Abstract

The paper is devoted to the relationship between investment activity and tax regulation. From the above, two concepts tax policy and tax regulation can be distinguished. In practice, the latter is intrinsically incorporated in the former, since tax policy is implemented through tax regulation. The model of state regulation in the framework of tax regulation is supported through a set of methods and tools. The paper considers the instruments of state regulation towards investment activity and provides the main directions of an investment policy for the establishment of a favorable investment environment in the Chechen Republic. It concludes that a well-functioning system of instruments to affect the economic activity of entities facilitates the effective tax regulation. The stages of investor actions were previously considered. Given a long-term investment period, each investor involved in the implementation of an investment project requires stability established by laws and acts. In the Russian Federation, this process has not been fully shaped yet, but is viewed to be only on the way to improvement.

Keywords: Investment activitytax regulationinvestment policytax policy

Introduction

State tax policy is directly geared to regulate the revenue of all business entities through tax regulation. Investment activity is not an exception. From the above, two concepts

Problem Statement

The lack of an impact system towards the activity of economic entities, as well as the relationship between investment activities and tax regulation.

Research Questions

Instruments of state regulation of investment activity.

Purpose of the Study

The study of state regulation instruments of investment activity, and the main directions of investment policy to create an enabling investment environment in the Chechen Republic.

Research Methods

The methodological basis of this work delineates the provisions of dialectical logic, systemic and integrated approaches. The authors used such scientific methods and techniques as scientific abstraction, analysis and synthesis, methods of grouping and comparison, a functional approach, and modern analytical methods and technologies.

Findings

From the above definitions given by the leading scientists, it is possible to say that the term

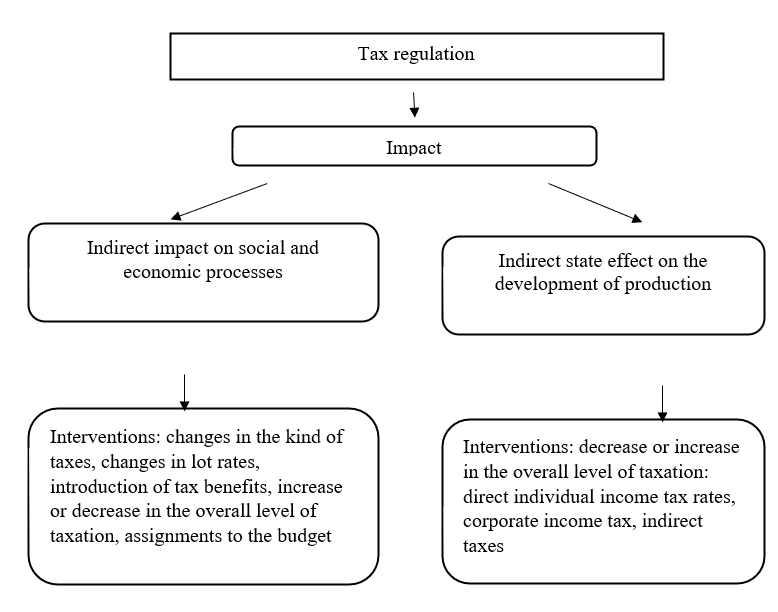

The model of state regulation in the framework of tax regulation (Figure

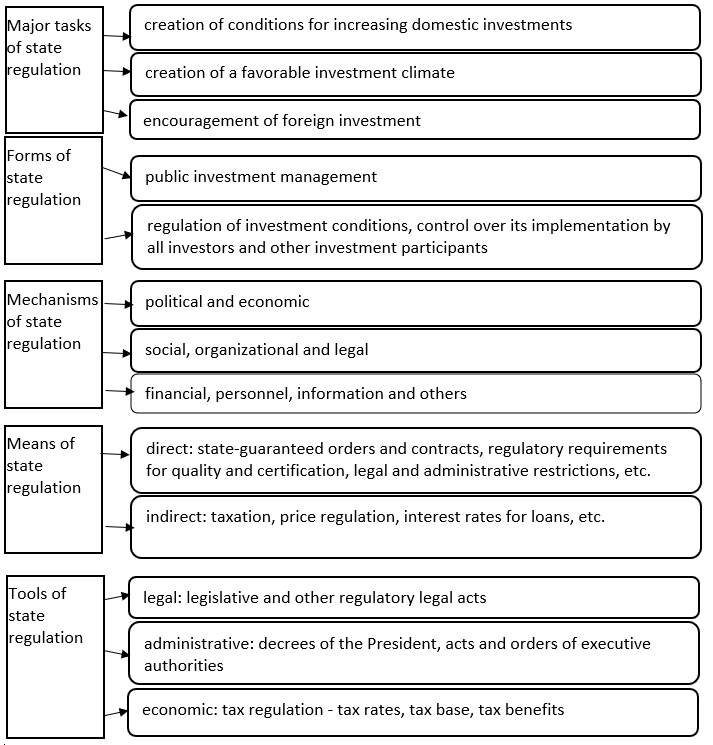

In the Russian Federation, state regulation of the economy as a whole and investment activity in particular is based on the neoclassical model that embraces the theories of monetarism and supply-side economics. Figure

The instruments of state regulation of investment activity can be complemented as follows:

state policy in the field of remuneration (minimum wage),

pricing policy (prices, price limits, tariffs), monetary policy (discount rate in percent, purchase and sale of securities, reserve requirements),

credit provision (credits, credit facilities) and macroeconomic planning.

Today, there are three main concepts of economic development, which, subject to the role of state regulation, involve planning and administrative, liberal and accelerated development strategy. The study determines the place of tax regulation of investment activity in each of the concepts.

The first model of economic development, planning and administrative, provides for the complete dominance of state regulation over the market mechanisms. It is a kind of state ownership over the redistribution of profits of the state and business entities.

The second model of economic development, liberal, provides for the superiority of market mechanisms over state regulation, the limitation of government intervention in the economy and the minimization of tax rates, which should serve as a stimulus to the surge of investment growth and a high implementation of state functions.

The third model, accelerated development strategy, implies a significant effect of regulatory bodies (state in general and tax in particular) on the economy. Using targeted tax incentives it is possible to stimulate the sectors of the economy, trigger investment activity and build the country’s potential.

As can be seen, each of the above concepts of economic development utilizes state regulation of investment activity as one of the components of the economy at large.

The main directions of investment policy aimed to create a favorable investment environment in the Chechen Republic are specified in the subprogram on the Establishment of Favorable Conditions for the Promotion of Investments in the Chechen Republic of the state program on Economic Development and Innovative Economy of the Chechen Republic (ChR Government, 2013).

The subprogram ensures the implementation of a consistent, comprehensive and effective investment policy by the state bodies and local authorities of the Chechen Republic.

Republican bodies work hard to improve the regulatory framework in the field of investment. The Ministry of Economic Development of the Chechen Republic initiated the adoption of 2 laws of the Chechen Republic, 6 decisions of the Government of the Chechen Republic, 3 orders of the Government of the Chechen Republic.

The current legislation of the Chechen Republic provides for a number of benefits and preferences (reduction in the profit tax rate in the part assigned to the budget, reduced property tax rate, interest rate subsidies) for organizations engaged in investment activities in priority sectors of the economy or implementing investment projects included in the list of priority investment projects of the Chechen Republic, which is approved by the Government of the Chechen Republic (Nagorny, 2015).

The updated list of priority investment projects of the Chechen Republic includes 67 projects aimed at the reconstruction of existing and construction of new modern high-tech industries, totaling 289.378 billion rubles with over 21,000 jobs.

An accessible business support infrastructure was created including multifunctional centers providing services to small businesses, 11 business incubators, 4 technology parks and 3 microfinance organizations.

The Ministry of Economic Development of the Chechen Republic constantly updates the Register of Investment Sites of the Chechen Republic, which includes 73 land plots. 13 of them are fully equipped and currently housing 14 projects with a total investment of more than 3.0 billion rubles and 492 jobs.

In the framework of the creation and functioning of the special tourist-recreational economic zone Veduchi, the Government of the Chechen Republic, JSC Resorts of the North Caucasus and LLC Veduchi agreed and signed the Plan for the implementation of the all-weather tourist and recreational center Veduchi, which ensures the implementation of the first stage of the resort construction (2016–2020) with an investment of 24.3 billion rubles.

On January 2018, Veduchi ski resort, the first in the Chechen Republic and the third in the North Caucasus tourism cluster, was opened.

Under the subprogramme on Socio-economic Development of the Chechen Republic for 2016-2025 of the state program of the Russian Federation on Development of the North Caucasus Federal District for the period until 2025 (ChR Government, 2016), 3 priority investment projects of the Chechen Republic are being implemented:

The construction of the second stage of the dairy cluster (CDF for 1,200 milk cows) in Gudermes district of the Chechen Republic in the village of Oyskhara (initiated by LLC Dairy company Caucasian Health; worth – 1,554.1 million rubles).

The construction of a vegetable storehouse for 4 thousand tons in the Chechen Republic (initiated by Medics LLC; worth – 231.9 million rubles).

The construction (reconstruction) of CJSC Raipischekombinat Urus-Martan in Urus-Martan, Urus-Martan district of the Chechen Republic (initiated by CJSC Raipischekombinat Urus-Martan, worth – 152.501 million rubles).

In 2017, a federal subsidy of 500 million rubles was attracted to implement these projects in accordance with the concluded Agreement. These funds were spent in full.

On February 10, 2018, within the implementation of the specified state program, the Ministry of Caucasus and the Government of the Chechen Republic signed Agreement No. 370-08-2018-013. The Agreement launched the investment project on Establishment of Intensive Perennial Plantations with Drop Irrigation with an Area of 300 Hectares in Bachi-Yurt, Kurchaloevsky district and Storage Facilities for 10,000 tons (initiated by Fruttis-Group LLC). The amount of the subsidy provided in accordance with the Agreement for 2018 is 401.0 million rubles, of which 275.83 million rubles will be spent to complete the projects launched in 2017, and the remaining funds in the amount of 125.17 million rubles will be spent at the initial stage of the project implemented by Fruttis-Group LLC.

In 2017, over 200 investment projects worth of 12,870.34 million rubles were completed in the Chechen Republic through extrabudgetary investments. 2,684 jobs were created.

The tax policy for regulating investment activity is aimed at supporting investment processes through the creation of preferential regimes and tax preferences. As in any other field of activity, the concept of demand also exists in investments. Tax rates are aimed at optimizing, expanding and increasing the field of investment activity.

Conclusion

The stages of investor actions were previously considered, but in the conditions of economic instability, it is not always possible to rely on the analysis and calculations. Given a long-term investment period, each investor involved in the implementation of an investment project requires stability established by laws and acts.

An effective tax regulation is facilitated by a well-functioning system of leverages over the activity of economic entities. In the Russian Federation, this process has not been fully shaped yet, but is viewed to be only on the way to improvement.

References

- Basnukaev, M. S. (2016a). Investment policy, tax potential and budget revenues: a regional aspect. Current issues of the modern economy in the world, 5, 552–558.

- Basnukaev, M. S. (2016b). The tax system and tax policy: problems and areas of improvement. Bull. of the Chechen State Univer., 4(24), 92–98.

- ChR Government (2013). Decree of the Government of the Chechen Republic dated 19 December 2013 no. 330. On Approval of the State Program of the Chechen Republic on Economic Development and Innovative Economy of the Chechen Republic (as amended on 25 January 2019). http://docs.cntd.ru/document/428586910

- ChR Government (2016). Decree of the Government of the Russian Federation of 15 April 2014 no. 309 (as amended on February 27, 2016) On the Approval of the State Program of the Russian Federation on Development of the North Caucasus Federal District for the period until 2025. https://minkavkaz.gov.ru/upload/iblock/780/postanovlenie-pravitelstva-rf-ot-15-04-2014-_-309-ob-utverzhdenii-gosprogrammy-skfo.pdf

- Koryakovsky, D. G. (2012). Legal and economic aspects of attracting foreign investment in the Russian economy. Finance and Credit, 10, 70–80.

- Mamrukova, O. I. (2013). Taxation of innovative activities of enterprises in Russia: problems and directions of improvement. Int. Account., 48.

- Nagorny, V. V. (2015). Taxation of innovation and ways to improve it. Busin. in law, 3.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

27 October 2020

Article Doi

eBook ISBN

978-1-80296-091-4

Publisher

European Publisher

Volume

92

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3929

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, translation, interpretation

Cite this article as:

Musostova, D., Basnukaev, M., Dzagoeva, M., Musostov, Z., & Poshuev, N. (2020). Investment And Tax Regulation. In D. K. Bataev (Ed.), Social and Cultural Transformations in the Context of Modern Globalism» Dedicated to the 80th Anniversary of Turkayev Hassan Vakhitovich, vol 92. European Proceedings of Social and Behavioural Sciences (pp. 767-772). European Publisher. https://doi.org/10.15405/epsbs.2020.10.05.103