Abstract

The article deals with the issues of interaction of tax system elements and tax mechanism as a whole. Interaction of tax system elements makes part of the concept of 'tax mechanism'. General theoretical consideration of this content reflects the area of tax theory, in which the action of tax mechanism elements is differentiated by a number of subsystems. These subsystems reflect reproductive function, regulating function, and control function. It is noted that imbalance of tax system elements results from the imperfection of acts and measures carried out by the state in the field of taxation. Double tax withdrawal, which is characteristic of the current taxation system, is one of the major imbalances. Mechanism of interaction between tax elements, the system of taxes and the tax system is a very important issue for working out tax policy strategy by any state. It should be noted that the elements of the system of taxes are conditioned by functional relationships that determine the varying degree of closeness between the elements. The main task of economic reforms in Russia is to reform the fiscal system. Inefficient budget policy contributes to the growth of subsidized budgets, the dispersion of funds in numerous and poorly controlled extra-budgetary funds. Fiscal policy should be based on effective budget mechanism to ensure conceptual unity in the development of Russia's entities' budgets, the balance of interests at all levels of the budget system, improvement of methodological principles of evaluation criteria of budget relationships.

Keywords: Tax systemtax mechanismelements of taxation

Introduction

Expediency of considering the interaction of tax system elements is determined by the fact that the tax system is included in the concept of 'tax mechanism', the improvement of which by optimizing the tools is a very important area of modern research. Besides, thorough general theoretical investigation of this content will reflect the area of tax theory, in which the action of tax mechanism elements is differentiated by a number of subsystems characterized by reproductive, control, and regulatory functions.

The latter function, or rather its implementation at the national level, determines the degree of territorial tax flows' centralization by authorities. This process has worsened since 2002, when local budgets lost their stable and long-term share of the most collected taxes in their territories – VAT and income tax.

Problem Statement

It is obvious that the imbalance of tax system elements results from the imperfection of acts and measures carried out by the state in the field of taxation. Double tax withdrawal, which is characteristic of the current taxation system, is one of the major imbalances.

Research Questions

Effectiveness of economic decisions for the coming 2018–2022 years largely depends on successful implementation of tax policy. Only the tax policy that stimulates accumulation and investment and promotes economic growth, which is especially important for Russia today, can be considered effective. Determining the content of tax policy requires studying the essence of its main category – tax. The essence and content of tax is still one of the most relevant issues in the tax theory. What does the concept of 'tax' contain? We may assume that it reflects two aspects of the tax. The first aspect consists in alienation of a part of personal property to the state in compliance with the established order . The second aspect reflects a more capacious content of the concept of 'tax', a complex system of relations connected with the definition, establishment and withdrawal of tax.

The tax consists of separate elements, each reflecting a certain value: economic or legal. The tax is considered to be established only when all its elements are secured in legislation. As it is known, the tax elements, defined by individual components, are enshrined in the Law on the basics of the tax system. The tax elements constitute the body of a tax, its internal structure.

Purpose of the Study

Development of an optimal model of economic relations, from the viewpoint of financial interests of the state and taxpayers, especially in municipal territories, should be facilitated by the tax policy implemented over the past years (2012–2019). One of the main tasks of tax policy at the present stage is to create favorable conditions for active financial and economic activity of economic entities and to stimulate economic growth through combining personal and public interests, i.e. an optimal ratio between the taxpayer's funds and the funds that are redistributed through the tax and budgetary mechanisms. Solution of this problem is important for improving the tax mechanism of grassroots budgets, most of which have been characterized by budgetary gap for a long period.

Research Methods

The research methodology includes traditional methods (abstract-logical, graphic, tabular, absolute and relative values method) and the methods of structural-functional and statistical analysis.

Findings

Mechanism of interaction between tax elements, the system of taxes and the tax system is of utmost importance for developing tax policy strategy by any state. This is especially urgent for Russia having three types of budgets and complex financial structure due to the large extent of the territory, its uneven settlement, different production base.

Investigation of this mechanism requires specifying the concepts of 'tax system' and 'system of taxes'. First of all, the concept of 'tax system' is much broader than the concept of 'system of taxes', which is an integral part of the tax system (Gritskiv, 2018; Shishkanova, 2016). At the same time, it should be noted that during the entire period of functioning of any tax system, both the tax system and the system of taxes change.

The tax system, which also consists of separate elements, includes elements of all types of taxes and elements of the taxation system, characterized by the principles of organization of tax collection (Borisov, 2010). Structure of the tax system can be compared with the human body, where each individual organ has its own structure, where the functional dependencies of these organs are determined and their influence on the human body as a whole is revealed.

A detailed analysis of main elements of the tax will allow drawing right conclusions about the essence of the tax and the content of the tax system, identifying patterns of its development and making proposals aimed at improving its effectiveness (Varaksa, 2012). To characterize the main elements related to the definition of 'tax', let us consider their content from the legislative point of view (Evstafyeva, 2016). First of all, the tax (collection, duty) is a mandatory contribution to the budget of appropriate level (federal, regional, local), carried out by the taxpayer in the manner and on the terms determined by law. Subjects of taxation or tax payers are legal entities and individuals who must pay taxes in accordance with the law.

A tax payer is characterized by an independent source of income. In the context of the problem under consideration, it should be emphasized that subjects of taxation are hardly identified for various reasons. Objects of taxation result from legal factors (actions, events, conditions) that determine the subject's obligation to pay tax. Such factors include sales of goods, execution of works, rendering services, import of goods into the territory of Russia, possession of property, transactions of purchase and sale of securities, entry into inheritance rights, receipt of income in any form, etc.

The list of objects of taxation is established by legislation: profit (income), value of goods, added value of products, works, services, property of legal entities and individuals, transfer of property (donation, inheritance), transactions with securities, certain activities, and other objects established by law.

Since the object and subject of taxation are in close relationship, the above issues exacerbate the problem of improving methodological approaches to the formation of income base due to incomplete accounting of the number of taxpayers and their property and intangible assets. In this regard, it should be noted that a taxable item has the signs of actual (not legal!) character that justify the collection of relevant tax.

The taxation base is a quantitative expression of a taxable item. In the absence of a single complete national or, even, regional, land register, the taxable base gets lost. In some cases, the taxable base is actually a part of a taxable item, and the tax rate is applied to it as well.

The source of taxation is used to pay the tax. The source of taxation differs from the object of taxation. Only net income (profit) or capital of the taxpayer should be the source of tax payments.

The above elements of the tax are specific to each of its types separately. Analysis of the elements of the system of taxes shows that the elements characteristic of each individual type of tax have different relationships and the degree of combination with another type of tax.

For example, earlier we argued that the object and subject of taxation are in close relationship. However, it should be remembered that the nature of this relationship is very different, and it involves the construction of a tax system on the basis of different principles, namely:

the principle when the subject of taxation determines the object of taxation;

the principle of territorial belonging of taxes, where the object determines the subject of taxation.

Implementation of the first principle assumes that the state extends its tax right to all incomes of persons with permanent residence in a particular country, and to the income gained abroad. In Russia, the concept 'resident' includes the notion of a legal entity and an individual. The criteria for residency in different countries are very significant. In Russia, the residency involves registration of a legal entity or an individual. In other countries, the criteria for residency are represented with the minimum volume of services or goods produced, the location of the company's management bodies, etc.

This principle is implemented in developed countries, where the main business is located within a country, not abroad. The territory-based principle is typical of countries with a large share of foreign investments.

Many countries, including Russia, apply a combination of the above principles when building a tax system (Zibareva & Sakhchinskaya, 2017). Analysis of tax elements shows that the element also consists of separate parts. Let us call them 'microelements'. Such a structure, or rather disunity of the element into its components, is not typical of all tax elements.

Absence of microelements in certain tax elements predetermines the differentiation of the types of rates (increased, reduced, standard). This allows attributing the element 'types of rates' not to taxes, where the element 'tax rate' prevails, but to the system of taxes, where there are different types of rates (differentiated).

It should be noted that the elements of the system of taxes are conditioned by functional relationships that determine the varying degree of closeness between the elements. Thus, the element 'object of taxation' is very closely linked with the other element 'taxable base'. In case of their concurrence, the first element refers to the tax element. In case of non-concurrence, the taxable base' is an element of the system of taxes. This brings up the following question – in which cases non-concurrence takes place and why? In our opinion, the "loss" of separate microelements from the tax element leads to their non-concurrence.

Thus, the element 'object of taxation' of income tax coincides with the element 'taxable base' if a legal entity has no benefits. It should be taken into account that the unit of measurement used to value the amount of the above elements must be uniform and ensure the comparability of the two elements.

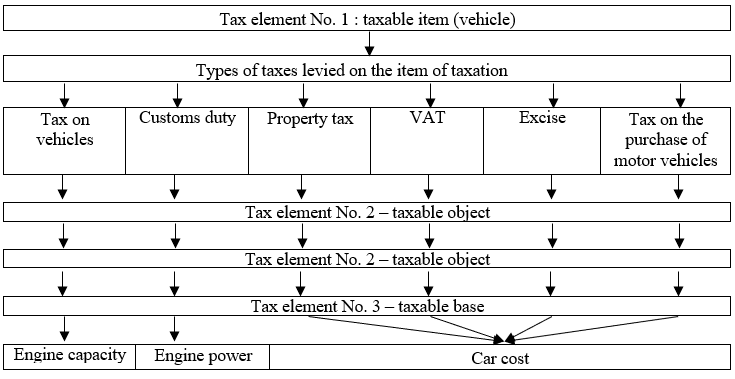

Tax consequences are connected with two elements: taxable item and object Analysis of the element 'subject of taxation' shows complexity in the difference between the two elements of the tax considered in the tax system (Dyukina, 2016). The concepts of these elements are very different with respect to individual taxes. The major difference is obvious with respect to property tax and income tax. Property of an individual (in the local budget) or a legal entity can be an item of several taxes, where the element is represented with a taxable item (Figure

Different types of taxes may have different objects of taxation with a common element (taxable item). In our example, the 'taxable item' (a car) is common to all of the above six types of taxes, while the element 'object of taxation' is different.

This relationship shows the complexity in determining the scale of tax, the difference in the methods of determining taxable bases. At the same time, taking into account different objects of taxation and taxable bases, tax amounts are withdrawn to different budgets.

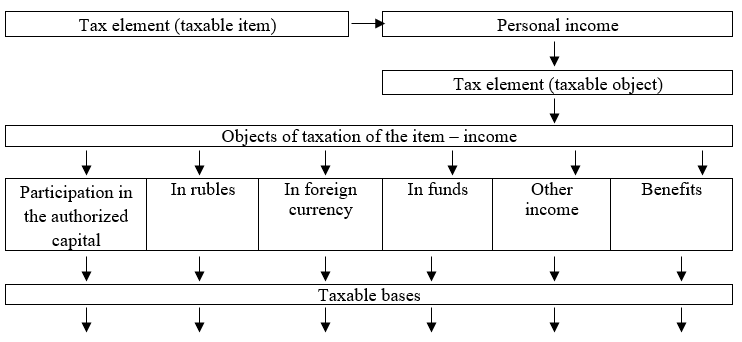

Taxation of personal income is characterized by even more difficult combination of the above elements (item and object). This circumstance is complicated by the specifics of payments by individuals in Russia. Thus, objects are very different even with a single taxable item (Figure

Analysis of the taxation system elements shows that they include elements of taxes, elements of the system of taxes and legal facts that determine the implementation of such a tax element as the "procedure and terms of payment". For example, possession of material assets (goods) by a legal entity does not cause the obligation to pay VAT, while the purchase and sale in accordance with the legislation of the Russian Federation cause emergence of the element 'object of taxation', i.e. the fact which determines the obligation to pay tax (payment procedure).

Elements of the tax system are formed from the structures of its components, i.e. elements of the tax, the system of taxes and the tax system. The presented structure of the main elements of the tax system shows the presence of elements corresponding to different categories, or levels, of the tax system. It gives us an idea not only about the number of elements corresponding to the tax "chain". Ultimately, all elements from the first link to the last one are concentrated in the system. Insufficient interaction generates "repulsion" of elements of the tax system and leads to malfunction, violation of the harmonious interaction of all mechanisms of the tax system, which will be reflected further on.

Interaction of tax system elements makes part of the concept of 'tax mechanism'. General theoretical consideration of this content reflects the area of tax theory, in which the action of tax mechanism elements is differentiated by a number of subsystems. These subsystems reflect reproductive function, regulating function, and control function. It is obvious that the imbalance of tax system elements results from the imperfection of acts and measures carried out by the state in the field of taxation. Double tax withdrawal, which is characteristic of the current taxation system, is one of the major imbalances.

Conclusion

The main task of economic reforms in Russia is to reform the fiscal system. Inefficient budget policy contributes to the growth of subsidized budgets, the dispersion of funds in numerous and poorly controlled extra-budgetary funds. Fiscal policy should be based on effective budget mechanism to ensure conceptual unity in the development of Russia's entities' budgets, the balance of interests at all levels of the budget system, improvement of methodological principles of evaluation criteria of budget relationships.

Taxes as an important tool of the state's budget policy, are intended to serve the strategic goals of budget reforms. Creation of a flexible fiscal mechanism implies an optimal differentiation of powers between the federal and regional authorities, a constant composition of taxes at all levels of the tax system. In our view, the specifics of economic relations development in Russia determines the fixing of taxes to the levels of government, followed by their redistribution.

References

- Borisov, A. M. (2010). 'Tax system', 'taxation system' or 'system of taxes and fees'? Taxes and taxation, 3, 66–75.

- Dyukina, T. O. (2016). Definition of 'tax system': new view. Innovat. Develop. of the econ., 3-2(33), 53–55.

- Evstafyeva, A. K. (2016). Ratio of tax definitions: system of taxes, tax system and tax administration. Issues of reg. econ., 1(26), 82–98

- Gritskiv, M. A. (2018). Mechanism of functioning of the tax system as the central link of financial and budgetary systems. Bull. of modern res., 6.4(21), 15–19.

- Shishkanova, O. V. (2016) Analysis of indicators of tax payments and control work of tax authorities of the Federal tax service of the Russian Federation. Econ., 49-1. https://novainfo.ru/article/7288

- Varaksa, N. G. (2012). Formation of structural elements of the tax mechanism and their interaction at the macro- and microlevel. Econ. sci. and human., 7(246), 92–98.

- Zibareva, E. V., & Sakhchinskaya, N. S. (2017). Tax system of Russia and its comparative analysis with the tax systems of developed countries. Bull. of the Samara Acad. of Human. Ser. Econ., 1(19), 80–82.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Basnukayev, M. S., Klyukovich, Z. A., Mambetova, A. A., Sugarova, I. V., & Elzhurkaev, I. Y. (2020). Mechanism Of Tax System Elements Interaction. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 145-151). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.20