Abstract

In Malaysia, the matters related to waqf fall under the jurisdiction of the states and not under the jurisdiction of the federal authority. Due to the fact that, Malaysia is consist of 14 different states, this would mean Malaysia has 14 different unique with different ways of Waqf Management. The latest new financial mechanism, which is Cash Waqaf, could be an alternative financial instrument for Muslim to achieve high rate of economic development. The purpose of this study is to scrutinize the level of awareness among Malaysia Citizens towards the implementation of cash waqaf in Pahang. This study will apply the quantitative method through surveys and questionnaires. The confirmatory by the purposive sampling through semi structure interview with Government Practitioners, which is Majlis Agama Islam Pahang (MAIPs). Finally, this study will definitely help Government Practitioners especially Majlis Agama Islam Pahang (MAIPs) to identify the level of awareness towards the implementation of Cash Waqf in Pahang States. The findings will help to eradicate poverty and align the community to the sustainability economy development, which was highlighted in the 11th Malaysia’s Plan.

Keywords: WaqfCash WaqfMAIPssustainability economy development

Introduction

As the definition of Waqf usually significance with the use of property for private purposes, giving it up for waqf means that the owner returns it to God for the benefit of the society. The waqf property could not be subjected to any sale, disposition, and inheritance and so on. The concept of inalienability species the urgency of mutawalli in handling waqf properties as per donor’s intention in ensuring the benefits are continuously return to the beneficiaries. No one has right to the waqf properties for any personal use except for waqf purposes. Due to this reason, the donors will receive continuous intangible reward from God as long as the asset is being utilized. Irrevocability will ensure that the donated asset could not be taken back by its owner. The income received from waqf properties shall be used for community purposes (Adam & Lahsasna, 2013).

Alpay and Haneef (2015) recommend that there must be transparency and accountability between funding and implementing agencies for achieving the ultimate goal of poverty reduction. In the same line of thought, with regards to the management, administration and governance aspect of waqf in contemporary times, many scholars also highlight the importance of professional management and transparent administration of waqf for effective results. Hassan and Shahid (2010) argue that professional business management will improve institutional quality, service delivery and effective delegation of responsibility so as to ensure and ease accountability. Hence, corporate structure is suitable for professional management and perpetuity.

Cash waqf refers to the one who is giving out some money from his properties, and then accomplish a waqf in the purpose of giving it to persons who are permitted to get the reimbursements from the return of waqf or allocating it for the community development. The fund from cash waqf financiers will be collected by cash waqf fund managers and the money will be invested in the real sector or in any Shari’ah based investment opportunities (Khademolhoseini, 2008). Subsequently, gaining the return from the investment, it can be distributed among poor families and also can be channeled through businesses and cultural progress.

The study of cash waqf was done by several researchers in recently time. Cizakca (1998) explains that historical evidence indicates that the real exiting potential lies in the cash awqaf. The awqaf system has provided throughout Islamic history all the essential services at no cost to the state and a successful modernism of the system implies a significant cut in government expenditure and all the associated benefits including downsizing the state sector and a reduction or elimination of riba. In a society where health, education and welfare were entirely financed by gifts and endowments, the cash awqaf carried serious implications for the very survival of the Ottoman social fabric. Islahi (1992), stated that the internationalize the voluntary institution of awqaf is needed nowadays, by setting up a non-government world Muslim foundation which should provide public goods on large scale and in much more significant fashion than has been the case up till now, to combat illiteracy, sickness and lack of technical know-how.

Kahf (1998) explain the importance of waqf for socioeconomic development, which is consists of creating and developing a third sector distinct from the profit-motivated private sector and the authority-based public sector, and changing this third sector with the responsibility of performing a group of tasks whose nature make them better achieved. This third sector assigned in education, health and social and environmental welfare. Furthermore, it can provide defence services and public utilities in many instances.

Chowdhury et al. (2011) explain that cash waqf would also help to reform the present institutional setup and their networking relationship throughout the country with a view to increasing their performance in the direction of the efficient and need based dynamic management of the waqf affairs and systems which total policy dimensions at micro and macro mixed with the diversified objectives of innovations and development in the waqf management systems complying with the Sharia guidelines.

Problem Statement

In Malaysia, the matters related to waqf fall under the jurisdiction of the states and not under the jurisdiction of the federal authority. Since Malaysia consists of 14 different states, this would mean Malaysia has 14 different unique with different ways of Waqf Management. The latest new financial mechanism, which is Cash Waqaf, could be an alternative financial instrument for Muslim to achieve high rate of economic development.

Research Questions

The research questions for this study are as follows:

How much percentage of the level awareness among the public towards cash waqf implementation in Pahang?

What is the current level of knowledge and consciousness among the public towards cash waqf implementation in Pahang?

Purpose of the Study

The purpose of this study can be outlined as follows:

To measure the level awareness among the public towards cash waqf implementation in Pahang.

To measure the level of knowledge and consciousness among the public towards cash waqf implementation in Pahang.

Research Methods

This study utilizes quantitative methods based on surveys, expert opinion, and literature and existing knowledge in this area. A total of 100 respondents involved in this study were access through online and physical questionnaire distributed to people of Kuantan, Pahang Malaysia. The study accompanied various level of sample with breast cancer experience and those who did not experience any cancer cases.

Findings

Discussion Analysis of Knowledge of Cash Waqf

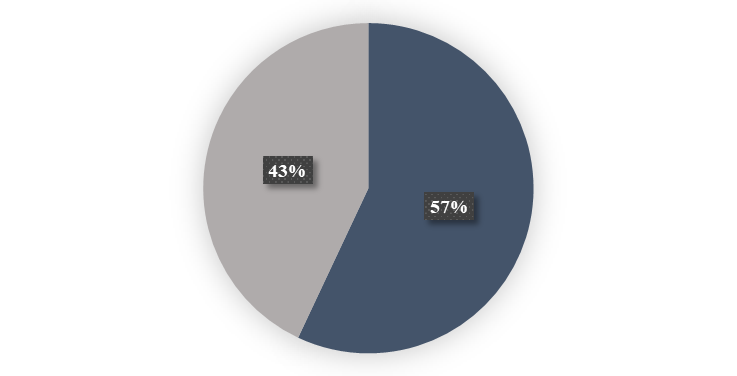

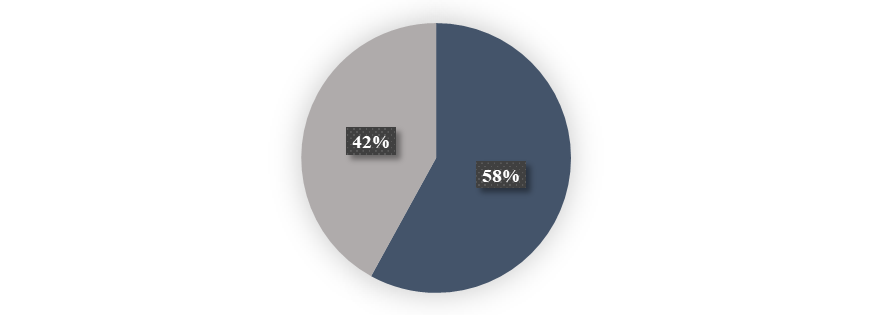

Implementation of Cash Waqf could successful implemented if there is awareness among the public towards the implementation. Based on the pie chart in Figure

It is vastly recommended to make on going promotion on Cash Waqf in Kuantan, Pahang especially towards the young generation to ensure the success fullness of the implementation of Cash waqf in enhancing socio economy and wellbeing.

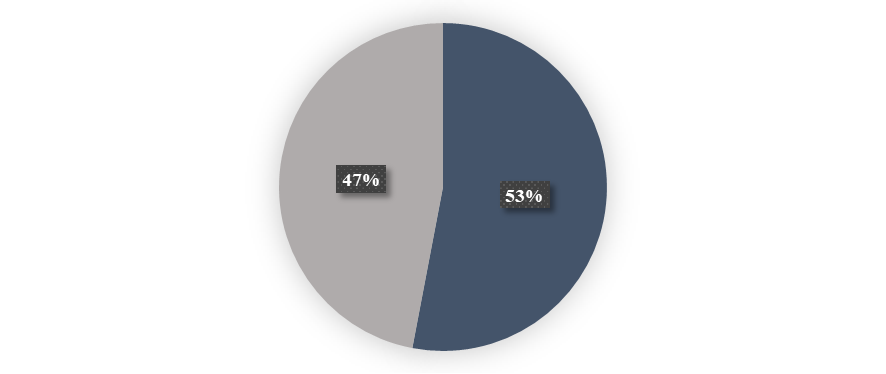

Discussion on Analysis of Academic Background of Donors

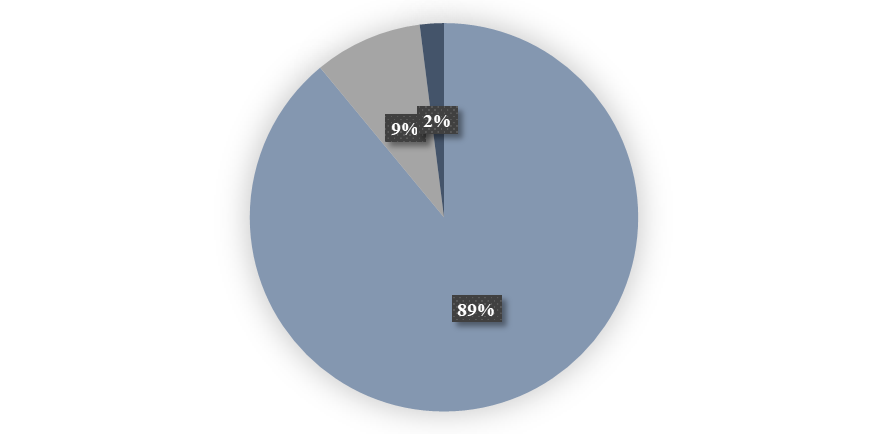

Academic background as shown in Figure

Nevertheless, those respondents with lower education level can be also educating by on-going promotion by Pahang State Islamic Religion Council, Malaysia.

Discussion on the understanding on Concept of Waqf

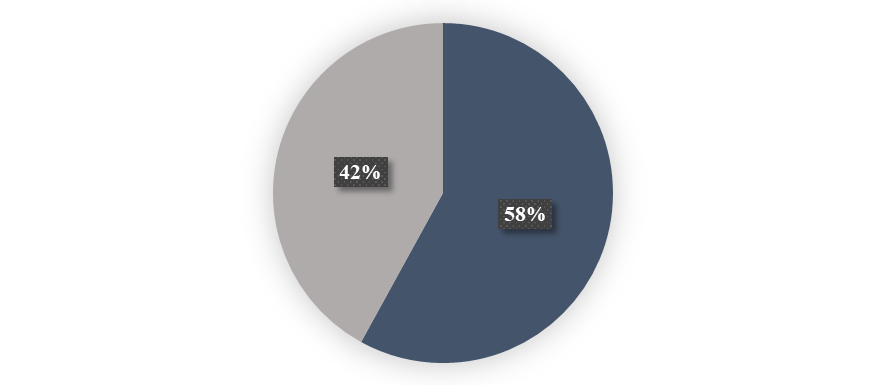

The major challenges and obstacles of cash waqf implementation is the understanding of Waqf Concept. Figure

Discussion on How to Make Transaction of Cash Waqf

Even though MUIP, Majlis Ugama Islam Negeri Pahang has an integrated cash waqf system, but seem based on the survey results as shown in Figure

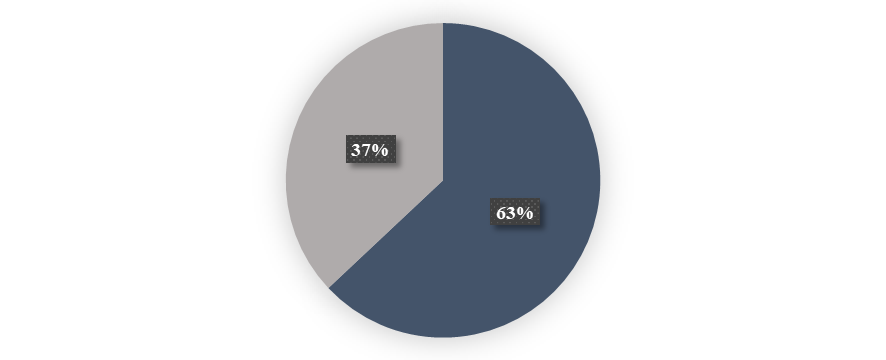

Discussion on the Awareness on Organization Managing Cash Waqf Transaction

Under the services quality principles, tangibility and reliability of the organization or services company in dealing with services should be taken seriously. Unfortunately, the survey results in Figure

This situation indicates, the level of awareness couldn’t be successfully promoted if the organization itself doesn’t looks tangible and reliable for them to deal with. The confidence level among the public should be increased by publishing and exposing the latest information and current projects under MUIP, Pahang, Malaysia.

Discussion on the Respondent’s family member made the Cash Waqf Transaction

Based of previous discussion, seems the awareness very poor among the respondents in Kuantan, Pahang towards the implementation of cash waqf. Due that scenario, based on Figure

Limitation

The awareness of cash waqf among the public in Pahang State should be keep improving from time to time. Based on the result there are list of limitations:

i) Cash Waqf Technology

The public in Kuantan, Pahang should be updated with Cash Waqf Tecnology which can be accessed anytime and anywhere. Most of SIRCs in Malaysia already implemented Cash Waqf system to monitor Waqf Funds Transactions.

ii) BlockChain

Instead of cash waqf transactions, nowadays the technology and new principles has been introduced to waqf endowers as another options to transact waqf funds.

iii) IT Literacy

IT Literacy plays vital roles in ensuring the succession of Cash waqf System in SIRCs, Malaysia since majority of SIRCs already has their own Cash waqf System in monitoring Cash Waqf Funds Transactions.

iv) Knowledge about Waqf

The public should be able to differentiate the concept and notion of waqf and cash waqf. This would be very crucial point to waqf endowers to be encouraged to make more endowment if they feel familiar and understand with the principles of waqf.

v) Promotion

MUIP should make the promotion in a big circulation as the awareness among the public towards waqf still in low percentage and need to have proper future in executing the marketing strategy. Waqf should be included in sub topic in schools or university as early exposure to the public as early as in young age.

Conclusion

Promotion of cash waqf also has the little contribution to influence donors to participate on cash waqf for financing in micro businesses. Promotion on cash waqf brings positive perception and awareness towards donors especially among young Muslims through numerous media, campaigns and talks in masjid etc. However, in order to create more awareness among Muslim society the waqf institutions should run campaign and conduct various talks and promote the cash waqf benefits (Norazlina & Rahim, 2011).

References

- Adam, S., & Lahsasna, A. (2013). Cash endowment as source of fund in Islamic micro-Financing. In 4th International Conference on Business and Economic Research (4th ICBER 2013).

- Alpay, S., & Haneef M.A. (Ed.) (2015). Integration of Waqf and Islamic Microfinance for Poverty Reduction: Case Studies of Malaysia, Indonesia and Bangladesh, SESRIC & IIUM publication.

- Chowdhury, M. S. R., bin Ghazali, M. F., & Ibrahim, M. F. (2011). Economics of Cash WAQF management in Malaysia: A proposed Cash WAQF model for practitioners and future researchers. African Journal of Business Management, 5(30), 12155-12163.

- Cizakca, M. (1998). Awqaf in history and its implications for modern Islamic economies. Islamic Economic Studies, 6(1). https://ssrn.com/abstract=3164811

- Hassan, A., & Shahid, M. A. (2010). Management and development of the awqaf assets. In Seventh International Conference—The Tawhidi Epistemology: Zakat and Waqf Economy, Bangi (pp. 309-328).

- Islahi, A. A. (1992). Provision of public goods: role of the voluntary sector (waqf) in Islamic history. Financing Development.

- Khademolhoseini, M. (2008). Cash-Waqf: A New Financial Instrument For Financing Issues: An Analysis Of Structure And Islamic Justification Of Its Commercialization. Imam Sadiq University.

- Kahf, M. (1998, March). Contemporary issues in the management of investment Awqaf in Muslim countries and communities. In International Conference on Awqaf and Economic Development, Kuala Lumpur (pp. 2-4).

- Norazlina A. W., & A. Rahim, A. R. (2011). A Framework to Analyse the Efficiency and Governance of Zakat Institutions. Journal of Islamic Accounting and Business Research, 2(1), 43-62.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Abd Razak, S. F. F. B., & Taufek, F. H. B. M. (2020). An Analysis of Cash Waqf Involvement Among Malaysia Citizen in Pahang, Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 388-395). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.41