Abstract

This study investigates the impact of the capital’s disclosure extent of the Integrated Reporting’s six capitals (Financial Capital, Manufactured Capital, Intellectual Capital, Human Capital, Social and Relationship Capital and finally the Natural Capital) of the Malaysian oil and gas public listed companies (PLCs) within Bursa Malaysia, moderated by the Woman Board of Directors. The study will follow the purposive sampling method followed by descriptive statistics, regression analysis and content analysis derived from the International Integrated Reporting Framework and previous studies. Malaysian oil and gas PLCs’ publication of the Integrated Report’s six capitals are still in its infancy in which Integrated Reports have not been published and replaced the Annual Reports and Sustainability Reports. This study is among the pioneer in determining the effectiveness of the Integrated Reporting’s 6-capitals implementation towards firm financial performance since the Integrated Reporting framework was established in 2013. This study is a systematic review of recent research developments in Integrated Reporting focusing on the practice and disclosure of the entity’s 6 capitals which consists of the Financial Capital, Manufactured Capital, Intellectual Capital, Human Capital, Social and Relationship Capital and finally the Natural Capital which are the 6 capitals. The moderation factor of gender equality is of utmost importance among the Malaysian oil and gas industry which are lacking the expertise from women.

Keywords: Bursa MalaysiaFinancial International Integrated Reporting Council (IIRC)Integrated Report (IR)Malaysian oil and gas industrypublic listed companies (PLCs)woman board of directors

Introduction

Integrated Reporting draws together material information on the organization's policy, administration, results and vision in a way that represents the market, social and environmental background within which it works. This provides a clear and succinct description of how a company performs stewardship and how it generates and sustains prof-it. The Integrated Report should be the key accountability method of the enterprise ( International Integrated Reporting Council, 2011).

Since the current business management paradigm was developed, there have been significant changes in the way the business operates, how the business produces revenue and the sense in which the business operates. Such developments are interdependent and represent patterns such as: globalization; increasing policy action around the world in reaction to political, governance and other crises; enhanced demands of corporate transparency and accountability; actual and potential resource scarcity; population growth and environmental concerns.

Against this context, the type of information required to determine the past and current success of organisations and their potential sustainability is much broader than that offered by the current business reporting model.

While there has been an improvement in the information provided, crucial differences in transparency exist. The corporate reports are lengthy, and they're getting longer.

Nevertheless, as reporting has developed into independent, separated streams, the essential interdependencies between policy, administration, activities and financial and non-financial results are not evident. In order to meet the growing demand for a wide range of knowledge from consumers, policymakers and civil society, a structure is required that can help the future development of coverage, representing this growing uncertainty.

Such a structure needs to bring together the varied yet still fragmented branches of coverage into a cohesive, interconnected whole and demonstrate the ability of the enterprise to create value both now and in the future ( International Integrated Reporting Council, 2011).

Reporting requirements in different jurisdictions have evolved separately and accordingly. It significantly increased the cost of enforcement for a rising number of organizations operating in more than one jurisdiction which makes it difficult to evaluate the success of organizations across jurisdictions. Evidence has shown that recording impacts behaviour. Integrated coverage helps in a more comprehensive clarification of success than conventional news. This makes clear the organization's use and reliance on different resources and relationships or "capitals" (financial, produced, human, intellectual, environmental and social) and the organization's exposure to and effect on them. Sharing such knowledge is vital to; a fair evaluation of the long-term feasibility of the business model and policy of the organization; satisfying the information needs of customers and other stakeholders; and, eventually, an efficient use of scarce resources. The initial focus is on the management of large companies and on the interests of their customers. The Framework would help ensure effective reporting by organisations, include specific guidelines for policy makers and regulators, and provide a guide on harmonizing reporting standards.

Problem Statement

Malaysia's economic problems have been exacerbated by three external factors: the global decline in oil prices, the economic slowdown in China and the outflow of foreign capital. Malaysia is not the only nation to confront such global economic problems but has been particularly hard hit. Ringgit is the worst-performing currency in Asia, having lost more than 20% of its value to the US dollar in 2014. The pace of the ringgit downturn, slipping below the symbolic RM 3.8 mark, is reminiscent of the risk-averse investors in the Asian financial crisis. The lack of transparency inside corporate Malaysia has been indicated to minimize investor confidence in foreign capital outflows, which in turn has had an effect on the ringgit ( Saleem, 2015).

Consumer interest has been severely undermined, despite best efforts by governments, regulators and other institutions to further reinforce regulatory frameworks specifically designed to inspire investor confidence in capital markets. Corporations and executives are under stronger investor pressure than ever before, not only in terms of their financial scorecards, but also in terms of developing and enforcing strong environmental, social and corporate governance policies. Investors at all rates – from fund managers to lenders – are seeking greater corporate accountability to determine the company's current status and better understand its long-term outlook and investment value proposition ( Kaye, 2018).

Despite the low global crude oil price, Malaysia's oil and gas sector remains important to the country as it contributes 20-30% to the country's Gross Domestic Product (GDP). The multiplier effect produced in this sector is still significant and is recognized as a strategic and priority sector by Petroliam Nasional Berhad (PETRONAS, The National Oil Company) and the Government of Malaysia ( United States Department of Commerce International Trade Administration, 2018) with over 3,500 oil and gas (OG) companies in Malaysia, both international and local.

Corporate reporting has grown and ripened in Malaysia over the years and has gained strong support from regulators, professional bodies, investor groups and the companies themselves through annual reports and reports on sustainability. On the other hand, investor demands continue to be extremely demanding for the highest level of transparency and the holistic features of organizations that are somewhat in keeping with the new form of corporate reporting that emerged in August 2010 from the International Integrated Reporting Council (IIRC). The CEO of the IIRC, Paul Druckman, commented in 2014 on his visit to Malaysia and was surprised at the low quality of the Malaysian public listed companies consolidated reporting practices on Bursa Malaysia ( PricewaterhouseCoopers, 2014).

From the consolidated reporting frame released in December 2013 on 31 May 2014, PwC Malaysia analysed the top 30 identified public institutions in the state of Bursa Malaysia. The findings of its benchmarking review suggest that while Malaysian organizations have the fundamental reporting elements protected, their records are still not incorporated. From its study, PwC Malaysia noticed that a certain number of elements were identified in the Integrated Reporting System of the IIRC, namely, 90% expose a policy dream, 90% address market trends, 43% relate to a business model, 87% to culture and values and "language from the top," 93% identify the mechanism through which ri Integrated reporting is a collaborative practice and although it is different than the conventional results that seem to be separated from the financial reports of the company, it seems that there is not enough of key drivers to move the integrated approach across the enterprise ( PricewaterhouseCoopers, 2014) .

According to Corporate Reporting Research in South Africa, which made integrated reporting obligatory for companies expected to be included in the largest share exchange in that country since 2010, the main drivers of sustainable development and integrated reporting were established. Key drivers for sustainability and holistic transparency were: 1) regulatory and statutory requirements; 2) neutral representation and signatory organizations; 3) the business industry; 4) the environmental and social effect of the product; and, ultimately, 5) the understanding and interest of stakeholders ( Clayton et al., 2015).

The Integrated Reporting Framework (< IR >) was released in 2013 as a reference for PLCs to incorporate the < IR > and consists of 8 material elements as follows; an operational summary and an external environment; governance; business model; danger and opportunities; policy and resource management (6 capitals); performance; outlook; basis of planning and presentation.

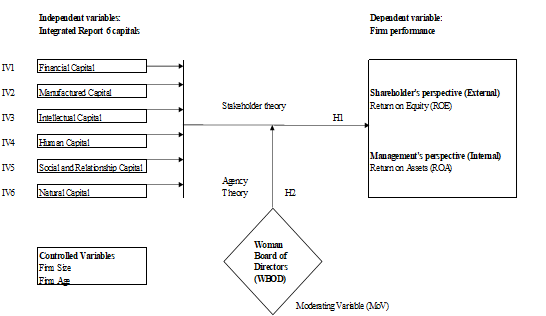

This work will therefore attempt to determine whether Integrated Reporting could be used as a method to restore faith between local and foreign investors to the Malaysian oil and gas industry, with the goal of implementing the six capitals in the Integrated Report as the main driver for the restoration of shareholders and market confidence to achieve solid success of the Malaysian oil and gas PLC which will be determined through the proposed conceptual framework in Figure

Research Questions

Following are the proposed questions of the study.

What is the disclosure level of the Integrated Report’s 6 capitals practices and the related practices of having the Woman Board of Directors across the Malaysian oil and gas PLCs?

Does the disclosure extent of the Integrated Report’s 6 capitals have impact on the financial performance of the Malaysian oil and gas PLCs?

Does the Woman Board of Directors, positively moderates the relationship between the components of the Integrated Report’s 6 capitals and the financial performance of the Malaysian oil and gas PLCs?

Purpose of the Study

Following are objectives of the proposed study:

To examine the disclosure level of the Integrated Report’s 6 capitals practices and the related practices of having Woman Board of Directors across the Malaysian oil and gas PLCs.

To investigate the impact of the disclosure extent of the Integrated Report’s 6 capitals on the financial performance of the Malaysian oil and gas PLCs.

To investigate if the moderating role of the Woman Board of Directors positively affects the relationship between Integrated Report’s 6 capitals and the financial performance of the Malaysian oil and gas PLCs.

Research Methods

The research sample would analyse publicly listed firms that issue annual reports or consolidated reports from a community of 888 Malaysian PLCs on Bursa Malaysia.

The data will be compiled from 2013 to 2017. This study proposes an objective sample of 33 publicly listed oil and gas companies (PLCs) in Bursa Malaysia. This research suggests a framework for descriptive statistics and regression analysis as well as quantitative content analysis for the presentation of annual reports or consolidated studies. Gender equality as per UNSDG No. 5 will be calculated by the Malaysian Code of Corporate Governance 2017 ( MCCG 2017) Practice Notice 4.5–For Large Organizations, the board of directors includes at least 30% female directors as assessed by WBOD.

Gender equality as per UNSDG No.5 will be measured by WBOD, a dichotomous procedure whereby disclosure is assigned a value of 1 if the item is disclosed in the company report and0 if not. Given that the data are only collected from 2013 to 2017 and that 30% of women directors could only be published in the 2018 Annual Reports and Integrated Reports, this research will therefore use the 2012 MCCG Measurement Method, in which, if there is evidence of one female director, 1 will be awarded and 0 will be awarded to companies with male directors only. In MCCG 2012, the Code mostly promoted the diversity of committees, which did not specifically address woman executives.

Proposed Conceptual Framework

The IIRC has defined six different types of capitals for the purpose of IR ( Ernst & Young, 2013; IIRC, 2013a, 2013b) which are the Financial capital; Manufactured capital; Intellectual capital; Human capital; Social and relationship capital, and Natural capital.

Capitals are stores of capital that can be built up, converted or run down over time in the production of goods or services. Their supply, efficiency and competitiveness may influence the long-term stability of the business model of the company and therefore its ability to generate value over time. Capitals must therefore be protected if they are to continue to help companies build value in the future ( Ernst & Young, 2013).

Moderating variable – woman board of directors

Compliance by 30% of women on the board of directors of Malaysian oil and gas PLCs in the annual report review is a new best practice adopted by the Malaysian Code of Corporate Governance 2017 ( Securities Commission Malaysia, 2017). As per the 2012 MCCG, there was no specific requirement to have the exact number of women directors on board, but in 2012 the Code clarified that there was only a need for Board Diversity ( Securities Commission Malaysia, 2012).

According to MCCG 2017, which is the most updated regulations, 30% of women must be on board. In which, if there are 10 members on the board, then three must be women and seven must be men to completely fulfil the 30 per cent provision of the Code. Since the data was collected from 2013 to 2017 (5 years), the MCCG 2017 would only be introduced in 2017 and would only be expressed in the 2018 Annual Report / Integrated Report. To date, some of the 2018 Annual Reports have not yet been released, so some details would not be available.

The technique used was then that if there is only 1 woman on the board then I will reward 1 mark and if there are no women on board, 0 mark will be rewarded (reflecting dichotomous procedure). This is close to the 2012 MCCG.

Dependent variable – firm performance (return on equity and return on assets)

Return on equity is described as a calculation of how much the business earns for its shareholders, ROE is proportional to the net profit divided by the book value of the shareholder's equity. Shareholder interest usually includes the benefit of the assets as they could be paid out to creditors ( Richard et al., 2009). Many metrics, such as return on assets (ROA) ( Huang et al., 2006; Khanna & Palepu, 2000), return on equity (ROE), Tobin's Q ( Habib & Ljungqvist, 2005; Khanna & Palepu, 2000); market-to-value ratio (MBVR) ( Sarkar & Sarkar, 2009), return on employed property, operating profit margin, etc., have been used in existing literature to measure firm efficiency. Metrics such as ROA and ROE are accounting-based productivity indices, while metrics such as Tobin's Q and MBVR suggest market-based measures. Accounting-based metrics represent past financial performance, whereas market-based indicators assess future performance. When ROA is used as a measure of the firm's success, it would only illustrate how well the company used the assets to generate profits. Nevertheless, this is not the only determinant of the well-being of the business. Apart from leveraging cash, the company still needs to invest strategically in equity to generate higher profits that will keep the firm's investors happy. This can encourage the use of equity return (ROE) as a metric of company success. How-ever, the use of ROE can be troublesome. When investors are not cautious, they will divert attention from company trends and contribute to unwelcome surprises. Companies may turn to financial tactics to falsely maintain a healthy ROE for a while and to cover declining results in market fundamentals. Growing debt leveraging and stock buybacks supported by surplus capital will help maintain the ROE of a business even though operating profitability is eroding. All ROA and ROE are determined by looking at the balance sheet and other financial statements of the firms and therefore do not compensate for market-oriented considerations. Therefore, owing to investor perceptions, the release of balance sheets could have an effect on stock market interventions ( Chaudhuri et al., 2016).

Controlled variables: firm size and firm age

In most research, firm scale is calculated by natural logarithm of total assets ( Dissanayake et al., 2016; Kansal et al., 2014). Therefore, in this analysis, firm scale is calculated by using the normal logarithm of total assets.

The business age is determined by the length of the years from its inception to the period of measurement or by the number of years since the foundation of the company ( Dissanayake et al., 2016; Kansal et al., 2014). In this analysis, then, the firm age is determined by the use of a normal logarithm of a firm period.

The company age and business scale must be balanced by the reality that larger and older companies should usually have more capital assets and would generally have better firm output relative to smaller and younger firms.

Hypotheses of the study

Proposed models for future empirical testing

Against this background, and in line with the objectives of this study the following models are proposed for future empirical testing:

Model 1:

ROE = β0 + β1FINCAP + β2MANCAP + β3INTCAP + β4HUMCAP + β5SOCRELCAP + β6NATCAP + β7AGE + β8SIZE + εit

Whereas

ROE = Return on Equity for measuring accounting performance of the Malaysian oil and gas PLCs (External perspective)

ROA = Return on Assets for measuring accounting performance of the Malaysian oil and gas PLCs (Internal perspective)

FINCAP = Financial Capital

MANCAP = Manufactured Capital

INTCAP = Intellectual Capital

HUMCAP = Human Capital

SOCRELCAP = Social and Relationship Capital

NATCAP = Natural Capital

WBOD = Woman Board of Directors

AGE = Firm Age

SIZE = Firm Size

εit = Error term

Model 2:

ROA = β0 + β1FINCAP + β2MANCAP + β3INTCAP + β4HUMCAP + β5SOCRELCAP + β6NATCAP + β7AGE + β8SIZE + εit

Model 3:

ROE = β0 + β1FINCAP + β2MANCAP + β3INTCAP + β4HUMCAP + β5SOCRELCAP + β6NATCAP + (β7FINCAP * WBOD) + (β8MANCAP * WBOD) + (β9INTCAP * WBOD) + (β10HUMCAP * WBOD) + (β11SOCRELCAP * WBOD) + (β12NATCAP * WBOD) + β13AGE + β14SIZE + εit

Model 4:

ROA = β0 + β1FINCAP + β2MANCAP + β3INTCAP + β4HUMCAP + β5SOCRELCAP + β6NATCAP + (β7FINCAP * WBOD) + (β8MANCAP * WBOD) + (β9INTCAP * WBOD) + (β10HUMCAP * WBOD) + (β11SOCRELCAP * WBOD) + (β12NATCAP * WBOD) + β13AGE + β14SIZE + εit

Content analysis is the most popular and widely employed tool for testing and accounting disclosure ( Zahid & Ghazali, 2015; Boesso & Kumar, 2007). The content analysis may have qualitative and quantitative measurements. Quantitative content analysis is considered to be more reliable ( Zahid & Ghazali, 2015; Day & Woodward, 2009). The current study will use the method of quantitative content analysis.

Data coding according to the content analysis method would be based on themes, words or items found in the data ( Nilsson, 2016; Collis & Hussey, 2014).

During classification, a score system will be used to determine the extent to which items have been reported. The scor-ing system was based on a review of previous studies using content analysis to determine the appropriate number of points. Larsson and Ringholm ( 2014) and Eccles et al. ( 2014) used a four-point system while Wang, Song, and Yao ( 2013) used a three-point system. Also, Boiral ( 2013) and Setia et al. ( 2015) used two-point schemes. The analysis will use a framework similar to the previous Nilsson ( 2016) Integrated Reporting work to allow for some distinction between companies while still being a time-efficient method. The method and the parameters used are laid out in Table

A new integrated reporting’s 6- capitals scoring index

Findings

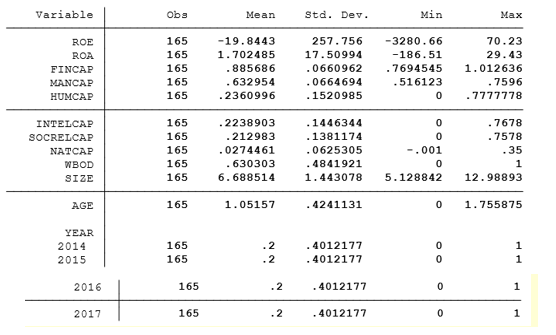

Descriptive statistics

The mean of ROA is positive is due to the fact that the publication of the <IR> 6 capitals are positively increasing the internal management’s value. On the other hand, the mean of ROE is negative is due to the fact that the <IR> 6 capitals are negatively increasing the external shareholders value.

The minimum value of ROE of -3,280.66 reflects that the Malaysian oil and gas PLCs have experienced negative returns over the past five years from 2013 to 2017 which is also the same for ROA at -186.51. This reflects poor firm financial performance.

The financial capital and manufactured capital components are the most reported and disclosed capitals as per the International Integrated Reporting Framework (<IR>) which were classified as Share Capital and Non-Current Assets in the Annual Report framework. Therefore, these two capitals are common in the Annual Report era and are just re-classified as capitals in the Integrated Reporting era. The other 4 new categories of capitals, which are human capital, intellectual capital, social and relationship capital and natural capital which are introduced within the <IR> era was not disclosed extensively by the oil and gas PLCs in which explains the minimum to be 0 and the maximum disclosed is a small amount.

To test the first objective of to examine the disclosure level of the Integrated Report’s 6 capitals practices and the related practices of the Woman Board of Directors across the Malaysian oil and gas PLCs, the descriptive statistics measures are applied and the results are achieved as follows:

Level of disclosures / practices

Figure

Frequency of disclosures

In the aspect of the frequency and percentage of disclosures, companies may not frequently disclose the new 4 capitals which are Human Capital, Intellectual Capital, Social and Relationship Capital and the Natural Capital which is reflected in the minimum number of disclosures of 0. The maximum number of tripartite capital disclosures are 0.78 for Human Capital which is the highest of the four new capitals, Intellectual Capital at 0.77, the Social and Relationship Capital at 0.76 and finally the lowest, Natural Capital 0.35. This reflects that most companies will practice and disclose the Human Capital first, the Intellectual Capital second, the Social and Relationship Capital third and finally the lowest, the Natural Capital. Over the years, there are no changes in the minimum of 0 but there is a small increment in the disclosure of maximum number of disclosures for the four capitals. This indicates a very bad sign for the Malaysian oil and gas PLCs in which they are dealing with stakeholders that are operating at a global level and needs to be more transparent of the 6 capital structures.

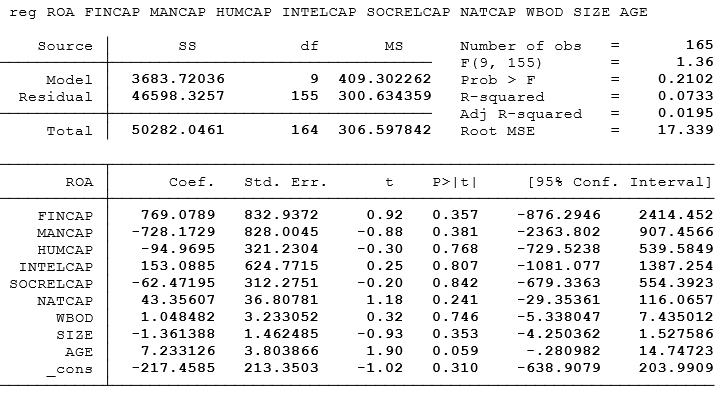

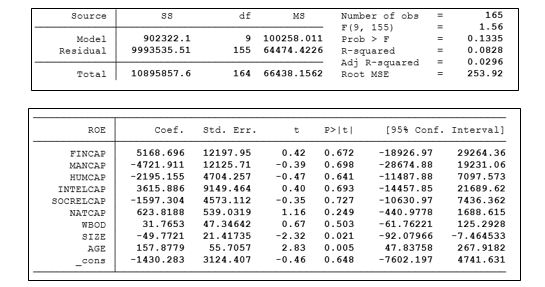

Regression Analysis

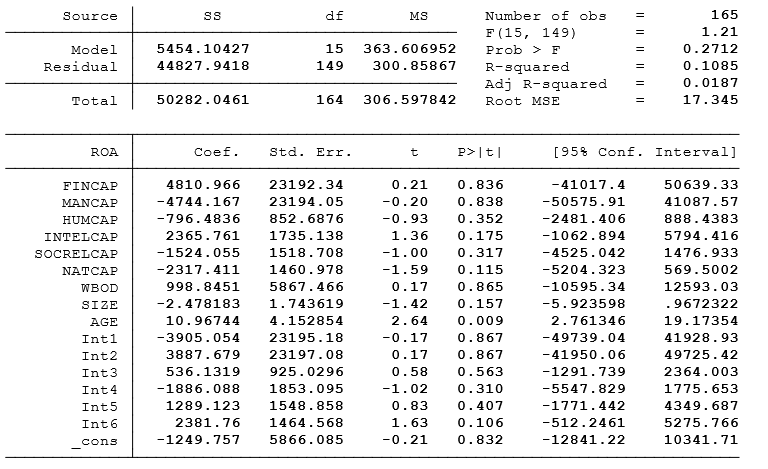

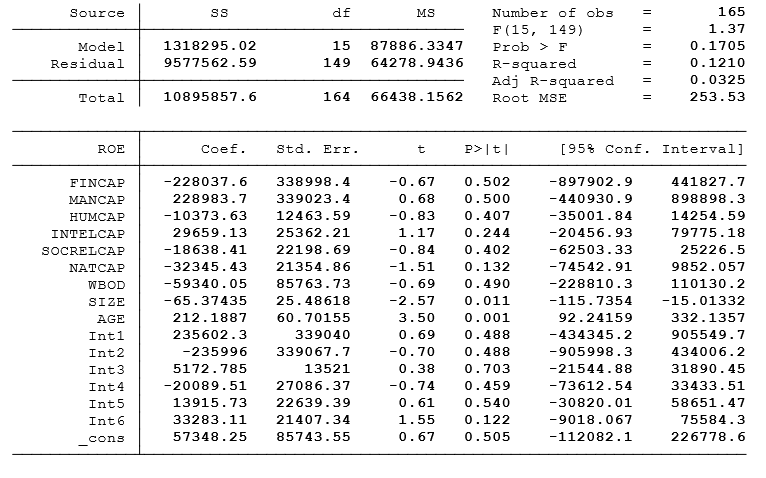

Multiple regression is applied to test the second objective of to investigate the impact of the disclosure extent of the Integrated Report’s 6 capitals on the financial performance of the Malaysian oil and gas PLCs which the results are shown in Figure

The results of Figure

Multiple regression is applied to test the third objective which is to investigate if the role of the Woman Board of Directors positively moderates the relationship between Integrated Report’s 6 capitals and the financial performance of the Malaysian oil and gas PLCs in which the results are shown in Figure

The results of Figure

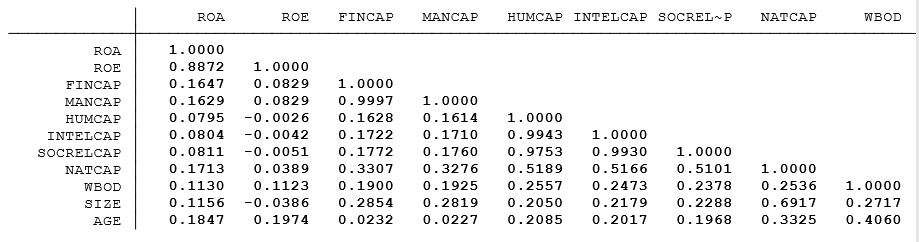

Pearson correlation analysis

In this study, ROA is used to measure the firm performance based on the management’s perspective taking an internal outlook and the ROE is used to measure the firm performance based on the shareholder’s perspective taking an external outlook. Figure

Conclusion

The most common capitals to report and disclose within the Annual Reports are the Financial Capital and the Manufactured Capital. Natural Capital is the most difficult capital to report on. The three human related capitals which are also known as the tripartite human related capitals which consists of the Human Capital, Intellectual Capital and Social and Relationship Capital are not disclosed much as well in the Annual Report.

This shows that hypotheses 1 is rejected as the publication of the <IR> 6 capitals has an insignificant impact on firm performance which is coupled with the fact that the level of transparency of the 6-capitals disclosure items amongst the Malaysian oil and gas PLCs are still at its infancy and could be detrimental when dealing with global stakeholders with the current low level of transparency in which the oil and gas industry are always exposed to the international stakeholders and shareholders in the normal course of day to day business.

The development of Integrated Reporting is designed to enhance and consolidate existing reporting practices and, through collaboration, consultation and experimentation, to move towards a reporting framework that provides the information needed to assess organizational value in the 21st century.

Hypotheses 2 is rejected as Woman Board of Directors has an insignificant moderating effect on the relationship between <IR> 6 capitals and firm performance. This is evidenced by the lack of women on the boards across the 33 oil and gas PLCs as the oil and gas industry is seen as the playing field for the male and not the female.

The Malaysian oil and gas PLCs would need to improve in the disclosure practices of the 6-capitals within the Integrated Report and to replace the Annual Report and Sustainability Reports with the ‘One Report’ which is another name for the Integrated Report in order to be at the same level of global practices amongst the global MNCs as recommended by the IIRC.

Acknowledgments

This research was supported by the Bridging-Incentive Grant from Universiti Sains Malaysia (Grant no: 304.PMGT.6316561). The usual disclaimer applies.

References

- Boesso, G., & Kumar, K. (2007). Drivers of corporate voluntary disclosure: A framework and empirical evidence from Italy and the United States. Accounting, Auditing & Accountability Journal, 20(2), 269-296. https://doi.org/10.1108/09513570710741028

- Boiral, O. (2013). Sustainability reports as simulacra? A counter-account of A and A+ GRI reports. Accounting, Auditing & Accountability Journal, 26(7), 1036-1071.

- Chaudhuri, K., Kumbhakar, S. C., & Sundaram, L. (2016). Estimation on firm performance from a MIMIC model. European Journal of Operational Research, 255, 298 – 307.

- Clayton, A. F., Rogerson, M. J., & Rampedi, I. (2015). Integrated reporting vs. sustainability reporting for corporate responsibility in South Africa. Bulletin of Geography: Socio-economic series, 29, 7-17.

- Collis, J., & Hussey, R. (2014). Business research, A practical guide for undergraduate and postgraduate students (4th edition). Palgrave MacMillan.

- Day, R., & Woodward, T. (2009). CSR reporting and the UK financial services sector. Journal of Applied Accounting Research, 10(3), 159-175.

- Dissanayake, D., Tilt, C., & Xydias-Lobo, M. (2016). Sustainability Reporting by publicly listed companies in Sri Lanka. Journal of Cleaner Production, 129, 169-182. https://doi.org/10.1016/j.jclepro.2016.04.086

- Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835-2857. http://dx.doi.org/10.2139/ssrn.1964011

- Ernst & Young (2013). The Concept of Capital in Integrated Reporting. EYGM Limited.

- Habib, M. A., & Ljungqvist, A. (2005). Firm value and managerial incentives: A stochastic frontier approach. Journal of Business, 78, 2053–2094.

- Huang, S-M., Oua, C-S., Chena, C-M., & Lin, B. (2006). An empirical study of relationship between IT investment and firm performance: A resource-based perspective. European Journal of Operational Research, 173(3), 984–999.

- IIRC (2013a). Business Model background paper for Integrated Reporting. Chartered Institute of Management Accountants (CIMA), IFAC & PwC. IIRC.

- IIRC (2013b). Capitals backgroud paper for Integrated Reporting. Association of Chartered Certified Accountants (ACCA) & Netherlands Institute of Chartered Accountants (NBA). IIRC.

- International Integrated Reporting Council (2011). Towards Integrated Reporting, Communicating Value in the 21st Century. IIRC.

- International Integrated Reporting Council (2013). The International Integrated Reporting <IR> Framework. IIRC.

- International Integrated Reporting Council (IIRC) (2016a, 2 November, 2016), “IRC of South Africa: Integrated Reporting is a key feature of King IV”. http://integratedreporting.org/news/irc-of-south-africa-integrated-reporting-is-a-key- feature-of-king-iv/

- International Integrated Reporting Council (IIRC) (2016b, 5 September, 2016), “Richard Howitt appointed as next Chief Executive Officer of the IIRC”. http://integratedreporting.org/news/richard-howitt-appointed-as-next-chief- executive-officer-of-the-iirc/

- Kansal, M., Joshi, M., & Batra, G. (2014). Determinants of corporate social responsibility disclosures: Evidence from India. Advances in Accounting, incorporating Advances in International Accounting, 30, 217–229. http://dx.doi.org/10.1016/j.adiac.2014.03.009

- Kaye, T. (2018, August 1). In The Black Leadership Strategy Business. Retrieved from Rebuilding Trust Through Integrated Reporting. https://www.intheblack.com/articles/2018/08/01/rebuild-trust-integrated-reporting

- Khanna, T., & Palepu, K. (2000). Is group affiliation profitable in emerging markets? an analysis of diversified Indian business groups. Journal of Finance, 55, 867–891.

- Larsson, J., & Ringholm, L. (2014). Governance Disclosures According to IIRC’s Integrated Reporting Framework – Are Annual Reports of Swedish Listed Companies in Line with the Framework? University of Gothenburg, School of Economics, Business and Law.

- Nilsson, A. (2016). A touch of Integrated Reporting. An exploration of large Swedish companies' compliance with the IIRC's six capital. University of Gothenburg

- PricewaterhouseCoopers. (2014). The state of Integrated Reporting in Malaysia, An Analysis of the Bursa Malaysia's top 30 companies' annual reports. PwC.

- Richard, P. J., Devinney, T. M., Yip, G. S., & Johnson, G. (2009). Measuring Organisational Performance: Towards Organisational Best Practice. Journal of Management, 3, 718-804.

- Saleem, S. (2015, August). Malaysia's Economic Challenges: Implications of Ringgit's Fall. S Rajaratnam School of International Studies Commentary.

- Sarkar, J., & Sarkar, S. (2009). Multiple board appointments and firm performance in emerging economies: Evidence from India. Pacific-Basin Finance Journal, 17, 271–293.

- Securities Commission Malaysia (2012). Malaysian Code of Corporate Governance 2012 (MCCG 2012). Kuala Lumpur.

- Securities Commission Malaysia (2017). Malaysian Code of Corporate Governance 2017 (MCCG 2017). Kuala Lumpur.

- Setia, N., Abhayawansa, S., Joshi, M., & Huynh, A. V. (2015). Integrated reporting in South Africa: some initial evidence. Sustainability Accounting, Management and Policy Journal, 6(3), 397-424.

- United States Department of Commerce International Trade Administration (2018). Malaysia Oil and Gas, International Trade Administration, U.S Department of Commerce.

- Wang, J., Song, L., & Yao, S. (2013). The Determinants of Corporate Social Responsibility Disclosure: Evidence from China. Journal of Applied Business Research, 29(6), 1833.

- Zahid, M., & Ghazali, Z. (2015). Corporate sustainability practices among Malaysian REITs and property listed companies. World Journal of Science, Technology and Sustainable Development, 12(2), 100-118.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Baharudin, D. M., Marimuthu, M., & Jie, Q. W. (2020). A New Integrated Reporting’S 6-Capitals Scoring Index Towards Firm Financial Performance. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 136-151). European Publisher. https://doi.org/10.15405/epsbs.2020.10.12