Abstract

An important development component of the economy of any state is its investment policy with the core objective to ensure that the investment project is implemented effectively. To achieve this objective, companies need an informed choice of financing form. In Russia, a promising form of investment is project financing which is a multi-tool form of financing that allows ensuring that the financial resources are spent for the intended purpose, to concentrate the funds and competencies of all participants interested in implementation of the project. Measures of public financing of the construction industry are one of the key mechanisms for maintaining its stable development and ensuring its effective operation in the near future. Digitalization of economic relations, based on the creation of industry platforms, would actively contribute to the reduction of costs in the construction industry, reduce the degree of opportunistic behavior on the part of one-day companies created only to ensure the conduct of a single project. Besides, one of the effective ways to reduce contradictions in the author's opinion is the use of blockchain technology.

Keywords: Digitalizationinvestment project implementationinvestment policymulti-tool formproject financing mechanism

Introduction

For a very long time, the main real estate market of the Russian Federation had its share of the construction market, and the security level of such a transaction didn’t carry a lot of risks. Risks are related not only to the delay in the delivery of the object, but also to the impossibility of returning the invested funds to the object. Under the equity participation agreement, which is concluded between the developer and the investor, the former not only organizes the entire working process, from the beginning of construction to commissioning of the object, but also helps to formalize ownership rights (Kudryavtseva, 2017; Kudryavtseva, & Vasilyeva, 2018; Vasilyeva & Bachurinskaya, 2018).

As of 01.01.2019 in the Russian Federation according to the data presented by the Ministry of Construction of Russia in 68 subjects there are 894 problem new buildings in which more than 98 thousand contracts of share participation are concluded.

Adoption and implementation of the Federal Law No. 214-FL of 30.12.2004, when the developer was obliged to broadcast the work online and/or demonstrate it in the form of photographic images, did not improve the situation with the suspension of construction and bankruptcy of the developer.

Nevertheless, the Ministry of Construction of the Russian Federation introduced amendments to the law on shared construction No. 214-FL. Some criteria for classifying property as "problematic" were transformed (Budanov et al., 2018): delay of construction terms by more than six months; violation of the obligation to transfer the property to the shareholder under a registered equity participation agreement; bankruptcy proceedings were instituted against the developer in accordance with Bankruptcy Law No. 127-FL.

Problem Statement

Modern construction business has to be transformed. The economic development of Russian and the Russian regions influences the construction industry. Interaction of construction companies and changing external conditions require consolidated efforts aimed at implementing investment and innovative policies (Nuriev, 2014; Pereverzeva & Yurieva, 2017; Surinov, 2017).

The investment policy is the main tool of the government and construction companies. Using this tool, construction companies manage the process of expanded reproduction of capital construction projects and implement their economic tasks. Therefore, it is necessary to boost the investment activity of construction enterprises.

Researchers dealing with investment issues identified a large number of factors that have a negative impact on the functioning and development of construction companies:

high tax rates;

low solvency or poor solvency of clients;

regular changes in the pricing policy (increasing costs of building materials);

a decrease in the purchasing capacity of the population;

reduction of the volume of public orders for objects financed from the budget due to its limited capabilities;

high depreciation of fixed assets of construction companies;

unavailability of cheap loans;

continuous improvement of legislation (Robotova, 2009).

Moreover, the national construction industry is undergoing significant changes: the reform of estimated pricing which began in 2016, the development of the digital economy, the implementation of rational digital strategies, the abandonment of equity financing in favor of the project investment scheme.

Investment with the help of project management is typical mainly for large business, such as construction, defense, oil and gas complex and information technology.

Every year, about $10 trillion is spent on the construction of buildings, infrastructure and industrial facilities in the world — this is 13% of world GDP, and demand keeps growing. Spending is expected to rise up to 14 trillion by 2025. Construction industry employs 7% of the world's working population, but the impact of this industry extends far beyond, because these 7% erect buildings and structures we all live and work in, which allow us to generate energy and produce goods.

However, over the past 20 years, productivity in the industry has lagged behind other sectors of the economy. Globally, labour productivity in construction has increased by an average of 1% annually (in some advanced economies it did not increase at all), while for the entire world economy the figure was 2.8%, and for industry — 3.6%.

Research Questions

According to the data published by the Federal state statistics service of Russia, the insufficient volume of own financial resources is one of the key factors that constrain investment activities of more than 60% of Russian companies (Vishnevetskaya & Ablyazov, 2018).

In general, in Russia, the transformation of economic relations has disrupted the stability of investment flows intended for construction and reconstruction activities.

In this regard, in the Russian construction industry, the current situation is quite difficult (Khazheeva, 2020a). The use of various schemes to raise funds is inevitable for most companies. But for the market economy, the use of various methods for attracting financial resources is quite acceptable: it is likely that an economic entity has no own financial resources to implement investment projects. Therefore, the search for the best option is necessary for any company with limited financial resources. At the same time, the project financing scheme is one of the most attractive ways to implement investment and construction projects.

Purpose of the Study

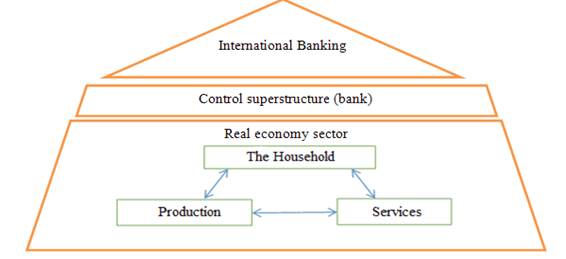

Investigating project financing in more detail, it is possible to ascertain that there appear the third persons interested for certain time "temporary workers", from it transaction costs of the builder increase, as well as cost of the final object by the sum of percent of payment to the third persons for the executed work or service increases (Khulukshinov, 2016). It is considered that this superstructure in the form of services from third parties is paid by the investor, while the developer becomes an extremely unprofitable position of a "dependent" with the most unfavorable scenario of further construction on the part of the third party. The real sector of the economy suffers as well as an ordinary investor. Only the banking sector, which most often acts as a third party, will benefit most from this option of project investment, i.e. there will be a concentration of capital and/or financial capital. According to the law of concentration of financial capital, financial resources are concentrated in the structures that initially had the largest capital ("Money to money") (Budanov et al., 2018, p. 11) K. Marx, graphically depicted the "food" chain of capitalism (Figures

Research Methods

The fact that enterprises and households are built into the food chain at the lowest level, with all the income generated by the real sector of the economy being used by commercial banks, while at the top are large global financial institutions. At the same time, households and enterprises (both production and non-financial services) form a typical symbiosis, as they need each other in their livelihood. The financial sector, on the other hand, plays the role of a typical "parasite" that redistributes funds of the real sector of the economy in its favor (Budanov et al., 2018, p. 14; Khazheeva, 2020b).

Thus, in the study of project financing from the point of view of the system of preferences in society based on the study of individual preferences, any process related to aggregation should be sensitive to the transformation of preferences of individual members of society. It is necessary to know the rank of possible states, taken both by individuals and in the organization of the same states in the aggregate in society.

The general view of the functions proposed by K. Arrow is based on the aggregation of individual preferences and is reduced to the probability of obtaining different and unequal types of functions of public welfare (Arrow, 2004; Astrakhantseva, 2020).

These changes have a positive impact on all participants in the construction process, and the emerging structure of construction financing corresponds to the financing structure in developed countries.

Findings

Let us analyze the concept of project financing. To begin with, it should be noted that there is no unified definition of the term project financing due to the natural complexity and multi-instrumentality of the concept. The widely-used definition of the term is raising funds to implement long-term investment projects.

It should be noted that the project financing mechanism is an effective scheme to attract investment which has been successfully operating in the Western market. Since July 2019, this scheme has been implemented in the Russian construction sector replacing the equity financing scheme.

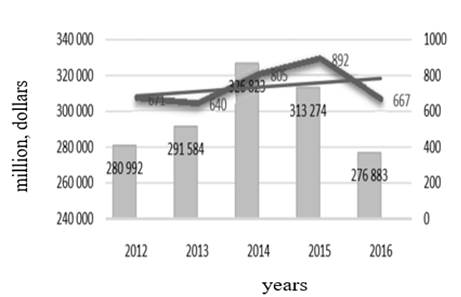

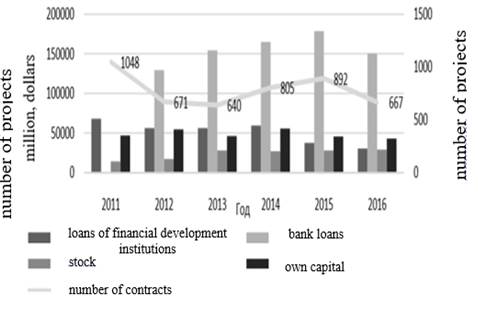

In foreign countries, the project financing is studied by experts from various financial institutions (the International Monetary Fund, the World Bank, the Bank for International Settlements) and legal or consulting organizations (PricewaterhouseCoopers, Thomson Reuters, Standard & Poor's). The world market of project financing characterized by sustainable development has already been formed (Figures

In the world market, the BOOT (build-own-operate-transfer) scheme is widely used. The scheme is based on the public-private partnership mechanism according to which the project company is responsible for financing, managing and maintaining the construction object within a specified period, after which the object is transferred to the government (D’Souza & Williams, 2017; Petrov, 2019).

Transformation of the manufacturing sectors of the largest industrial companies contributed to the implementation of the principles of lean manufacturing and aggressive automation. In construction, the opposite is true, changes are taking place very slowly, implementation of changes is hampered by inconsistent initiatives on the part of customers and contractors, market shortcomings: fragmentation and opacity.

Often discussed is the question of the extent to which the transition from a long-term investment model to quarterly payments affected the ability of the industry to invest in itself.

Digital technologies and new materials - these are tools and tools that can provide the required increase in labor productivity. If the productivity of the construction industry were higher, it could offer more opportunities to investors, which would lead to a dramatic improvement in the global infrastructure, an increase in the quality of life of the level of well-being of individuals. The lack of change, on the contrary, casts doubt on the industry's ability to meet global infrastructure and housing needs.

All the players in the construction market can be divided into two groups: large players implementing large-scale projects in the field of industrial and civil construction, including the construction of large residential complexes; and a huge number of companies specializing in various fields, such as metalwork, electrical or plumbing, acting as subcontractors or implementing small-scale projects, for example, the construction of private houses or, more often, their repair and reconstruction (especially in Europe and the USA) (Sink, 1989).

In the first group, productivity is significantly (approximately 20–40%) higher than in the second: contractors engaged in large-scale industrial construction demonstrate the highest productivity, which averages 124% of the total industry indicator; they are followed by companies working in the field of civil engineering (119%); and home builders close the top three (104%); data are presented as of 01.01.20019.

Highly specialized subcontractors that generate a significant share of the cost in small individual construction and reconstruction projects are typically represented by small companies. Their productivity is usually 20% less than the industry average. But the half of the industry that demonstrates higher productivity is not immune from the influence of the less productive second half.

Large construction players regularly hire small specialized companies as subcontractors, which is why in the USA, for example, overall labor productivity (including small subcontractors) fell by 12% in civil engineering, by 26% in industrial construction and by 28% in the housing sector as of 01.01.2019.

Thus, any measures aimed at increasing labor productivity in the construction industry should be applied both to the entire supply chain and to both segments of this market, since each of them is significantly behind the production sectors in terms of productivity.

Several reasons for low productivity in the construction industry. At the macro level, projects and construction sites are becoming more complex, more often they involve reconstruction or modernization, rather than the construction of new facilities. Additional difficulties create a geographical dispersion and fragmentation of the markets for the purchase and sale of land.

In addition, the construction industry is heavily regulated and heavily dependent on the demand for its services in the public sector. The market is influenced by informal relationships and contacts. The interaction processes that have taken shape in the industry only exacerbate these problems and contribute to low labor productivity.

As a result, companies make mistakes in operating activities, the quality of project development often decreases (amid insufficient standardization), there is not enough time to plan and implement the latest project management technologies and qualified personnel. In addition, profitability in construction is characterized by extreme volatility, which limits the possibility of investment in new technologies, including digital, which could contribute to productivity growth.

The most characteristic difficulties and trends are different in each of the two groups. As for large contractors, public and private customers often set non-optimal criteria for concluding contracts (aimed at lowering initial prices and reducing risks), which, combined with possible corruption or inexperience of customers (especially in the public sector and housing), leads to a situation when contractual obligations do not correspond to the level of the proposed remuneration.

As a result, conflicts arise, the project is constantly being reviewed, and changes are being made to it - such cooperation cannot be called productive or mutually beneficial (Bylkova & Belobrov, 2015; Petrov, 2019).

In a more detailed study of project financing, even taking into account the public-private partnership mechanism, a number of contradictions can be observed:

Commercial banks as well as various additional interested parties in the form of sponsors/initiators of the project, project company, third-party investors, contractors, customers, suppliers, buyers, insurance companies, risk managers, government agencies, consultants, etc. will act as a kind of managing superstructure that pursues its own interests in the first place, and the interests of investors more often than not do not coincide with the interests of "third" persons, all of which will lead to the development of asymmetry of information, opportunistic behavior on the part of management, which contributes to the growth of transaction costs.

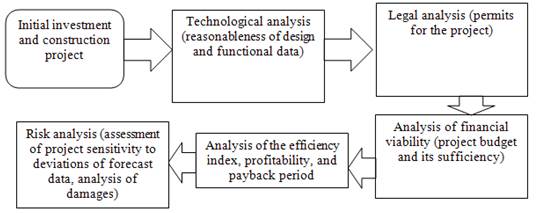

A special conflict of interest will be observed in the separation of risks and benefits from the production of goods, works and services. As this superstructure in the form of a project company has a limited lifespan, while the existence of construction companies has no time limit. However, the standard preference is given to the project financing model in the situation when a large amount of investments is required in case of the lack of own funds, and the implementation of the project itself is characterized as a complex one with a high level of risks. Project financing involves project analysis, the level of detail of which depends on the scale of the project, the volume of investments, possible risks, social and economic consequences of management decisions and others. The question arises about the effectiveness of the existing contractual system. Distribution of responsibilities in accordance with the contracts, the emergence of temporary one-day companies, which can receive funding without performing the volume of services performed.

The most important contradiction is that in the conditions of project finance application a high interest rate on the loan will be established for the borrower, and significant time and transaction costs and constant control by lenders may contribute to the emergence of an absolutely opposite effect. The low level of independence in making management decisions allows "temporary workers" to act as external managers of a construction organization, which is practically impossible by the structure of the organization. Besides carrying out of the profound design analysis promotes leaving and bankruptcy of a considerable quantity of regional building operators.

The complexity and diversity of modern construction projects require transformation of tools and management methods in order to improve their adaptation to the digital business environment (Vishnevetskaya & Ablyazov, 2018). Therefore, to boost the activity of construction enterprises, it is necessary to develop the investment infrastructure. An example of one of these activities is the decree of the government of the Russian Federation No. 158 of 15.02.2018 on the program "Factory of project financing". Its main purpose is "to create a mechanism for investment project financing providing for the provision of funds on the basis of syndicated loan agreements."

Taking into account the changing external conditions, the construction industry needs new approaches to the development and management of investment and construction projects according to the following requirements:

assessment of the effectiveness of project participation in order to verify feasibility and attractiveness of the project;

use of target values for project indicators and qualitative assessment of their efficiency and attractiveness;

importance of each indicator in relation to each other;

a strict hierarchy of strategic indicators: economic effects and risks arising from the implementation of such projects.

Particular attention is paid to the analysis of the potential of investment projects which may include five areas presented in Figure

The project financing scheme has a huge potential which can have a positive impact on the entire investment and construction process. The positive aspects of the project financing scheme are as follows: expanding the portfolio and project options, improving quality of design project development, improving quality of design and construction works, monitoring target expenditures, implementing project management methods, project risk management, improving the efficiency of sales of projects/facilities, ensuring high motivation of participants in project financing transactions, building long-term relationships with reliable partners (contractors, suppliers, consultants), cost optimization, etc.

The negative aspects of project finance implementation include: if the wrong source of financing is chosen, the project company may lose all assets to the advantage of the bank; the pre-investment stage should include a well-designed program, including contractual relations between all project participants, excluding duplication of work and services, which is poorly implemented as a result of imperfection of the regulatory framework on this issue; the banking sector of the Russian Federation does not generally consider long-term lending, it specializes mainly in short-term financing at high interest rates for a short period of time (as lenders during the Aristotle period).

The imperfection of legislation, in particular, the abundance of heterogeneous zoning rules for building codes, also impedes the efficiency of the participants in project finance transactions. Many industry players even manage to profit from the current situation and earn money on finalizing projects, resolving conflicts between the parties, further reducing competition in this opaque market.

In the authors' opinion, there are seven ways to increase productivity:

Change in regulation and increase industry transparency;

Review of contractual structure;

Reorganization of planning and design;

Optimization of procurement and logistics;

Optimization of construction processes

The introduction of digital technology, new materials and modern automation;

Staff development.

Conclusion

Measures of public financing of the construction industry are one of the key mechanisms for maintaining its stable development and ensuring its effective operation in the near future.

Project financing is rapidly taking over the construction market of Russia, being the most realistic tool for the implementation of large construction and reconstruction projects. The project financing scheme helps accumulate a large amount of various financial resources in order to implement investment projects. During the development of the digital economy, the use of the project financing mechanism is of particular importance

However, in our opinion, digitalization of economic relations, based on the creation of industry platforms, would actively contribute to the reduction of costs in the construction industry, reduce the degree of opportunistic behavior on the part of one-day companies created only to ensure the conduct of a single project.

Besides, one of the effective ways to reduce contradictions in the author's opinion is the use of blockchain technology.

In addition, one of the effective ways to reduce contradictions in the opinion of the author is to use technology and direction for high productivity. Four proven factors must be used that have contributed to significant productivity gains in other areas:

stimulating demand while increasing requirements for cost, quality and environmental friendliness;

consolidation of players, market transparency and the emergence of new, future-oriented players;

higher availability of new technologies, materials and processes;

increase in labor costs amid partial and restrictions on labor of migrant workers.

An increase in construction productivity would yield $ 1.6 trillion in additional product annually. That would be enough to cover half of the world's infrastructure needs or increase global GDP by 2% per year. The construction industry is emerging from many years of stagnation and is preparing for the changes that have already occurred in many other industries.

References

- Arrow, K. J. (2004). Social Choice and Individual Values. The Publishing House of the State University — Higher School of Economics.

- Astrakhantseva, A. S. (2020). Occupational burnout as a factor affecting the decline in organizational performance. Journal of Economy and Entrepreneurship, 14(3), 864-867.

- Bloom, N., Sadun, R., & Van Reenen, J. (2012). Americans do IT better: US multinationals and the productivity miracle. American Economic Review, 1, 167-201.

- Budanov, V., Kurdyumov, V., Kolesova, L., & Oleskin, A. (2018). Introduction to the Theory of Digital Economy. Grifon.

- Bylkov, V. G., & Belobrov, E. A. (2015). Alternative assessments of labor productivity in postindustrial society. Baikal Research Journal, 6, 12-16.

- Cardona, M., Kretschmer, T., & Strobel, T. (2013). ICT and productivity: conclusions from the empirical literature. Information Economics and Policy, 25(3), 109-125.

- Charlie, A. (2016). Global Project Finance. Full Year 2016. League Tables. IJGlobal. Project Finance & Infrastructure Journal, 8.

- D’Souza, C., & Williams, D. (2017). The Digital Economy. Bank of Canada Review, 2, 47.

- Khazheeva, M. A. (2020a). Impact of digital economy on well-being of population. Proceedings of the International Session on Factors of Regional Extensive Development (FRED 2019), Series: Advances in Economics, Business and Management Research, 113, 191-194.

- Khazheeva, M. A. (2020b). Some aspects of a welfare of population. Journal of Economy and entrepreneurship, 14, 8(121), 79-83.

- Khulukshinov, D. E. (2016). Sources of financing infrastructure projects based on public-private partnerships. Young Scientist, 10, 927–929.

- Kudryavtseva, V. А. (2017). Сondition adeveloppment evaluation of the residential development sector. Proceedings of Universities: Investment. Construction. Real Estate, 1(20), 45-52.

- Kudryavtseva, V. A., & Vasilyeva, N. V. (2018). On some problems of the legal regime of unauthorized constraction. Investment. Construction. Real Estate: new technologies and special purpose development priorities, 09002.

- Nuriev, A. Kh. (2014). Regulation of Project Finance: Towards International Standards. International banking operations, 1, 35-39.

- Petrov, F. (2019). Young scientist International scientific journal, 4(240), 25.

- Pereverzeva, V., & Yurieva, T. (2017). Strategic analysis in the crisis management system based on the project approach. STAGE: Economic Theory, Analysis, Practice, 5, 36–45.

- Robotova, L. (2009). Development of the Innovation and Investment Strategy of the Enterprise (on the Example of Innovation and Investment Activities of the Construction Enterprise. St. Petersburg Aerospace University.

- Surinov, A. (2017). Investment in Russia. Rosstat.

- Sink, D. (1989). Performance Management: Planning, Measurement and Evaluation, Control and Improvement. Progress.

- Vasilyeva, N. V., & Bachurinskaya, I. A. (2018). Problematic aspects of digitalization of the construction industry. Bulletin of the Altai Academy of Economics and Law, 7, 39-46.

- Vishnevetskaya, A., & Ablyazov, T. (2018). Key areas of digital transformation of construction organizations. Theory and Practice of Service: Economics, Social Sphere, Technologies, 4(38), 31-36.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2020

Article Doi

eBook ISBN

978-1-80296-098-3

Publisher

European Publisher

Volume

99

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1040

Subjects

Multicultural context, learning environment, modern society, personality formation, informatization of the society, economics and law system of the region

Cite this article as:

Khazheeva, M., Kudryavtseva, V., & Bondarchuk, E. (2020). Project Financing Mechanism As A Basis For Successful Investment Project Implementation. In N. L. Shamne, S. Cindori, E. Y. Malushko, O. Larouk, & V. G. Lizunkov (Eds.), Individual and Society in the Modern Geopolitical Environment, vol 99. European Proceedings of Social and Behavioural Sciences (pp. 365-375). European Publisher. https://doi.org/10.15405/epsbs.2020.12.04.43