Abstract

The article shares the findings about the share and role of the state property in Russian economy. The work is new and relevant because it is necessary to find an optimal share of the state property to provide a stable and fast economy growth in the country. The authors analyse the conditions and volume of the state sector in the economy of developed countries and their impact to GDP growth. The authors conclude that the part of the state property in the Russian economy grows. It includes state enterprises, the companies where the government and the public administration take part (the structures with functions of public administration). Ultimately, the growth of state property slows the GDP growth. The authors of the article state that in the whole world and in Russia the enterprises formed on state ownership should be oriented, first of all, to social and economic needs even though it decreases the profits. The system of the state property management is at the formation stage in Russia, that is why it is necessary to organize a systematic way to its optimal share. Nowadays there are elements of a new organizational and economical mechanism of state property management and state real estate which are in force, other elements are defined in legislative and normative acts and others are going to be introduced in the nearest future.

Keywords: Economic growthGDPpublic ownershippublic sectorpublic entrepreneurship

Introduction

As market economy is developing in Russia, optimal size of state property and its effective management are basic and priority tasks of the government.

This direction is in priority in the system of national management because it has a special role in the public policy of the state property management. It combines aims and tasks to increase state profits based on effective management of the state property, increase of its competitive condition, improving its financial and economic parameters and creation of public system of state property management.

One of the reasons that economic modernizations connected with formation and development of the market economy in Russia is so ineffective is that the property forms and relations are not enough elaborated. The types and forms of property, the nature of property relations are the defining features of the economic system.

The system of the state property management is at the formation stage in Russia, that is why it is necessary to organize a systematic way to its optimal share. Nowadays there are elements of a new organizational and economical mechanism of state property management and state real estate which are in force, other elements are defined in legislative and normative acts and others are going to be introduced in the nearest future.

Problem Statement

The growth of the state property state slows the growth of the country's GDP. It is necessary to reduce the share of the state property in order to increase the rate of economic growth.

Research Questions

The main question is to make a research about the size and dynamics of state property in the economy of Russia as well as to find the role and degree of impact of public sector on economic growth.

Purpose of the Study

To study the issue about the share and dynamics of the state property in Russian economy and its impact on GDP growth.

Research Methods

We used empirical, theoretical, quantitative and qualitative methods of research using monographic, dynamic and other methods of research.

Developed countries experience shows that the state property grows, first of all, in the fields of society which were "voluntary" left by the owners of private property, that means where it is hard or almost impossible to receive the average normal profit. These are the fields of economy where the feedback is either small or comes after a long period. Firstly, there are branches of social infrastructure and capital branches of industry (education, healthcare, environment protection, energy, communications, transport, iron and steel industry).

The state ownership at the market is believed to be connected with the activity which basically aims to improve other industry, not to make profit (Kuzyashev & Topunova, 2017).

That means that the government nationalizes unprofitable industries and improves them investing money from the state budget.

The structural reorganization of the national economy is made by means of the state budget as well; science and research experiment and constructional centers are built and maintain; policy to improve branches in crisis is carried out; regional improvement policy is implemented etc. (Alimanova & Nasretdinova, 2014).

The state property spreads in market economy in a volatile way (Allagulov et al., 2006).

It is usually explained by the government policy about the reforming, nationalization and privatization of the property. The public sector in the economy should be considered as an entrepreneur sector where the government has economic activities to produce goods, do work and provide services, using state property (Kovalev, 2018).

Although different countries have a different public economy sectors, the developed Western European countries have the general parameters (such as share of state enterprises in GDP, amount of employed people, total sum of actives etc.) close to the average in the recent decades. For example, public economy sector of Germany produces 10% of GDP, the British sector - 11%. There are 10% of employed people working in the public sector annually in France, 8% - in Great Britain (Osipov, 1991). The highest indicators are in the countries of Western Europe - Sweden and Austria (some assess the public sector of Sweden produces more than 60% of GDP.) Here we are speaking about the general grouping of countries with high percentage of state property in their economy. State ownership is less in the economy of the USA and Japan.

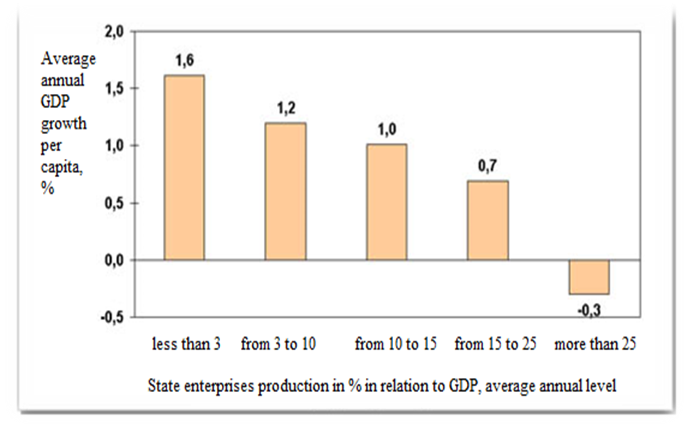

There is a published research of World Bank which shows the scale of government entrepreneurship in 76 countries in 1978-1991: "Bureaucrats in business." This research shows that if the state enterprises produce less than 7% of country's GDP, the economy growth reached the maximal values (table

A. Illarionov, the director of The economical analysis institute in his article "Criteria of economic security" shows the table #3 where the dependence of an average annual growth of gross domestic product per capita of the scale of state entrepreneurship in 1978-1991 is presented. The 111 countries, about which there is the information available, were grouped according to the percentage of state entrepreneur production in GDP (see figure

The first group includes the countries with the lowest values of this parameter - less than 3%. The average annual growth of GDP per capita in these countries appeared to be maximal - 1.6%. The second group consists of the countries where state enterprises production was from 3% to 10% of GDP. The economic growth of the countries in this group appeared to be lower than in the first group, in average it was 1.2% per year. The third group of the countries where the scale of state entrepreneurship was from 10 to 15% of GDP, the economic growth was lower - in average 1.0% per year. The countries of the fourth group where the percentage of state enterprise production reached 15-25% of GDP, the economical growth was 0.7% per year. Finally, the countries where maximal share of GDP is produced in state enterprises, economical growth becomes negative - minus 0.3% annually in average (Illarionov, 1998).

There are a lot of researches which show that increasing the state entrepreneurship the government lowers the economic growth. It is believed that they become negative when the amount of production at state enterprises is higher than 20% of GDP.

The inverse relationship is also veritable. The negative economic growth is noted in the group of the countries where the share of state enterprises in GDP is maximal. Reducing the amount of state enterprises, carrying out the privatization of ownership stimulates the growth of economy.

Government plays an important role of a major economic subject both in the countries with post-soviet transitional economy and autocratic politic regime and in developed market democracies (Dolinsky & Gabuev, 2013).

Organization of economic cooperation and development (OECD) shows that the member-states which have 59% of global GDP, implement three quarters of international trade and 18% of world heritage, have also more than 2 thousand state-owned enterprises (SOE). Together they cost $1.9 trillion, there are 6 million employed people.

Excluding the USA and Japan, which do not provide relevant detailed statistics, the biggest public sector of OECD member-states is in China - $177.6 miliard. Then France ($157.7 miliard) and Norway ($131 miliard). France is the leader in the number of employed in SOE — 838.5 thousand people. It is followed by Great Britain (378.3 thousand) and Italy (289.3 thousand). Studying the industries, usually the OECD member-states participate the capital of energy and gas-distributing companies (26% of total amount of SOE), financial institutes (24%) and transport enterprises (19%).

Forbes rating of 2 thousand biggest corporations in the world providing for 51% of world GDP includes 204 state-owned companies (10%) from 37 countries. There are 70 SOE in China, 30 in India, 9 in Russia and the UAE each, 8 in Malaysia. The total turnover of state enterprises of Forbes Global 2000 rating is about $3.6 trillion, that is equal to GDP of Germany, 5.7% of global economy or 8% of general capitalization of all companies trading in world exchanges.

The calculation of an average profit indicator, net profit and market capitalization of the top 10 largest national companies shows that the share of Chinese SOE is 96%. The same indicator of UAE is 88%, of Russia is 81%. The only European country which has the indicator over 20% is Norway (48

table

Let us focus on the share of the state enterprises and organizations in the total amount of all enterprises and organizations in Russia in 2008-2010. Table

According to Table

Let us focus on the share of state enterprises and organizations in total amount of all enterprises and organizations in Russia in 2015-2017. The table

table

But the matter is that the public sector does not consist of only state-owned enterprises and organizations. The statement of the researchers from the Y.T. Gaidar Institute of economic policy seems veritable: "There are two general ways for the government to participate the creation of added value: 1) through the activities of the companies with state participation; 2) through the services (in wide meaning of the word) of state management and organizations supported by state budget. Respectively, the size of public economy sector, as a rule, includes two components: analysis of the share of the largest companies with state participation (CSP) in the economic indicators of the country (scale of the state ownership) and estimation of state management sector (SMS) influence to GDP" (as cited in Mau, 2018).

It is very difficult to estimate the share of the public sector in the Russian economy accurately. Organization of economic cooperation and development (OECD) standards state that companies with state participation (CSP) include all the enterprises with the state share more than 10%. But their influence to economy was not estimated definitely. "The statistics of CSM influence to GDP is not stable, there is no unified method to calculate this indicator. The data about CSM in Russia is fragmentary or approximate in this indicator and some other characteristics (such as capitalization, amount of employed, size of profit etc.)" - the RANEPA researchers note.

Thus, the experts and officials have different opinions about the share of public sector in Russian economy. The Federal Antimonopoly Service (FAS) states 70% to be public. RANEPA Academy states only 44% as public property. However this indicator has increased by 12 percentage points (p.p) in recent 15 years. It is noteworthy that the companies connected with the government producing the less part of GDP have the major set of privileges and state finances. But the increase of public sector negatively influences competition and slows the growth of GDP.

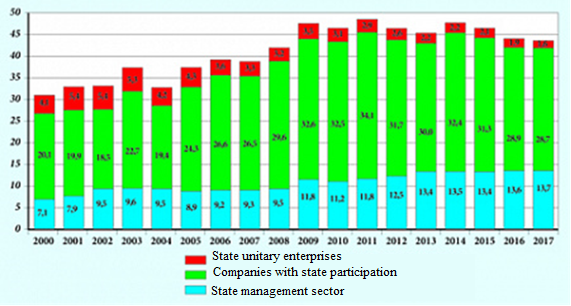

There is no common methodology to estimate the influence of state management sector (SMS, structures with the functions of state management) to GDP. "Often this influence is estimated from the point of view of state finances distribution, that means relative size of total state profit such as taxes, property income, operations with actives, service profit etc. or the relative expenses. This extended approach leads to overestimation of public administration influence to GDP. Many specialists and researchers explain that their analysis of the share of state participation in GDP bases on three components: CSM share, SMS share and share of value produced by state unitary enterprises (SUE) (see figure

Thus, a lot of specialists and researchers say that total share of public sector in GDP, including CSM, SUE and SMS shares increased from 31.2% in 2000 to 43.8% in 2017. The main contribution to the size of public sector in made by CSM. According to conservative assessment, their share in GDP increased from 20% in 2000 to 28.7% in 2017. The share of SMS increased almost twice in the same period - from 7.1 to 13.7%. The share of SUE, inversely, reduced from 4.1 to 1.6%.

The experts also underline negative relations between the GDP growth and index of state property. "When the public sector grows by 1 p.p. the GDP slows by 0.5 p.p. in average and all other are equal", - the scientists say. Thus, the growth of public sector in a way is connected with the degradation of Russian economy, they emphasize.

If we compare the investments of the domestic public sector to the economies with other countries, Russia will be a leader. In 2015 the value of CSM in percent from the total market capitalization of shares of all companies was one of the highest among the countries with a liquid fond market. In Russia the value was 46.2% when the average level of 39 countries (excluding China) was only 4%.

However, a lot of experts estimate a probable influence of the government to the economy as rather low. For example, the Center for Strategic Research (CSR) concluded that the share of public sector in domestic GDP is 46& in average. At the same time they emphasized: in a number of sectors, the government plays a much more important role. In particular, they calculated the share of state profit together with the profit of 100 largest companies of each industry. They also included the values of subsidiaries of Russian state companies. CSR calculations showed that more than two thirds of total profit is the share of state companies in industries of transport, energy and mining.

The federal antimonopoly service of Russia (hereinafter FAS) provides higher assessments. FAS of Russia states that in recent 10 years the government and state companies contribution in Russian GDP increased from 35% to 70% (Public sector in Russian economy, 2019).

Thus, it may be concluded that the economy in Russia is being nationalized. The governmental and monopolistic capitalism is occurring. Business is accreting to the power. When the sanctions were introduced, the role of the government in the economy became more important.

At the same time, if we take into consideration the conclusions of many specialists and scientists, we may say that the government and state companies contribution to the domestic GDP is less than a half, the rest is produced by private sector. A clear bias in state enterprises support is noted. Authorities usually prefer to support "their" companies - state enterprises can obtain many more privileges from the government than their commercial "colleagues" though all of them invest into Russian economy almost the same money (Solovyova, 2019).

The expansion of the state property and state entrepreneurship which is connected with it together with the policy of nationalization leads to occurrence of mixed forms of ownership. However, state share companies (when the government holds the shares), mixed subsidiaries and further subsidiaries formed within state holdings do not change the role of state form of ownership. These holdings should crease kind of “incubators” for the enterprises based on modern technology (electronics, biotechnology, laser techniques etc.)

Findings

-

The research showed that the share of state property in the economy of the country is more than it is necessary, it leads to slow economy;

-

In Russia as well as in the whole world the enterprises of state ownership should be oriented, first of all, to meet the social and economic needs even though it can reduce the profit.

Conclusion

Thus, increase of state property and public sector affects the competitive ability and slows the GDP growth.

There is a process of the economical “nationalization in Russia, the state-monopoly capitalization creation, the business joins the power.” When the sanctions were introduced, the role of government in the economy became more important. There is a negative relationships between GDP growth and index of state property. When the public sector grows by 1 p.p. the GDP slows by 0.5 p.p. in average and all other are equal. Thus, the growth of public sector in a way is connected with the degradation of Russian economy.

The state form of ownership in a modern market economy often is not highly efficient, usually it is due to the bulky organization system which does not allow to react on the changes of consumers interests immediately.

But it is a subject of ownership and entrepreneurship as it fulfils a number of necessary tasks such as to provide for conditions for economic growth and innovative activities, to create the appropriate atmosphere for all the types of entrepreneurship of small, medium and large corporations. The government has finance and material resources, takes administrative and legislative measures and applies different forms and methods of regulation to influence the production, prices, structural adjustment, investment processes etc.

It is necessary to reduce the share of public sector in Russia to improve economy. In Russia and in the whole world, the state-owned enterprises should be oriented, first of all, to meet the social and economic needs even though it reduced the profit.

References

- Alimanova, E. S., & Nasretdinova, Z. T. (2014). O zarozhdenii rossijskoj kooperacii [On the origin of the Russian cooperation]. Successes of modern science, 8, 168.

- Allagulov, R. Kh., Bryalina, G. I., Gabitov, I. M., Enikeev, D. D., Ishmukhametov, S. N., Kashaev, N. K., …, & Singizova, N. B. (2006). Ehkonomika v dvukh tomakh [Economy in 2 volumes]. Ufa, Bashkir State University Publisher. Retrieved from: https://elibrary.ru/item.asp?id=28161989

- Dolinsky, A., & Gabuev, A. V. (2013). V kompanii s gosudarstvom [Companies with the state]. Kommersant Power, 27, 9.

- Illarionov, A. (1998). Kriterii ehkonomicheskoj bezopasnosti [Criteria for economic security]. Economic Issues, 10, 51.

- Illarionov, A. (1996). Modeli ehkonomicheskogo razvitiya i Rossiya [Models of economic development in Russia]. Economic Issues, 6, 8.

- Kovalev, V. V. (2018). Upravlenie gosudarstvennym sektorom ehkonomiki [Public Sector Management]. Minsk: Ed. Center BSU. Retrieved from: http://elib.bsu.by/bitstream/1.pdf

- Kuzyashev, A. N., & Topunova, I. R. (2017). Zakonomernosti mnogoobraziya form sobstvennosti v ehkonomike [Patterns of diversity of ownership in the economy]. Azimuth of scientific research: Economics and Management, 6, 148. Retrieved from: https://elibrary.ru/item.asp?id=32351182

- Mau, V. (2018). Rossijskaya ehkonomika v 2017 godu. Tendencii i perspektivy [The Russian economy in 2017. Trends and prospects]. Moscow: Publishing House of Gaidar, 201. Retrieved from: https://www.iep.ru/files/text/trends/2017/Book.pdf

- Osipov, Yu. M. (1991). Gosudarstvennaya vlast' i predpriyatie: ot komandy k partnerstvu [State power and enterprise: from team to partnership]. Moscow.

- Russian statistical yearbook (2004). Moscow: Rosstat.

- Russia in figures (2011). A brief statistical compilation. Moscow: Rosstat. Retrieved from: http://www.gks.ru/bgd/regl/b11_11/Main.html

- Russian statistical compilation (2018). Moscow: Rosstat. Retrieved from: http://www.gks.ru/free_doc/doc_2018/year/year18.pdf

- Solovyova, O. (2019). Dolyu gosudarstva v ehkonomike ocenili po-novomu. Chastnyj sektor proizvodit bol'she poloviny VVP, no pochti ne poluchaet podderzhki vlastej [The share of the state in the economy was evaluated in a new way. The private sector produces more than half of GDP, but receives almost no support from the authorities]. Retrieved from: http://www.ng.ru/economics/2018-12-26/4_7474_gossektor.html

- Zaitsev, V. (2013). Gossektor v stranakh mira [The Public sector in the world]. Kommersant Power, 27, 10.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

15 November 2020

Article Doi

eBook ISBN

978-1-80296-092-1

Publisher

European Publisher

Volume

93

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1195

Subjects

Teacher, teacher training, teaching skills, teaching techniques, special education, children with special needs, computer-aided learning (CAL)

Cite this article as:

Kuzhyashev, A., Nasretdinova, Z., Akhmetov, V., & Chushkina, S. (2020). The Share And Role Of The State Property In Russian Economy. In I. Murzina (Ed.), Humanistic Practice in Education in a Postmodern Age, vol 93. European Proceedings of Social and Behavioural Sciences (pp. 594-603). European Publisher. https://doi.org/10.15405/epsbs.2020.11.61