Abstract

Financial Sustainability is listed as Shift five in the Malaysia Education Blueprint 2015-2020. This to ensure the self-sufficiency of the public universities in Malaysia and reduce the dependency on Government. In 2016, the Ministry of Education, has launched the University Transformation Programme Purple Book to guide the Public Universities to engage on income generating initiatives. This book also provides suggestions on income generation activities that can consider to diversify the sources of income. The purpose of this study is to assess on the income generation activities through public contributions, implemented by Public Universities for self-efficiency. Activities suggested on public contributions activities such as university endowment, sustainable waqf, and philanthropic income and fundraising, are adapted and transformed to questionnaire. Questionnaire was distributed to the top management of Public Universities with regard to implementation of these activities. Interesting result was revealed where endowment activities are the most agreeable approach implemented by public universities. Whereas, sustainable waqf earned the lowest agreement. There is also an indication that some Public Universities are really work on all activities that have been suggested. Thus, this study suggested that further study on income generation activities is needed by separating the universities according to the age of establishment, to assess on the most effective income generating activities.

Keywords: Financial sustainabilityendowment and waqf in HEIincome generating activities in HEI

Introduction

Malaysia is well poised to be the preferred destination for top notch universities in this region. This is seen as an important pillar in realising the country’s aspiration to become a “high-income knowledge-based economy”. As far as Public Universities (PUs) is concern, this plan was part of National Higher Education Strategic Plan (NHESP) 2007-2020. The initiatives were intended to promote Malaysian PUs programmes to be equal with international standards, especially of those in first world nations such as Americans, British, Japanese and Canadians (Tibek et al., 2014).

Various plans were initiated by the Ministry of Education (MOE) to ensure the PUs can embrace change and brilliantly confront the challenge existed at international education market. As of 2018, all the 20 PUs in Malaysia were bestowed autonomy status. This status allows for more prominent self-governance and responsibility. There is a legal structure to empower PUs and to supplant the University Council with the Board of Director (BOD). Four universities which are Universiti Putra Malaysia, Universiti Teknologi Malaysia, Universiti Kebangsaan Malaysia and Universiti Malaya are promoted as Research Universiti. Whereas, Universiti Sains Malaysia (USM) was crowned with the coveted Apex University title.

As a prerequisite to survive in this aggressive scenario, PUs shall have in place hefty long term and specific policies. Kettunen (2008), Rolfe (2001), Strehl et al. (2007) highlighted that it is very important for universities to have a strong financial plan. Accordingly, a strong financial plan is relied upon to trigger long term operations of the universities. This is important for human capital nourishment, and enhancements of university’s “structures, outcomes, operations and processes”.

Therefore, the PUs should place emphasis on expanding strategies to increase income flow in accordance with the MOE’s vision. This is among the main objectives of NHESP to empower PUs and become self-funding from avenues within the coffers. PUs need to find multiple sources of income and initiate creative ways to capitalise their resources. Perhaps, through the multiple income generating initiatives, the universities can be self-sufficient and more importantly, have excesses for reinvestment and regeneration (León, 2001). This is the reason for PUs to allow some degree of independence by the government to manage their finance.

Currently, the major sources of funding for PUs are generated through the core activities which are the students' fee, rental or lease of assets, services rendered to others, interest gained from fixed deposit placements, and research and development projects. PUs are also forced to explore other sources which include from public contributions such as endowment and waqf. In fact, public contributions is very important for university development. There are many world famous universities such as universities of Oxford and Cambridge in the UK and the universities of Harvard and Yale in the USA, are established through the contributions (Mahamood & Ab Rahman, 2015). This study is designed to assess on how PUs in Malaysia implemented activities to attract public contributions in order for them to achieve self-sufficiency.

Problem Statement

Wan Saiful (2017) highlighted that universities in Malaysia need to be financially viable in order to excel in research and academic. This will allow them to face educational global challenges and improve their international standing. Therefore, there is a need for the Government and the PUs to find a neutral ground and balance between having in place control mechanism on the PUs and giving full autonomy to the PUs to make them self-sufficient.

Currently, PUs cannot depend on single sources of funding anymore to remain afloat. This will effect their ability to become the world class university. Such is the trend globally, as Governments continue to tighten budgets and reduce spending on universities. University needs to find their own sources to fill the gap in their income. This can be either through their operation, or public contributions. Universities need to find creative ways remain viable. Rozmus and Cyran (2012) illustrated that Universities of Cambridge and Oxford created variety of avenues to generate income. Instead of students' fees, they generate income from services provided to external parties and commercialisation of intellectual property. In top of that, they also earned government grant, and benefaction and donations. The endowment received are reinvested and gain further income to be used by the universities.

In 2016, the MOE has launched the University Transformation Plan Purple Book (UniTP PB) which serves as a guide to navigate activities related to university income generation. By virtue of this book, the Government has significantly cut funding of public universities by 19.23% in 2017. This is to encourage and further cultivate the income generation activities of universities. The UniTP PB activities on income generation can be categorised into two, (i) through university operations such as academic and research programmes, asset monetisation, financial management activities and corporate alliances, and (ii) through public contributions such as university endowment, sustainable waqf and fundraising initiatives. This study in concentrated on generating income through public contributions.

For university endowment, to the best knowledge during conducting this study, there is no civil law that governs endowments activities. Western academic institutions viewed endowments as an integral part of the universities operational system and the size of the endowment funds are used to measure the universities’ well-being. According to U.S. News & World Report, in 2017, Harvard University has the biggest endowment size of $37,096,474,000, followed by Yale University with endowment size of $27,216,639,000, Stanford University with endowment size of $24,784,943,000, Princeton University with endowment size of $23,353,200,000 and Massachusetts Institute of Technology with the endowment size of $14,832,483,000.

Back to the local scenario, by virtue of Section 39 (1), Part IV, First Schedule of AUKU, PUs are allowed to accept endowment. Section 40 (1) provided that the endowment to be used and managed in accordance with endower’s wish and be well accounted for. Endowments fund can either created by PUs or received by the PUs in various forms such as money, financial instruments in term of securities, shares or bonds, moveable assets and fixed assets. There are many intentions behind the endowment such as to ensure the financial health of specific departments or the universities as a whole, establish chairs, professorships, scholarships for students, fellowships or to ease the financially underprivileged students (Acharya & Dimson, 2007).

Developing sustainable waqf (SW) is another income generating initiative suggested in UniTP PB. Waqf has played as major role in establishment of many universities around the world. Al-Azhar University in Egypt is the best example on how university benefited from waqf. Accordingly, waqf is different from other type of funds because the properties or money given cannot be revoked by the giver and it is perpetual in nature to ensure the sustainability of the assets (Mohsin, 2013). However, it can be reinvested as being permitted by the governing bodies and the giver, and the benefits gain shall be given back to society (Mohsin, 2013). This allow the waqf fund to be extended to other social purposes such as supporting financial aids to the underprivileged, educational aids, agricultural and horticultural, veterinary aids and other humanitarian needs (Mahamood & Ab Rahman, 2015). Similar to endowment, PUs are allowed to receive and manage waqf under Section 39 (1) and Section 40 (1), Part IV, First Schedule of AUKU.

UniTP PB also mentioned about Philanthropic Income and Fundraising (PI&F) initiatives as among the sources of university income. Philanthropic and fundraising income are funds that are received for a charitable cause. The non-profit organisations are normally used the funds from PI&F to finance their activities. Philanthropy generally refers to the act of an individual or an organisation, giving or doing something for humanitarian causes to improve the welfare of other people. It can be for those underprivileged, under duress or suffering from natural catastrophes. Some PUs received philanthropic funds from individuals or organisations, with the intention of among others, to financing the education, to provide food and accommodation for bright but underprivileged students. Whereas, fundraising is the act of creating of an event or a platform or avenue to seek individuals or organizations to contribute money to fund for any purposes.

This study is concentrated on how the PUs implemented activities being as suggested in UniTP PB to attract public contributions in order to attain self-sufficiency. This research will look at three activities suggested in the UniTP PB, which are university endowment, developing sustainable waqf, and philanthropic income and fundraising activities. The PUs are expected to implement these activities to allow income to flow to university in order for them to achieve self-sufficiency.

Research Questions

This study is to assess on how PUs in Malaysia implemented activities suggested in UniTP PB in order to achieve self-sufficiency. These activities were aim to attract public to contribute to the universities. Therefore, this study is seek to answer:

What are the activities suggested in the UniTP PB that have been implemented by the Malaysian PUs?

Purpose of the Study

The Government has provides the necessary tools and guidelines to assist the PUs in transformation journey. Although, there was an increase of budget allocation for PUs by 14% from RM12.13 billion in 2017 to RM13.89 billion for 2018, this is still not enough. To date, the Government is funding almost 90% of PUs operational expenditure. The PU still need to cover the 10% gap in their operational income. Through UniTP PB, suggestions on income generating initiatives and activities has been highlighted. The purpose of this study is to reveal the following:

i.Whether the PUs had implemented the suggested activities on generating income through public contributions as stated in the UniTP PB; and

ii. The implementation level of suggested activities by the PUs.

Research Methods

This is a descriptive study. It will be the first investigation to provide an understanding with regards to the income generating activities by PUs through public contribution. The unit of analysis in this study is the PU. The data was gathered from the questionnaires given to the selected respondents, which will represent the PU. Since the respondents need to have a clear understanding about university direction, only the respondents at top management level are selected as respondents. Therefore purposive sampling is the most suitable method for this study.

There are 20 PUs in Malaysia and they are getting yearly grants from the Government. This study used UKM structure to determine the total number of respondents. In the top management chart of UKM, there are one Vice Chancellor (VC), four Deputy Vice Chancellors (DVCs), one University Treasury (UT) and three University Deputy Treasury (UDTs). Therefore, the total number of respondents in one university shall be around eight. For 20 PUs, the total respondents will by 160. For each university, there will be a representative from MOF in the BOD and selected officers from the Policy Division in MOE. It is expected that the number of MOF and MOE representatives in the PUs is around 40. Based on this estimation, number of population from the top management of PUs, include the representatives from MOF and MOE are around 200.

Based on Krejcie and Morgan (1970), for the total population of 200 respondents, the most appropriate sample should be around 132 respondents. However, realising the challenges in obtaining response from the top management that have very tight and eventful schedules, only 105 questionnaires are given out to respondents. The questionnaire distributed equally among the top management, comprised of 20 VCs, 20 DVCs, 20 UTs, 20 UDTs, 20 MOF representatives in the BOD and 5 officers from MOE. The questionnaire was designed based on activities suggested in the UniTP PB. The likert scale was used as measurement ranging from 1 as strongly disagreed to 5 as strongly agreed.

Pre-testing was carried out on a small sample of respondents from the target population. It is intended to reduce errors and ensure the questions are valid, reliable and can be understood (Grimm, 2010). Pre-testing of this study was conducted on eight (8) officers at the MOF and two (2) officers at the MOE, ranging from the grade of M41 to M48. Feedbacks from the pre-testing were used to make necessary modification and improvements before they were distributed to the respondents. This study used online survey via Google Forms to collect the data. A period of 9 weeks was used to collect the data and the questionnaire is a self-administered question.

This study used descriptive analysis to analyse the result. It shall provide an understanding of respondents’ characteristic and the variables being studied (Sekaran & Bougie, 2013). Descriptive analysis shows a simple quantitative summary of the data collected that helps the study to understand the data. SPSS is used to calculate data and find the statistical result such as mean and standard deviation, and also agreement of activities conducted.

Findings

Due to the position of respondents as the top management of PUs, to obtain responses from them is very challenging. This is due to their tight schedules. After few times reminder were sent through email and WhatsApp, a total number of 30 responses were obtained. This represent 28.6% of respondent rate. Encouragingly, 33.3% of the respondents are the VC of PUs. Accordingly, this sample size is adequate to conduct a valid study (Roscoe, 1975). The summary of respondent/university profile is tabulates as in Table

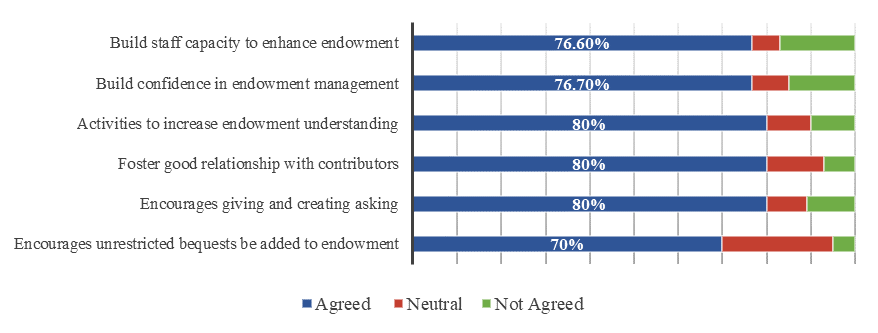

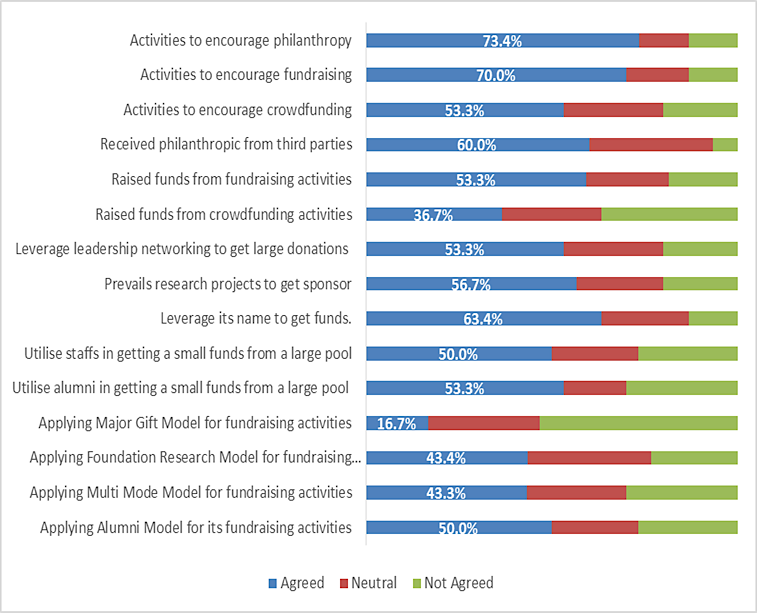

The UniTP PB has suggests three income generating activities that the PUs can undertake in order to assist then in achieving self-sufficiency. Figure

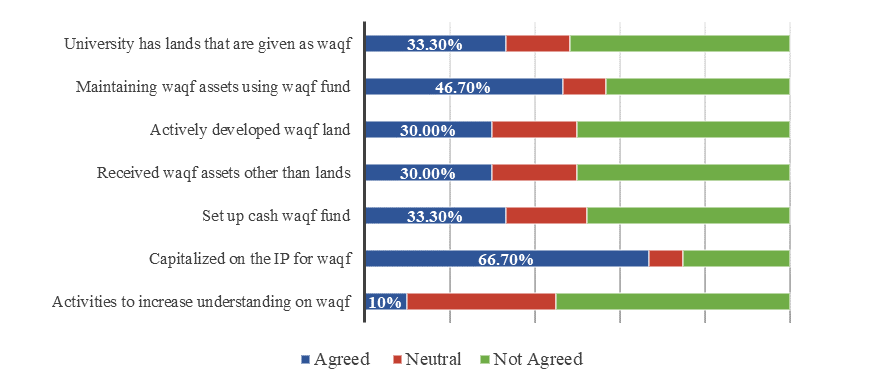

Activities to enhance income through sustainable waqf is shows in Figure

Based on the finding in Figure

Conclusion

The PUs should take initiatives to increase their efforts to meet the targets set for them by engaging in income generating activities recommended in UniTP PB. As the size of public funds are getting smaller, they need to actively find ways to diversify their source of income and reduce their dependency on the Government. Compare to generating income through operation, major advantage of getting income through public contribution is a very low cost of operation and almost no risk. Although it is quite hard to convince the public, continuous efforts are needed to show how this contributions will be given back and benefited society and nation.

From the three initiatives on public contributions, it is clearly showed that generating income through endowment activities are the most popular approaches done by the PUs. Some researcher quotes endowment is similar to waqf (Dahlan et al., 2014), and Aziz et al. (2013) as they share many similar principles and attributes. However, actually there are some differences, such as in the trusteeship power perpetuity requirement and vesting authority (Mahamood & Ab Rahman, 2015). The differences might be seen as disadvantages of having waqf, although it is nothing different. This might make the PUs are concentrated more on the endowment activities, rather than waqf activities as being described in UniTP PB.

Another important finding to highlight is the large standard deviation found for all activities suggested in the UniTP PB. This indicates that some universities, they are very committed to the suggested activities, while others might not so. Some of the universities already matured, have been established for more than 50 years, while some are still young, established for less than 20 years. For the matured universities, they have good reputation, respectable human capital, strong alumni network and already gained public confidence. They have privileged to enter the public and attract contributions. They have experienced and committed to explore all the activities being suggested in UniTP PB. Compare to the young universities, they might be still looking for the right approach. Therefore, this study would suggest to separate the PUs by the age of establishment, and studying on their income generating activities. This might help the young universities, or other as well, to concentrate on the right activities.

References

- Acharya, S., & Dimson, E. (2007). Endowment asset management: investment strategies in Oxford and Cambridge. Oxford University Press.

- Aziz, M. R. A., Johari, F., & Yusof, M. A. (2013, September). Cash Waqf models for financing in education. In The 5th Islamic Economic System Conference (iECONS2013) (pp. 835-842).

- Dahlan, N. K., Yaa'kub, N. I., Hamid, M. A., & Palil, M. R. (2014). Waqf (endowment) practice in Malaysian society. International Journal of Islamic Thought, 5, 56 - 61.

- Grimm, P. (2010). Pretesting a questionnaire. Wiley International Encyclopedia of Marketing. https://doi.org/10.1002/9781444316568.wiem02051

- Hussein, N., Omar, S., Noordin, F., & Ishak, N. A. (2016). Learning organization culture, organizational performance and organizational innovativeness in a public institution of higher education in Malaysia: A preliminary study. Procedia Economics and Finance, 37, 512-519.

- Kettunen, J. (2008). A conceptual framework to help evaluate the quality of institutional performance. Quality Assurance in Education, 16(4), 322-332. https://doi.org/10.1108/09684880810906472

- Krejcie, R. V., & Morgan, D. W. (1970). Determining sample size for research activities. Educational and psychological measurement, 30(3), 607-610. https://doi.org/10.1177/001316447003000308

- León, P. (2001). Four Pillars of Financial Sustainability. The Nature Conservancy.

- Mahamood, S. M., & Ab Rahman, A. (2015). Financing universities through waqf, pious endowment: is it possible? Humanomics, 31(4), 430-453. https://doi.org/10.1108/H-02-2015-0010

- Ministry of Education. (2016). Enhancing University Income Generation, Endowments, and Waqf. University Transformation, Purple Book.

- Mohsin, M. I. A. (2013). Financing through cash-waqf: a revitalization to finance different needs. International journal of Islamic and Middle Eastern finance and management, 6(4), 304–21. https://doi.org/10.1108/IMEFM-08-2013-0094

- Rolfe, H. (2001). University strategy in an age of uncertainty: The effect of higher education funding on old and new universities. Discussin paper No. 191

- Roscoe, J. T. (1975). Fundamental Research Statistics for the Behavioral Science, International Series in Decision Process (2nd Edition), Holt, Rinehart and Winston, Inc.

- Rozmus, A., & Cyran, K. (2012). Diversification of University Income–Polish Practice and International Solutions. Finansowy Kwartalnik Internetowy e-Finanse, 8(4), 64-75.

- Sekaran, U., & Bougie, R. (2013). Research Methods for Business: A skill building approach (6th edition). Wiley.

- Strehl, F., Reisinger, S., & Kalatschan, M. (2007). Funding systems and their effects on higher education system (Vol. 6). OECD Education Working Papers.

- Tibek, S. R., Mujani, W. K., Yusoff, M. I. K., Sham, F., & Ashari, M. F. (2014). The Implementation of Malaysian Higher Education Strategic Plan for International Marketing: A Focus Study on West Asian Students. The Online Journal of Quality in Higher Education, 1(4), 40-45. https://www.tojqih.net/journals/tojqih/articles/v01i04/v01i04-06.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Abdul Kadir, M. R., & Cotter, C. D. (2020). Generating Income Through Public Contribution In Malaysian Public Universities For Self-Sufficiency. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 445-454). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.48