Abstract

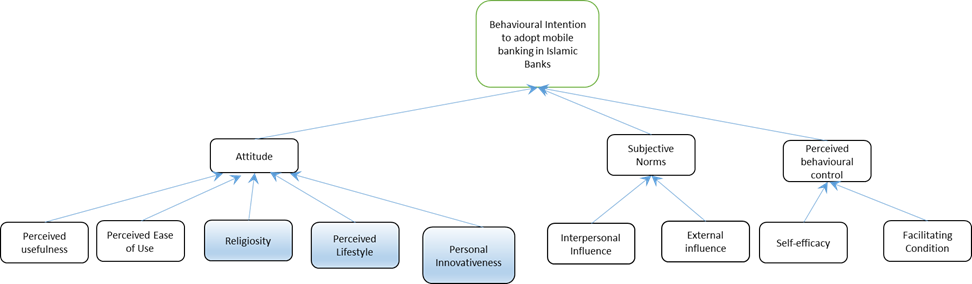

The asymmetry between mobile internet subscription and mobile banking subscription in Malaysia has sparked an important issue for Malaysian Islamic banks to address. Malaysia is a hub for Islamic banking with among the highest market share amongst other countries, yet in terms of mobile banking usage rate, Malaysia is still left behind in comparison to its neighbouring countries. It is important to address the low mobile banking usage rate so that Malaysian banking system which significantly include the Islamic banking to remain competitive along with the global mainstream banking. The main objective is to scrutinize the factors that influence people’s intent to adopt mobile banking technology among Islamic banking customers by means of literature research. It is hypothesised that religiosity, perceived lifestyle and personal innovativeness are three additional important determinants that affect consumer attitude and ultimately the consumer intention towards using mobile banking. This paper utilises the decomposed theory of planned behaviour DTPB to explain how these determinants.

Keywords: Behavioural intentionIslamic bankingmobile bankingsharia

Introduction

The development of technology, particularly mobile communication technology, has changed the way people interact with each other. Instead of the traditional face-to-face interaction, people also interact using technology, in which according to Steinmetz (2018), a preferred communication channel. Examples of such technology is social media available in smartphones. Among the advantages of mobile banking is that it is quick, efficient, ubiquitous, and cost effective.

Mobile communication technology has also been utilised by businesses to advertise (Martins et al., 2019), sell, and receive payments for their products and services (Asongu & Nwachukwu, 2018). With mobile communication technology, most businesses do not even need physical business premises which incur high cost and investment (Newbery & Bosworth, 2010) even for those that are geographically, politically, and bureaucratically constrained. In this sense, the key efrazanabler for businesses to operate is mobile banking.

Nevertheless, the advent of mobile banking has limitations and disadvantages. One obvious disadvantage is that mobile banking eliminates face-to-face interaction. Face-to-face interaction is an important factor for personalised attention that influences loyalty and retention (Levy, 2014). Mobile banking also indirectly encourages compulsive spending behaviour (Cobla & Osei-Assibey, 2018; Garrett et al., 2014) which results to default in monthly obligations and ultimately put pressures in the economy as it affects the economic growth (Theong et al., 2018) .

Mobile banking is defined as the act of retrieving banking information and performing financial transactions via smartphones and other mobile devices such as tablets (Valaei et al., 2018). One of the applications of mobile banking is m-commerce (Al-jabri, 2012; Baabdullah et al., 2019; Phiri & Mbengo, 2017) whereby users purchase goods online via smartphones and pay via the extension that is smartphone-friendly. For example, Phiri and Mbengo (2017) define mobile banking as an e-commerce application that facilitates customers to check their account balances, make payments, perform transfers, and many other financial transactions. In Malaysia, mobile banking appears in the form of application or better known as apps and mobile-friendly website that is redirected after customers agree to make purchases and payments.

The first section of this paper is the introduction that discuss what mobile banking is and its benefits. Next, the second section discusses the problem statement that demonstrates the importance of this paper. It considers the asymmetry of data available for section three, which is the literature review. Section four then discusses the research questions which are formulated based on the literature review, while section five explains the research purposes. Finally, section six presents the research methods and section seven presents the research conclusion.

Literature review

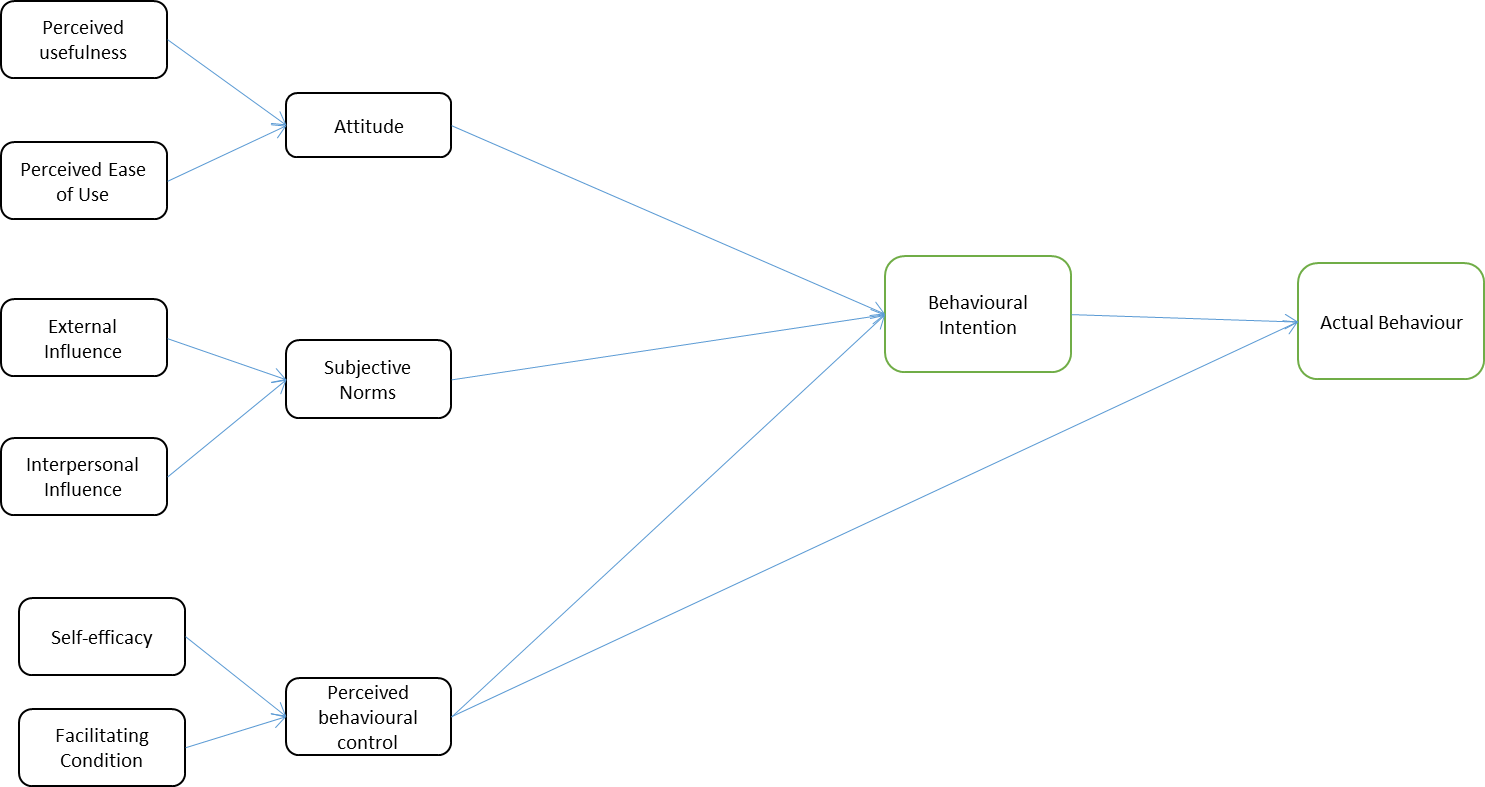

This subsection highlights the various concepts related to customers’ intention, attitude, subjective norms, and the perceived behavioural control with its dimensions which are explained based on the Decomposed Theory of Planned Behaviour (DTPB) and the Innovation Diffusions Theory (IDT). The present research used the DTPB developed by Taylor and Todd (1995) shown in Figure

Behavioural intention (BI)

BI was initially defined in the context of the TRA, which is subjective probability towards performing a behaviour (Fishbein & Ajzen, 1975). As other intention-based theories were developed, more narrowed and specific definitions have also been produced, for example when the TPB was introduced, BI was defined as motivational factors that capture the extent to which a person is willing to make in order to carry out a particular behaviour (Ajzen, 1991). Next, in the context of TAM, the theory became technology-specific, focusing on individual intention to perform a behaviour (Davis et al., 1989). In essence, those definitions emphasised on the extent to which a person performs behaviour.

The understanding of BI in mobile banking (MB) is essential for banks to remain competitive and for the society to benefit from new opportunities as a result making use of MB. In banking sector, understanding BI is beneficial for the introduction of new technology-based banking products (Sohail & Al-Jabri, 2014; Zolait, 2010). There are several variables that are extensively examined to better understand BI and all the variables proposed in the intention-based models.

Attitude (ATT)

ATT is a variable used to predict BI (Muñoz-Leiva et al., 2017; Tao & Fan, 2017; Zolait, 2010). ATT is different than BI in terms of realisation whilst both ATT and BI consist of dispositions (Rummel, 1976). Ajzen’s (1989) definition of ATT captures the essence of the word that is favourable or unfavourable responses to any aspect of one’s world. Other studies either adopted or adapted Ajzen’s (1989) definition by slightly changing the wording. For instance, Spears and Singh (2004), Lee (2009), Wessels and Drennan (2010), and Maduku (2013) adopted Ajzen’s (1989) definition while Celik (2008), Eagly (2007), and Zolait (2010) adapted Ajzen’s (1989) definition using other words such as “good” or “bad” instead of “favourable” or “unfavourable”.

Generally, for most studies that applied the intention-based models, ATT has been proven to have a positive relationship with BI. The closest example is a study made on m-banking by Wessels and Drennan (2010) in Australia whereby favourable ATT towards m-banking leads to the increase in BI. Meanwhile for internet banking in Yemen, the same favourable relationship of ATT towards behavioural BI (Zolait, 2010).

Perceived usefulness (PU)

The technological advancement of MB is aimed at improving the efficiency of activities such as checking account balance or making payment for bills or online shopping. One way of gauging the improvement of MB in banking activities is by assessing how consumers perceived MB technology to be useful. The definition of PU by Davis et al. (1989) were applied in many studies before. It is described as one’s subjective evaluation in which how far using a technology will boost a person’s performance in their jobs.

Krishanan et al. (2015) did a conceptual research for a Malaysian context, whereby the increase of PU is argued to also enhance positive attitude towards MB. This suggestion is also similar with a study by Raza et al. (2017) for the context of Pakistan, whereby there is a direct relationship between these two variables, indicating that MB in Pakistan is user friendly. Although literature concerning PU of MB are scarce, there are many internet banking literatures that focus on the direct predecessor of MB. For instance, Pikkarainen et al. (2004) and Wang et al. (2003) also suggested the same findings.

Perceived ease of use (PEOU)

MB technology is developed by experts or professionals, and the technology may not easily be used by laymen. Davis et al. (1989) believed that technology is only useful when it can be used with ease. Therefore, perceived ease of use is essential in appraising the user-friendliness of MB. The definition of PU by Davis et al. (1989) were also widely replicated and modified. Following Davis et al. (1989), PEOU can be defined as the extent to which a person perceive using MB can be done without putting much effort. What distinguishes perceived ease of use from PU is that PEOU is about the user-friendliness of the technology itself while perceived usefulness is the perceived enhancement of conducting everyday tasks.

Literature on the connection between PEOU and ATT are quite straight forward. Davis et al. (1989) postulated the increase in the perception of ease of use would result in favourable ATT towards computer technology. As technology enhances over time, Wang et al. (2003) and Celik (2008) supported the studies on internet banking. However, there are also studies that shows no support for the relationship (Chong et al., 2010; Ernovianti et al., 2012). This basically means the sample is already versed in using the aforesaid technology.

Religiosity (R)

One of the variables that affects ATT is R. The meaning of R has evolved from as simple as church attendance (Azzi & Ehrenberg, 1975) to as complicated as Muslim Religiosity Personality Index (MRPI) (Krauss et al., 2005) to as specific as perception towards Sharia compliance and requirement (Amin et al., 2011; Aziz et al., 2019; Jamshidi & Hussin, 2016). Sharia-compliant related variables mean the adherence to the Islamic or Sharia law. In this sense, there are many transactions related to MB, for example account transfer, e-commerce, and bill payments are perceived to be free from riba, maysir and haram objects. Nevertheless, the problem with MB in Islamic banks is in terms of commercial transaction. It is perceived not to fulfil the traditional norms of commercial Islamic business transaction. According to Yeh and Li (2009), without the ability to physically examine the product by looking and touching, customers do not feel secured to perform any purchase transaction. The same instance might occur for Sharia-conscious customers who are the potential users of MB for shopping transactions (Sarker, 1999). Without the confidence to shop online via MB, MB usage is only limited to checking the account balance and bill payment.

R, in terms of Sharia compliance is a relatively new variable that is tested in the literature, particularly when it comes to electronic-based banking as shown in Figure

Perceived lifestyle (PL)

MB is a modern innovation that is possible to be widely applied if it is compatible with individual lifestyle (Tan, 2000). Nowadays, people’s lifestyle revolves around mobile technology, for example the use of GPS (global positioning system) as destination guidance and the use of Google as an effective “search engine” to do anything like finding cooking recipes and revising for exams. Historically, lifestyle has been a part of religion until secularisation takes place (Ziad Esa et al., 2014). Thus, PL is argued to be differentiated with R (Porter, 1973).

Chawla and Joshi (2017) with their empirical evidences demonstrated the important influence of PL on attitude towards internet banking. Based on the samples obtained from engineering graduates who use the internet as part of their lifestyle, empirical results showed that they are significantly high probability to have favourable ATT towards internet banking. Next, in terms of the context of mobile payment in Portugal, Pancho and Afonso (2018) suggested that PL has a positive relationship with reuse intention. Meanwhile, Yu and Li (2015) examined the effects of lifestyle towards MB but only in terms of the moderating role of lifestyle. Nonetheless, the present research assessed PL as a determinant rather than moderator, following the studies made by Chawla and Joshi (2017). Mobile technology is the most recent trend; hence it is expected when a person uses mobile technology as part of a person’s PL, it more likely that the person will use MB.

Personal innovativeness (PI)

The tendency to adopt new technology differs from one person to another. People who are innovative are more willing to adopt to new technologies (Agarwal & Prasad, 1998). PI, or also known as technology readiness, is the inherent willingness to try out and embrace new technology to fulfil one’s goals (Rao & Troshani, 2007). It is linked to the IDT and serves as a process where innovation is propagated through a period of time (Rogers, 1995). IDT classifies five different level of PI from the highest, which are the innovators and the lowest, which are known as laggards.

There are a few studies that delve in to the connection between PI and ATT in the context of new technologies. For instance, for a sample of rural communities of Zimbabwe, PI positively affect ATT, in the context of MB (Chitungo & Munongo, 2013). This shows that for the Zimbabwean sample, they are intrigued and eager about new technologies and willing to learn. Meanwhile, for a sample of American students in the United States, there is an increase in PI seem to hamper the adoption of internet banking (Lassar et al., 2005). This shows that in terms of the classifications of adopters in the IDT, they are among the opinion leaders who found it difficult for technology to penetrate the users (Rogers, 1995). Another explanation provided by Sarel and Marmorstein (2007) is that innovation is not exciting enough for the Americans as compared to the Zimbabwean sample. Hanafizadeh et al. (2014) explained that the assimilation of technology differs on the development levels of a country whereby people from less developed countries are more open for new technology assimilation.

Subjective norms (SN)

When the technology is relatively new, a person’s own feelings and beliefs may not be enough to trigger an intention or perform action towards the technology. Davis et al. (1989) argued that there must be a mandate that triggers an intention, in some cases contrary to a person’s own feelings and beliefs. Malaysia can be categorised as collectivist culture which means that social norms are highly valued (Hofstede, 1984). SN is essentially a social approval driven by what a person think of others namely people who a person deem important whether or not the behaviour in question should be executed (Fishbein & Ajzen, 1975). SN can be divided into two distinct influences, interpersonal and external (Bhattacherjee, 2000). The reason for this distinction is that these different groups may have different views with regards to the technology studied (Taylor & Todd, 1995). For instance, parents may have different views of a technology compared to what has been advertised in the mass media. Taylor and Todd (1995) argued that this may result in SN having no influence towards intention because each group might cancel each other out.

Empirical evidences from previous literature demonstrated direct relations between SN and behavioural intention (Amin et al., 2009; Amin et al., 2011; Gopi & Ramayah, 2007). Among the reasons for the relationship between these two variables is the fact that these studies were mostly done in Malaysia (Ramayah et al., 2009). Nevertheless, despite the collective culture of Malaysians, the nature of the technology product does not require its users to be influenced by social norms. One example is online video services whereby it does not require interaction with others (Truong, 2009). MB, on the other hand, involves two-way transaction from the buyers to the sellers.

Interpersonal influence (II)

II refers to the influence of personal known to a person such as family members, friends, colleagues, and superiors (Bhattacherjee, 2000). Considering Malaysia as an Asian cultural melting pot, filial piety can certainly influence technology usage (Lim, 2008), which means that family, especially parents can greatly influence their children to use MB.

For most studies in the literature showed that there are positive relationships between II and SN except for one isolated exception. One of the closest study that closely resembles this study is by Kazemi et al. (2013) and Ting et al. (2016) that postulated that the increase of II will also rise SN in the context of MB in Iran and Malaysia respectively.

However, the technology in focus is slightly different to that of mobile payment system. Ting et al. (2016), suggests that II positively affect SN. Hung et al. (2003) and Zolait (2010) also suggested positive relationships between II and SN in different contexts that are Taiwan and Yemen respectively. Hung et al. (2003) looked at WAP services while Zolait (2010) looked at internet banking. Tao and Fan (2017) found that II do not seem to have any significant affect towards SN in the context of e-toll collection in Taiwan because of a special circumstance. The e-toll collection device is already pre-installed. Provided that there is no special circumstance or the fact that the aforesaid technology is by nature does not need any II, the relationship between II and SN should be a positive one.

External influence (EI)

EI is non-personal information source that is known to a person such as expert opinions, mass media, reports, and other information sources that can influence a person’s decisions (Bhattacherjee, 2000). Advertisement in the mass media for instance can heighten the pressure to conform to the norms of society such as the technology (Abrahamson et al., 1993).

Thus far, the closest study in relation to MB in Malaysia is on mobile payment by Ting et al. (2016). It was suggested that EI positively affect subjective norm. Zolait and Sulaiman (2009) used a more specific term that is mass media norms instead of EI in general. Based on the empirical results, it was found that the increase of mass media norms also significantly increase SN. On the other hand, for II, Zolait and Sulaiman (2009) termed it as word of mouth. In Yemen itself the word of mouth has more influence towards SN due to the lack of mass media development in Yemen. In Malaysia however, the mass media is well developed and it is expected that EI would have a positive relationship with SN.

Perceived behavioural control (PBC)

In taking into account non-volitional behaviour in predicting intention and action, PBC is introduced. PBC is the perception that a person has on the feasibility on performing the behaviour (Ajzen, 1985). The feasibility of performing a behaviour depends on the person, called SE and the facilities around the person called facilitating conditions (Taylor & Todd, 1995).

Kazemi et al.’s (2013) Isfahanian example gives a glimpse on how MB technology will fare in a progressive Muslim nation. Empirical evidence provided by Kazemi et al. (2013) proposed that people who perceive MB to be feasible are more likely to have the usage intention. Another almost similar study by Ting et al. (2016) analysed mobile payment in Malaysia. It was found that the same outcome also applies to mobile payments. Additionally, a non-banking based study by Tao and Fan (2017) also suggested the same results for the context of distance-based electronic toll collection services in Taiwan. Based on the applicability of PBC across different technologies at different settings, it is expected that for MB in Malaysia, PBC have positive affect towards BI.

Self-efficacy (SE)

SE is the perceive feasibility on an individual level in order to achieve certain goals. Naturally, technologically savvy individuals typically incline to believe that MB can be used successfully (Balabanoff, 2014). It is important to differentiate its subtle difference with perceived ease of use, which is the former is about one-self while the latter is about the technology itself. A study on mobile payments in Malaysia done by Ting et al. (2016) is a good reference point for this study. The difference is that Ting et al. (2016) studied mobile payment while the present research is looking at MB. Ting et al. (2016) argued that higher self confidence in operating mobile payments also increases the PBC. The same outcome is also observed for the Isfahanian MB example (Kazemi et al., 2013). Furthermore, Hsu, Wang and Wen (2006) examined mobile coupons as an effective marketing tool in Taiwan and the outcome is still similar, which is positive relationship. In short, on the basis of previous findings, it is reasonable to extrapolate that for the Malaysian context of MB in Islamic banks, the increase in SE also increases the PBC.

Facilitating conditions (FC)

FC refer to a person’s perceived availability of resources that can facilitate in using the aforesaid technology (Venkatesh et al., 2003). To put it differently, it is referring to the infrastructure support in facilitating the use of technology (Venkatesh, 2012) like the access to smartphones, stable internet connection, and financial resources (Lu et al., 2008). Unlike SE, FC focus on external notions rather than internal ability. To demonstrate, authors such as Hung et al. (2006) and Zolait (2010) even define FC as external resource and constraints. The Isfahan’s example by Kazemi et al. (2013) suggested that increase in the infrastructure support are likely to increase PBC. This indicates that adequate facilities and infrastructure should increase PBC. On the contrary, in Taiwan, Hsu et al. (2006) showed insignificant relationship. This means that for the Taiwanese consumers, the infrastructure is already adequate and that improving the infrastructure is insignificant in their PBC. A customer who believes that there are better accesses to favourable FC such as MB online tutorial, support chat, and demo. These bring greater impacts on the PBC and ultimately the BI to use MB.

Problem Statement

The utilisation of mobile banking differs across different countries, for instance developed countries in Europe have high mobile banking penetration rate such as in Western Europe i.e the United Kingdom (50%) and Ireland (60%). Across the Chanel is the Netherlands (51%) while in the Northern Europe Sweden (64%) and in the Southern Europe in Spain (52%). To the East is Poland (52%). The United States also has high mobile banking penetration rate at 53%. The high mobile banking penetration rate in developed countries occurs because of innovativeness. Countries with high level of innovativeness are more open towards the utilization of the latest technology (Chitungo & Munongo, 2013). In fact, the African emerging nations are also following this trend, for example South Africa (57%), Kenya (49%), and Nigeria (43%). In those countries, mobile banking connects people, especially those who are out of reach due to improper road infrastructure and lack of bank branches (Popper, 2015).

Within the ASEAN (Association of South East Asian Nations) region, Malaysia’s neighbouring nations have relatively higher mobile banking penetration rate compared to Malaysia at 30%, for example Thailand (43%), Singapore (52%), and Indonesia (77%), showing that Malaysia is lagging behind. Next, the OIC (Organisation of Islamic Cooperation) countries have relatively lower rate of mobile banking penetration, with most GCC (Gulf Cooperation Council) countries saw mobile banking as something new (ATKearny, 2013). The United Arab Emirates, Kuwait, Qatar, and Saudi Arabia have mobile banking penetration rate of 34%, 27%, 19%, and 15% respectively. In Saudi Arabia, the low mobile banking penetration rate is mainly because the introduction of mobile technology is quite late (Sohail & Al-Jabri, 2014). Meanwhile, in Kuwait, mobile banking is still perceived as an inferior good in terms of user experience, speed, accessibility, and the lack of serving the customers’ needs (Earnst & Young, 2016).

Thus far, the data on mobile banking in Islamic banks are limited for most GCC countries. Earnst & Young (2016) reported that the percentage of Islamic bank customers using mobile banking is 26%, which is lower than the conventional bank customers (38%). For instance, in Malaysia, Bank Islam has 900,000 mobile banking users (Kar Inn, 2017) compared to Maybank with 4.6 million users (Malayan Banking Berhad, 2018).

Although Malaysia is one of the main hubs for Islamic banking, there is an ongoing debate with regards to whether Islamic banking truly demonstrates Islamic or Sharia principles. Mohamad and Saravanamuttu (2015) and Khan (2010) argued that Islamic banks still in many ways operate like conventional banks. However, Eddy Yusof (2010) argued that at least for Malaysia, Islamic banks are fully Sharia-compliant because its Islamic banks practice interest-free banking system, sets justifiable prices, and produces Sharia-compliant products. The conflicting views from different authors affect the perceptions of customers regardless of the authenticity of the compliancy towards Sharia principle. In this sense, the absence physical presence is not helping with the perception.

Developed countries in Europe, Malaysia’s neighbouring countries, and even the third world countries in Africa have received the mobile banking technology considerably well, however in terms of its role as a hub for Islamic banking, Malaysia is quite left behind. Furthermore, disputes between scholars regarding the compliancy of Sharia make the consumers having second thought to use mobile banking. Hence, the perceived religiosity is deemed as one of the determinants that influences behavioural intention.

Research Questions

This research delve in to the determining factor of the intention of MB usage among Islamic bank customers using the DTPB. This research is particularly interested in the effects of religiosity, lifestyle, and PI towards attitude and ultimately the intention towards MB. The following are the research questions:

Research Question 1: Are ATT, SN, and PBC determinants of BI to adopt MB in Islamic banks?

Research Question 2: Are PU, PEOU, R, PL, and PI determinants of ATT to use MB in Islamic banks?

Research Question 3: Are EI and II determinants of SN?

Research Question 4: Are SE and FC determinants of PBC?

Research Question 5: What are the least and the most important determinants of BI, ATT, SN, and PBC as perceived by the Malaysian Islamic bank customers?

Research Question 6: What are the relationships between STT, SN, PBC, and BI to adopt MB in Islamic banks?

Purpose of the Study

This research examined the effects of the variables of the DTPB, namely attitude, SN, and PBC on their respective dimensions towards the intention of MB usage among Islamic banking customers. The research is distinctive as it added new variables to the theory, namely R, PL, and PI.

Research Methods

The main method for this research is by means of literature research. The literature used as references for this paper are mostly the previous works on Islamic banking, internet banking, mobile technology, and MB. Other than academic journals and newspaper articles, the secondary data were retrieved from the annual reports released by Earnst & Young and Bank Negara Malaysia.

Findings

Based on the literature research, the findings indicate that for the majority of the studies, there are positive relationships between each variables that lead to the behavioural intention variable. These include the existing variables in the DTPB model and the variables that are proposed on top of the DTPB model. There are however exceptions in studies that involve other technologies. Some technologies by nature do not require some of the variables in the DTPB due to some unique circumstances. For instance, some technologies are pre-installed or the nature of the technology do not need interactions with other users or the condition of the place in context.

Conclusion

This paper has proposed a conceptual model by means of applying the DTPB to investigate the factors affecting BI to use MB among Islamic bank customers. In addition to using the existing factors in the theory, other factors include the effects on attitude based on the aforementioned issues pertaining to the Sharia-compliant aspect. They are the PL and PI. Future studies should work on constructing questionnaires with suitable variables using literature related to the DTPB as references. In the future, researchers should also assess the validity and reliability of research instruments to see if they fit for the fieldwork. The data should also be analysed using structural equations modelling.

Acknowledgments

This research was funded by Universiti Utara Malaysia Islamic Business School PhD grant.

References

- Abrahamson, E., Rosenkopf, L., & Abrahamson, E. (1993). Innovation diffusion and competitive institutional bandwagon : Using mathematical modeling as a tool to explore innovation diffusion. The Academy of Management Review, 18(3), 487–517.

- Agarwal, R., & Prasad, J. (1998). The antecedents and consequents of user perceptions in information technology adoption. Decision Support Systems, 22(1), 15–29. https://doi.org/10.1016/S0167-9236(97)00006-7

- Ajzen, I. (1985). From intentions to actions: A theory of planned behavior. In J. Kuhl, J. Beckmann (Eds.), Action Control (pp. 11–39). Springer. https://doi.org/10.1007/978-3-642-69746-3_2

- Ajzen, I. (1989). Attitude structure and behavior. In A. R. Pratkanis, S. J. Breckler, & A. G. Greenwald (Eds.), Attitude Structure and Function (pp. 241–274). Lawrence Erlbaum Associates. https://doi.org/10.2307/2072868

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211. https://doi.org/10.1016/0749-5978(91)90020-T

- Ali, S. A., Hassan, A., Juhdi, N., & Razali, S. S. (2018). Employees’ attitude towards Islamic banking: Measurement development and validation. International Journal of Ethics and Systems, 34(1), 78-100. https://doi.org/10.1108/IJOES-05-2017-0070.

- Al-jabri, I. M. (2012). Mobile banking adoption : Application of diffusion of innovation theory. Journal of Electronic Commerce Research, 13(4), 379–391.

- Amin, H., Abdul Rahman, A. R., Sondoh Jr., S. L., Chooi Hwa S., & Chooi Hwa, A. M. (2011). Determinants of customers’ intention to use Islamic personal financing. Journal of Islamic Accounting and Business Research, 2(1), 22–42. https://doi.org/10.1108/17590811111129490

- Amin, H., Abdul-Rahman, A.-R., & Abdul-Razak, D. (2009). Is the theory of planned behaviour valid for Islamic home financing? MPRA Paper 43179. University Library of Munich.

- Asongu, S., & Nwachukwu, J. (2018). Comparative human development thresholds for absolute and relative pro-poor mobile banking in developing countries. Information Technology and People, 31(1), 63–83. https://doi.org/https://doi.org/10.1108/ITP-12-2015-0295

- ATKearny. (2013). Online banking in the GCC. http://www.middle-east.atkearney.com/documents/10192/707238/Online+Banking+in+the+GCC.pdf/bc3dadf2-25f4-4127-bde7-c2bad974abde

- Aziz S., Md Husin M., Hussin N., & Afaq Z. (2019). Factors that influence individuals’ intentions to purchase family takaful mediating role of perceived trust. Asia Pacific Journal of Marketing and Logistics, 31(1), 81-104. https://doi.org/10.1108/APJML-12-2017-0311

- Azzi, C., & Ehrenberg, R. G. (1975). Household allocation of timed and church attendance. Journal of Political Economy, 83(1), 27–56. Retrieved from http://www.jstor.org/stable/1833272

- Baabdullah, A. M., Alalwan, A. A., Rana, N. P., Kizgin, H., & Patil, P. (2019). Consumer use of mobile banking (M-Banking) in Saudi Arabia: Towards an integrated model. International Journal of Information Management, 44, 38–52. https://doi.org/10.1016/j.ijinfomgt.2018.09.002

- Balabanoff, G. A. (2014). Mobile banking applications: Consumer behaviour, acceptance and adoption strategies in Johannesburg, South Africa (RSA). Mediterranean Journal of Social Sciences, 5(27), 247–258. https://doi.org/10.5901/mjss.2014.v5n27p247

- Bhattacherjee, A. (2000). Acceptance of e-commerce services: The case of election of mobile banking in India: An empirical study. IEEE Transactions on Systems, Man and Cybernetics – Part A: Systems and Humans, 30(4), 410–424. https://doi.org/10.1177/0972262917733188

- Celik, H. (2008). What determines Turkish customers’ acceptance of internet banking? International Journal of Bank Marketing, 26(5), 353-370. https://doi.org/10.1108/02652320810894406

- Chawla, D., & Joshi, H. (2017). High versus low consumer attitude and intention towards adoption of mobile banking in India: An empirical study. Vision, 21(4), 1-15. http://doi.org/10.1177/0972262917733188

- Chitungo, S. K., & Munongo, S. (2013). Extending the technology acceptance model to mobile banking adoption in rural Zimbabwe. Journal of Business Administration and Education, 3(1), 51–79.

- Chong, Y. A., Ooi, K., Lin, B., & Tan, B. (2010). Online banking adoption: An empirical analysis. International Journal of Bank Marketing, 28(4), 267–287. https://doi.org/10.1108/02652321011054963

- Cobla, G. M., & Osei-Assibey, E. (2018). Mobile money adoption and spending behaviour: The case of students in Ghana. International Journal of Social Economics, 45(1), 29-42. https://doi.org/10.1108/IJSE-11-2016-0302.

- Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A comparison of two theoretical models. Management Science, 35(8), 982–1003. https://doi.org/10.1287/mnsc.35.8.982

- Eagly, A. H. (2007). The advantages of an inclusive definition of attitude. Social Cognition, 25(5), 582–602. https://doi.org/10.1521/soco.2007.25.5.582

- Earnst & Young. (2016) World Islamic banking competitiveness report 2016. http://www.ey.com/Publication/vwLUAssets/EY-world-islamic-banking-competitiveness-report-2014-15/$FILE/EY-world-islamic-banking-competitiveness-report-2014-15.pdf

- Eddy Yusof, E. F. (2010). Are Islamic Banks in Malaysia Really “Islamic”? Munich Personal RePEc Archieve. MPRA Paper No. 20901. http://mpra.ub.uni-muenchen.de/20901

- Ernovianti, E., Nik Mat, N. K., Kassim, U., Rashid, R., & Meor Shaari, M. S. (2012). The usage of internet banking service among higher learning students in Malaysia. American Journal of Economics, 2(4), 105–108. https://doi.org/10.5923/j.economics.20120001.24

- Fishbein, M. (1967). A behavior theory approach to the relations between beliefs about an object and the attitude toward the object. In M. Fishbein (Ed.), Readings in attitude theory and measurement (pp. 389–400). John Wiley & Sons.

- Fishbein, M., & Ajzen, I. (1975). Attitude formation. In Belief, attitude, intention, and behavior: An introduction to theory and research (pp. 216-285). Addison-Wesley. https://doi.org/10.1016/B978-0-12-375000-6.00041-0

- Garrett, J. L., Rodermund, R., Anderson, N., Berkowitz, S., & Robb, C. A. (2014). Adoption of mobile payment technology by consumers. Family and Consumer Sciences, 42(2), 358–368. https://doi.org/10.1111/fcsr.12069

- Gopi, M., & Ramayah, T. (2007). Applicability of theory of planned behavior in predicting intention to trade online. International Journal of Emerging Markets, 2(4), 348–360. https://doi.org/10.1108/17468800710824509

- Hanafizadeh, P., Behboudi, M., Abedini Koshksaray, A., & Shirkhani Tabar, M. J. (2014). Mobile-banking adoption by Iranian bank clients. Telematics and Informatics, 31(1), 62–78. https://doi.org/10.1016/j.tele.2012.11.001

- Hofstede, G. (1984). The cultural of quality of relativity concept life. The Academy of Management Review, 9(3), 389–398. https://doi.org/10.5465/AMR.1984.4279653

- Hsu, T., Wang, Y., & Wen, S. (2006). Using the decomposed theory of planned behaviour to analyse consumer behavioural intention towards mobile text message coupons. Journal of Targeting, Measurement and Analysis for Marketing, 14(4), 309–324. https://doi.org/10.1057/palgrave.jt.5740191

- Hung, S., Chang, C., Yu, T. (2006). Determinants of user acceptance of the e-government services: The case of online tax filing and payment system. Government Information Quarterly, 23, 97-122.

- Hung, S., Ku, C., & Chang, C. (2003). Critical factors of WAP services adoption : An empirical study. Electronic Commerce Research and Applications, 2, 42–60.

- Jamshidi, D., & Hussin, N. (2016). Forecasting patronage factors of Islamic credit card as a new e-commerce banking service: An integration of TAM with perceived religiosity and trust. Journal of Islamic Marketing, 7(4), 1-24. http://dx.doi.org/10.1108/JIMA-07-2014-0050

- Kar Inn, T. (2017). Bank Islam plans to grow mobile banking space. The Star. https://www.thestar.com.my/business/business-news/2017/08/03/bank-islam-plans-to-grow-mobile-banking-space/

- Kazemi, D. A., Nilipour, D. A., Kabiry, N., & Hoseini, M. M. (2013). Factors affecting Isfahanian mobile banking adoption based on the decomposed theory of planned behavior. International Journal of Academic Research in Business and Social Sciences, 3(7), 230–245. https://doi.org/10.6007/IJARBSS/v3-i7/29

- Khan, F. (2010). How ‘Islamic’ is Islamic banking? Journal of Economic Behavior & Organization, 76(3), 805–820. https://doi.org/http://dx.doi.org/10.1016/j.jebo.2010.09.015

- Krauss, S. E., Hamzah, A., & Rumaya, J. (2005). The Muslim Religiosity-Personality Inventory ( MRPI ): Towards understanding differences in the Islamic religiosity among the Malaysian youth. Pertanika Journal of Social Sciences & Humanities, 13(2), 173-186.

- Krishanan, D., Khin, A., & Teng, K. (2015). Attitude towards using mobile banking in Malaysia: A conceptual framework. British Journal of Economics, Management & Trade, 7(4), 306–315. https://doi.org/10.9734/BJEMT/2015/17660

- Lassar, W. M., Manolis, C., & Lassar, S. S. (2005). The relationship between consumer innovativeness, personal characteristics, and online banking adoption. International Journal of Bank Marketing, 23(2), 176–199. https://doi.org/10.1108/02652320510584403

- Lee, M.-C. (2009). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141.

- Levy, S. (2014). Does usage level of online services matter to customers’ bank loyalty ? Journal of Services Marketing, 28(4), 292–299. https://doi.org/10.1108/JSM-09-2012-0162

- Lim, S. S. (2008). Technology domestication in the Asian homestead: Comparing the experiences of middle class families in China and South Korea. East Asian Science Technology and Society: An International Journal, 2(2), 189–209. https://doi.org/10.1007/s12280-008-9045-6

- Lu, J., Liu, C., Yu, C., & Wang, K. (2008). Determinants of accepting wireless mobile data services in China. In International Conference on Innovation, Management and Technology Research, 45, 52–64. https://doi.org/10.1016/j.im.2007.11.002

- Maduku, D. K. (2013). Predicting retail banking customers’ attitude towards Internet banking services in South Africa. Southern African Business Review, 17(3), 76–100. http://reference.sabinet.co.za/sa_epublication_article/sabr_v17_n3_a4

- Malayan Banking Berhad. (2018). Circular dated 25 April in relation to US$15,000,000,000Multicurrency Medium Term Note Programme (the “Offering Circular”) and the pricing supplement relating to the issue of Notes dated 25 September 2018 (the “Pricing Supplement”, together with the Offer. http://www.kgieworld.com.tw/UpLoadFiles/Bond/Announce/181002_0_140736965.pdf

- Martins, J., Costa, C., Oliveira, T., Gonçalves, R., & Branco, F. (2019). How smartphone advertising influences consumers’ purchase intention. Journal of Business Research, 94, 1–10. https://doi.org/10.1016/j.jbusres.2017.12.047

- Mohamad, M., & Saravanamuttu, J. (2015). Islamic banking and finance: Sacred alignment, strategic alliances. Pacific Affairs, 88(2), 193–213.

- Muñoz-Leiva, F., Climent-Climent, S., & Liébana-Cabanillas, F. (2017). Determinants of intention to use the mobile banking apps: An extension of the classic TAM model. Spanish Journal of Marketing – ESIC, 21(1), 25-38. https://doi.org/https://doi.org/10.1016/j.sjme.2016.12.001

- Newbery, R., & Bosworth, G. (2010). Home‐based business sectors in the rural economy. Society and Business Review, 5(2), 183–197. https://doi.org/https://doi.org/10.1108/1746568101105559

- Pancho, A., & Afonso, C. (2018). Mobile as payment: The role of early adopters’ perceptions in mobile payment reuse intention in the travel industry. In Universidade Do Alagarve (Eds.), 2nd International Forum on Management (pp. 28–42). Universidade do Algarve.

- Phiri, M. A., & Mbengo, P. (2017). Governance of the impact of price satisfaction dimensions on mobile banking adoption. Risk Governance and Control: Financial Markets & Institutions, 7(4–2), 270–278. https://doi.org/10.22495/rgc7i4c2art9

- Pikkarainen, T., Pikkarainen, K., Karjaluoto, H., & Pahnila, S. (2004). Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Research, 14(3), 224–235. https://doi.org/10.1108/10662240410542652

- Popper, B. (2015). Can mobile banking revolutionize the lives of the poor. https://www.theverge.com/2015/2/4/7966043/bill-gates-future-of-banking-and-mobile-money

- Porter, J. R. (1973). Secularization, differentiation, and the function of religious value orientations. Sociological Inquiry, 43(1), 67-74. https://doi.org/10.1111/j.1475-682X.1973.tb01152.x

- Ramayah, T., Rouibah, K., Gopi, M., & Rangel, G. J. (2009). A decomposed theory of reasoned action to explain intention to use Internet stock trading among Malaysian investors. Computers in Human Behavior, 25(6), 1222–1230. https://doi.org/http://dx.doi.org/10.1016/j.chb.2009.06.007

- Rao, S., & Troshani, I. (2007). A conceptual framework and propositions for the acceptance of mobile services. Journal of Theoretical and Applied Electronic Commerce Research, 2(2), 61–73.

- Raza, S. A., Umer, A., & Shah, N. (2017). New determinants of ease of use and perceived usefulness for mobile banking adoption. International Journal of Electronic Customer Relationship Management, 11(1), 44–63. https://doi.org/10.1504/IJECRM.2017.086751

- Rogers, E. M. (1995). Diffusion of Innovations. Collier Macmillan Publishing. https://doi.org/citeulike-article-id:126680

- Rummel, R. J. (1976). Understanding conflict and war. John Wiley & Sons.

- Sarel, D., & Marmorstein, H. (2007). Marketing online banking services: The voice of the customer. Journal of Financial Services Marketing, 8(2), 106–118. https://doi.org/10.1057/palgrave.fsm.4770111

- Sarker, M. A. A. (1999). Islamic banking in Bangladesh: Performance, problems & prospects. International Journal of Islamic Financial Services, 1(3), 1–22.

- Sohail, M. S., & Al-Jabri, I. M. (2014). Attitudes towards mobile banking: Are there any differences between users and non-users? Behaviour and Information Technology, 33(4), 335–344. https://doi.org/10.1080/0144929X.2013.763861

- Spears, N., & Singh, S. N. (2004). Measuring attitude toward the brand and purchase intentions. Journal of Current Issues and Research in Advertising, 26(2), 53–66. https://doi.org/10.1080/10641734.2004.10505164

- Steinmetz, K. (2018). Teens are over face-to-face communication, study says. TIME. http://time.com/5390435/teen-social-media-usage/

- Tan, M. (2000). Factors influencing the adoption of internet banking. Journal of the Association for Information Systems, 1(5), 1-43.

- Tao, C.-C., & Fan, C.-C. (2017). A modified decomposed theory of planned behaviour model to analyze user intention towards distance-based electronic toll collection services. PROMET - Traffic & Transportation, 29(1), 85–97.

- Taylor, S., & Todd, P. A. (1995). Understanding information technology usage: A test of competing models. Information Systems Research, 6(2), 144–176. https://doi.org/10.1287/isre.6.2.144

- Theong, M. J., Osman, A. F., & Yap, S. fei. (2018). Household indebtedness: How global and domestic macro-economic factors influence credit card debt default in Malaysia. Institution and Economies, 10(3), 37–56.

- Ting, H., Yacob, Y., Liew, L., & Lau, W. M. (2016). Intention to use mobile payment system: A case of developing market by ethnicity. Procedia - Social and Behavioral Sciences, 224(August 2015), 368–375. https://doi.org/10.1016/j.sbspro.2016.05.390

- Truong, Y. (2009). An evaluation of the Theory of Planned Behaviour in consumer acceptance of online video and television services. The Electronic Journal Information System Evaluation, 12(2), 177–186.

- Valaei, N., Nikhashemi, S. R., & Ha Jin, H. (2018). Task technology fit in online transaction through apps. In L. Alcaide-Muñoz, & F. J. Alcaraz-Quiles (Eds.), Optimizing E-Participation Initiatives Through Social Media (pp. 236-251). IGI Global.

- Venkatesh, V. (2012). Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Quarterly, 36(1), 157–178.

- Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 27(3), 425–478.

- Wang, Y., Wang, Y., Lin, H., & Tang, T. (2003). Determinants of user acceptance of Internet banking: An empirical study. International Journal of Service Industry Management, 14(5), 501–519. https://doi.org/10.1108/09564230310500192

- Wessels, L., & Drennan, J. (2010). An investigation of consumer acceptance of M-banking. International Journal of Bank Marketing, 28(7), 547–568. https://doi.org/10.1108/02652321011085194

- Yeh, Y. S., & Li, Y. M. (2009). Building trust in m-commerce: Contributions from quality and satisfaction. Online Information Review, 33(6), 1066–1086. https://doi.org/10.1108/14684520911011016

- Yu, C., & Li, C. (2015). Analysis of consumer e-lifestyles and their effects on consumer resistance to using mobile banking: Empirical surveys in Thailand and Taiwan. International Journal of Business Information, 10(2), 198–232.

- Ziad Esa, Y., Ahmad Fauzi, A. H., & Folmer, H. (2014). Secularisation in western society : An overview of the main determinants. Pensee, 76(6), 393–413.

- Zolait, A. H. S. (2010). An examination of the factors influencing Yemeni Bank users’ behavioural intention to use Internet banking services. Journal of Financial Services Marketing, 15(1), 76–94. https://doi.org/10.1057/fsm.2010.1

- Zolait, A. H. S., & Sulaiman, A. (2009). The influence of communication channels on internet banking adoption. Asian Journal of Business and Accounting, 2(1&2), 115–134.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Yazid, Z. E., Zainol, Z., & Bakar, J. A. (2020). Behavioural Intention To Use Mobile Banking In Islamic Banks: A Conceptual Model. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 409-423). European Publisher. https://doi.org/10.15405/epsbs.2020.10.36