Abstract

This study focuses on Malaysian Grab drivers’ awareness and perception on tax assessments on their income. Using online survey involving 44 Grab drivers, this study assesses their views on the tax assessment concerning the e-hailing services and proposes a tax assessment method for Grab drivers in Malaysia based on the suggested preferences of the Grab drivers. This paper also studies the reaction of Grab drivers on the new policy (i.e. Public Service Vehicle license). Questionnaires were posted in Facebook to a closed group of full time and part time Grab drivers. The questions were designed in such a way that we could observe their feelings, actions and opinions, as well as their level of awareness and perceptions on the current Malaysian tax administration system. The essential outcome of this study is to expose and educate Malaysian Grab drivers to be familiar with the bases (or principles) of Malaysia’s current tax administration system, as well as to propose to government to have a simple tax assessment method on Grab drivers where 60% of income from e-hailing ride services is deemed as expenses, following Singapore’s tax authority in charging its e-hailing drivers.

Keywords: Capital allowancechargeable incomedeemed expensesGrabqualifying expendituretax assessment

Introduction

Today’s world is moving towards the internet economy such as e-commerce including e-hailing ride. The South-east Asia’s internet economy is projected to shift from US$50 billion in the year 2017 to potentially exceed US$200 billion by the year 2025. E-commerce refer to the commercially oriented transactions conducted electronically, which encompass such activities as providing information, making promotion and advertisement, marketing, and delivering goods and services. These are followed by making payments through online or offline mediums. Under the Income Tax Act 1967, the income derived from e-commerce business is taxable either on individual or company basis. According to Inland Revenue Board (IRB)’s guidance, Grab drivers are eligible to register a tax file if his chargeable income exceeds RM34,000 (after EPF deduction). The chargeable income is calculated by net income after deduct allowable expenses minus personal reliefs. The CEO of IRB, Datuk Seri Sabin Samitah, once commented that Grab’s application is fully computerised, thus IRB has full list of Grab drivers. Grab drivers’ income must be declared as taxable business income in Form B regardless whether they are full-time or part-time Grab drivers. Hence, all entities now are compulsory to pay tax if they are eligible to the tax bracket imposed by the tax authorities and hence, comply with the tax rules and regulations. IRB could easily trace financial information through bank when the Grab drivers purchase vehicles and properties. There is no way to dodge IRB ( Surendra, 2017).

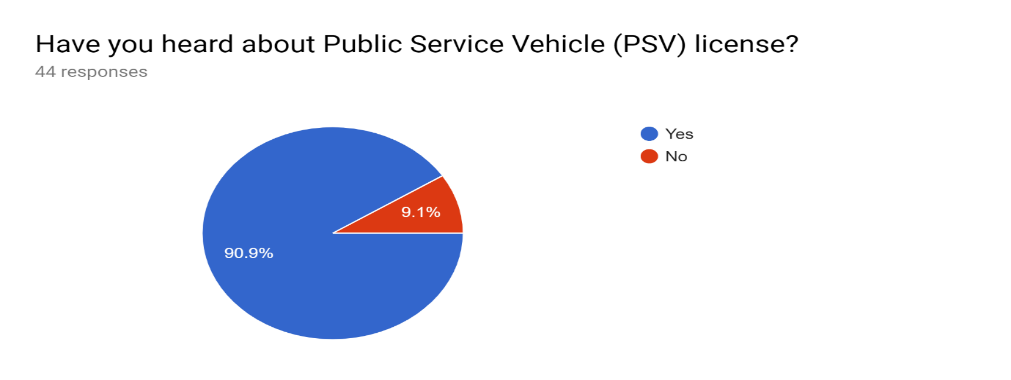

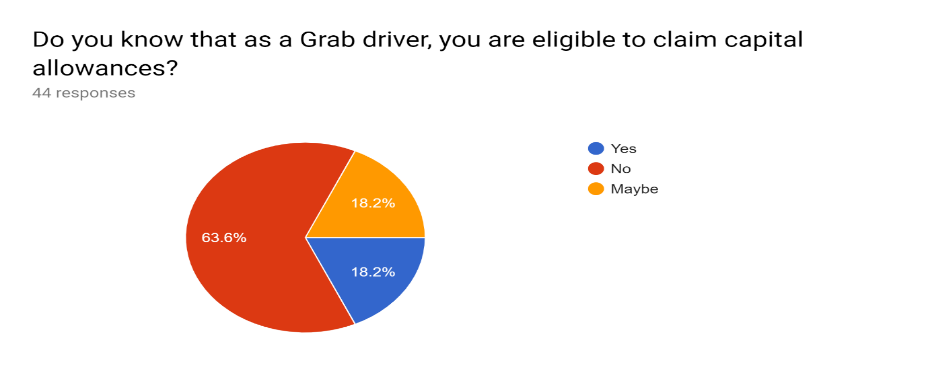

However, in Malaysia there are no definite rules and regulations regarding the tax assessment on the Grab drivers. In the case of Singapore, the Grab drivers are able to file their income tax easily as there are clear procedures and step by step guidance given to them. All the instructions are available in the official Grab Singapore website that will assist their drivers just in a click away. Some of the information available such as eligibility for the pre-failing income tax. Malaysia is still in the process of legalising the ride e-hailing services among their drivers. They are compulsory to take the Public Service Vehicle (PSV) license in order to be the legal Grab drivers in Malaysia as it was initially mandated to be fully operated by 12th July 2019, but then was extended to 11 October 2019. By being a legal Grab driver, individual is entitled to claim capital allowances on qualifying expenditure incurred on the motor vehicle used in rendering e-hailing services. Hence, government agencies must cooperate to smoothen the tax assessment on Grab drivers in Malaysia.

Literature review

Government’s main revenue is from tax collection. With this revenue, government can utilize it for social welfare purpose ( Manual & Xin, 2016). Under the implementation of self-assessment system, individual taxpayers and companies take the responsibilities to assessment tax payable and then file the tax returns. The documents have to be kept for seven years. The main reason of implementing the self-assessment system is to enhance the awareness and voluntarily compliance of taxpayers towards their tax duty. Effectiveness and efficiency in collecting tax very much depend on two angles, which are tax payers and tax system. Tax-payer’s tax knowledge is crucial for filing tax correctly. A user friendly and simplified system would further enhance the collection of tax ( Saad, 2014).

Although doing e-commerce business without declaring and filing the income is a severe tax evasion which will attract heavy penalty, many are ignorant of this and they are ill-equipped with e-commerce tax ( Mahalingam, 2017). Al-Maghrebi et al. ( 2016), Andini et al. ( 2018) and Hassan et al. ( 2016) concluded that tax knowledge through education is crucial to lead to tax compliances.

E-hailing is an online transportation service that has sprung up as the passengers’ best-loved in transportation industry that encompass interactions between customers and service providers. According to Joia and Altieri ( 2018), e-hailing apps are the mobile device software to order any form of transportation pick-up that have become very well-known in the society due to the instant growth of smartphone worldwide. Currently, many ride-hailing services have been developed on online basis to match the passengers and drivers. The apps enable both parties to trace the route which increase the security, the passengers are able to know the waiting time, it has polished up the standard and immaculate of online ride-hailing services.

The development of Transportation Network Companies (TNCs) in Malaysia is indicating that the e-hailing services are well-accepted by consumers ( Rosnan & Abdullah, 2018). The arising of TNCs has altered the traditional way of commuting and the quality life of the citizens are rising up. Grab drivers and taxi drivers are following the same guidelines on providing e-hailing services so that none of them are at disadvantages. Some taxi drivers provide both taxi service and e-hailing service, depends on the request from customers. Grab already have more than 60% market share in Southeast Asia after acquiring Uber on March 26, 2018 in its Southeast Asia operation ( Trefis Team 2019).

Singapore’s simple and automated tax system on the providers of e-hailing service is a good example to follow as it eased the tax filing procedures, effective from year of assessment 2018. According to The Straits Times, Inland Revenue Authority of Singapore (IRAS) worked out an arrangement directly with Uber and Grab companies for the driver to file their tax return of their income automatically, thus limit the probability of Grab drivers to under declare such earnings ( Tan, 2017).

If the drivers sign up for the pre-filing on a yearly basis, Grab will pre-fill their earnings with IRAS. They just need to login to the IRAS myTax portal and confirm if the earnings are correct to file the income tax. 60% of gross income will automatically be accounted as deemed expenses. In other words, only 40% of the revenue will be subject to tax. The drivers do not have to keep any receipts or documents. However, if they opt not to pre-fill their earnings and wish to claim the expenses as per incurred, then they have to provide evidence of such expenditures and keep it for tax audit purpose ( Grab, 2019).

Problem Statement

Malaysia is heading towards cashless digital economy and e-hailing service is very popular in major cities. On 31st March 2017, IRB released a press statement that Grab driver’s earning has to be taxed as business income regardless of whether they are on part-time or full-time basis. Hence, this study was carried out to check with the Grab drivers if they were aware of it and subsequently filed their tax returns. While exploring the challenges faced by the Grab driver in terms of filing tax, our study proposed a tax assessment method to IRB for tax collection.

Research Questions

Research questions can be expressed as follows:

What is the level of awareness of Grab drivers towards the prevailing tax administration system within the Malaysian context?

How do Grab drivers perceive Malaysia’s tax administration system?

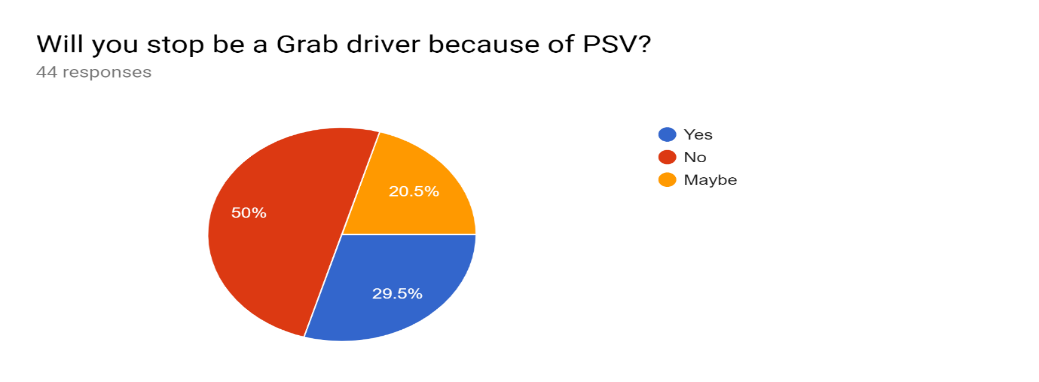

What is the reaction of Malaysian Grab drivers on the new policy (i.e. Public Service Vehicle license)?

What tax assessment method that should be imposed to govern Grab drivers in Malaysia?

Purpose of the Study

The objectives of this paper are:

To study the awareness of Grab drivers on the administration of tax system in Malaysia administration

To investigate the perception of Grab drivers on the administration of tax system in Malaysia

To study reaction of Grab drivers in Malaysia on the new policy (i.e. Public Service Vehicle license)

To propose a tax assessment method on Grab drivers in Malaysia

Research Methods

This qualitative study uses primary data via survey (i.e. questionnaires). A set of questions were developed and posted on an online platform (i.e. Facebook) to a closed group of participants who are Grab drivers. We managed to get the responses from 44 Grab drivers within two days before being eliminated from the group.

We also review IRB’s website, Singapore Tax Authority website articles from universities, research reports and news articles mostly in Malaysia.

Findings

This section discusses the findings on our survey. The survey has been divided into two sections. The first section is the personal profiles of the Grab drivers. The second section is the tax knowledge of the Grab drivers.

Section A: Personal details

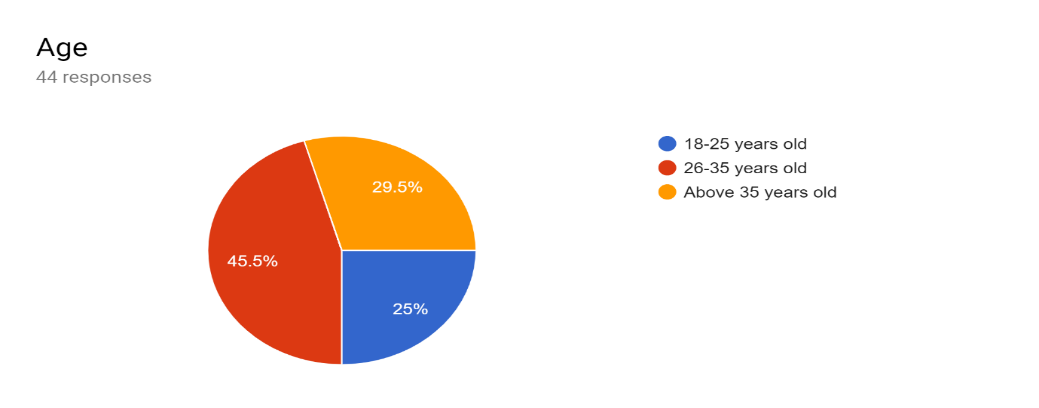

As shown in Figure

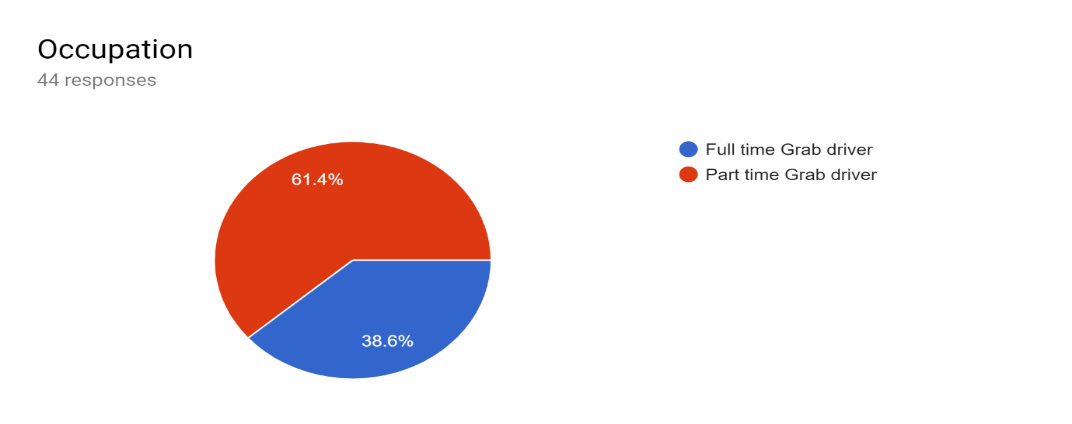

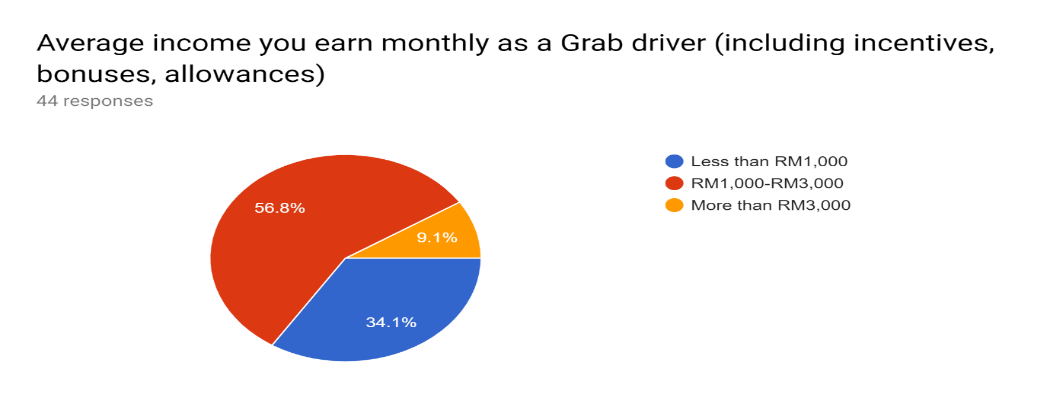

Based on Figure

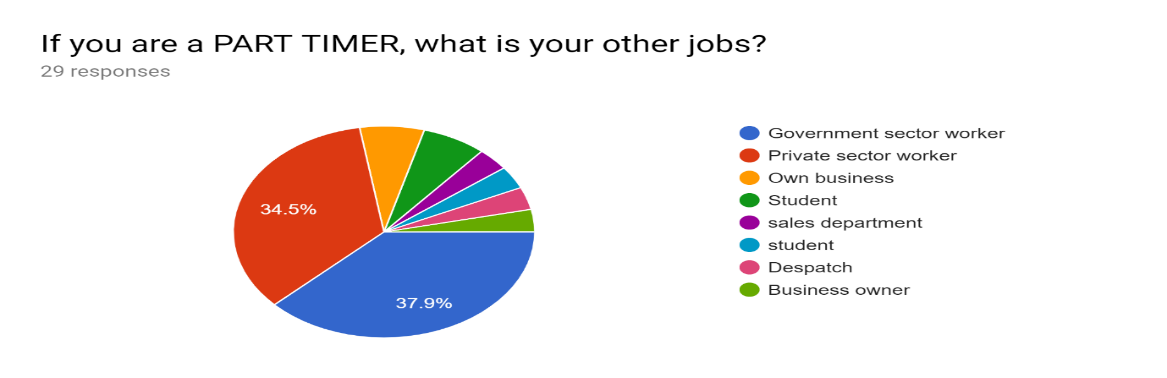

Figure

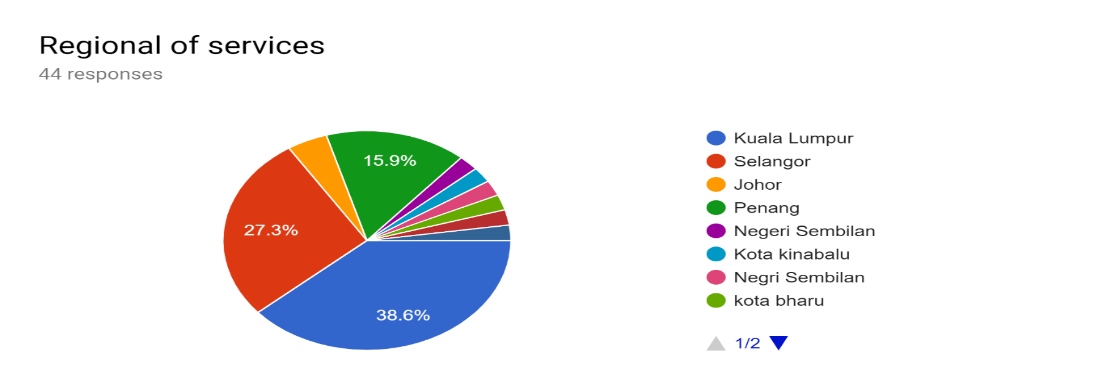

Figure

Figure

Based on Figure

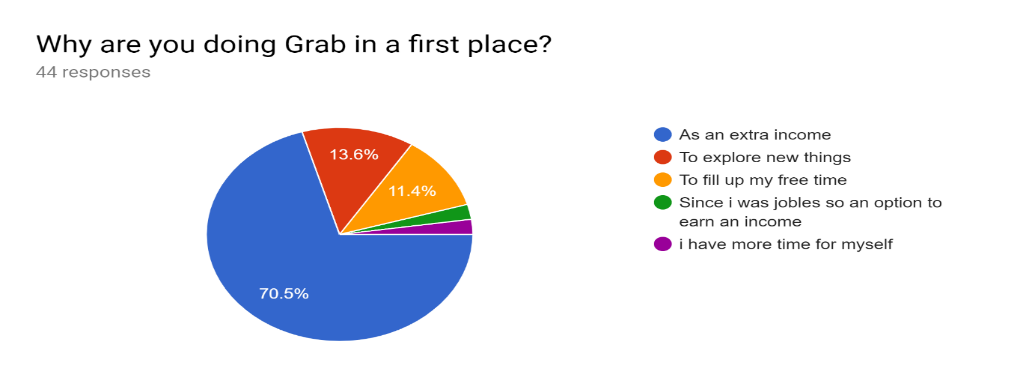

In terms of reasons for immersing in providing e-hailing services, Figure

According to Figure

Referring to Figure

Section B: Tax knowledge

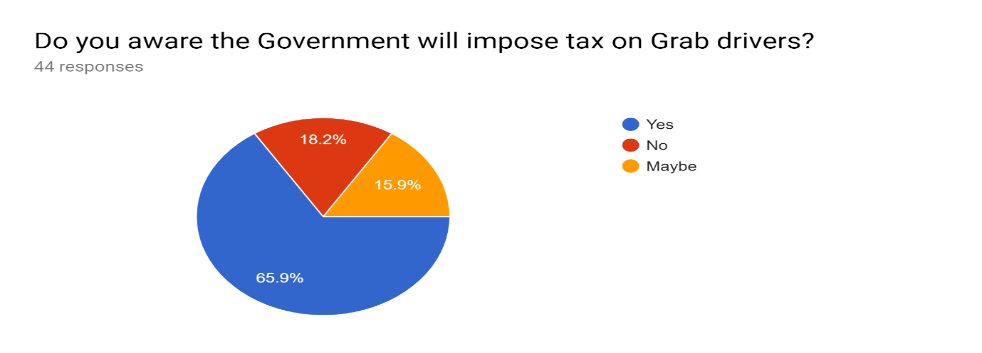

Figure

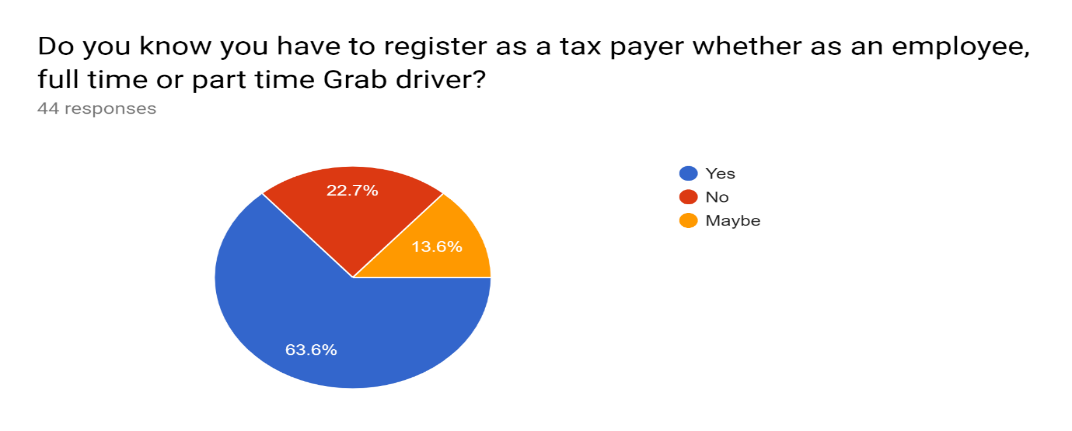

In conjunction with the findings that one-third are not paying tax as shown in Figure

Figure

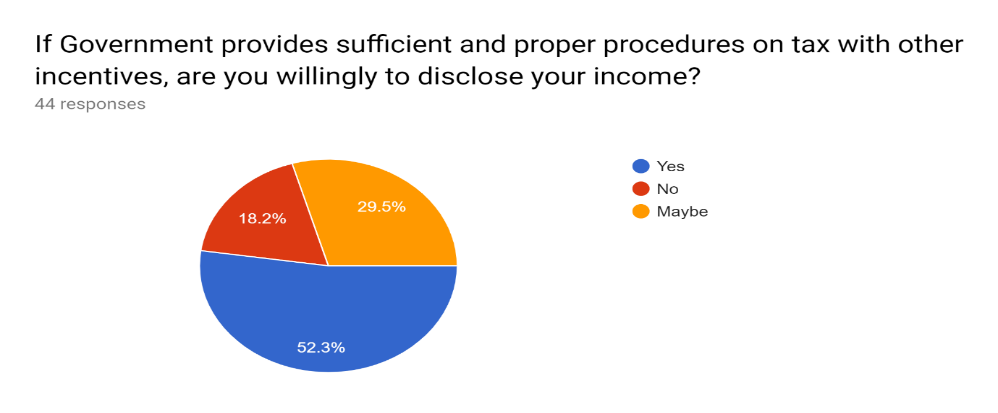

Figure

Conclusion

The survey had analysed the awareness and perception of Grab drivers on the tax assessment in Malaysia, the reaction on the new regulation which is the Public Service (PSV) license and also the proposition of taxation model on the Grab drivers in Malaysia. The survey has received 44 respondents from the Grab drivers in all over the Malaysia. They are most active in the three big cities of Malaysia such as Kuala Lumpur, Selangor and Penang. By receiving the responses from the Grab drivers, the research questions of this paper are successfully answered.

Majority of the Grab drivers in Malaysia is part-timers who are searching for an extra income and they are well-aware that they have to register as taxpayers. One-third of them are still unaware or unsure whether to file tax. Interestingly we found that even those who are aware that they have to file tax (two-third of them), more than 80% of them do not know or are not sure how to claim capital allowance on their Grab car. It implies that a simple tax assessment model is in need to avoid incorrect tax filing and tax evasion.

Therefore, we would like to propose a simple tax assessment model with reference to IRAS which 60% of income from e-hailing ride is deemed as expenses, to be used for income generated from e-hailing ride. Besides the simplified model, IRB has to educate the drivers to file their tax returns properly as findings from the survey that Grab drivers are willing to disclose their income if government establish proper and detailed tax assessment guidelines. In line with Saad’s (2014) study, the more tax knowledge possessed by the tax-payers, the more tax government is able to collect. A simplified and user-friendly tax collection platform would definitely enhance tax collection. This research also supports findings by Al-Maghrebi et al. ( 2016), Andini et al. ( 2018) and Hassan et al. ( 2016) tax knowledge is crucial to lead to tax compliances.

The study conducted by Oei and Ring (2016) further supported our recommendation to adopt Singapore’s model. The authors found that Uber and Lyft drivers were confused on the deductibility of expenses even though they fully understood the income tax filing and income inclusion obligations. Therefore, a simplified tax reporting procedure is crucial to enhance tax collection from Grab drivers in Malaysia. Currently IRB has yet to adopt Singapore’s model.

For those Grab drivers who did not declare their income in the previous years, they are encouraged to declare them under the Special Voluntary Disclosure Programme (SVDP) Supriya and Gigi (2019) reported that the IRB has called on taxpayers to trust the government’s intention to introduce SVDP as one of the means to let tax payers disclose their unreported income and to avoid paying heavy penalty once being audited and found guilty.

Acknowledgments

Grant Bridging Incentive Fasa 1/2019 (304.PMGT.6316562)

References

- Al-Maghrebi, M. S., Ahmad, R., & Palil, M. R. (2016). Budget transparency and tax awareness towards tax compliance: A conceptual approach. South East Asia Journal of Contemporary Business, Economics and Law, 10(1), 95-101.

- Andini, P., Riyadi, S., & Lestari, S. D. (2018). Law enforcement, taxation socialisation, and motivation on taxpayer compliance with taxation knowledge as moderating variable. Pertanika Journal of Social Sciences & Humanities, Special Issue(26T), 77-87.

- Grab (2019). Legal and Tax. https://help.grab.com/driver/en-sg/360000670908-Filing-of-Income-Tax

- Hassan, N., Nawawi, A., & Salin, A. S. A. P. (2016). Improving tax compliance via tax education-Malaysian experience. Management & Accounting Review (MAR), 15(2), 243-262.

- Joia, L. A., & Altieri, D. (2018). Antecedents of continued use intention of E-Hailing apps from the passengers’ perspective. The Journal of High Technology Management Research, 29(2), 204-215.

- Mahalingam, E. (2017). Taxing the digital economy. The Star Online. https://www.thestar.com.my/business/business-news/2017/09/19/taxing-the-digital-economy/

- Manual, V., & Xin, A. Z. (2016). Impact of tax knowledge, tax compliance cost, tax deterrent tax measures towards tax compliance behavior: A survey on self-employed taxpayers in West Malaysia. Electronic Journal of Business and Management, 1(1), 56-70.

- Oei, S.-Y., & Ring, D. M. (2016, February 10). The Tax Lives of Uber Drivers: Evidence from Internet Discussion Forums. Columbia Journal of Tax Law, 8. http://dx.doi.org/10.2139/ssrn.2730893

- Rosnan, H., & Abdullah, N. C. (2018). International transportation network companies: Behaviour of drivers and consumers. Environment-Behaviour Proceedings Journal, 3(8), 167-171.

- Saad, N. (2014). Tax knowledge, tax complexity and tax compliance: Taxpayers’ view. Procedia-Social and Behavioral Sciences, 109(1), 1069-1075.

- Supriya, S., & Gigi, C. (2019, January 15). IRB: Trust Us with Special Voluntary Disclosure Programme The Edge Markets. https://www.theedgemarkets.com/article/irb-trust-us-voluntary-disclosure-programme.

- Surendra, E. (2017, March 31) Part-Time Grab And Uber Drivers Must Declare Income. https://www.imoney.my/articles/grab-uber-drivers-declare-pay

- Tan, C. (2017, September 17). Taxman Calls on Grab, Uber Drivers. https://www.straitstimes.com/singapore/transport/uber-grab-drivers-in-taxmans-sights

- Trefis Team (2019) Forbes: How Much Is Grab Worth? [Accessed 29 January 2020] https://www.forbes.com/sites/greatspeculations/2019/01/10/how-much-is-grabworth/#3f5c92ee56d4

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Roslan, N. A. D., Lim, T., & Azhar, Z. (2020). "Tax Assessment, Awareness And Perception Amongst Grab Drivers In Malaysia". In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 207-217). European Publisher. https://doi.org/10.15405/epsbs.2020.10.19