Abstract

Integration processes on the area of Eurasian Economic Union (further in the text – EEU) directly impact operation of pensionary protection of population, as labour market blurring as well as capital markets, difference in socio-economic development of the regions complicate pension rights organisation and their adequate conversion for labour migrants and people employed in a foreign state via the Internet (“digital” labour migrants). The complex structure of pension systems in EEU participating countries, based on different principles and economic mechanisms, does not allow organize pension rights to a full extend, and fully take into account paid-in insurance pension tax, when applying personal record keeping in pensionary protection of population. These issues make it actual to decrease the existing barriers across population when organising pension rights with the account of integrational processes. For this purpose, the research deals with the main economical mechanisms applied in the system of population pension protection in EEU participating countries. Main problems of pension rights organization have been studied, with the account of digitization; the solution has been suggested at the initial stage when the difference in socio-economical development of the countries is significant. The authors suggest creation of a specialized supranational organization of EEU countries, which will control organization of pension rights for labour immigrants and “digital” labour immigrants as well as be responsible for collecting insurance pension tax and pension payments.

Keywords: Pensionpension protection of populationpension rights

Introduction

Issues of the effective system of pensionary protection for the population are important for any state, which provides adequate standard of living for its citizens at every stage of their life. Loss of income or inability to receive it due to some reasons (health problems or age) allows a citizen to receive fixed payments called a pension. Organization of pension rights differs from country to country. The common rule is that these rights are formed during individual’s labour activity; here citizenship, residence and area of legal labour activity are important.

Economy digitalization also complicates organization of pension rights for the population. Besides labour migration, there is digital reality where it is possible to work without territory bounds, the so-called “digital” labour migration without real displacement of a person, and free-lancing, which is mostly illegal worsens the situation.

Problem Statement

Integration processes within Eurasian Economic Union (further - EEU) increase labour migration and capital flow from country to country, hence, it threatens organisation of pension rights for the population and states’ pension funds are under threat, that disrupts social bases of these countries. Thus, an opportunity to convert pension rights for the population of EEU is vital as it will provide adequate opportunities for the population in EEU participating countries and will further raise the standard of pensioners’ living.

Research Questions

Studying the issues of pensionary protection for the population in EEU participating countries allows determining their common interests, key parameters, taken into account when organizing pension rights for population. It allows estimating the existing problem deeper and finding the rational choice of the necessary transformations.

Purpose of the Study

The purpose of this work is to analyze organization of pension rights for population within EEU, to suggest conditions for adequate conversion of pension rights with the account of disproportions in the standards of socio-economical development in countries and peculiarities of the pension protection system for the population.

Research Methods

The work systemizes facts on the issues of organizing systems of pension protection for population in EEU participating countries with the methods of system and comparative analysis, induction and deduction, supported by tabular, and graph methods of data presentation.

Findings

The architecture of pension protection for population in EEU participating countries

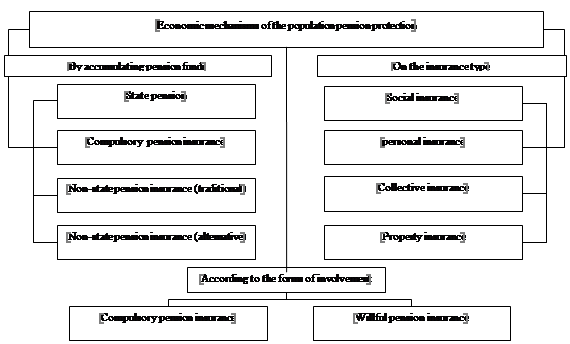

Different mechanisms are used to organize systems of pension protection for population (Grigorieva, Gorshkova, & Mytareva, 2017) (figure

As practice of pension organization shows, when the national system of pensionary protection of population is organized, governments of countries apply combination of several economical mechanisms creating a complex structure. The most popular is simultaneous combination of 3 economic mechanisms: state pension provision (its aim is providing population with minimal social pensions, state pensions for certain groups of population (for example, military emploees, government emploees and so on), compulsory pension insurance and non-state owned pension insurance (provision). In this case, minimal pensions and state pensions receive finance from the State budget. Pensions from mandatory pension insurance and non-state-owned pension insurance are based on pension tax paid individually or by an employer for a worker (at full or pari passu).

To prove this argument, the experience of the pension protection within EEU is interesting. Having common roots of the national pension system for population (from the times of the USSR), every country had its own way, choosing individual profile. Table

Thus, on the area of EEU most systems of pension protection are rather complicated, but all countries provide minimal social protection in the form of social/basic pensions. Pension systems in the Republic of Armenia and the Republic of Belarus especially stand out on the background of other countries. In particular, the former is characterized by a funded element, where citizens themselves have a special role in pension formation; and the latter (the Republic of Belarus) has the predominant role of the state budget in pension formation (Grishchenko, 2016). Many countries abandon the second system due to the increase in the demographic burden on the system.

Issues of pension formation in the economy integration and digitization in countries of EEU

Pension organization in EEU countries is directly connected with the earnings, as the income loss is a ground for pension payment in the participating countries according to some parameters. The importance of this aspect for labour migration within EEU was stressed in the Report “Barriers, withdrawals and limitations of EEU”. According to the point 90 of the Report “Organization of the common labour market, proper social and pension provision of the working citizens in participating countries is possible when the countries observe mutual non-discriminatory approach to the working citizens. In the agreed-upon list of challenges there is one limitation applied to all participating countries. There is no equality in providing pension to citizens of participating countries within their area”. To solve this problem it was suggested to enter into a separate international agreement on the pension provision of workers in EEU participating countries. The project has been created but not has not been signed yet. According to the data of the Pension Fund in the Russian Federation only the Republic of Belarus signed a Cooperation agreement in the sphere of social security in 2006.

The most limitations when organizing and recording pension rights arise in cases of “labour migration to another country” (there a necessity to record employed service within another country when granting of a retirement pension); labour migration to another country and further claim of the pension here; when a pensioner moves to another country for a permanent citizenship” (Karabchuk, 2014). Here, the processes of official labour migration can be theoretically traced in a full rate, and when forming regulatory control and prove documentarily the organized pension rights, then the economy digitization in EEU countries will neutralize the obtained results.

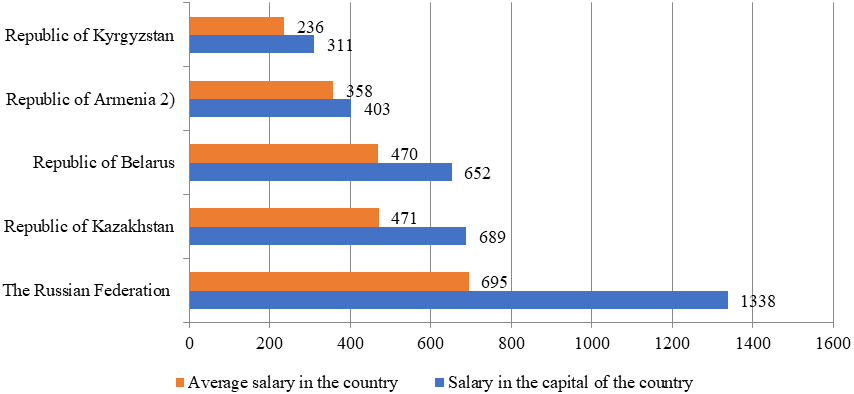

One more problem is different level of the earnings on the area of EEU, which is a starting point of pension rights organization (figure

Note: 1) The parameter is calculated by the rate of the national currency per year: in Belarus – by average weighted exchange rate of the Belarusian ruble to the USA dollar, in Armenia, Kazakhstan, Kyrgyzstan and Russia – by the average weighted exchange rate of the national currency to the USA dollar.

2) With the account of compulsory social insurance made by the employer.

These problems are aggravated by the fact that the system of pension protection of population is not ready to economy digitization (Grigorieva, Mytareva, & Shkarupa, 2019). As integration in EEU increases social mobility, and economy digitization creates common digital space, the opportunities for earnings widen. Dealing with problems the states encounter when providing pension protection of the population we can note:

1. Earnings from business in the Internet are not always legalized, as they are not clear for agencies responsible for organization of pension rights, hence, there are no obligatory payments (taxes, insurance payments and so on) necessary for pension organization. It is conditioned by the fact that people earning in the Internet, first, are often not registered according to the labour legislation, secondly, do not declare the earnings, thirdly, there is no territorial binding to the place of business, that is the citizen of one state can have business in another country thus creating “digital” labour migration.

2. Developing information and communication connections between all the participants of pensionary relations which include: receiving state services via remote application to corresponding bodies; providing full information on changes pension protection (via different informational portals in the Internet); access to information on the status of own pension assets in specialized financial institutions (state and private); about formed pension rights depending on the area (state) of the legalized labour income without the account of population who have no access to modern information and communication technologies.

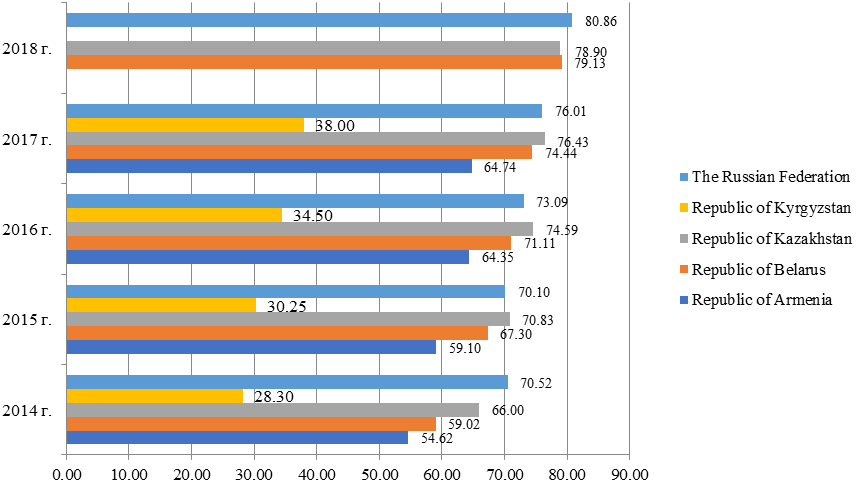

Lack of possibility to use the worldwide web to access information is conditioned by “digital inequality”, caused by presence of small areas where internet-providers do not give access to the Internet as it is not profitable, due to non-coverage of remote places by the operators of the cellular communication. According to the cross country analysis of the International Telecommunications Union (ITU) “Percentage of people using the Internet” (figure

Possibilities to harmonize the systems of pensionary protection of population in EEU countries

Harmonization of the systems of population pensionary protection in EEU countries is a process aimed at the formation of ways and mechanisms to convert pension rights of the population, due to its labour migration or remote employment via the Internet on the territory of a foreign country.

The most perspective solution of the problem is a supranational organization on organization of the population pension protection on EEU area, responsible for collection of premiums of the labour immigrants, recording employed service on the area of EEU participating countries, and then providing pension payments to the population under the national legislation. In addition, such an organization would provide more effective interaction between the countries on the issue of recording pension rights of the population and providing pension payments, the means accumulated in it could be invested and used for the development of EEU participating countries.

Conclusion

In conclusion, it should be noted that systems of pension protection in EEU participating countries first, have own unique profiles, with some common characteristic features – providing minimal social guaranties to the population, as well as the record of labour and financial contribution of every person; second, the structure of the systems is based on combination of different economic mechanisms, that creates premises to convert adequaly pension rights when working in a different state; thirdly, non-registered employment even via the Internet creates a situation of exclusion of a person from the system of the pension protection of the population.

One of the solutions is creating a supranational organization that would provide the record of pension rights for labour immigrants, as well as “digital” immigrants; accumulate the insurance payments of these people and provide further pension payments. It should be noted that harmonizing the systems of pension protection of the population on the area of EEU countries is not restricted only by this direction. The received results do not disclose all the ways to solve the problems of formation of the pension rights for the population of EEU participating countries.

References

- Diatlov, S. А., Feigin, G. F., & Lebedeva, L. F. (2017). Pension systems transformation in EEU countries. Region’s Econ., 13(4), 1151–1163.

- Grigorieva, L. V., Gorshkova, N. V., & Mytareva, L. A. (2017). Economic mechanisms of population protection against pension risks as a tool for socio-economic development of the region. J. of Volgograd State Univer. Ser. 3 Econ. Ecol., 1(38), 31–44.

- Grigorieva, L. V., Mytareva, L. A., & Shkarupa, E. A. (2019). Failure of the Funded Model of the Russian Pension Syste. Reasons and Solutions Lecture Notes in Networks and Systems, 57, 371–384.

- Grishchenko, N. (2016). Pensions after pension reforms: A comparative analysis of Belarus, Kazakhstan, and Russia 1st Int. conf. on applied economics and business (vol. 36, pp. 3–9). Sci. Journals Publisher.

- Iskakova, Z. D. (2012). The mechanism of financial stability in Kazakhstan in the CES terms Vith Ryskulov readings: Socio-economic modernization of Kazakhstan under conditions of global financial instability (pp 1109-1126). Almaty: Ryskulov Kazakh economic univ.

- Karabchuk, Т. S. (2014). Pension mobility within EEU and the CIS. Saint-Petersburg, CIS EDB. Retrieved from https://eabr.org/upload/iblock/ddd/edb_centre_report_24_wb_mirpal_analytical_ report_full_rus.pdf

- Samsonova, V. O. (2016). Right to a pre-schedule pension due to upbringing of a disabled child according to the legislation of CIS Vestnik Tomskogo gosudarstvennogo universiteta-pravo, 21(3), 150–156.

- Tobatayev, D. (2012). Kazakhstan's pension system: problems and perspectives. Vith Ryskulov readings. Socio-economic modernization of Kazakhstan under conditions of global financial instability (pp. 1368–1385). Almaty: Ryskulov Kazakh econ. univ.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Alievich, Y. R., Grigorieva, L. V., & Gaisumova, L. J. (2020). Issues Of Pension Rights Organization For Population Within Eeu. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 2649-2656). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.351