Abstract

In recent years, Islamic capital has occupied a substantial niche in the world economy. The number of Islamic banks that fully meet the requirements of the Islamic economic model has significantly increased. At the same time, due to globalization of the world economy, not only Islamic banks, but also traditional European banks provide financial products based on sharia canons. Islamic sukuk securities form an important part of Islamic finance. The international market for Islamic sukuk is relatively new but quite dynamic. The need to take into account diverse interests in financial relations determines the interest in the structure and trends of this market. The paper describes the dynamics and structure of the sukuk market. The main issuers of national and international sukuk were identified. The main obstacles to the development of the sucuk market were highlighted. These include: difficulty for Western investors, the need for sharia control, lack of guidance for pricing. The forms of sukuk in the Russian Federation were described. They may involve the attraction of foreign investors from Muslim countries to implement large infrastructure projects.

Keywords: Islamic financesecuritiessukuksecurities market

Introduction

Just a few decades ago, the Islamic model of economics seemed far from being a reality, or simply utopian. However, the increased interest in shariah-based financial products in recent years has led to the establishment of Islamic financial institutions not only in Islamic countries but also around the world, and to the opening of Islamic windows in traditional European credit institutions. The inevitable processes of globalization of the world economy, the increasing pace of international investment, the need to find alternative means of financing affected, among other things, the actors of the Russian economy that are showing increased attention to Islamic financial instruments.

The study (Tashtamirov et al., 2015) suggests that the Islamic concept is flexible and can be actively applied not only in Muslim countries, but also in other countries, as eloquently evidenced by the pace with which the number of Islamic financial institutions successfully functioning in the world today is growing. The importance of Islamic finance for the Russian economy is also great.

A distinctive feature of Islamic security is its non-debt nature: instead of an obligation, it provides a stake in a basic asset (this binding to basic assets partly gives birth to Islamic securities with innovative forms of financial entrepreneurship emerging in the Western model (Kotlyarov, 2010)). In this regard, the risks associated with ownership of the asset are borne by the bondholders, not the issuer. Thus, the issuer is not guaranteed payment on the bond. However, in case of default, the holders are entitled to exercise property rights by selling their share and thus returning some or all of the investment.

Problem Statement

At present, there is a growing interest to both the Islamic financial model in general and the feasibility of using certain Islamic financial instruments. However, the use of these instruments in Russia is complicated by the fact that there is no methodological mechanism to assess their economic efficiency. Most of the works published in our country on the problems of Islamic finance are mainly devoted to the analysis of differences between the Islamic financial model and the traditional or world experience of the former, while the problems of calculating the efficiency of specific financial instruments are often neglected.

Research Questions

The main objectives of this study are as follows:

To identify the content and purpose of Islamic sukuk securities.

To analyze the practice of issuing and circulation of Islamic sukuk securities in the world financial system.

To identify peculiarities of sukuk production and prospects of development of this financial instrument in the Russian economy.

To detect possible obstacles to the introduction of Islamic sukuk securities in Russia.

Purpose of the Study

The purpose of this study is to identify the possibilities and potential of using Islamic sukuk financial instruments to further attract investment and overcome sanctions pressures.

Research Methods

In 2008, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) defined sukuk as certificates of equal value providing an indivisible share of ownership in tangible assets and services, assets of any project, and the right to use and generate income.

Modern economic theory offers a different classification of Islamic bonds. Generally, bonds are divided into two types: asset-backed and asset-based. The bond is also classified on the basis of Islamic financing models: direct financial participation (profit and loss participation – mudaraba and musharaka), indirect financial participation (trade margin principle – murabaha, leasing – ijara, preliminary prepayment – salam) and charitable participation. Most types of sukuk do not involve the actual sale of basic assets, they are rather their temporary placement to raise funds.

According to sukuk mudaraba, the dividends are paid on the basis of the profit distribution ratio specified by the parties, payments are made twice a year, maturity – up to 10 years. Despite its long maturity, bonds are popular in the interbank transactions market as they are rated by financial institutions as highly liquid instruments (GEMS, 2015). The securities are subject to repayment at nominal value, except in cases of markdown or loss of the underlying asset.

Value Determination Methodology

The market price of sukuk, based on its face value of 100 MYR – Malaysian ringgits (the currency in which most Islamic bond issues are traded), is calculated by the formula:

Pr(1)

(2)

where P – market price of a bond;

r – yield to maturity;

C – indicative coupon;

t – frequency of coupon payments;

N – number of days between the last coupon payment and the date of transaction;

T – number of days between the transaction and the next coupon payment;

Prcd – income from the sale of sukuk;

Q – amount of issued bonds.

Based on the essence of the Islamic leasing deal, it is possible to build an approximate model of evaluation of sukuk ijara. Its price is made up of aggregated discounted cash flows from future periods. However, the discount rate cannot be determined by the interest rate, as in traditional funding. The literature does not contain any model of evaluation of sukuk ijara. Based on the financing mechanism of the ijara, it can be assumed that the bond price is the sum of two components: the present value of payments on the bond and the present value of the expected price of the underlying asset as of the maturity date.

In this case, the expected value of the underlying asset can be determined as a weighted average of several possible prices:

(3)

Alternative source of funding under Western sanctions.

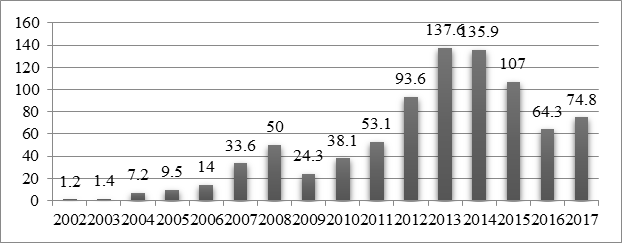

The first issues of sukuk were registered at the end of 1996, but they appeared on the market only in 2001 with more active use of this financial instrument (Niyazbekova, 2012). The sukuk market is now a large and dynamic part of the world’s Islamic finances. The dynamics of production volumes of sukuk in the world is shown in Figure

The diagram shows that since 2015 there has been a slight decrease in the volume of sukuk production in the world. The fall in volumes in 2016, which was 43 % compared to the volume of issues in 2015, is particularly noticeable. The experts explain this by the fact that since 2016 the National Bank of Malaysia has decided not to issue short-term domestic bonds sukuk. The total value of sukuk in the market reached $318.5 billion by the end of 2017, an increase of 6.06 % compared to the situation at the end of 2016 (IDBank, 2011).

From the perspective of a potential participant, the study of the structure of issuers and the objectives of the issue of Islamic securities present a particular interest. The world market of sukuk is analyzed depending on whether securities for internal or international turnover are issued and also on the specifics of the issuer – the state, government institutions or the corporate sector.

Domestic markets form about 80% of the total value of sukuk in the world. These are mainly short-term securities issued in various national currencies. In this sector, Malaysia is a major player offering about 80 % of all issues in value over 15 years, with a total of 4647 issues and a total of $486.5 billion.

Predominantly non-Muslim countries producing international sukuk (France, Luxembourg, etc.) do not use them on the domestic market. The main purpose of issuing these securities in such cases is to attract the capital of financial companies and state funds of Islamic states, to ensure the opportunity to invest in foreign assets in compliance with all principles of sharia.

The first Western state to issue sukuk on behalf of the government was Great Britain in 2014. The demand for this instrument was 11 times higher than the original intended amount of the subscription. In a number of developing countries (Gambia, Nigeria, Oman, etc.) only domestic sukuk was produced or its volume was much larger than international ones (Sudan).

It shall be noted that the most common issuers of non-state sukuk are Islamic banks, in particular Saudi Arabia, Turkey, Kuwait and Qatar. In Malaysia and Indonesia sukuk issuers are represented not only by the banking sector, but also by a number of other industries. Currently, international trading sites for the placement and circulation of sukuk include the London and Luxembourg Exchanges, which for a long time have held the leadership in attractiveness for foreign issuers (Zotova & Shevchenko, 2010).

The major ones in this sphere are still the large exchanges of Islamic countries, which are important not only for the international, but also for the national circulation of securities: Bahrain Stock Market in Bahrain, BURSA Malaysia Berhad in Malaysia, Dubai Financial Market in the UAE, Istanbul Stock Exchange in Turkey, Exchange in Iran Stock Exchange. As a rule, the yield of sukuk as a whole slightly exceeds the yield of ordinary bonds. This is because sukuk are shorter-term instruments and have a higher investment quality. Trading in these securities is not very active as their main investors are Islamic banks and takaful companies (insurance companies), which usually buy bonds and keep them in their portfolios until maturity without trading them in the secondary market. As a result, the volume of the secondary sukuk market is far behind that of the similar market of traditional non-Islamic bonds (Razumova, 2015).

Russian issuers are not yet present on the sukuk market. At the same time, there are separate examples of participation of the largest Russian banks (Vnesheconombank, Sberbank, VTB) in international transactions of this kind. Thus, in April, 2017 the VTB Capital helped arrange a dollar sukuk for UAE property developer.

Findings

Summarizing the analysed data, four segments of the global sukuk market can be distinguished depending on the issuers and the securities circulation market (Table

Sukuk is a very attractive and promising instrument of Islamic finance as it allows to structure the financial process differently without departing from the principle of risk sharing between the issuer and the investor, which best meets the needs of financing large infrastructure projects. At the same time, their full application implies the development of national markets and the need to produce sovereign sukuk to form adequate benchmarks for subsequent corporate issues (IDBank, 2011). The experience of the markets of Malaysia, Indonesia and the UAE demonstrates the logic and success of this approach.

A significant problem limiting the spread of sukuk is the need to exercise sharia control over transactions that claim to conform to Islamic postulates.

Sharia control is a necessary part of the process of preparing the issue of Islamic securities, which, together with the difficulty for Western investors of the mechanism and principles of sukuk itself, appears to be a significant obstacle to their spread in non-Muslim countries.

The examples of developed Western countries and some CIS States show that the governments and non-state entities (banks, enterprises) can issue sukuk-type securities and offer them to investors in Muslim countries. This can be done both directly and through large international stock exchanges. Some examples of participation of the largest Russian financial institutions in transactions of this kind show the possibility of such transactions with Russian participation. In the future, it is possible to assume the use of sukuk for the implementation of regional infrastructure projects in the republics of the North Caucasus, Tatarstan and Bashkortostan, as well as for structuring international investment transactions with the participation of partners from Muslim countries.

Despite the novelty of sukuk as an instrument of the international financial market, there is every reason to believe that its potential will be in demand in the future, and its scope will expand with the development of Islamic banking and the increasing role of regional financial centers in the Middle East and Asia and the Pacific.

The sanctions imposed on Russia in 2014 had a very painful impact on a number of sectors of the domestic economy, in particular, they restricted the access of large Russian banks and enterprises to foreign long-term financing. In this regard, the management of financial institutions faced the task of finding a source of financing alternative to the most common debt instrument – Eurobonds. Such a source could be a sukuk bond (Alexey, 2014). State banks have a sufficient base to implement an Islamic finance scheme, and recent changes in the economic environment show increased interest in the economies of the Middle East and Asia.

Currently, Russia is working on the introduction of Islamic finance thus establishing the corresponding institutions to develop standards in this field. In 2010, the Working Group on Islamic Financial Institutions and Instruments was transformed into a permanent non-profit organization, the Russian Association of Islamic Finance Experts (RAEFE). Its purpose is to create conditions for the development of Islamic finance in Russia, as well as to coordinate the actions of experts to study and use ethical principles of financial activity based on the rules of Islamic finance and the system of Russian legislation.

However, in the field of Islamic finance, bond valuation models vary from issue to issue, and specialists have not found a single system, which can significantly slow the preparation of the issue prospectus. In order to implement the issue, an initiator will need additional resources to develop his own pricing scheme involving experts and consultants from Arab countries on Sharia compliance.

Conclusion

Even in case of successful preparation of the road show prospectus and other procedures, the issuer may face obstacles at the macroeconomic level: many measures are required to standardize, control and regulate in the field of Islamic finance, increase attractiveness and reduce risks of financial instruments. Further steps are therefore needed:

To create an institution assigning the ranking of compliance of the company’s activities with sharia norms. Since 2013, only 7 companies have received an independent Shariah compliance ranking.

To establish a central supervisory body responsible for the development and observance of Sharia norms, their conformity with Russian legislation, for the staff of experts in this field.

To introduce liquidity management instruments for alternative financial instruments.

To raise investors’ awareness, their perception of risks and characteristics of Islamic financial instruments.

To adopt the laws regulating alternative forms of investment and protecting the rights of foreign investors.

To create a scheme for taxation of sukuk issues in Russia.

First of all, it is necessary to classify the transaction and create a scheme for translating the terminology of the Islamic financial system. For example, sukuk ijars – leasing, sukuk murabaha – contract of purchase and sale (sale on credit), sukuk istisna – investment project, sukuk salam – advance purchase, sukuk mudaraba –partner agreement / contract of trust management. Sukuk musharaka and sukuk vakala currently have no analogues in the Russian legislation.

According to various estimates, it may take 5 to 7 years to create a sufficient base for the development of Islamic finance in Russia. If we consider the sukuk issue by the five largest Russian banks as a substitute for funding sources in the West, we will need to coordinate this with experts from the Persian Gulf and Malaysia on the specifics of Islam’s mechanisms and norms. To date, two sukuk issues have been organized by traditional banks (HSBC’s Middle Eastern Unit, Goldman Sachs). The issues were part of the Luxembourg Exchange listing, the access to which is temporarily restricted by Russia.

Despite revolutionary ideas, Islamic funding can be effective even with many limitations (Baele et al., 2010; Bijur, 2007). Thus, when solving the problem of unfavorable selection (possibly by changing the terms of the contract), sukuk mudaraba can be attractive for Russian banks as it fits into the principles and logic of valuation of traditional bonds, on the basis of which the model of their pricing was built. Other types of sukuk financing have not yet been studied, especially their application by traditional financial institutions.

With the active release of sukuk in the world, finance theory does not have a single bond valuation system. The contradiction of some types of sukuk to sharia standards is still discussed in the scientific world and prevents real issues of these securities. The ranking agencies such as the Capital Intelligence and the Malaysian Rating Corporation rely on the same factors that apply to traditional securities (FATF, 2016). However, the Islamic financial system needs a new ranking methodology different from that of ordinary bonds, such as taking into account real macroeconomic factors such as GDP. The specificity of the Islamic finance market and the monopoly on assessing the conformity of traditional bank issues with the norms of Muslim countries also places a limit on the global development of sukuk.

When issuing sukuk the bank is subject to restrictions (faced, for example, by Goldman Sachs) on the direction of funds accumulated through Islamic bonds – it is possible to finance only Islamic transactions or to make investments in real assets.

In general, provided that experts are involved in the field of Islamic financing, state subsidies, support at the legislative level, as well as transparency of the transaction for the successful operation of such a specific mechanism as sukuk, and intensive work in the field of risk assessment, the production of sukuk initiated by the Russian company is possible, but it will be quite expensive.

Acknowledgments

The study was carried out within the grant of the Russian Foundation for Basic Research No. 18-410-200002.

References

- Alexey, V. (2014). On modern problems and challenges of the Russian economy. Official Website of the Ministry of Economic Development of the Russian Federation. http://economy.gov.ru/minec/press/news/201420111820

- Baele, L., Farooq, M., & Ongena, S. (2010). Of Religion and Redemption: Evidence from Default on Islamic Loans. http://www.istfin.eco.usi.ch/ongena-139141.pdf

- Bijur, D. (2007). Islamic Finance: From niche to Mainstream. http://news.bbc.co.uk/2/ hi/business/6483343.stm.

- GEMS (2015, May 22). The official site of Thomson Reuters. GEMS Perpetual Sukuk. https://www.zawya.com/sukuk/profile/2013110814280721/GEMS_Perpetua_Sukuk/

- FATF (2016). International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation. The FATF Recommendations.

- IDBank (2011). Islamic Development Bank 36th Annual Report, 1431Н. http://www.isdb.org/irj/go/km/docs/documents/IDBDevelopments/Internet/English/IDB/CM/Publications/Annual_Reports/36th/AnnualReport36.pdf

- Kotlyarov, I. D. (2010). Analysis of economic and organizational essence of modern forms of financial entrepreneurship. Corporate finance, 3, 104–112.

- Niyazbekova, Sh. U. (2012). Islamic sukuk securities on the global stock market. Econ. and manag.: probl., solutions, 2, 48.

- Razumova, I. A. (2015). Islamic banking: world experience and opportunities for Russia. Sci. notes of the Int. Bank. Instit., 11-1, 162.

- Tashtamirov, M. R., Saralieva, E. R., & Okueva, A. E. (2015). CIS experience in the formation of Islamic banking and prospects for its development in the Russian Federation. Econ. and Entrepreneurship, 12-3(65), 109–113.

- Zotova, A. I., & Shevchenko, D. A. (2010). Choice of a trading platform when placing securities by Russian companies on the global financial market. Financial res., 15, 48.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

31 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Tashtamirov, M., Adamanova, Z., Kelekhsaeva, M., Akoeva, M., & Muskkhanova, H. (2020). Islamic Securities As A Tool To Overcome Sanctions And Attract Investments. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 1078-1085). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.142