Abstract

The article is devoted to the disclosure of the criteria of public utility under resource constraints by assessing the effectiveness of state budget expenditures. The purpose of the article is linked to its relevance and is determined by the role and functions of the state in the market economy: to provide society with a set of public goods determined by public choice. The article describes the current system of budget expenditures formation, based on measuring the degree of satisfaction with the use of budget resources in the form of public and private products through the apparatus of utility functions, and although in Russian practice there are no reliable methods for determining them, there is no reason to abandon this generally accepted research tool, as well as substantiates common problems and causes of inefficiency in the use of budgetary resources and determines the influence of the factor of public utility that produces the effectiveness of budget expenditures and allows for detailed analysis and a proper assessment. This study identifies the key problems of improving the efficiency of budget expenditures and the basic principles and approaches to assessing their effectiveness in the production of public goods. It is concluded that costs are determined by the amount of budget expenditures on the production and consumption of public goods and the level of negative social consequences, and this dependence is shown through the use of econometric methods of analysis.

Keywords: Budgetpublic utilitypublic goodsefficiencybudget expenditures

Introduction

The criterion for maximizing public utility under resource constraints is an integral criterion for assessing the effectiveness of state budget expenditures. The validation of this approach is due to the role and functions of the state in the market economy: the state is obliged to provide society with a set of public goods determined by public choice (Alklychev & Zoidov, 2017a).

In modern scientific studies on the public utility of budget expenditures, the model of the economy fully controlled by the government is taken as a basis (Atkinson & Stiglitz, 1995; Demidenko, Babkin, & Kudryavtseva, 2009). It is assumed that in the formation of budget expenditures, the government is guided by the accepted amount of expenditure of the public product G and the distribution of private products for each economy Hj (j=1,..., m).

Problem Statement

To measure the degree of satisfaction with the use of budgetary resources in the form of public and private products, the apparatus of utility functions is traditionally used in economic theory, and although in Russian practice there are no reliable methods for determining them, there is no reason to abandon this generally accepted research tool (Abdulgalimov et al., 2019).

We define the individual utility function of each economy, representing it

Concerning this function, it is assumed that it is continuous and twice differentiable (the first derivative is positive, the second is negative, which reflects the nature of "decreasing growth").

Suppose also that the social utility function is the sum of individual functions:

(1)

We also define the transformation function, reflecting the production capabilities of society:

(2)

where – the production functions connecting the number of produced individual and public products with the stock A of the production resource available in society. With this representation of the transformation function, the number of individual and social products produced in society will be on the line of production capabilities.

The distribution of private products maximizing public utility under given transformation conditions can be found using the Lagrange function:

(3)

where – Lagrange multiplier.

To solve the problem, we formulate a first-order condition:

(4)

Research Questions

As it is known from economic theory, the production and distribution of private products are Pareto-efficient if the marginal substitution rates of any pair of these products are the same for all consumer economies and equal to the marginal rate of product transformation in the production of these products. The same rule is true for determining the efficiency of the production of public products:

Let the economy produce two types of private products and one social product, and also there are two economies consuming these products. The distribution and production of private products is presented in table

For this case, based on the accepted assumptions, the Lagrange function and its optimization conditions are defined as follows:

(5)

Hereinafter (6),(7),(8), (9),(10)

From conditions (6)–(8) and (7)–(9) optimization conditions for individual products are obtained:

(11), (12)

Dividing each element of condition (10) into expressions (11) and (12), we obtain the conditions of individual products substitution by public ones for individual product 1:

(13)

and for individual product 2:

(14)

Conditions (13) and (14) show that in the production and distribution of resources and products corresponding to the optimal or Pareto-efficient budget plan, the sum of the marginal norms of individual products substitution by public ones is equal to the marginal norm of the production transformation of these products (Knysh, 2003).

Purpose of the Study

From the conditions presented above, it can also be seen that the marginal norms of mutual substitution of individual products, which under the “usual” equilibrium (the so-called Cournot-Nash equilibrium) are equal to the marginal norms of the industrial transformation of these products, in the presence of public products are less by the sum of the marginal substitution norms by public ones. This is obvious, since each consumer uses public products instead of a part of individual ones, and the need for private products decreases. However, in the context of limited resources, the expansion of public goods production leads to a decrease in private goods production, which in practice is expressed in the expansion of the public sector, absorbing resources. In these conditions, the problem of determining the efficiency of the budget resources use is relevant (Alklychev & Zoidov, 2017b).

As indicators of assessing the distribution effectiveness and use of budgetary funds can be used marginal norms for the private and public products substitution in the budget plan. The normative estimates for them can be the optimal norms of substitution and production transformation of products, presented in formulas (13)–(14).

Measuring the individual utility of public goods is a technically challenging problem of collecting and processing information. The use of marginal norms of industrial transformation in the formation of an optimal production plan of public goods greatly simplifies the task and puts it in the task area of organizing the efficient production of public goods (Abdulgalimov & Arsakhanova, 2019).

The efficiency of budget expenditures without taking into account their external action can be achieved through the optimal use of resources for the production of public products. In this regard, the problem of determining the criteria for assessing the efficiency of production and consumption of public goods to justify the goals, directions and amounts of budget expenditures is urgent.

State budget expenditures are the costs incurred by the society as a result of production and distribution of all public goods and services, the list of which is determined by the priorities of state policy. The amount of budget expenditures for the purchase of public goods and services, as a result of budgetary and political processes, depends on the amount of resources available to society, and the ability of society to transform these resources into public goods (Tavbulatova, Tashtamirov, Kulakova, & Nazaeva, 2019).

Traditionally, budget resources are understood as monetary resources that are directly managed by the state. These monetary resources include revenues from the operation of state property and its sale, as well as part of the gross public product in monetary terms, redistributed through the budget, the main source of which is tax revenue (Alklychev & Zoidov, 2017c).

In our opinion, such a narrow interpretation of the budgetary resources concept does not correspond to the socio-economic problems currently facing the state, and does not meet modern economic realities. To overcome the limitations of the traditional interpretation, it is proposed to expand the concept of budgetary resources, including the following elements along with monetary resources:

material resources, the amount of which depends on the provision degree of society with natural resources, development of infrastructure and sectors of the national economy;

human resources, which can be assessed as the intellectual potential accumulated by society, determining the level of labor productivity in the public sector;

institutional and organizational resources, determined by the degree of socio-economic institutions effectiveness, such as political, legal, judicial systems, etc., providing public choice, institutions of state contracting, licensing and certification, etc.

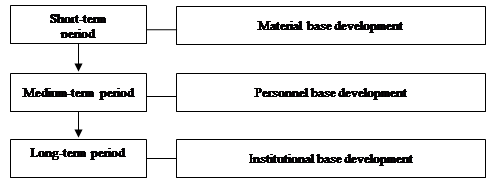

These elements of budget resources are characterized by different periods of formation, use and recovery (Figure

It should be noted that the influence of the above elements of budgetary resources on the results of budgetary expenditures is manifested through performance indicators of using the funds allocated to achieve results or through the coefficient of transformation of funds into results. The material base of the society is an essential condition for the implementation of the processes of using both monetary and other budgetary resources. The personnel base as a set of civil servants involved in the use of budget resources is developing due to the increase in the human capital of society. The institutional base, that is, the set of norms and rules that governs public servants, develops in the process of using material and human resources to provide budgetary services to society as a whole and to individual consumer groups.

Budgetary resources have a dual nature. On the one hand, being limited, they constitute a potential base for generating income of the state, economic entities and the population, providing an increase in available resources, and the wider this base, the greater the amount of public goods can be produced on its basis. On the other hand, the involvement of budgetary resources in the process of generating revenues is their expenditure, that is, a decrease associated with uncertain future results and risk.

The target point for the efficient use of social resources for the production, distribution and consumption of public goods is to obtain maximum results at minimum costs. The results include the receipt by the society of public goods of satisfactory quality in the desired volumes and the achievement of positive social effects, such as reducing unemployment, increasing the level of income, improving the quality and availability of educational and health services, etc. Costs are determined by the amount of budget expenditures on the production and consumption of public goods and the level of negative social consequences.

Figure

The efficiency of budget expenditures

,

where

– the volume of production and consumption of the public good

The amount of budgetary expenditures necessary to achieve a result in the form of a given number of produced public goods is determined by the efficiency of using different types of budgetary resources, including material, human and institutional.

The efficiency of the resources use for public goods production is determined by the efficiency and productivity of the transformation process (Atkinson & Stiglitz, 1995).

Research Methods

This study used general scientific research methods such as analysis and synthesis, description, comparison. An important part of the study was the structural and logical method, system analysis and spatial approach, which allowed identifying and analyzing the effectiveness of the budget resources use for the production of public goods, to establish specific features and characteristics of economic development both within and around the macro-region, to characterize the features of subjects localization and the level of their economic development. The method of structural analysis helps to determine the impact of individual elements of budget resources on the results of budget expenditures. Statistical and econometric methods of analysis made it possible to establish the interdependence of indicators, which is manifested through efficiency indicators of use of monetary resources allocated to achieve results or through the transformation coefficient of monetary resources into results.

Findings

Effectiveness (Ec) characterizes the amount of a resource of type n allocated to achieve the result per unit of actually spent resource of this type. The effectiveness of using a resource of type n is equal to:

,

where Smn – the amount of resource of the n-th type allocated to achieve the result in the direction m.

Effectiveness is achieved when the actually spent amount of the resource is less than the allocated amount. The allocated amount of resources is actually a measure of the maximum amount of the type n resource, which society is willing to spend in order to obtain the desired result.

However, effectiveness does not reflect the degree of the result achievement; for this purpose, a performance indicator (Pd) is used, which shows the amount of received public goods per unit of the allocated resource. The higher the performance level of resources, the more efficient their use. The productivity of the n-th type resource, aimed at the production of a certain volume of public good of the m-th type, is equal to:

The economic interconnection of effectiveness indicators, efficiency and productivity is described by a two-factor multiplicative model:

Conclusion

Thus, the efficiency of budget expenditures is achieved through the economical use of resources and increasing their productivity.

The quantitative assessment of effectiveness indicators of budget expenditures is complicated by the complexity of measuring and converting to a comparable form the non-monetary elements of resources spent in the production of public goods and services. It should be noted that the practical application of the proposed indicators to assess social effects requires the development of reliable methods for measuring these effects.

The results of budget expenditures are largely determined by the level of development and the state of socio-economic institutions involved as a resource in the process of transforming the allocated monetary resources into desired results. This applies not only directly to the production of public goods, but also to the scale of positive and negative social effects of an external nature associated with the production of these goods. The effectiveness of socio-economic institutions involved in the allocation and use of budgetary resources of all kinds determines the effectiveness of ways to achieve the desired results.

References

- Abdulgalimov, A. M., & Arsakhanova, Z. A. (2019). Development of foreign trade turnover as a factor of economic grouth in Caucasus. European Proceedings of Social & Behavioural Sciences, 58, 2734–2743. https://doi.org/10.15405/epsbs.2019.03.02.319

- Abdulgalimov, A. M., Arsakhanova, Z. A., Filina, M. A., & Akhmedova, Z. A. (2019). Methodological problems in additional cost taxation in Russian economics. European Proceedings of Social & Behavioural Sciences, 58, 2726–2733. https://doi.org/10.15405/epsbs.2019.03.02.318

- Alklychev, A. M., & Zoidov K. K. (2017a). The price of institutional resources and efficiency of investments in the production of public goods. Coll. of articles of Int. sci.-pract. Conf. Financial mechanisms of acyclic regulation of structural disproportions in the economy of Russia and other CIS countries (pp. 138–145). Moscow.

- Alklychev, A. M., & Zoidov, K. K. (2017b). Budget resources and the criterion of public utility in assessing the effectiveness of budget expenditures. Coll. of articles of the Int. sci. and pract. Conf. Results of market reforms and the future of Russia, dedicated to the 80th anniversary of academician N.Ya. Petrakov (pp. 81–90). Moscow.

- Alklychev, A. M., & Zoidov, K. K. (2017c). Principles and approaches to assessing the effectiveness of budget expenditures for the production of public goods. Coll. of articles of the Int. sci. and pract. Conf. Results of market reforms and the future of Russia", dedicated to the 80th anniversary of academician N.Ya. Petrakov (pp. 90–99). Moscow.

- Atkinson, E. B., & Stiglitz, J. Y. (1995). Lectures on Public Economics. Moscow: Aspect-Press.

- Demidenko, D. S., Babkin, A. V., & Kudryavtseva, T. Y. (2009). Theoretical aspects of evaluating social-economic efficiency of investments in public services. St. Petersburg Polytech. Univer. J., 3, 255–261.

- Knysh, V. A. (2003). Marketing concept of government order management. St. Petersburg: SPbPU publ. house.

- Tavbulatova, Z. K., Tashtamirov, M. R., Kulakova, N., & Nazaeva, M. I. (2019). Peculiarities of inter-budgetary equalization in Russia. European Proceedings of Social & Behavioural Sciences, 58, 1655–1662. https://doi.org/10.15405/epsbs.2019.03.02.192

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Magomedovich, A. A., Hodzhievicy, Z. K., Mayramovna, D. Z., Viktorovna, D. F., & Igorevna, D. N. (2020). Budget Resources In The Context Of Efficiency Of Budget Expenditures. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 2829-2836). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.374