Abstract

Digital currencies, despite its reputation of not being actual money by conventional definition, has found its way in the market. Although the initial issuer of digital currency like Bitcoin was not known and had no tie with central banks or any financial institutions, the digital currency is trending dynamically despite it being volatile. Many researchers found that its low correlation to stocks makes it a good complementary new financial instrument to be added to traditional assets such as stocks or gold. Owing to the reason, the objectives of this study are twofold; first, to observe the performance of the ‘new’ portfolio, and second, to examine the appropriate weight that should be allocated. Considering Bitcoins and conventional resources such as KLSE Index, Emas (gold), and oil price, this research used the return/risk and Sharpe ratio. It is found that a portfolio that combines Bitcoin, KLSE Index, Emas (gold), and oil performed well when the weight allocation for the digital currency is higher (in this context, 30 to 50 per cent). Also, by building an efficient frontier portfolio using the mean-CVaR approach, it is suggested that Bitcoins should be at a minimum of 3 per cent to ensure the portfolio is compensated by the appropriate return.

Keywords: Bitcoinefficient portfolio frontierportfolio diversificationSharpe

Introduction

In the traditional backing of a central bank, traditional assets like stock, bond, gold, oil or real estate have long existed in an investor portfolio. Despite increased awareness of new financial instruments such as digital currency among investors, the idea of including them in the investment portfolio initiate deliberation among economists and policy-makers. The debates are mainly focused neither on its function as money nor digital money but more on digital currency. While digital money, according to ( Grignon, 2009), is a digital element that has an exclusive serial number and can be exchanged incognito without accounting for the identity of the issuer, digital currency holds a different concept. Digital currency is similar to actual currency, albeit they are not issued by principal banks, monitoring authority or financially supported by any currency ( Weinmayer et al., 2019). The issuing is decentralised without anyone knowing who the issuer is. The digital currency operates using a cryptographic algorithm made by network users ( Melik, 2012) and functions on a regionalised peer-to-peer network to endorse trade; thus, creating a defined new Bitcoin. Bitcoin is one of the many digital or virtual currencies existing in the financial system. Although the abovementioned characteristics did not qualify Bitcoin as money, its share of the entire cryptocurrencies market capitalisation equals to just under 45% ( Hileman & Rauchs, 2017)

The absence of regulation and interruption by any legit financial institution, however, did not deter the price of Bitcoin from soaring upwards. Unlike traditional assets where the prices are determined by ‘classical’ factors of economics supply and demand variables, Bitcoin price is determined by non-conventional items such as social media influence. A study by Georgoula et al. ( 2015) on the connection between Bitcoin values and elemental economic variables, technological factors, and assessment of collective mood found that Bitcoin prices are positively associated with Twitter sentiment ratio. Besides, the findings also showed that various Wikipedia search queries that indicate the level of public attention in Bitcoin and the hash rate (the measure of mining difficulty) might also positively influence the price of Bitcoin. Conversely, the value of Bitcoin is negatively impacted by the exchange rate between the USD and the Euro (which reflects the overall price level). The study, which investigated the possible existence of long-term relationships, reported that the price of Bitcoin is positively affected by the amount of circulating Bitcoin (a representative of the overall stock of money supply) while in the same time negatively correlated to the Standard and Poor’s 500 stock market index (an indicator of the general state of global economy).

The exciting mixture of variables has caused the Bitcoin price to increase with a dynamic move, and this caught investors’ interest. While exposed to high uncertainty, Bitcoin and other cryptocurrencies are an attractive portfolio investment due to their high average return and low financial correlation ( Guesmi et al., 2019). Liu and Tsyvinski ( 2018) of Yale University demonstrated that six per cent of an investment portfolio should include Bitcoin in a diversification analysis along with Ethereum and Ripple. They also found out that the returns of cryptocurrency exhibited low exposures compared to traditional asset classes such as stocks, currencies, and commodities. Their verdicts led a dispute on prevailing descriptions that cryptocurrencies’ behaviour is guided by its functions as a stake in the future of stock-like blockchain technology, as a currency-like account unit, or as a value store similar to precious metal commodities.

Bitcoin is a cryptocurrency, i.e. a type of digital cash. Bitcoin is a devolved digital currency that does not involve any central bank for transactions from one party to another on the peer-to-peer bitcoin system without using the middlemen ( Eberwein & Steiner, 2014). Bitcoin-led businesses are verified through cryptography by network nodes and documented in a publicly distributed ledger known as the blockchain. The research, therefore, evaluates the inclusion of Bitcoin as a portfolio investment, and the connection between Bitcoin and other traditional investment assets such as stocks, gold and house prices. Weinmayer et al. ( 2019) analysed the possibility of Bitcoin having a positive impact on a diverse portfolio of investment based on the ‘popularity’ and sentiment on the digital currency. Ever since its introduction in the market, Bitcoin has been traded in large volumes in a dynamic environment that led to the increased interest of regulators, academics, media, and the public. The acceptance of various webpages (Wikipedia, Microsoft, Expedia, and Overstock) in online transactions of the Bitcoin as an alternative payment method proved the prevalent usage of Bitcoin.

Researchers are seeking to include the digital currency in the investment portfolio together with traditional assets for diversification purposes due to Bitcoin’s appeal and dynamic trend. The ultimate objective of portfolio diversification and improvement is to reduce risk. Examination of Bitcoin returns demonstrated surprisingly low connections with conventional venture resources, for example, different monetary standards, stocks, securities or items such as gold or oil ( Eisl et al., 2015). Instead of using the mean-change approach, owing to the non-typical existence of Bitcoin returns, Eisl et al. ( 2015) resorted to the Conditional Value-at-Risk model that does not allow capital to be allocated regularly. They found out that Bitcoin ought to be incorporated into ideal portfolios. Even though interest in Bitcoin improves a portfolio’s CVaR, significant yields could overcompensate this extra risk.

Brière et al. ( 2013) used weekly data over 2010–2013 period to investigate a Bitcoin investment from the perspective of a US investor with a diverse portfolio that includes both conventional assets (global stocks, bonds, hard currencies) as well as alternative investments (hedge funds, commodities, and real estate). Similar to Guesmi et al. ( 2019), they noticed a remarkably low correlation with other capital and reported that the digital currency renders convincing divergent benefits. Bitcoin’s inclusion of a limited weight improved the risk-return transaction of well-diversified portfolios.

Gangwal ( 2016) analysed whether the inclusion of Bitcoin into a portfolio with other categories of conventional assets offers an improved risk-adjusted profit. It consisted of analysing the impact of Bitcoin inclusion by contrasting the Sharpe ratio with and without Bitcoin for the same portfolio. The study, which incorporated two-asset portfolio analyses, found low correlations between Bitcoin and S&P 500, Barclays Bond Index, Gold (USD) and real estate (MSCI World Real Estate Investment Trust, Table

The low relationship of Bitcoin with the other asset category demonstrates that it is capable of diversifying the portfolio; therefore, minimising the risk. Nevertheless, the results are based on the assumption that investors transact all asset categories daily, including Bitcoin; i.e. the asset holding period is one day.

Pursuing Sharpe’s measurement, Gangwal ( 2016) compared these assets with and without Bitcoin in the portfolio (Table

A considerable ambiguity with regards to allocating the right weight in a portfolio is always a challenge to a portfolio manager and the mean-variance optimisation methodology used. Nonetheless, due to the sensitivity of mean-variance, which could greatly affect investment decisions due to even a small change, researchers have opted for semivariance, value-at-risk (VaR) and conditional VaR (CVaR) for risk measures. Investors are concerned with the subtlety of mean‐variance portfolios because even a slight variation in model details can have a significant impact on investment decisions. Portfolio selection has so far focused on minimising regret defined in terms of wealth growth ( Uziel & El-Yaniv, 2017). Due to the analytical unevenness nature of stock returns, risk measures like semivariance, value‐at‐risk (VaR), and conditional VaR (CVaR) accentuate losses causing portfolio optimisation prototypes that incorporate the measures to be developed ( Kim et al., 2015).

Using the mean-CVaR approach, Aggarwal et al. ( 2018) analysed from an Indian investor’s point of view, the extent and robustness of divergence benefits for a wide range of portfolio with Bitcoin. Eight indices were utilised to construct a portfolio that spans across six asset groups (fixed income, commodities, equity, real estate, gold, and alternative investments). Three investment strategies were employed categorised as ‘long only’, ‘constrained’ and ‘equally weighted’ portfolios. Of the three strategies employed, portfolios lacking in Bitcoin in the ‘long only’ and ‘equally weighted’ strategies showed lower risk-adjusted returns compared to portfolios that include Bitcoin. However, the results implied that relatively constant weights were spread across the investment horizon for Bitcoin in the ‘long only’ strategy compared to the ‘constrained’ structure.

Problem Statement

It is not yet known whether digital currency could meet the objective of diversifying an investment portfolio. Despite the debatable issues of Bitcoin and other cryptocurrencies, investors have started to include Bitcoin in the basket of investment. The last couple of years have seen a growth in the study of Bitcoin as one of the investment tools to minimise the investment risks. Bitcoin will soon be a significant class of assets given it holds the property of low correlation with other financial assets – at least in the US. Despite the concerns about its monetary role, Liu and Tsyvinski ( 2018) indicated that Bitcoin could also be predicted using financial variables with the likes of mining costs, price-to-dividend ratio, or realised volatility other than momentum and investors’ attention. Having these financial elements perhaps gave a little reason to convince investors to include Bitcoin in their portfolio. The main problem with integrating digital currency with conventional resources into a portfolio is that research has been done in developed countries, not developing ones, so two possible results could have emerged from the incorporation of digital currency. First is the positive impact, that is the ‘global’ factor following the US market regarding Bitcoin versus local (in this case Malaysia) traditional assets, and second, the negative impact that would appear from weight ignorance if Malaysian investors included Bitcoin in their portfolio.

Research Questions

-

What is the financial performance of investment portfolio with the inclusion of Bitcoins using Sharpe and Treynor measures?

-

What are the optimal weight range of Bitcoin investment portfolio?

Purpose of the Study

The characteristic of Bitcoin as an investment tool has not yet been established in developing countries like Malaysia. Therefore, this paper aims to investigate; i) the financial performance of investment portfolios with the inclusion of Bitcoin using Sharpe and Treynor measures, and ii) the optimal weight range of an investment portfolio with Bitcoin in it. We analysed Bitcoin investment from a Malaysian investor’s point of view with a diverse portfolio including conventional assets such as Malaysia stock index, gold, and the US oil price.

Research Methods

This paper aimed to investigate the financial performance of investment portfolios with the inclusion of Bitcoin. Traditional assets were combined with Bitcoin to examine whether its inclusion benefits the portfolio diversification from the viewpoint of global diversification and non-asset instruments. The traditional assets that are used include a stock index, gold price, and oil price. The stock index was based on the Kuala Lumpur stock index; gold price was based on Ringgit Malaysia while the oil price was based on USD per barrel.

To investigate the performance of these assets (research objection 1), first, we test the correlation between the variable return to see the association between the variables. After that, portfolio diversification performance is examined on the combinations of assets. We measured the portfolio performance using standard measurements, i.e. Sharpe and Treynor. Each measurement has its characteristics; therefore, we did not compare the results across different types of measurement, but the comparisons were made between portfolio combinations. For simplicity, we assumed a combination with three different portfolios;

individual performance,

two-asset portfolio with weight

½

10:90 (Bitcoin: traditional assets) and,

c) three-asset portfolio with weight

⅓

10:45:45 (Bitcoin: traditional asset 1: traditional asset 2)

Sharpe’s ratio is the simplest risk/return measurement. The ratio defines the number of excess returns a portfolio has for extra volatility. It indicates how well a portfolio function compared to a risk-free investment rate of return. The Sharpe’s ratio follows this formula:

Where

To achieve research objective 2, we observed the optimal weight to be taken in the Bitcoin portfolio graphically by plotting the efficient frontier. In this research, the portfolio from the perspective of a Malaysian investor included traditional local and global assets such as KLSE index (which represents stocks), Malaysia gold price (Emas), US oil price, and Bitcoin price. The observation was made daily and spanned between August 2, 2010, until February 25, 2019, with an overall of 2074 observations. Data for KLSE index and Malaysia gold price was taken from the Bank Negara Malaysia report, US oil price was obtained from the US Energy Information Administration while the Bitcoin price was taken from the Coin Market Cap website.

Findings

Our research begins with looking at the individual basic descriptive analysis (Table

The correlation between assets is shown in Table

The results of asset performance are as shown in Table

Individual performance

Based on the individual measurement (Table

Two-asset portfolio (½ and 10:90)

In portfolios combining Bitcoin and KLSE index, similar ratios were given by return/risk of different weight (0.086 vs 0.087). A portfolio combining Bitcoin and Emas (gold), however, produced different results when we changed the weight from 50:50 to 10:90. The return/risk ratio of Bitcoin + Emas (gold) with weight ½ appeared to be higher than weight 10:90 (0.087 vs 0.021), indicating significant adjustment when the proportion of Bitcoins are higher. Similar results were obtained from the Sharpe calculation.

Three-asset portfolio (⅓ and 10:45:45)

In portfolio combining Bitcoin and two Malaysian assets, the ratio from return/risk ratio is again higher when the weight of Bitcoin is higher than 10 per cent, with similar results in the Sharpe measurement. Like in the two-asset portfolio, results from R/R for Bitcoin and another two traditional assets are higher when the Bitcoin weight is about 33 per cent. Interestingly, results in the weight of10:45:45 allocation is higher than 10:90, suggesting that the higher the number of assets in a portfolio, the better the diversification objective could be met.

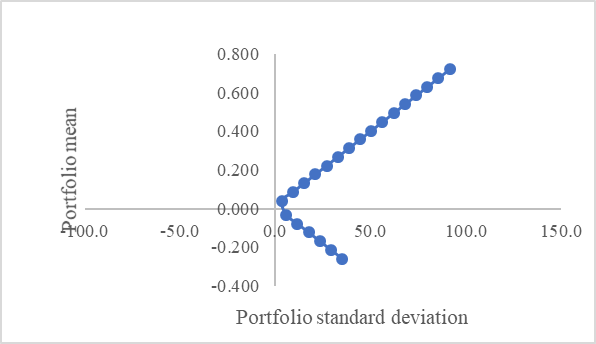

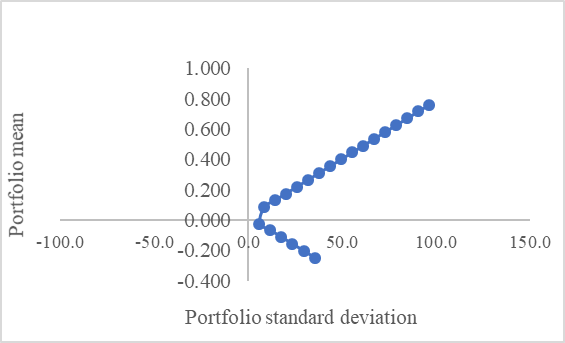

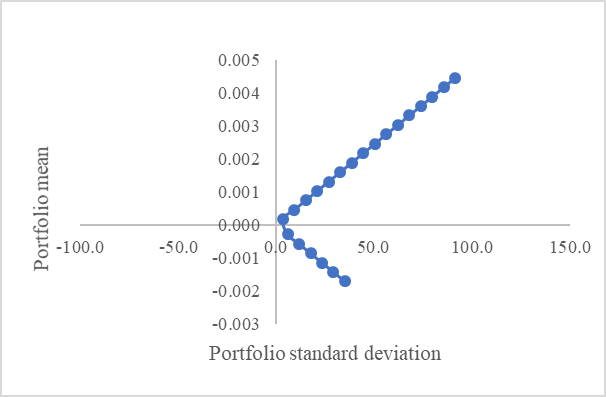

Plotting portfolio frontier

We plotted a two-asset portfolio frontier to find the set of ideal portfolios that provide the highest expected return for a defined risk level. The portfolio below the efficient frontier is sub-optimal because it does not provide sufficient return on the level of risk. Based on our diagrams (Figure

Conclusion

In conclusion, digital currencies, despite its reputation of not being true money by conventional definition, has found its way in the market. Although the issuer of digital currency like Bitcoin was not known, and it has no tie with central banks or any financial institutions, the digital currency is trending dynamically and volatile. Nonetheless, interesting findings by many researchers have found that it has a low correlation with stocks – one of the reasons being Bitcoin gained less participation compared to traditional assets. It is also due to the question of if Bitcoin is to be included in the investment portfolio along with traditional assets, how will the ‘new’ portfolio perform, and what weight should be allocated? This research aimed at examining these issues.

Based on our findings using the return/risk and Sharpe ratio, we found that a portfolio which combines Bitcoin, KLSE Index, Emas (gold), and oil performed well when the weight allocation for the digital currency is higher (in this context, 30 to 50 per cent). However, based on the suggestion of Liu and Tsyvinski ( 2018) with six per cent as the guiding principles, we built a portfolio efficient frontier using mean-CVaR approach. Based on the diagram, it is suggested that Bitcoins should be at a minimum of 3 per cent to ensure the portfolio is compensated by the appropriate return. Nonetheless, these findings should be considered with concern since the data may imitate early-stage behaviour that is short-lived in the medium or long haul. Nonetheless, the results are applicable to institutional and retail investors seeking higher risk-adjusted returns for a portfolio denominated in both Malaysian Ringgit and US Dollar. This research features the capability of Bitcoin as a venture option in the digital age of finance. Furthermore, it adds new proof to the literature gap on Bitcoin, especially from the viewpoint of a developing country.

Acknowledgments

The author would like to thank Universiti Sains Malaysia for sponsoring this research under Bridging Grant Scheme 2019.

References

- Aggarwal, S., Santosh, M., & Bedi, P. (2018). Bitcoin and portfolio diversification: Evidence from India. In A. Kar, S. Sinha, & M. Gupta (Eds.), Digital India. Advances in Theory aCoind Practice of Emerging Markets. https://doi.org/http://doi-org-443.webvpn.fjmu.edu.cn/10.1007/978-3-319-78378-9_6

- Bovaird, C. (2018). Will Your Token Be Listed on an Exchange? Bitcoin Market Journal. https://www.bitcoinmarketjournal.com/token-exchange/

- Brière, M., Oosterlinck, K., & Szafarz, A. (2013). Virtual currency, tangible return: Portfolio diversification with Bitcoin. J Asset Manag, 16, 365–373. https://doi.org/10.1057/jam.2015.5

- Eberwein, H., & Steiner, A. Z. (2014). Bitcoins. Wien Jan Sramek Verlag KG.

- Eisl, A., Gasser, S., & Weinmayer, K. (2015). Caveat emptor: Does Bitcoin improve portfolio diversification? https://dx.doi.org/10.2139/ssrn.2408997

- Gangwal, S. (2016). Analyzing the effects of adding Bitcoin to portfolio. International Journal of Economics and Management Engineering, 10(10).

- Georgoula, I., Pournarakis, D., Bilanakos, C., Sotiropoulos, D., & Giaglis, G. M. (2015). Using time-series and sentiment analysis to detect the determinants of Bitcoin prices. https://ssrn.com/abstract=2607167

- Grignon, P. (2009). Digital coin in brief. https://archive.org/details/Digital_Coin_in_Brief_07-17-09

- Guesmi, K., Saadi, S., Abid, I., & Ftiti, Z. (2019). Portfolio diversification with virtual currency: Evidence from Bitcoin. International Review of Financial Analysis, 63(C), 431–437. https://doi.org/10.1016/j.irfa.2018.03.004

- Hileman, G., & Rauchs, M. (2017). Global cryptocurrency benchmarking study. Cambridge Centre for Alternative Finance.

- Kim, W. C., Kim, J. H., & Fabozzi, F. J. (2015). Shortcomings of mean‐variance analysis. In W. C. K. Kim, J. H. Kim, & F. J. Fabozzi (Eds.), Robust Equity Portfolio Management + Website: Formulations, Implementations, and Properties Using MATLAB (pp. 22–38). https://doi.org/10.1002/9781118797358

- Liu, Y., & Tsyvinski, A. (2018). Risks and returns of cryptocurrency (No. 24877). http://www.nber.org/papers/w24877

- Melik, J. (2012). Digital currency: Brave new world or criminal haven? BBC Business Daily. https://www.bbc.com/news/business-19785935

- Uziel, G., & El-Yaniv, R. (2017). Growth-optimal portfolio selection under CVaR constraints. https://arxiv.org/abs/1705.09800

- Weinmayer, K., Gasser, S., & Eisl, A. (2019). Bitcoin and investment portfolios. In H. Treiblmaier & R. Beck (Eds.), Business transformation through blockchain (pp. 171–195). https://doi.org/https://doi.org/10.1007/978-3-319-98911-2

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Kepili, E. I. B. Z. (2020). Diversifying Malaysia Portfolio With Digital Currency: Evidence With Bitcoin. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 160-169). European Publisher. https://doi.org/10.15405/epsbs.2020.10.14