Abstract

For business, zakat must be paid either by the company or the shareholders. If the company completes zakat payment at the company level, information about the basis used must be disclosed to the shareholders. However, if the company did not pay zakat, then the obligation to pay zakat shall pass to the shareholders. This also requires information to be disclosed by the company to assist the shareholders in making the right payment. Thus, either way, the business needs to disclose information about zakat. This study is a two-phase study designed to explore and obtain a consensus on a separate disclosure for business zakat and the use of Zakat per Share to assist zakat payment. This study interviewed experts in the zakat field, then followed by a distribution of questionnaire surveys to accounting practitioners to obtain the consensus. Significant results are revealed when the consensus gained is not only for a separate disclosure for business zakat but also on applying business zakat’s concepts to accounting practices and its usage as one of the measurement tools for business performance. Thus, a thorough investigation is conducted to design a well-structured framework for business zakat disclosure to be used in accounting practices.

Keywords: Disclosure for business zakatAccounting for business zakatharmonising zakat conditions with accounting principles

Introduction

Zakat is an act of subordination to God Almighty. For business, zakat must be paid either by the company or the shareholders (E-Fatwa, 2009; Mohd Saleh, 2006). Traditionally, the calculation of t was based on urud al-tijarah (tradable goods) (Al Qaradawi, 1999; Al-Zuhayli, 2002; Ash Shiddieqy, 1996). The concept is expanded to the use of the net working capital which can be derived from the accounting’s statement of financial position (Ismail et al., 2013; Syed Mohd Ghazali Wafa, 2006).

However, accounting disclosure cannot adequately supply the information needed for zakat purposes. This problem can be attributed to two reasons; different definitions used in zakat and accounting in defining assets, and there are conditions of zakat which are not within the ambit of accounting. Currently, information beyond financial statements is needed for business zakat calculation. This includes a discussion with the company’s finance department to attain information that is not disclosed in financial statements, for business zakat computation purposes.

As agreed, zakat must be paid by a company on behalf of its shareholders (E-Fatwa, 2009; Mohd Saleh, 2006). If the company does not pay zakat, the onus to pay zakat shall fall on the shareholders. If the company paid zakat at the company level, information about the payment must be available. However, there are few complications for the company to pay zakat at the company level. Among the issues are the ownership of non-Muslims in the business (Halizah et al., 2011), the loss of rebate for zakat payment (Noor et al., 2011), and accounting entries which will result in lower profit reported for the business.

Alternatively, the company can pass the obligation for business zakat payment to its shareholders. However, this requires information about zakatable assets. For shareholders who hold shares as a long-term investment, paying zakat based on the current value of share is quite inappropriate. This approach resulted in higher zakat payment which is unfair for the payers. Therefore, information about zakatable assets must be disclosed to the shareholders to assist them in discharging their zakat obligation.

As information about zakat must be disclosed, a disclosure about business zakat is mandatory. It has been discussed before that the information required for zakat computation cannot be fully satisfied by the current accounting reporting practices (Abdul Rahim, 2007; Syed Mohd Ghazali Wafa, 2006). Therefore, a separate disclosure for zakat in financial statements is critically needed (Syed Mohd Ghazali Wafa, 2006). This study suggests the disclosure to be made until Zakat per Share (ZPS) to facilitate the payment for business zakat.

This study is a two-phase study designed to explore and to obtain a consensus on a separate disclosure for business zakat and the use of ZPS. It is started by exploring expertise opinion on a separate disclosure for business zakat, and extend the finding by getting consensus form accounting practitioners concerning the issue.

Problem Statement

Business zakat computation is strongly associated with financial reporting. Information from financial reporting is needed in zakat calculation (Abdul Rahim, 2007; Syed Mohd Ghazali Wafa, 2006). Based on business zakat conditions, assets are subject to zakat when it meets the criteria of full ownership, ready to be traded, and under the control of business. This information can be gathered from the financial statement and notes to the account. However, the information is dispersed as it needs to follow the standards. For certain specific conditions such as zakat on only halal sources, this information is still unavailable in financial reporting. The separation of income between halal and haram sources is not practised in accounting. This makes zakat computation difficult as internal information is needed. Usually, a discussion with the finance department will be held to gather the required information.

A limitation of accounting has been highlighted in the Corporate Report (ASSC, 1975) that reporting practices cannot fully meet the demand of information from all stakeholders. Thus, they recommend that other significant economic information should be published in additional statements such as (a) a statement of value added, (b) an employment report, (c) a statement of money exchange with government, (d) statement of transactions in foreign currencies, (e) statement of future prospects and (f) statement of corporate objectives. Due to the importance of zakat information and limited disclosure of financial reporting, a separate disclosure for zakat as Value Added Statement (VAS) in financial statements was recommended (Syed Mohd Ghazali Wafa, 2006).

Currently, zakat as a separate disclosure is not practised in Malaysia, but by several companies in Middle East. The ruling of Middle East on zakat payment is different from Malaysia. In Middle East, the business zakat payment is the responsibility of the shareholders. Their disclosure follows the requirement specified in FAS 9, a standard issued by an independent accounting body, the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI). The separate disclosure is called as ‘Zakat Guide’. The disclosure was made until the ZPS to assist the shareholders in paying zakat. ZPS refers to the amount of zakat needed to be paid for each share held by the shareholders. This is only applicable for investors who hold shares as a long-term investment.

Even though FAS 9 is for Islamic Financial Institutions and it is not applicable in Malaysia, but it has been used to guide the development of Malaysian technical guidelines on zakat, MASB TR i-1 Accounting for Zakat on Business. Gulf Investment House (GIF) is among the companies that disclosed zakat as a separate disclosure to guide their shareholders and investors on zakat payment. Among the information released in the zakat guide is (a) the company responsibility to compute the business zakat per the Shariah requirement, (b) the party responsible for zakat payment, (c) the amount of zakat for the year, and (d) the information about ZPS. Although ZPS is not applicable in Malaysia, the framework for the disclosure can be used as a guide for future practices.

The current practice of business zakat in Malaysia demonstrated that zakat on shares can be divided into short-term (traded shares) and long-term investment (non-traded shares) (Hamat et al., 2017). For short-term and speculative investment, the zakat on shares is based on the current value. For long-term investment, if the zakat is paid at the company level, then the shareholders are released from zakat obligation. However, if the company does not pay zakat, then the shareholders need to pay zakat (Rosele & Abdullah, 2018). The zakat payment for long-term investment differs across the states in Malaysia (Hamat et al., 2017). Some states would calculate it based on the current value which will result in higher zakat payment. This is not suitable as it is unfair to the buyer. Some states calculate zakat based on dividend received by the shareholders. This is also quite inappropriate since dividend payment will be paid after the profit is taken into account for expansion. This will result in lower zakat payment which is unjust for the asnaf.

Therefore, the zakat payment at the company level as being agreed by the Fatwa is best approach for business zakat. However, if the company does not pay zakat, then the obligation belongs to the shareholders. To assist the shareholders to complete the zakat payment, the needed information must be available. This requires for a separate disclosure and needs to be made until the ZPS. Thus, this study is designed to explore this option and obtain a consensus from accounting practitioners concerning this matter.

Research Questions

Based on the problem stated, this study is designed to answer the following questions:

a.How the zakat expertise perceived about separate disclosure for business zakat and the use of Zakat per Share to facilitate business zakat payment?

b.Do the accounting practitioners agree on the practices of separate disclosure for business zakat and the use of Zakat per Share to facilitate business zakat payment

Purpose of the Study

A separate disclosure for business zakat is every important to facilitate business zakat payment. While Zakat per Share can assist in making a correct payment. Therefore, the purpose of this study is to:

i.Explore the opinion of zakat expertise about separate disclosure for business zakat and the use of Zakat per Share to facilitate business zakat payment; and

ii. Gain a consensus from accounting practitioners with regard to the practices of separate disclosure for business zakat and the use of Zakat per Share to facilitate business zakat payment.

Research Method

This study employed a two-phase data collection process to fulfil the research objectives. The phases are designed sequentially, where the early phase must be completed before the next stage begins. This study is initiated by collecting the data through interviews. Interviews were conducted to eliminate reasonable guesses and contribute to greater confidence in the generalisability of results (Jick, 1979).

Purposive sampling was used to select the respondents. Purposive sampling is designed to pick a small number of cases that will yield the most relevant information about a phenomenon (Bickman & Rog, 2009). The study has set that respondents must have a minimum experience of ten years in their related field. This is to ensure the reliability of their feedback. The respondents were grouped according to their field and classified into five main categories which are (i) auditor, (ii) accountant from zakat paying companies, (iii) business owners, (iv) zakat authority, and (v) appointed zakat agent. The diversity of experience in the groups of respondents will deter bias and avoid one-sided analytical practices in the study (Pyett, 2003). In each group, at least one respondent is selected for a face-to-face interview.

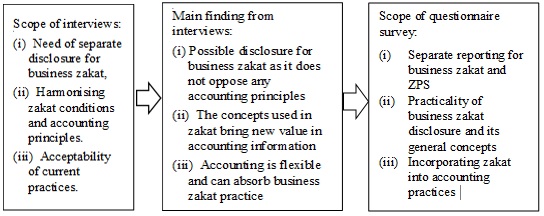

The interview questions are focused on the needs of separate disclosure for business zakat. From the literature and interviews, three main issues were highlighted which are (i) the need of separate disclosure for business zakat, (ii) harmonising zakat conditions with accounting principles, and (iii) acceptability of current practices.

The data from the interviews were analysed using the constant comparative method. It is an inductive data coding process used for categorising and comparing qualitative data through symbolic interactionism, which enables the study to build an understanding of the phenomenon (Freeman, 2017). The interviews were analysed using the qualitative data software, ATLAS.ti to speed up data analysis. This study used the same procedures of coding involving open coding, axial coding and selective coding. All the codings are done in the system.

The results from the qualitative analysis would become a starting point for further investigation (Walker, 1988). This study uses qualitative survey results and transforms it into questionnaire surveys for a larger coverage of respondents and better generalisation. The interviews conducted highlighted that only respondents with knowledge in business zakat can answers the questions intended for this study. Thus, purposive sampling is the most suitable approach to collect data. Only practitioners who have attended workshop or seminar on business zakat are taken as respondents for this study. The respondents for the questionnaire surveys in this study are accounting practitioners who have knowledge of business zakat. Only Muslim practitioners are considered for this study to avoid bias from non-believers.

The questionnaire was developed primarily based on interviews. The process of finding the scope for questionnaire survey is illustrated as in Figure

Descriptive statistics were employed to analyse the data collected. Since the research objective is to obtain a consensus, no inferential statistics are involved. A group opinion, general agreement, or group solidarity in sentiment and belief can be taken as consensus (Von Der Gracht, 2012). Statistical Package for Social Science (SPSS) was used to analyse the quantitative data from the questionnaires. The consensus can be achieved through mean and median. The mean and median values are important to show the group’s aggregate rank (Holey et al., 2007). Von Der Gracht (2012) had tabulated many studies and proposed the consensus is achieved if the mean reached ‘3 and above’ in the use of a 5-point Likert scale or reach more than 67% if the Yes/No scale is used. Therefore, this study used mean and percentage of the agreement to infer the consensus.

Findings

This finding is divided into two parts interviews and questionnaire surveys. Ten (10) interviews were conducted with various stakeholders of zakat, and 182 questionnaires were collected from the respondents. The feedback from the data collected is discussed in the next section.

Interviews - A separate disclosure for Business Zakat

The respondents of the interview were from three different states. A total of six (6) respondents is from the Federal State of Kuala Lumpur, two (2) from Penang, and two (2) from Pahang. They are considered as experts in their respective fields as they possess relevant experience of more than 10 years of experience with the longest experience being 25 years. The actual interviews ranged between 40 minutes and 1 hour 20 minutes. A complete description of the participants’ demographics is depicted in Table

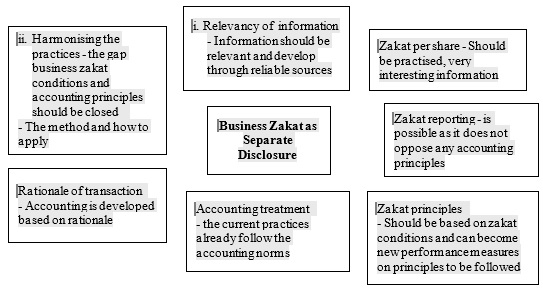

Based on the discussion with the respondents, seven codes were captured as shown in Figure

(i) Relevancy of information – information of disclosure should be relevant and derived from reliable sources. If possible, this information should not only be for zakat purposes but should also extend as part of performance measurement.

(ii) Harmonising business zakat conditions and accounting principles – the current gap between the practices needs to be closed. Accounting disclosure needs to be restructured since all information needed for zakat computation is available from accounting records.

(iii) Rationality of the practise – rationality and practicality are very important in accounting. Accounting is develop based on these premises. To materialise separate disclosure for business zakat, the rationality of the practice must exist.

(iv) Accounting treatment – the current accounting treatment for business zakat payment already followed the accounting norm. The practitioners recorded it correctly without needs to refer to the guideline. However, there are few practices on how to determine zakat payable.

(v) General concepts to guide business zakat computation – the disclosure needs to follow zakat conditions which were pointed out by several respondents as ‘good information’. Therefore, the general concepts of the information must be made available to the practitioners.

(vi) Zakat reporting – there are two suggestions on separate disclosure for business zakat, (i) disclosed as separate reporting as VAS, or (ii) disclosed in the notes. Accordingly, both disclosures do not oppose any accounting principles.

(vii) Zakat per Share (ZPS) – ZPS is an excellent practice. The idea is to pass the responsibility of zakat payment to the shareholders as there are many issues regarding zakat payment at the company level. ZPS might introduce very interesting information.

The seven codes captured on business zakat and its disclosure during the interviews are illustrated as in Figure

From the interviews, three important inferences can be drawn:

(i) A separate zakat reporting does not oppose any accounting principles

Two ways of disclosures were suggested by the respondents, and none of it opposes the accounting principles. This issue received overwhelming feedback from the respondents. One of the respondents provided a vague idea of what the disclosure should look like, in terms of elements of reporting, space taken for reporting, and comparability for performance measure. It does not oppose any accounting principles, and in return, can further enhance the value of financial statements. Therefore, the respondents agreed that separate reporting for business zakat should be practised.

(ii) The concepts in zakat disclosure and ZPS

The zakat agents highlighted two concepts of zakat which are deemed as very good information to be absorbed in accounting. The concepts are full ownership concept and potentially growth concept. This information is very good but is currently only used for zakat purposes. These concepts are used to calculate zakat, derive the ZPS value and generate a disclosure. Interestingly, the respondents are eager to see the disclosure. Some have even imagined that ZPS might be a good tool for performance measurement.

(iii) Flexibility in accounting to absorb the practice of business zakat

Respondents who are accounting practitioners agreed that accounting which is a developed practice based on social demand is flexible. It can absorb and practise the conditions of business zakat as required. Currently, more complex transactions are handled in accounting. Thus, zakat is not seen as a burden or something impossible to be practised. However, they collectively agreed that information disclosed in business zakat disclosure must be relevant, and the rationale of the practice must be there.

Questionnaire Surveys - Consensus on Separate Disclosure for Business Zakat

Almost 400 questionnaires were distributed to accounting practitioners who have experienced in attending workshops or seminars on business zakat. After removing incomplete questionnaires, a total of 182 questionnaires were concluded as valid, which represent 45.5% response rate. The demographic profile of the respondents is tabulated in Table

For the first element of the questionnaire on separate reporting for business zakat, almost all the respondents agreed that it should be reported by businesses fully-owned by Muslims (92.4%) and have Muslim ownership (90.1%). ZPS reporting also received an overwhelming feedback with mean value 4.12, where 76.8% of the respondents agreed it is a good practice. They also agreed that ZPS will assist shareholders to discharge their zakat obligation and enhance the value of the financial report. Thus, there is a consensus, which emphasises the need for business zakat disclosure and ZPS. The disclosure would not only assist in business zakat payment but also enhance the value of the financial report. The result is shown in Table

For the practicality of business zakat disclosure, 83.5% of respondents agreed it is understandable, 82.5% agreed it is practicable, and 83.5% agreed it is a good practice. On business zakat general concepts, the respondents agreed that they could understand the concept of ownership (79.7%), ready to trade (71.5%), and growth (75.1%) in zakat. The overall result as shown in Table

Interesting result is demonstrated on the last element, which is incorporating zakat into accounting practices. This is shown as in Table

Conclusion

This study revealed very encouraging findings. There is a consensus that separating business zakat reporting and ZPS is practical and that the general concepts in computing business zakat can be applied and incorporated in accounting practices. Zakat computation which is based on wealth of the business can be a critical tool for performance measurement of the business. As integration between zakat assessment and zakat accounting are very crucial (Tajuddin, 2017), this study highlighted that it is possible.

Zakat disclosure should be analysed beyond the religious perspective. The information disclosed will not only help Muslims in determining their zakat obligation, but also enhances the value of the financial statement. Since the disclosure does not oppose any accounting principles, it should be practised. Moreover, the accounting practitioners are willing to practise it as they believe in the good value inheritance of the information. It is also should be noted that difficulties created in calculating business zakat will contribute to late payment or nonpayment of zakat resulting to less zakat collection and less distribution to the asnaf (Muhammad, 2016). Therefore, by separating business zakat reporting and introducing ZPS, the collection of zakat might also increase.

It is suggested for future studies to develop a framework for business zakat disclosure to be conducted. Accounting is dynamic and is developed based on social demand. The practice is very structured and internationally accepted. To materialise a separate disclosure for business zakat, a well-structured framework is needed. This can be done through harmonising zakat conditions with accounting principles and use accounting conceptual framework as the basis to integrate the practices.

References

- Abdul Rahim, A. R. (2007). Pre-requisites for Effective Integration of Zakah into Mainstream Islamic Financial System in Malaysia. Islamic Economic Studies, 14(1), 91–107.

- Al Qaradawi, D. Y. (1999). Fiqh al zakah [Jurisprudence of Zakat] (1st ed.). Scientific Publishing Centre.

- Al-Zuhayli, W. (2002). Financial Transactions in Islamic Jurisprudence. In M. A. El-Gamal (Ed.) (1st ed.). Beirut: Dar al-Fikr.

- Ash Shiddieqy, T. H. H. (1996). Pedoman Zakat [Zakat Guidelines] (1st ed.). Darul Fikir.

- ASSC. (1975). The Corporate Report. London.

- Bickman, L., & Rog, D. J. (2009). Applied Social Research Method (2nd ed.). Sage Publications.

- E-Fatwa. (2009). Himpunan Keputusan Muzakarah Jawatankuasa Kebangsaan: Berhubung Dengan Isu-Isu Muamalat-Zakat Ke Atas Syarikat. Fatwa Kebangsaan [Collection of Muzakarah Results of the National Committee: In Relation to Muamalat-Zakat Issues on the Company. National Fatwa]. www.e-fatwa.gov.my/fatwa-kebangsaan/zakat-ke-atas-syarikat

- Freeman, M. (2017). Modes of thinking for qualitative data analysis. Routledge.

- Von Der Gracht, H. A. (2012). Technological Forecasting & Social Change Consensus measurement in Delphi studies Review and implications for future quality assurance. Technological Forecasting & Social Change, 79(8), 1525–1536. https://doi.org/10.1016/j.techfore.2012.04.013

- Halizah, M. A., Kasumalinda, A., & Agoos Munalis, T. (2011). Factors Influence Company Towards Zakat Payment: An Explanatory Studies. In 2nd International Conference on Business and Economic Research (2nd ICBER) (pp. 2515–2522).

- Hamat, Z., Endut, W. A., & Hanapi, M. S. (2017). Shares Zakah Accounting in Malaysia: Fatawa, Manual and Practices. International Journal of Academic Research in Business and Social Sciences, 7(2) 812 – 824.

- Holey, E. A., Feeley, J. L., Dixon, J., & Whittaker, V. J. (2007). An exploration of the use of simple statistics to measure consensus and stability in Delphi studies. BMC Medical Research Methodology, 7(52), 1–10. https://doi.org/10.1186/1471-2288-7-52

- Ismail, A. G., Tohirin, A., & Ahmad, M. A. J. (2013). Debate on Policy Issues in the Field of Zakat on Islamic Bank Business (pp. 1–13).

- Jick, T. D. (1979). Mixing Qualitative and Quantitative Methods: Triangulation in Action Mixing Qualitative and Quantitative Methods: Triangulation in Action. Administrative Science Quarterly, 24, 602-611. https://doi.org/10.2307/2392366

- Joshi, P. L., & Ramadhan, S. (2002). The adoption of international accounting standards by small and closely held companies: evidence from Bahrain. The International Journal of Accounting, 37, 429–440. https://doi.org/10.1016/S0020-7063(02)00190-5

- Lin, Z. J., Chen, F., & Tang, Q. (2001). An empirical evaluation of the new system of business accounting in China. Journal of International Accounting, Auditing and Taxation, 10(1), 23-49.

- Mohd Saleh, A. (2006). Penentu Hukum Syarak dalam Taksiran Zakat Perniagaan. In I. Abdul Ghafar & H. M. Tahir (Eds.), Zakat Pensyariatan Perekonomian dan Perundangan (1st ed.). Universiti Kebangsaan Malaysia.

- Muhammad, I. (2016). Factors that influence business zakat compliance among small and medium entrepreneurs. The Journal of Muamalat and Islamic Finance Research, 13(1) 97-110.

- Noor, R. M., Rashid, N. M. N. N. M., & Mastuki, N. (2011). Zakat and tax reporting: Disclosures practices of Shariah compliance companies. In 2011 IEEE Colloquium on Humanities Science and Engineering (pp. 877–882). IEEE. https://doi.org/10.1109/CHUSER.2011.6163862

- Pyett, P. M. (2003). Validation of qualitative research in the “real world.” Qualitative Health Research, 13, 1170-1179.

- Rosele, M. I., & Abdullah, L. (2018). Zakah on shares: Theory and reality in Malaysia. Journal of Emerging Economies & Islamic Research 6(2), 30-39

- Shahul Hameed, M. I. (2000). The Need for Islamic Accounting; Perceptions of Its Objectives and Characteristics by Malaysian Muslim Accountants and Accounting Academics. University of Dundee.

- Syed Mohd Ghazali Wafa, S. A. W. (2006). Harmonisation of Conditions of Zakat Accounting into the Accounting Reporting Framework. Universiti Kebangsaan Malaysia.

- Tajuddin, T. S. (2017). Business Zakat Accounting and Its Assessment. Jurnal Pengajian Islam, 10(2) 18-30.

- Walker, R. (1988). Applied Qualitative Research (2nd ed.). Gower.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Kadir, M. R. A., Wafa, S. M. G. W. S. A., & Abdullah, A. A. (2020). A Study on Disclosure for Business Zakat in Malaysia. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 268-278). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.28