Abstract

This study aims to analyze the psychology of investor in making investment decision. Investment decision is the factor in constituting market price of stocks as well as composite index in capital market. The purpose is to prove whether stock prices are constituted by merely rational decision making such as using fundamental or technical analysis or also by irrational one such as psychological investors such as fear, ambition, greedy or panic. This study uses qualitative methods approach, especially phenomenological approach to address the research questions. The data are generated from semi-structured interviews with several investors/traders in the Indonesia stock market. The results reveal that psychology condition has a role in the behavior of investors in making investment decisions and not only using rational consideration such as fundamental analysis or technical analysis to analyze the stock prices. Hence, the daily stock market or aggregately stock market composite index are constituted by simultaneously rational and irrational consideration of investors.

Keywords: Investment decisionirrational analysispsychology of investorrational analysis

Introduction

Nowadays capital market is one of vital part in modern economy. It has two roles, a) for company, it is a powerful source of company financing on the other hand b) for investor, it is a powerful tool of investment that can boost investors’ wealth. Recently, Indonesia Stock Exchange (IDX) launches a program called ‘Yuk Nabung Saham’ (Let’s saving our money into stock). The program is aimed to motivate Indonesian people to invest their money in capital market regularly ( PT-Bursa-Efek-Indonesia, 2016). The target of the program is to change Indonesian people behavior from saving society into investing society ( PT-Bursa-Efek-Indonesia, 2016).

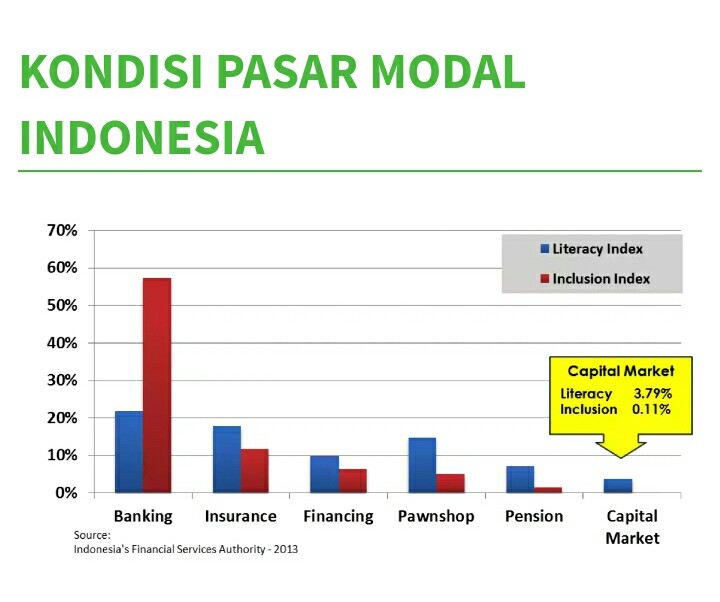

The motivation of the program is there are still low amount of Indonesian people that are interested to invest in stock market. As shown in figure

The more people interesting in stock market lead to further question about how the stock price will be constituted, as stock prices are not shaped merely by rational decision. Stock prices also can be manipulated by speculators ( Allen & Gale, 1992). The prices manipulation attack investors’ emotion and psychology.

Wu ( 1997) stated that many economists conclude that stock prices are too unstable to be attributed to market fundamentals. It means that so many factors influence and constitutes stock prices in stock market. Yao and Luo ( 2009) argued that stock prices cannot be purely relied on economic theories written in the text books such as price/earnings ratios or CAPM (Capital Asset Pricing Model). There are non-economic factors especially investors psychology such as greed, envy and speculation to understand how stock market developed ( Yao & Luo, 2009).

Daniel et al. ( 1998) survey the influence of investor psychology to security market. They use investor overconfidence assumption. Overconfident investor is those who expects too much that his/her private information signal is accurate, but not of information signal publicly available. The result is that the overconfident investors tend to overemphasize the private signal rather than to publicly available one. This causes the stock price becomes to overreact.

Armstrong-III ( 2012) suggests that keeping investor’s emotions in check is a key trait of successful investors. He argues if investors allow their emotions to drive their investment decision making, they can quickly become their own worst enemy.

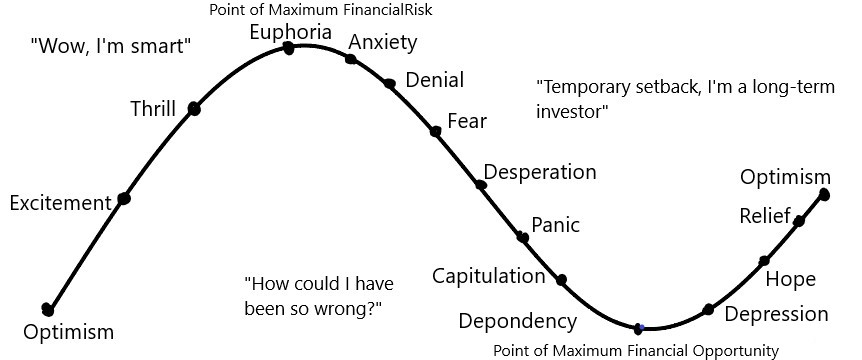

Hannon ( 2009) explains more detail about the cycle of market emotions as follows:

Optimism – A positive viewpoint reassures investors about the future, leading them to buy stocks.

Excitemen – Investors begin to consider that, after seeing their initial ideas work, they could accomplish their success in the market.

Thrill – At this point, investors begin to convince how smart they are because of their success in the market.

Euphoria – At this point investors begin to be careless and ignoring the risk since they feel it is very easy to make profits and believe that every trade to become profitable.

Anxiety – Investors begin to be worried because for the first time the market moves against them. At this point they begin to consider to be long-term investors so that their ideas will eventually work.

Denial – Investors at this point begin denying about their choices as the markets have not rebounded yet.

Fear – At this point investors begin to believe that their stocks will never be back to the price in their favor as the market realities become confusing.

Desperation – At this point investors have no idea what thing to do, so that they grasp any idea that possible to bring back their stock price at least into breakeven.

Panic – At this point investors feel very tired and at a loss for what to do next.

Capitulation – At this point investors decide to cut loss their stocks to avoid more losses as they are sure that their stock’s price will never increase again.

Despondency – At this point investors don’t want to buy stocks ever again.

Depression – At this point investors feel so depressed and don’t know how come they could be so foolish; we are left trying to understand our actions.

Hope – Finally investors realize that markets move cyclically. At this point they begin to believe the market again and seeking next opportunity.

Relief – Investors begin to buy stocks again as they believe in market again and confident that there is a future in investing in market.

Problem Statement

Investment decision is an activity that influencing daily stock price as well as the composite index of stock market. However, investment decision is not always based on careful analysis or rational thinking. Irrational decisions such as panic buying/selling or neglecting any important issues are often become main reason in doing buy or sell decision.

Research Questions

Based the explanation of investors’ emotion and psychology above, the research question of this research is: Does investors’ psychology and emotion influence stock price in the market? How does investors’ psychology have effect in constituting stock price?

Purpose of the Study

The objective of the study is to explore the complexity of stock price constitution in stock market. As many literatures said that stock price is not only shaped by rational decision, but also by irrational decision.

Research Methods

This research uses phenomenology as a method to address the research questions. Phenomenological study tries to describe several individuals’ realization of their lived experiences of a concept or a phenomenon ( Creswell, 2007). By quoting several scholars, Creswell ( 2007) stated that phenomenological research is popular in sociology, psychology, nursing and health sciences and education.

Data generation

In this research, data will be generated through interviews, especially semi-structured interview.

Data analysis

According to Huberman and Miles ( 2000) qualitative data analysis consists of data reduction, data display, and conclusion drawing/verification. Data reduction is aimed to reduce the potential universe of data in an anticipatory way as the researcher choose a conceptual framework, research questions, cases, and instruments. Data display is about organizing, compressing assembly of information that permits conclusion drawing and/or action taking. Lastly, conclusion includes comparison/contrast, noting of patterns and themes, clustering, and use of metaphors.

Findings

Five interviewees participated in this research. We undertook the interviews at interviewees’ available time. They are all active investors/traders in Indonesian Stock Exchange.

1. Niky

Niky is professional stock analyst. Currently he works at one of prominent securities company located in Jakarta, Indonesia. When I asked him about his strategy of investing in stock market, he said:

“I always look at financial report to analyze a stock. For me a good stock always come from a good firm, and a good firm is reflected in its financial report. Sooner or later, stocks of good financial report will win over the ones that come from bad financial report. Following solely technical analysis just make investors entrapped in speculative actions. As long as there is no serious problem with the company, there is no reason to sell stock. I hate to be a speculator and I often suggest my customers to not to be speculators”.

2. Bambang

Bambang is a branch manager at one of securities company branch. The company is one of the biggest securities in Indonesia. Bambang used to give recommendation to customers about which stock to choose, as he said:

“I used to give advice to my clients in order to not too worry to a stock with good fundamental analysis. Besides seeing fundamental financial performance, I also see the prospect of the company as well as the industry. For any stock that has fallen at very low price but it has large potential to rebound, I often give suggestion to my clients to buy it and keep it for a little bit longer.

For those who has reached very much gain from certain stock, I suggest to take the amount of profit part from the stock and put it in another good stock. I call it “planting stock”.

3. Nouri.

Nouri is a lecturer. He used to teach on capital market and investment theory. But his acknowledgment about his investment style is a little bit shocking:

After six years involved in stock market, I am still feeling silly to be an investor. Even though I theoretically understand the investment theory, I even teach my students about it, but I myself often make careless decision of my investment. I still often make emotional decision such as panic selling or panic buying in deciding which stock to buy or to sell. I ever experience big loss in 2011 and it took about 50% of my capital. Until now I cannot still bring back the loss due to my foolishness of investment.

4. Andre

Andre is an accounting student. He is very interested and very active in stock market and often gain much profit from stock market. He is a true trader actually since he consistently notices stock chart rather than analyzing financial reporting. “I usually use Bollinger-band indicator to decide whether to buy or to sell a stock. I notice that if there is two lower Bollinger-band in two days, it is time to buy and vice versa.

The four interviews above show different interesting styles of investment decision. Experience, education, or enthusiasm into stock business influences the style of investment decision. Niky and Bambang are professional in stock market. They both are branch managers of different securities companies in Indonesia that surely concern with daily stock dynamics. Their securities company manage billions rupiah of customers’ fund. Thus they are of course familiar with sophisticated stock analysis.

Nouri is a lecturer in a business faculty. However, even though he teach portfolio theory and investment management, he acknowledges that he often make wrong decision in stock investment. Unlike Bambang and Niky that doing practice in stock investment analysis and decision making, Nouri mostly only read textbook of investment in stock market. He also has no special training in stock market analysis.

According to Loewenstein ( 2000), the emotions and feelings experienced at the time of making a decision often propel behavior in directions that are different from that dictated by a weighing of the long-term costs and benefits of disparate actions. Lucey and Dowling ( 2005) explain there are two recent areas of stock market research have addressed the impact of feelings on investor decision-making. The first area covers mood misattribution. This research investigates the impact of environmental factors, such as the weather, the body’s biorhythms and social factors, on equity pricing. This area builds on research from psychology which argues that people’s decisions are guided, in part, by their feelings.

The second area of research looks at the impact of image on investor decision making, the argument here is that the image of a stock induces emotions in investors that partially drive their investment behavior ( Loewenstein, 2000).

Niky and Bambang are steadier in making investment decision. Their job experience and training background shaping their attitude of investment. They are not easy to panic in addressing market condition, whether panic buying or panic selling. Discipline is their main attitude in making decision. For example, in addressing a down trend of a stock Bambang said, “If a stock price down more than 3 percent from previous day, sell it. It is easier to make a rebound from minus 3 percent rather than more than minus 3 percent”.

The case of Nouri investment is much different with Niky’s or Bambang’s ones. Nouri is much more prone to make false decision in investment. His primary weakness is unable to maintain discipline behavior in investing. He often follows solely his bare feeling rather than analyzing fundamental financial performance or technical chart of stock price. “I couldn’t maintain my discipline behavior. My decision is often derived from greedy, fear or panic feeling rather than from careful and deep analysis”.

Nouri’s style of investment confirms the involvement of psychology and emotion in investment decision making. Achelis ( 2000) argued as humans are always involved in investment decision making, many investment decisions are based on irrelevant criteria. “Our relationships with our family, our neighbors, our employer, the traffic, our income, and our previous success and failures, all influence our confidence, expectations, and decisions” ( Achelis, 2000, p. 2).

Andre is a student and of course still young. He seems a good learner when he said that he disciplinary practices one of technical analysis indicators, “I usually use Bollinger-band indicator to decide whether to buy or to sell a stock. I notice that if there is two lower Bollinger-band in two days, it is time to buy and vice versa”. However, Andre sometimes also cannot avoid from his emotional condition. He said he ever sold his stock because of fear of market down trend’ even though there was no problem with his stock.

Evidences above show that psychological and emotional factor influence the making of investment decision in different level. This in turn shows that stock prices in the market are constituted not merely based on rational basis but also by irrational basis.

Conclusion

Based on the findings in this study, it can be concluded that the behavior of investors in making investment decisions in the stocks not always rely on fundamental analysis and technical analysis to analyze the stock price on the stock market. This study showed that investors often use their psychology and emotion in making decision to invest in the stock market.

As Achelis ( 2000) said, the price of a security represents a consensus between one person that agrees to buy and another that agrees to sell. Investors is willing to buy or sell at certain price based on their expectation. If they are sure the stock’s price to rise, so they will buy it; but if they are sure the price to fall, they will sell it. Due to investment decision making always involves human, the consensus of stock price is not only relying on rational basis, but also on irrational one such as emotional and psychological factors.

Limitations of the study

This study has limitations in the lack of information that can be interviewed because of it is not so easy to identify the one that actively doing business in stock market. Another limitation is the time limit in doing this research.

Suggestion for future research

Future researchers who want to study the same topic are expected to fill gaps identified include lack of data obtained to analyze within the limits of the study to obtain more data from investors. The importance of controlling the psychology of investors for investment decisions made will affect the level of profit and loss that investors will experience. Thus, more research is needed to investigate the psychology of investors in Indonesia because capital markets have an important role for the country's economy.

References

- Achelis, S. (2000). Technical Analysis from a to Z (2nd ed.). McGraw Hill.

- Allen, F., & Gale, D. (1992). Stock-Price Manipulation. The Review of Financial Studies, 5(3), 503-529.

- Armstrong-III, F. (2012, 12 October). Understand The Cycle of Market Emotions to Make Better Investing Decisions. Forbes.

- Creswell, J. W. (2007). Qualitative Inquiry & Research Design: Choosing Among Five Approaches (2nd ed.). Sage Publications.

- Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor Psychology and Security Market: Under- and Overreactions. Journal of Finance, 53(6), 1839-1885.

- Hannon, S. (2009). Trading Psychology, The 14 Stages of Investor Emotions. https://www.stocktrader.com/2009/05/14/trading-psychology-stages-investor-emotions/

- Huberman, A. M., & Miles, M. B. (2000). Data Management and Analysis Methods. In N. K. Denzin & Y. S. Lincoln (Eds.), Handbook of Qualitative Research (2nd ed., pp. 428-444). Sage Publications.

- Loewenstein, G. (2000). Emotions in Economic Theory and Economic Behavior. The American Economic Review, 90(2), 426-432.

- Lucey, B. M., & Dowling, M. (2005). The Role of Feelings in Investor decision Making. Journal of Economic Surveys, 19(2), 211-237.

- PT-Bursa-Efek-Indonesia (2016). Yuk Nabung Saham. http://yuknabungsaham.idx.co.id/

- Wu, Y. (1997). Rational Buble in Stock Market: Accounting for the US Stock Price Volatilty. Economic Inquiry, 35, 309-319.

- Yao, S., & Luo, D. (2009). The Economic Psychology of Stock Market Bubbles in China. The World Economy, 32(5), 667-691.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Adib, N. (2020). The Effect Of Investor’S Psychological Condition In Investment Decision Making. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 98-105). European Publisher. https://doi.org/10.15405/epsbs.2020.10.9