Abstract

Dialectical unity and contrast of economic interests of individuals and fiscal interests of the state will always exist. On the one hand, arising tax obligations create serious economic restrictions for the subject of property relations, and it helps form optimal property relations in the tax sphere. A powerful incentive for tax authorities to properly perform their functions in tax relations is the civil law institution of public liability for harm caused, since the state can bear public liability in the form of compensation for losses through its bodies. In this regard, the subject of the study is public relations related to public liability in the tax sphere as applied to enterprises in the real economy. The object of the study is the rule of law governing social relations and processes that arise in the tax sphere being liable to enterprises in the real economy. The purpose of the study is to assess the influence of public liability on the development of the real economy. To achieve this purpose, the authors analyzed the regulatory framework and statistical data of cases by arbitration courts in the sphere of relations under consideration. The authors used common scientific, statistical, and special legal methods in this study.

Keywords: Public liabilitycompensation of lossestax authoritiestax control

Introduction

Dialectical unity and contrast of economic interests of individuals and fiscal interests of the state will always exist. So, Art. 57 of the Constitution of the Russian Federation states that everyone is obliged to pay legally established taxes and fees. On the one hand, the arising tax obligations create serious economic and psychological restrictions for the subject of property relations, because of the need to ultimately abandon a certain share of funds in favor of the state. It is a powerful incentive for finding optimal property relations in the tax sphere. On the other hand, the most important incentive factor for tax authorities to properly perform their functions in tax relations is the civil law institution of public liability for harm caused, since the state can bear public liability in the form of compensation for losses.

From the beginning, the state has been and remains a unique product of social development, which, developing according to laws of social progress, is increasingly becoming nation-wide, focusing on ensuring social and economic well-being. And being a specific subject of legal relations and participating in these relations, it remains a political and legal organization with sovereignty, state-power authority and state-coercive mechanisms (Ioffe, 2004). Being the subject of legal relations, it enters into contractual relations along with citizens and legal entities. Its participation in the civil turnover and economy of the country is quite diverse. When the state enters into legal relations, there are questions of its delictual responsibility as the subject of these relations. The state that proclaims itself to be “social” and “legal” cannot evade the social obligation to compensate for losses by persons acting on behalf of the state and other public law entities, since a legal state is a responsible state. From which it follows that the state, along with other equal entities, can be held accountable for violating the rights and interests of another participant of these relations protected by law and vice versa.

Problem Statement

The problem of public liability arises from its particular status as a participant in legal relations. The Civil Code of the Russian Federation N 51-FZ proceeds from the principle of plurality of entities acting on behalf of the state. They are assigned in accordance with Art. 124 of the Civil Code of the Russian Federation - the Russian Federation, constituent entities of the Russian Federation: republics, territories, regions, cities of federal significance, autonomous regions, autonomous okrugs, as well as urban, rural settlements and other municipal entities. In the theory of civil law, they are called public law entities. The second problem is related to the correlation of private and public interests when considering issues of public liability in the tax sphere. Thirdly, there is a qualitative and quantitative assessment of the impact of holding the state and its bodies in the tax sphere liable for the development of the real economy. Specific issues of applying public liability in the tax sphere are a research issue that has been actively discussed in recent years. We should mention studies on public liability and its bodies in Russia (Vorobel, 2015; Oglezneva, & Sadrieva, 2018; Kozhevnikov, 2018; Babakov, 2015; Panova, 2015), Netherlands (Plakokefalos, 2015), Brazil (Cristovam, da Costa, & de Moraes, 2019), China (de Lisle, 2012). Public liability issues arising from criminal justice were addressed in Spain (Rodrigo, 2017) and USA (Fougere, 2010). The relationship between financial liability of the state and its subjects in federal states was studied in the USA (Super, 2005). Issues of the legal status of a taxpayer were analyzed in Poland (Drywa, 2017). The concept of losses as the main element of civil liability was studied in Brazil (Faria, 2017). The issues of tax liability and its impact on enterprises were analyzed by Brazilian scientists (Campos & Branco, 2016).

Research Questions

The interconnection of economic interests of individuals and fiscal interests of the state causes, on the one hand, serious economic restrictions to the subject of property relations that arising out of tax obligations. On the other hand, the civil law institution of public liability for harm is an incentive for tax authorities to properly perform their functions in tax relations. In this regard, the subject of the study is public relations related to public liability in the tax sphere as applied to enterprises in the real economy. The object of the study is the rule of law governing social relations and processes arising in the tax sphere being liable to enterprises in the real economy.

Purpose of the Study

The purpose of the study is to assess the influence of public liability on the development of the real economy. To achieve this purpose, the authors analyzed the regulatory framework and statistical data of cases by arbitration courts in the sphere of relations under consideration. The key objective of the study was to justify the need to amend a number of articles of the Tax Code of the Russian Federation.

Research Methods

The authors used common scientific and special legal methods in this study.

The method of system analysis. Its application is associated with the study of complex legal phenomena, which are considered as a system. In this case, such a system is the sphere of tax law, individual elements of which are related both to each other and to the external environment (for example, economic relations and the sphere of entrepreneurship);

The method of dialectics. It involves a comprehensive study of legal phenomena in their development, interconnectedness and emerging conflicts. This allows you to find “gaps” in law and enforcement;

The hypothetical method. It is based on a scientific hypothesis: assumptions about the existence of causes and effects. In this case, we assume that there is a connection between the implementation of the tax policy by the state and the degree of development of entrepreneurship in the country;

The graphical method. This is a data visualization method that transfers textual and numerical information into graphic images, which simplifies its perception;

The statistical method was chosen as a special legal method, which allows quantifying the legal phenomena. As for this study, the authors used a variation of it - the time series analysis method. It includes elements of econometrics and allows identifying development patterns of the phenomenon over a long period of time, building its model and making a forecast. The calculations were carried out in the applied statistical package Gretl.

Findings

First of all, liability in civil law, as a kind of legal liability, has features due to the specifics of civil law. Since civil law mainly regulates property relations, public liability also has property content, and its actions (civil sanctions) are of a property nature. Thus, this public category performs the function of property (economic) impact on the offender and becomes one of the methods of economic regulation of public relations. When losses are paid, the offender pays money or provides some other property to the victim and thereby loses this property.

Secondly, the peculiarity of state liability follows from the specifics of the subject, its status and the relationship of private and public interests through it.

The forms of public liability (sanctions) include: compensation for losses (Article 15 of the Civil Code), payment of a penalty (Article 330 of the Civil Code), loss of a deposit (Article 381 of the Civil Code), etc. Usually they are compensatory and are to make compensation for property losses to the party suffered these losses (paragraph 2 of article 15 of the Civil Code). There are losses in civil law that are levied from the offender in favor of the victim regardless of the losses incurred, for example, fines or penalties for late performance under the contract.

The right to compensation for losses of the taxpayer is enshrined in the Tax Code of the Russian Federation N 146-FZ (hereinafter referred to as the Tax Code of the Russian Federation). According to Art. 35 of the Tax Code, tax and customs authorities are liable for losses incurred by taxpayers, payers of insurance premiums and tax agents as a result of their illegal actions (decisions) or acts of omission, as well as illegal actions (decisions) or acts of omission of officials and other employees of these bodies in executing their official duties. Losses caused to taxpayers, payers of insurance premiums and tax agents are reimbursed from the federal budget in the manner prescribed by the Tax Code and other federal laws.

The state should be interested in reducing budget losses and, accordingly, in strengthening tax liability of authorities before the law. In order to quantify the situation, we will turn to the official statistics of arbitration courts of the Russian Federation and analyze the dynamics of some categories of cases related to disputing non-compliance of law of taxation by tax authorities.

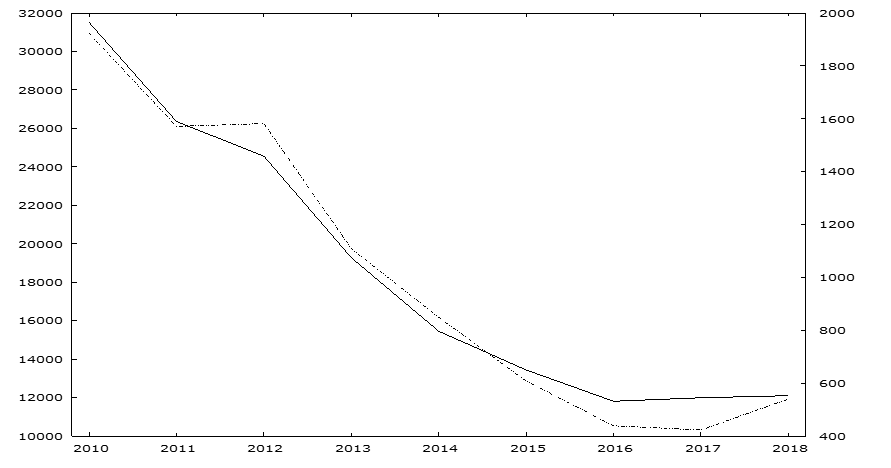

We will consider 2 statistical indicators for which there is a sufficient data set:

X1 - the number of cases challenging non-normative regulations of tax authorities and actions (acts of omission) of officials;

X2 - the number of cases on the return of funds from the budget excessively collected by tax authorities or excessively paid by taxpayers.

Time series contain 9 levels (2010 - 2018). In Figure

Source: authors.

Throughout the period under review, there was a decrease in the number of cases related to Russian tax legislation, although in 2012 the number of heard cases on the return of funds from the budget excessively collected by tax authorities or paid excessively by taxpayers increased in courts. The stabilization of the dynamics of both indicators began in 2016, and in the future, the trend gradually began to change its direction. At the same time, it is too early to talk about the increase in the number of cases.

The length of the series allows making a short-term forecast, and in two versions these forecasts are pessimistic and optimistic. In the first case, we assume a worsening of the situation, that is, an increase in the number of cases heard in the corresponding category; in the second case, there is an improvement in the situation. The results are shown in Table

Let's make a note: we calculated only point forecasts for indicator X2, since interval forecasts have no real meaning due to the fact that their lower boundary have negative values. The forecasting results with a high probability indicate that in 2019-2020 the trend of a decrease in the number of cases related to tax legislation will continue. This will positively affect not only the indicators of the federal budget, but also the degree of confidence of entrepreneurs in state fiscal authorities.

And according to Art. 37 of the Tax Code of the Russian Federation, internal affairs bodies, investigative bodies are liable for losses incurred by taxpayers, payers of insurance premiums and tax agents as a result of their illegal actions (decisions) or acts of omission, as well as illegal actions (decisions) or acts of omission of officials and other employees of these bodies in executing their official duties. And losses as a result of such actions (decisions) or acts of omission are reimbursed from the federal budget in the manner prescribed by the Tax Code of the Russian Federation N 146-FZ and other federal laws.

Whereas Art. 103 of the Tax Code of the Russian Federation regulates the grounds and procedure for compensation for unlawful harm caused during tax control, which distinguishes it from Art. 35 and 37 of the Tax Code of the Russian Federation that state all actions or acts of omission of tax authorities and their officials. This study refers to the inadmissibility of causing losses during tax control. Losses caused by such unlawful actions of tax authorities and their officials shall be fully compensated. This greatly complicates the practical activities of tax authorities. Since there are no special rules in tax legislation governing the compensation for losses caused by unlawful actions of tax authorities and their officials, they are guided by civil law (Articles 15, 16, 1070 of the Civil Code of the Russian Federation N 51-FZ).

It should be noted that the issues of compensation for losses incurred have become even more relevant since 01.01.2006 by virtue of Federal Law of 04.11.2005 N 137-FL “On Amending Certain Legislative Acts of the Russian Federation and Repeal Some Provisions of Legislative Acts of the Russian Federation on Grounds of Measures Improving Administrative Procedures for Dispute Resolution” (hereinafter - the Law of 04.11.2005 N 137-FL), when the right was presented to tax authorities to collect penalties from organizations and individual without legal proceedings.

The main goal of adoption of Federal Law of 04.11.2005 N 137-FL is to relieve the judicial system, to free arbitration courts from same small cases and thereby improve the quality of more complex issues (cases). Indeed, arbitration courts were simply up to their neck with cases of small tax fines. After all, before Federal Law of 04.11.2005 N 137-FL, tax inspectorates did not have the right to collect tax fines, as well as arrears and penalties (in relation to individual entrepreneurs) without going to court. Of course, at the same time budget money was spent, a huge number of employees were involved. For information, the cost of one arbitration process of the first instance amounted to more than 3000 rubles for the state. At the same time, the amounts collected are often much less, and trying such cases in the arbitration court lost its meaning from the point of view of budget replenishment.

If Federal Law of 04.11.2005 N 137-FL set a goal to reduce the costs of only state bodies in terms of reducing the number of lawsuits, then it is very likely that they will increase. Since, in accordance with Art. 137 of the Tax Code of the Russian Federation, the taxpayer has the right to appeal any non-normative acts of the tax inspection (decisions, requirements). The decision to recover a tax sanction is no exception. The organization may appeal either to a higher authority, or with a statement of claim to the arbitration court. Of course, organizations (individual entrepreneurs) will incur legal costs, which may exceed the amount of sanctions, and, probably, the payer may think whether it makes sense to go to court.

The waiver of trial to collect tax penalties reduced legal guarantees for the protection of the rights of taxpayers, and this affected representatives of small businesses who do not have their own lawyers. Thus, the right of tax authorities to collect penalties from organizations and individual entrepreneurs without legal proceedings increased tax losses.

The Tax Code of the Russian Federation N 146-FZ (subparagraph 5, clause 21) identifies that a taxpayer is entitled to a timely offset or refund of excessively paid or excessively collected taxes, penalties, and fines. The procedure for offsetting and refunding excessively paid or excessively collected amounts is regulated by Chapter 12 of the Tax Code. However, the norms of the Tax Code of the Russian Federation determine the pre-trial order in this case.

If tax authorities have not fulfilled or improperly fulfilled their obligations to return excessively paid or withheld amounts, then the taxpayer appeals to the court on the basis of Art. 15 and 16 of the Civil Code of the Russian Federation N 51-FZ (1994), according to which, claims are made for compensation for losses caused by the unjustified application of such sanctions. “The return of excessively paid taxes due to the fault of the tax authority is carried out within the framework of the civil law institute on returning unjust enrichment” (Kabanova, 2015, p.6). In accordance with paragraph 14, paragraph 1, Art. 21 of the Tax Code - the taxpayer has the right to demand full compensation for losses caused by illegal decisions or actions (acts of omission) of tax authorities and their officials in the prescribed manner.

Conclusion

Public liability for the harm caused should be understood as one of the types of public liability, which means that the court takes remedial state measures for harm caused by acts of state authorities and local self-government and their officials, set by sanctions in the established procedural order - pecuniary complaint, aimed at compensating the violated property and non-property sphere of the victim.

Public liability for harm caused in the tax sphere is one of the most important mechanisms for protecting the rights of individuals and organizations. The existing mutually complementary mechanism for combining pre-trial and judicial procedures for the recovery of collected or overpaid tax amounts, as well as losses caused by unlawful actions of tax authorities, allows protecting the rights of legal entities. This fact has a great influence on the development of the real economy, because, firstly, it increases the level of trust on the part of legal entities and individual entrepreneurs in the state, secondly, it ensures their protection against illegal actions by the state, and thirdly, it provides an opportunity for further business development by directing the collected amounts to working capital, etc.

Analysis of statistical data showed that there was a tendency to reduce the number of cases related to legislative execution for the period 2010-2018 in the Russian Federation. Despite their insignificant growth in 2016-2018, the forecast indicates a high probability of a decrease in this indicator (for the main categories of cases) in the period 2019-2020. This indicates an increase in tax liability of authorities before the law and can be positive.

The analysis revealed the need to amend Articles 78 and 79 of the Tax Code of the Russian Federation N 146-FZ, supplementing them with provisions related to the assignment of the shared burden on budgets for the return of amounts excessively paid or excessively collected from taxpayers, based on the interest rate of tax crediting to the corresponding budget. Based on the General provisions of Article 21 and 35 of the Tax Code, the following main conclusions can be drawn:

Only losses are subject to compensation;

The right to compensation belongs to taxpayers;

Losses should be the result of illegal actions (acts of omission) of officials and other employees of tax authorities in executing their official duties;

The assignment of losses is the responsibility of tax authorities, which provides a guarantee to compensate for these losses by the state;

Liability is borne by tax authorities, and not by its specific employees;

Losses are reimbursed from the federal budget.

References

- Babakov, V. A. (2015). The concept of the state involvement in civil legal relations in terms of civil law methodology components. Bulletin of Perm State University, Law Sciences, 3(29), 71-76.

- Campos, H. S. O., & Branco, D. D. S. C. (2016). Responsibility tax and economic group of fact. Quaestio Iuris, 9(2), 1194-1211. DOI: 10.12957/rqi.2016.19452.

- Constitution of the Russian Federation (1993). Retrieved from http://www.constitution.ru/en/10003000-01.htm. Accessed: 01.11.19. [in Rus.].

- Cristovam, J. S. D., da Costa, M. S., & de Moraes, A. B. (2019). State civil liability for damages resulting from activities of the third sector. A&C Revista de Direito Administrativo & Constitutional, 19(76), 105-123. DOI: 10.21056/aec.v19i76.1108

- De Lisle, J. (2012). A common law-like civil law and a public face for private law: China's tort law in comparative perspective. In L. Chen, C. H. van Rhee (Eds.), Chinese Civil Code: Comparative and Historical Respective, 1 (pp. 353-394). Leiden/Boston: Martinus Nijhoff Publishers.

- Drywa, A. (2017). The quality of the tax law as a factor shaping the taxpayer's legal position. In M. Radvan, J. Gliniecka, T. Sowiński, P. Mrkývka (Eds.), 4th International Baltic Conference on Financial Law - the Financial Law towards Challenges of the 21st Century (pp. 289-304). Brno: Masaryk University.

- Faria, L. (2017). Fundamentals for the adoption of a preventive model of civil liability of the state. A&C Revista de Direito Administrativo & Constitutional, 17(69), 211-241. DOI: 10.21056/aec.v17i69.833

- Federal Law N 137-FZ “On amending certain legislative acts of the Russian Federation and repeal some provisions of legislative acts of the Russian Federation on grounds of measures improving administrative procedures for dispute resolution” (2005). Retrieved from http://www.consultant.ru/document/cons_doc_LAW_56311/ Accessed: 01.11.19. [in Rus.].

- Fougere, J. J. (2010). Paying for prisoner suits: How the source of damages impacts state correctional agencies' behavior. Columbia Journal of Law and Social Problems, 43(3), 283-332.

- Ioffe, O. S. (2004). Selected works: Volume II. Soviet civil law. St. Petersburg: Publishing House “Legal Center Press”. [in Rus.].

- Kabanova, I. E. (2015). Responsibility of the treasury for actions of public entities and the responsibility of public entities before the treasury: Civil law aspects. Journal of Lawyer, 22, 4-9. [in Rus.].

- Kozhevnikov, V. V. (2018). To the problem of the theory of legal responsibility. Tomsk State Law University Journal of Law, 28, 5-19. DOI: 10.17223/22253513/28/1

- Oglezneva, T. N., & Sadrieva, R. R. (2018). Legal entity of public law in civil legislation as phenomenon of globalization. In D. K.-S. Bataev (Ed.), Conference on Social and Cultural Transformations in the Context of Modern Globalism. The European Proceedings of Social & Behavioural Sciences, 63 (pp. 1452-1457). London: Future Academy. DOI: 10.15405/epsbs.2019.03.02.168

- Panova, I. V. (2015). The order of recovering losses harmed by illegal actions of state bodies and officials. Law Journal of High School of Economics, 4, 91-102.

- Plakokefalos, I. (2015). Causation in the law of state responsibility and the problem of overdetermination: In search of clarity. European Journal of International Law, 26(2), 471-492. DOI:10.1093/ejil/chv023

- Rodrigo, V. M. (2017). Attenuation of the penalty for undue delays and responsibility of the state to the victim. Revista General de Derecho Renal, 27, 418557.

- Super, D. A. (2005). Rethinking fiscal federalism. Harvard Law Review, 118(8), 2544-2652.

- Tax Code of the Russian Federation N 146-FZ (1998). Retrieved from https://www.wto.org/english/thew to_e/acc_e/rus_e/WTACCRUS58_LEG_2.pdf Accessed: 01.11.19[in Rus.].

- The Civil Code of the Russian Federation N 51-FZ (1994). Retrieved from https://www.wto.org/english/ thewto_e/acc_e/rus_e/WTACCRUS58_LEG_25.pdf Accessed: 01.11.19. [in Rus.].

- Vorobel, D. Y. (2015). The concept of civil liability of state bodies. Young Scientist, 22, 564-567. [in Rus.].

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Nechipas, Y. V., Poberezhnaya, I. A., & Persteneva, N. P. (2020). Public Tax Liability To Enterprises. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 653-661). European Publisher. https://doi.org/10.15405/epsbs.2020.04.83