Abstract

International Financial Reporting Standards (IFRS) has become the global standards in producing high quality, understandable and enforceable accounting standards. Malaysia have committed on full convergence since the year of 2012. Since then, most of the prior studies in the field focused on the impact of IFRS adoption on accounting or companies’ perspective. To complete the view, this study aims to investigate the investor’s views on convergence with IFRS and how it would impact the Malaysian Capital Market. By interviewing institutional investors, the findings of our study suggest that institutional investors welcome the move of IFRS convergence in Malaysia and they are positive on such a move. The investors agree that IFRS convergence will bring benefits to the Malaysia capital market. The convergence is helpful in increasing the investors’ confidence when making investment decision making in the country. It is also important to bring the financial reporting environment in the country to the international level.

Keywords: IFRS convergencecapital marketinvestorsMalaysia

Introduction

A set of high-quality financial reporting standards will serve as the basis to produce high-quality financial reports and hence ensure that investors are equipped with transparent, complete and relevant information when coming to investment decision making (Levitt, 1998). With that, Malaysia announced its plan on convergence with International Financial Reporting Standard (IFRS) in the year of 2008 and aimed for full convergence in the year of 2012 (Hanefah & Singh, 2012). Convergence is argued, will bring a positive impact to the country’s financial and capital market and benefit various market constituents (Ball, 2006). Convergence enhances investors’ confidences in the credibility of financial reporting and hence the liquidity and efficiency of the capital market (Levitt, 1998). Convergence will also enhance comparability and promote the inflow of foreign investment fund. This is because when the investors are well informed, this would then reduce the investors’ investment risk and hence the firms’ cost of capital (Ball, 2006; Hanefah & Singh, 2012; Phang & Mahzan, 2017; Rad & Embong, 2013). Hence, convergence is important to increase the financial reporting quality in the country and most importantly, putting Malaysia financial reporting environment at international standard.

While it is argued that convergence to IFRS will result in many benefits, such a claim has not been tested in full in Malaysia. Review of the convergence studies in Malaysia revealed that focus was given on the impact of convergence from accounting or preparers’ perspective. There are limited studies which examine the impact of convergence on the capital market. It has been argued that the capital market of a country has a significant influence on its financial accounting and reporting practices (Adhikari & Tondkar, 1992; Gray & Roberts, 1991). As such, the impact of convergence on the capital market should be significant. Yet, the analysis of the impact of convergence with IFRS on the Malaysian capital market is not well documented. In addition, the view from the investors has also yet to be explored. As a result, it is important for future studies to close the gap in order to provide a more comprehensive view of the impact of IFRS convergence on Malaysia.

Therefore, this study aims to gauge the investor’s view on convergence with IFRS to analyse the impact on the Malaysian Capital Market. It is also important to investigate how convergence can impact the confidence of investors and hence provide a competitive advantage to the Malaysian capital market in attracting global investors.

Literature Review and Research Questions Development

The issue of convergence is not new in accounting history. The impact of convergence started to receive much attention during the early 2000s since the International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) have signed the Memorandum of Understanding (MOU) to converge the two different sets of accounting standards. Since then, most of the study focused on the impacts on financial accounting and reporting and on constituents. Prior studies evidenced that there is a positive association between convergence and financial information quality (Armstrong et al., 2010; Barth et al., 2008; Hla & bin Md Isa, 2015; Rad & Embong, 2013). With IFRS converged, information quality is improved and hence, resulted in improved disclosure and higher transparency (Armstrong et al., 2010; Karamanou & Nishiotis, 2009). Higher information quality will then contribute to greater transparency and hence reduce the information asymmetry to the investors and the risk to less-informed investors due to adverse selection (Ball, 2006). This will then lead to more-informed valuation in the equity market and is helpful in reducing the investment risks (Ball, 2006).

Higher transparency will also have a significant influence on greater financial statement comparability (Bissessur & Hodgson, 2012; Khurana & Michas, 2011; Yip & Young, 2012), which enhances cross-border integration of capital market and consequently attracts foreign investors to invest in the country (Bradshaw et al., 2004; Covrig et al., 2007; Owusu et al., 2017). Foreign direct investment is important to a country’s economic growth as it will lead to more employment opportunities, greater technology advancement, greater knowledge transfer and most importantly improve a country’s economic condition (Rashid et al., 2017). Prior studies suggest that greater comparability is positively associated with analyst following and forecast accuracy, and negatively associated with forecast optimism and dispersion (De Franco et al., 2011; DeFond et al., 2011). In addition, improved comparability leads to an increase in the foreign mutual fund ownership (DeFond et al., 2011) and institutional holdings (Florou & Pope, 2012), reduce cost of capital (Barth et al., 2013) and increase market liquidity (Covrig et al., 2007; Frino et al., 2013).

Taken as a whole, it is noticed that the primary focus of current strand literature was given on the impact and challenges of convergence from accounting or preparers perspective while very limited studies have looked into the impact of convergence on the capital market. As discussed earlier, studies have argued that convergence to IFRS will result in better financial reporting quality, enhance comparability, ease of foreign capital access and higher capital market efficiency. While it is argued that convergence to IFRS will result in many benefits, such claim has not been tested in full in Malaysia since most of the literature in the field only focused on the benefits from the accounting or companies’ perspectives. The investors’ point of view regarding the impact of IFRS convergence on Malaysian capital market is yet to be explored in full. More studies are hence, required in order to provide a better picture of how convergence will impact Malaysia capital market. Such empirical evidence is substantial to confirm the theoretical arguments that IFRS does bring such claimed benefits to the country in a more confident manner.

Methodology

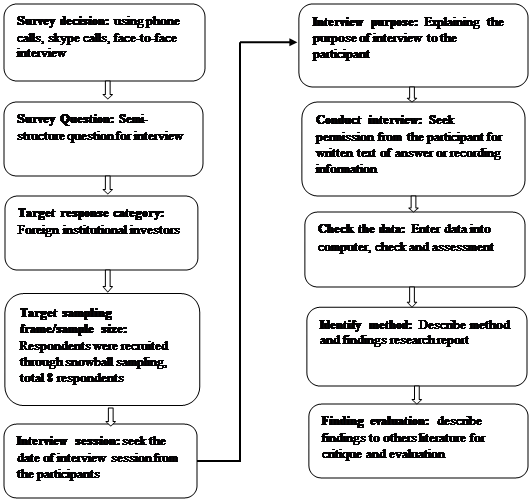

This study employs a qualitative method to examine the IFRS adoption in capital markets. This study employed a structured interview in collecting the required data. Data were collected through interviews using phone calls, skype calls or face-to-face interview. The targeted respondents are foreign institutional investors. The data collection process of this study is outlined in Figure

Sampling

Foreign institutional investors are the target participants of the study. The main reason of focusing on foreign institutional investors is because they have been managing funds and investing in various countries, hence, will be able to provide a better view on how convergence to IFRS has impacted Malaysia capital market. Three main areas where the CEO and head of investment firm participants reside, namely Kuala Lumpur, Selangor and Putrajaya were purposively chosen. Within these areas, the snowballing sampling method was used to reach the participants. Snowball sampling is suitable for collecting data from respondents who have specific knowledge, i.e., professional institutional investors in our study (Cavana et al., 2001). Due to the difficulty in recruiting respondents, only a total of 8 respondents were interviewed. The respondents range from 31 to 46 years. The summary of the respondents’ profile is provided in Table

Data collection process had been challenging for the study as foreign institutional investors were reluctant to participate in the interview due to their busy schedule. Besides, some were concerned on the type of questions that would be asked in the interview and whether they would be asked to disclosure sensitive information such investment strategies or investment decision making processes. With that, target respondents were recruited through snowball sampling. The final sample of the study consist of CEO of Investment firm, Head of equity research and equity analysts. It is to be highlighted that even though the sample of the study is small, however, the responses from the respondents had reached saturation and hence, the validity of the findings should not be in question (Fusch & Ness, 2015).

Conducting Interviews with The Investors

This study used semi-structured interviews to investigate the impact of IFRS adoption in capital markets. The sampling frame for this study was drawn from the investment firm. The CEO of an investment firm, Head were contacted for the permission of conducting interviews. The interviews took two months to be completed and they were carried out in July and August 2018.

To begin, researchers of this study described the purpose of the study to the respondents, and sought their consent to audio-tape recording and writing text note the interview. Researchers ensured that the data collection would be used for academic research purposes only and respondents’ participation was anonymous. When the participants provided their consent, the discussions started based on the semi-structured of questions. Interviews were conducted in a conversational and informal environment for free expression between the respondents and the researchers. Researchers listened carefully and participated actively throughout the conversation to elicit in-depth information from the respondents. Participants received a token of appreciation for their time, effort, and willingness. On average, each individual interview took between 50 minutes to 60 minutes to be completed.

Data Analysis

The recorded interviews were then transcribed into MS-Word and describe findings for evaluation and analysis. The interview session notes were then being read several times by the researchers of this study independently before coming to a detailed discussion on the common finding and conclusion drawing.

Findings and Discussion

Data gathered from the interview can be organised into the following main findings. The discussion will start with the participants’ overall awareness of IFRS convergence in Malaysia, impact of IFRS convergence on Malaysia capital market and factors affecting investors investment decision making.

Awareness of IFRS Convergence in Malaysia

Though Malaysia has announced its decision to converge with IFRS in the year of 2008 and targeted to achieve fully converged in the year 2012, 5 years after, the foreign investors’ awareness on this decision was not encouraging. Findings of the study revealed that all the interviewees are aware that Malaysia will be heading towards IFRS convergence.

I think that's definitely something that is positive for Malaysia and a very good step forward for Malaysia. It gives a lot of confidence, a lot of credibilities if Malaysia can be part of that global standard as well. It shows credibility and transparency of how Malaysian companies conduct their business. Also, it’s a good step forward for Malaysia who actually aspires to become a developed country (Inv_4_CEO_41_M).

However, some of them did not realise that Malaysia has actually obtained full convergence in 2012.

I noticed a lot of the listed companies that I cover, there have been a lot of changes in their quarterly statement. There are various IFRS out there and I am aware that a lot of companies in various sectors starting to adopt more and more of these standards (Inv_6_HER_46_M).

Impact of IFRS Convergence On Malaysia Capital Market

Despite, investors in general, have a positive view of IFRS adoption in Malaysia. They welcome the convergence and of the view that it will bring a positive impact on promoting investors’ confidence and Malaysian capital market. As IFRS tends to be associated as a set of accounting standards with higher quality, convergence with IFRS will not only standardize the reporting system in Malaysia, it will also increase the quality of the Malaysian firm’s annual report and put it on par with the rest of the globe. This will eventually facilitate a better comparison across the globe and attract more investors in the Malaysian capital market. Four foreign institutional investors stated that:

When you use local accounting standard, the barometer changes. The benchmark changes in every country. That becomes very difficult for us because what is acceptable in local accounting standards might not be acceptable in the IFRS (Inv_1_CEO_42_M).

Malaysia is way ahead in that sense (convergence) and definitely made it a lot easier for foreign investors to appreciate our financial statements (Inv_2_HER_31_M).

I think that (IFRS convergence) should provide greater transparency and good confidence in Malaysia financial reporting system. I think convergence is a positive thing for foreign investors definitely. It gives them a lot of convenience in judging the company's potential. When a company's data are more transparent that would enable me more confidence in their earnings forecast. Overall, I think that should give the foreign investor more positive to take away (Inv_5_HER_45_M).

For countries that do not adopt IFRS, I won't be able to value those assets as accurately as the Malaysian assets. What I tend to do, at the end of the day, I will attach a slight discount to those assets (Inv_4_CEO_41_M).

The additional disclosure requirement imposed by IFRS is also another important contributing factor that is helpful to build the investors’ confidence. The additional disclosures enhance the reliability and comparability of the annual reports prepared by Malaysian firms. However, it is to be highlighted that the impact of IFRS on disclosure of information may largely depend on the sector. Taken as an example, in the banking sector, any changes in the IFRS requirements will have a high impact on the way the investors view these stocks, but the impact is comparatively less on other sectors. This view is supported by the fact that IASB has recently moved into fair value accounting which will bring significant impact to the banking industry. Fair value accounting is not only complicated when coming to the application, but the standards are also highly judgmental which required numerous decision inputs and justification. With the fact that the participants of the study are professional investors, it is not surprising for them to notice such a tremendous change introduced in the financial statement of the banking institutions. Two foreign institutional investors stated that:

Generally, in Malaysia, as you go down the sizes of the company, you will find that the larger companies tend to publish a lot more information, and the smaller companies tend to do the bare minimum, which is for us still an issue. Although you might be doing the numbers from an accounting international standpoint, there's not enough meat in the numbers to kind of explain (Inv_2_HER_31_M).

At the end of the day, whatever the standard is, companies will always make it fit them. When you dig through the numbers and you go through the classifications and the notes, to see how the companies define certain things, you will have a mental flow of what these numbers meant (Inv_7_HER_40_M).

Even though IFRS required a higher level of disclosure, investors noticed a tendency where some companies only disclosure at the minimum level. Although Malaysia Securities Commission has provided guidelines about the information that should be published by the listed companies, there are some incidences where some companies will just disclose minimally. This might be attributed to the concern on costs and benefits by the companies. In preparing the financial reports, companies tend to face such constraint and they need to ensure that the cost incurred justifies the information produced. In the case where the cost outweighed the potential benefits, it might deter the company from taking extra efforts in gathering and producing the additional information to the outsiders. In addition, as the higher level of disclosure tends to unveil the company more to the outsider, companies might take precaution on how much to be disclosed as a higher level of information disclosure allows the competitors to have more insight on the company’s business strategies and future direction. This might endanger the competitiveness of the company in the future.

Investment Decision Making: Is IFRS The Only Consideration?

On the other hand, though investors acknowledged that IFRSs convergence will bring positive impacts, financial performance reported in the financial statement is not the only factor that is taken into consideration when making investment decisions. Investors will make their investment evaluation based on additional research conducted on the firms, instead of merely relying on the set of accounting standards adopted by the firms and the financial reports produced. Amongst the other main financial performance indicators are liquidity, bad debt, and equity, of which do not very much in a different set of standards. In addition to the reported financial performance, the other factors that will significantly influence the investors’ decision making are corporate governance of the firm, integrity and capability of the management, sustainable source of growth and growth prospects, durable competitive advantage, and credit rating level.

Hence, it is believed that the adoption of any international standard contributes to the competitive advantages of attracting global investors. However, aligned with the previous discussion, while foreign investors consider investing in the emerging market, attention will be placed on the opportunity of growth rather than emphasizing on IFRS adoption by the country. The impact of IFRS on attracting global investors might not be significant, as it contributed to a small portion of the investment valuation. Many investors are interested to make investments to some countries that have high prospective growth such as Vietnam despite it is having considerable poor financial reporting standards. Investor understands the risks involved with the market and thus are willing to take that risks for a higher return. One of the participants highlighted that:

The impact of IFRS convergence on giving a competitive advantage to Malaysia in attracting investors may not be big because it is one small portion in investors’ decision. They look at all other things such as growth and country perspectives (Inv_3_HER_33_F).

A country with poor financial reporting standards could have gained more benefits in adopting IFRS. For instance, if China and India adopt IFRS then they will be able to attract more global investors as their current reporting standard is yet to reach the international standard. The fact that poor financial reporting standards do not necessarily deter investors rather the prospective growth of the country does. One of the investors pointed out that:

If Vietnam or Cambodia would adopt the international standard, then their firm valuation would be a lot higher, and it would drive more foreign investors into their market (Inv_8_HER_34_M).

Taken as a whole, having full convergence with IFRS may not have a significant impact in attracting additional foreign investors as the previous Malaysian financial reporting standard was having a considerable international standard. In terms of financial reporting standard, Malaysia is way ahead of many emerging countries and this made easier for foreign investors to appreciate the financial statements produced. Malaysia’s financial reporting environment has reached a considerable standard and that ease the investors in assessing the information provided in the financial reports. Disregarding the issues of growth, Malaysia’s capital market is still preferred to many foreign investors when comes to investment. The implementation of international standards is deemed an important turning point by the regulators in transforming Malaysia’s market from an emerging market to a developed market.

Conclusion

The main objective of the study is to examine the investors’ view on IFRS convergence in Malaysia and how such a move will impact the Malaysia capital market. Findings of the study confirmed the argument that IFRS convergence will bring positive impact to the country. Even though most of the investors in the market do not realise that Malaysia has achieved full convergence starting the year 2012, they do feel the changes that IFRS brings. The convergence with IFRS is crucial for Malaysia to move forward from being an emerging country to developed country in terms of financial reporting. Moreover, the disclosure of information and standardization of financial reporting in terms of comparability are being emphasized as a positive change in the capital market and it provides more confidence to the investors when coming to investment decision making in the country.

It is to be highlighted that while the implementation of IFRS is useful in building the confidence of stakeholders and potential investors, there are various factors affecting investment decisions apart from the financial reporting. The impact of IFRS on attracting global investors to Malaysia may not be big given that the financial reporting standard in Malaysia is already having considerable global standards as Malaysia has been adopting IFRS even before convergence. This has then reaffirmed the concerned of the investors that if convergence is only on the surface, it will not bring many benefits. Investors are hoping for a more in-depth disclosure to facilitate the evaluation and decision making. Additionally, strong enforcement and facilitating institutional infrastructure are also important in ensuring that the country will benefit from the decision to converge with IFRSs.

This study is not without limitation. With the fact that the participants of the study felt sceptism on the interview with the worry that sensitive or confidential questions might be asked, future studies should try to approach professional bodies such as Charted Financial Analysts (CFA) in order to get the green light to approach its members. This might then ease the participants recruiting process. Besides, future studies might consider complimenting the findings of the study by getting the view from local analysts or institutional investors. This can provide a more complete view on the overall impact of IFRS convergence on Malaysia capital market.

References

- Adhikari, A., & Tondkar, R. H. (1992). Environmental factors influencing accounting disclosure requirements of global stock exchanges. Journal of International Financial Management & Accounting, 4(2), 75-105.

- Armstrong, C. S., Barth, M. E., Jagolinzer, A. D., & Riedl, E. J. (2010). Market reaction to the adoption of IFRS in Europe. The accounting review, 85(1), 31-61.

- Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of accounting research, 46(3), 467-498.

- Barth, M. E., Konchitchki, Y., & Landsman, W. R. (2013). Cost of capital and earnings transparency. Journal of Accounting and Economics, 55(2-3), 206-224.

- Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of accounting research, 46(3), 467-498.

- Bissessur, S., & Hodgson, A. (2012). Stock market synchronicity–an alternative approach to assessing the information impact of Australian IFRS. Accounting & finance, 52(1), 187-212.

- Bradshaw, M. T., Bushee, B. J., & Miller, G. S. (2004). Accounting choice, home bias, and US investment in non‐US firms. Journal of Accounting Research, 42(5), 795-841.

- Ball, R. (2006). International Financial Reporting Standards (IFRS): pros and cons for investors. Accounting and business research, 36(sup1), 5-27.

- Cavana, R., Delahaye, B., & Sekeran, U. (2001). Applied business research: Qualitative and quantitative methods. John Wiley & Sons.

- Covrig, V. M., Defond, M. L., & Hung, M. (2007). Home bias, foreign mutual fund holdings, and the voluntary adoption of international accounting standards. Journal of Accounting Research, 45(1), 41-70.

- De Franco, G., Kothari, S. P., & Verdi, R. S. (2011). The benefits of financial statement comparability. Journal of Accounting Research, 49(4), 895-931.

- DeFond, M., Hu, X., Hung, M., & Li, S. (2011). The impact of mandatory IFRS adoption on foreign mutual fund ownership: The role of comparability. Journal of Accounting and Economics, 51(3), 240-258.

- Florou, A., & Pope, P. F. (2012). Mandatory IFRS adoption and institutional investment decisions. The Accounting Review, 87(6), 1993-2025.

- Frino, A., Palumbo, R., Capalbo, F., Gerace, D., & Mollica, V. (2013). Information Disclosure and Stock Liquidity: Evidence from B orsa I taliana. Abacus, 49(4), 423-440.

- Fusch, P. I., & Ness, L. R. (2015). Are We There Yet? Data Saturation in Qualitative Research. The Qualitative Report, 20(9), 1408-1416.

- Gray, S. J., & Roberts, C. B. (1991). East-West accounting issues: A new agenda. Accounting Horizons, 5(1), 42.

- Hla, D. T., & bin Md Isa, A. H. (2015). Globalisation of financial reporting standard of listed companies in ASEAN two: Malaysia and Singapore. International Journal of Business & Society, 16(1), 95-106.

- Hanefah, H. M. M., & Singh, J. (2012). Convergence towards IFRS in Malaysia: Issues, challenges and opportunities. International Journal of Business, Economics and Law, 1(2), 85-91.

- Karamanou, I., & Nishiotis, G. P. (2009). Disclosure and the cost of capital: Evidence from the market's reaction to firm voluntary adoption of IAS. Journal of Business Finance & Accounting, 36(7‐8), 793-821.

- Khurana, I. K., & Michas, P. N. (2011). Mandatory IFRS adoption and the US home bias. Accounting Horizons, 25(4), 729-753.

- Levitt, A. (1998). The importance of high quality accounting standards. Accounting Horizons, 12(1), 79-82.

- Owusu, G. M., Saat, N. A. M., Suppiah, S. D. K., & Siong, H. L. (2017). IFRS Adoption, Institutional Quality and Foreign Direct Investment Inflows: A Dynamic Panel Analysis. Asian Journal of Business and Accounting, 10(2), 43-75.

- Phang, S. Y., & Mahzan, N. (2017). The responses of Malaysian public listed companies to the IFRS convergence. Asian Journal of Business and Accounting, 6(1), 95-120.

- Rad, S. S. E., & Embong, Z. (2013). International financial reporting standards and financial information quality: principles versus rules-based standards. Jurnal Pengurusan (UKM Journal of Management), 39, 93-109.

- Rashid, M. A. A., Sarmidi, T., Nor, A. H. S. M., & Noor, N. G. M. (2017). Does Income Gap Matter for Household Debt Accumulation? Institutions and Economies, 9(1), 1-19.

- Yip, R. W., & Young, D. (2012). Does mandatory IFRS adoption improve information comparability? The Accounting Review, 87(5), 1767-1789.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 December 2020

Article Doi

eBook ISBN

978-1-80296-099-0

Publisher

European Publisher

Volume

100

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-905

Subjects

Multi-disciplinary, accounting, finance, economics, business, management, marketing, entrepreneurship, social studies

Cite this article as:

Rahman, M., Zhee, L. Y., Ismail, I., & Isa, C. R. (2020). Investors’ Perspective on the Impact Of IFRS Convergence on Malaysian Capital Markets. In N. S. Othman, A. H. B. Jaaffar, N. H. B. Harun, S. B. Buniamin, N. E. A. B. Mohamad, I. B. M. Ali, N. H. B. A. Razali, & S. L. B. M. Hashim (Eds.), Driving Sustainability through Business-Technology Synergy, vol 100. European Proceedings of Social and Behavioural Sciences (pp. 13-22). European Publisher. https://doi.org/10.15405/epsbs.2020.12.05.2