Abstract

The global economic internationalization and integration, especially in the sector of financial interaction through capital investment flows, as well as the purchase of securities of corporations and government bonds, affects, inter alia, a large developing region such as the Community of Latin American and Caribbean States (CELAC). Since the end of the 1990s, as well as during the crisis period of 2008-2014 Spain managed to strengthen its position as one of the largest financial partners of the region. Within the created commonwealth of Ibero-American countries (Spain, Portugal and CELAC countries), the partner countries go hand in hand to the internationalization of banking operations. Over the past decade, Spain became the main European investor in America focusing on such sectors as energy, telecommunications, infrastructure, banking and hydrocarbons. The growth of these investments in the region is caused by the development opportunities created by privatization and liberalization in CELAC countries. Since the 1990s, some banks and Spanish companies have felt the need to expand and compete in international markets, seek business abroad and achieve a higher level of efficiency thus making them more competitive in a globalized world. However, they faced some difficulties entering the established European market and turned their attention to Latin America. According to Ramon Casilda, professor of the Institute for Stock Market Studies and the University Research Institute, “this is the era in which private banks pay attention to the importance of taking advantage of financial and economic globalization…”.

Keywords: Ibero-American economyinvestment cooperationmergers and acquisitionsinvestment activityfinancial market

Introduction

The study considers the formation and development of the financial market of Ibero-American countries with the identification of the Spain’s role and place in the economies of Latin America. It demonstrates the integration dynamics of the Ibero-American banking sector. The analysis of the growth of investments of Spanish companies into the economies of Latin America was carried out with the identification of priority sectors of the economy. The development dynamics of the trade relations of Spain with Latin American countries is considered with the identification of the impact of these processes on the intensification of investment cooperation.

Problem Statement

The relevance of this topic is caused by the scale of its importance since Spain is one of the largest economies of the EU. At the same time, the EU position is quite unstable now, and the CELAC region (Latin America and the Caribbean) showed sustainable stability and even growth during the global economic recession. This made Spain and Portugal and recently large Asian economies (including China) to shift towards the South American continent.

Research Questions

The main task of sustainability and sustainable growth or at least the exclusion of recession is critical for both developed and developing states. In this situation the coordination between countries with certain prerequisites for integration seems quite typical despite differences in the level of development, and in the case of Spain and Latin America, on the contrary, it is favored by this fact, i.e. through North-South integration. The example of such transatlantic interaction scheme is a clear and relevant model for modern international economic integration. In general, following the independence of Latin America and over the past two hundred years its relations with Iberian related countries have developed with the establishment of cultural and economic structure of their relations. Since the 1980s, there has been a continuous integration at the highest level, and regional groupings of the continent such as MERCOSUR, UNASUR, etc., have been actively involved in the process along with the governments and major companies in Spain.

At present, the economic situation in the world is complicated by price turbulence, politicization of decisions at the highest levels, sanctions and counter-sanctions policies, instability of relations between countries and various disasters, including natural disasters, wars, armed conflicts, terrorist attacks, etc.

In such a situation, even the most stable economic and political ties, for example, in the European Union, are being undermined. Uncertainty in the future is pushing financial systems, banks, investors for radical changes in partner search and current decision-making policies, which in turn is causing market shocks leading to economic crises. This state of affairs forces the players of the international trade arena to seriously analyze the market conditions and to take serious deliberate steps towards cooperation. The Ibero-American economy is a clear example of this kind.

Purpose of the Study

The purpose of the study is to analyze the main trends and prospects of financial, including investment cooperation of the Ibero-American countries.

Research Methods

The methodological basis of the study was such popular scientific methods as dialectical, system-structural, logical, analysis and synthesis.

Findings

Spanish banks decided to invest abroad by acquiring other banking chains thus becoming multinational companies as part of the national procurement process. This was the beginning of the internationalization of banks. At first, the expansion to other European countries was not perceived as viable due to some factors, such as lack of capital, but primarily due to socio-cultural aspects. Latin America was then represented as an emerging market that was not developed enough and which presented many opportunities for major Spanish banks. At the same time, Spain has demonstrated a developed market with high level of bank penetration and stagnation in the country’s inner field. The middle class – one of the great discoveries of Spanish banking in the region – started in the 1990s in South America. The structure of the population with the highest rates among young people made it a very attractive business area since the level of banking services was very low and made only 20 %. This market offered something nobody else could: a common language that facilitated and accelerated negotiations with local companies and banks. The internationalization of banks also allowed Spanish banks to protect themselves from possible mergers or acquisitions by other European banks because they were organized around independent subsidiaries. José Maria Roldan, president of the Spanish Banking Association, notes that the objective of this model was “to protect Spain from turbulence in Latin America and, after all, that is what protected it from Eurozone turbulence”. According to him, the expansion showed that “Spanish banks know how to manage finances and they have technologies that make them competitive”.

Historically, the Spanish financial “reconquista” began with the expansion of the BBV bank (Banco Bilbao Vizcaya) through its amalgamation with Argentaria in 1901, when the first office in Paris was opened. By 1918 it already had its fourth international office in London. In 1995, the bank began its international diversification with a plan of “1.000 days” acquiring the Continental Bank of Peru in Latin America through a privatization campaign that the Peruvian government began in 1992, resulting in the creation of BBVA Continental. In 1996, BBV acquired 30% of shares in Banco Francés in Argentina, and after another series of purchases, it became its owner. The future BBVA Francés then became the second legal entity in Argentina by the volume of deposits and the third by the volume of loans. The group was also seen in Mexico as a major expansion target in CELAC. BBV acquired 70 % of Proburs and in 2000 finished a merger with the Bancomer group, from which it acquired 58 %. This is how the multinational bank BBVA Bancomer emerged (España y América Latina: de la mano en la internacionalización bancaria, 2018). In the ranking of the largest Latin American banks BBVA Bancomer holds the 6th position (Table

After rapid expansion the Latin America banking sector has recently showed slower growth due to political turmoil and steep drop in commodity prices. While the future seems uncertain, major banks hope to return to the double-digit annual growth they saw a decade ago. Today, according to the analytical company S&P Global, the largest banks in Latin America are mainly concentrated in three countries. Brazil claims the five largest institutions by asset size, while three are in Mexico and two are in Colombia. At the same time, it can be observed that three of the ten largest banks in the region are Spanish, including the first participant of the CELAC market – BBVA. Analyzing the data in Table

Gómez (2018) in his article refers to the study by the National Institute of Statistics (INE), which presents the ranking of 10 countries where Spanish companies invest more money. Half of these markets are Latin American. In 2016 there were 5,851 Spanish companies abroad, their turnover amounted to 195.093 million euros, they employed 737.562 people. The areas of activity with the greatest penetration are manufacturing (19 %) and information and communications (18.9 %).

The United States was the first country to achieve the highest turnover (14.7 %) followed by the United Kingdom (13.4 %) and Brazil (12.2 %). The fact that Spain is active in the region is that some Latin American countries are displacing traditional markets for Spain, such as France, Portugal and Italy. The Vice President of Banco Santander acknowledged that Latin American subsidiaries were saving the group’s global business because they were losing money in Spain. “Of the total profit, 60% comes from Latin America, 21 % from the UK and 17 % from Santander Consumer Europe Business in Spain, including Banco Santander España. The corporate center and real estate division do not bring profit”, he assured the Investigation Commission in the Spanish Congress dealing with financial crisis. Mexico holds the fourth place after Brazil. Its turnover reached 6.1 %, one tenth higher than France, which ranks fifth, and 1.3 points more than Portugal, which ranks sixth. It is also worth noting that 9 % of Spanish companies have French subsidiaries, 12 % have Portuguese subsidiaries, and 4.8 % have companies in Mexico. This data shows the competitiveness of Spanish companies in Latin America. Argentina is the seventh and Peru is the eighth, ahead of Italy. Chile closes the table on the tenth place because the turnover there made 2.8 %. It should be borne in mind that 2.9 % of Spanish companies have a subsidiary in the country. Brazil is the first international market for Banco Santander and Telefónica. It should be noted that the top 10 countries with the largest turnover represented by INE account for 70.6 % of all activity. They also concentrated 55.8 % of the total number of subsidiaries of Spanish companies abroad and 61.5 % of the total number of people working for these subsidiaries.

The INE report highlights that by region most Spanish subsidiaries were located in the euro area (41.2 %) and in America (28.5 %). As for turnover, the companies generated 50.6 % of the total activity in the Americas, while the subsidiaries in the euro zone received 21.2 %.

In recent years, Latin America has become a major focus of Spanish investment, especially in such sectors as infrastructure, which diverted its efforts beyond Spain before construction work stopped during the country’s recession. In addition to this sector, Spanish investment in Latin America also focuses on telecommunications, manufacturing, financial activities, and energy. Besides, it should be noted that other activities, such as trade or hotel business, are also attractive for investments despite economic ups and downs.

IE Business School prepared the eleventh edition of its Panorama de Inversió Española en Iberoamérica report (Aumenta la inversión española en América Latina, 2019), which concludes that Spanish companies have improved their economic expectations in relation to the region to the extent that three out of every four companies expected an increase in their investments in CELAC in 2018–2019. IE study, which was prepared on the basis of responses from 105 companies, shows that 24% of companies intend to keep their investments compared to 1 % who will reduce them. Juan Carlos Martínez Lazaro, a professor of economics at IE Business School, stressed that this increase in investment is driven by a widespread expectation of improvement. Thus, when in 2017 the IMF predicted that the 1.9 % growth in Latin America and the Caribbean compared to 1.3 % in 2016, Spanish companies also predicted their participation in the Latin American market. Segmentation across countries, Mexico and Peru, stands out in the report as the most attractive to Spanish investors. According to IE, the Aztec country is the country in which more Spanish companies intend to invest. Mexico is at the head of the ranking of attractive countries for Spanish business followed by Colombia, Peru, Chile, Argentina, Brazil. Only Venezuela shows a decline in investment attractiveness against the background of the country’s turmoil.

However, despite the volatility of the region’s economies, the ties that unite Spain with Latin America remain quite strong. The imprint of centuries-old Spanish colonization on the continent gave rise to numerous interdependencies, some of which were as important as the common language. The Elcano Global Presence Index (2018) aims to measure the country’s impact forecast overseas differentiating the types of presence in three dimensions (economic presence, military presence, and soft presence), which are divided into different indicators. Latin America ranks fifth in the classification of global presence by region despite being the fourth region by its population and GDP. Similarly, the fact that most of the Latin American countries included in the index constitute the production structure of primary exports has led to a decline in the value of their exports as a result of a halt in commodity prices. It should be borne in mind that these data reflect the aggregation of the external forecast of the countries that make up the regions, and therefore very much depend on the degree of interconnection of the economies of the countries belonging to the same region, i.e. it shows not the external forecast of Latin America, but the aggregate forecast of each of the Latin American country included in the index.

On the other hand, a published assessment of Spain’s global presence by country and geographical region shows that Latin America is the second region with the largest presence in Spain (Table

The role of Spanish transnational corporations in the region, as well as the importance of the Latin American market for these companies, is indisputable. Although the region’s presence is increased by commodity exports, and the most of its foreign direct investment (FDI) is aimed at taking control of the commodity sector, this contrasts with the fact that most Spanish companies are service providers (finance, telecommunications, electricity) focused on important domestic markets of these countries. The three largest Spanish companies of The Fortune’s world 500 rating, receive, as mentioned above, an important part of revenues in this region.

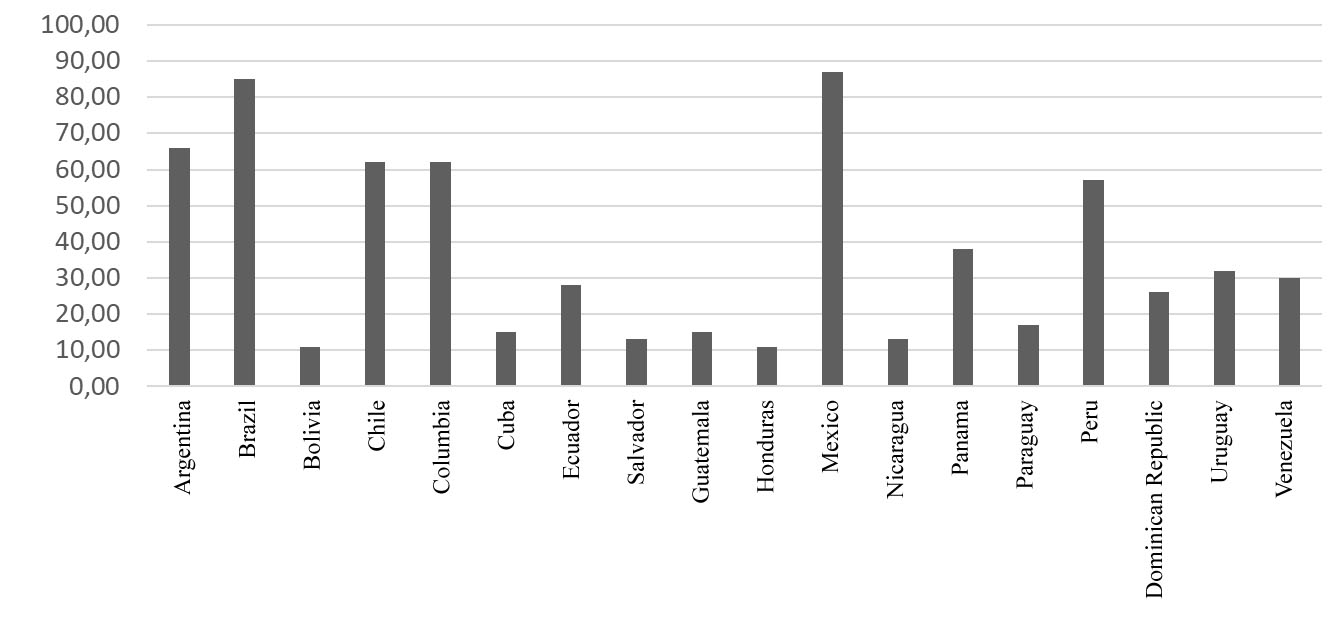

In the economic dimension, the indicator that most contributes to the presence in Spain is the investment, which accounts for 7.8 % of the total presence in the region (13.6 %). This is consistent with data provided by the Secretary of State for Trade on Spanish FDI in Latin America, which in 2015 accounted for 29 % of the total flows and 30.4 % of Spain’s investments abroad (Figure

The relevance of investment in the Spanish presence in the region should be viewed from both sides. On the one hand, it is obvious that international financial flows have become more relevant in the economy. On the other hand, the history of Spanish companies in the region is linked to the process of mergers and acquisitions that took place in the 1990s, in which FDI played a leading role. This process was related precisely to internal privatization of state-owned companies, whose acquisitions allowed these Spanish companies entering large emerging domestic markets.

Spanish investment was mainly directed to sectors with a greater domestic orientation, allocating financial and insurance services with 40 % of FDI shares in 2015, compared to less than 5 % focused on the primary sector. Therefore, although Latin America is the appropriate region for Spain’s presence and this forecast is marked by its investments, it cannot be said that they affect the region’s outlook or that they may change it in the near future.

The 1990s marked a turning point in trade relations between Spain and Latin America. These are the two territories, united by cultural, linguistic and historical ties that gave a new step towards expanding their commercial relationships. During this decade, Spain’s foreign direct investment in Latin America increased four times. 46% of Spanish investment was directed to the region. Spanish companies landed in the region, increasing exports, buying other companies, installing their headquarters on the continent, and increasing capital. European companies already have a strong presence in Latin America. According to the Economic Commission for Latin America and the Caribbean (CELAC), some 41 % of the region’s foreign direct investment (FDI) flows from European companies, a presence that is particularly important in South America.

These European investments are dominated mainly by Spain, which accounts for 29 % of European investment in new projects in the region and 29% of European mergers and acquisitions between 2005–2017. Germany (16 %), Great Britain (13 %), Italy (12 %) and France (11 %) are the other most notable investment countries. According to financial analysts, in order for Spain to become a link between Europe and Latin America, “it is important to maintain bilateral direct investment flows between the two regions and avoid protectionist trends”. From the commercial perspective the importance of this region to Spain is growing rapidly, and in turn has led to the existence of eighteen economic and commercial divisions of the Ministry of Commerce, and an extensive network of agreements to avoid double taxation and in the fight against tax fraud, as well as a series of investment promotion and protection agreements (APPRI) that cover most countries in this region.

Today, Spanish companies are leaders in the region in such sectors as telecommunications, banking, energy, infrastructure, tourism and business services, including through companies such as Telefonica, Indra, Hispasat, Endesa, Agbar, Repsol, Mapfre, BBVA, Santander, Melicia, Iberdrola, Abennas or Técnicas Reunidas. Moreover, Spanish companies have expanded their investment in the region in recent years, doubling their commitment and confidence in Latin America’s growth and development. For example, one of the most important engineering works in the world, the expansion of the Panama Canal, was carried out by a consortium led by the Spanish company Sacyr.

Conclusion

The outcome of this study is a confirmation of the importance of financial internationalization processes, which serve as a tool for diversifying risks in crisis situations, as well as increasing revenues by expanding the spread of corporations and banks. Defending financial globalization and showing that finance is always the other side of the real economy, despite the difficulties and obstacles that arise in deepening and establishing ties with foreign partners, is a fundamental task for active financial market players, represented by banks, corporations, states and influence organizations such as the IMF, OECD and others. An example of this process is the approach explored in this paper to the issue of financial consolidation of CELAC countries and Spain, which had a huge number of prerequisites for integration, as well as certain problems on the way. In this line of internationalization, the technological revolution erases the boundaries. Spanish banking internationalization has huge advantages of the system and is preparing new models for banking sectors and retail for global organizations. Therefore, having entered the external market and managed to create new communication flows Spanish banks are an example for the world banking system and investment agents of various countries.

References

- Aumenta la inversión española en América Latina (2019). https://dirigentesdigital.com/hemeroteca/aumenta_la_inversion_espanola_en_america_latina-DPDD72948

- Elcano Global Presence Index (2018) https://explora.globalpresence. realinstitutoelcano.org/en/country/iepg/global/ES/ES/2018

- España y América Latina: de la mano en la internacionalización bancaria (2018). https://www.bbva.com/en/corporate-information/#bbva-in-the-world

- Gómez, D. (2018). Las empresas españolas facturan más en América Latina que en Europa. https://alnavio.com/noticia/15145/economia/las-empresas-espanolas-facturan-mas-en-america-latina-que-en-europa.html

- Panorama de Inversión Española en Iberoamérica (2018). https://www.marcasrenombradas.com/wp-content/uploads/2018/03/16-INFORME-IE-2018.pdf

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Tsutsieva, O. T., Tsogoeva, M. I., Sikoeva, M. T., & Gazyumova, L. (2020). Spain'S Large Business Investment Policy In Latin America Under The Ibero-American Economy. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 1115-1122). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.147