Abstract

On the current stage, an important direction towards completion fiscal regulation is to local government and intergovernmental relations, decentralize an important part of state functions on the local authorities. Local self-government is one of the main signs of democratic development of the country and constitutional order, democracy practical tool and characteristic. Since the independent day of Georgia, the local government is more or less influential factor on political order. Despite the fact, that there have been made many reforms in this field still it is uncertain how this system will work. Ongoing changes are controversy and incomplete- there often early starting point changes and after some success completions we face stagnation and after that again centralization methods are vivid. The reform of municipalities need sufficient financial resources for development. And without the necessary financial funding and more in the whole country without using a robust, formula-driven equalization mechanism is hard to achieve development. The paper examines the budgetary relations established between the center and a region in terms of economic endowment - transfer distribution. The deficiencies that characterize the distribution of financial resources and prevent the formation of a stable financial market for the revenue of territorial units' budgets have been analyzed. The paper justifies and presents recommendations for improving the mechanism of financial resource transfer and for further strengthening the financial independence of municipalities.

Keywords: Equalization transferintergovernmental relationstransfer mechanismintergovernmental transfersbudgetary regulationlocal development

Introduction

At a modern stage, when the country aspires to European integration, the establishment of a new economic system and its effectiveness requires the mobilization of colossal financial resources that cannot be achieved without a proper financial mechanism. This in turn requires the establishment of a proper budgeting system, with inter-budgetary relations being one of the crucial areas.

Inter-budgetary relations are a system of financial-economic relations, through which the distribution and redistribution of gross domestic product and national income is produced for the socio-economic development of territorial units. Optimizing of inter-budgetary relations provides funding for a wide range of activities related to public utilities and socio-cultural services.

Problem Statement

The main topics of this work are the following: the budgetary relationships between the center and the region are studied in the aspect of equalization transfer distribution. The analyzes of the shortcomings are implemented being characterized for revenue distribution and preventing socio-economic equalization of territorial units and their development, the paper substantiates and provides recommendations for improvement of budgetary relationships to strengthen their further financial independence and finally, by researching modern tax revenues defining positive and negative tendencies and their influencing factors. Based on the analysis of local self-government and consolidated budgets are drawn conclusions.

Research Questions

At the modern stage, it is important to highlight the legal aspects that are of the utmost importance for the harmonization of interests and actions between state and regional authorities. Any action, any policy at the highest state or lower hierarchical level, takes place in the existing legal space. Properly defining this legal space means avoiding the contradictions between the defined priorities of the common good in society, as well as the contradiction between the common tactics and the strategy of action.

Purpose of the Study

The object of research is the income of territorial units. The calculations of the basic data. The aim is to analyze the interbudgetary relations in the aspect of distribution of intergovernmental transfers between center and the regions; analyzing of the deficiencies typical for the existing order of distribution of revenues; proving of necessity of improvement of budgetary regulation, their generalization and development of the appropriate proposals and recommendations.

Research Methods

Review of Literature

Issues of financial equalization of the development of territories and organizations of inter-budgetary relations were studied by economy scientists, among them D. Bergvall, A. Bernard, J. Blouin, M. Busso, K. Clausing, A. Cristea, R. Dekle, T. Seidel, D. Swenson and others. In their scientific researches, they have deeply disclosed issues of budgetary regulation, financial equalization and organization of inter-budgetary relations, defined problem issues in this area, however, the system of financial equalization of the development of territories requires continuous improvement and research (Bergvall, Charbit, Kraan, & Merk, 2006; Bernard, Jensen, & Schott, 2006; Blouin, Robinson, & Seidman, 2018; Busso, Gregory, & Kline, 2013; Clausing, 2003; Cristea, & Nguyen, 2016; Dekle, Eaton, & Kortum, 2007; Ehrlich, & Seidel, 2018; Swenson, 2001).

Methodological Data

According to the Budget Code of Georgia (Ministry of Finance of Georgia, 2019a) the amount of equalization transfers to the budget of each local self-government unit is calculated by the formula:

,

Where: T - Transfer to local self-government unit’s budget; E - the sum of budget spending of local self-government unit and non-financial asset growth, calculated on the basis of statistical data(number of population, number of children under 6, number of adults 6 to 18, number of population whose socio-economic status (rating score) is lower than the threshold set by the government of Georgia, area of local self-government unit and length of roads of local importance) and equalization ratio by dividing self-governing cities and municipalities; R - Local government budget revenue (excluding grants), which is calculated for each local government budget in accordance with the current year's forecast and the trend of actual figures for the past 3 years (Art. 74).

Calculation of equalization transfers in the Law of Georgia on Local Government Budget (Legislative Herald of Georgia, 2009) begins with the calculation of the amount of lack of budget. The amount of the lack of budget is obtained by multiplying the difference between the per capita income of the country and the per capita income of the self-governing unit to the correction coefficient and the number of population. At least 70% of the self-governing unit lack of budget is provided by the state budget as an equalization transfer. Equalization transfer calculation formula:

,

Where, Ti - is equalization transfer; R - Average annual per capita income of all local self-government units; Ri - the average annual income of a specific self-government unit per capita; I - Number of population in self-governing units; K - correction coefficient, K=K1+K2, Among them K1 is the coefficient of highlandness and K2 is coefficient of small population territorial unit.

To calculate the Highlandness coefficient (K1), the population of the self-governing unit and the population of the territorial units are taken. And the value obtained is differentiated by its increase. Based on this data the percentage share of the population living in highlands of total self-governing unit population is calculated. Small population territorial unit coefficient (K2) is defined depending on the scarcity of the population and preference is given to a less populated self-governing unit. The abovementioned coefficients were approved by the resolution of the Government of Georgia. In particular, according to the resolution, the coefficient in the transfer calculation formula was defined as follows:

a) Highlandness coefficient

K1 = 0,5 - If 30% of the population of the self-governing unit is settled in the highlands;

K1 = 1,0 - If the population of the self-governing unit is 30 to 70% of the highland area;

K1 = 1,5 - If 70% of the population of the self-governing unit is settled in the highlands.

b) Coefficient of small population territorial units

K2 = 1,8 - If the population of the self-governing unit does not exceed 25 thousand; K2=0,4 - If the population of the self-governing unit is 25 to 50 thousand;

K2 = 0,1 - If the population of the self-governing unit exceeds 50 thousand.

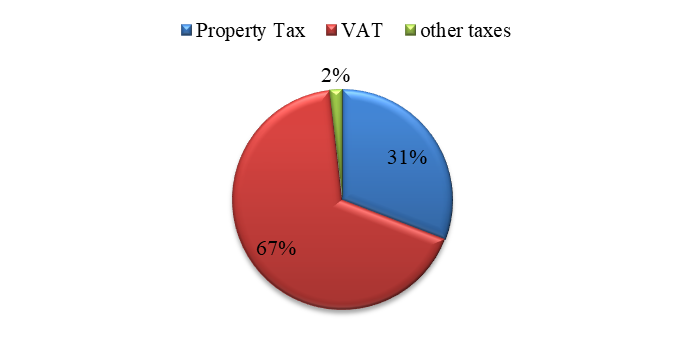

Following the reforms implemented in the field of self-government, by the decision of the Government of Georgia from 2019, 19% of VAT revenues will be distributed to the local self-government. As it is clear from the budget legislation (2019), the distribution of VAT is based on a specific criterion:

60% of the VAT allocated to municipalities will be distributed according to municipality population;

15% – According to the number of children under 6 registered in the municipality;

10% –According to the number of adolescents aged 6 to 18 registered in the municipality;

5% –According to the area of the municipality;

10% –According to the number of persons living in high mountainous settlements.

As the equalisation formulas interact, a municipality’s overall loss in equalisation grants may in some cases be greater than its gain in additional tax revenue resulting from development efforts (Blöchliger, Merk, Charbit, & Mizell, 2007).

From our point of view, the legal norms should be adopted by analyzing the socio-economic situation of the regions in order to enable us to further minimize the socio-economic disparities between different territorial units. This is the basis for the establishment of an equal basis between the budget levels not in the final results but in the starting conditions.

Discussion

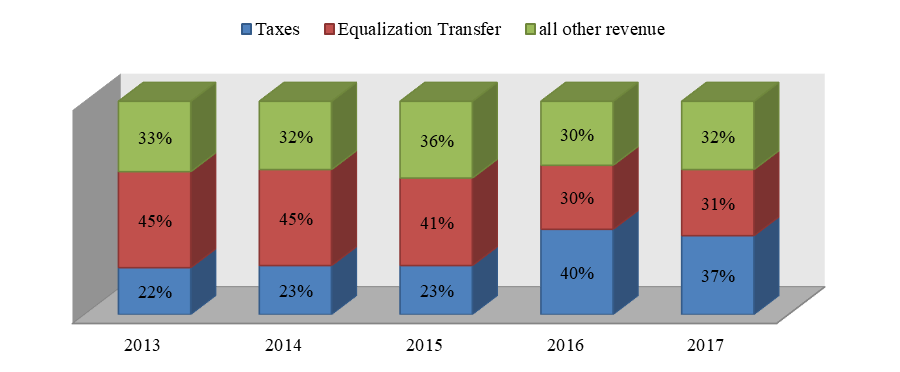

The scarcity of financial resources of self-governing units in Georgia since independence has always been a topic of discussion in scientific also political circles. For years, the central government has used various means of financing self-governments to try to balance the asymmetrically distributed income base with economic endowments, but the scarcity of resources allocated has not ensured equalization. Along with the reduction in both its shared and absolute own tax revenues, the state has made equalization transfers the main source of revenue for local self-governments.

If we look at the state transfer policy, it is clear that the volume of transfers is almost half of the revenue of self-governing cities. It is considered that one of the most important tasks of the state government is to implement an effective policy of allocation of financial resources to the municipalities in the country, which should ensure fair distribution and competition of financial resources between individual regions. On the other hand, by shifting resources from rich to poor places, transfers may distort incentives and induce some workers or firms to locate in regions that they otherwise would not have chosen (Kline & Moretti, 2014).

Financial support in the form of equalization transfers played an important role in the equalization of regions in Georgia, with the aim of equalizing financial resources for the implementation of own rights and responsibilities.

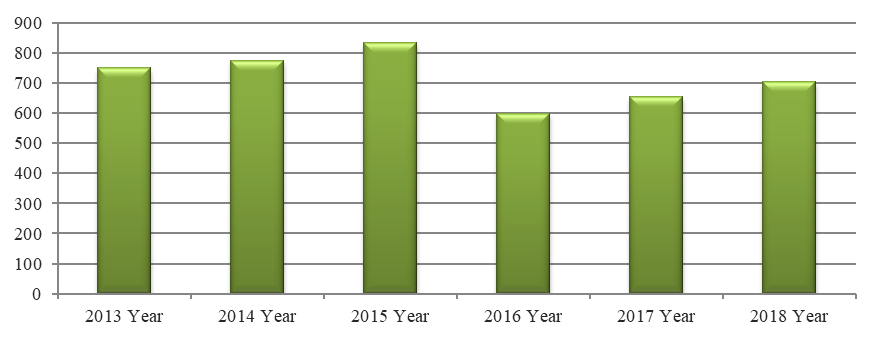

In 2018, in the state budget of Georgia in the form of equalization transfers to local governments GEL 705 million was envisaged, which is GEL 50.3 million more (8% increase) compared to the previous year, while GEL 105.7 million increase (18% increase) compared to 2016. The largest share of the allocated equalization transfers is 61% to 5 self-governing cities - GEL 427.8 million, while the remaining 39% to the rest 64 municipalities - GEL 277.2 million.

As can be seen from the trend shown in Figure

Local governments no longer receive equalization transfers and, in parallel, the small portion of income tax that was remaining in local budgets till 2016, has been fully directed to state budget from 2019. In particular, instead of equilization transfer and income tax, 19% of the value added tax revenue is distributed to municipalities. Considering this, the share of the state budget out of the total VAT amounts to GEL 4 036.0 million (which is 9.0 percent of GDP) and the share of municipalities to GEL 946.0 million. Accordingly, the 2019 state budget defines which specific municipality and what amount will receive the funding (Figure

According to the budget and the new funding rule, from 19% of VAT, 50.01% to the capital, 11.19% to the 4 self-governing cities in total and 38.8% to the other 58 municipalities.

As shown in the table

It is interesting what other cities will receive? Batumi - 5.07% (47 million GEL); Poti - 0.36% (GEL 3.4 million); Kutaisi - 3.48% (GEL 32.9 million); Rustavi - 2.28% (21.6 million GEL). According to the census, the total population in these four self-governing cities is 467,042, or just over half - 641 674 less than in Tbilisi. Against this background, the new scheme shows that their total financing rate is 11.19% and the total amount is GEL 105.8 million, which is four times less than Tbilisi's GEL 367.6.

The explanatory note of the 2019 State Budget states: “Following these changes, the municipalities' own revenues will continue to grow, which will significantly increase their independence” (Ministry of Finance of Georgia, 2019b, p.15). If the current system is maintained, municipalities' financing (income tax and equalization transfer) would be GEL 900.6 million in 2019 (excluding municipalities on the occupied territories), which is GEL 61.9 million higher than in 2018. According to the new financing system, the financing of these municipalities amounts to GEL 946.6 million, which is GEL 107.9 million higher than in 2018, and GEL 46.0 million higher than the 2019 calculated under the old system (Ministry of Finance of Georgia, 2019b). The explanatory note of the amendments of the Local self-government and state budget codes states that according to the current rule, other incomes have affected to the capacity of the equalization transfer, this was a kind of demotivator for municipalities to generate their own revenues. The revenue received under the new system no longer envisages the municipality's own revenues and creates additional incentives for municipalities. Forecasting distributed VAT compared to the equalization transfer formula is simpler for each municipality and will help municipalities to develop medium-term and annual action plans. According to the Explanation Cards, it is also clear that in the transition period - 2019-2023 local governments are allowed to increase current spending only by a percentage of GDP growth (Ministry of Finance of Georgia, 2019b). As municipalities' incomes increase substantially as a result of the change in the municipal financing system, municipalities in transition period (2019-2023) are authorized to increase current expenditures only by a percentage of GDP growth. The above limitation does not apply to the cases when the amendments to the legislation of the Parliament of Georgia increase the functions of municipalities in comparison with the previous year. Paragraph 10 of Article 164 provides that the municipalities specified in this Article shall receive a special transfer from the state budget each year to carry out their functions – The explanatory note to the amendments to the Code of Local Self-Government and the Budget Code reads (Ministry of Finance of Georgia, 2019a).

Although under the new system, local governments will receive more than GEL 46 million in 2019, the initiative is far from fiscal decentralization It does not respond to the essence of decentralization, to the European Charter of Self-Government, nor to the Council of Europe's many-year-old congressional recommendations. The main problem that people working on the issue of self-government see is that, under the proposed model, the ability and responsibility of the self-government to increase their own incomes actually equals zero, whereas one of the tasks of decentralization is to increase the competencies, responsibilities and capacities of local authorities, to find resources and to solve local problems.

As we have seen, various policies have been implemented at different times in the process of budget formation of self-government units and financial support to them on the way to fiscal decentralization. However, if central government is to retain control over the proper use of equalisation funds, it can do better through appropriate public service regulation such as minimum standards or output and performance indicators, while leaving operation and management of fiscal resources at the discretion of local and regional governments (Bergvall, Charbit, Kraan, & Merk, 2006).

Findings

One of the weaknesses of the current model of financing self-governments was that the existing system did not stimulate the economic activity of municipalities. That is, the economic development of municipalities was less reflected on their incomes. Redistribution of 19% of mobilized VAT would not solve the problem if the municipality attracted investment, created new jobs, and it would not receive any financial benefit, as it would only be a property tax. Property tax, in fact, cannot increase its income. According to the model, municipal revenues will increase only if the country's GDP increases.

Conclusion

There are various variations in the creation of a financial base for a municipality with general state tax resources (leaving revenue tax at the place, leaving part of value added tax, etc.). It is important, when selecting it, to take into account the extent of municipalities' powers, their real resources and their actual contribution in generating specific common state taxes. Of course, leaving income tax/VAT in local budgets is one and not the only option, but the main thing is that these funds could have a real impact on municipal finance.

In our view, in order to successfully implement the principle of equalization of socio-economic condition, it is necessary to differentiate the levels of socio-economic development in the regions. It is advisable not only to take into account such indicators as: Population density of the region, economically active population, quantity of population employed at a disadvantage, per capita income, natural-climatic conditions, poverty level, percentage of unemployed population, region's needs on financial resources for resolving current socio-economic problems, level of participation of the region in the formation of central budget revenues and crediting debts of budgetary institutions (Abuselidze, 2013, 2019), but to this extensive list should be added such an important indicator as it is the amount of the money required for the region's economic potential and domestic inactive reserves, this will in fact raise the level of development of the regions and solve the problem of equalizing their levels of economic and social development with the achievement of future economic growth.

References

- Abuselidze, G. (2013). Areas of improvement of finance policy in the process of advancing of upgrading the territorial economic activity and financial capacity. International Business Research, 6(5), 194-200.

- Abuselidze, G. (2019). Analysis of the formation and use of budgetary policies ensuring the socio-economic development of territorial units. Economic Archive, 2, 3-15.

- Bergvall, D., Charbit, C., Kraan, D-J., & Merk, O. (2006). Intergovernmental transfers and decentralised public spending. OECD Journal on Budgeting, 5(4), 111-58.

- Bernard, A.B., Jensen, J.B., & Schott, P.K. (2006). Transfer pricing by US-based multinational firms. NBER working paper series, w12493. Cambridge, M.A.: National Bureau of Economic Research.

- Blöchliger, H., Merk, O., Charbit, C., & Mizell, L. (2007). Fiscal equalisation in OECD countries. OECD economic studies, No. 44. Paris: OECD.

- Blouin, J. L., Robinson, L. A., & Seidman, J. K. (2018). Conflicting transfer pricing incentives and the role of coordination. Contemporary Accounting Research, 35(1), 87-116.

- Busso, M., Gregory, J., & Kline, P. (2013). Assessing the incidence and efficiency of a prominent place based policy. American Economic Review, 103(2), 897-947. DOI: 10.1257/aer.103.2.897

- Clausing, K. A. (2003). Tax-motivated transfer pricing and US intrafirm trade prices. Journal of Public Economics, 87(9-10), 2207-2223.

- Cristea, A. D., & Nguyen, D. X. (2016). Transfer pricing by multinational firms: New evidence from foreign firm ownerships. American Economic Journal: Economic Policy, 8(3), 170-202.

- Dekle, R., Eaton, J., & Kortum, S. (2007). Unbalanced trade. American Economic Review, 97(2), 351-355. DOI: 10.1257/aer.97.2.351

- Ehrlich, M. V., & Seidel, T. (2018). The persistent effects of place-based policy: Evidence from the West-German Zonenrandgebiet. American Economic Journal: Economic Policy, 10(4), 344-374. DOI:10.1257/pol.20160395

- Kline, P., & Moretti, E. (2014). People, places, and public policy: Some simple welfare economics of local economic development programs. Annual Review of Economics, 6(1), 629-662.

- Legislative Herald of Georgia (2009). Law of Georgia on Local Government Budget. Retrieved from https://matsne.gov.ge/en/document/view/26332?publication=5 Accessed: 09.01.2020.

- Ministry of Finance of Georgia (2019a). Budget code of Georgia. Retrieved from https://mof.ge/images/File/budget_legislation/BUDGET_CODE_OF_GEORGIA_ENG.pdf Accessed: 09.01.2020.

- Ministry of Finance of Georgia (2019b). Law of Georgia on State Budget 2019. Retrieved from https://matsne.gov.ge/en/document/view/4419670?publication=2 Accessed: 09.01.2020.

- Swenson, D. L. (2001). Tax reforms and evidence of transfer pricing. National Tax Journal, 54(1), 7-26.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Abuselidze, G. (2020). Mechanism Of Transfer Of Financial Resources To Territorial Units: A Case Study. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 192-200). European Publisher. https://doi.org/10.15405/epsbs.2020.04.25