Abstract

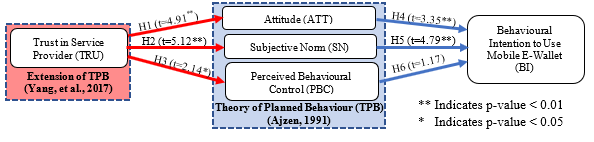

The purpose of this paper is to develop a model to explain mobile e-wallet adoption among smartphone users in Malaysia. Using an extended Theory of Planned Behaviour (TPB), we collected data using a purposive sampling technique and self-administered questionnaire with validated instruments adopted from the literature. A total of 122 responses were used in the final analysis with the application of SmartPLS 3.2.8 a second generation structural equation modelling software. The findings show that trust in service provider (TRU) influences positively attitude (ATT), subjective norm (SN) and also perceived behavioural control (PBC). Overall, the model accounts for 41% of the variance in behavioural intention to use mobile e-wallet. Surprisingly perceived behavioural control did not have an effect on behavioural intention to use. The implications of the findings are the mobile e-wallet providers should enhance trust and focus on shaping the attitude and subjective norm of the users through some concerted campaigns that can be also done through some advertisements through the social media and other traditional media.

Keywords: Mobile paymentmobile e-walletsmartphonetechnology adoptiontrust in service providerTheory of Planned Behaviour

Introduction

The usage of internet nowadays has changed the traditional way of doing things in our daily life. For example, information searching, sharing of data, shopping, socialising, entertainment and many more are mostly depending on internet technology in the recent years. Apart from that, the traditional way of doing financial transaction also has changed by using the internet. Where cash was the only method for payment previously, now the payment using electronic money (e-money) has taken over the way we do the financial transaction.

The Financial Services Act 2013 defines e-money as any payment instrument, whether tangible or intangible, that stores funds electronically in exchange of funds paid to the issuer; and is able to be used as a means of making payment to any person other than the issuer. Nowadays, e-money providers, either banking institutions or non-bank organisations, are competing in introducing new ideas and technologies to support the effort of cashless payment. The payment by using e-money is called electronic payment (e-payment). The effort to minimise the usage of cash by using e-payment has been launched in many years. For instance, Bank Negara Malaysia which is Central Bank of Malaysia encourages the use of debit cards amongst consumers and keep on promoting it.

In conjunction with the Bank Negara Malaysia’s reform measure in 2018 to use mobile payment (m-payment) as part of e-payment to replace cash and cheques, and the rising of smartphone users growth (MCMC, 2017; PwC Malaysia, 2018; Wei & Tsu, 2018), many organisations in Malaysia are interested in coming out with their m-payment systems such as mobile e-wallet.

Smartphone Users in Malaysia

The rise of e-payment by using smartphone has been triggered by the rapid growth of smartphone usage among consumers. Madan and Yadav (2016) and Singh et al. (2017) reckon that globally, the total numbers of smartphone users are exceeding the bank account holder figures. This statement shows that almost everyone in the world owned at least one smartphone.

In Malaysia, the smartphone users keep growing, and this is supported by the Malaysian Communication and Multimedia Commission latest Hand Phone Users Survey 2017, reported that smartphone penetration rate grew by 7.2% from 68.7% in 2016 to 75.9% in 2017. This fact has also been reported by Wei and Tsu (2018) in Bank Negara Malaysia Quarterly Bulletin 2018, mentioning there were 42.4 million mobile phone subscriptions consisted of 75.9% smartphones amongst 32.1 million Malaysia population as at the end of 2017. From the Hand Phone Users Survey 2017, it also shows that the electronic commerce (e-commerce) transaction by using smartphone is on rising as Malaysian Communications and Multimedia Commission (MCMC) analysed more than quarter (28.4%) of the percentage of the smartphone users in 2017 were using smartphone to make online purchases, and this shows that m-payment transaction including mobile e-wallet usage was influent by the growth of smartphone users (MCMC, 2017).

Nevertheless, many business organisations are taking the opportunity on this smartphone user growth to come out with many mobile-technology-based alternative business solutions such as mobile commerce (m-commerce), m-payment, mobile transfer, mobile credit card and mobile e-wallet (Kanagasundaram Visvanathamuthaliyar & Wikramanayake, 2014), and therefore do their best to make awareness for consumer to adopt the technology. The popularity of smartphone adoption has created a phenomenon among business organisations to invest in a mobile platform such as developing mobile apps, conducting business transactions through m-commerce or implement the business operation to fit the smartphone environment usage like a mobile e-wallet.

Mobile E-Wallet System and Its Industry in Malaysia

An e-wallet is defined as a heterogeneous managed store of content items related to daily transactions, both electronic and physical, providing secure, automated multi-channel access to the user and other parties (Shetty et al., 2014). Hence the e-wallet transaction that conducted via mobile device is called mobile e-wallet.

Before mobile e-wallet was introduced in Malaysia, there was another m-payment technology that gained interest among smartphone users in Malaysia which is mobile credit card. It is called mobile credit card as the technology does not store cash but only integrates the credit/debit card digitally on a smartphone. Because of the integration of credit card with a smartphone, this technology also known as a smartphone credit card (Ooi & Tan, 2016). Mobile credit card can be defined as a payment of goods and services via smartphone that deducts the money directly from the credit/debit card account or individual’s bank account with the aid of Near Field Communication (NFC) technology, where then consumers can conveniently complete their transactions by simply touch their smartphone to an NFC enabled payment terminal (Fan et al., 2018; Khalilzadeh et al., 2017; Ooi & Tan, 2016).

Then in the past few years, the mobile e-wallet or simply known as eWallet was launched in Malaysia and the mobile e-wallet’s service providers including many non-bank organisations and also few bank organisations. Examples of the mobile e-wallet providers such as Boost, GrabPay, Touch ‘n Go eWallet, vcash, WeChat Pay, Razer Pay, and Maybank Anytime Everywhere (MAE).

The mobile e-wallet is almost similar with the mobile credit card except that the mobile e-wallet is not restricted to the linkage of credit card/debit card or individual’s bank account into a smartphone; it is a digital service that helps people pay for things through smartphone application by storing e-money into e-wallet account. In this study, mobile e-wallet in Malaysia is defined by its common characteristics to store e-money in the e-wallet account and conduct the transaction via mobile device, payment using Quick Response (QR) code scanning or in-application payment, and an option to transfer funds between individuals which is also known as Peer-to-peer (P2P) transaction (Boost, 2019; Grab Malaysia, 2019; Maybank, 2019; Razer, 2019; Touch ‘n Go, 2019; vcash, 2019; WeChat, 2019).

Unlike a mobile credit card, mobile e-wallet payment mechanism is not depending on NFC technology. This technology is to suit the user that owns a smartphone without NFC feature. The users can make the transactions on mobile e-wallet by scanning the QR code, a form of 2D bar code using the smartphone’s camera. Scanning a QR code, key in the amount, and tapping the buttons in the mobile e-wallet’s application for authorisation is all it takes to make the payments and the user’s e-money will be deducted immediately from the e-wallet account. Payment by using a QR code is called QR Pay. This payment mechanism supports P2P cash exchange or makes merchant payments (Boost, 2019; Grab Malaysia, 2019; Maybank, 2019; Razer, 2019; Shetty et al., 2014; Touch ‘n Go, 2019; vcash, 2019; WeChat, 2019).

E-wallet is available online and the consumers can use e-wallet by logging-in into the e-wallet application on the smartphone. From there, consumers will load the e-money into their e-wallet account from the online banking or the activated online payment credit/debit card, and use their smartphone to make payments to people/merchants using the same e-wallet, thus providing a convenient cashless mode (Bagla & Sancheti, 2018; Boost, 2019; Grab Malaysia, 2019; Maybank, 2019; Razer, 2019; Touch ‘n Go, 2019; vcash, 2019; WeChat, 2019). Bagla & Sancheti (2018) stated that the e-wallet payments and transactions are mostly conducted through smartphone with its built-in application, and therefore the smartphone application payment mechanism has overshadowed its website when it comes to usage on smartphones. On the surface, mobile e-wallets are like payment cards that work out of an application. User load funds into an e-wallet account, and then use only those funds to pay for goods and services.

Globally, with the new entrants, and mergers and acquisitions, the e-wallet industry is forecasted to grow very fast (Bagla & Sancheti, 2018). Mobile e-wallet technology is believed to help various industries like retail, hospitality, telecommunication, technology, and financial institution to expand their businesses (Singh et al., 2017). In 2016, the global e-wallet transactions were estimated to total of 41.8 billion in volume which represented around 8.6% of global non-cash transactions (Capgemini & BNP Paribas, 2018). The expectation that the mobile e-wallet industry in Malaysia will expand in the near future also supported by the increasing number of approved e-money issuers and e-wallet providers either from bank institutions or non-banks (Bank Negara Malaysia, 2019b; Wei & Tsu, 2018). PricewaterhouseCoopers (PwC) Malaysia estimated that the e-wallet market will contribute a huge amount to Malaysia’s economy as it is projected to grow to USD20bn by 2024, where the market potential and favourable industry growth dynamics is showing a positive response (PwC Malaysia, 2018). Non-bank e-money issuers in Malaysia are mushrooming since the last few years as the numbers of approved non-bank e-money issuers are increasing significantly since 2016, with most of the new entrants offering mobile-based payment solution (PwC Malaysia, 2018; Wei & Tsu, 2018). The mobile e-wallet was expected to be part of m-payment transactions that generated 7.2 million transactions that valued at RM404.7 million in the first half of 2018, and these figures were contributed by non-bank e-money issuers alone (Wei & Tsu, 2018). Based on the scenario, the aim to reduce the usage of cash in Malaysia can be achieved due to their usage for lower value transactions nature.

Problem Statement

Bank Negara Malaysia has come out with the agenda to reduce the usage of paper-based instruments, such as cash and cheques by migrating to e-payment culture. To drive the agenda forward, the Bank has released the Financial Sector Blueprint 2011-2020 that explains the future direction of the financial system over the next ten years (Bank Negara Malaysia, 2019a). One of the main objectives is to cut the cash usage cost as managing cash is expensive (Bank Negara Malaysia, 2018).

To encourage the cashless payment among consumers, e-payment such as mobile e-wallet is promoted as it is believed to lead to a high-income economy with adequate safeguards to preserve financial stability and high value-added (Bank Negara Malaysia, 2019a). Bank Negara Malaysia encourages the consumers to use the e-payment especially m-payment technologies because the Bank sees its potential to increase the efficiency of the nation’s payment systems and nation’s competitiveness. Complementing that, the mobile e-wallet has been targeted to be the main choice amongst other m-payment technologies because of its flexible nature, ubiquity, and many service providers. In order to accelerate the migration to e-payments such as mobile e-wallet, Bank Negara Malaysia has put a big effort by introducing a few frameworks that will smooth the migration process such as Interoperable Credit Transfer Framework (ICTF) and Real-time Retail Payments Platform (RPP). Meanwhile, RPP which was launched at the end of 2018, is a strategic initiative to modernise Malaysia’s retail payments as RPP will enable the transactions in a matter of seconds and supports the payment information details (Payments Network Malaysia, 2019). Through these efforts from Bank Negara Malaysia, many local e-money issuers including both banks and non-banks are increasing to provide the mobile e-wallet platform.

Malaysia is a prime market for the mobile e-wallet adoption among consumers based on its high smartphone and internet penetration rate, substantial young and tech-savvy population, and high banked population (PwC Malaysia, 2018). Studies show that high penetration of mobile devices such as smartphone and internet usage will increase the rate of e-payment and m-payment adoption (Bagla & Sancheti, 2018; Dahlberg et al., 2015; Sharma et al., 2018). However, although it was predicted that those internal and external factors would lead to high adoption rate on mobile e-wallet, the current situation is not what the industries have been expected. In the second half of 2018, PwC Malaysia conducted a customer survey to gain insights regarding the mobile e-wallets in Malaysia and only 22% of the respondents were mobile e-wallet users (PwC Malaysia, 2018). Meanwhile based on the Malaysia’s Payment Landscape 2018 report by Nielsen – a leading global information & measurement company that provides market research, insights & data – despite the benefits and positive environment for mobile e-wallet, the majority of consumers in Malaysia still prefer to make payment by using cash and only 8% of the consumers were using mobile e-wallet (Nielsen, 2019). Additionally, cashless payments contributed about 20% of total payments in the country in 2018, but only about half of the figure contributed by mobile e-wallet transactions (Yuen, 2019). The latest Malaysia's basic payments indicator in 2018 shows that m-payment transactions (refer to payment service offered by banking institutions that facilitates payments or funds transfer using a mobile device) excluding transactions using payment card and mobile banking were accounted for 0.04 transaction volume per capita, which represented RM2.20 of transaction value per capita (Bank Negara Malaysia, 2019c). This shows that in general m-payment mechanism including mobile e-wallet were not yet fully utilised and the usage were really low.

In spite of the fact that the penetration rate of mobile banking users was 44.6% from the total population in Malaysia by the end of 2018 (Bank Negara Malaysia, 2019c), an only small number of the users prefer to use the mobile e-wallet. This situation probably influenced by the hesitation of smartphone users to do banking-related activities such as bill payment, money transfer, and checking of bank balance via smartphone (MCMC, 2017). Apart from that, e-wallet industry is still in its infancy stage in this country, and thus the mobile e-wallet payment usage is still low among consumers where many players are spending heavily to acquire customers and merchants (PwC Malaysia, 2018). While there are tremendous advantages in adopting mobile e-wallet system as an alternative m-payment solution, the adoption rate is far from full utilization in Malaysia as mobile e-wallet services are considered still quite new to the smartphone users in Malaysia.

With the sudden increase in e-wallets service providers in Malaysia, it begs the question of whether e-wallets and e-money would dominate cashless payment in Malaysia and become the future of Malaysia's cashless society in the making. Many factors need to be considered before migrating to mobile e-wallet payment. PwC Malaysia found the key concerns raised by users to adopt mobile e-wallets such as security risks, perception on low merchant adoption, and poor user interface. The Chase on their survey revealed that almost half (46%) of their respondents were not using mobile e-wallet due to the perceived security risk (Rampton, 2017). It is not a surprise to hear that concerns on security and risk are the biggest barriers to mobile e-wallet adoption. Chandra et al. (2017) explained that while it is true that e-wallet security had always been increased, the use of a password is often not enough to convince the safety of users’ financial information. Risk of data theft is one of the drawbacks of the e-payment systems such as e-wallet, and because of that, the mobile e-wallet is not considered secure as there are chances of losing money (Chauhan & Shingari, 2018; Sivathanu, 2019). Hence, the security issues have put the trust towards mobile e-wallet service providers in question as Yang et al. (2017) explained that trust was instrumental in the acceptance of internet technologies such as mobile e-wallet. Other than that, Malaysians are still very attached to using cash in their day-to-day expenses and transactions (Nielsen, 2019; Teng & Idris, 2018). Consumers’ habit and subjective norms may hinder the change to technology use (Matemba & Li, 2018). Apart from those factors, the consumers are hesitant to adopt mobile e-wallet because they perceived that they would overspend in shopping as they believe that they have better ability to control their expenses through the use of cash (Nielsen, 2019; Sivathanu, 2019). Whilst Bank Negara Malaysia has been very supportive in encouraging growth in this area, mobile e-wallets nevertheless face a number of challenges in Malaysia.

As most studies were conducted outside Malaysia, there is a little study in Malaysia that adapted the m-payment topic compared to the other countries (Leong et al., 2013; Mun et al., 2017; Ooi & Tan, 2016; Ting et al., 2016). To researcher knowledge, this is one of the earliest studies that conduct on investigating the factors and its relationship with the behavioural intention to adopt the mobile e-wallet technology among smartphone users, especially in Malaysia. The dominance of cash-based modes of payments has probably discouraged scholars from putting more efforts along this research direction (Matemba & Li, 2018). Much effort is needed to fill the gaps in knowledge of the various factors influencing the technology adoption from the consumers’ perspective. This is because such researches can be a guideline for the related parties to boost the system usage. This is an interesting topic of research given that Malaysia has a high smartphone penetration rate but an insignificant number are using mobile e-wallet for financial transactions although many technological pundits predict that the use of m-payment especially mobile e-wallet will increase rapidly in the near future (Yuen, 2019). It was mentioned that mobile e-wallet technology has gain awareness, but has not yet been significantly exploited by retailers or consumers due to the existence of multiple inhibitors (Sharma et al., 2018).

Research Questions

Considering a vague idea behind the low adoption rate of mobile e-wallet in Malaysia and to answer the research problem, the following research questions are formulated:

What is the relationship between trust in service provider and attitude towards mobile e-wallet?

What is the relationship between trust in service provider and subjective norm of mobile e-wallet?

What is the relationship between trust in service provider and perceived behavioural control on mobile e-wallet?

What is the relationship between attitude and behavioural intention to use mobile e-wallet?

What is the relationship between subjective norm and behavioural intention to use mobile e-wallet?

What is the relationship between perceived behavioural control and behavioural intention to use mobile e-wallet?

Purpose of the Study

This study intends to examine the various factors that affect smartphone users’ behavioural intention to adopt mobile e-wallet technology. By examining public’s outlook and opinions of the mobile e-wallet, the outcome of the study will be significant to facilitate further expansion of the technology in term of reference for future researches and as a benchmark for the industries to improve the existing systems and platforms. It is assessed that this research finding will be a considerable interest not only to researchers, but also for practitioners such as financial and banking institutions, regulatory bodies, technology providers, entrepreneurs, retailers, government sectors, and telecommunications to name a few. Apart from that, this research findings can be a guideline in assessing the required and suitable strategic framework in order to achieve the country’s agenda towards a cashless society. In other words, there are three levels that will gain benefits from this research which is individual academic level as a guideline for future researchers to conduct a study on various m-payment technologies adoption among consumers such as mobile e-wallet, organisational level as to reveal the possible limitations that may prevent mobile e-wallet technology from further adoption and where the industries need to take action based on the root cause, and lastly national level as a guideline to help the national legislators and policymakers to plan and improve their strategies/frameworks to support the e-money issuers as part of the effort of Bank Negara Malaysia.

Research Methods

Quantitative research design is used in this study. This research is a cross-sectional study using survey methodology. As such, the data were collected only once at a specific point of the time by a structured questionnaire method to answer the research questions (Sekaran & Bougie, 2010). This study is a correlational survey research. Hence, this study aims at establishing relationships between predictors and dependent variable.

Data collection

This study attempts to examine the intention to use the mobile e-wallet among the smartphone users in Malaysia. This study focuses on the smartphone users who have an internet banking account or/and activated online payment debit/credit card, and are aware about the mobile e-wallet but not yet adopt the technology. Only smartphone users will be selected because the mobile e-wallet payment mainly conducted via smartphone and this population propensity for this technology use is the most relevant. The statistic shows that the smartphone users in Malaysia are not yet fully utilizing the m-payment despite the rapid growth of smartphone adoptions (MCMC, 2017). Hence, the unit of analysis for this study is an individual. Purposive sampling is utilized as a part of a situation where the specialty of authority can be selected from a more representative sample that can bring more precise outcome than by using other probability sampling methods. Therefore, purposive sampling is sampling those who have sufficient knowledge and the experience of the topic to provide the relevant data (Angland et al., 2014). Therefore, purposive sampling is employed for this research based on three criteria. First, only the respondents that has a smartphone therefore results can explain only the smartphone users’ behavioural intention. Second, only the respondents that are aware of the mobile e-wallet but never use it are eligible for the questionnaire. Third, only the respondents that has the online banking account or/and the activated online payment debit/credit card as the most e-wallet applications require its users to load funds into an e-wallet account only by using online banking or activated online payment debit/credit card. Based on G*Power program, the minimum sample size required for this study framework which has three predictors is 119 with the effect size of 0.15 and power of 0.95 (Cohen, 1988). However, we managed to collect 122 respondents to have a better result.

Measurement

The measurement items for trust in service provider were adapted from the instrument developed by Yang et al. (2017) which comprised of four items while the measurement items for attitude were adapted from the instrument prepared by Taylor and Todd (1995), and Yang et al. (2017) which comprised of five items. The measurements for subjective norm were adapted from Taylor and Todd (1995), and Yang et al. (2017). Moreover, the three measurement items for perceived behavioural control were adapted from Taylor and Todd (1995), and Yang et al. (2017). Finally, the measurements for behavioural intention to use mobile e-wallet contained three measurement items that were adapted from Yang et al. (2017), and Venkatesh and Morris (2000). All items are measured by using Likert scale.

Findings

The data was analysed by using the partial least squares - structural equation modelling (PLS-SEM) technique applying SmartPLS software version 3.2.8 (Ringle et al., 2015).

Hypotheses Testing

The relationships among variables and the result of the findings are interpreted in Figure

Discussion

This study extends the Theory of Planned Behaviour (TPB) by Ajzen (1991) with trust in service provider factor, and it shows that the extension developed an important relationship with those three antecedents of behavioural intention to use mobile e-wallet which is attitude, subjective norm, and perceived behavioural control. When the potential users trust the service provider, they are likely to develop a positive thought about the subject. Then, trust in service provider would strongly enhance potential users’ normative beliefs about the viewpoint of people surrounding such as friends, families, and colleagues who concern about the adoption of the mobile e-wallet. On the other hand, trust in service provider would strengthen the potential user’s perceived behavioural control as they trust that the mobile e-wallet service provider is reliable to make use of the technology and help them to control their spending.

Among these relationships, attitude and subjective norm are two major direct influencers on smartphone user’s behavioural intention to use mobile e-wallet. This study shows that attitude shapes the user’s behavioural intention where they think to use the mobile e-wallet as a payment method is a good idea and positively thought about it. This implies that a smartphone user needs to have a positive psychological state to adopt the mobile e-wallet technology. Meanwhile, as part of the eastern culture to be respectful and socially oriented, subjective norm factor indicates more importance than attitude in determining behavioural intention to use mobile e-wallet. This shows that Malaysians are more concerned with social relationships and receiving approval or suggestion from people surrounding them in trying something new like mobile e-wallet. Apart from that, smartphone users have no experience in using mobile e-wallet are willing to depend on the opinions of others as the technology related to monetary is very sensitive. Nevertheless, perceived behavioural control does not produce significant impacts on behavioural intention to use mobile e-wallet in this study. Smartphone users might think that by having a mobile e-wallet, they would not be able to control their spending. Other than that, resources and the knowledge, and the ability to make use of the mobile e-wallet might be limited to them as the users are required to load funds into an e-wallet account and they might perceive to have limited e-money compare to having cash in hand.

Conclusion

In order to increase the mobile e-wallet user, a number of challenges need to be identified and overcome. As those factors will affect the user acceptance of the technology, the service developers need to understand the consumer perceptions in depth and this study can be a framework for a basic guideline for future research in consumer’s behavioural intention to adopt new m-payment technology such as mobile e-wallet. Future research should aim to expand the proposed model with a better predictive power. For example, perceive characteristics of the technology can be explored further while taking into the consideration of the potential user’s background such as cultural dimensions and habits.

As a conclusion, it is believed that this study will enhance the creation of cashless society because as this study helps the related parties with the mobile e-wallet development, there will be a rapid growth of consumers that confident in adopting the technology for daily transactions. Encouraged by high penetration of mobile devices, the mobile e-wallet users will grow significantly, thus it is not impossible for Malaysia to make the transition into a cashless society.

References

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-T

- Angland, S., Dowling, M., & Casey, D. (2014). Nurses’ perceptions of the factors which cause violence and aggression in the emergency department: a qualitative study. International Emergency Nursing, 22(3), 134–139.

- Bagla, R. K., & Sancheti, V. (2018). Gaps in customer satisfaction with digital wallets: challenge for sustainability. Journal of Management Development, 37(6), 442–451. https://doi.org/10.1108/JMD-04-2017-0144

- Bank Negara Malaysia. (2018). Governor’s Keynote Address at the Malaysian E-Payments Excellence Awards (MEEA) 2018 - ‘The resurgence of payments in a digital world’. www.bnm.gov.my website: http://www.bnm.gov.my/index.php?ch=en_speech&pg=en_speech&ac=795&lang=en

- Bank Negara Malaysia. (2019a). Driving towards electronic payments. www.bnm.gov.my website: http://www.bnm.gov.my/index.php?ch=ps&pg=ps_mep_drv_toward&ac=193&lang=en

- Bank Negara Malaysia. (2019b). List of Regulatees. www.bnm.gov.my website: http://www.bnm.gov.my/index.php?ch=ps&pg=ps_regulatees

- Bank Negara Malaysia. (2019c). Malaysia’s Payment Statistics. www.bnm.gov.my website: http://www.bnm.gov.my/index.php?ch=ps&pg=ps_stats&lang=en

- Boost. (2019). Boost App - Your Mobile Wallet. Pay without the hassle of cash. www.myboost.com.my website: https://www.myboost.com.my/features/

- Capgemini, & BNP Paribas. (2018). World Payments Report 2018. Retrieved from https://worldpaymentsreport.com/wp-content/uploads/sites/5/2018/10/World-Payments-Report-2018.pdf

- Chandra, Y. U., Ernawaty, & Suryanto. (2017). Bank vs telecommunication E-Wallet : System analysis, purchase, and payment method of GO-mobile CIMB Niaga and T-Cash Telkomsel. In 2017 International Conference on Information Management and Technology (ICIMTech) (pp. 165–170). https://doi.org/10.1109/ICIMTech.2017.8273531

- Chauhan, M., & Shingari, I. (2018). Future of e-Wallets: A Perspective From Under Graduates’. International Journal of Advanced Research in Computer Science and Software Engineering, 7(8), 146. https://doi.org/10.23956/ijarcsse.v7i8.42

- Cohen, J. (1988). Statistical Power Analysis for the Behavioral Sciences (2nd Edition). Routledge.

- Dahlberg, T., Guo, J., & Ondrus, J. (2015). A critical review of mobile payment research. Electronic Commerce Research and Applications, 14(5), 265–284. https://doi.org/10.1016/j.elerap.2015.07.006

- Fan, B., Ji, H., Wei, J., & Lambert, S. (2018). Development of tactical solutions for the e-credit card issuing industry. International Journal of Accounting and Information Management, 26(1), 115–131. https://doi.org/10.1108/IJAIM-02-2017-0014

- Grab Malaysia. (2019). GrabPay - Mobile Wallet Payment Solution. www.grab.com website: https://www.grab.com/my/grabpay/

- Kanagasundaram Visvanathamuthaliyar, K., & Wikramanayake, G. (2014). Next generation smart transaction touch points. https://doi.org/10.1109/ICTER.2014.7083886

- Khalilzadeh, J., Ozturk, A. B., & Bilgihan, A. (2017). Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Computers in Human Behavior, 70(2017), 460–474. https://doi.org/10.1016/j.chb.2017.01.001

- Leong, L. Y., Hew, T. S., Tan, G. W. H., & Ooi, K. B. (2013). Predicting the determinants of the NFC-enabled mobile credit card acceptance: A neural networks approach. Expert Systems with Applications, 40(14), 5604–5620. https://doi.org/10.1016/j.eswa.2013.04.018

- Madan, K., & Yadav, R. (2016). Behavioural intention to adopt mobile wallet: a developing country perspective. Journal of Indian Business Research, 8(3), 227–244. https://doi.org/10.1108/JIBR-10-2015-0112

- Matemba, E. D., & Li, G. (2018). Consumers’ willingness to adopt and use WeChat wallet: An empirical study in South Africa. Technology in Society, 53, 55–68. https://doi.org/10.1016/j.techsoc.2017.12.001

- Maybank (2019). MAE - Digital Products & Services. www.maybank2u.com.my website: https://www.maybank2u.com.my/maybank2u/malaysia/en/personal/services/digital_banking/MAE.page

- MCMC (2017). Hand Phone User Survey 2017-Statistical Brief Number Twenty-Two. https://www.mcmc.gov.my/skmmgovmy/media/General/pdf/HPUS2017.pdf

- Mun, Y. P., Khalid, H., & Nadarajah, D. (2017). Millennials’ Perception on Mobile Payment Services in Malaysia. Procedia Computer Science, 124, 397–404. https://doi.org/10.1016/j.procs.2017.12.170

- Nielsen. (2019). Cash Or Cashless? Malaysia’s Shifting Payment Landscape. https://www.nielsen.com/my/en/insights/reports/2019/cash-or-cashless-malaysias-shifting-payment-landscape.html

- Ooi, K.-B., & Tan, G. W.-H. (2016). Mobile technology acceptance model: An investigation using mobile users to explore smartphone credit card. Expert Systems with Applications, 59, 33–46. https://doi.org/10.1016/j.eswa.2016.04.015

- Payments Network Malaysia. (2019). Real-time Retail Payments Platform (RPP). www.paynet.my website: https://www.paynet.my/fi-rpp.html

- PricewaterhouseCoopers (PwC) Malaysia. (2018). Banking on the e-wallet in Malaysia. www. pwc.com/my/deals-strategy

- Rampton, J. (2017). Digital Wallet Usage on the Rise? Trulioo website: https://www.trulioo.com/blog/digital-wallet/

- Razer. (2019). E-Wallet Mobile App. https://pay.razer.com/my/

- Ringle, C. M., Wende, S., & Becker, J.-M. (2015). SmartPLS 3. SmartPLS.

- Sekaran, U., & Bougie, R. (2010). Research Methods for Business: A Skill Building Approach (5th edition). John Wiley and Sons.

- Sharma, S. K., Mangla, S. K., Luthra, S., & Al-Salti, Z. (2018). Mobile wallet inhibitors: Developing a comprehensive theory using an integrated model. Journal of Retailing and Consumer Services, 45(July), 52–63. https://doi.org/10.1016/j.jretconser.2018.08.008

- Shetty, S., Shetty, T., & Amale, R. (2014). QR-Code based Digital Wallet. International Journal of Advanced Research in Computer Science, 5(7), 105–110. https://search-proquest-com.ezproxy.conricyt.org/docview/1639254039?pqorigsite=summon&https://search.proquest.com/technologycollection

- Singh, N., Srivastava, S., & Sinha, N. (2017). Consumer preference and satisfaction of M-wallets: a study on North Indian consumers. International Journal of Bank Marketing, 35(6), 944–965. https://doi.org/10.1108/IJBM-06-2016-0086

- Sivathanu, B. (2019). Adoption of digital payment systems in the era of demonetization in India. Journal of Science and Technology Policy Management, 10(1), 143–171. https://doi.org/10.1108/JSTPM-07-2017-0033

- Taylor, S., & Todd, P. (1995). Decomposition and crossover effects in the theory of planned behavior: A study of consumer adoption intentions. International Journal of Research in Marketing, 12(2), 137–155. https://doi.org/10.1016/0167-8116(94)00019-K

- Teng, L. J., & Idris, A. N. (2018). Tech: Consolidation seen further ahead in the crowded e-wallet space. The Edge Markets. https://www.theedgemarkets.com/article/tech-consolidation-seen-further-ahead-crowded-ewallet-space

- Ting, H., Yacob, Y., Liew, L., & Lau, W. M. (2016). Intention to Use Mobile Payment System: A Case of Developing Market by Ethnicity. Procedia - Social and Behavioral Sciences, 224(August 2015), 368–375. https://doi.org/10.1016/j.sbspro.2016.05.390

- Touch ‘n Go. (2019). About the Touch ‘n Go eWallet. www.tngdigital.com.my website: https://www.tngdigital.com.my/faq.html

- vcash. (2019). Malaysian eWallet App - Pay, Send & Transfer Money for Free. vcash.my website: https://vcash.my/features

- Venkatesh, V., & Morris, M. G. (2000). Why Don’t Men Ever Stop to Ask for Directions? Gender, Social Influence, and Their Role in Technology Acceptance and Usage Behavior. MIS Quarterly, 24(1), 115. https://doi.org/10.2307/3250981

- WeChat. (2019). WeChat Pay Malaysia. https://pay.wechat.com/en_my/index.html

- Wei, L. Z., & Tsu, D. K. P. (2018). Transforming mobile phones into e-wallets in Malaysia. Bank Negara Malaysia Quarterly Bulletin, 35–43. www.bnm.gov.my

- Yang, H., Lee, H., & Zo, H. (2017). User acceptance of smart home services: an extension of the theory of planned behavior. Industrial Management & Data Systems, 117(1), 68–89. https://doi.org/10.1108/IMDS-01-2016-0017

- Yuen, M. (2019, February 3). Cashing in on e-wallets. The Star. https://www.thestar.com.my/news/nation/2019/02/03/cashing-in-on-ewallets-its-a-growing-trend-more-people-are-using-ewallets-in-their-phones-these-days/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Fadhil, M. K., Vafaei-Zadeh, A., & Ramayah, T. (2020). Sustaining The Environment Through Technology: Modeling Mobile E-Wallet As A Payment Option. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 1039-1050). European Publisher. https://doi.org/10.15405/epsbs.2020.10.97