Abstract

Gas industry is the largest source of replenishment of the state budget of Russia, and therefore it is of great strategic importance for the economy and social sphere of the country. For a long time, the Russian Federation has been at the forefront of the entire global gas industry, but since the early 2000s, the United States and China have been taking active steps to introduce their financial interests in this segment of global economy. The study revealed a close dependence of revenues from gas industry on the dynamics of the total revenue of the federal budget of Russia. The reasons for the change in the level of oil and gas revenues in the context of the economic crisis, which influenced the amount of revenues from gas industry, are world gas prices and the depreciation of the ruble. In the future, the decrease in demand for Russian gas may present another problem. The strategic interests of world leaders in gas industry in modern economic conditions, which are expressed not so much in the increase of profit margins, but in the increase of the focus on the diversification of their investment projects, expanding the priorities of strategic development of companies, moving from an interval in the production chain “gas production-sale” to “production – processing – sale”. Russian Gazprom also follows these trends, however, it lags behind in the introduction of innovative forms of gas delivery, which may in the future become a fatal mistake and badly affect a state budget.

Keywords: Gas industryoilgasrevenues

Introduction

Energy can be called the main “food” of the economy of any state. This is the core of the state life support. It is the level of energy that determines the standard of living as a whole, since automation and mechanization of labor depend on it. Gas industry is one of the components of the fuel and energy complex (FEC), the value of which is determined, first of all, by the fact that in the structure of global consumption of fuel and energy, natural gas takes third place after oil and coal.

Problem Statement

Practice showed that in recent years, the Russian gas industry is facing some problems. This is reasoned by the expensive construction of the main gas pipeline, a drop in gas demand, along with a drop in the price of this fuel. Political motives of various countries also play their roles. Thus, the Power of Siberia project (the cost is 1.1 trillion rubles, construction started in 2014, planned launch is on December 1, 2019) implies gas deliveries to China in the amount of 38 billion cubic meters per year (a multi-year contract was signed in 2014, the delivery price is not disclosed), that is, gas delivery from the largest exporter to the largest importer. However, more than once during this time, China abandoned the planned investment in construction, did not see the need to build a second branch of the Power of Siberia stream. During this time, China increased its own shale gas production, the missing gas is purchased in the form of LNG from other Asian countries, and interest in American LNG is growing (an agreement was signed in the spring of 2019 between the United States and China, which gives Americans access to the Chinese energy market). In addition to China, other countries of the world are also more and more inclined to supply gas in the form of LNG. The LNG market will inevitably be fully competitive, which is ensured by the features of this product. LNG technology allows quick change in the volume of gas production and supply depending on market conditions, making pricing more flexible. There is an opportunity to easily smooth out seasonal and daily fluctuations in demand, while contracts for surplus products, if necessary, can be traded on the stock exchange. LNG facilities require less start-up capital and less construction time: if it is necessary to complete the gas pipeline in order to start pumping gas through pipelines, LNG production capacities can be put into operation gradually.

Possessing such an advantage, the growth rate of liquefied gas consumption in recent years has greatly outstripped the growth of pipeline gas and is becoming an increasingly serious competitor. Nowadays, more than a quarter of international gas trade is in LNG supplies. There are no major leaders on this market yet, which allows fair competition for customers on a price basis. For Russia, the growing popularity of LNG may turn into a problem. Thus, according to the Ministry of Energy of the Russian Federation (MinEn RF, 2019), the prospects for the growth of the LNG market by 2030 may reach 400 million tons per year. Russia, being one of the leaders in the global gas industry, is still among the lagging ones in the liquefied natural gas market: Russia's share in the global LNG market is 4 %, however, investing in this direction, it is possible to increase its share in the global LNG market to 15–20 % .

Nowadays, there are two LNG plants in Russia: Sakhalin-2 project and the Yamal LNG project. The China Development Bank (70 % of the total investment), was supposed to invest in the construction of the Amur Gas Processing Plant (it is planned to become the largest in Russia and the second largest natural gas processing company in the world), and refused to invest, which slowed down the construction.

Research Questions

The object of the study is economic relations that arise in the process of functioning of gas industry as the basis of the formation of the revenue side of the Russian budget.

Purpose of the Study

The last decades of the functioning of the Russian economy show that the revenues from oil and gas are the main source of budget revenues for the country, which reflects the strategic importance of gas industry for the Russian economy. The purpose of this research is to study the problems and prospects for the development of gas industry under the conditions of a crisis.

Research Methods

During the research, information was collected on oil and gas revenues in the federal budget of the Russian Federation, on gas production and sales. The empirical material was processed using methods such as analysis and synthesis, induction and deduction, which revealed trends in the development of gas industry. The graphical method made it possible to visualize the patterns of development of gas industry.

Findings

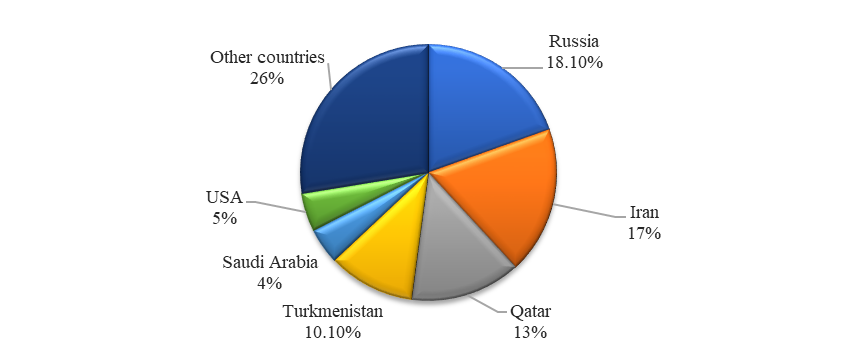

There is more than a quarter of the world's natural gas reserves on the territory of Russia (Figure

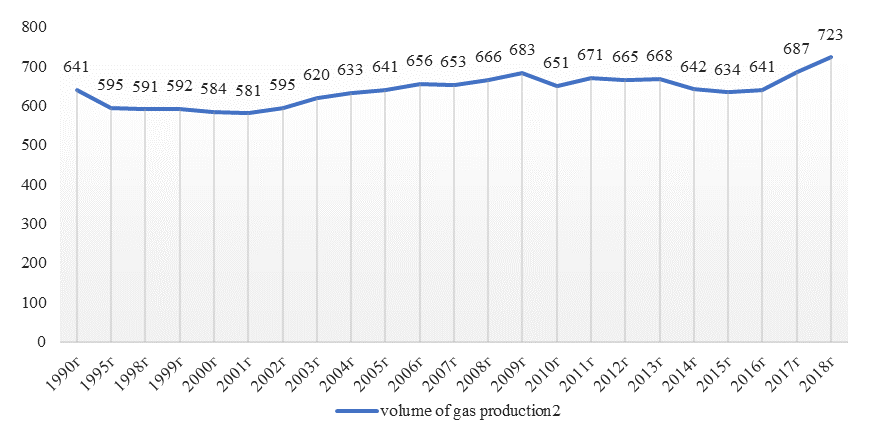

The development of the industry received a powerful impetus in 2002–2009, due to gas exploration in the Arctic (on land and in the coastal Arctic and offshore shelves), the introduction of a number of new facilities in the Leningradskoye and Zapolyarye, and a sequential increase in production (Figure

After the crisis, which caused a decrease in demand and energy prices in 2009, there is a decline in gas exploration, development and production. Since 2012, Russia has begun implementing large-scale LNG projects such as: Yamal LNG, Sakhalin 3, and work has begun on the largest gas pipeline projects: Nord Stream, South Stream, and Power of Siberia. In 2016–2018 in the production sector and the whole gas industry, steady growth is observed. The relatively low gas price compared to the competitors in global gas market has enabled Russia to gradually increase the gas complex and regain its previous leadership position.

However, it is necessary to note that theoreticians and practitioners in the fuel and energy sector recognize that in the near future there is hardly any alternative to existing fuels. Therefore, there is a search for new technologies for the use of existing types of energy.

According to estimates and forecasts of leading analytical centers, it follows that in the coming decades, hydrocarbon resources will remain the main source of energy, in connection with this, the growth in hydrocarbon consumption will steadily increase. The growth in gas industry is projected at 1.5–4 % each year and for 2023–2025 may comprise 4000 billion m3. According to the latest estimates, gas consumption in the world will be more than 4300 billion m3 in 2030 (NANGS, 2019). Almost the same numbers are also given by the Ministry of Economic Development of the Russian Federation: according to their latest forecast, in 2030 the volume of natural gas consumption will amount to 4443 billion m3 (MinEcon RF, 2019).

According to these aspects, the value of the Russian gas complex is becoming even more relevant today, as it plays an important role in state economy and the global energy supply system and has a powerful resource, production, technological and human potential, occupying a leading position in global economy as a gas exporter.

Historically, the Russian economy is directly dependent on any changes in this area: financial turmoil in the Soviet Union or modern Russia has always occurred against the backdrop of changes in global hydrocarbon market. The authors considered oil and gas revenues in the total revenue of the federal budget of the Russian Federation for the period from 2015 to 2017 (Table

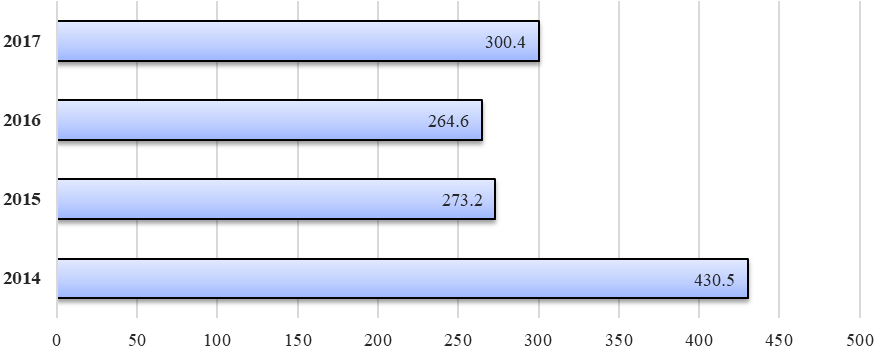

In 2016, compared to 2015, the revenues of the federal budget of the Russian Federation decreased by 199 billion rubles or 1.5% and amounted to 13460.0 billion rubles. Oil and gas revenues decreased by 1018.6 billion rubles, while gas industry revenues increased by 44.9 billion rubles or 4%, mineral extraction tax amounted to 487.9 billion rubles, the increase of 60.9 billion rubles, export duties 536.5 billion rubles reduced by 16 billion rubles. At the same time, the average annual price of natural gas at international trading sites fell from $ 273.5 / thousand m3 up to $ 264.6 / thousand m3 (Figure

The decrease in gas prices was partially compensated by the devaluation of the ruble against the US dollar (from 56.2 rubles per US dollar in 2015 to 72.5 rubles per US dollar in 2016), which allowed fulfilling budget obligations in ruble terms (Rubaeva, Tegetaeva, 2019).

One of the factors that contributed to the increase in federal budget revenues in 2017 compared to 2016 was the increase in oil and gas revenues, which increased by 23.2 %. The revenues from gas industry in 2017 amounted to 1245.6 billion rubles and increased by 22 % compared to 2016. Income from MET amounted to 669.4 billion rubles, and from export duties – to 576.2 billion rubles, which was 37.2 and 7.4 % more, respectively. Such the increase was reasoned by the increase in natural gas prices from 264.6 to $ 300 US per 1000 m3, the change in mineral extraction tax and the increase in demand in global hydrocarbon market.

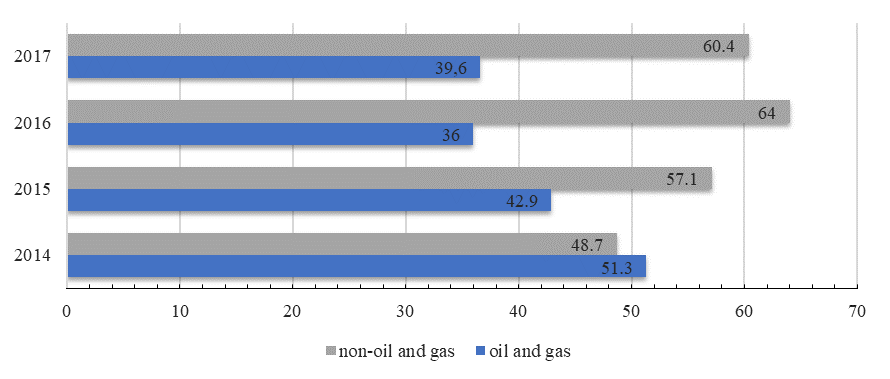

Conducting the analysis of changes in the budget revenue structure for 2014–2017, it is possible to notice a consistent decrease in the share of oil and gas revenues (Figure

These reductions in the budget structure occurred against the backdrop of serious fluctuations in hydrocarbon prices. If we look at the price of natural gas, then from the beginning of 2014 to 2016, it fell from 494.3 US dollars / thousand m3 to $ 171.1 / thousand m3, actually having fallen in price three times, which in turn led to a financial crisis in the country (Investing, 2019).

Taking into account these factors, the share of oil and gas revenues in the total federal budget revenues decreased from 51.3 % in 2014 to 36.0 % in 2016 and then again increased slightly to 39.6 % in 2017, changing the trend in the opposite direction.

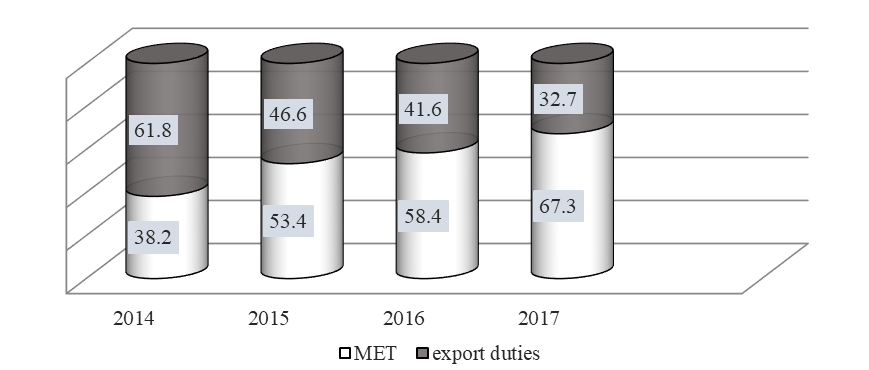

Considering the structure of oil and gas budget revenues, it can be noted that it remained stable for many years: approximately 40 % of mineral extraction tax and 60 % of export duties. The

changes have been taking place since 2015 (Figure

Against the backdrop of the financial crisis and a sharp drop in energy prices in the world, the leadership of our country had to take emergency measures. In particular, there have been changes in the mineral extraction tax: the “tax maneuver” provided for a gradual reduction in the maximum rate of the export duty on oil from 59 % in 2014 to 30 % in 2017. At the same time, the base mineral extraction tax rate gradually increased from 493 rubles per ton in 2014 to 919 rubles in 2017, while increasing the rate of export duties on petroleum products and lowering the excise tax rate on motor fuel. As a result, the share of mineral extraction tax in the structure of oil and gas revenues amounted to 67.3 % by 2017, having increased by 29.1 % compared to 2014.

It is necessary to note that the changes in mineral extraction tax and changes in the rate of export duties were aimed mainly at the oil industry, which is the main one in the structure of oil and gas complex, as well as gas condensate.

The conclusion is as follows: the export of crude oil, petroleum products, natural and liquefied gas remains the foundation for the Russian economy, providing about 40 % of Russia's budget revenues. The income from production and export duties on gas provide 9 % of the budget of the Russian Federation and about 5 % of national GDP. The export of natural gas brings a significant part of the country's foreign exchange revenues. The revenues from gas production and the use of oil and gas raw materials are the main ones in the formation of specialized funds and reserves.

It is necessary to note that the strategic priorities of the largest companies in the world are of a similar nature: business growth is of greater interest than the growth of profitability per se. In our opinion, the reasons for this are as follows:

oil and gas companies need to constantly prove their ability to grow;

exploration involves a significant risk, mainly due to the unpredictability of the geological characteristics of reserves, possible political and technical problems, and price volatility.

Conclusion

Russian companies need to optimize their investment profiles according to a geographical and functional principle. The main direction of the optimization of investment profiles is the look at the assets associated with production. A positive point is the fact that such tactics of action have already been noted recently. If earlier oil and gas companies were focused on increasing production indicators, now they are refusing such a one-sided approach and are striving for a balance between volumes and profit. The tasks of the reduction of costs and increase of profitability should be in the priorities of the strategic development of companies.

Thus, we believe that the following trends should be the current trends in the formation of the strategy and strategic priorities of the largest Russian oil and gas companies:

Intensification of activities in the development of new oil and gas regions, both in Russia and abroad;

Getting rid of inefficient deposits and focusing on the most profitable projects;

Grouping of projects according to territorial (regional), product and functional characteristics;

Intensification of work on LNG gas projects;

Intensification of work on transportation projects;

Intensification of financial and investment discipline.

It is necessary to note that some of the above mentioned areas are already being implemented by large companies in oil and gas industry. For example, Gazprom is seriously expanding in the foreign direction, implementing the following projects:

El-Assel project signed in 2008 between Gazprom and the Algerian National Agency for the Development of Hydrocarbon Resources ALNAFT. The share of Gazprom in the project is 49 %, Sonatrach is 51 % (Tegetaeva, 2016);

Bolivia project – Gazprom, together with YPFB and Total, is participating in a project for the exploration of hydrocarbon reserves in Bolivia, and for the development of hydrocarbons in the Asero, Ipati and Akio sections. The share of Gazprom in the project is 20 %, of Total is 50 %, of Tecpetrol is 20 %, of Yacimientos Petroliferos Fiscales Bolivianos (YPFB) – 10 % (Tegetaeva, 2016);

The creation of a joint venture of the Banatsky Dvor facility; Gazprom and Serbijagazom signed an agreement on the possibility of the development of cooperation in the field of underground gas storage, gas engine fuel and small-capacity LNG, including scientific and technical cooperation. Gazprom's share in the Serbian company is 56.15 %.

Determining the strategic priorities of the near future in the direction of Russian investments in gas industry, we believe that the LNG market should become one of the priority areas for Russian companies. It is necessary to note that today there are only two LNG plants in Russia: Sakhalin-2 project and Yamal LNG project.

References

- Investing (2019). Natural Gas Futures. Retrieved from: https://en.investing.com/commodities/natural-gas

- MinEcon RF. (2019). Forecast of the long-term socio-economic development of the Russian Federation for the period until 2030. Retrieved from http://economy.gov.ru/minec/activity/sections/macro/ prognoz/doc20131108_5

- MinEn RF. (2019). Production of natural and associated petroleum gas. Retrieved from https://minenergo.gov.ru/node/1215

- MinFin RF (2018). Execution of the federal budget and budgets of the budget system of the Russian Federation for 2017. Retrieved from https://www.minfin.ru/common/upload/library/2018/03/ main/Ipolnenie_federalnogo_budzheta.pdf

- NANGS (2019). National Association of Oil and Gas Services. BP: Statistical Review of World Energy-2019. Retrieved from https://nangs.org/analytics/bp-statistical-review-of-world-energy

- Rubaeva, L. M., & Tegetaeva, O. R. (2019). Features of inflationary processes in Russia. Econ. And Manag.: Probl. And Solut., 2(6), 36–41.

- Tegetaeva, O. R. (2016). World oil market: key players and strategic interests. World Economy in the 21st Century (pp. 85–92). Vladikavkaz: North Ossetian Univer. named after K.L. Khetagurova.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Ruslanovna, T. O., Maharbekovna, R. L., Vladimirovna, B. L., Ivanovna, S. I., & Kazbekovna, T. I. (2020). Prospects For Development Of Gas Industry In Russia Under The Crisis Conditions. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 3417-3425). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.454