Abstract

There is a need to have the effort on protecting the environment by focusing on good governance aspect as the failure to protect the environment affects the global economy. Due to that reason, this study aims to explore the current green governance practices and disclosures among public listed companies in Malaysia. A total of 237 companies in the environmentally sensitive industries were selected as the sample and the content analysis was used on annual reports and sustainability reports 2017. Findings have confirmed that only 39 companies have specific board environmental/ green committee of which only two companies have environment working committee, one company has green team and 104 companies have committee relevant to environment. However, only 24 companies have full disclosure on green governance in their annual reports and sustainability report. The finding will conclude that there are minimum practices of green governance as well as its disclosures in the environmentally sensitive industry. Therefore, Bursa Malaysia should take initiative by imposing mandatory requirement on the green governance practices and enforcing the green governance disclosures in the annual reports and sustainability reports purposely to support Sustainable Development Goals (SDG).

Keywords: EnvironmentgreengovernanceSDGenvironmentally sensitive industryMalaysia

Introduction

Every year, World Economic Forum (WEF) conducted a Global Risks Perception Survey (GRPS) among the global multi-stakeholder community. The result revealed that the environment becomes the top 10 global risk likely to happen within a decade beginning from year 2011. In year 2018, the environmental risk continues to dominate the results. WEF (2019) accounted environment issues for three of the top five risks by likelihood and four by impact. There are likelihood risks on extreme weather events, failure of climate-change mitigation and adaptation, natural disasters, man-made environmental disasters, and biodiversity loss and ecosystem collapse. To address this issue, the world leaders have adopted the United Nation’s Sustainable Development Goals (SDG) with targeted to achieve in 2020. However, it will require extend efforts to 2030 if the target not achieve in 2020 (United Nations, 2019).

Malaysia is a relatively young country with the formation of the Federation of Malaya in August 31, 1957 and later the Federation of Malaysia in September 16, 1963. Malaysia was once considered one of the most resource rich countries in the world during that time (Hezri & Alizan, 2015). Malaysia is undergoing rapid economic development to cope with the rapidly changing world over the past five decades. However, Malaysia and its sources was affected with rapid deforestation, indiscriminate mining practices and accelerated expansion. Besides, socio economic development is vital in rising the quality of lives of Malaysian, but limited natural resources are not used efficiently, which disturb the environment. Therefore, it has stridden up enforcement and elevate preventive measure as highlighted in 10th (2011 – 2015), 11th (2016 – 2020) Malaysia plan and Economic Plan Unit (2010; 2015). It is also supported as today in National Readiness Assessment of SDGs for Malaysia, managing natural resources are high priority concerns in all the government and management (Hidah, 2015).

Environment is highly affected and polluted especially in the developing countries as many companies in a particular country bring employment, services and infrastructures. Recently, most of the companies have initiated voluntary steps in reducing the destruction of environment. The voluntary step reflected in their voluntary actions has been taken to make disclosures of behaviour towards environmental implications. Therefore, to control the destruction and wastage of environment, green governance is encouraged as preventive measures. The proper green governance structure and mechanism can reduce personal interest’s behaviour and provide possible ideas for new initiatives in sustainable development.

Problem Statement

Based on the sustainability concept, the sustainable company is the company that able to sustain by implementing and balancing economy (high profit), protecting environment and social right. This consistent with Hezri (2016) that reveal economic, social and environmental are three pillars of sustainability development. However, as reported by Country Sustainable Ranking (2018), most of the companies are more focus and have greater disclosure on economy and social rather than environment aspect. Therefore, all countries in the world need to continually deal with the effort of protecting environment. This initiative is essential as most of the countries have the active work underway related to explore more green growth pathways for their economics through implementing green practices (Tamanini et al., 2014). Besides, this initiative also tends to integrate between global agenda to national and local context towards sustainability goals.

In line with Malaysia’s policy, all Malaysia public listed companies are required to protect the natural environment and maintain the sustainability of economic development. However, the environmental pillar of sustainability is under threat. It has been proved through Environmental Performance Index 2018, where Malaysia ranked 75th out of 180 countries compared to 54th in year 2014 (EPI, 2018). Moreover, Peninsular Malaysia is currently left with only four fragmented and damaging large islands of forests. Therefore, the Malaysian Government is need to putting more attention on the prominent of having preventive measures in protecting the environmental, such as introducing a holistic framework of green governance.

Although various initiatives have been implemented at the national and international level, the extent of which Malaysian companies respond to green governance has not been extensively investigated. Haslinda (2014) discussed on concept of environmental governance and its current status in Malaysia. Hezri and Alizan (2015) also conducted a research on environmental governance in Malaysia. Nevertheless, they only explained on concept of resource resurgence and its looming scarcity related to land development in Malaysia. Hence, both studies are merely more on the concept, but the findings were no empirical.

Besides, the current research of green governance is limited and more focus on green finance (Saboori et al., 2019), green entrepreneurship (Nordin & Hassan, 2019), green marketing (Goh et al., 2019), green supply chain (Tan et al., 2019) and green building (Khan et al., 2019). To the best of the researchers’ knowledge, there are limited research that revealed on the current status of green governance in Malaysia especially on environmentally sensitive industries. Due to the limited literature in recent green governance implementation, there is a need for more research in this area.

Research Questions

In light of the issues raised above, the research question for this study will be “what is the current green governance practices and disclosures in Malaysia specifically for environmentally sensitive industries?”

Purpose of the Study

The main objective of this study is to explore the current green governance practices and disclosures among public listed companies in Malaysia. Specifically, this study focuses on existence of green committee/ board environmental and its disclosures on the characteristic of green committee/ board environmental in environmentally sensitive industry for the year 2017 by examining the annual reports and sustainability reports of the companies.

Research Methods

Population and sample selection

This study focuses on environmentally sensitive industries listed in the Bursa Malaysia. North American Industry Classification System (NAICS) (2018), Jaffar (2006) and Manaf et al. (2006), and Nik Ahmad and Sulaiman (2004) categorized that the environmentally sensitive industries involve industrial products, plantation construction, property and mining industries. Besides, these environmentally sensitive industries are considered having more pressure and initiatives to disclose environmental information compared to others. As of 31 July 2018, there were 237 companies. However, 130 companies are dropped due to inexistence of board environmental/ green committee and related committee on environment. Therefore, the final sample became 107 companies. In terms of industry classifications, consumer product sector has the largest number of representatives with 31 (28.72%) followed by industrial products (28; 26.17%), property development (14; 14%), energy (10; 9.35%) and construction (10; 9.35%). Utilities and transportation only represent 8 (7.5%) and 6 (5.7%), respectively for this study.

Data collection and method

The green governance was defined differently by many scholars which depend on the research objectives. Currently, there are three definitions on green governance. Firstly, governance is related with management. Secondly, Padilha and Verschoore (2013) explained that governance is related to the structure of management. Thirdly, Post et al. (2011) relate green governance with sustainable development. For this study, we consider governance as management. This definition is also consistent with Dieng and Pesqueux (2017) who defined green governance as the strategic approach which involve a bottom-up approach from the management to the employee for sustainable management of natural resources, particularly in the developing countries. Besides, Dieng and Pesqueux (2017) explained that green governance relates to the government vision and strategy in supporting a sustainable management of natural resources.

For this study, data are collected using content analysis on annual reports and sustainability reports. These reports are downloaded from the Bursa Malaysia and/or companies’ website. The year 2017 represented the most recent data available for the entire sample at the commencement of the research. This study is based on reviewing the annual reports, specifically on the director’s profile. The data are collected according to the series of interrelated attributes of green governance, namely, board environmental/ green committee composition, board environmental/ green committee leadership, board environmental/ green committee qualification and board environmental/ green committee activity.

Below are the measurements for attributes in Green Governance (see table

Kesner and Johnson (1990), and Pfeffer and Salancik (2003) explained that based on resource dependency theory, the directors bring various resources such as information, skills, knowledge, key constituents (suppliers, customers, public policy decision makers and social groups) and legitimacy. These resources are important to reduce uncertainty, which in turn reduces transaction costs. It shows that the companies depend on economic resources within society to achieve their goals and objectives. Due to that reasons, Pfeffer and Salancik (2003) revealed that the resource dependence theory focuses on the importance of the external linkages and networks of company to enhance their interests and benefits. This statement also supported by Lawrence and Lorsch (1967), where they concluded that the resource dependent theory has an environmental influence on corporate governance. They argued that successful organizations have internal corporate governance structures that match external environmental demands. Accordingly, this study assumes that the green governance probably has a link between the company and its external resources, helping to reduce uncertainty via improved corporate disclosure practices, which is important for long-term sustainability.

Findings

To summarize, table

For the existence of the board environmental/green committee, only three companies have specific board environment/ green committee of which two companies have environment working committee and one company has green team. There are 38 companies used other than sustainability committee name of which consist of sustainability steering committee (9), sustainability working group (5), sustainability working committee (4), sustainability management committee, (2) sustainability reporting committee (2), sustainability steering team (2), corporate sustainability champion (1), corporate sustainability committee (1), CSR committee (1), sustainability council (1), sustainability development committee (1), sustainability management team (1), sustainability project team (1), sustainability task force (1), sustainability team (1), sustainability project committee (1), sustainable development working committee (1), sustainable working champion (1) and sustainability reporting working committee (1). Meanwhile, there are four companies combine sustainability committee with other committee for example nomination and sustainability committee investor relations (1), corporate communications and sustainability department (1), internal group sustainability committee (1) and health, safety and environment committee (1). On the other hand, there are eight companies that have sustainability governance policy but they did not clearly state the name of committee. According to Liao et al. (2015), a company that has environmental committee can lead to be more environmentally responsive and more transparent about the environmental. Environmental committee members act as an advisor to a sounding board for each other about environmental issues, strategies and initiatives. Thus, the board is more likely to allow the company to offset the financial and non-financial goals.

In terms of green governance reporting, out of 107 companies, only 24 companies have board environmental/ green committee with full disclosure of 16 information on green governance. While the other 83 companies have limited information. Therefore, this study only analysed the companies that have disseminated full information on green governance.

Table

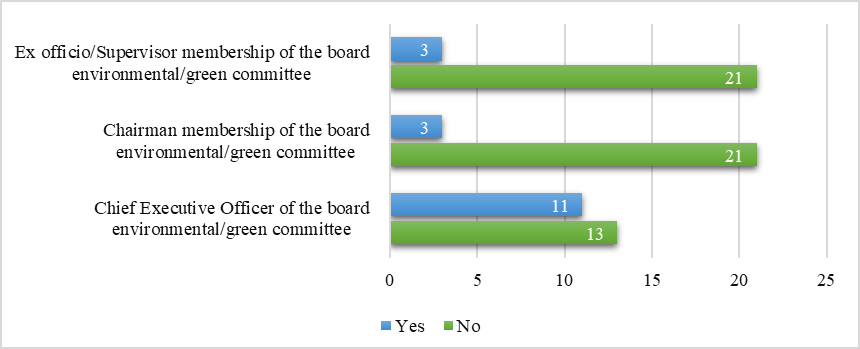

For board environmental/ green committee composition, it can be measured by using board environmental/ green committee size, board environmental/ green committee gender diversity, board environmental/ green committee independence, board environmental/ green committee multi-directorship and board environmental/green committee age. Concerning to the size of board environmental/ green committee, it ranges between 3 and 11 with an average of 5 members. Bryson (2018) explained that small size of committee will require an additional individual effort to fulfil their contribution. Besides, Mahmood and Orazalin (2017) highlighted that the small size of committee will be more effective in addressing sensitive issue including on environment issues. In terms of diversity, the maximum of female in board environmental/ green committee is 60% with the mean of 20.40%. Victor Chiedu and Fodio (2012) elucidated on the beneficial of having women on the board, for instances, achieving competitive advantage and gain a better corporate communication. They also added that women may make contributions on corporate boards by creating alliances, preparation and involvement, taking part in important decision, taking leadership roles and being invisible. Hence, board diversity may increase the likelihood of green accounting disclosure.

Independent directors in board environmental/ green committee are still relatively low with an average of 28.13%. There is a need to have more independent directors in board environmental/ green committee as board independence plays their roles effectively by forming a sound decision that can protect the rights of shareholders and stakeholders. Haniffa and Cooke (2005) further supported that as these independent directors would represent the interests of other stakeholders, they would have more influence on environmental issue. For multi-directorship, board environmental/ green committee only have maximum of four companies’ directorships with an average of one company. Resource dependence theory suggests that when board members hold multiple directorships, it increases strategic and governance issues of other companies related to environmental practices. Next, the average of age of board environmental/ green committee is 56.82 years old, with a range from 41.5 to 73.33. According to Eberhardt-Toth (2017), board with younger top managers are more likely to have a better understanding on the changes in the strategy of the companies. Besides, they also have more knowledge on the environmental issues. However, the older directors can have better ideas on the company processes due to the experience that they have.

Pertaining to board environmental/ green committee qualification attribute, this study measured this attribute by using board environmental/ green committee educational attainment, board environmental/ green committee educational with legal background and board environmental/ green committee training. For board environmental/ green committee educational attainment, on average, only 20% directors are equipped with advanced degrees, either in master’s degree or doctorates. However, there are companies that have more than half directors (66.67%) are equipped with advanced degrees. Post et al. (2011), and Elm et al. (2001) explained that the more educated committee will concern more on environmental issue due to their ability to hold broader views and have better understanding on environment issue. In terms of legal background for directors, on average, only 9.55% of directors have legal background. Kock et al. (2012) claimed that a greater exposure to the legal and regulatory system increases managers’ dependency on stakeholders, which strengthens stakeholders’ ability to enforce their environmental claims. Moreover, managers exposed to the legal and regulatory system have an incentive to meet its requirements in order to achieve lower liability costs, and avoid potentially costly litigation and fines for their companies and, in particular, themselves (Lankoski, 2006). Next, for board environmental/ green committee training, on average, only three trainings attended by the board environmental/ green committee during the financial year 2017. This training is vital to enhance the awareness of employees on the environmental aspects of their jobs and responsibilities to reduce negative impacts (Liao et al., 2015)

With regard to board environmental/ green committee activity attribute, the indicators employed in this study are meetings related to green issue organized by board environmental/ green committee, awards received on green initiatives, green business certifications, green activities organized and collaboration activities with green club/ society/ NGO. In relation to meeting, there are less frequent meeting convened related to the environment matter with an average of three times during that particular financial year. Eberhardt-Toth (2017) explained that board environmental/ green committee meeting is important to emphasize any environmental issues. On the other hand, it can be observed that the awards on green initiatives and green business certifications (i.e.: ISO 14001), on average is only one award and one green certification received by the companies. These awards and green business certifications are important to the company which act as a guideline in managing the environmental issues effectively. Hasan and Ali (2015) explained that this initiative provides company with the benefit of fulfilling business and social responsibility on environmental management. For green activities, it is worthy to mention that, on average, 12 activities have been performed during the financial year 2017. However, there are still lack of collaboration with green club/ society/ NGO. Molina-Azorín et al. (2009) revealed that when managers realize that implementing of social and environment strategies will be favored, it may give benefits to the companies’ financial performance and environment. Moreover, as green activities become an important aspect, the company and society will be paying their attention progressively towards the idea of corporate social responsibility (Lamond, 2007). Besides, commitment to the natural environment also has become a strategic issue within the current competitive scenarios.

Conclusion

This study aims to explore the current green governance practices and disclosures among companies in environmentally sensitive industry. To this end, it has developed a green governance framework and content analysed annual reports and sustainability reports of 237 companies for financial year 2017. To recapitulate, it is found that there are only few companies (1%) that have specific committee for environment or green matter and about 43.88% have relevance committee related to environment or green matter. The extent of reporting and disclosure on green governance is quite low, with approximately 10% of the companies made a discussion about the green governance. To be specific, the report disclosed substantially on board environmental/ green committee composition, qualification and leadership, but it disclosed insufficiently on board environmental/ green committee activity.

This study contributes to the body of knowledge by emphasizing on green governance. This study also developed a green governance framework and provided discussion on current practice of green governance in environmentally sensitive industries. The results provided the important insights to companies and regulators towards improving the current practice of green governance.

As the Malaysian Government in relentless efforts pursue green growth for sustainability and resilience as stated in 11st Malaysia Plan, such a low finding on green governance practice and disclosure may indicate the lower level of concern and readiness among companies on the environment matter. Accordingly, a proper guideline is needed to ensure the preparers and users aware on the need of green governance in the companies with the enforcement from the authority, for instance, Bursa Malaysia.

There are a number of limitations in this study as well. First, this study is a descriptive study and it does not link with any environment outcome such as environmental disclosure, which probably might provide a better view on the need of green governance in environmentally sensitive industries. Besides, this study only covers one-year data of annual reports and sustainability reports, which may lead to difficulty in performing comparison. Thus, the analysis of at least two years’ annual reports and sustainability reports may provide a better view of practice and reporting’s trend.

References

- Bryson, J. M. (2018). Strategic planning for public and nonprofit organizations: A guide to strengthening and sustaining organizational achievement. John Wiley & Sons.

- Country Sustainable Ranking. (2018). Country Sustainability Ranking Update – November 2018. https://www.allnews.ch/sites/default/files/files/20181212_Robecosam-country-sustainability-ranking.pdf

- Dieng, B., & Pesqueux, Y. (2017). On green governance. International Journal of Sustainable Development, 20(1-2), 111-123.

- Eberhardt-Toth, E. (2017). Who should be on a board corporate social responsibility committee? Journal of Cleaner Production, 140, 1926-1935.

- Economic Plan Unit. (2010). 10th Malaysia Plan 2011-2015. Putrajaya (Malaysia): Economic Planning Unit, Prime Minister’s Department.

- Economic Plan Unit. (2015). 11th Malaysia Plan 2016-2020. Putrajaya (Malaysia): Economic Planning Unit, Prime Minister’s Department.

- Elm, D. R., Kennedy, E. J., & Lawton, L. (2001). Determinants of moral reasoning: Sex role orientation, gender, and academic factors. Business & society, 40(3), 241-265.

- Environmental Performance Index 2018. (2018). 2018 EPI Results. https://epi.envirocenter.yale.edu/epi-topline

- Goh, W. H., Goh, Y. N., Ariffin, S. K., & Salamzadeh, Y. (2019). How green marketing mix strategies affects the firm's performance: a Malaysian perspective. International Journal of Sustainable Strategic Management, 7(1-2), 113-130.

- Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391-430.

- Hasan, Z., & Ali, N. A. (2015). The impact of green marketing strategy on the firm's performance in Malaysia. Procedia-Social and Behavioral Sciences, 172, 463-470.

- Haslinda, M. A. (2014). Environmental governance in Malaysia: An overview. In: UUM International Conference on Governance 2014 (ICG), 29th - 30th November 2014, Flamingo Hotel by The Beach, Pulau Pinang.

- Hezri, A. A. (2016). Embedding the environment sustainability for the 2030 Agenda in Malaysia/Dr. Hezri Adnan.

- Hezri, A. A., & Alizan, M. (2015). 7 Confronting the ‘new scarcity’? Environmental Challenges and Governance: Diverse perspectives from Asia, 129.

- Hidah, M. (2015). National Readiness Assessment of SDGs for Malaysia. Economic Planning Unit. Malaysia.

- Jaffar, R. O. (2006). The environmental reporting practice of ‘environmentally problematic companies’ in Malaysia. The International Journal of Accounting, Governance and Society, 1, 37-47.

- Kesner, I. F., & Johnson, R. B. (1990). An investigation of the relationship between board composition and stockholder suits. Strategic Management Journal, 11(4), 327-336.

- Khan, J. S., Zakaria, R., Shamsudin, S. M., Abidin, N. I. A., Sahamir, S. R., Abbas, D. N., & Aminudin, E. (2019). Evolution to Emergence of Green Buildings: A Review. Administrative Sciences, 9(1), 6.

- Kim, B., Burns, M. L., & Prescott, J. E. (2009). The strategic role of the board: The impact of board structure on top management team strategic action capability. Corporate Governance, 17(6), 728.

- Kock, C. J., Santalo, J., & Diestre, L. (2012). Corporate governance and the environment: What type of governance creates greener companies? Journal Management Study, 493, 492–514

- Lamond, D. A. (2007). Corporate social responsibility: making trade work for the poor. Management Decision, 45(8), 1200-1207.

- Lankoski, L. (2006). Environmental and economic performance: The basic links. In S. Schaltegger, & M. Wagner (Eds.), Managing the Business Case for Sustainability (pp. 32-46). Greenleaf Publishing.

- Lawrence, P. R., & Lorsch, J. W. (1967). Differentiation and integration in complex organizations. Administrative Science Quarterly, 1-47.

- Liao, L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review, 47(4), 409-424.

- Mahmood, M., & Orazalin, N. (2017). Green governance and sustainability reporting in Kazakhstan's oil, gas, and mining sector: Evidence from a former USSR emerging economy. Journal of Cleaner Production, 164, 389-397.

- Manaf, N. A. A., Atan, R., & Mohamed, N. (2006). Environmentally sensitive companies’ social responsibility and reporting: A study of Malaysian companies. In the 5th Australasian Conference on Social and environmental Accounting Research, Victoria university of Wellington, New Zealand.

- Molina-Azorín, J. F., Claver-Cortés, E., López-Gamero, M. D., & Tarí, J. J. (2009). Green management and financial performance: a literature review. Management Decision, 47(7), 1080-1100.

- North American Industry Classification System. (2018). North American Industry Classification System. https://www.census.gov/eos/www/naics/

- Nik Ahmad, N. N., & Sulaiman, M. (2004). Environment disclosure in Malaysia annual reports: A legitimacy theory perspective. International Journal of Commerce and Management, 14(1), 44-58.

- Nordin, R., & Hassan, R. A. (2019). The Role of Opportunities for Green Entrepreneurship Towards Investigating the Practice of Green Entrepreneurship among SMEs in Malaysia. Review of Integrative Business and Economics Research, 8, 99-116.

- Padilha, L. G. D. O., & Verschoore, J. R. D. S. (2013). Green governance: a proposal for collective governance constructs towards local sustainable development. Ambiente & Sociedade, 16(2), 153-174.

- Pfeffer, J., & Salancik, G. R. (2003). The external control of organizations: A resource dependence perspective. Stanford University Press.

- Post, C., Rahman, N., & Rubow, E. (2011). Green governance: Boards of directors’ composition and environmental corporate social responsibility. Business & Society, 50(1), 189-223.

- Saboori, B., Azman, A., & Moradbeigi, M. (2019). Green Finance in Malaysia: Barriers and Solutions. Handbook of Green Finance: Energy Security and Sustainable Development, 1-24.

- Tamanini, J., Bassi, A., Hoffman, C., & Valenciano, J. (2014). Global Green Economy Index: Measuring National Performance in the Green Economy. United Nations: Washington, DC, USA

- Tan, C. L., Zailani, S. H. M., Tan, S. C., & Yeo, S. F. (2019). Green supply chain management: impact on environmental performance and firm competitiveness. International Journal of Sustainable Strategic Management, 7(1-2), 91-112.

- United Nations. (2019). The Sustainable Development Agenda. http://www.un.org/sustainabledevelopment/development-agenda/

- Victor Chiedu, O. B. A., & Fodio, M. I. (2012). Board characteristics and the quality of environmental reporting in Nigeria. The Journal of Accounting and Management, 2, 33-48.

- World Economic Forum. (2019). Global Risk 2019, 14th Edition, World Economic Forum: Geneva. http://www3.weforum.org/docs/WEF_Global_Risks_Report_2019.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Ahmad, N. N., Abdullah, W. M. T. W., Manap, M. I. A., & Jamil, N. N. (2020). Green Governance For Environmentally Sensitive Industries In Malaysia: An Overview. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 221-231). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.23