Abstract

The logistics service market is one of the priority areas of the domestic economy development. Globalization of world commodity markets leads to increased demand for transport and logistics services and develops new methods of reducing the cost of transporting products. The relevance of the logistics service market development is due to the activities of logistics providers in the context of globalization of the global economy and the increasing role of international organizations signing free trade zones. The volume of world exports in 2018 amounted to 19.228 trillion. dollars and grew by 8.5 % compared to 2017 (17.727 trillion dollars), and the volume of GDP of all countries in the world reached 125.2 trillion. dollars, which indicates that exported goods account for 14.2 % of global GDP. Despite the enormous potential and demand, the Russian logistics services market is developing slowly. It depends on issues such as the costs of implementing digital technologies and logistics innovations, insufficient information flow for the efficiency of logistics processes, and the training of qualified personnel for the logistics business. We believe that one of the effective directions of the development of the logistics service market is logistics outsourcing, which is the process of transferring business processes – transportation, warehousing – to third parties using third-party resources. To provide logistics outsourcing services in the logistics service market, it is necessary to have logistics providers, which are classified according to the range of logistics services provided: 1PL-operator, 2PL-operator, 3PL-operator, 4PL-operator, 5PL-operator.

Keywords: Logisticslogistics servicelogistics outsourcinglogistics providerglobalization

Introduction

According to experts, the growth of the logistics services market is 18-20% per year (Lukinsky, Lukinsky, & Pletneva, 2019). The Russian market of logistics service has both domestic companies such as PEK, SDEK, GlavDostavka, DA-TRANS, TC YugTransLogistic, TEK Gruzovoye Voyage, SOGRUZ, GK ITEKO, TRASCO, etc., which make up the “gold” hundred »of the best logistics companies, as well as foreign companies with vast experience in the implementation of logistics activities.

In modern conditions, enterprises prefer to transfer part of the logistic business processes to third-party organizations – to an outsourcer, which are classified according to the range of logistics services provided: 1PL-operator, 2PL-operator, 3PL-operator, 4PL-operator, 5PL-operator with the necessary resources, including the availability of qualified personnel, digital technologies and automated warehouse complexes.

For enterprises, logistics outsourcing is a tool to reduce logistics costs, to ensure efficient logistics services and to ensure the company's competitive advantages and price competition, as well as to satisfy consumer demand.

According to that information, the logistics outsourcing is considered as the process of transferring business processes (transportation, warehousing) to third parties using third-party resources.

The main reasons for using logistics outsourcing include:

Lack of logistic knowledge for the effective provision of logistic activities.

The increasing role of transport enterprises between the manufacturer and the supplier.

Reducing time costs in the process of transferring auxiliary logistics functions to an outsourcer.

Achieving a synergistic effect in the process of logistics activities.

The provision of a full range of logistics services, using other people's resources, in order to reduce logistics costs.

According to Sergeev (2019), logistics contractors (intermediaries) include companies that provide logistics services on the principles of outsourcing, including freight forwarders, carriers, warehouse operators, freight terminals, customs brokers, insurance companies, etc.

Problem Statement

In modern conditions, the transport and logistics system of the Russian Federation shows low efficiency as Russian companies underestimate the role of logistics in the effective development of a business. In foreign countries, logistics is one of the leading business integration tools, unlike Russian business, which perceives logistics only as a tool for delivering products from A point to B point.

The study suggests range of problems the Russian logistics service market faces.

First of all, the lack of the required number of logistics providers performing the entire range of logistics services. The role of logistics providers is limited to transportation and storage of products.

Secondly, an increase in demand for qualified personnel in the field of logistics, accompanied by a shortage of personnel. Here it is necessary to highlight two important points. The first – older people educated in Soviet times do not have the necessary skills to work in conditions of increasing competition. The second point – there are people from related areas without specialized education dealing with the logistics service. So, for example, in an attempt to make up for the shortage of personnel, entrepreneurs attract people with education in marketing. At such enterprises, logistics is not given close attention, and instead of creating logistics services, entrepreneurs leave it in the competence of other departments.

Thirdly, the share of outsourcing of transport and logistics services in Russia amounts only 20 %, while the global average is 50 % (Volkov et al., 2014). Outsourcing involves such logistics operations as transportation, warehousing, packaging, procurement and inventory management. By 2024, growth in the transport and logistics service market is expected to increase by 15 % (Volkov et al., 2014) It depends on increase in the share of outsourcing of transport and logistics services, an increase in the share of multimodal transportation and an increase in the share transportation of goods with high added value in the total volume of cargo transportation in Russia.

In the world ranking of the Logistics Performance Index 2018, Russia ranked 75th out of 160 in terms of the efficiency of logistics development (Table

Germany ranked first in the ranking in terms of logistics efficiency. It has the largest logistics service market amounting 25 % of the European market for logistics services, in which the largest expense item is transport – 45 %. The second is Sweden, Belgium is listed the last in the top three.

After the United States and the European Union, China is given the third place in terms of the market of transport and logistics services, while logistics outsourcing accounts for more than 57% of total transport and logistics costs.

Today, the European logistics service market is one of the fastest growing market with a direct impact on the socio-economic development of countries.

The European logistics service market demonstrates the interest of logistics operators in long-term partnerships with customers, which implies the presence of liability of logistics companies for possible risks. When signing the long-term contracts one should mention the presence of competitive advantages, the quality and transparency of actions, the introduction of digital technologies in order to increase the efficiency of logistics activities, the formation of a positive image in the logistics services market, and the experience in carrying out logistics activities in the regional market.

The experience of foreign countries need to be applied into our country to increase the efficiency of the Russian logistics service market. For example, the introduction of automatic construction systems for optimal delivery routes in order to reduce the cost of the fleet and timely delivery of products; staff training on international standards, as well as the use of information technology for the effectiveness of logistics processes, including a supply chain management system and a warehouse management system.

Research Questions

The Russian market of logistics services is divided into transportation and freight according to various means of transport; storage services; supply chain integration and management services.

There is 302 thousand m2 of warehouse space commissioned in 2018. The largest warehouse logistics facilities were put into operation:

Yaroslavl (distribution center of X5 Retail Group – 34 thousand m 2);

Kazan (the Russian Post logistics center – 36 thousand square meters and the ETM retail and warehouse complex – 22.5 thousand square meters);

Voronezh (warehouse complex “AVS-Electro” – 35 thousand m 2);

Yekaterinburg – (Monetka distribution center – 34 thousand m 2);

Samara (warehouse complex “Pridorozhniy” – 26 thousand m 2).

The area of storage facilities in the Chechen Republic is about 20 thousand square meters (Tasueva & Israilov, 2013).

The retail market has priority in the formation of demand for high-quality warehouse space. In 2018, the total volume of regional transactions by retail operators amounted to 50 % or 111 thousand m2.

Thus, we can state that an increase in consumer demand leads to an increase in demand for transport and logistics services.

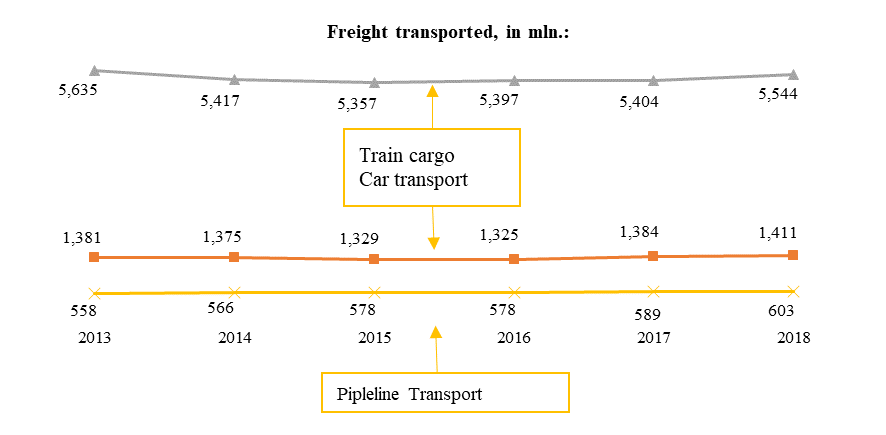

The main mode of transport for the carriage of goods remains road transport. It accounts for a large share in the carriage of goods (Figure

The pipeline transport accounts for the largest share in the structure of Russia's cargo turnover in 2018 – 2,668 billion tons-km (Table

In 2018, the volume of cargo transportation (tonnage of goods transported) in Russia amounted to 8.3 billion tons.

According to M.A. Research, Business Lines remain the largest player in the transport and logistics service market in Russia, followed by PEC, closes the Globaltruck three (Goryachev, 2019). One should note that the aggregate turnover of the Russian freight forwarding service market is expected to reach 4.12 trillion. rub. by 2022 (Goryachev, 2019).

Supporting the idea of Lukinsky et al. (2019).the study suggests the Russian market is in its infancy and some trends can be identified in its development: globalization of the activities of logistics operators, consolidation of the activities of logistics operators, consolidation and consolidation of logistics companies in the field of container transportation.

Purpose of the Study

The formation of the logistics service market is aims to be effective and competitive. Therefore, it is necessary to mention the causes of the logistics service market and its ultimate goal. The provision of integrated logistics services by logistics providers is aimed at meeting the needs of customers with high quality logistics services. This will allow the outsourcer to take a leading position in the logistics service market, create the image of a reliable partner and contribute to the further development of the company.

Another important goal of the market of logistics services is the prompt provision of logistics services with minimal time and logistics costs, using all the logistics methods on the way from the transfer of services to outsourcing companies for their full implementation. This goal may be achieved by training qualified personnel, who will expand the market for logistics services on the Asian continent, increase the volume of cargo transportation with Asian countries, provide customs escort of goods before delivery to the final consumer, and also help eliminate barriers in Russian legislation (Higgins, Ferguson, & Kanaroglou, 2012).

Along with this, the logistics service market is characterized by high entry barriers. The logistics infrastructure is the main tool to achieve this goal. For example, most logistics operators start their activities with 2PL, which requires the availability of storage facilities. The next level – 3PL requires not only warehousing capacities, but also the ability to provide international transportation, solve customs problems, have containers and attract investment in the development of digital technologies.

The development of the logistics service market may not be reached without reducing logistics costs, which are crucial in the establishment of outsourcing of logistics companies. As well as attracting customers by improving logistics services and reducing logistics costs helps to improve the quality of logistics services.

According to the study, the priority goal of the development of the logistics service market is the desire to reduce total costs in business processes by minimizing the risk of possible losses in the implementation of logistics activities (Tasueva, 2013).

Research Methods

The development of the logistics services market aims to provide a full range of services, including warehousing, transportation of goods, customs security, optimization of business processes, improving forms of business management, organization, management and control of supply chains. In this regard, the effective provision of logistics services enhances the competitiveness of enterprises, the development of new markets for the provision of logistics services and the development of logistics strategies for companies (Colman, 2016). At the same time, digital technologies have a great influence on the formation of the market for logistics services, except for logistics providers, specialists and outsourcers. Therefore, there is a great attention paid to the development and implementation of unmanned systems. According to experts, by 2050, the economy of the EU countries from the introduction of unmanned vehicles will amount to 17 trillion. euros, and US operating companies will save up to 190 billion dollars a year.

The process of establishing a logistics services market is accompanied by various risks: uncertainty in the market environment, low level of organization of interfunctional relationships and the conflicts frequency (Tasueva, 2013).

The main tasks of establishing a logistics services market include: optimization of economic flows accompanying business processes, cost reduction in order to maximize the system-wide effect; streamlining operations related to the organization of logistics activities (Tasueva, 2013).

Thus, to solve the problems of the formation of the logistics industry, it is necessary to apply a systematic approach that will allow us to derive a criterion in order to analyze the activities of the entities in the logistics service market and solve the appearing problems.

Findings

The development of the logistics service market makes logistics companies to improve the quality and efficiency of logistics services in the supply chain, especially in the context of growing digitalization. In other words, the formation of a logistics service market will result in increased competitive advantages for enterprises, coverage of Asian markets for the provision of logistics services, and improved logistics performance (Huws, 2014).

Consideration of logistics through the prism of the provision of logistics services allowed not only to identify the main problems of the logistics services market, but also the reasons for using logistics outsourcing. In modern conditions, the market of logistics services in Russia is still developing slowly and not all regions have logistics providers that provide a full range of logistics services.

We believe that the logistics services market is a collection of facilities that provide a range of logistics services on a long-term partnership between the manufacturer and the logistics providers.

Conclusion

Based on the findings, the main logistics services in the market are known transportation, warehousing, customs clearance. Freight services are particularly in demand. One should note note that not all logistics operators provide a full range of logistics services, so this issue needs to be taken into account. In addition, entry barriers to the logistics services market are very high and requires investment. The transition from one provider level to another is also has a number of problems, as the lack of the necessary amount of financial resources in order to rent storage facilities and the corresponding infrastructure.

References

- Colman, A. M. (2016). Game Theory and Experimental Games: The Study of Strategic Interaction. Oxford, UK: Pergamon.

- Goryachev, S. (2019). Improving the quality of the road network will spur the development of the freight transportation market. Retrieved from https://regnum.ru/news/economy/ 2713304.html/

- Higgins, C. D., Ferguson, M., & Kanaroglou, P. S. (2012). Varieties of logistics centers: Developing standardized typology and hierarchy. Transportation research record, 2288(1), 9-18. https://doi.org/10.3141/2288-02

- Huws, U. (2014). Labor in the Global Digital Economy: The Cybertariat Comes of Age. New York, NY: NYUPress.

- Lukinsky, V. S., Lukinsky, V. V., & Pletneva, N. G. (2019). Logistics and supply chain management: a textbook and workshop for academic undergraduate studies. Moscow: Yurayt Publishing House.

- Sergeev, V. I. (2019). Supply Chain Management: a textbook for undergraduate and graduate programs. Moscow: Yurayt Publishing House.

- Tasueva, T. S. (2013). To the question of the goals and objectives of warehouse logistics of innovative service type. Basic res., 4(4), 955–958.

- Tasueva, T. S., & Israilov, M. V. (2013). Key elements of warehouse logistics in the region of innovation and service type. Economic Sciences, 3(100), 92–95

- Volkov, M., Dunaev, O., Yezhov, D., Pamukhin, V., Perapechka, S., Rubin, G., & Timofeev, A. (2014). Logistics in Russia: new ways of unlocking potential. Retrieved from http://image-src.bcg.com/ Images/Logistics-in-Russia_tcm27-166353.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Khasanovna, R. B. (2020). Russian Logistics Service Market: Problems And Development Trends. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 3274-3280). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.435