Abstract

The article shows that one of the urgent problems of the assessment of modern cadastral valuation is to ensure its reliability, which allows maintaining a balance between property rights and fiscal interests of the state. In the course of the analysis, it was shown that the assessment of the cost of capital construction facilities is carried out by the base of the income and comparative approaches and requires the exclusion of the cost of land, which is included in the cost of analogues. The last aspect is convincingly shown on the basis of the analysis of the regulatory framework and the economic logic of real estate turnover. In case when the value of land from the results of the assessment is not excluded it leads to double counting and the overestimation of tax base. In the framework of this study, the basic methods of accounting for the value of land in the assessment of capital construction facilities are analyzed and structured. It is shown that the comparative sales method – the simplest and most often used by valuation officers – is not universal and does not provide due accuracy and reliability. Substantial attention is paid to practical aspects of the implementation of these methods. The results of the study are illustrated on the basis of the Tambov regional market. In addition, the authors made recommendations on the application of the proposed methods and determined the prospects and direction for further research.

Keywords: Cadastral valuationmarket valuecapital construction facilityland share

Introduction

The Russian Institute of Cadastral Valuation originates from Decree of the Government of the Russian Federation of August 25, 1999 N 945 “On State Cadastral Valuation of Lands”. Thus, in August 2019, it turned 20 years. The age is solid and, it would seem, that the main aspects of conducting a cadastral valuation, the practice of its application and even challenging should be proven over the years. However, in practice, everything is not so simple.

It is necessary to take into account that the cadastral valuation itself was conceived as a quasi-market or conditional market. The idea of transferring taxation on land and property taxes to the market base has been vital since the early 1990s. However, the problem of its technical implementation arose. Obviously, the volume of Russian real estate is huge (for example, in the Tambov region there are only one of seven categories of land plots of 550 thousand units), while owners themselves have no motivation to evaluate real estate at their own expense.

The cadastral value was the solution, which was originally implied as determined by the methods of mass (and in practice, statistically methods) valuation of the market value. In practical terms, it looks like this: the pricing factors that determine the market (and therefore the cadastral value) are identified; a statistical model is developed that includes significant pricing factors, its statistical significance is tested and the assessment is made.

In fact, the approach itself already initially implies the possibility of errors, since any statistical model has one or accuracy, that is, it cannot give 100% accuracy in all cases. Moreover, the situation has become quite typical when the cadastral value in a given region is overestimated, often several times (Fedotova & Grigoryev, 2014; Sutyagin & Bespalov, 2018).

In order for the owners to be able to protect their rights, the law described the dispute mechanism. Thus, the federal law of July 29, 1998, No. 135-FL, indicated two grounds for challenging cadastral value:

• Inaccuracy of information about the property used in the determination of its cadastral value;

• Determination of the market value of a property according to the date on which its cadastral value was established.

In practice, the vast majority of claims are carried out on a second basis.

For a long time, cadastral valuation was applied exclusively to land. However, Federal Law of 04.10.2014 N 284-FL “On Amending Articles 12 and 85 of Parts 1 and 2 of the Tax Code of the Russian Federation and invalidating the Law of the Russian Federation“ On Property Taxes of Individuals ”amended individual property tax. Hereinafter, the cadastral value has become the taxable base. Moreover, the same law amended the tax on property of organizations: now, in relation to certain types of real estate of an organization (mainly retail, office real estate and public catering facilities), the cadastral value should also be used as a tax base.

Problem Statement

The changes in the legislation of 2014 raised aggravated the problem. The fact is, in the case of the assessment of the structure (both within the framework of the cadastral value and market for the purposes of challenging), in fact, an artificial object is assessed – an object of capital construction, a building without land. However, the assessment itself is based on market data on sales of similar real estate, which is sold (which is quite natural) with land. In a similar situation, the problem of accounting (or, more precisely, isolating) the value of land arises. At the same time, there are several options in practice: a building with a formed land plot is assessed; a facility in a building is assessed as well as the area under which is formed; a facility in a building is assesses along with the area under which it is not formed, etc. Depending on whether the value of land is determined or not, the tax base can be significantly higher or lower.

Research Questions

The subject of the research is the features of existing methodological approaches of accounting for the value of land in a single property.

Purpose of the Study

The purpose of the study is to analyze existing methodological approaches to the assessment of the market value of land in a single property under the conditions of the lack of information on the quantitative and qualitative characteristics of the land under a property unit.

Research Methods

During the research the following general scientific research methods was used: analysis and synthesis, formal and logical methods. The important role in this study is given to statistical methods (including the method of grouping, sample observation, regression analysis, etc.), as well as specific methods of the assessment of property unit (comparative sales method, expert estimates, distribution method, etc.). Illustrations and examples are considered on the basis of the Tambov regional real estate market. Their direct use for practical purposes for other constituent entities of the Russian Federation requires consideration of the relevant regional specifics of the real estate market.

Findings

As it was mentioned above, the assessment of the market value of the capital construction facility requires a separate accounting of the value of land.

The fact is usually real estate assessment is performed using comparative and / or income approaches. The methodology of both approaches basically uses the prices of the sale or lease of a similar property. The only difference is that in the first case, the value of the property being assessed is derived directly from the prices of analogues. At that time, as in the second case, based on the analysis of analogue prices, the rental rate is first calculated and then it is capitalized (or, less commonly, discounted in case of non-standard cash flow).

In this regard, it is necessary to analyze what the prices of analogues “contains”. Here, two aspects should be considered: legal and economic. The first stems from the current regulatory framework; the second is from the logic of economic relations.

Let us start with the legal point of view. Thus, article 1, paragraph 5 of the Land Code of the Russian Federation establishes “the unity of the fate of land plots and objects tightly connected with them, according to which all objects tightly connected with land plots follow the fate of land plots, with the exception of cases established by federal laws”. Paragraph 1 of Article 35 of the Land Code of the Russian Federation establishes: “upon transfer of ownership of a building or structure located on a land plot to another person, it acquires the right to use the corresponding part of the land plot occupied by the building, structure and necessary for their use on the same conditions and to the same extent as their previous owner.

In case of transfer of ownership of a building to several owners, the procedure for using the land shall be determined taking into account the shares in the ownership of a building or the existing procedure for using the land.”

Then, it is indicated: “the alienation by a participant of shared ownership of the share in the right of ownership to a building or alienation by an owner of the parts of a building belonging to him shall be carried out together with the alienation of the share of these persons in the right of ownership to a land plot on which a building is located” .

A similar norm (although less detailed) is reflected in article 273 of the Civil Code of the Russian Federation.

A similar position is postulated in Paragraph 4, Part 1, Article 36 and Article 38 of the Housing Code of the Russian Federation: “when acquiring ownership of a building in an apartment building, the share in the right of common ownership of the common property in the apartment building passes to an acquirer.”

Moreover, the common property includes “the land on which this house is located, with elements of landscaping and other objects intended for the maintenance, operation and improvement of this house located on this land”.

Here we will pay attention to two aspects:

The indicated norm reflects the fact that the rights to a land plot (or rather, the rights to common shared property) are transferred when the premises are sold;

The specified norm does not specify that it applies to residential premises and, therefore, is identical to both residential and non-residential premises.

According to the meaning of the above norms, it follows that upon the sale of buildings, rights in common shared ownership of a building, as well as premises, rights to a land plot (rights in common shared ownership) are simultaneously transferred.

It is necessary to note that these standards are related not only to buildings, but also to premises. This is separately emphasized by the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of July 23, 2009 N 64 “On some issues of the practice of resolving disputes on the rights of owners of premises to the common property of a building”: “the right to common shared ownership of common property belongs to the owners of premises in the building by virtue of law regardless of its registration in the Unified State Register of the Real Estate Property and transactions with it”. Moreover, “when the ownership right to the premises is transferred to new owner, the share in the common ownership right to the common property of the building also passes regardless of whether there is an indication of this in the agreement on the alienation of the premises”.

In this regard it is necessary to say some words about the logic of economic relations. The simultaneous transfer of rights to a building (premises) and land is justified from an economic point of view.

Firstly, a construction is always firmly connected with land. This is obvious both from the physical fact and from the legal interpretation of the concept of “real estate” (for example, Article 130 of the Civil Code of the Russian Federation). In such a situation, the alienation of both elements seems logical at the same time.

Secondly, even in cases when during the alienation of a building (as well as parts of real estate and shares in it) the legal fact of transfer of rights to land (rights in common shared ownership) was not registered, an owner of a building receives the right to use the respective land (or share in it). Thus, article 271 of the Civil Code of the Russian Federation stipulates: “An owner of a building, construction or other real estate located on a land plot owned by another person has the right to use the land provided by such a person for this property. Upon transfer of ownership of the property located on another person’s land to another person, he acquires the right to use the respective land plot on the same conditions and in the same volume as the previous owner of the real estate.”

In the same manner, the norm of Paragraph 3 of Article 35 of the Land Code is formulated, according to which “an owner of a building located on another person’s land has the prerogative right to purchase or lease a land ...”

Essentially, the above mentioned aspects mean that upon the alienation of a building (in any form), its owner transfers the economic benefits of using the land on which such a building is located, even if the rights to land and their transfer are not properly executed.

Thus, during the alienation of a construction, its owner simultaneously transfers land legally and economically to a buyer, regardless of the fact that the transaction was completed in this part.

It is necessary to note that this can equally be applied not only to a comparative approach, but also to a profitable one. Since renting a property, an owner (lessor) in requires compensation for the costs of maintaining land in the form of rent (for example, as a rule in the structure of operating expenses land tax or rent for land are taken into account).

However, the following question arises: how to take into account the value of land? Indeed, since land is “located” in the value of a single real estate object (in analogues), and land and building objects are different objects of tax accounting, it is necessary to somehow exclude it. Otherwise, there is a danger of double counting and the tax base for land taxes will be overestimated (just the cost of the specified land).

The most obvious answer, and at the same time, is not the most universal: to evaluate land using comparative sales. In this sense, there is nothing new here, but there are certain problems.

The first thing – several real estate objects are located on land plot (especially if some of them are constructions that also require a certain area of land);

The second thing – the premises are evaluated and there is no information about the remaining premises and land plot;

The third – a land plot is not formed under a building (this happens all the time in relation to the "old" real estate).

In fact, this means that there is no land (or rather, its area is unknown). Sometimes it is possible to recommend forming it independently in the assessment process based on the current urban development standards and SNiPs. However, in practice this is also a dead end option, since often the development was carried out in violation of such norms, there is no land plot with a “normative” area under the building.

Finally, there is another problem (specific to the practicing validation officer) in the comparative sales method. Cadastral valuations are held at a retrospective date. In such a situation, it is not always possible to find a sufficient number of sales announcements (offers) to implement the comparative sales method. Moreover, given the retrospective date and close attention on the part of state bodies and the court to such estimates, it is not always possible to confirm all the pricing parameters. The last aspect can be “fatal” to assessment report in a lawsuit. It is necessary to note that paragraph 5 of Federal Valuation Standard No. 3 indicates that “the information provided in valuation report, which significantly affects the value of valuation subject, must be confirmed”. In practice, almost any announcement of the sale of land can be considered unreliable, because it does not contain all the information about the pricing factors of land, or such a site itself is not an analogue.

The second option requires justification of the value of the share of land in the cost of a single property. The indicated share can be obtained on the basis of empirical analysis of market data.

The calculation of the most probable share for the estimated object can be obtained using one of three ways:

Method of expert assessment;

Scoring method;

Regression Analysis Method

The source material for any option can be the data of Federal Agency for State Registration, Cadastre, and Cartography, as well as data from valuation companies (in connection with the challenging of cadastral value, a large volume of valuation reports has become available in the public domain).

Nowadays, a number of studies are devoted to the analysis of a typical share of a land plot in a single property (Demidova & Gorelikov, 2015; Gladkikh & Kuznetsova, 2015; Leifer, 2003; Morozova, 2015).

As a rule, in the above mentioned studies, the authors calculate a typical share of land in the market value of a single property, as well as the interval (confidence interval) in which it is included.

It is also necessary to note that the use of average ratings is usually incorrect, since each land is largely individual, and therefore, in each case, the proportion will shift “to the right” or “left” from the average.

This problem can be solved through expert evaluations or scoring methods. In the first case, the expert working with the range makes a judgment on the size of the share of land (Saati, 1993). Here, however, a specific difficulty for valuation officer arises, because according to paragraph 13 of the Federal valuation standard No. 3 “if the value determined by valuation opinion is used as the information significant for the value of the valued property, the analysis should be carried out in the valuation report for compliance with market data (if market information is available)”.

The scoring algorithm is well known and described, for example, in the work (Sutyagin, 2015). Conventionally, the sequence can be divided into several stages:

1.Determination of the range of uncertainty. In this case, we are talking about the range in which the share of land in a single property. We mentioned this above.

2. Determination of the list of factors that form the value of the share of the value of land. In fact, the work at this stage consists of two stages: firstly, the identification of factors determining the value of the share of land, and, secondly, their formulation. We draw attention to the fact that a single object consists of a land and a building.

The cost of each of these elements is characterized by a set of factors.

Factors affecting the value of a land plot include:

1. The relief of the land;

2. The configuration of the land;

3. Transport accessibility;

The main factors determining the value of the capital construction facility are:

1. Physical condition;

2. Quality finishes;

3. Building material;

4. Storeys;

5. Type of object

In the process of final formulation of the identified factors, it is important that they all are uniformly formalized, so that the increase in the value of each of them leads to a unidirectional change in the resulting parameter.

3. Determination of a point scale for the valuation of each factor. The choice of a scale for scoring is not of fundamental importance. More important is the determination of the step of the score (for example, one point), as well as the maximum and minimum achievable value of the assessment of each factor.

4. Assessment of the specific gravity of each factor. In practice, different factors have different weights. Moreover, empirically, it was noted that factors characterizing the value of the capital construction facility are more sensitive to the share of land plot. Moreover, it was noted that the most significant contribution to the share of land during the valuation of premises is made by such factors as “number of storeys”. When evaluating a building, the largest share falls on “physical condition”, “quality of decoration” (especially office and retail property), “Building material” (especially “industrial and warehouse real estate” and “transport accessibility”).

The influence of other factors is negligible. The assessment of the specific gravity of factors can be provided by one of the following methods:

Expert assessment;

Ranking of factors;

Analysis of hierarchies (11).

5. Scoring assessment of the value of each factor and a conclusion about the size of the share of land plot.

During the process of this assessment, each factor affecting the size of the share of land is subject to point digitization. Next, the sum of the scores (Bi) is calculated (as the sum of the scores of all factors). In the end, the total value of the share of the value of land (Di) is calculated.

In the case when the minimum score in the assessment of factors is not equal to zero, the calculation of the value of the factor attribute (Di) will be carried out according to the following formulas:

а) if there is a direct relationship between factors and the resulting pricing parameter, then the calculation model is:

(1)

а) if there is feedback between the factors and the resulting pricing parameter, the calculation formula is as follows:

(2)

where Бmax, Бmin, Бi – maximum, minimum possible, estimated number of points; Дmax, Дmin – the maximum and minimum possible value of the resulting parameter (share of land). It is necessary to note that the maximum and minimum number of points is set by the declared rating scale and the number of applied factors.

A completely different view is offered by regression analysis, although it takes the same initial informational basis. The general sequence of the method in this case is as follows:

1. Determination of the list of factors that form the value of the share of land. The issue of identifying a list of factors is described above.

2. Formation of the initial sample and its analysis for gross errors. As we have already said, in recent years, in connection with the challenging of cadastral value, a significant amount of public data has accumulated. Even more information is available to valuation firms. Unfortunately, the last source is not public.

It is necessary to take into account one more aspect: the generated sample should be checked for gross errors. As the dropout criteria, the “standard deviation rule”, the Grubbs, Smirnov-Grabbs, and Titien-Moore criteria can be used. The purpose of this test is to exclude atypical objects that distort the sampling.

3. The choice of the regression model and the derivation of the regression equation. Most often, alignment is based on a linear, less often on power function. It is necessary to take into account that in the first case, it implies the independence of factors, in the second – their mutual conditionality.

It is necessary to note that in practice, the quality of regression can be improved by the optimization of the numerical gradations of cost factor scores.

It is necessary to take into account that this calculation option looks more promising, although there are not many reliable studies in this direction (Topal & Baybarina, 2014).

Conclusion

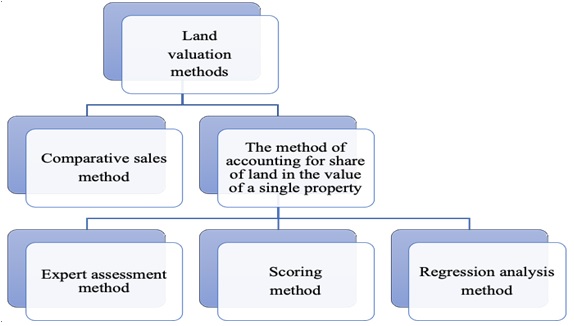

During the course of the research, it was shown that one of the most important problems of ensuring the reliability of the cadastral (and market in the case of its challenging) valuation is the accounting (or rather, exclusion) of the value of land. In the framework of this study, the structure of the land valuation methods that can be used was described (Figure

During the analysis, it was shown that the most promising methods are scoring and regression analysis. The article proposes the authored version of the scoring methodology for the valuation of the share of a land in the market value of a single property, successfully tested on the data of Tambov regional real estate market. In addition, it was found that the direction of regression analysis requires further research.

References

- Demidova, P. M., & Gorelikov, V. G. (2015). The influence of the share of the value of the land plot of a single property on the market value of the land of horticultural non-profit associations of the Leningrad Region. Notes of the Mining Instit., 3, 198–201.

- Fedotova, M. A., & Grigoryev, V. V. (2014). Cadastral value of real estate: 8 problems of challenging it and 8 measures to solve these problems. Property Relations in the Russ. Federat., 11(158), 40–45.

- Gladkikh, N. I., & Kuznetsova, V. V. (2015). Determining the share of the value of a land plot in the value of a single industrial and warehouse property in Chelyabinsk. Property value: evaluation and management. Mater. of the Seventh Int. Sci. and Methodol. Conf. Compiled by I.V. Kosorukova. Moscow: Moscow Financial and Industrial Univer. “Synergy”.

- Leifer, L. A. (2003). The share of land in the total value of a single property. Real estate valuation issues, 2.

- Morozova, E. V. (2015). On the issue of determining the share of a land plot in the value of a single real estate property. Issues of assessment, 3.

- Saati, T. (1993). Decision Making. Hierarchy Analysis Method. Moscow: Radio and Communicat.

- Sutyagin, V. Y. (2015). Notes on expert amendments. Property Relat. in the Russ. Federat., 4(163), 29–36.

- Sutyagin, V. Y., & Bespalov, M. V. (2018). Problems of reliability of cadastral valuation at the present stage. Account.Anal. Audit, 6, 73–80.

- Topal, E. G., & Baybarina, P. A. (2014). The share of land in the cost of a single property as a function of the utilization of the territory. Issues of assessment, 4, 38–53.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Yuryevich, S. V., Yuryevna, R. Y., Viktorovna, S. V., Aleksandrovna, S. A., & Nikolayevich, P. N. (2020). Challenging The Cadastral Valuation Of A Capital Construction Facility: Land Accounting. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 3401-3409). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.452