Abstract

The ability of MNC subsidiaries to incorporate, construct and reconfigure knowledge to cope with environmental changes are necessary to sustain competitive advantage, especially in fast-moving global environments. Failure of some MNC subsidiaries to sustain in the industry in Malaysia has create an alert whether these MNC subsidiaries has sufficient knowledge to stay competitive. The goal of this study is to analyse the impact on the competitive advantage of a subsidiary MNC and the role of knowledge building capability of the various types of information (home knowledge and host knowledge). This study also examined the impact of subsidiary’s knowledge stock on the relationship between knowledge inflow and knowledge creation capability. Online surveys were carried out in Malaysia from 130 subsidiaries in the E&E industry. The collected data were then analysed using partial least squares–structural equation modelling via SmartPLS. The obtained results revealed that home knowledge inflow and host knowledge inflow significantly and positively affect knowledge creation capability. As for the relationship between the mediator and the dependent variable, it was found that knowledge creation capability significantly and positively affected competitive advantage. In term of knowledge stock as the moderator, the relationship between knowledge inflow and the knowledge creation capability was found to not be strengthened by all dimensions of the knowledge stock. There was also discussion of the theoretical and practical contributions of this study.

Keywords: MNC subsidiarycompetitive advantageknowledge inflowknowledge creation capability

Introduction

The rapid changes in the current business world have propelled the significant need for organisation to possess sustainable competitive advantage through continuous knowledge sourcing and knowledge creation. The organisations need to promptly address the subject of knowledge-based competitiveness, given its significance. The market demands, as well as the technological and organisational conditions, have compelled the organization to adapt to the current knowledge (Nonaka, 1994). Knowledge is the primary source of competitive advantage (Nonaka, 1994) and a significant mechanism to enhance innovation and business performance.

Literature Review

Considering the importance of knowledge for the MNCs in Malaysia, this study identified several gaps. According to the KBV theory, importance of knowledge was highlighted, however there is no clear roadmap or a guide to manage knowledge (Pandey et al., 2017). Many literatures stressed the importance of successful creation and implementation of knowledge in improving the efficiency and effectiveness of an organisation but did not adequately address the question of how MNC subsidiaries achieve competitive advantage in the host country.

Competitive advantage of MNC subsidiary depends on knowledge inflows. The knowledge inflow encourages the exchange and creation of knowledge at the organisational level for higher competitive advantage (Liao et al., 2010). The integration of both home and host country knowledge inflow positively influences the survival of subsidiaries in the industry (Hallin & Holmström Lind, 2012). Different sources of knowledge (home and host knowledge) lead to different KCC of subsidiaries; thus, affecting their competitive advantage (Almeida & Phene, 2004). Therefore, the home knowledge inflow and host knowledge inflow are vital for success at the MNCs level.

Therefore, to identify which type of knowledge inflow positively influence the KCC of MNC subsidiaries, the following hypothesis were tested:

Hypothesis 1 (H1):Home knowledge inflow positively influences the KCC of MNC subsidiaries.

Hypothesis 2 (H2):Host knowledge inflow positively influences the KCC of MNC subsidiaries.

Despite the significance of knowledge inflow for the subsidiaries to attain competitive advantage, the capability to make use of the acquired knowledge remains evidently imperative for these MNCs (Phene & Almeida, 2008). This study measure if KCC plays a vital role for the MNCs to remain competitive by testing the following hypotheses:

Hypothesis 3 (H3):KCC positively influences the competitive advantage of MNC subsidiaries.

MNC is seen as a knowledge network, the capability to transmit acquired knowledge from various sources (home and host country) are necessary to effectively integrate the different types of knowledge acquired. Therefore, KCC facilitates effective knowledge exchange and improve the organisational performance (Lai et al., 2014). Recognising the significance of KCC, this study assessed the mediating role of KCC in enhancing home knowledge inflow and host knowledge inflow for higher competitive advantage as below:

Hypothesis 4 (H4):KCC mediates the relationship between knowledge inflow and competitive advantage of MNC subsidiaries.

Prior studies often emphasised the need to learn from different sources of knowledge, as the capacity to acquire new knowledge of an organization depends on its knowledge stock (Cohen & Levinthal, 1990). The knowledge stock (KS) of a subsidiary influences its ability to effectively apply specific knowledge inflow for the development of KCC (Phene & Almeida, 2008). KS refers to the existing knowledge within the boundary of an organisation at a point of time in terms of human capital, social capital, and organisational capital. However, not all dimensions of knowledge stock improve the organisations’ performance (Collins et al., 2001). Hence, it is crucial to explore the influence of different dimensions of knowledge stock on KCC of MNC subsidiaries, which propelled this study to assess the moderating role of the knowledge stock in the relationship between MNC subsidiaries' knowledge inflow and KCC as below :

Hypothesis 5 (H5):Knowledge stock positively moderates the relationship between knowledge inflow and KCC of MNC subsidiaries.

Problem Statement

The closure and restructuring of numerous multinational companies (MNC) in Malaysia over the past recent years due to the challenging business environment, turbulent market conditions, and the high cost of operation demand; demonstrate the failure of these MNCs in Malaysia to achieve competitive advantage (Says, 2017). The strength of MNCs distributed across different countries lies precisely in its ability to utilise the knowledge network (Fleury et al., 2013). The proper knowledge strategies is the key for organization to be survived through the industry (Rahimli, 2012). Therefore, the closure on MNCs in Malaysia raises several questions: If these subsidiaries in Malaysia are able to sustain their competitive advantage in their global business ventures, what are the factors that deter these subsidiaries from continuing their operation in Malaysia? Does this mean that the subsidiaries in Malaysia do not possess sufficient knowledge or fail to utilise the acquired knowledge to gain a competitive market edge?

Therefore, it is prime time to explore the competitive advantage of subsidiaries in Malaysia from knowledge-based perspective. It is imperative to determine whether the knowledge inflow to the MNC subsidiaries in Malaysia from home and host country influences their capabilities to create knowledge for competitive advantage.

Research Questions

Aligned with the current status of the manufacturing sector in Malaysia and the study’s problem statement, the aims of this study are presented in the following:

Does the type of knowledge inflow that positively influences the knowledge creation capability (KCC) of MNC subsidiaries in Malaysia?

Does the relationship exist between KCC and competitive advantage of MNC subsidiaries in Malaysia;

Does KCC mediate the relationship between knowledge inflow and the competitive advantage of MNC subsidiaries in Malaysia?

Does dimensions of knowledge stock moderate the relationship between knowledge inflow and KCC of MNC subsidiaries in Malaysia?

Purpose of the Study

Aligned with the current status of the manufacturing sector in Malaysia and the study’s problem statement, the aims of this study are presented in the following:

To determine the type of knowledge inflow that positively influences the knowledge creation capability (KCC) of MNC subsidiaries in Malaysia;

To assess the relationship between KCC and competitive advantage of MNC subsidiaries in Malaysia;

To examine the mediating role of KCC in the relationship between knowledge inflow and the competitive advantage of MNC subsidiaries in Malaysia

To explore the moderating role of the dimensions of knowledge stock in the relationship between knowledge inflow and KCC of MNC subsidiaries in Malaysia

Research Methods

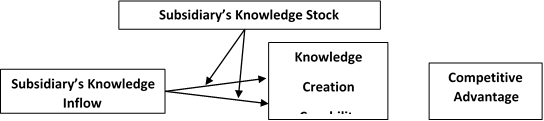

The main objective of this study was to assess the competitive advantage of MNC subsidiaries in Malaysia. This study attempted, in particular, to establish "what affects MNC subsidiaries' competitive advantage from a theory of KBV”. This study developed and tested the model that proposed the relationship of knowledge inflow, knowledge stock, KCC, and competitive advantage of subsidiaries in Malaysia as in Figure

A cross-sectional sample survey field study was conducted on the grounds of a structured research questionnaire. In this study, the relation of variables to the competitive advantage of MNC subsidiaries was assessed with a quantitative approach. The questionnaire for this study was developed using a combination of existing validated measures based on a comprehensive literature review.

The unit of analysis for this study focused on the subsidiaries of the MNCs in the E&E industry in Malaysia. The impact of the E&E industry on the national economy is significant given its contribution to the expansion of other industries. Given the importance of the E&E industry to the economy, the competitive advantage of MNC subsidiaries of the E&E industry is extremely important.

Respondents of this study are the key employees of E&E organizations. Key employees are regarded as individuals with critical positions in the organization and have a direct impact on company management and performance. The obtained data from key employees were then aggregated at the organisational level.

This study considered the mail questionnaire as the data collection method. The online link to the survey form was provided to the respondents via e-mail. Using a purposive sampling technique, this study distributed a total of 550 online survey form via e-mail to the E&E MNC companies that were listed in the FMM directory (of 2016). As a result, considering the minimum required sample size of 123 according to the G power requirement of 0.8 at 0.05 level with medium effect size, this study successfully sampled 130 respondents and considered sufficient.

Findings

SmartPLS 3.0 was used to examine this study's research model. The present research opted to perform PLS-SEM since it is deemed more fitting for a study to evaluate complex models that include mediator and moderator and the reciprocal relationships between the variables under study (Hair et al., 2017). All constructs in the model of this study were reflective constructs. First, the measurement model was tested to validate the research tools and then subsequently the structural model tests to investigate the relationships hypothesized in this study.

Measurement model analysis

The measurement model of this study was tested by using convergent validity, discriminant validity and reliability. The minimum required cut-off value of 0.40 was reached by loading values of all measurement items of each constructs (Hair et al., 2013). The average extracted variance (AVE) of all the constructs exceeded the threshold value of 0.50 (Fornell & Larcker, 1981). This suggested an appropriate convergent value. In addition, the composite reliability of all the constructs is higher than the proposed threshold of 0.708, which support the reliability of the study (Hair et al., 2013). Besides that, the cross-loading for each construct as shown was higher than its relationship to other constructs, suggesting discriminatory validity.

Assessment of the structural model

A collinearity analysis to test the existence of the higher correlated construct was performed before the structural model was evaluated. The result shows that the VIF of all exogenous constructs ranged from 1,516 to 2,063 and were below the threshold of 3.3, which indicates the absence of significant multi-collinearity amounts (Ramayah et al., 2018).

Testing of Hypotheses on Direct Relationships

Three main hypotheses (H1–H3) on the direct relationships between constructs were proposed in this study. Based on a path coefficient assessment (Table

Predictive Accuracy (R2)

The assessment of structural model proceeded with the measurement of the predictive accuracy (R2) for each endogenous variable, namely KCC and competitive advantage. Accordingly, R2 is typically used to calculate the predictive power of the estimated model. The R2 of KCC recorded 0.153, which implies that home knowledge inflow and host knowledge inflow explained 15.3% of the total variance in KCC. The recorded R2 of KCC suggests moderate effect based on the guideline provided by Cohen and Levinthal (1990). As for the relationship between KCC and competitive advantage, the recorded R2 value was 0.182, which implies that KCC explained 18.2% of the total variance in competitive advantage. Similarly, the obtained R2 was considered moderate based on the guideline by Cohen and Levinthal (1990). In other words, KCC moderately influenced the competitive advantage of subsidiaries in this study.

Testing of Hypotheses on the Mediating Effect

The obtained results shown in Table

Testing of Hypotheses on the Moderating Effect

This study applied the orthogonalisation approach to examine the interaction effect of moderator using PLS-SEM to detect the moderating role of knowledge stock. Based on the results in Table

In short, it appeared that the presence of knowledge stock affected the relationship between knowledge inflow and KCC. The relationship between the home knowledge inflow and KCC has been improved under high levels of human and social capital. Meanwhile, the relationship between host knowledge inflow and KCC was strengthened under a high level of social capital. However, this relationship was not affected by a high level of human capital. Whereas, the relationship between host knowledge inflow and KCC was weakened under a high level of organisational capital, therefore the hypotheses were not supported.

Conclusion

This study provided empirical support on the influence of different types of knowledge inflows on competitive advantage through KCC as mediator. Secondly, this study showed that the knowledge stock was important in improving the relationship between knowledge inflows and KCC of MNC subsidiaries in Malaysia.

The direct relationship of knowledge inflows and KCCs was empirically demonstrated based on KBV theory. Moreover, the mediating role of KCC in the relation between knowledge inflow and competitive advantage has been empirically demonstrated in this research, which extended the theoretical scope of the KBV theory. Both home knowledge inflow and host knowledge inflow are said to be relevant and applicable for MNC subsidiaries in Malaysia.

It was deemed highly imperative to note that the significant moderating impact of knowledge stock did occur for the relationship between knowledge inflow and KCC of subsidiaries in this study. However, not all dimensions of knowledge stock strengthened the relationship. In this study, the organisational capital of subsidiaries did not strengthen the relationship between knowledge inflows (home and host knowledge inflow) and KCC. These findings collectively demonstrated that certain underlying exploratory mechanism of intellectual capital theory does not seem to apply to the subsidiaries of MNCs in Malaysia, which requires modification in its theoretical setting. Basically, there were theoretical justifications and empirical evidence to believe that exploratory mechanism of KBV theory. Furthermore, this study introduced new avenues for further theoretical and empirical advancements for the management research based on the findings where host knowledge inflow was found more significant for the KCC of subsidiaries in the host country, compared to home knowledge inflow. As a result, this study expanded the research potential through the significant theoretical implications of this study on international management.

The obtained results of this study contributed significant managerial implications for practitioners, especially policymakers and managers, in the formulation of policies and strategies for subsidiaries in Malaysia for higher competitive advantage. This study empirically demonstrated positive, direct relationships between home knowledge inflow and KCC, between host knowledge inflow and KCC, and between KCC and competitive advantage of subsidiaries. In other words, subsidiaries do have the capability to create knowledge, instead of merely absorbing knowledge, in order to remain competitive. The competitiveness of MNCs is primarily associated with knowledge. Besides that, subsidiaries should proactively seek to develop their KCC by learning from the local industry players in Malaysia and transform their learning experience into desirable goals. Adding to that, subsidiaries should also seek greater knowledge on the local market needs from various sources, such as customers, suppliers, universities or research institutes, competitors, and government agencies in Malaysia.

The subsidiaries in Malaysia must realise that host knowledge may not be as reliable in an emerging economy, compared to a developed economy. In order to leverage knowledge, subsidiaries in Malaysia should make an effort to grasp their strengths and weaknesses. An audit on the knowledge stock of subsidiaries would provide essential information on human capital, social capital, and organisational capital, which would encourage these subsidiaries to play a leading role in promoting activities that serve to identify and measure the pool of tacit knowledge and its importance for knowledge creation. The acquired knowledge then form the underlying basis for future innovation that benefits both subsidiaries and their respective MNCs.

Realising the negative influence of organisational capital on the relationship between knowledge inflow and KCC, the subsidiaries should make several elemental changes in terms of organisational capital to be more project-based and team-oriented. Working in a group is a platform for tacit knowledge sharing. When people work together in a team, they can see how other people conceptualize situations, deal with problems and produce and evaluate solutions. Basically, the more people collaborate, the longer they spend socializing and discussing experiences, anecdotes and impressions informally, the more tacit knowledge they share. The blending of tacit knowledge often leads to novel insight and innovation. In general, these ideas come from intuition and not logical processes. The transfer of organizational capital would therefore increase the organization's social capital and thereby improve overall creativity and innovation.

In addition, high-quality pools of knowledge, expertise and abilities are key drivers for the generation and implementation of new ideas. In other words, human capital creates a better milieu for innovativeness. If high-quality human capital's organisation provide the required time, management support, openness, flexibility or incentives for their work they will improve their creativity efficiency. In this situation, leaders who value innovativeness would invest in creating such an organisation in which workers are aware that if they behave as entrepreneurs and produce viable, risky ideas for innovation and entrepreneurship, their support would be granted. If their ideas are given serious consideration, they would feel encouraged to bring their ideas into action with sufficient emotional physical and financial support; they would not be weakened even if their suggestions were not embraced. The fear of failure and loneliness appear to be critical factors that adversely influence the implementation of innovative projects. An internal environment delivers promising support for such unfavourable cases.

This study collectively demonstrated that certain underlying exploratory mechanism of intellectual capital theory does not seem to apply to the subsidiaries of MNCs in Malaysia, which requires modification in its theoretical setting. Basically, there were theoretical justifications and empirical evidence to believe that exploratory mechanism of KBV theory. Furthermore, this study introduced new avenues for further theoretical and empirical advancements for the management research based on the findings where host knowledge inflow was found more significant for the KCC of subsidiaries in the host country, compared to home knowledge inflow. As a result, this study expanded the research potential through the significant implications of this study on international management.

In conclusion, knowledge is essential to solve problems today, as it has become increasingly crucial for organisations to be aware of environmental changes and to create new knowledge for higher competitiveness (Awad & Ghaziri, 2003). Although companies have access to different knowledge from their country of origin and the host country, their knowledge stocks play an important role in enhancing their KCC . In view of the above, the subsidiaries differ from one another in terms of their KCC due to the different depth and quality of knowledge stock. MNC subsidiaries in Malaysia need to be familiar with the existing market circumstances, capable to react to the changing market conditions and be adequately prepared to rapidly and efficiently develop a wide range of quality products and accelerate their innovation cycle for higher competitive advantage in the industry. The MNC subsidiaries should thus be able to use their knowledge network to broaden their worldwide reach and strategies in order to remain competitive (Gupta & Govindarajan, 2000).

References

- Almeida, P., & Phene, A. (2004). Subsidiaries and knowledge creation: the influence of the MNC and host country on innovation. Strategic Management Journal, 25(89), 847–864. https://doi.org/10.1002/smj.388

- Awad, E. M., & Ghaziri, H. M. (2003). Knowledge creation and knowledge architecture. Knowledge Management (pp. 91–105). Pearson Prentice Hall.

- Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity : A new perspective on learning and innovation. Administrative Science Quaterly, 35(1), 128–152. https://doi.org/10.2307/2393553

- Collins, C., Smith, K. G., & Stevens, C. K. (2001). Human resource practices, knowledge-creation capability and performance in high technology firms. Center of Advanced Human Resource Studies, (01–02), 1–36.

- Fleury, A., Tereza, M., Fleury, L., & Mendes Borini, F. (2013). The Brazilian multinationals’ approaches to innovation. Journal of International Management, 19, 260–275. https://doi.org/10.1016/j.intman.2013.03.003

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal ofMarketing Research, 18(1), 39–50.

- Gupta, A. K., & Govindarajan, V. (2000). Knowledge flows withinmultinational corporations. Strategic Management Journal, 21(4), 473–496

- Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2017). A primer on Partial Least Squares Structural Equation Modeling (PLS-SEM) (Second Ed.). Sage Publication.

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial Least Squares Structural Equation Modeling: Rigorous Applications, Better Results and Higher Acceptance. https://doi.org/10.1016/j.lrp.2013.01.001

- Hallin, C., & Holmström Lind, C. (2012). Revisiting the external impact of MNCs: An empirical study of the mechanisms behind knowledge spillovers from MNC subsidiaries. International Business Review, 21(2), 167–179.

- Lai, Y.-L., Hsu, M.-S., Lin, F.-J., Chen, Y.-M., & Lin, Y.-H. (2014). The effects of industry cluster knowledge management on innovation performance. Journal of Business Research, 67(5), 734–739. https://doi.org/10.1016/j.jbusres.2013.11.036

- Liao, S.-H., Wu, C.-C., Hu, D.-C., & Tsui, K.-A. (2010). Relationships between knowledge acquisition, absorptive capacity and innovation capability: An empirical study on Taiwan’s financial and manufacturing industries. Journal of Information Science, 36(1), 19–35. https://doi.org/10.1177/0165551509340362

- Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 1(5), 14–37. https://doi.org/10.1287/orsc.5.1.14

- Pandey, S. C., Dutta, A., & Nayak, A. K. (2017). Organizational capabilities and knowledge management success: a quartet of case studies. Kybernetes. https://doi.org/10.1108/K-01-2017-0041

- Phene, A., & Almeida, P. (2008). Innovation in multinational subsidiaries: The role of knowledge assimilation and subsidiary capabilities. Journal of International Business Studies, 39(5), 901–919. https://doi.org/10.1057/palgrave.jibs.8400383

- Rahimli, A. (2012). Knowledge management and competitive advantage. Information and Knowledge Management, 2(7), 37–43. https://doi.org/10.1.1.826.1852

- Ramayah, T., Cheah, J., Chuah, F., Ting, H., & Menon, M. A. (2018). Partial Least Squares Structural Equation Modeling (PLS-SEM) using SmartPLS 3.0 (Second). Pearson Malaysia Sdn Bhd.

- Says (2017, July 7). These Global Factories in Malaysia Will Shut Down by End of 2017. https://says.com/my/news/foreign-companies-that-have-shut-down-their-factories-in-malaysia

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Subramaniam, V., & Chelliah, S. (2020). Knowledge Inflow And Competitive Advantage Of MNC Subsidiaries In Malaysia. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 829-838). European Publisher. https://doi.org/10.15405/epsbs.2020.10.75