient is the degree of change in the dependent variable for every 1-unit of change in the independent variable. For pool sample, the coefficients are all negative and statistically insignificant. As all the beta coefficients are negative, each one unit increase in TETA, TELD and RDI will result in the decrease of Profit Margin by the respective beta coefficient value. However, the coefficients for Malaysia are all significant with TETA and TELD at 1% level and RDI at 1% level while only TELD (-2.751) is negatively associated with Profit Margin. The TELD for Thailand (482.371) is positively related to profit margin and only the RDI is significant, at 1% level. All the coefficients for Singapore are significant at 1% level with only TELD have a positive relationship. Through this model, it can be concluded that to increase the profit margins, the banks in Malaysia should increase their TETA and RDI and both banks in Thailand and Singapore to increase their TELD. The variation in results was caused by the differences in terms of country risks and banks’ policy.

Conclusion

This study is carried out to examine the impact of financial technology (fintech) investment towards the bank’s performance in Malaysia, Thailand and Singapore by evaluating 3 banks from each country from the year 2008 to 2017. In order to examine the significant impact of the independent variables towards the dependent variables, this study uses multiple linear regressions. The proxies used to determine the banks’ performance is Profit Margin (Pooled Model). The outcome for this study was observed by examining the impact of technology spending ratios and R&D intensity towards the pool samples (banks in Malaysia, Thailand and Singapore combined), and the three individual countries. As the data was collected from three different countries, the outcome was expected to vary. Each of the countries has their own bank’s policy and regulation thus the expected result cannot be similar. Pooled model which examined the impact towards profit margin of banks can be accepted as the outcome from the model summary of pool sample, which is the main focus in this study, is negatively insignificant and the null hypothesis is rejected. This indicates that to increase the profit margin, banks need to decrease their investment in technology spending ratio and R&D intensity. Pooled model rejects the findings from Feng and Wu (2018). However, when this model is applied to the individual country, there is a mixed outcome. For banks looking to invest in other countries, it is recommended for them to further research on the policy and regulations of that certain country. As from this study, it can be concluded that some technology investment in one country is able to increase their banks’ performance while it contradicts for the other countries. Additional research on the impacts of financial technology investment towards the performance of banks with different sizes and in different Asia countries is warranted.

References

- Beccalli, E. (2007). Does IT investment improve bank performance? Evidence from Europe. Journal of Banking & Finance, 31, 2205–2230

- Berger, A. N. (2003). The economic effects of technological progress: Evidence from the banking industry. Journal of Money, credit and Banking, 141-176.

- Bharadwaj, A. S., Bharadwaj, S. G., & Konsynski, B. R. (1999). Information technology effects on firm performance as measured by Tobin's q. Management science, 45(7), 1008-1024.

- CIMB denies its online banking system was hacked, assures all is secure (2018). The Star. https://www.thestar.com.my/news/nation/2018/12/17/cimb-denies-its-online-banking-system-was-hacked-assures-all-is-secure/

- Delehanty, G. E. (1967). Computers and the Organization Structure in Life-Insurance Firms: The External and Economic Environment. In Charles A. Myer (Ed.), The Impact of Computers on Management (pp. 61-106). The MIT Press.

- DeYoung, R., Lang, W. W., & Nolle, D. L. (2007). How the Internet affects output and performance at community banks. Journal of Banking and Finance 31(4), 1033-1060.

- Durbin, J., & Watson, G. S. (1950). Testing for serial correlation in least squiares regression. I. Biometrika 37, 409-28.

- Durbin, J., & Watson, G. S. (1951). Testing for serial correlation in least squiares regression. II. 38, 159-78.

- Feng, Z., & Wu, Z. (2018). Technology Investment, Firm Performance and Market Value: Evidence from Banks. Seminar at Florida International University. https://www.communitybanking.org/~/ media/files/communitybanking/2018%20papers/session3_paper4_feng.pdf

- Hall, B. H. H., & Khan, B. (2003). New Economy Handbook, Chapter Adoption of New Technology. Elsevier Science.

- Hitt, L. M., & Brynjolfsson, E. (1996). Productivity, business profitability, and consumer surplus: three different measures of information technology value (pp. 121-142). MIS quarterly.

- Indjikian, R., & Siegel, D. S. (2005). The impact of investment in IT on economic performance: Implications for developing countries. World Development, 33(5), 681-700.

- Jayawardhena, C., & Foley, P. (2000). Changes in the banking sector – the case of Internet banking in the UK. Internet Research, 10(1), 19-31.

- Lee, I., & Shin, Y. J. (2018). Fintech: Ecosystem, business models, investment decisions, and challenges. Business Horizons, 61(1), 35-46.

- Mata, F. J., Fuerst, W. L., & Barney, J. B. (1995). Information technology and sustained competitive advantage: A resource-based analysis. MIS quarterly, 487-505.

- Rennock, M. J. W., Cohn, A., & Butcher, J. R. (2018). Blockchain technology and Regulatory Investigations. https://www.steptoe.com/images/content/1/7/v3/171269/LIT-FebMar18-Feature-Blockchain.pdf

- Shin, N. (2001). The impact of information technology on financial performance: the importance of strategic choice. European Journal of Information Systems, 10(4), 227-236.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Bakar, S., & Nordin, N. A. (2020). Fintech Investment And Banks Performance In Malaysia, Singapore & Thailand. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 610-618). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.66