Abstract

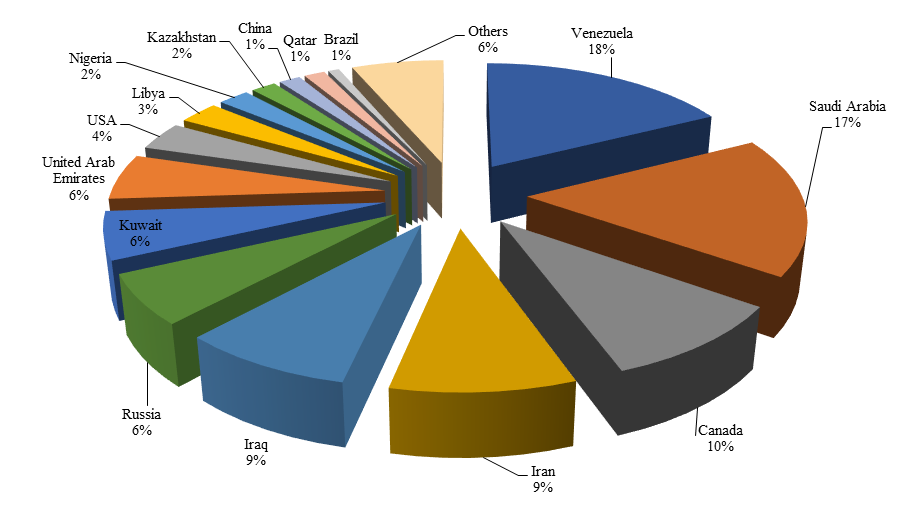

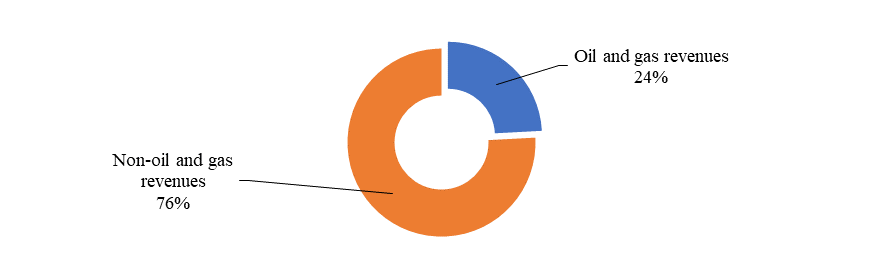

The article is devoted to specific features of assigning oil rents and the impact of oil and gas revenues on the quality of life in Russia. The research object is the distribution mechanism of oil revenues, the research subject – the impact of oil revenues on the country's welfare. Russia has 6% of the world's proven oil reserves. The main problem of the Russian oil resource base is still the gradual deterioration of its structure with an increase in the share of hard-to-recover reserves and an increase in the oil production cost. For the removal of the oil rent, the fiscal mechanism is used. The maximum level of oil rents in Russia was reached in 2008, due to the binding of Mineral Extraction Tax to the oil world price and the peak oil prices. Oil and gas revenues for many years played a key role for the budget of our country. In different periods, the share of oil and gas revenues ranged from 17.2% to 27.8% of the consolidated budget of the Russian Federation. In 2018, this share was 24.2%. To assess the impact of rental income on the national welfare, the authors studied the dependence of Russian GDP and Human Development Index on oil and gas revenues, developed an economic and mathematical model for predicting GDP depending on oil and gas revenues, and a regression model that reflects the dependence of the Human Development Index on the forecast of oil and gas revenues.

Keywords: Oil and gas revenuesoil rentstaxesnational welfare

Introduction

Oil reserves of the Russian Federation and their quality characteristics

The Russian Federation has 6% of the world's proven crude oil reserves (Figure

Source: authors.

The state balance of mineral reserves of the Russian Federation takes into account 3074 deposits with technologically recoverable oil reserves, including 2511 oil and 563 complex ones (oil and gas, gas and oil, oil and gas condensate).

The state of the world economy and its segments will depend to a large extent on the success of data transfer, storage, processing, use and protection. It is obvious that one the business priorities in oil companies as well today is the high-quality processing of the information flow. According to expert evaluations, Russian oil companies are actively engaged in the application of smart wells into their business environment. If the world used the technology at 800 wells in 2011, only Rosneft had about 2,000 wells with signs of artificial intelligence by 2017 (Peskova, Khodkovskaya, Charikov, & Sharafutdinov, 2019; Peskova, & Sharafutdinov, 2019).

By 1.01.2018, there were 2,641 objects in the distributed subsoil fund, including 1,909 developed and 732 explored objects, which together contain oil reserves of 16.09 billion tons of categories A+B1, 1.75 billion tons of category C1 (97.3% of developed and 89.6% of explored reserves in Russia), 5.8 billion tons of category B2, 4.36 billion tons of category C2 (92.6% and 89.4%, respectively) (Table

In the regional context, the largest share of the mining industry in the gross regional product is the Republic of Tatarstan (23.4%), the Irkutsk region (11.4%), the Republic of Bashkortostan (7.7%) (Yusupov, Toktamysheva, Yangirov, & Akhunov, 2019). At the same time, the quality of oil, the conditions of its reserves, and, consequently, its value and cost affect the profitability of production. The qualitative characteristics of the marker types of world exchanges, as well as the Russian export grade “Urals” are shown in Table

The Urals export grade of Russian oil is obtained by mixing different grades of oil in the Druzhba pipeline. Urals oil, having a higher density and sulfur content, is inferior to the stock exchange's marker grades in price (Figure

Source: authors.

The Russian raw material base of liquid hydrocarbons has a high concentration. The quality of the basin's oil is relatively high: 47% of the basin's reserves are represented by particularly light and light grades, and other 28% are medium-density oil types. Low-and medium-grained oil accounts for about 70% of the oil and gas reserves in the basin (Korzhubaev, Filimonova, & Eder, 2007).

Features of assigning oil rents in Russia

Two industry taxes are applied for the withdrawal of oil rents – the mineral extraction tax and the export duty (Table

In accordance with article 261 of the Tax Code of the Russian Federation of July 31, 1998 N 146-FZ, the subsoil user takes into account certain types of expenses for the development of natural resources, which is carried out during the geological study and development of license areas, when forming the tax base for the profit tax. Taking into account the tasks specified in the Energy Strategy – 2030 (Institute of Energy Strategy, 2019), only subsoil users who are engaged in the search and evaluation of new offshore hydrocarbon deposits can use the preferential coefficient of 1.5 to the amount of received expenses (Sharf & Mikhalchuk, 2019).

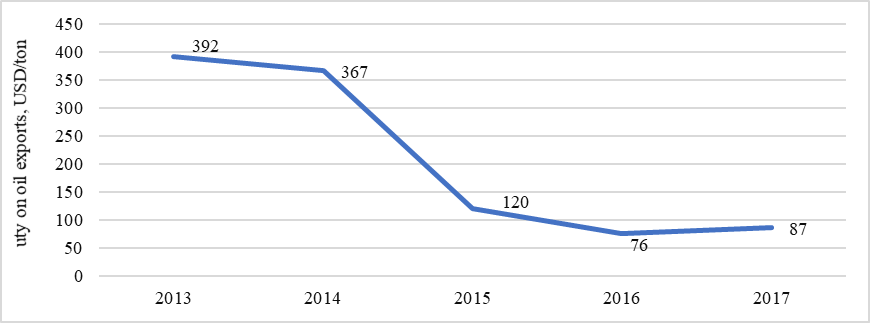

The mineral extraction tax (MET) is a federal tax that was introduced on January 1, 2002. Through this tax, the state withdraws from all enterprises of the mineral resource industries a part of the mining rent, that is, a part of the income determined by the action of the natural factor. In general, over the five-year period, the MET value per ton of oil increased by 1.5 times. The main reason is the increase in the tax rate. When exporting oil and petroleum products, the price includes export duty, VAT is not included. The value of the export duty is unstable (Figure

Source: authors.

It is set in absolute terms in US dollars per ton and is calculated monthly on a progressive scale based on the average price of Urals grade oil (Table

The rent corresponding to the exported ton of oil is divided by the export duty into a part received by the state and a part remaining at the disposal of the oil company (profit before taxation). The rent of a ton sold on the domestic market is divided into a part received by the company (profit before taxation) and a part received by oil consumers – manufacturing enterprises, transport, and households. Experience of various countries serves as an important reference point for the formation of price policy in the oil products sector (Volkonsky & Kuzovkin, 2019).

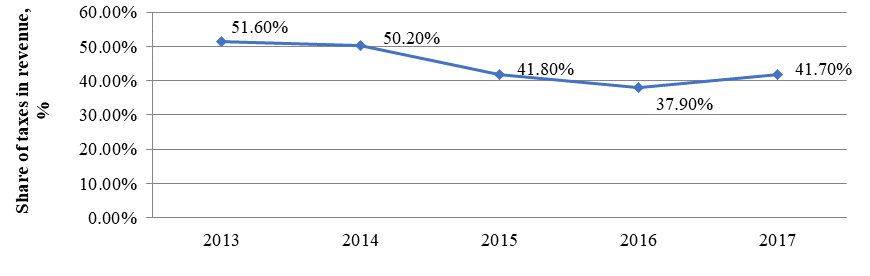

According to domestic analysts, the main share of the tax burden of vertically integrated oil companies consists of MET, export duties on oil and petroleum products, and corporate income tax (Figure

Source: authors.

New in the taxation of the oil and gas sector was the introduction of a new tax from January 1, 2019 – a tax on added income (AIT) from the extraction of hydrocarbon raw materials which will be carried out in a test mode on certain subsurface areas located in both traditional and new regions of the oil production. Tax reform for oil companies involves partially replacing the MET with a new tax on added income. The tax rate will be 50%, and it will be levied on income from oil sales minus export duties, reduced MET, production and transportation costs. The transition to this system is still voluntary. The goal of the new regime, in particular, is to increase the oil production at fields that will be included in the number of pilot projects.

When discussing the problems of business development, one of the main issues is to ensure that the state establishes constant long-term rules of the game in the economy. This should allow businesses to best adapt to existing conditions (Burenin, 2019).

Problem Statement

The role of oil and gas revenues in the Russian budget

Oil and gas revenues of the federal budget of the Russian Federation include (Figure

Taxes that are paid for the development of minerals such as oil, combustible natural gas, gas condensate from all fields, gas condensate obtained from other hydrocarbon raw materials;

Customs duties for selling abroad crude oil, gas, and goods produced from hydrocarbons.

Source: authors.

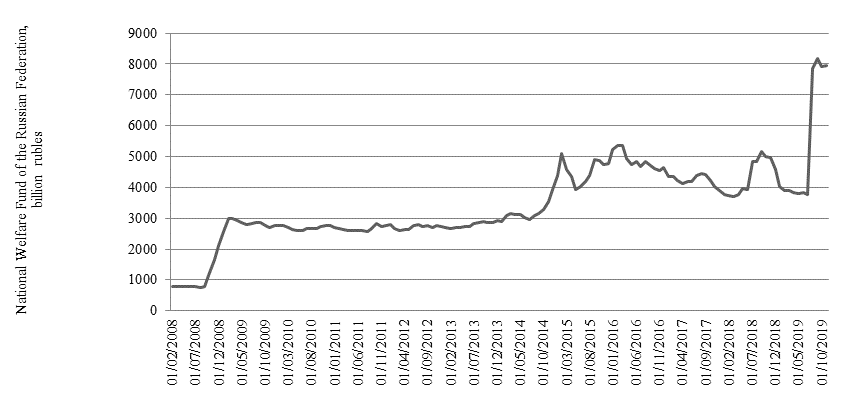

Since 2004, the government of the Russian Federation has decided to allocate a part of its oil and gas revenues to a separate fund, so called “Stabilization Fund”. In 2008, the stabilization fund has ceased to exist, and created were news ones: the National Welfare Fund (established to provide co-financing voluntary pension savings of Russian citizens and balancing (deficit) budget of the Pension Fund of the Russian Federation) and the Reserve Fund (established to finance the oil and gas transfer). A part of the national welfare fund (NWF) is used in projects that are unacceptable for placing international reserves in terms of risk and liquidity. Thus, the NWF serves as a riskier, but potentially more profitable instrument for the Russian government. For 11 years, the NWF has grown 10 times: from 783.31 billion rubles in 2008 to 7949.61 billion rubles in 2019 (Figure

Source: authors.

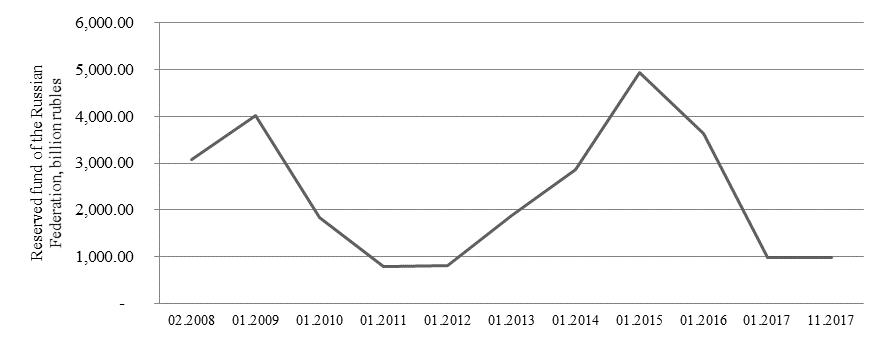

The Reserve Fund for 9 years of its existence has grown 1.5 times by 2015 and decreased to 975.25 billion rubles by the time of the merger with the NWF (Figure

Source: authors.

By joining financial resources of two funds, the purpose of the NWF remained the same – co-financing of voluntary pension savings of Russian citizens, ensuring a balanced budget for the Pension Fund. This was added with a goal of regulating the balance (covering the deficit) of the consolidated budget of the Russian Federation.

The impact of rental income on national well-being

To assess the impact of rental incomes on the national welfare of the Russian Federation, the authors conducted a study of the dependence of Russian GDP on oil exports and oil prices, as well as the dependence of GDP and the Human Development Index (HDI) on oil and gas revenues (Vanchukhina, Leybert, Khalikova, Rudneva, & Rogacheva, 2019).

The idea of the impact of oil and gas exports on macroeconomic indicators can be illustrated by data on the attraction of rental incomes for the formation of the state budget and replenishment of state reserves. As a result, the share of rent in GDP is huge (Vasileva, Shalina, Tokareva, & Baykova, 2017; Sovacool, Walter, Van de Graaf, & Andrews, 2016).

The model of dependence of the Russian GDP on oil exports and oil prices will allow forecasting the Russian GDP for future periods with the forecast oil price and the planned export volumes. Correlation and regression analysis was used as a mathematical tool in this research (Table

The calculations revealed a high direct linear relation between X and Y1, and a slightly weaker one between X and Y2. The authors derived a regression equation that reflects the dependence of the country's GDP on oil and gas revenues:

Y1 = 12 X (1)

Thus, the resulting regression equation puts Russian GDP in the direct dependence on oil and gas revenues.We derived a regression equation that reflects the dependence of the country's HDI on oil and gas revenues.The regression equation was obtained in the following form:

Y2 = 0.00013 X (2)

The resulting regression equation makes Russian HDI directly dependent on oil and gas revenues.

Research Questions

The authors examine the oil reserves of the Russian Federation and their qualitative characteristics; the mechanism for assigning oil rents in the Russian Federation: the state assigns oil rents through the taxation of industrial enterprises with a tax on mining and export customs duties on oil. To assess the impact of rental income on the national welfare of the Russian Federation, the authors conducted a study of the dependence of the Russian GDP on oil exports and oil prices, as well as the dependence of the Russian GDP and the Russian Human Development Index on oil and gas revenues.

Correlation and regression analysis was used as a mathematical tool. The tightness of the relation between the factors was determined using the Pearson linear correlation coefficient. The calculation was performed using the application for statistical data processing Microsoft Excel – "Data Analysis". As a research result, an economic and mathematical model is proposed for forecasting the GDP of the Russian Federation depending on the forecast of the price of Urals oil. The proposed economic-mathematical model allows predicting GDP and HDI depending on oil and gas revenues. A generated regression models reflects the dependence of the Human Development Index of the Russian Federation on oil and gas revenues.

Purpose of the Study

The purpose of the study is to assess the impact of mechanisms for assigning oil revenues on the level of well-being in the Russian Federation. The work is based on modern theoretical concepts for analyzing the impact of oil revenues on the economic development of resource-owning countries. The authors also analyzed the experience of foreign countries in the field of the distribution mechanism implementation for oil revenues and its impact on the quality of life of the population.

Research Methods

The methodological basis of this research is formed by such areas of the economic science as economic theory and mathematical methods in economics, etc. Using the method of mathematical modeling, it was possible to obtain models reflecting the dependence of the country's GDP and HDI on oil and gas revenues. Economic analysis methods were used to solve the set tasks (Gajfullina, Nizamova, Musina, & Alexandrova, 2017; Wicaksono, Bin Arshad, & Sihombing, 2019).

Findings

The regression equation (1) obtained in paragraph 2.2, which reflects the dependence of the country's GDP on oil and gas revenues, has the following meaning: an increase in oil and gas revenues by 1 billion rubles leads to an increase in GDP by 12 billion rubles. This model can be used in forecasting Russian GDP depending on oil and gas revenues.

The derived equation (2), which reflects the dependence of the country's HDI on oil and gas revenues, has the following meaning: an increase in oil and gas revenues by 1 billion rubles leads to an increase in HDI by 0.00013 units. This model can be used in forecasting the HDI of Russia depending on oil and gas revenues.

Conclusion

When preparing the study, the authors linked scientific novelty to the lack of elaboration of theoretical and practical issues on the relation between the gross domestic product and the level of welfare depending on oil and gas revenues. The author's approach was developed to evaluate the dependence of the economic welfare of the state on oil and gas revenues: the proposed economic-mathematical model shows the dependence of the Russian GDP on oil and gas revenues; a regression equation reflects the dependence of the Human Development Index of the Russian Federation on oil and gas revenues. The suggestions made by the authors have applied nature.

References

- Burenin, A. N. (2019). The limits of macroeconomic policy under the eye of economic crisis. Ekonomicheskaya Politika, 14(1), 76-91. DOI: 10.18288/1994-5124-2019-1-76-91

- Gajfullina, M. M., Nizamova, G. Z., Musina, D. R., & Alexandrova, O. A. (2017). Formation of strategy of effective management of fixed production assets of oil company. In A. Y. Karpov, N. Martyushev (Eds.), Proceedings of Trends of Technologies and Innovations in Economic and Social Studies (TTIESS 2017). Advances in Economics, Business and Management Research, AEBMR, 38 (pp. 85-190). Paris: Atlantis Press.

- Human Development (2019). Human Development Report. Retrieved from: http://hdr.undp.org/en. Accessed: 28.01.2020.

- Institute of Energy Strategy (2019). Russian energy strategy for the period up to 2030. Approved by order of the Government of the Russian Federation No. 1715-R of November 13, 2009. Retrieved from http://www.energystrategy.ru/projects/es-2030.htm Accessed: 28.11.2019. [in Rus.].

- Korzhubaev, A. G., Filimonova, I. V., & Eder, L. V. (2007). Bright future in hydrocarbon tones. Neft' Rossii, 23, 23-27.

- Peskova, D., & Sharafutdinov, R. (2019). The influence of economy digitalization on the activity of oil companies. MEST Journal, 7(1), 85-91. DOI: 10.12709/mest.07.07.01.12

- Peskova, D. R., Khodkovskaya, J. V., Charikov, V. S., & Sharafutdinov, R. B. (2019). Development of business environment of oil and gas companies in digital economy. In V. Mantulenko (Ed.), Proceedings of the GCPMED 2018 International Scientific Conference "Global Challenges and Prospects of the Modern Economic Development". The European Proceedings of Social & Behavioural Sciences, 57 (pp. 1205-1212). London: Future Academy. DOI: 10.15405/epsbs.2019.03.122

- Sharf, I. V., & Mikhalchuk, A. A. (2019). Tax incentives in the system of the natural resources management: Reproduction aspect. Economy of Region, 15(3), 791-805. DOI: 10.17059/2019-3-13.

- Sovacool, B., Walter, G., Van de Graaf, T., & Andrews, N. (2016). Energy governance, transnational rules, and the resource curse: Exploring the effectiveness of the extractive industries transparency initiative (EITI). World Development, 83, 179-192. DOI: 10.1016/j.worlddev.2016.01.021

- Tax Code of the Russian Federation of July 31, 1998 N 146-FZ. Retrieved from http://www.consultant.ru/document/cons_doc_LAW_19671/ Accessed: 28.01.2020. [in Rus.].

- Vanchukhina, L. I., Leybert, T. B., Khalikova, E. A., Rudneva, Y. R., & Rogacheva, A. M. (2019). Industry 4.0 and closed-loop economy in the context of solving the global problems of modern times. In E. Popkova, Y. Ragulina, A. Bogoviz (Eds.), Studies in Systems, Decision and Control, 169 (pp. 31-53). Cham: Springer.

- Vasileva, Y. P., Shalina, O. I., Tokareva, G. F., & Baykova, E. R. (2017). Economic growth in Russia: Influence of oil shock and macro-economic factors. In E. Popkova, V. Sukhova, A. Rogachev, Y. Tyurina, O. Boris, V. Parakhina (Eds.), Integration and Clustering for Sustainable Economic Growth. Contributions to Economics (pp. 537-551). Cham: Springer. DOI: 10.1007/978-3-319-45462-7_52

- Volkonsky, V. A., & Kuzovkin, A. I. (2019). Prices and taxes on oil and oil products in the context of long-term economic development of Russia. Problems of Forecasting, 3, 28-39. [in Rus.].

- Wicaksono, F. D., Bin Arshad, Y., & Sihombing, H. (2019). Monte Carlo net present value for techno-economic analysis of oil and gas production sharing contract. International Journal of Technology, 10(4), 829-840. DOI:10.14716/ijtech.v10i4.2051

- Yusupov, K. N., Toktamysheva, Y. S., Yangirov, A. V., & Akhunov, R. R. (2019). Economic growth strategy based on the dynamics of gross domestic product. Economy of Region, 15(1), 151-163. DOI: 10.17059/2019-1-12

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Vasileva, Y. P., Musina, D. R., Orlova, D. R., & Fazrakhmanov, I. I. (2020). Distribution Of Natural Oil Rent In The Russian Economy. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 440-449). European Publisher. https://doi.org/10.15405/epsbs.2020.04.57