Abstract

Documented evidences show that there are about 13 million tons of hydrocarbons spillages in the Niger Delta region, which causes substantive land and coastal contamination. As a result, more than 2000 land were contaminated with oil that posit serious economic problem for the communities. When an oil spill occurs on the land, fires often break out, killing vegetation and creating a crust over the land, making remediation or revegetation difficult. The objective of this paper is to propose the use of economic deterrence model as a panacea for the restoration/remediation of Niger Delta. A thorough search of the following databases; United Nations (UN) database, World Bank database, International Monetary Fund (IMF) database, Transparency International database, Human Rights Watch Reports, African Union (AU) Reports, Scopus database, Web of Science, Emerald, Google Scholar, among others were conducted to come up with the relevant and related literature on the subject matter. Economic deterrence approach nexus with effective enforcement of environmental taxation could be one of the best restoration approaches to the endemic social, political and economic problem of Niger Delta, hence, a framework using this approach is proposed in this study. Validation of this framework can serve as a policy tools available to the government, to restore contaminated land and other environmental challenges cause by oil and gas company’s operation. Finally, the study design to guide policymakers, especially in developing countries to explore the model so as to achieve the desired environmental policy.

Keywords: Environmentalwatercontaminationoil companieseconomicdeterrence

Introduction

Niger-Delta is in Nigerian territory. The area where mostly populated by several different tribal groups, predominantly dominated by different ethnic group, who were lived in the vicinity for over 500 years. Niger Delta has abundant natural oil and gas resources. Oil companies’ activities such as oil giants Royal Dutch Shell, and other multinational oil companies, rendered the water, land and air to be extremely polluted to a great extent that Niger Delta people livelihood is threatened. Furthermore, Niger Deltan economic activities centered on two basic categories; Agricultural farming and Fishing. However, United Nation (UN) environmental report (2011) indicates widespread contamination of Niger Delta area specifically Ogoniland’s Agricultural land, fisheries and drinking water, that causes thousands of people largely affected by environmental related illness (UN, 2011). Ogoni people business activities is totally jeopardized as a result of oil companies’ activities in the communities. Fishing which considered as the most popular means of livelihood of Ogoni people is no longer an option, because most of the fish died due to water contamination and the air has been severely polluted. In the same vein, the ground water is contaminated rendering it unsafe for drinking. The Ogoni people quote as saying “our right to drinking water, farming and right to clean air has been carted away by oil companies (Nnadozie, n.d).

More importantly, a World Bank survey on the linkages between environment and poverty found that over half of extremely poor Niger-Delta indigene including obtain more than 60% of their income from environmental resources (World Bank, 2003). In another development, United Nation Development Partners (UNDP) in one of its report stated that looking at the dependency of local livelihood structures on natural resources virtually more than 60% of Niger Delta including depend heavily on resources from natural environment (United Nations Development Programme [UNDP], 2006). From the economically perspective, the deteriorating condition of Niger Delta caused by oil spillages, deforestation, gas flaring invariably made the vulnerable communities to faced significant negative effect on their economic growth and development, that may result to long run multiplier negative effect on peace and prosperity in the communities. Additionally, oil company’s operation in the region seen as the causative agent of the lingering problem affecting economic activities of Niger Delta people as reported by many reports for instance World Bank report (2003; 2006) and (UN, 2011a).

Report indicate that oil companies are not doing the needful to reduce the hardship and suffering of Niger Deltan (UNEP, 2011b). Thus, government which saddle with the responsibilities of enforcing environmental regulations such as environmental tax rate, penalty of non-compliance with environmental regulations, and detection probabilities of non-compliant oil companies, report indicate that this are lacking which encourage the oil companies to continue with their oppression on the vulnerable communities (Energy Information Administration [EIA], 2007). Moreover, EIA reports further indicate that environmental regulations on oil industry where totally absent, and only recently government intensified powers to encourage better environmental responsibility on the part of oil companies.

Despite the environmental damages, very few studies concentrate on environmental restoration in Niger Delta (Adelana et al., 2011; Sam et al., 2016; Zabbey & Arimoro, 2017; Zabbey et al., 2017; Sam & Zabbey, 2018). However, none of these studies used economic deterrence approach as a mechanism for environmental restoration. They mostly focus on job creation, and emphasized on government to use the UN report (2011), as the optimal way to restore the social, political and economic wellbeing of Niger Delta. Interestingly, literature highlights that environmental challenges and difficulties put pressure on governments to discover ways and approaches to minimize environmental pollution while reducing harm to financial and economic growth (Organization for Economic Co-operation and Development [OECD], 2011). Governments have a scope of tools at their disposal, which include innovative policies, regulations, and environmental taxes. Environmental taxes have numerous and essential merit, for example, environmental effectiveness, ecological viability, economic efficiency, monetary productivity, the capacity to raise revenue from general public, and transparency (OECD, 2011).

Therefore, based on this evidence environmental taxation could be one of the policy tools if enforce amicably could address substantial part of the challenges affecting Niger Delta in general.

Problem Statement

This study contributes to the analytical, theoretical literature in two ways. Firstly, the study proposes to use the economic deterrence model of Allingham and Sandmo (1972) which comprises (tax rate, penalty & detection probabilities), in the environmentally related area for policy reason. And the model has been described as the optimal tools available to the government for optimum decision making (Allingham & Sandmo, 1972). Secondly, previous remediation approach uses either coastal environmental clean-up case studies to demonstrate the effectiveness of bioremediation in the case of Zabbey et al. (2017), skills and unskilled job creation Sam and Zabbey (2018), integrated risk assessment using principles of sustainability and stakeholder’s engagement Sam et al. (2016). However, these approaches failed to identify how government can drive the funding for the restoration from economic point of view. Thus, there are several calls for good framework capable of providing funding for environmental remediation in Niger Delta area (UNEP, 2011; Könnet, 2014; Sam et al., 2016). Hence, the propose framework which will serve as the instrument for the policymakers to drive so much revenues from environmental polluters, which can be used for land remediation or restoration and economic recovery of the livelihood of the immediate communities.

Research Questions

Is there workable framework that could drive funding for Niger Delta environmental remediation.

Purpose of the Study

Despite the existence of few remedial proposal, and several legislations, laws and pronouncements on contaminated land, water and air in Nigeria heavily caused by oil and gas companies operations, it was argued that there is need to develop a new framework for remediation of the affected areas, using new scientific approach (Sam et al., 2016). Based on this evidence the current study proposed the use of economic deterrence model as a panacea for the restoration of Niger Delta.

Research Methods

The paper is a review paper. A thorough search of the following databases; UN database, World Bank database, IMF database, Transparency International database, Human Rights Watch Reports, African Union (AU) Reports, Scopus database, Web of Science, Emerald, Google Scholar, among others were conducted to come up with the relevant and related literature on the subject matter.

Findings

Figure

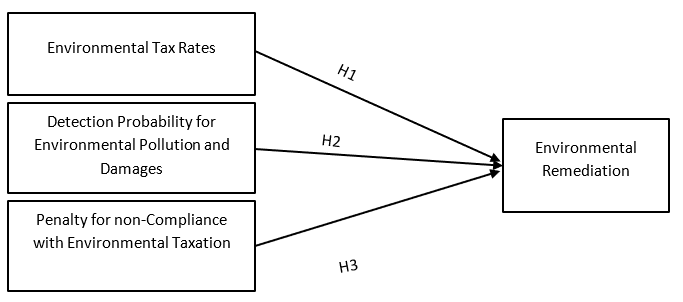

The framework consists of three proposed hypotheses, and if validated imperially will provide new knowledge capable of assisting policymakers, with new idea on how to address remedial challenges. The hypotheses have different directions as follows:

The hypothesis is non-directional, this is because literature on the effect of tax rate on compliance behaviour have mixed findings. Some of the literatures found that high tax rate is negatively related to tax compliance while some found tax rates is positively related to tax compliance behaviour. Though, the target of this study was not to examine compliance level but rather to explore means of generating revenue from companies, which causes environmental damages, to be used for environmental remediation. Therefore, only empirical analysis of this hypothesis will determine its direction.

Prior literature on the effect of detection probability on tax compliance mostly shows positive and significant relationship among the two constructs. This study focuses on the idea that, once the companies are fully aware about the government ability to detect any act that causes pollution, they will be mindful and cautious on their activities, and that will reduce significantly the level of pollution in the immediate environment. Moreover, empirical validation of the hypothesis will offer more insights on the postulation made.

Extent literature on the influence of penalty on tax compliance behaviour largely reported that, penalty influence tax compliance. Building from this assertion, this study believes that proposing penalty for non-environmental taxation compliance, will affect positively environmental remediation. The central argument here is that, effective employment of penalty mechanism by relevant authority, will influence companies to comply with environmental taxation, and in turn government will generate more revenue for environmental remediation. Though, this postulation was not tested imperially, hence, only validation of the proposed model will provide the direction of the proposed hypotheses. Consequently Figure

Conclusion

This study proposes a framework designed to address environmentally related challenges caused by externalities with specific reference to Nigerian oil and gas industry, and by extensions other countries with similar environmentally related issues. The framework looks robust, policymakers, green environmental agitators, researchers and other environmentally related stakeholders can adapt and validate the framework. Developing framework of this nature will be a well come development for policymakers. World leaders are currently focused their attention on global warming, looking for alternative solution to save the world from it. The current framework can influence environmental players to be more caution and preserve the environment. Hence, the current framework may offer useful implication to reduce environmental risks concurrently by making the environmental players accountable for their actions. Oil spillages in Niger Delta and its surrounding had leads to an extensive ecological devastation, infrastructural damage and negative human health impacts. Currently, soil, air and water contamination are gaining global attention, as it posits a great threat to the present and future generation. Due to this perception most of the Developed countries for example UK and USA have developed methods and policies to deal with contaminated environment (Luo et al., 2009).

Developing countries like Nigeria is yet to reflect this global response on Niger Delta clean-up. Nigeria need to developed policies that meet international standards. Scholars like CL:AIRE (2010) advocate for the development, adopting and adapting models or instrument on the contaminated land applicable to real environment, that would encourage skills development and long term opportunities, which can support economic fortune in the communities. Hence, the development of the proposed framework. Based on UNEP recommendation it will take 25 to 30 years to remediate the environmental damages in Niger Delta.

The report further recommended the creation of Niger Delta Environmental Authority, Center of Excellence in Environmental Restoration, and Environmental Restoration Fund for Niger Delta. These project demand huge capital outlay, at a stake government concentrate more on fighting insecurities which is of national and public importance. Oil companies need to pay for what they pollute, so that government can generate more revenue to carry out those gigantic remedial project as recommended by UNEP. Based on these scholars like Xiong and Li (2019) recommended that energy sector shall introduce ecological tax which has huge ecological footmark. The proposed framework specifically, focuses on the use of economic deterrence theory to reduce illegal environmental challenges resulted from externalities, through the employment of environmental taxation, penalty, detection probability and tax rate as depicted in figure

However, the study has some limitations for instance its focus on specific region, conceptual in nature, and the framework had not been validated empirically. Future research should cover other region where similar environmental challenges exist. The framework should be validated empirically to get statistical significance of the latent exogenous and endogenous constructs. The framework should also be expanded to take into accounts different contextual and conceptual peculiarities across the globe.

Acknowledgments

One of the researchers wishes to acknowledge the received of PhD scholarship from PTDF.

References

- Adelana, S. O., Adeosun, T., Adesina, A. O., & Ojuroye, M. O. (2011). Environmental pollution and remediation: challenges and management of oil Spillage in the Nigerian coastal areas. American Journal of Scientific and Industrial Research, 2(6), 834-845. https://doi.org/10.5251/ajsir.2011.2.6.834.845

- Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of public economics, 1(3-4), 323-338.

- Chan, C. W., Troutman, C. S., & O’Bryan, D. (2000). An Expanded Model of Taxpayer Compliance: Empirical Evidence from the United States and Hong Kong. Journal of International Accounting, Auditing Taxation, 9, 83-103. https://doi.org/10.1016/S1061-9518(00)00027-6

- Chau, K. K. G., & Leung, P. (2009). A critical review of Fischer tax compliance model: A research synthesis. Journal of Accounting and Taxation, 1(2), 34-40 https://doi.org/10.5897/JAT09.021

- CL:AIRE. (2010). A Framework for Assessing the Sustainability of Soil and Groundwater Remediation. SuRF-UK Report. CLAIRE, London.

- Energy Information Administration (2007). International Energy Outlook 2007. Energy Information Administration, Washington, DC.

- Fischer, C. M., Wartick, M., & Mark, M. M. (1992). Detection probability and taxpayer compliance: A review of the literature. Journal of Accounting Literature, 11, 1. Retrieved from http://eserv.uum.edu.my/docview/216306252?accountid=4259

- Goulder, L. H. (1995). Environmental taxation and the double dividend: a reader's guide. International Tax and Public Finance, 2(2), 157-183. https://doi.org/10.1007/BF00877495

- Könnet, B. R. (2014). Inadequate Monitoring and Enforcement in the Nigerian Oil Industry: The Case of Shell and Ogoniland. Cornell International Law Journal, 11(2010), 181–205.

- Luo, Q., Catney, P., & Lerner, D. (2009). Risk-based management of contaminated land in the UK: lessons for China? Journal of Environmental Management, 90, 1123–1134. https://doi.org/10.1016/j. jenvman.2008.05.001

- Manaf, N. A. (2004). Land tax administration and compliance attitude in Malaysia (Unpublished doctoral thesis). University of Nottingham, United Kingdom.

- Mohd Isa, K. (2012). Corporate taxpayers’ compliance variables under the self-assessment system in Malaysia: a mixed methods approach (Doctoral dissertation, Curtin University). Retrieved from http://hdl.handle.net/20.500.11937/1796

- Mustafa, H. H. (1997). An evaluation of the Malaysian tax administrative system and taxpayers' perceptions towards self-assessment system, tax law fairness and tax law complexity (Unpublished manuscript). Universiti Utara Malaysia, Sintok, Malaysia.

- Nnadozie, E. (n.d). Oil and Socioeconomic Crisis in Nigeria. Retrieved 4 October, 2020, from http://umich.edu/~snre492/cases_03-04/Ogoni/Ogoni_case_study.htm

- Organization for Economic Co-operation and Development (OECD). (2011). Sustainable Management of Water Quality in Agriculture (Paris: OECD). http://www.oecd.org/agr/env/water/

- Sam, K., & Zabbey, N. (2018). Contaminated land and wetland remediation in Nigeria: Opportunities for sustainable livelihood creation. Science of the Total Environment, 639, 1560-1573. https://doi.org/10.1016/j.scitotenv.2018.05.266

- Sam, K., Coulon, F., & Prpich, G. (2016). Working towards an integrated land contamination framework for Nigeria. Sci. Total Environ. https://doi.org/10.1016/j.scitotenv.2016

- United Nation Environment Programme (UNEP). (2011a). Environmental Assessment of Ogoniland. UNEP, Switzerland.

- United Nation Environment Programme (UNEP) (2011b). Environmental Assessment of Ogoniland. Job No.: DEP/1337/GE

- United Nations Development Programme (UNDP). (2006). Niger Delta human development report. Abuja: UNDP. http://hdr.undp.org/sites/default/files/nigeria_hdr_report.pdf

- World Bank. (2003). Nigeria Poverty-Environment Linkages in the Natural Resource Sector. Africa Environment and Social Development Unit. World Bank Institute.

- Xiong, Z., & Li, H. (2019). Ecological deficit tax: A tax design and simulation of compensation for ecosystem service value based on ecological footprint in China. Journal of Cleaner Production, 230, 1128-1137. https://doi.org/10.1016/j.jclepro.2019.05.172

- Zabbey, N., & Arimoro, F. O. (2017). Environmental forcing of intertidal benthic macrofauna of Bodo Creek, Nigeria: Preliminary index to evaluate cleanup of Ogoniland. Regional Studies in Marine Science, 16, 89-97. https://doi.org/10.1016/j.rsma.2017.08.004

- Zabbey, N., Sam, K., & Onyebuchi, A. T. (2017). Remediation of contaminated lands in the Niger Delta, Nigeria: Prospects and challenges. Science of the Total Environment, 586, 952-965. https://doi.org/10.1016/j.scitotenv.2017.02.075

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

12 October 2020

Article Doi

eBook ISBN

978-1-80296-088-4

Publisher

European Publisher

Volume

89

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-796

Subjects

Business, innovation, sustainability, environment, green business, environmental issues, urban planning, municipal planning, disasters, social impact of disasters

Cite this article as:

Ya’u, A., Saad, N., & Mas’ud, A. (2020). Framework For Resolving Environmental Damages in Niger Delta Through Deterrence Measures. In N. Samat, J. Sulong, M. Pourya Asl, P. Keikhosrokiani, Y. Azam, & S. T. K. Leng (Eds.), Innovation and Transformation in Humanities for a Sustainable Tomorrow, vol 89. European Proceedings of Social and Behavioural Sciences (pp. 522-529). European Publisher. https://doi.org/10.15405/epsbs.2020.10.02.47