Abstract

Сredit solvency of the borrower in the world banking practice is a key object of assessment when making decisions about loan granting. The borrower's ability to repay the loan depends on their financial and managerial capabilities to increase the borrowed capital, permanent employment and income, type of entrepreneurial activity, moral qualities and other factors. In the global financial market, there are many methods and models based on the classification (statistical) approach and the conception of complex analysis. The article deals with traditional and innovative methods of credit scoring, identifies the reasons for the low level of using advanced innovative solutions in Russian banking practice. We propose an approach to determining the reliability of a potential credit user on the basis of the theory of pattern recognition. The article describes successive stages of credit risk management and the content of each stage; identifies the main types of credit risks and the factors affecting risk levels. The method of borrower's assessment is based on the ideas of pattern recognition methods through estimation algorithms. A formal approach implies building classification of borrowers into 3 classes according to the risk level: high level of credit risk; medium level of credit risk; and low level of credit risk. The article proposes a certain algorithm for pattern recognition and calculation of risk estimates through a set of key elements. To demonstrate capabilities of the methodology, we propose a system of assessment of retail lending risks, which allows increasing the efficiency of banks' credit resources management.

Keywords: Credit solvencyborrowerriskpattern recognition

Introduction

Lending being the main banking process generates a number of banking risks. To maintain a stable position in the banking market and avoid bankruptcy, credit organizations need to seek and apply increasingly effective methods and tools for managing credit risks. Early recognition of signs of borrowers' financial insolvency allows rejecting unsecured loan applications by credit institutions in a timely manner and taking measures on structuring the credit portfolio so as to reduce bank losses. A variety of models that are currently used in banking practice to assess credit risks testifies to the existence of persistent problems in the recognition of credit risk.

Problem Statement

Expediency of carrying out the analysis of existing models and methods for assessment of credit risks generated by credit solvency of borrowers and revealing the most reliable and effective ones among them is determined by the need to apply academic knowledge to the given problem, to identify the most objective tools of assessment, and to form a scientific base for future research.

Research Questions

All methods and models of credit scoring can be classified as traditional and innovative. The first class of methods that have become widespread in banking practice include the method of expert assessments, regression analysis (Buckley & James, 1979), discriminant analysis (Altman, 1968).

Innovative technologies applied in credit scoring include the methods based on Data Mining (Hastie et al., 2016), neural network approach (Aggarwal, 2018), and the use of evolutionary and genetic algorithms (Marsland, 2015). Despite the innovative nature of such solutions and their initial functional prospects, they are not used in the practice of most Russian banks due to low adaptation to the requirements of the banking system.

For example, when using Data Mining, not all algorithms are promising and convenient for building bank scoring models.

The disadvantage of the neural network approach consists in the need to work with a huge amount of training sample. Besides, even a trained neural network implies more questions than answers: information on several hundred transneuronal connections is completely beyond human analysis and interpretation (Hu, 2008).

Genetic and evolutionary algorithms do not yet constitute a serious competition to other methods. They are inconvenient and unstable in settings and time-consuming when used in solving problems of patterns search in databases (Maslennikova & Maslennikov, 2015).

Currently, the problem of assessing the credit solvency of the borrower in commercial banks is mainly solved in two ways:

expert assessment of the borrower's personal characteristics and financial condition by a credit specialist;

scoring system for assessing the borrower.

Credit scoring is an automated credit risk assessment system (Abdou & Pointon, 2011) that became widespread in the United States and Western Europe in the late twentieth century (Boyle et al., 1992). In Russia, this method of risk assessment is now more common than others. Scoring is based on the use of mathematical models built on the basis of statistical analysis of accumulated information about solvent and insolvent clients.

Analysis of traditional and innovative models and methods of risk assessment allows summarizing that none of them can be recognized as universal and free from shortcomings that limit the scope of its application. Building universal systems of indicators and parameters is actually impossible. This is due to the fact that different methods of risk assessment can be used depending on the goals and opportunities of obtaining reliable information about multiple internal and external factors that determine the final performance of the transaction (Maslennikov, 2016).

Study of the world and Russian experience of scientific research in the field of risk assessment associated with the credit solvency of the borrower, has formed the author's approach to the given problem.

Purpose of the Study

Purpose of the study is to generalize and assess the opinion of the world scientific community on credit scoring, to develop an approach to assessing the credit solvency of the borrower using pattern recognition methods within the scoring model of evaluation.

Research Methods

Both theoretical and empirical methods of scientific knowledge have been used in the study. The methods of monographic research, analysis, synthesis and induction allowed systematizing the existing in the world financial market models and methods of assessing the borrower's credit solvency, as well as considering shortcomings of certain models for understanding the reasons for their low prevalence in banking practice. This has allowed proposing the most appropriate approach to assessment of loan applications to ensure achievement of research objectives. Empirical methods have made it possible to process the facts of economic reality of the financial market and apply them in the justification of the proposed approach.

Findings

Modern banking practice is faced with the problem of developing a system that would let the credit manager obtain a fairly accurate assessment of possibility of debt and interest repayment by setting certain parameters at the time of application consideration.

We propose an approach to determining the reliability of a potential credit user on the basis of the theory of pattern recognition. The approach is based on the creation of stable classifications and pattern recognition algorithms. The method of pattern recognition refers to the class of traditional methods of assessing credit solvency. The proposed approach can be used not only at the time of loan application consideration, but also when making decisions on previously concluded loan agreements.

Banking operations management is essentially the management of risks associated with a bank portfolio, with a set of assets providing the bank with income. The main part of the bank's portfolio consists of loans to legal entities and individuals, which is accompanied by the risk of losing some of the bank's credit resources.

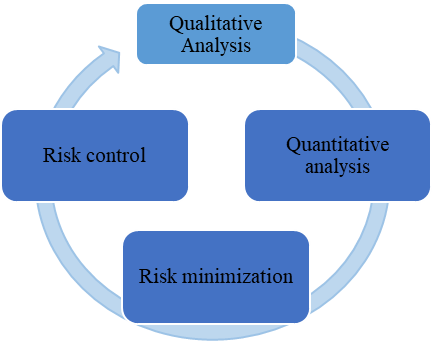

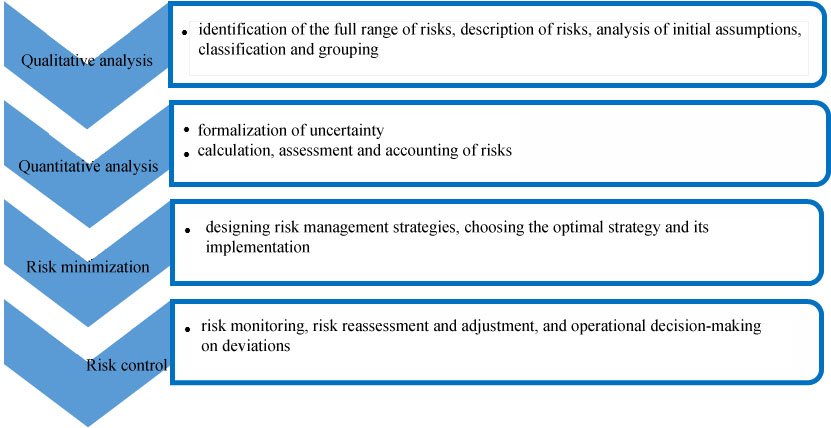

The following sequence of risk management has been used in the development of the assessment system (Figure

The content of each stage of credit risk management is presented below (Figure

The main types of lending risks are: liquidity risk, interest rate risk, credit risk. The latter type of risk is of special importance, since failure to repay the loan by borrowers brings tangible losses to banks. This is one of the most common causes of bankruptcy. The form of lending, the size of the loan, the method of repayment and collateral requirements depend on the risk of lending to the borrower. In this regard, the task of quick and objective assessment of credit risk is very relevant for all credit organizations.

The degree of bank risk is reflected in the highest interest rate on operations that have a credit nature (loans, guarantees) in comparison with other assets. Interest rates on the loan should compensate the bank for the cost of funds provided for a term, the risk of changes in the value, and the risk of default by the borrower.

The risk of default by the borrower is determined by a large number of factors included in the concept of client's credit solvency. The credit solvency of the bank's client is traditionally understood as their ability to completely settle credit obligations on time. Assessment of the borrower's credit solvency, as the task of determining financial stability of the borrower, is important both at the stage of selection of potential borrowers and at the stage of monitoring the progress of loan repayment.

When assessing the credit solvency, risk factors are taken into account: type of transaction, credit history of the client, economic situation, financial stability of the client, possibility of providing effective collateral by the client.

Credit risk analysis is a complex task that includes the development of methodological approaches to analyzing a potential borrower, monitoring and analysis of changes in the financial stability of a potential borrower, identification of adverse trends and their causes at an earlier stage of their occurrence.

Obtaining a more objective assessment of the financial and economic condition of the borrower requires creation of an algorithm for more effective analytical procedures.

The paper proposes a formalized approach that allows making decisions on reasonability of loan granting by using the methods of pattern recognition. The task of assessing the financial solvency of borrowers consists in classifying them on the basis of rather weak requirements for initial data (Laha, 2007). Thus, borrowers belonging to the same class of patterns will have common characteristics, i.e. be approximately at the same level of financial and credit solvency.

Classification of borrowers by in an expert way lets reveal three classes of risk level: high level of credit risk; medium level of credit risk; and low level of credit risk. Each class consists of borrowers with the same risk estimate, i.e. each borrower is described by a certain set of characteristics inherent in a particular class. Then, a recognized borrower is referred to one of the risk classes.

The method of pattern recognition involves several stages of creating an appropriate mechanism:

Training of the system. The purpose of training consists in selecting such thresholds which would allow for minimum number of errors in the training set of objects with a known class affiliation.

Testing of the system. This is the stage of training control aimed at calculating the error of recognition of the objects from the examination set that belong to the known classes.

Recognition of an unknown object by the system.

Thus, after recognition, the borrower will be assigned to one of the selected classes. Depending on the selected risk class, the system determines which credit policy is recommended for the manager.

Currently, a large number of object recognition algorithms have been developed and extensive experience in solving applied problems in various fields of science and technology has been accumulated. The most developed and well-known model of recognition is the model of estimation algorithms. Algebraic theory of pattern recognition was created in the second half of the 20th century (Zhuravlev, 1978). Later on, multi-criteria algorithms of this model were used as a basis for decision support system in determining the loan size (Syryamkin et al., 2016).

The class of algorithms based on calculation of estimates is specified by describing the six key elements:

system of reference sets;

function of proximity;

calculation of estimates based on strings of a fixed reference set;

calculation of estimate for a class based on a reference set;

estimate for a class based on the system of reference sets;

decision rule.

Any recognition algorithm, the task of which consists of six elements, is actually an algorithm for calculating estimates. These estimates represent a set of all possible recognition algorithms that can be specified by the above six elements.

Thus, a specific algorithm for calculating estimates can be obtained by choosing a specific system of reference sets, defining a proximity function, setting rules for calculating estimates by strings of a fixed reference set and by a system of support sets, as well as by assigning a decision rule. The class of recognition algorithms based on estimates calculation includes all sorts of algorithms that can be built from the above six elements.

The advantages of this model are as follows: controlled parameters of the model, option of search for significant objects of classes, availability of shares and features of objects, option of choice of significant features, evaluation of expert division of objects into classes.

Using this approach allows getting a more accurate and objective result. This helps reduce the risk of losses, as well as justify the decisions made when working with borrowers and partners (Yakovleva, 2018).

The system "Risk assessment in retail lending" (hereinafter the system) has been developed to demonstrate possibilities of the proposed approach to determining the reliability of a potential borrower of the bank, based on the ideas of pattern recognition. The system is provided with characteristics of the borrower, represented with vector descriptions and divided by the expert into classes according to the risk level. The system determines the class of credit solvency for a recognizable borrower.

The system includes the following modules: feature normalization module, training module, exam module, recognition module. In addition, the system includes the module for analyzing the borrower's risk based on a dynamic set of features, the module for selecting significant features, the module for selecting borrowers, the module for selecting standards for each risk class, and the module for integrating heterogeneous remote systems.

The module for integrating heterogeneous remote systems is unique for this system and is responsible for the integration service. This service is responsible for performing verification of the borrower's personal data in real time in remote information systems of third-party organizations. Sequence of events and the set of parameters for real-time queries varies depending on the type of query. General structure of the query to the specified information systems is as follows:

the system generates a query to the integration service;

the integration service sends the query to the information system of third-party organizations by calling the necessary function of the system;

the information system returns the result of the function execution to the system.

Interface of the credit manager program provides for the output of systematized information about the borrower and possible problems. This allows making quality decisions as quickly as possible. Thus, the proposed system reduces the risk of retail lending, ensures quick decision-making and effective credit portfolio management, reduces the period of staff training, enables a rapid analysis of loan applications in the client's presence.

Conclusion

Growth of credit market, caused by stereotyped consumer behaviour of the population and by decrease in real disposable income of the population, provides banks with growth opportunities. However, credit organizations are faced with new problems:

increase in the number of loan applications requiring consideration;

submission of applications by financially insolvent and unscrupulous customers;

quick but poor-quality decisions on lending due to limited time for consideration of applications.

The proposed approach and the developed system for assessing the credit solvency of the borrower allow for more perfect automation of the process of making credit decisions by bank assistants. Use of the system significantly reduces the load on the Department of loans and on the Department of economic security due to combined technologies, methods and analyses of application. Recognition of the main qualitative and quantitative characteristics of the client and the class of their credit solvency allows reducing the initial set of clients by rejecting those that do not meet bank requirements. Besides, fraud protection mechanisms (setting thresholds at which the minimum number of errors is obtained) make it possible to identify suspicious applications in a timely manner.

Advantages of the proposed approach to client's credit scoring:

display of all databases available in the system in a single interface;

reduced time for searching the necessary information;

automatic detection of fraud signs;

automatic assessment of the borrower;

ability to obtain analytical reports on loans;

easy integration with existing systems;

improved quality of decisions and risks reduction.

Analysis of credit risk management issues in banks shows the preference of using recognition algorithms based on the calculation of estimates. Taking into account the specifics of the initial information for scoring, the method of comparison with the sample seems to be more convenient and productive as compared to other traditional methods. Despite having such shortcomings as the need to store in memory all information about clients, heuristic choice of measures of similarity with images, today this method is one of the most effective, since it ensures the financial stability of the credit organization.

References

- Abdou, H., & Pointon, J. (2011). Credit scoring, statistical techniques and evaluation criteria: a review of the literature. Intellig. Syst. in Account., Finance & Managem., 18(2-3), 59–88. https://doi.org/10.1002/isaf.325

- Aggarwal, C. C. (2018). Neural Networks and Deep Learning. Springer.

- Altman, E. I. (1968). Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. The J. of Finance, 23(4), 589–609. https://doi.org/10.2307/2978933

- Boyle, M., Crook, J. N., Hamilton, R., & Thomas, L. C. (1992). Methods for credit scoring applied to slow payers. In Credit Scoring and Credit Control (pp. 75-90). Oxford University Press.

- Buckley, J., & James, I. (1979). Linear regression with censored data. Biometrika, 66(3), 429–436. https://doi.org/10.1093/biomet/66.3.429

- Hastie, T., Tibshirani, R., & Friedman, J. (2016). The Elements of Statistical Learning: Data Mining, Inference, and Prediction. Springer.

- Hu, Y. (2008). Incorporating a non-additive decision-making method into multi-layer neural networks and its application to financial distress analysis. Knowledge-Based Syst., 21(5), 383–390.

- Laha, A. (2007). Building contextual classifiers by integrating fuzzy rule-based classification technique and k-nn method for credit scoring. Advanc. Engineer. Inform., 21(3), 281–291.

- Marsland, S. (2015). Machine Learning: An Algorithmic Perspective. Chapman and Hall/CRC Press.

- Maslennikov, A. A. (2016). Analysis and assessment of the creditworthiness of the borrower. Service in Russ, and abroad, 6(66), 58–68. https://doi.org/10.12737/21196

- Maslennikova, N. P., & Maslennikov, A. A. (2015). Innovative methods for assessing the borrower at all stages of the cash flow. Actual Managem. Issues, 1, 89–92.

- Syryamkin, M. V., Suntsov, S. B., & Sudakova, E. S. (2016). Intelligent distributed pattern recognition systems in monitoring, forecasting, diagnostics, management and security systems. Reshetnev readings, 1, 579–581.

- Yakovleva, A. Y. (2018). Improving the program for assessing the creditworthiness of borrowers – individuals. Theory and pract. of modern sci., 12(42), 562–565.

- Zhuravlev, Y. I. (1978). Algebraic approach to solving recognition and classification problems. Cybernetics issues, 33, 5–68.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Glushchenko, M. E., Khаdasevich, N. R., & Kaufman, N. Y. (2020). Assessment Of An Individual'S Credit Solvency By Credit Organizations. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 221-228). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.31