The Moderating Effect Of Risk Management Committee On Corporate Governance And Financial Performance

Abstract

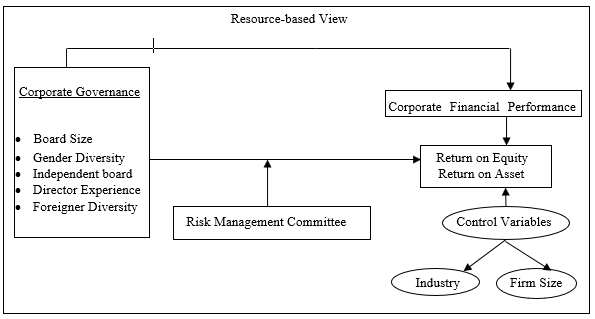

This paper attempts to deepen a better understanding of corporate governance research, specifically board diversity among the top listed companies due to the inconclusive results occurring in the past studies. Therefore, the board diversity influences financial excellence through the moderating effect of risk management committee (RMC) was investigated. The content analysis was undertaken to obtain data from the corporate annual reports of top 100 PLCs. The Partial Least Squares technique was used to assess the proposed relationships. The findings reveal that director experience, board size, foreigner diversity and gender diversity are significantly correlated with financial achievement while the independent board is insignificant correlated with financial achievement. RMC is found to have no relationships with corporate governance characteristics towards superior financial returns. From a theoretical side, this paper extends the previous academic literature by applying resource-based view (RBV) to address that diverse boards perform better, in particular financial performance, than less diverse boards. The findings support the RBV that diverse boards are more likely to represent diverse stakeholders and to achieve better financial returns. On the practical standpoint, these findings provide companies, researchers and policymakers with new strategic insights into the board governance structures that need future research and further development.

Keywords: Board diversitycorporate governanceresource-based viewrisk management committee

Introduction

The resource-based view (RBV) has been the approach widely used to explain corporate governance affects financial performance. According to the RBV, it is not the industry structure that develops a business competitive advantage ( Barney, 1997), but the ability of a company to utilize the firm’s internal resources in new dynamic industry contexts. Companies can create competitive advantages by using these unique bundles of resources to take advantage of its environmental risks and opportunities. From the RBV standpoint, the board members is a valuable resource in a company as they are in charge of managing business operation for the shareholders’ interest ( Fama & Jensen, 1983).

Corporate governance became a topic of debate after the 1997 Asian financial crisis. The debate merely focused on internal governance mechanisms, including boards, auditors and internal control, specifically, to increase shareholders’ influence on corporate behaviour on a different range of business affairs. Many companies have attempted to strengthen their internal governance mechanisms following financial scandals, for example, WorldCom, Ahold, Parmalat, and Enron. The importance of good board governance structure is evidenced by different standards developed at both the international level and the country level ( Druckeriv, 1992).

Corporate governance and corporate financial performance

A good board governance structure has been recognized as a central feature of modern corporations today as it is one of the determinants that leads to superior financial performance. A company which embraces a good board structure is in a strategic position to manage environmental, social and governance (ESG) issues in achieving superior financial returns including a higher rate of return and larger profit margins. Haniffa and Cooke ( 2005) commented that financial disclosure practices emanate from the board members, thus, the board structure constitutes a fundamental part of the corporate governance mechanism. Given such a scenario, it is crucial to consider the capacity of the board members in discharging their responsibilities. Board diversity, defined as the dissimilarities in the board attributes ( Frias‐Aceituno et al., 2013). According to Van der Walt and Ingley ( 2003), diversity among board members can be distinguished by age, ethnicity, industry background and gender. The diversity to boardroom is one of the methods to strengthen the internal governance structure and to protect investors’ interests ( Ngu & Amran, 2019). Additionally, the strength of diversity among board members has been discussed by Bing and Amran ( 2017) and Ngu and Amran ( 2018).

There is widespread debate about the board diversity as it can enhance board effectiveness, and, thereby, improve business performance. Empirical research has variously reported negative, positive, and no relationships between board diversity towards business performance. For instance, Reguera-Alvarado et al. ( 2017) reported a positive impact of gender diversity towards financial achievement in Spain. It was supported by Miller and del Carmen Triana ( 2009), they also found that financial achievement was influenced by gender diversity. Additionally, Mahadeo et al. ( 2012) focused the impacts of diverse boards on the financial benefits of PLCs in Mauritius. Their findings reported a satisfactory extent of heterogeneity with respect to age, educational background, independent board and financial benefits, however, women were poorly represented on the boards. In contrast, Carter et al. ( 2010) reported an insignificant relationships among ethnic diversity, gender diversity, and corporate excellence in US.

In the Malaysian context, Ganesan et al. ( 2018) conducted research on manufacturing industry and found no evidence to support the business performance was influenced by gender diversity, size of board and independent board. Zabri et al. ( 2016) also explored the corporate governance practices affecting corporate excellence among the largest 100 PLCs and concluded that return on equity was not affected by size of board. However, return on assets was negatively influenced by board size. Their findings demonstrated the insignificant link between independent board and superior financial returns.

Corporate governance, risk management committee and corporate financial performance

The RMC is receiving growing attention in this sustainability world, as the RMC establishes risk strategy, reviews risk reports and provides enterprise risk management advice to board members ( KPMG, 2001). Companies, however, differ in their processes and approaches they adopt towards controlling risks. Traditionally, an audit committee has been appointed to carry out the risk management duties ( Korosec & Horvat, 2005). However, in the era of increasing concern about sustainable development, the function of the RMC has increasingly gained recognition for managing sustainability risks and opportunities. Based on RBV standpoint, the RMC is a governance support mechanism. They assist board members to execute risk management duties, even though, ultimately, the board members are responsible for risk management ( ASE, 2007).

In the Malaysian context, Abdul Rahman et al. ( 2013) found that the board members involved in formulating and executing risk management policies among Malaysian Islamic banks was significantly higher than in Egypt. While the results of Ling et al. ( 2014) showed that RMC positively impacts board size, leverage and firm size. There is an increasing trend that the board members have assigned the financial reporting duties to the audit committee, whereas risk management oversight duties have been assigned to the RMC. The reason is that the risk management oversight responsibilities require an understanding of company-wide processes and structures. An effective RMC can assist board members to enhance their financial reporting, and, thereby, safeguard their reputation and attain their financial objectives ( Subramaniam et al., 2009).

Problem Statement

The effect of board characteristics on financial achievement has increased growing academic attention, however, it has provided mixed results. Much of the research has investigated how corporate governance influences financial excellent ( Ganesan et al., 2018; Jermias & Gani, 2014; Shukeri et al., 2012; Zabri et al., 2016). They concluded that board governance structure is one of the determinants contributing to corporate excellence as the diversification of the board resources may bolster corporate reputation, which in turn, corporate financial performance. However, the previous studies showed lack of definite findings and could not explain how board governance structure influences financial performance. Thus, an investigation concerning the board characteristics will provide new strategic insights into the improvement of board governance structure in an emerging economy (i.e., Malaysia).

The RMC has recently increased in prominence, as it is regarded as a governance support mechanism to assist board members in oversighting the process of risk management ( Subramaniam et al., 2009). In recent years, many businesses have become increasingly aware that the survival of their business is not solely rely on the good governance structure and audit committee, but also on the RMC. The Securities Commission Malaysia issued Malaysian Code on Corporate Governance in 2017 to encourage PLCs to form a RMC in achieving corporate excellence ( Securities Commission Malaysia, 2017). The responsibility of RMC is to discern the sustainability issues from the viewpoint of stakeholders to achieve corporate financial objectives such as superior financial returns. Based on the literature, this paper seeks to broaden corporate governance research by analysing the moderating impact of the RMC on corporate governance towards financial achievement.

Research Questions

This paper contends that a good governance structure and a risk management committee (RMC) are necessary conditions for achieving high-level financial performance. However, studies on these relationships are lacking. Thus, this paper has two research questions.

RQ1. What is the correlation, if any, between corporate governance and corporate financial performance?

RQ2.What is the effect of corporate governance towards corporate financial performance through the moderating role of RMC?

Purpose of the Study

This paper examines the impact of corporate governance, particularly board diversity, on financial achievement that is moderated by the RMC.

Resource-based View (RBV)

From the RBV perspective, firm’s human capital resources are fundamental to developing a business competitive advantage ( Barney, 1997). Dichter ( 1995) claimed that many companies have underutilized human capital resources, such as racial backgrounds, female and diverse ethnic, which might contribute to the various suggestions to their businesses. By utilizing these unique resources effectively and efficiently, it can improve boards’ decision-making and financial performance. Moreover, it is well documented that diverse boards could assist management in responding to the needs and expectations of diverse stakeholders and enhancing corporate reputation ( Bear et al., 2010).

Another research conducted by Robins and Wiersema ( 1995), revealed that a company can use the firm’s internal resources effectively to build a competitive advantage that can be reflected in the return on investment. Nakabiito and Udechukwu ( 2008) also confirmed that the business success and failure is dependent on the business leaders making proper use of its internal resources. As such, it is crucial that board members should comprise directors with different experience, gender, ethnicity, and age. This is the main reason that the RBV is applied to analyse the moderating impacts of RMC on corporate governance towards financial achievement in Malaysia.

Research model

Figure

Hypotheses development

Board size and corporate financial performance

The previous studies have investigated that board size is one of vital determinants on the level of financial performance. For instance, Jackling and Johl ( 2009) remarked that the achievement of financial returns was positively influenced by board size, it could be due to board members having more external linkage which can extract to critical resources (i.e., funding). Contrary to the above results, Mak and Kusnadi ( 2005) found that larger board was negatively linked with firm value in Malaysia and Singapore. They claimed that this negative link is due to both countries having adopted different corporate governance systems. In contrast, Ganesan et al. ( 2018) reported that board size was not an important predictor of business performance in Malaysia. Based on empirical studies, in most cases, a large board is negatively linked with the financial outcomes due to the lack of group cohesiveness among board members. Larger boards can also prove to be a disadvantage as it is expensive to maintain compared to smaller boards. This study proposes that large board negatively affects the financial outcomes. Thus, the above literature leads to the H1.

H1 Board size negatively impacts the corporate financial performance.

Independent board and corporate financial performance

The importance of external directors on the corporate board due to two reasons. Firstly, external directors are independent outside directors, therefore, they can better monitor the manager’s actions and maximise shareholders’ wealth ( Fama & Jensen, 1983). Secondly, external directors are more independent as they adopt greater objectivity in managing business to protect shareholders’ interest ( Prado-Lorenzo et al., 2009) because it can directly impact their reputation and professionalism ( Rao & Tilt, 2016). Empirical research on the influence of external directors on financial achievement seems to be nebulous. For instance, Sanda et al. ( 2011) reported that the financial outcomes (ROA and ROE) of 205 Nigerian listed companies were positively influenced by independent boards. In contrast, Shukeri et al. ( 2012) reported that external directors with multiple appointments were negatively linked with the financial achievement in Indian companies, while Zabri et al. ( 2016) failed to provide an association between independent board and financial excellence in Malaysia. Hence, H2 is formulated below.

H2 Independent board positively impacts the corporate financial performance.

Gender diversity and corporate financial performance

Increased presence of women to serve on boards may bring more benefits to the business ( Betz et al., 2013), because they adopt ethical criteria that different from those of male directors ( Kessler‐Harris, 1989). Likewise, Smith et al. ( 2006) also confirmed that the female directors on boards resulted in superior financial performance. They asserted that higher gender diversity may contribute new insights into strategic decisions and improve quality to board’s decision-making. Reguera-Alvarado et al. ( 2017) claimed that higher proportion of female board representation was positively correlated with financial excellence in Spain. In contrast, another group of studies revealed that gender diversity was not a significant predictor of the business performance in Malaysia ( Ganesan et al., 2018). Thus, this study proposes that gender-diverse board may improve corporate reputation and financial performance.

H3 Gender Diversity positively impacts the corporate financial performance.

Director experience and corporate financial performance

From the RBV, diverse working experience of the directors could provide better suggestions to the management. For instance, Westphal ( 1999) concluded that boards comprise directors with various areas of expertise (e.g. marketing specialists, community leaders, government officials, or lawyers) can facilitate counsel role to the management. However, another group of studies argued that the different advice provided by boards consisting of members with diverse fields of knowledge makes it more difficult to come to a decisive conclusion ( Maznevski, 1994). This could hamper the management in operating cohesively due to the different suggestions provided. Empirical studies paint an inconclusive picture on the influence of diverse working experience on the financial excellence. For example, Kim and Lim ( 2010) revealed that the link between director experience and financial performance was insignificant. On the other hand, Wellalage and Locke ( 2013) found that diverse working experience was negatively associated with financial outcomes. This study argues that the boards should comprise directors with different fields of expertise to make sure that tasks are performed efficiently. Thus, above discussion leads to the H4.

H4 Director Experience positively impacts the corporate financial performance.

Foreigner diversity and corporate financial performance

From the RBV standpoint, foreign directors are considered to be human capital resources as they are in charge of formulating and implementing the firm’s business strategy. If boards comprise directors who have international skills, they are unlikely to be obtained locally, and, hence, able to provide suggestions from different perspectives based on their international experiences ( Daily et al., 2000). Marimuthu and Kolandaisamy ( 2009) examined the correlation between ethnic diversity and corporate excellence of 100 Malaysian non-financial companies. Their results evidenced that foreign diversity was positively associated with financial outcomes. Contrary to the above results, Carter et al. ( 2010) reported that ethnic diversity was not related to the financial outcomes in US. This study argues that foreigner diversity may improve the boards’ decisions in understanding the interests of diverse stakeholders, which, in turn, may enhance the corporate reputation, and, ultimately, its financial returns. As such, H5 is proposed below.

H5 Foreigner diversity positively impacts the corporate financial performance.

Risk management committee as moderator

Empirical evidence revealed inconsistent findings how corporate governance influences financial excellence, and, hence, RMC need to be introduced to improve the understanding of the proposed relationships. From the RBV perspective, an effective RMC is crucial for managing ESG issues in this global context, because the survival of the business is not only depending on the good governance structure and audit committee, but also on the RMC. However, no previous studies provide empirical results demonstrating that corporate governance characteristics could be significantly moderated by RMC towards corporate excellence. Thus, the current study argues that the RMC helps the board members to achieve its financial objectives. Consequently, businesses that successfully manage the sustainability risks and opportunities via the RMC can develop a competitive advantage, which can result in financial benefits, such as a higher profit margin and a greater market share.

H6a: RMC moderates the negative link between board size and corporate financial performance.

H6b: RMC moderates the positive link between independent board and corporate financial performance.

H6c: RMC moderates the positive link between gender diversity and corporate financial performance.

H6d: RMC moderates the positive link between director experience and corporate financial performance.

H6e: RMC moderates the positive link between foreigner diversity and corporate financial performance.

Research Methods

Data collection

The content analysis was undertaken to obtain data from the corporate annual reports in year 2016. The data extracted from the corporate annual reports were gender diversity, board size, director experience, independent board, foreigner diversity, risk management committee, firm size, industry, and financial performance. Each company was identified as a unit of analysis.

Sample size

The sample size comprises the largest 100 listed companies by the market capitalization. Of the top 100 companies, 7 companies were taken from construction and REIT, 12 companies were selected from consumer goods, 10 companies were chosen from industrial products, 15 companies were taken from finance, 8 companies were chosen from plantations, 2 companies were selected from technology, 34 companies were taken from trading services, 4 companies were chosen from infrastructure project companies, and 8 companies were selected from properties.

Inter-coder reliability

This study employed a multiple-coder approach to test the reliability of data gathered and the consistency among two coders ( Milne & Adler, 1999). The result of Krippendorff’s alpha was 0.82, which revealed that an acceptable level of content analysis reliability and no significant differences between scores obtained ( as cited in Hayes & Krippendorff, 2007).

Measurement of variables

The financial performance was assessed by ROE and ROE ( Mahadeo et al., 2012; Zabri et al., 2016). While ROE measures the shareholders’ return (profit after tax ÷ total equity), ROA assesses the efficiency of assets (profit after tax ÷ total assets). This study proposed five corporate governance determinants (i.e., gender diversity, board size, director experience, independent board, and foreigner diversity) contributing to superior financial outcomes. The board size was measured using total directors sit on the board ( Hafsi & Turgut, 2013). The number of external directors over total directors was employed to assess the independent board ( Cheng & Courtenay, 2006). The gender diversity was assessed by percentage of female directors over board size ( Carter et al., 2010). Director experience was assessed by the proportion of directors who have a traditional experience (e.g. financial, consulting, or legal) and non-traditional experience (e.g. government, academia, or NGOs) over board size ( Strandberg, 2008). The percentage of foreign directors over total directors on board was employed to assess the foreigner diversity ( Hafsi & Turgut, 2013).

The moderator is RMC in this study; a dummy value of ‘1’ indicates that the company has a RMC or an audit committee joined with RMC, while a dummy value of ‘0’ otherwise ( Yatim, 2010). Following the academic studies in the corporate governance context, firm size and type of industry were introduced as control variables. For instance, Mak and Li ( 2001) revealed that the business performance was influenced by firm size. The total assets published in the annual report was utilized to examine the firm size ( Cheng & Courtenay, 2006). This study classified industries into two types: environmentally sensitive industries (construction and real estate, industrial products, plantations, properties, consumer products and infrastructure project companies), which use the value of ‘1’, and non-environmentally sensitive industries (finance, technology, and trading services), which take the value of ‘0’.

Analysis

The Smart-Partial Least Squares version 3.0 was used for data analysis. The next section discussed the empirical findings. While the reliability and validity of study variables were assessed in the measurement model, the proposed hypotheses were examined in the structural model.

Findings

Descriptive analysis

The ROE and ROA were employed to assess the corporate financial performance. While the ROA had a mean (standard deviation) of 10% (15%) and a minimum (maximum) of -19.50% (75%), ROE had a mean (standard deviation) of 24% (49%) and a minimum (maximum) of -45% (431%). Most of the sample companies had an average 9 directors sit on the corporate board whereas the minimum (maximum) board size was 4 (18), and the standard deviation was 2. For independent board, the maximum (minimum) percentage of external directors on corporate board was 78% (23%), while, on average, most of the companies had 48% external directors on corporate board.

For gender diversity, the minimum (maximum) proportion of female to serve on corporate board was 10% (50%) and the standard deviation (mean) was 12% (15%). With regard to director experience, the mean (standard deviation) was 24% (19%) and the minimum (maximum) was 0% (75%). For foreigner diversity, the minimum (maximum) proportion of foreign nationality on the board was 0% (70%), while, on average, most of the sample companies had 15% foreign nationality on the board. Meanwhile, around 11% of listed companies did not have a RMC; 89% of listed companies either had a RMC or an audit committee joined with RMC. With regard to industry, 51% of listed companies were environmentally sensitive, whereas 49% were non-environmentally sensitive. The average firm size was 40,661,183,825, a minimum (maximum) of 520,841,000 (735,956,253,000), and a standard deviation of 100,242,668,852.

Measurement model

The measurement items are reflective indicators for this current study. The risk management committee, board size, gender diversity, director experience, board independence, and foreigner diversity are single-item measures. The financial performance was assessed by ROE and ROA. Hence, the present study must examine the reliability and validity of the financial performance construct. Cronbach’s alpha and composite reliability (CR) were employed to test the internal consistency reliability, whereas convergent validity was analysed by average variance extracted (AVE). While the loadings and AVE were above 0.5, the Cronbach’s alpha and CR were above 0.70 (Table

Structural model

The correlation between constructs can be analysed in the structural model. The lateral collinearity issues can be measured by variance inflation factor (VIF). As shown in Table

This study applied bootstrapping to compute the t-value for examining the significance of the direct path relationships. Table

Moderating effects

In this study, risk management committee was found to have insignificant impact on the direction and strength of the links between corporate governance characteristics and corporate excellence. Hence, hypotheses 6a, 6b, 6c, 6d, and 6e were not supported, as shown in Table

Conclusion

This study views the board members and RMC as valuable resources to the businesses because they can assist management to manage ESG issues which are considered materiality to their stakeholders. This study claims that diversity of board compositions will eventually lead to the achievement of higher financial returns. This study proved that the financial achievement was influenced by corporate governance characteristics (e.g. board size, gender diversity, director experience, and foreigner diversity), however it was not influenced by independent board. This study provides empirical support for the RBV’s declaration that board attributes contribute to achieving a competitive advantage.

The current study confirmed that size of board was significantly and negatively linked with the financial outcomes. This result is supported by Mak and Kusnadi ( 2005), a large board is not effective compared to a small board in terms of board monitoring and directing ( Lipton & Lorsch, 1992). This study argues that independent boards can apply greater objectivity and independence in managing business. However, the direct path relationship between independent board and financial achievement was not supported. This finding is concurred by Ganesan et al. ( 2018) and Zabri et al. ( 2016), their findings found insignificant correlation between independent boards and financial results. This study confirmed that women on boards significantly and positively improved the financial performance, it signifies that higher gender diversity may enhance corporate reputation and generate higher financial returns ( Reguera-Alvarado et al., 2017; Smith et al., 2006). For director experience, diversity of working experience showed a positive impact on financial excellence. Kim and Lim ( 2010) found that financial performance was influenced by diversity of working experience. Moreover, this study also evidenced that the financial performance was significantly influenced by foreigner diversity. This result seems in line with Marimuthu and Kolandaisamy ( 2009), they concluded that the financial achievement of 100 non-financial companies was positively influenced by ethnic diversity.

This study found no moderating impacts of RMC on board governance structure towards financial achievement. These findings contradict the RBV in viewing RMC as a non-substitutable resource which can create a competitive advantage to the business and improve financial performance. However, these findings are supported by Abdullah and Chen ( 2010), who believed that the RMC is an effective risk management mechanism to assist board of directors in managing ESG issues. Nonetheless, it is not considered to be the best approach for all companies. This study introduced industry and firm size as two control variables. It is empirically evidenced that the achievement of superior financial performance was not influenced by size of companies, however, it was influenced by type of industry.

In current study, there are three limitations. First, the research model of this study used RMC to test the moderating impacts on the proposed relationships, however, these relationships were found to be insignificant. Hence, there are some other potential moderators that may fully explain the proposed relationships. Future research could examine the other potential moderators. Second, this study tested five corporate governance determinants. Therefore, other determinants, such as multiple directorships and CEO duality may influence the financial performance. Future research should consider adding them to this study. Third, this study has a limitation in terms of the generalization and sample size. Thus, the sample size should be increased in future research to achieve greater generalizability.

References

- Abdul Rahman, R., Noor, S., & Ismail, T. H. (2013). Governance and risk management: Empirical evidence from Malaysia and Egypt. International Journal of Finance and Banking Studies, 2(3), 21-33.

- Abdullah, M., & Chen, L. (2010). The association between committees responsible for risk management and the disclosure level of financial instruments information among listed companies in Malaysia (Master Thesis). University of Gothenburg.

- ASE (2007). Corporate Governance Principles and Recommendations (2nd ed.). ASX Corporate Governance Council.

- Barney, J. B. (1997). Gaining and sustaining competitive advantage. Addison-Wesley Reading, MA.

- Bear, S., Rahman, N., & Post, C. (2010). The impact of board diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics, 97(2), 207-221.

- Betz, M., O’Connell, L., & Shepard, J. M. (2013). Gender differences in proclivity for unethical behavior. Journal of Business Ethics, 8(5), 427-432.

- Bing, N. S., & Amran, A. (2017). The role of board diversity on materiality disclosure in sustainability reporting. Global Business & Management Research, 9(4), 96-109.

- Carter, D. A., D'Souza, F., Simkins, B. J., & Simpson, W. G. (2010). The gender and ethnic diversity of US boards and board committees and firm financial performance. Corporate Governance: An International Review, 18(5), 396-414.

- Cheng, E. C., & Courtenay, S. M. (2006). Board composition, regulatory regime and voluntary disclosure. The international journal of accounting, 41(3), 262-289.

- Cohen, J. (1988). Statistical power analysis for the behavioral sciences. Lawrence Earlbaum Associates, 2.

- Daily, C. M., Certo, S. T., & Dalton, D. R. (2000). International experience in the executive suite: the path to prosperity? Strategic Management Journal, 21(4), 515-523.

- Dichter, S. (1995). Real change leaders: How you can create growth and high performance at your company. Times Business.

- Druckeriv, P. (1992). Corporate governance after Enron and WorldCom applying principles of results-based governance. Working Paper presented at Insight Conference on Corporate Governance.

- Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law & Economics, 26(2), 301-325.

- Frias‐Aceituno, J. V., Rodriguez‐Ariza, L., & Garcia‐Sanchez, I. M. (2013). The role of the board in the dissemination of integrated corporate social reporting. Corporate Social Responsibility and Environmental Management, 20(4), 219-233.

- Ganesan, Y., Kanthan, G., Mushtaq, M., & Yeap, J. A. (2018). The moderating role of internal audit function on the relationship between board of director characteristics and business performance in Malaysia. Global Business and Management Research, 10(1), 356-378.

- Hafsi, T., & Turgut, G. (2013). Boardroom diversity and its effect on social performance: Conceptualization and empirical evidence. Journal of Business Ethics, 112(3), 463-479.

- Hair, J. F., Hult, G. T. M., Ringle, C., & Sarstedt, M. (2016). A primer on partial least squares structural equation modeling (PLS-SEM). Sage Publications

- Haniffa, R. M., & Cooke, T. E. (2005). The impact of culture and governance on corporate social reporting. Journal of Accounting and Public Policy, 24(5), 391-430.

- Hayes, A. F., & Krippendorff, K. (2007). Answering the call for a standard reliability measure for coding data. Communication methods and measures, 1(1), 77-89.

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modelling. Journal of the Academy of Marketing Science, 43(1), 115-135.

- Henseler, J., Ringle, C. M., & Sinkovics, R. R. (2009). The use of partial least squares path modeling in international marketing. In New Challenges to International Marketing, 277-319.

- Jackling, B., & Johl, S. (2009). Board structure and firm performance: Evidence from India's top companies. Corporate Governance: An International Review, 17(4), 492-509.

- Jermias, J., & Gani, L. (2014). The impact of board capital and board characteristics on firm performance. The British Accounting Review, 46(2), 135-153.

- Kenny, D. A. (2018). Moderation. https://davidakenny.net/cm/ moderation.htm

- Kessler‐Harris, A. (1989). Gender ideology in historical reconstruction: A case study from the 1930s. Gender & History, 1(1), 31-49.

- Kim, H., & Lim, C. (2010). Diversity, outside directors and firm valuation: Korean evidence. Journal of Business Research, 63(3), 284-291.

- Korosec, B., & Horvat, R. (2005). Risk reporting in corporate annual reports. Economic and Business Review for Central and South-Eastern Europe, 7(3), 217.

- KPMG (2001). Understanding enterprise risk management: An emerging model for building shareholder value. White Paper of KPMG's Assurance and Advisory Services Centre. http://www.kpmg.com

- Ling, L. C., Zain, M. M., & Jaffar, N. (2014). Determinants of risk management committee formation: an analysis of publicly-held firms. Academy of Accounting and Financial Studies Journal, 18(1), 37.

- Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The business lawyer, 59-77.

- Mahadeo, J. D., Soobaroyen, T., & Hanuman, V. O. (2012). Board composition and financial performance: uncovering the effects of diversity in an emerging economy. Journal of Business Ethics, 105(3), 375-388.

- Mak, Y. T., & Kusnadi, Y. (2005). Size really matters: Further evidence on the negative relationship between board size and firm value. Pacific-Basin Finance Journal, 13(3), 301-318.

- Mak, Y. T., & Li, Y. (2001). Determinants of corporate ownership and board structure: evidence from Singapore. Journal of Corporate Finance, 7(3), 235-256.

- Marimuthu, M., & Kolandaisamy, I. (2009). Ethnic and gender diversity in boards of directors and their relevance to financial performance of Malaysian companies. Journal of Sustainable Delopment, 2(3), 139-148.

- Maznevski, M. L. (1994). Understanding our differences: Performance in decision-making groups with diverse members. Human relations, 47(5), 531-552.

- Miller, T., & del Carmen Triana, M. (2009). Demographic diversity in the boardroom: Mediators of the board diversity–firm performance relationship. Journal of Management studies, 46(5), 755-786.

- Milne, M. J., & Adler, R. W. (1999). Exploring the reliability of social and environmental disclosures content analysis. Accounting, Auditing & Accountability Journal, 12(2), 237-256.

- Nakabiito, S., & Udechukwu, D. (2008). Factors influencing the degree of disclosure in sustainability reporting: A study of Swedish companies using the GRI reporting guidelines (Master Thesis). Linkopings University.

- Ngu, S. B., & Amran, A. (2018). Board diversity and materiality disclosure in sustainability reporting: A proposed conceptual framework. International Academic Journal of Accounting and Financial Management, 5(4), 1-14.

- Ngu, S. B., & Amran, A. (2019). The impact of sustainable board capital on sustainability reporting. Strategic Direction, 35(12), 8-11.

- Prado-Lorenzo, J. M., Garcia Sanchez, I. M., & Gallego-Alvarez, I. (2009). haracteristics of the board of directors and information in matters of corporate social responsibility. Spanish Journal of Finance and Accounting, 38(141), 107-135.

- Rao, K., & Tilt, C. (2016). Board diversity and CSR reporting: an Australian study. Meditari Accountancy Research, 24(2), 182-210.

- Reguera-Alvarado, N., de Fuentes, P., & Laffarga, J. (2017). Does board gender diversity influence financial performance? Evidence from Spain. Journal of Business Ethics, 141(2), 337-350.

- Robins, J., & Wiersema, M. F. (1995). A resource‐based approach to the multi business firm: Empirical analysis of portfolio interrelationships and corporate financial performance. Strategic Management Journal, 16(4), 277-299.

- Sanda, A. U., Garba, T., & Mikailu, A.S. (2011). Board independence and firm financial performance: Evidence from Nigeria. Usmanu Danfodyo University. The African Economic Research Consortium.

- Securities Commission Malaysia (2017). Securities. Malaysian Code on Corporate Governance. https://www.sc.com.my/api/documentms/download.ashx?id=70a5568b-1937-4d2b-8cbf-3aefed112c0a

- Shukeri, S. N., Shin, O. W., & Shaari, M. S. (2012). Does board of director's characteristics affect firm performance? Evidence from Malaysian public listed companies. International Business Research, 5(9), 120.

- Smith, N., Smith, V., & Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2,500 Danish firms. International Journal of Productivity and Performance Management, 55(7), 569-593.

- Strandberg, C. T. (2008). The Role of the Board of Directors in Corporate Social Responsibility. Conference Board of Canada.

- Subramaniam, N., McManus, L., & Zhang, J. (2009). Corporate governance, firm characteristics and risk management committee formation in Australian companies. Managerial Auditing Journal, 24(4), 316-339.

- Van der Walt N., I., C. (2003). Board dynamics and the influence of professional background, gender and ethnic diversity of directors. Corporate Governance: An International Review, 11(3), 218-234.

- Wellalage, N. H., & Locke, S. (2013). Corporate governance, board diversity and firm financial performance: new evidence from Sri Lanka. International Journal of Business Governance and Ethics, 8(2), 116-136.

- Westphal, J. D. (1999). Collaboration in the boardroom: Behavioral and performance consequences of CEO-board social ties. Academy of management Journal, 42(1), 7-24.

- Yatim, P. (2010). Board structures and the establishment of a risk management committee by Malaysian listed firms. Journal of Management and Governance, 14(1), 17-36.

- Zabri, S. M., Ahmad, K., & Wah, K. K. (2016). Corporate governance practices and firm performance: Evidence from top 100 public listed companies in Malaysia. Procedia Economics and Finance, 35, 287-296.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

06 October 2020

Article Doi

eBook ISBN

978-1-80296-087-7

Publisher

European Publisher

Volume

88

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1099

Subjects

Finance, business, innovation, entrepreneurship, sustainability, environment, green business, environmental issues

Cite this article as:

Ngu, S. B., & Amran, A. (2020). The Moderating Effect Of Risk Management Committee On Corporate Governance And Financial Performance. In Z. Ahmad (Ed.), Progressing Beyond and Better: Leading Businesses for a Sustainable Future, vol 88. European Proceedings of Social and Behavioural Sciences (pp. 106-119). European Publisher. https://doi.org/10.15405/epsbs.2020.10.10