Abstract

Water crises are listed in the top ten global risk in 2019. The demand for water are increasing as population increase globally, thus companies must step forward in supporting water sustainability and adapting to climate change. Companies engage in water initiatives and committed to achieve the Sustainable Development Goal (SDG), or particularly the SDG6 are disclosing information on water data and commitment to the stakeholders. Motivated towards exploring the impact of corporate water disclosures, this study aims to examine the trend of water related information disclosures for five years and to investigate the relationship between those water disclosures to financial performance of the sample companies. The sample companies are the 2018 CDP Water A-List companies. Using content analysis and deriving data for financial performance from annual reports, stand-alone reports, sustainability reports and integrated reports of the sample companies. There are ten items of corporate water disclosures adopted from CDP including water dependence, water accounting, value chain water engagement, water related business impacts, water risk assessment, water risks, water opportunities, water governance and strategy, water target and goals, and linkage or trade-offs between water. This study found that corporate water disclosures have positive significant relationship with earnings per share and share prices. The research indicates that corporate water disclosures are valuable to investors in making their decision.

Keywords: Water disclosurefinancial performanceearnings per shareshare priceCDP Water A-List

Introduction

The global risks are intensifying, but tackling the risks remain lacking in many ways. The Global Risks Report 2019 which provides the outcomes of the latest Global Risk Perception Survey involving approximately 1,000 decision makers from the private and public sector, civil society and including academia, assessing the risks facing the world (World Economic Forum [WEF], 2019). The reports unveil alarming scenario: environmental risks dominated the one half of the top ten risks in terms of likelihood and impact. In the year 2019, water crises fall the 4th of the top ten global risks in terms of impact and the 9th risk in terms of likelihood. The environmental risks include severe weather incidents, climate change adaptation and mitigation failures, natural disasters like flood and hurricane, man-made environmental calamities, and biodiversity damages and ecosystem loss. These also directly affect water availability, water quality and quantity globally. This is in contrast to the survey in 2014 where economic risks became the main concern of the public (WEF, 2014).

In Sustainable Development Goals (SDGs) provided a framework for collective action by government, the private sector and the society to focus on social and environmental issues that restrain economic development and prosperity. Organisations are being called to contribute to SDGs. Businesses are being warned that the long-term achievement and existence of some industries and businesses depends on the attainment of one or more of the SDGs, particularly climate action (Adams, 2017). The committed water goal, the SDG 6 is devoted to ensure water sustainable management, availability and sanitation for all. Companies with water stewardship and governance in line with SDG 6 targets can improved the water programmes, water quality data, water disclosure and reporting, building trust and assurance to the stakeholders. The collaboration between government and companies can promote the corporate investment, innovation, capacity building, rising awareness and collective action of all the involved parties.

Companies have a vital role to play in handling water resources. The world natural resources is a key ingredient for business processes that produce different services and products essential to lifestyle of modern society (Gleick 2012; World Water Assessment Programme [WWAP], 2012). Whilst this water management efficiency is a socially responsible activity, there are also company advantage from recognizing the risks and opportunities of water activities to a business. Bad management of water leads to disastrous eco-systems and human health and this can affect the operation suspension and/or failure of business (Carbon Disclosure Project, 2013; Wedawatta & Ingirige, 2012). Valuable water resources are insufficient, and this scarcity causes risks to businesses physically, reputably and financially (Jones et al., 2015). Hence, there is a crucial demand to redescribe water as a shared and economic resources. Therefore, companies should signify the ability to manage and facilitate social and environment, human requirements, and ensuring adequate provision to sustain the intensifying industrial needs (Alcamo et al., 1997; Lambooy, 2011; WWAP, 2012; World Bank, 2010).

Corporate Water Disclosure and Financial Performance

Water is to meet basic human needs and also imperative for sustainable economic development (Kundzewicz, 1997). Businesses are among the largest consumers of freshwater worldwide (Ortas et al., 2019). Previously, Sarni (2013) discovers value-creating programmes to create new water-efficient products, services and processes in a water scarce world, to cut the use of water in operations to control costs and risks, and to obtain reputation and solidify license to manage through better water stewardship. Water issues are recognised as one of the biggest risks facing business, and many sustainability standards include clear requirements on water management and stewardship (WWF, 2017). Water scarcity or natural disasters like flooding, financial as much as reputational risk can lead to business disruption (World Business Council for Sustainable Development, 2018). On the other hand, spending in water governance or sustainable water management provides opportunities to gain a competitive advantage. The findings from Banerjee et al. (2019) suggest that policy initiatives concentrated at the firm level will be more effective in promoting sustainable environmental strategies. Firms may have different policies and strategies in committing sustainable water goal. Morrison et al (2010) stated that efficient water accounting allows companies to verify the impact on direct or indirect use of water in communities and ecosystems, trace the effects of companies’ water management practices, assess material water risks, and report their trends including impacts to the stakeholders. Thus, this study aims to investigate the corporate water disclosure trends in CDP Water A-List companies which may leads to financial performance of the companies.

The market will better operate with a more forward-looking and detailed information provided by organizations (Ernst and Young, 2014). Therefore, companies demanded to rationalise their value creation goals. The value creation target can be either intangible or tangible assets and measures the value companies create from a precise and focus aim of environmental, social and governance (ESG) perspective. The aim is to enable investors and stakeholders to have informed decision making and closer to their intrinsic value. Asset and wealth managers have seen a substantial influx of client funds flow into sustainable investments (Ernst and Young 2019). This sustainable investment strategy has increase 107.4% annually since 2012 and currently accounts for 18% of the assets under management (AUM) in the wealth and asset management industry (The Forum for Sustainable and Responsible Investment, 2014). Sustainable investments strategy means incorporating factors of ESG into investment decision.

Global demand for food, water and energy will urge the need for inventive improvements in infrastructure to address the resource demand associated with a growing population with an estimated addition of 2 billion people by 2050 (Ernst and Young, 2019). Implementation of sustainability commitment by companies and organisations are important to legitimise the business operations. Companies have to adopt ways to enhance productivity with limited sources of natural resources with growing population. Other organisations, institutions and government may provide support system to achieve this sustainable goal. Clean water and sanitation as stated goal in the dedicated SDG6, innovations in energy generation and distribution, more efficient transportation, and improved health care to provide an abundance of opportunity for growth in sustainable investment (Ernst and Young, 2019). However, companies are to attract investors and stakeholders to be part of the sustainable investment growth particularly to achieve water sustainability, they have to be encouraged that the investments are significant and will maximize their wealth.

In practice, there is a significant connection between industry, government and community in managing water which involves constant strategies and collaboration to address and accelerate the increasing uncertainties associated with water (Gleick, 2012; Lambooy, 2011; Martinez, 2015). For a business perspective, the primary role of industry is to make profit by servicing human needs (Friedman, 1970). Nevertheless, nowadays, industries are said to internalize environmental and social costs (Gladwin et al., 1995). Environment Management Systems (EMS) and Corporate Social Responsibility (CSR) concepts are emerging to operationalize sustainability goals (Baxter, 2011; Carroll, 1999). Even though these conceptions have a positive influence on corporation’s social performance, but they are also lack the basic framework to identify the long-term impact on firm performance (Peloza, 2009; Steven & Melnyk, 2003; Stanwick & Stanwick, 1998; Weber, 2007).

This study investigates the association between corporate water disclosure and firm financial performance using the samples of CDP A-List companies in water performance.

Problem Statement

In the year 2018, water crises are the fifth most impactful global risk (WEF, 2018), linked to other significant risks, social and environmental (CEO Water Mandate, n.d.). Further in the year 2019 water crises fall under top ten global crises (WEF, 2019). Thus, businesses should not operate as usual but adapting to global demand and managing global water risk. Companies should move forward and implementing corporate water sustainability management to achieve the SDG6.

As a result of these growing business impacts, water-related opportunities and risks are becoming a bigger focus among global investors, thus most of investors seeking better and improved disclosure from companies on their water use and associated risks (Trausch et al., 2011). Thus, the challenge remains for global companies to use water reporting and disclosures to enable users and investors making informed decision.

Research Questions

Based on the arguments above, this study poses two research questions:

RQ1: What are the corporate water disclosure trends for the sample companies in the last five years from 2014 to 2018?

RQ2: Are there any significant relationship between water disclosure for the sample companies and corporate financial performance?

Purpose of the Study

Having presented the research questions above, the objectives of this study includes (1) to determine the trend of corporate water disclosure of CDP Water A-List companies and (2) to investigate the relationship between water disclosure of the companies and corporate financial performance.

Research Methods

This study emphasis on sample companies that contributed to the CDP Water A-List 2018. There are 31 companies in the sample and the data were collected for five years from 2014 to 2018. We used secondary data collection from the annual reports, stand-alone reports, sustainability reports for water related information. Meanwhile the financial data and financial performance of the companies were obtained through Thomson Reuter’s database. The Table

Findings

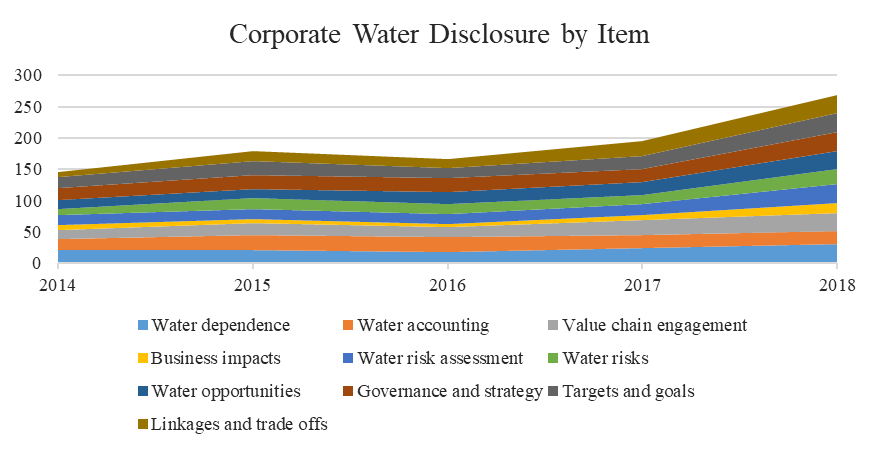

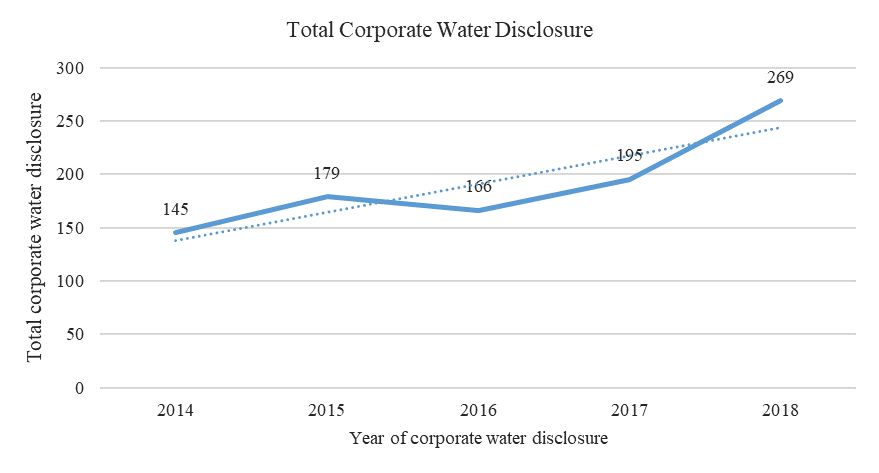

This paper aims to investigate the trend for five years on water related information disclosed by the sample companies to answer RQ1. Referring to Figure

The decrease in total corporate water disclosure as shown in the Figure

Having discussed the findings for RQ1, the table

Spearman correlation coefficient presented in Table

Conclusion

From the five years of data collection, 2014 to 2018 for CDP Water A-List companies implies that investors place high value on corporate water disclosures. Water related information is significant for investors in making informed decision. This study found that corporate water disclosures have positive significant relationship with EPS and SP. Therefore, it signifies that for companies to increase the value of earnings per share and share prices of the companies, the water related information must be disclosed, and in order to report and disclose water initiatives, companies may involve a lot in water commitment. Engaging in water sustainability activities lead to realising global water goal. However, these findings are not generalised to all global companies.

A research paper is not without its limitation. As this study only collecting data for certain years and for companies that actively involved in water commitment that were given A scores, it does not represent the whole population of the companies globally. Thus, this study does not indicate any comparison with other companies and other sectors or industries which not included in the sample companies. Future research may study the impact of corporate water disclosures from the theoretical lens.

Acknowledgments

The researchers would like to thank Universiti Tenaga Nasional for the fund provided to conduct this research (RJO10436494).

References

- Adams, C. A. (2017). The Sustainable Development Goals, integrated thinking and the integrated report. Institute of Charteted Accountants of Scotland.

- Alcamo, J., Döll, P., Kaspar, F., & Siebert, S. (1997). Global change and global scenarios of water use and availability: an application of WaterGAP 1.0. Center for Environmental Systems Research, University of Kassel, Kassel, Germany.

- Banerjee, R., Gupta, K., & McIve, R. (2019). What matters most to firm-level environmentally sustainable practices: Firm-specific or country-level factors? Journal of Cleaner Production, 225-240.

- Baxter, M. (2011). Environmental management systems. In J. Brady, A. Ebbage, & R. Lunn, R (Eds.), Environmental management in organizations. The IEMA handbook (2nd Edition, pp. 261- 273). Earthscan.

- Carbon Disclosure Project. (2013). Moving Beyond Business as Usual. A Need for a Step Change in Water Risk Management. CDP Global Water Report 2013, Carbon Disclosure Project, London.

- Carroll, A. B. (1999). Corporate social responsibility evolution of a definitional construct. Business & society, 38(3), 268-295.

- CEO Water Mandate. (n.d.). What Is Water Stewardship? Retrieved on 6 January, 2020, from https://ceowatermandate.org/university/101-the-basics/lessons/what-is-water-stewardship/

- Ernst and Young. (2014). Integrated Reporting Elevating Value. https://www.ey.com/Publication/ vwLUAssets/EY-Integrated-reporting/%24FILE/EY-Integrated-reporting.pdf$FILE/EY-Integrated-reporting.pdf

- Ernst and Young. (2019). Sustainable investing - How the millennial generation invests its wealth. https://www.ey.com/Publication/vwLUAssets/EY-sustainable-investing-how-the-millennial-generation-invests-its-wealth/$FILE/EY-sustainable-investing-how-the-millennial-generation-invests-its-wealth.pdf

- Friedman, M. (1970). The Social Responsibility of Business is to Increase its Profits. The New York Times Magazine. http://umich.edu/~thecore/doc/Friedman.pdf

- Gladwin, T. N., Kennelly, J. J., & Krause, T. S. (1995). Shifting paradigms for sustainable development: Implications for management theory and research.Academy of management Review, 20(4), 874-907.

- Gleick, P. H. (2012). The World’s Water Volume 7: The Biennial Report on Freshwater Resources, Pacific Institute for Studies in Development, Environment, and Security. https://islandpress.org/ books/worlds-water-volume-7

- Jones, P., Hillier, D., & Comfort, D. (2015). Water stewardship and corporate sustainability: a case study of reputation management in the food and drinks industry. J. Publ. Aff. 15, 116e126.

- Kundzewicz, Z. W. (1997). Water resources for sustainable development. Hydrological Sciences Journal, 42(4), 467-480. https://doi.org/10.1080/02626669709492047

- Lambooy, T. (2011). Corporate social responsibility: sustainable water use. Journal of Cleaner Production, 19(8), 852-866.

- Martinez, F. (2015). A three-dimensional conceptual framework of corporate water responsibility. Organization & Environment, 28(2), 137-159.

- Morrison, J., Schulte, P., & Schenck, R. (2010). Corporate Water Accounting. An Analysis of Methods and Tools for Measuring Water Use and its Impacts. Pacific Institute Oakland, California, USA and UNEP DTIE.

- Ortas, E., Burritt, R. L., & Christ, K. L. (2019). The influence of macro factors on corporate water management: A multi-country quantile regression approach, Journal of Cleaner Production, 1013-1021.

- Peloza, J. (2009). The challenge of measuring financial impacts from investments in corporate social performance. Journal of Management, 35(6), 1518-1541.

- Sarni, W. (2013). Getting ahead of the “ripple effect”. A framework for a water stewardship strategy. Deloitte Rev. 12, 84e97.

- Stanwick, P. A., & Stanwick, S. D. (1998). The relationship between corporate social performance, and organizational size, financial performance, and environmental performance: An empirical examination. Journal of business ethics, 17(2), 195-204.

- Steven A., & Melnyk, R. P. (2003). Assessing the impact of environmental management systems on corporate and environmental performance. Journal of Operations Management, 21(3), 329-351.

- The Forum for Sustainable and Responsible Investment. (2014). The Forum for Sustainable and Responsible Investment. http://www.ussif.org/Files/Publications/SIF_Trends_14.F.ES.pdf

- Trausch, J. J., Ceres, P., Reyes, F. E., & Batey, R. T. (2011). The structure of a tetrahydrofolate-sensing riboswitch reveals two ligand binding sites in a single aptamer. Structure, 19(10), 1413-1423.

- Weber, O. (2007). Factors Influencing the Implementation of Environmental Management Systems, Practices and Performance. In R. Sroufe, & J. Sarkis (Eds.), Strategic Sustainability: the State of the Art in Corporate Environmental Management Systems (pp. 190-204). Greenleaf.

- Wedawatta, G., & Ingirige, B. (2012). Resilience and adaptation of small and mediumsized enterprises to flood risk. Disaster Prev. Manag. Int. J. 21, 474e488.

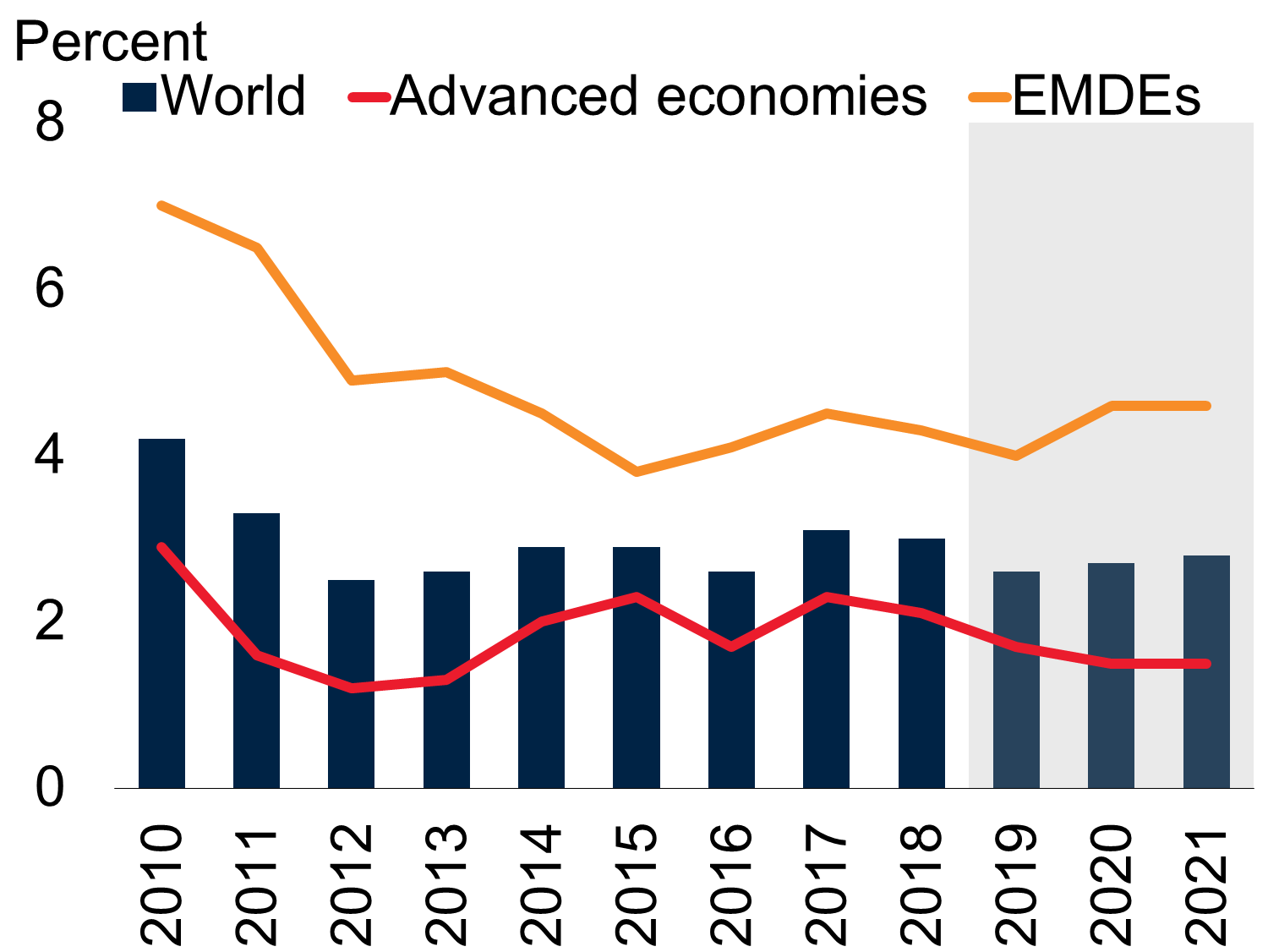

- World Bank (2019). Global Economic Prospects Heightened Tensions, Subdued Investment https://www.worldbank.org/en/publication/global-economic-prospects

- World Bank. (2010). World Development Indicator. http://data.worldbank.org/sites/default/files/wdi-final.pdf

- World Business Council for Sustainable Development. (2018). Enhancing the Credibility of Non-financial information–the investor perspective.

- World Economic Forum. (2014). Global Risks 2014 - Ninth Edition. World Economic Forum: Geneva. http://www3.weforum.org/docs/WEF_GlobalRisks_Report_2014.pdf

- World Economic Forum. (2019). The Global Risks Report 2019 - 14th Edition. World Economic Forum: Geneva. http://www3.weforum.org/docs/WEF_Global_Risks_Report_2019.pdf

- World Water Assessment Programme. (2012). The United Nations World Water Development Report 4: Managing Water under Uncertainty and Risk. http://www.unesco.org/new/en/natural-sciences/environment/water/wwap/wwdr/wwdr4-2012/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Ali, I. M., Ayub, N., Husin, N. M., & Alrazi, B. (2020). Water Disclosure And Financial Performance: The Case Of Cdp Water A-List Companies. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 259-267). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.27