Abstract

The article considers the processes of formation, functioning features and development prospects of market infrastructure in the regions of the Russian Federation as a goal-setting activity of the state and its entities in the market processes activation in the territories. In the process of studying the concept of market infrastructure of the region, the author defines it as a set of general conditions for the regional market functioning. Furthermore, the imbalances of regional economic development in the constituent entities of the Russian Federation are determined not only by differences in the economic potential of the territories but also by the underdevelopment of their market infrastructures. The legal basis of regulation assumes that regulatory methods at the regional level must comply with the laws of the Russian Federation and, accordingly, can be the basis of regional long-term forecasts and strategies for socio-economic development, targeted regional programs, and be used as an assessment and analytical tools The Chechen Republic, like any regional system, is characterized, along with the general development parameters, by a certain degree of uniqueness. Taking into account such factors, at the level of the republic, it is advisable to develop and adopt local legal provisions (corresponding to the laws of the Russian Federation) that would ensure the formation of a mechanism for the interaction of market infrastructure entities, that is, the creation of a single management system in the region from the existing individual elements of the legal mechanism.

Keywords: Market infrastructureinstitutionsregulation mechanismsmarket processes

Introduction

For the normal development of all sectors of the market economy, certain external conditions are required that constitute auxiliary functions in social reproduction (Abdulgalimov & Arsakhanova, 2019). The creation of such external auxiliary conditions for the functioning of economic entities is also carried out by a separate sphere of the economy, which is called infrastructure in the economic literature.

In an independent sphere of the economy, infrastructure has evolved from material production in the process of deepening the social division of labor and the growing need to ensure its external conditions.

Further expansion of its scope occurs in the course of separation of production services in specialized forms. Infrastructure sectors produce services rather than material products, so according to some authors, infrastructure is part of the service sector. However, other researchers propose to consider infrastructure as the "frame" and "foundation" of the economy.

Different subsystems of infrastructure do not exist separately from each other, they intertwine, interact and complement each other, thus allocating infrastructure in an independent sphere of economy. Spontaneously created market infrastructure in Russia only partially reflects the needs of the subjects of market relations and requires theoretical understanding and practical recommendations for its improvement, which allows predicting its further development (Gadzhieva, 2011).

Problem Statement

The peculiarity of this study is the definition of the market infrastructure concept, the basic principles of its formation and its main functions at the present stage of economic development of the Russian Federation regions. In our opinion, market infrastructure can be represented as a set of market institutions providing interaction and the presence of "feedback" between production and consumption and contributing to the sustainable development of the market system (Zoidov & Alklychev, 2017). In this definition, market institutions should be understood not only as the rules by which business entities interact with each other and carry out economic activities, but also as a set of organizations that formally implement these rules and behavioural procedures in practice.

The state participation in the creation of market institutions remains a controversial issue. Influential liberal doctrines in the West justify the point of view that market institutions arise independently, without government involvement, as a product of coordination the interests of independent economic entities (Timoshenko, 2014). So, for example, in Russia at the turn of the 80s and 90s commodity exchanges began to appear, when, in the context of liberalization of prices and trade, enterprises had a need for intermediaries capable of bringing sellers and buyers of certain goods together.

Economic theory states that demand always generates supply, in response to the emergence of a need always appears organizations or individuals ready to meet this need.

Thus, in response to a social need for an institution, economic agents necessarily create such an institution, and without any coercion.

However, in our opinion, the process of institutional development cannot proceed absolutely spontaneously and requires the participation of the state, because socially inappropriate institutions may arise and exist (as was confirmed by the experience of our country development in the late 80s-90s). The state should authorize socially reasonable self-emerging institutions by creating an appropriate legislative framework and monitoring compliance with laws (Alklychev, 2017).

Research Questions

The issue of the need to allocate market infrastructure as a relatively independent subsystem of the economy began to be considered in Western literature during the economic crisis of the 70s of the XIX century. Then the discrepancy problem of market circulation of goods system to the needs of the products sale sounded especially acute. The aggravation of products sales problem led to an increased interest of economists in the study of market problems, a number of proposals appeared on the reorganization of both the sphere of circulation in general and its separate elements, as well as on the creation of various market structures serving the goods distribution processes, which subsequently formed into a developed system of market infrastructure. However, despite such close attention to the problem of the market infrastructure development, it can be stated that a unified methodological approach to the subject and object of research has not been formed yet.

Based on the subject of the study, the following basic definitions of market infrastructure can be distinguished. Market infrastructure – a set of general conditions for the functioning of the market. This approach has developed in the framework of the concept of overhead costs. Within the framework of the distribution concept, the main attention is paid to the rules for the movement of goods flows in the sphere of circulation and their rationalization in terms of production and consumption.

Purpose of the Study

At present we can distinguish the concept of market infrastructure as a set of general conditions for the functioning of the market. Our goal – from the many definitions of the subject and composition of market infrastructure, which is explained by the lack of a unified methodological apparatus for studying this concept, as well as the underdevelopment of the institutional and legislative bases of market infrastructure, give our own vision of the problem, clarify the concept of the category “market infrastructure” from the standpoint of the current state of the economy in the regions of the Russian Federation, show its difference from the category "infrastructure of the market".

For domestic economic literature, the concept of market infrastructure begins with the emergence of market relations in the Russian Federation, because in the administrative and bureaucratic system of management that existed for a long time in the USSR, the functions of market infrastructure were performed with the help of such distribution bodies as the Gosplan (State Planning Committee), State Logistics Committee, sectoral ministries and departments, and their subdivisions. The transition to a market economy that emerged in the late 80s required the formation of both a new management system as a whole and a market infrastructure, designed to replace the existing administrative and distribution relations. During these years, domestic economists started talking about the reasonability of distinguishing market infrastructure as an independent subsystem serving processes in the sphere of circulation, along with production, social, and environmental infrastructures, which at that time had already received a sufficiently detailed consideration.

Since the beginning of the 90s, a lot of works of domestic authors appeared, devoted to the study of the essence of the market infrastructure concept. In our opinion, there are three main directions in the general flow of all definitions of market infrastructure (Salogubov, 2011).

The first direction is based on a distribution concept and considers market infrastructure as a combination of industries and fields of activity.

The second direction is closely related to the institutional concept and interprets the market infrastructure as a set of enterprises, institutions and organizations that provide effective interaction between the main subjects of market relations – sellers and buyers.

The third group of definitions is based on the logistics concept and market infrastructure is understood as a set of technical means and equipment that ensure market processes.

There are various points of view regarding the composition of market infrastructure. Some authors include only trade and intermediary organizations and thus reduce the concept of market infrastructures simply to the infrastructure of commodity markets.

Some authors supplement this composition also with a system of state regulation of the economy or elements of social infrastructure.

Other researchers in their works often identify the concepts of "market infrastructure" and "infrastructure of the market". Despite the obvious similarity of these categories, in our opinion, the category "infrastructure of the market" implies the presence of institutions serving certain types of markets or economic relations that develop in a particular type of market (food markets, financial markets, labor markets, etc.).

Research Methods

The study used general scientific research methods, such as analysis and synthesis, description, comparison. General scientific methods and methods of system and comparative analysis, empirical research (observation, comparison, collection and study of data), current, logical, prospective analysis and synthesis of theoretical and practical material were used in the research process. In the process of studying the concept of market infrastructure of the region, the author defines it as a set of general conditions for the regional market functioning. An important part of the study was the structural-logical method, system analysis and spatial approach.

Findings

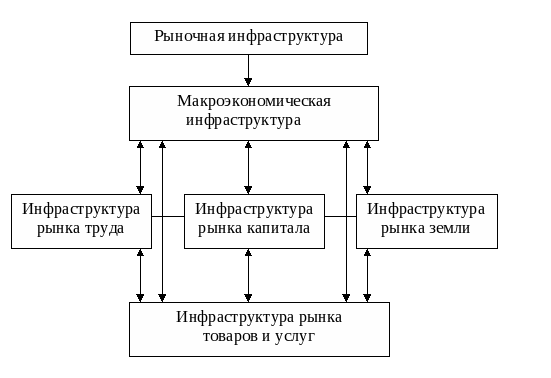

The analysis of the concepts proposed by various authors allows us to present the market infrastructure in the most general form as a complex organizational and economic system, where the constituent elements are the sectors of wholesale and retail trade, material and technical supply, credit, insurance, information services, and others operating in the social and economic sphere. Market infrastructure thus connects the spheres of production, circulation and consumption, effectively contributing to the turnover of material, financial and information flows in the market economy (see Figure

Some researchers in their works often identify the concepts of "market infrastructure" and "infrastructure of the market". Despite the obvious similarity of these categories, in our opinion, there are certain differences between them due to the nature, structure and volume of economic relations. Moreover, the category "infrastructure of the market" implies the presence of institutions serving certain types of markets or economic relations that develop in a particular type of market (food markets, financial markets, labor markets, etc.). In this case, the market is understood as a separate economic system and therefore the concept "infrastructure of the market" can be considered as part of the concept "market infrastructure".

The concept "market infrastructure" is much broader and includes all the links and relationships between the elements of the economic system, based on market principles. Based on this, in our opinion, the market infrastructure can be represented as a set of market institutions providing interaction and the presence of "feedback" between production and consumption and contributing to the sustainable development of the market system. In this definition, market institutions should be understood not only as the rules by which business entities interact with each other and carry out economic activities, but also as a set of organizations that formally implement these rules and behavioural procedures in practice.

Thus, in response to a social need for an institution, economic agents necessarily create such an institution, and without any coercion.

On the other hand, the state should authorize socially reasonable self-emerging institutions by establishing an appropriate legislative framework and monitoring compliance with laws.

One of the most important factors in the formation of market infrastructure is its institutional base, adequate to the development level of production and economic relations. The legislative framework of the emerging market infrastructure is characterized by extreme fragmentation and does not meet modern needs.

A specific feature of the market infrastructure formation in our country is its functioning in parallel with the centralized infrastructure system. Therefore, the institutional and legislative design of the market infrastructure was supposed to promote the free choice of consumers, as well as ensuring equal rights for everyone (Tavbulatova & Galazova, 2016).

In the economic literature, "institution" means a set of generally accepted rules and traditions within which economic entities perform their activities and interact with each other. In a broader sense, this concept includes specialized organizations that formally implement these rules. In the planned economy, which was characterized by a directive form of communication between production and consumption, the role of such infrastructure institutions was performed by ministries and departments, as well as centralized and local bodies of the State Planning Commission and the State Logistics Committee. Their decisions had the force of law for lower-level and subordinate economic units. Operating for quite a long time, this system caused a number of difficulties in the formation and development of new institutions in the transition of the state economy to market relations. Therefore, as a priority, it seemed necessary to carry out a radical restructuring of existing organizations and enterprises of the State Planning Commission, the State Logistics Committee, ministries and departments. At the same time, a very important task was the formation and development in the sphere of commodity circulation of fundamentally new institutions that meet the requirements of the formation of a civilized basis for a market distribution system. This means the creation of an extensive network of market institutions that perform wholesale and intermediary, financial and credit, information and advertising, trade and other services that promote products from producers to the final consumer.

Conclusion

Considering the fact that the formation of market infrastructure in our country took place in parallel with the existence of a centralized infrastructure system, there were two possible directions of its formation: this is the transformation of existing institutions in the previous economic system into market ones and the establishment of new institutions that are unique to the market system (Timoshenko, 2014).

The first group of institutions may include banks, insurance companies, as well as warehouse and some types of trading companies. The second group is more numerous and includes exchanges, investment funds, brokerage houses, clearing companies, depository, trading houses and others.

The formation of the institutional base of market infrastructure is impossible without the adoption of the appropriate legislative framework for the transition to the market and the creation of an immanent infrastructure. Thus, in 1990, with the adoption of the laws "On the Central Bank of the Russian Federation" and "On Banks and Banking Activities" (in 1995 and 1996, these laws were adopted in a new revised version), the legislative foundations for the functioning of the modern banking system of Russia were created. Banks were declared economically independent institutions with the right to carry out banking operations established by law.

The law "On Banks and Banking Activities in the RSFSR" put an end to the activities of specialized banks. Instead, a course was set for commercial banks creating. According to the law, all banks were transformed into joint-stock commercial banks, the participants of which could be both legal entities and individuals. In addition, the law allowed the formation of a bank on the basis of any form of ownership, including with the attraction of foreign capital.

The Federal Law "On Banks and Banking Activities" dated 1996 more accurately shows the differences between credit institutions and other commercial institutions in terms of their purpose, scope of operations, and organizational and legal form. Moreover, the difference between the bank and non-bank credit organizations was clarified, which gave rise to the development of clearing and other settlement organizations, as well as credit organizations with a limited number of banking operations.

Commercial banks, regardless of ownership, are independent organizations that profit from intermediation in the movement of funds in the national economy.

Sberbank has always played a special role in the domestic banking system. In May 1996, the development concept of Sberbank of Russia until 2000 was approved. The strategic activities of Sberbank were formulated as follows: "consolidation of the achieved positions of the universal commercial bank, adequate to the conditions of the market economy and occupying a worthy place in the numerous ratings of the largest credit institutions in the world."

According to the data provided in the concept, Sberbank loans should have accounted for more than 10 % of the total amount of loan investments of commercial banks in the country. A significant part of the bank loans was initially directed to the development of the Russian economy.

Another dynamically developing sector of the banking system was municipal banks, which acted as a necessary link in the formation and strengthening of new elements of the financial and credit infrastructure of cities and regions that would allow more rational implementation of regional, and on its basis, federal financial policy.

The Law "On Insurance" ensured the reform of the Russian insurance system and contributed to the emergence and establishment of insurance companies in the country. The main goal of insurance companies is the accumulation of insurance fund necessary for compensation of material losses of the company, as well as for the formation of monetary capital. The insurance company has full economic independence in carrying out its activities, has an independent balance sheet and operates in the economic system as an independent institution, which builds its relations with other insurers on the basis of reinsurance and insurance. Insurance, as a monetary institution, along with traditional functions, began to conduct active investment activities.

The competitors of insurance institutions in the financial and credit market have become investment forms, in addition to traditional rivals – commercial banks. Currently, insurance companies, along with savings banks, are a major channel for the movement of loan capital, which creates a favorable basis for the merging of insurance, banking and industrial capital.

A necessary condition and an organic element of Russia transition to market relations was the formation of the securities market. Today, the stock market in the Russian Federation is regulated by a number of legislative acts, presidential decrees, and resolutions of the Russian Federation Government, the most important of which are: The Civil Code of the Russian Federation, Law of the Russian Federation "On Securities Market" (1996), Law of the Russian Federation "On Joint-Stock Companies" (1995), "Regulation on the Procedure for the Issue and Circulation of Securities and Stock Exchanges in the RSFSR" (1992), etc. These legislative acts regulate the relations arising from the issue and circulation of securities, determine the range of professional participants in the securities market, features of their creation and activity. Securities transactions are conducted on stock exchanges, which are the most important institution of the securities market infrastructure.

Along with the formation of the stock market infrastructure, the emergence of a purely market infrastructure of commodity markets was also new in the transitional Russian economy (Abdulgalimov, Arsakhanova, Filina, & Akhmedova, 2019). The main subsystems of the commodity markets infrastructure are the subsystem of resellers and the subsystem of storage facilities – i.e. these are organizations that carry out intermediary activities and ensure the interaction of manufacturers and consumers in terms of purchase and sale of goods through the establishment of domestic markets, stock trading, holding of exhibitions and fairs, the provision of warehouse services, etc.

The process of formation and development of these structures proceeded very spontaneously, explosively. For example, in the initial period of market relations development (1991–1992), on the territory of Russia there were more than 100 commodity exchanges. During this period, the capital of large exchanges exceeded the assets of many commercial banks. Only for 1990–1991 over 10 billion rubles were invested in the development of exchanges as a whole across the regions of the country.

The elimination of the negative consequences of the degradation of institutional structures (former State Logistics Committee systems, ministries and departments, state and cooperative trade) allowed as a result of the state self-removal from privatization and corporatization processes in the sphere of circulation was possible, first of all, by strengthening the role of the state in the structural transformations of the economy. In particular, the development of the program of transition to a market distribution of public products, the development of existing and the formation of new elements and blocks of market infrastructure. Therefore, the necessary changes were made to the relevant legislative acts, new laws were adopted regulating the state approach to the formation of institutional prerequisites in the establishment of a civilized market infrastructure (Idziev, 2016).

The essence of state regulation of market infrastructure is most fully revealed when determining its main functions:

legal support for the functioning of market infrastructure entities, legislative establishment of rules and legal norms of managing, strict control and full guarantee of their compliance by all market infrastructure institutions.

development of a unified economic and technical policy for the development of market infrastructure institutions.

creation of a unified information system for analysis and forecasting of various markets (commodity, housing market, services market, etc.)

coordination of work of separate elements of market infrastructure for the purpose of the

general economic tasks decision.

creation of a favourable economic climate for the development of entrepreneurship and attracting investment.

ensuring a competitive environment in the markets and antitrust policy conducting.

The processes of formation and development of market infrastructure in the region are influenced by various forms and methods of both administrative and economic nature from a large number of regulatory bodies. Such bodies of state administration and

regulation are: departments of the regional administration apparatus, territorial departments of ministries and agencies, various committees and offices, state financial and credit authorities, tax departments and inspections, etc.

Despite the presence of many regulatory bodies, the management of the process of formation and development of market infrastructure as a single system has not developed yet. The processes of market infrastructure formation proceed without targeted regulation by regional regulatory bodies, there is no clear idea of a comprehensive program for the development of market infrastructure at the territorial level.

When regulating these changes, a system of economic and administrative methods for managing the development of market infrastructure was used.

The bodies of state administration and regulation were departments of the regional administration apparatus, territorial departments of ministries and agencies, various committees and offices, state financial and credit authorities, tax departments and inspections, etc.

In modern conditions, regional administrations exert influence on market infrastructure entities mainly by economic methods in order not to interfere in their activities, direct their efforts towards mutual benefit, primarily in solving the problems of the socio-economic development of the region. Economic methods, in contrast to administrative ones, have an indirect impact on management objects, assuming complete independence and responsibility of economic entities. Through economic methods related to taxation, credit, centralized investments, subventions, etc., mechanisms of orientation of market infrastructure subjects to an effective mode of functioning of regional reproduction are created (Tsvetkov, Zoidov, & Medkov, 2017). Their essence consists of indirect influence on the economic interests of regional market entities using the above-mentioned tools, whenever possible, without the direct intervention of management bodies, but within the limits established by these bodies. Through the system of economic benefits and sanctions it is possible to ensure:

production of goods and services in accordance with the changing conditions of regional markets;

accelerating scientific and technological progress and improving the quality of goods and services;

development of small and medium enterprises;

activation of business activities, etc.

Today the following administrative methods are used in the regions:

development of administrative orders, decrees, and instructions that are binding for market infrastructure entities.

determination of the rules for the development of economic entities operating in the region;

influence through control and supervision.

adoption and implementation of administrative and legal enforcement decisions in relation to the subjects of market infrastructure.

Administrative and economic methods regulating regional markets are applied in the form of legal norms. The legal basis of regulation assumes that the methods of regulation at the regional level must comply with the laws of the Russian Federation.

Speaking about the use of administrative and economic methods of regulating market infrastructure, it is necessary to consider the legal regulation of this impact.

First, – the basic laws that directly regulate the formation of market infrastructure, laying its basic principles and introducing basic concepts.

Secondly, – there are legislative acts regulating the activities of market infrastructure entities. For example, the Federal law "On banks and banking activities", "On the Central Bank of the Russian Federation", "On commodity exchanges and exchange trade".

Third, – there are laws relating to the conditions for the formation and development of market infrastructure, establishing a tax regime and antitrust legislation.

Another essential element of the legal framework for the formation and development of market infrastructure are legislative acts of the constituent entities of the Russian Federation regulating the implementation of this process within their competence. Regarding legislative activity at the level of the Chechen Republic, it has a fundamental drawback that the adoption of relevant regulations governing the formation and development of the republican market infrastructure is extremely slow and uneven.

References

- Abdulgalimov, A. M., & Arsakhanova, Z. A. (2019). Development of foreign trade turnover as a factor of economic growth in Caucasus. European Proceedings of Social & Behavioural Sciences, 58, 2734–2743. https://doi.org/10.15405/epsbs.2019.03.02.319

- Abdulgalimov, A. M., Arsakhanova, Z. A., Filina, M. A., & Akhmedova, Z. A. (2019). Methodological problems of additional cost taxation in Russian economics. European Proceedings of Social & Behavioural Sciences, 58, 2726–2733. https://doi.org/10.15405/epsbs.2019.03.02.318

- Alklychev, A. M. (2017). Managing the development of the market infrastructure of the commodity market: regional aspect. Coll. of articles of the III Int. sci. and pract. conf. Competitiveness of regions. Sustainable development strategy (pp. 61–69).

- Gadzhieva, G. D. (2011). Market infrastructure: main components, conditions of formation and development. Reg. probl. of econ. transform., 1, 244–250.

- Idziev, G. I. (2016). Regional peculiarities of development of market infrastructure institutions. Reg. probl. of econ. transform., 3, 81–88.

- Salogubov, S. T. (2011). Development of market infrastructure in the conditions of economy modernization. Transp. Busin. of Russ., 3, 170–171.

- Tavbulatova, Z. K., & Galazova, S. S. (2016). Territory and cluster policy. Int. sci. period. “Modern fundam. and appl. Res.”, 1(2(21)), 233–238.

- Timoshenko, M. A. (2014). Market infrastructure as the basis for the growth of competitiveness of the agricultural economy of Russia. Russ. J. of Entrepreneurship, 20, 70–80.

- Tsvetkov, V. A., Zoidov, K. K., & Medkov, A. A. (2017). Public-Private Partnership as the Core Form of the Implementation of Russia's Transport and Transit Potential. Econ. of Reg., 13(1), 1–12.

- Zoidov, K. K., & Alklychev, A. M. (2017). Managing the development of the market infrastructure of the regional commodity market. Coll. of articles of Int. sci.-pract. Conf. Financial mechanisms of acyclic regulation of structural disproportions in the economy of Russia and other CIS countries, ed. by V.A. Tsvetkov, K.Kh. Zoidov (pp. 132–138).

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Arsahanova, Z. A., Magomedovich, A. A., Galachieva, S. V., Elzarikoevna, S. T., & Aslambekovich, S. Z. (2020). Market Infrastructure Of The Region: Concept, Basic Principles Of Formation And Functions. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 2819-2828). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.373