Abstract

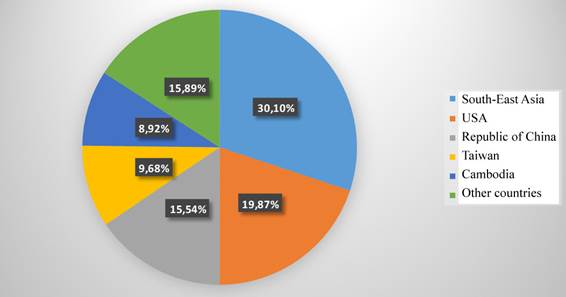

In the first half of 2019 paper and paper products export turnover slightly decreased in the paper industry of Vietnam compared to the same period in 2018. Vietnam exports paper and paper products mainly to the countries of Southeast Asia, the share of exports to this market is 30.1 %. Paper-producing enterprises operate stably, but experience difficulties due to price fluctuations and competition from countries in the region. A slight increase in the price of raw materials and chemicals used in the industry in the first quarter of 2019 led to an increase in paper prices. Therefore, in the near future, for the stable development of the paper industry in Vietnam it is necessary to adopt a new legal framework for the implementation of opportunities within the industry. Although enterprises rely on their own strength, the development of wood raw material zones and the development of production require a legal framework and assistance in forest planting and technological development of production, ensuring the provision of high quality products and environmental protection.

Keywords: Paper industry of Vietnamexportimportsectoral marketdevelopment

Introduction

According to the General Department of Customs Administration of Vietnam, the export turnover of paper and paper products in Vietnam in June 2019 looks unsightly and shows a decrease of 5.6 % compared to May of the same year. According to general estimates, from the beginning of the year to the end of June 2019, the export turnover of this product group amounted to only 506.04 million US dollars, which is 0.2 % less than in the same period of 2018.

Vietnam exports paper and paper products mainly to the countries of Southeast Asia, the share of exports to this market is 30.1 %, and to the EU countries is only 1.14 %.

In the top list of 10 key markets for the export of paper and paper products, the largest share is occupied by the US market with 19.87 %, which amounts to 100.59 million US dollars and this is 56.18 % more than in the same period of the previous year. In June 2019 alone, paper and paper products worth $ 15.94 million were delivered to this market, which is 40.51 % less than in May 2019, but 88.08 % more than in June 2018.

Problem Statement

Continental China, with its location and geographical proximity to Vietnam, follows the United States from 78.68 million US dollars, but at the same time, the pace of exports to this market has decreased by 39.71 %. If we count only June 2019, exports to mainland China amounted to 8.89 million US dollars, which is 57.38 % less than in May 2019, and 78.6 % less compared to June 2018 (Figure

This is followed by the markets of Taiwan (Republic of China), Cambodia, the turnover of which amounted to 49.02 million US dollars and 45.16 US dollars, respectively, which shows respective increase of 8.58 % and 46.35 % compared to the same period of the last year (VietStat, 2019a, 2019b).

In general, in the first half of this year, there is an increase in the rate of export to the paper and paper products market, whose share is 52.94 %; export to the markets of Great Britain and Germany is growing especially strongly, when exports to the UK increased by more than 3.7 times (by 272.78 %, respectively), amounting to 3.32 million US dollars overall; in June 2019, the export turnover to the UK decreased by 24 % compared to May 2019 and increased 2.7 times (168.79 % respectively) compared with June 2018, amounting to 548.1 million American dollars in value; export to Germany increased by 3.1 times (210.04 % respectively) and amounted to 2.43 million US dollars. In June2019, exports to Germany amounted to US $ 420.9, which is 16.3 % less than in May 2019, but 2.7 times more (172.21 % respectively) than in June 2018 (Table

The reverse phenomenon: the Philippines sharply reduced imports of paper and paper products from Vietnam, which amounted to 52.93 %, 7.13 million US dollars respectively; only in June 2019 did the Philippines increase imports from Vietnam by 20.44 % compared to May 2019, which amounted to 1.48 million U.S. dollars, but it was 8.43 % less than in June 2018 (Statistical data of the Main Customs Administration on the import-export of the paper industry for the first half of 2019);

Research Questions

Due to the fact that the Indonesian government has relaxed its new policy for the import of recycled paper, planned to be implemented from June 1, 2019, this has become favorable information for paper industry enterprises in Vietnam, exporting to this market. After all, Indonesia ranks 6th in terms of the export turnover of paper and paper products in Vietnam in the first half of 2019, the share of which is 6.1 %.

Earlier, the Indonesian government decided to control the delivery of goods by opening at least two packages of each container to check the condition of the recycled paper to ensure that the imported recycled paper is clean, dry and uniform.

Purpose of the Study

The decision immediately affected manufacturers importing recycled paper, the need for this type of product decreased in the country, and suppliers stopped selling recycled paper to Indonesia.

But, apparently, the Indonesian government has been backtracking in imposing previously proposed limits on pollutants at a rate of 0.5 % for imported recycled paper. Instead, it announced a move toward the implementation of the American Institute of Scraping Recycling Industries (ISRI) Guidelines of 2018 for Paper Stock: PS-2018. Meanwhile, the American PS-2018 allows in all cases to limit the presence of pollutants to more than 0.5 % (1–2 % for prohibited impurities (prohibitive materials) and 3–4 % for other permitted impurities (Outthrows)). Indonesian authorities have also clarified the term “homogenous” to compare these standards with the Vietnam FastMarkets Paper Association RISI / 6.2019. ( VPPA, 2019c).

Research Methods

This applies not only to the Indonesian market. There were many opportunities for exporting Vietnamese paper to the Chinese market when the PRC government announced the 8th action of issuing permits for the import of recycled paper in 2019 in the amount of 5.940 tons. This time, the Chinese government issued such permission for only two small companies. Similarly, with 5–7 actions of issuing permits, the volume of imports under new permits decreased by about 37.5 % compared with the estimated quotas at the beginning of 2019. Laizhou Rutong Specialty Paper company in Laizhou was allowed to receive 5,250 tons, while Guangdong Tonli Customization company in Guangdong was permitted to import 690 tons. The total permitted volume after 8 actions in 2019 was 8.238.995 tons. Compared with the same period in 2018, then the Chinese government held only 13 permits issuing actions, the total volume of which amounted to 10.844.135 tons. In 2018, China issued import permits totaling 18.2 million tons of recycled paper. According to forecasts in 2019, the total quota for imports of recycled paper by China will decrease and amount to 11–12 million tons.

Findings

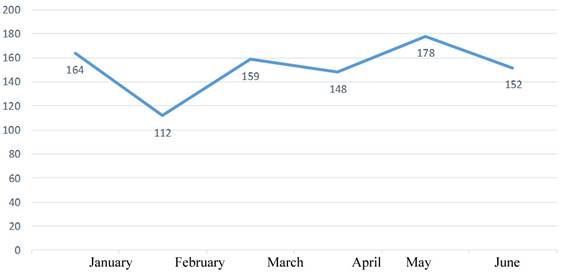

After growth in May 2019, paper imports in June 2019 decreased, namely, decreased by 13.1 % in terms of volume and 13.3 % in value, which corresponds to 152.6 thousand tons and a cost of 140.93 million US dollars.

According to general estimates, from the beginning of the year to the end of June 2019, paper imports amounted to 914.7 thousand tons worth US $ 853.1 million, which is 6.5 % less in volume and 6.3 % less in value compared to the same period of 2018 (see Figure

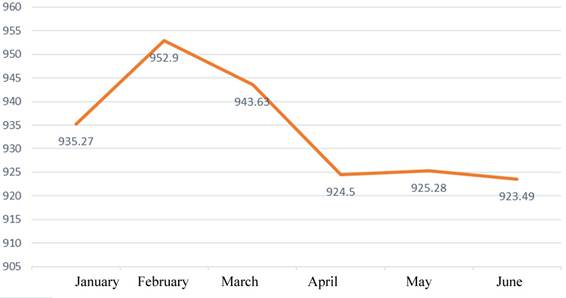

From the beginning of the year to the present, the value of imported paper has shown a downward trend. If in February 2019 there was a big increase, then in March and April a significant decrease began, in May 2019 the increase started again, but it was not sustainable and in June 2019 the cost began to fall.

In June 2019, the price of imported paper amounted to $ 923.49 per ton, which is 0.19 % less than in May 2019 and lower by 1.26 % compared to the beginning of 2019 ( VPPA, 2019b).

On average, during the first half of 2019, the price of imported paper amounted to $ 932.61 per ton, which is 0.04 % more than in the same period in 2018 (see Figure

Vietnam imports paper mainly from Southeast Asian countries, accounting for 27.4 % of total paper imports. However, compared with the same period, the pace of imports from Southeast Asian countries decreased both in volume and value, by 16.9 % and 17.39 % respectively, i.e., by 251.38 thousand tons and by 270.22 million US dollars; the average import price was 1074.95 US dollars per ton, with a decrease of 0.59 % compared to the same period of 2018.

Continental China with its location and geographical proximity to Vietnam is a major market for the supply of paper to Vietnam, it occupies 21.62 % of the market share, which is 197.8 thousand tons worth 172.40 million US dollars with an increase of 6.08 % in volume and 4.41 % in value compared to the same period in 2018; the average import price is $ 871.5 per ton, which means a decrease of 1.57 %. In June 2019 alone, Vietnam imported from China 34.19 thousand tons of various types of paper worth 31.09 million US dollars, which is 20.87 % less in volume and 14.01 % lower in value; the average import price was 909.52 US dollars per ton, which is 8.67 % higher than in May 2019.

South Korea ranks the second place after the mainland China market with 197.83 thousand tons worth 172.40 million US dollars, with an increase in volume of 6.08 % and in value of 4.41 %; at the same time, the average import price is 871.5 US dollars per tonne, which is 1.57 % less than in the first half of 2018. Namely, in June 2019, imports from South Korea fell both in volume and in value , respectively, by 19.2 % and by 9.44 %; the average cost of imports was $ 931.98 per ton, which is 12.08 % higher than in May 2019 (Statistical data of the Main Customs Administration on the import-export of the paper industry for 8 months of 2019 – Table

Next are the markets of Japan, Indonesia, Taiwan (China), Thailand.

It is noteworthy that in the first half of 2019, Vietnam significantly increased paper imports from the Austrian market and, although the volume is only 0.85 thousand tons and the cost is 0.45 million US dollars, but compared to the same period, the increase is more than 6.9 times (which is equivalent to 592.68 %) in terms of volume and 2.6 times (which is equivalent to 159.84 %) in value compared to the same period in 2018; the average cost of imports is 538.4 US dollars per ton, which is 62.49 % less. In June 2019 alone, 116 tons were imported worth 55.2 thousand US dollars, which is 2.5 times more in volume (which is equivalent to 146.81 %) and more by 29.23 % in value compared to May 2019; the average import price was 476.59 US dollars per ton, which is 47.64 % less.

Along with this, Vietnam sharply increased paper imports from Sweden, which amounted to 6.5 thousand tons worth 6.47 million US dollars, which is 3.2 times more in volume (which is equivelent to 203.5 %) and 2.6 times (which is equivalent to 155.78 %) in value compared to the same period in 2018.

The reverse phenomenon: Vietnam significantly reduced paper imports from the French market, which amounted to only 46 tons worth 90.8 thousand US dollars, which is 23.33 % less in volume and 1.77 % lower in value compared with the first half 2018; only in June 2019, 15 tons worth 35.40 thousand US dollars were imported from the French market with a decrease in volumes by 16.67 % with an increase in value by 32.11 % compared to May 2019 ( VPPA, 2019a).

Dependence on imports of raw materials

Although manufacturing activities were notable for their sustainability, industry enterprises faced significant difficulties due to price fluctuations and competition. On the world market, in the first quarter, prices for paper of all types increased and a slight increase continues due to the growth of production costs for source materials, starting from paper pulp, raw materials and chemicals, in the industry.

Enterprises of the industry were also informed that from the end of 2017 to the present, their Chinese competitors have been actively purchasing raw materials and finished paper products. This is due to the fact that in China, paper production is being reduced in the direction of choosing projects that ensure environmental protection.

A similar trend is driving paper suppliers into a tense situation. Therefore, enterprises predict future growth in prices for raw materials and paper imports.

In the Vietnamese market, the main production begins seasonally to meet the needs of the new school year and economic and production activities in the last months of the year.In addition, there is a growing need for paper packaging for the manufacturing activities of developing industries, which creates opportunities for paper and cardboard industry to succeed.

According to estimates by the Vietnam Packaging Association, packaging production in the country has grown significantly over the past 10 years, so there is a great need for raw materials.In 2017, Vietnam imported paper and paper products of all types in the amount of about 2.5 billion US dollars, while imports from China amounted to over 600 million US dollars. The purchase of raw materials and paper by Chinese enterprises contributes to the explosive growth in the export turnover of the industry ( RIPPI, 2019).

The development of commodity zones is becoming an urgent need

According to the explanations of the paper industry, the situation with the growth of imports is due to the fact that enterprises are not actively using sources of raw materials for the production of finished paper products. And the reason is that the industry lacks conveyors for the production of pulp from wood. Currently, the unprocessed raw wood is mainly exported to other countries, in order to subsequently import paper pulp as a raw material for the production of paper products. It should be added that the sources of unprocessed raw wood are replenished with new forest plantations, but there are not so many of them due to competition from the woodworking industry.

Now, the investment in paper companies is the result of their own efforts in the development of domestic segments of the paper market, in helping to compete with foreign enterprises in the domestic market.

However, depending on financial capabilities, each company has its own plan for the pace of its implementation. The Tanmai Corporation is the confirmation of this is. In 2018 and in 2019, it initiated an additional investment in a paper packaging plant with a capacity of 200,000 tons per year in Long Thanh (Dongnai Province) and a paper pulp mill in Kontum after abandoning the Kuang Ngai factory project due to difficulties with the site to place it.

For sustainable development, in addition to investments in equipment, enterprises determine a strategy for investing in paper feed zones with development plans for 20 to 25 years depending on the type of forest. In accordance with this, the enterprise concentrated on the formation of a land fund for forestry and extensive raw material zones in all provinces and cities of the southern part of the country.

For example, the Tanmai paper corporation manages forest and land grounds in Daklak, Ducknong, Lamdong, Dongnambo, Quang Ngai and Kontum with a total area of 31.105 ha. The corporation is also engaged in new forest plantations, so in 2017 they were established on the territory of 542.36 hectares, and in 2018 it was planned to additionally develop 1.187 hectares.

Conclusion

The paper industry has many opportunities and prospects for its development and expansion of the market. This is the effect of free trade area agreements, such as the Comprehensive and Progressive Trans-Pacific Partnership Agreement (CPTPP), the EU-Vietnam Free Trade Agreement (EVFTA), 2018. The EU was seen as a favorable market for consumer products in general, thus it was a great opportunity for enterprises to expand the market, to increase production.

Although enterprises rely on their own strength, the development of wood raw material zones and the development of production require a legal framework and assistance in forest planting and technological development of production, ensuring the provision of high-quality products and environmental protection.

Along with this, only in the presence of interaction between the population and enterprises, as well as between enterprises of the industry, can we hope for the rapid development of local raw material zones that meet the needs of high-quality production.

References

- RIPPI (2019). Vietnam's paper industry metrics for 2018. Paper Industry magazine, 1, 6. January 2019. http://rippi.com.vn/cong-nghiep-giay-so-1/2019-bid311.html

- VietStat (2019a). Statistics of the Main Customs Administration on the import-export of the paper industry for the first half of 2019. https://www.customs.gov.vn/Lists/ThongKeHaiQuan/ViewDetails.aspx?ID=1673&Category= Ph %C3 %A2n %20t %C3 %ADch %20 %C4 %91 %E1 %BB %8Bnh %20k %E1 %BB %B3&Group=Ph %C3 %A2n %20t %C3 %ADch

- VietStat (2019b). Statistics of the Main Customs Administration on the import-export of the paper industry for 8 months of 2019. https://www.customs.gov.vn/Lists/ThongKeHaiQuan/ViewDetails.aspx?ID=1696&Category= Ph %C3 %A2n %20t %C3 %ADch %20 %C4 %91 %E1 %BB %8Bnh %20k %E1 %BB %B3&Group=Ph %C3 %A2n %20t %C3 %ADch

- VPPA (2019a). Economic Newsletter of the Paper Industry, no. 1, 04.01.2019. Publ. House “Vietnam Pulp and Paper Association”. http://vppa.vn/ban-tin-kinh-te-nganh-giay-so-01-2019-vppa-news-no-01-2019/

- VPPA (2019b). Economic Newsletter of the Paper Industry, no. 19–22.05.2019. Publ. House “Vietnam Pulp and Paper Association”. http://vppa.vn/ban-tin-kinh-te-nganh-giay-so-19-2019-vppa-news-no-19-2019/

- VPPA (2019c). Economic Newsletter of the Paper Industry, no. 22–13.06.2019. Publ. House “Vietnam Pulp and Paper Association”. http://vppa.vn/7465-2/

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Nguen, K. N., & Karpus, N. P. (2020). Paper Industry Of Vietnam: Export, Import And Ways Of Sustainable Development. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 2210-2218). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.292