Abstract

When making a decision on capital investment, a domestic or foreign investor first of all assesses the level of return on investment and the likelihood of the risk of loss of investment. In addition to traditional approaches to the analysis of investments attractiveness, assessment of planned investment return, investors are increasingly considering the regional institutional environment in which capital allocation will take place. The institutional environment can be understood as a set of policy measures, the purpose of which is to create favorable and comfortable conditions for the allocation of capital. In the case of a reduction in the number of large foreign investors in the regional economy, one can talk about lowering investment ratings and deterioration in the institutional environment, since foreign enterprises consider and study the behavior of local enterprises. The final decision on investing money by non-resident investor depends on the number of local enterprises and their sustainable development. Since, after launching production and termination of tax benefits and various preferences, the representations of foreign market participants may become branches of foreign divisions. And this turns them into full-fledged participants in the regional economy in terms of tax payments and full compliance with local legislation. When deciding on final production location abroad, non-residents pay significant attention to the business confidence index, which is an excellent source of information about the state of the institutional environment of the future capital allocation, as it is an aggregate indicator compiled from sociological surveys and the performance of key financial indicators.

Keywords: Business cyclereturn on investmentbusiness confidence indexinstitutional environment

Introduction

Recently, there has been a lot of research carried out regarding the reasons for the decline in the import of foreign capital into the Russian economy. Among others, many authors highlight increased transaction costs, red tape, sanctions, and declining growth in consumer demand and income. We analyzed the reasons for the outflow and reduction in the growth rate of foreign capital investments in the real sector of the economy using the example of the Samara region of the Russian Federation, proving the decisive impact of the institutional environment on the behavior of investors, both internal and external. The study considers the level of business risk in the regional economy, as a most important indicator reflecting the current institutional environment.

Problem Statement

The main purpose of the study is to identify undeniable influence of the institutional cycle on the performance of economic indicators in the region’s economy. Institutional transformations undoubtedly affect the economic cycle, the change of its phases, and also justify the multidirectional movement of institutional and economic cycles. We have decided to more deeply analyze the state of the institutional environment in the Samara region, to emphasize indicators that can study the performance of the institutional regional, and also the impact of variable institutional variables on the inflow and outflow of foreign capital into the economy of the Samara region and on sustainable economic development as a whole.

To this end, an approach to determine the state of the institutional environment and its impact on macroeconomic indicators has been developed. In our opinion, foreign investors (first of all, we are talking about those participants in the capital movement who invest in job creation, creation and expansion of production), making decisions on investing projects abroad, primarily consider the activity of local (domestic) investors. And one of the main indicators of such activity is the size of investments in fixed assets, as an indicator of expansion, re-equipment of production capacities. If the positive dynamics of this indicator for the period under consideration is insignificant, then there is concern regarding the development of the regional production potential, which is considered by a foreign investor. Since the withdrawal of local producers from the domestic market or the reduction of their production potential indicates an “unfriendly” institutional environment (Makhmudov, Konovalova, Kuzmina, & Persteneva, 2018).

Research Questions

The key research questions of this study were determining the quality of the regional institutional environment, identifying the reasons for the decision of non-resident investors to invest in the Russian economy, and calculating the rate of return on invested capital. By providing a credit resource to a small business entity that is part of a group of companies, a bank can, without knowing it, redeem troubled debt from one of the group's enterprises.

Purpose of the Study

The purpose of the study is to determine the reasons for high volatility of macroeconomic development indicators of the Samara region as a whole and the volume of direct foreign investment received in the region in particular. The existing institutional environment in the financial sector of the Russian economy, which is formed by regulatory legal acts and forms of control of the Central Bank of the Russian Federation.

Research Methods

The main method used in the study was design-constructive used in compiling the calculated values of the rate of return on invested capital. The comparison method was used when comparing various indicators characterizing the institutional environment of the Samara region.

Findings

The period of tax preferences and credit accommodation in terms of deregulation to a foreign investor at some point will end and the foreign enterprise will be in the same conditions as local manufacturers. Of course, in order to attract foreign capital, it is necessary to develop a legislative framework, in particular, to develop regulatory legal acts protecting a foreign investor. The existing institutional environment in the financial sector of the Russian economy, which is formed by regulatory legal acts and forms of control of the Central Bank of the Russian Federation, provides for the bank’s financing model for losses, which, in our opinion, can lead to a significant reduction in credit resources by the banking system.

We suggest to an analyze enterprises’ activity in the Samara region in order to determine the level of risk that is taken by regional enterprises in production activities and which foreign investors consider when deciding on investing capital. The level of this risk directly depends on the state of the regional institutional environment. We have conducted a study of business risk in foreign literature (Du & Rousse, 2018). The enterprise always has a certain degree of risk inherent in its operating activities, increasing in proportion to the amount of external borrowing. We define business risk as the rate of return on capital invested in the enterprise. For this we will use the indicator ROIC: return on investment ratio, which is determined as follows:

ROIC = *100%,

where NP - net operating profit (net of taxes, interest on loans and borrowings, depreciation);

InvCap - invested capital (mainly borrowed capital) in the main activities of the enterprise.

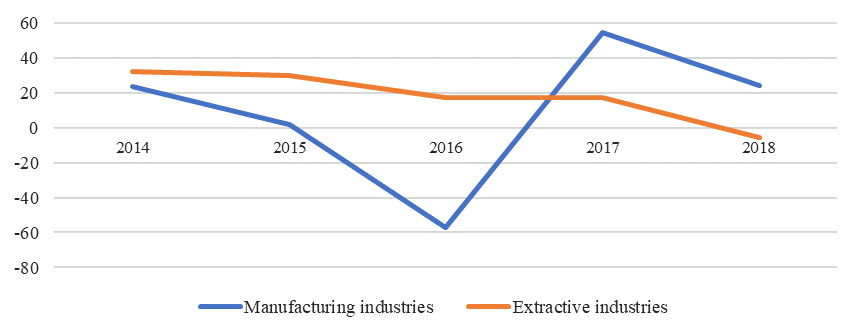

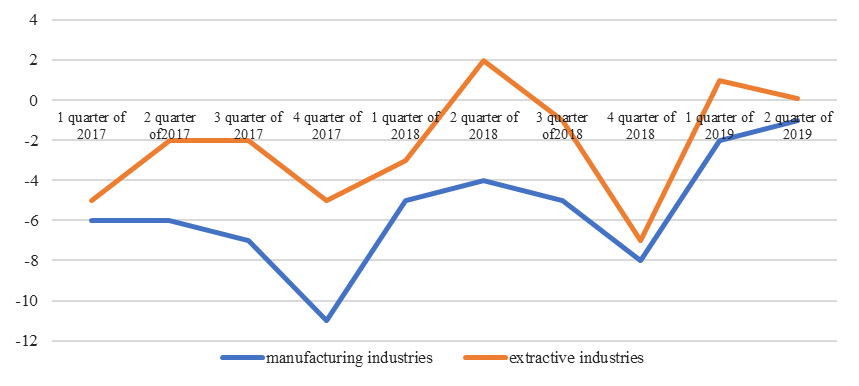

We deliberately calculate the ROIC indicator using the amount of operating borrowed funds of the enterprise, since the volume of external loans indicates the state of the regional institutional environment. For calculations, we have selected enterprises that have a cyclical nature of production: manufacturing and extractive enterprises (their cyclical nature of production is due to the influence of the level of demand for products, primarily from counterparty enterprises, as well as the dependence of the new production cycle on the amount of external borrowing), and agricultural producers, whose cyclical nature of production is determined, first of all, by the criterion of seasonality.

We have analyzed the indicators of profit and borrowed capital of enterprises in the extractive and manufacturing industries of the Samara region, as well as agricultural enterprises. According to our calculations, the largest return on invested capital can be obtained in manufacturing enterprises. However, enterprises in this sector are also characterized by the greatest risks of loss, reflected in negative ROIC values. Agricultural enterprises demonstrate sound return on invested capital. There are several reasons for this. Firstly, the borrowings of this segment of enterprises, for the most part, are internal corporate loans of enterprises of a group of related parties, as well as a stricter bank policy when lending to these enterprises, which are characterized by seasonality in doing business.

Figure

As can be seen from the graphs, the dynamics of the institutional environment, expressed through the business confidence index, accompanies the dynamics of economic indicators, in some periods slightly ahead of them.

“According to managers' answers about the forecast of production, stocks and demand for it, this indicator allows characterizing the economic activities of “Extractive”, “Manufacturing” organizations and provides proactive information on changes in economic variables” (Wang, 2019, p.76).

It should be noted that business risk depends on a number of factors, among which are: variability of demand, variability of selling prices, variability of the cost of resources, the ability to regulate selling prices, the ability to develop new types of goods, services, other products, and technological innovations in a timely and cost-effective manner.

Speaking about indicators involved in calculating the rate of return on investment, it is necessary to consider the indicator of corporate debt financing. By providing a credit resource to a small business entity that is part of a group of companies, a bank can, without knowing it, redeem troubled debt from one of the group's enterprises. The redistribution of funds within a group of companies to pay off one of its members' troubled debts does not contribute to the creation of new added value or expansion of production (Cauwenberge, Vancauteren, Braekers, & Vandemaele, 2019). As a result, enterprises that received the loan will not have the money to pay off the main debt and interest on it. Troubled debts in the economy will increase, output will decrease and the quality of the loan portfolio of the country's banking sector will deteriorate. Moreover, the lack of funds to pay off the main debt and the amount of interest will make banks implement a strategy to combat troubled debts: withdraw the pledged item from fixed or current assets of enterprises, which may lead to enterprise bankruptcy and further worsen the economic situation in the country, the protracted recession of the economic cycle (Chen, Yu, & Zhang, 2019).

We fundamentally disagree with the statement of IMF experts, who indicate that banks are restructuring existing debts of enterprises as a reason for productivity growth in the economy, which will facilitate access to credit and stimulate investment in tangible and intangible capital. In our opinion, debt restructuring in realities of the Russian economy may provoke the withdrawal of capital goods from business, redistribution of funds within a group of companies, as well as an increase in the value of borrowed funds from banks, which will reduce their ability to lend, including the real sector. In this case, there is no expansion of lending and production.

The regional institutional environment can be characterized by the business confidence index and, as we believe, by enterprise bankruptcies. This indicator is proactive, that is, its dynamics can predict the dynamics of future output in production and the volumes of future lending to enterprises, since banks can, when analyzing loan applications, introduce an industry coefficient in their models of financial assessment of enterprises, which reflects the dynamics of liquidation, reorganization and bankruptcy of organizations (Hsieh, Boarelli, & Vu, 2019).

The decision of foreign enterprises to invest in the region’s economy can be significantly affected by the growth of regional unemployment and the dynamics of price levels. Studying cyclic processes, we should consider the model of the political cycle of W. Nordhaus, trying to explain the influence of the institutional environment on the economic cycle (Alesina, 1989). The rate of inflation and unemployment rate, both before and after the election campaign, depend on the actions of political parties and executive bodies, for whom an election campaign will soon begin. Accordingly, foreign investors make a decision on investing based on prevailing conditions in the labor market and price level dynamics.

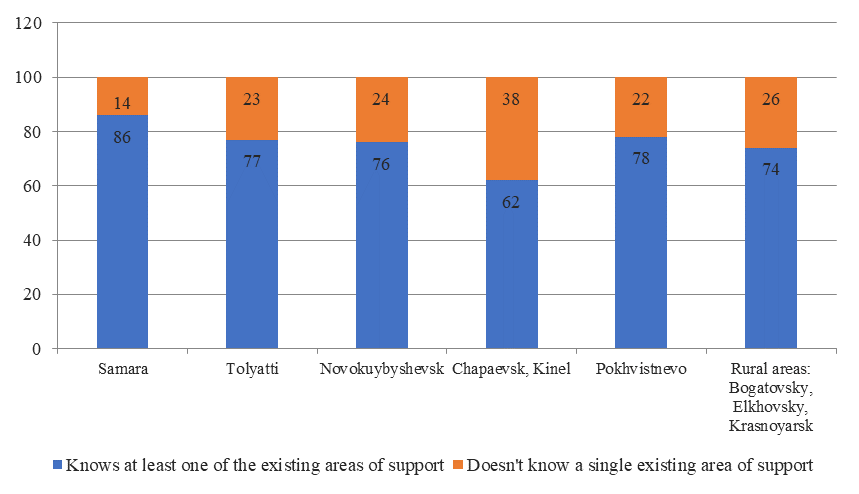

An important point characterizing the state of the regional institutional environment is the interaction of executive authorities with entrepreneurs in terms of explaining business development prospects. There are frequent cases when entrepreneurs are inferiorly aware of existing programs for the development and support of entrepreneurship (Figure

Conclusion

Thus, the most significant factors restraining investment activity are uncertainty of the economic situation, insufficient demand in the domestic market associated with a reduction in real incomes of the population. Factors that can have a positive impact on the industrial development are a decrease in the propensity to save. The government needs to develop a program to promote economic growth through the development of medium-term action plans that offer practical solutions to urgent priorities and help restore investor confidence. According to a number of researchers (Azur, 2017), five levers will be of decisive importance: sound fiscal policy, wide access to financial services, reform of the labor market and education system, improvement of management and business environment.

References

- Azur, D. (2017). It's time to act. Finance and Development, 4(54), 5-9. [in Rus].

- Alesina, A. (1989). Comments on alternative models of political business cycles by W.D. Nordhaus. Brookings Papers on Economic Activity, 2, 50-56.

- Cauwenberge, A. V., Vancauteren, M., Braekers, R., & Vandemaele, S. (2019). The value relevance of nonfinancial disclosure: Evidence from foreign equity investment. Economic Modelling, 81, 361-386. DOI:10.1016/j.econmod.2019.07.001

- Chen, D., Yu, X., & Zhang, Z. (2019). Foreign direct investment comovement and home country institutions. Journal of Business Research, 95, 220-231. DOI:10.1016/j.jbusres.2018.10.023

- Du, D., & Rousse, W. (2018). Foreign capital flows, credit spreads, and the business cycle. Journal of International Financial Markets, Institutions and Money, 57, 59-79. DOI: 10.1016/j.intfin.2018.06.001

- Makhmudov, T., Konovalova, M., Kuzmina, O., & Persteneva, N. (2018). The impact of the institutional environment on the shadow economy. Acta Oeconomica, 68(1), 115-133. DOI: 10.1556/032.2018.68.1.6

- Hsieh, H., Boarelli, S., & Vu, T. H. C. (2019). The effects of economic policy uncertainty on outward foreign direct investment. International Review of Economics & Finance, 64, 377-392. DOI: 10.1016/j.iref.2019.08.004

- Wang, L. (2019). Stock market valuation, foreign investment, and cross-country arbitrage. Global Finance Journal, 40, 74-84. DOI:10.1016/j.gfj.2018.01.004

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

01 April 2020

Article Doi

eBook ISBN

978-1-80296-081-5

Publisher

European Publisher

Volume

82

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-1004

Subjects

Business, innovation, management, management techniques, development studies

Cite this article as:

Petrov, N. A., Mikhaylov, A. M., & Abramov, D. V. (2020). The Influence Of The Regional Institutional Environment On The Allocation Of Capital. In V. V. Mantulenko (Ed.), Problems of Enterprise Development: Theory and Practice, vol 82. European Proceedings of Social and Behavioural Sciences (pp. 105-111). European Publisher. https://doi.org/10.15405/epsbs.2020.04.14