Abstract

The high competition in the field of telecommunications in Indonesia causes telecommunications companies to add large capital to provide satisfying services for their customers. The same thing was also said by Joy Ahyudi as the director of Indosat who stated that to increase the seriousness of Indosat services to customers, Indosat was willing to add capital of Rp 8 Trillion to build a network. Financial director Curt Stefan Carlsson also stated that even though the value of the rupiah which was declining against the dollar and causing inflation also had an impact on Indosat's financial performance. Based on the above background, the author wants to examine how the influence of Indosat on inflation and the rupiah exchange rate to the number of customers. It turns out that the findings obtained are that the Network greatly impacts the number of customers and Exchange Rates while inflation does not have a significant impact. Research using the Application Path.

Keywords: Number of customersnetwork investmentinflationexchange rate

Introduction

The contribution of smartphones and the Information and communications technologies sector as a driver of economic growth in Indonesia, users cellular contributes to GDP by 5.5% in 2015.Nonetheless, the rupiah exchange rate over the US dollar has an impact on the stability of the economy in the country, including the telecommunications industry. Although the people's purchasing power towards access to communication is still relatively high, the impact of the current economic conditions has a long-term effect. In long-term, the investment in the telecommunications industry is usually not directly felt in the same year when new investments begin, but in subsequent years (Ragandhi, 2011). The impact has not yet been felt now, but it might be around 1.5 to 2 years into the future. If the rupiah exchange rate continues to decline, the impact that will be felt is the decline in quality and reach. Although all expenditures from capital expenditure issued are fixed, but because of the high dollar value, the number of services or goods purchased will be alias reduced. The statistics from the Institute for Development of Economics and Finance in Indonesia , estimated the rupiah exchange rate could depreciate to a level of IDR 14,000 per dollar. The lowest point of rupiah since 2018. The weakening of the rupiah, certainly an impact on, first, the flow of foreign capital that came out could be even higher. Since the beginning of 2018, it has reached Rp. 8.6 trillion. The statistics also reported that the competition of Indonesian products, both domestic and export, has weakened due to some industrial sectors depend on imports of goods. If the dollar is expensive, production costs will definitely increase. The price of goods will be more expensive. While domestic consumption is still stagnant, the effect on profits to entrepreneurs can also be lower. The next three risks are the burden of repayments and the interest of government and corporate foreign debt is getting bigger. Risk of default, especially private debt that has not been hedged will rise. Finally, the fourth Indonesia as a net importer of crude oil is very sensitive to the movement of the dollar. Imports recorded Indonesian oil as much as 350-500 thousand barrels per day, because domestic production is not sufficient for fuel consumption (INDEF, 2018).

Problem Statement

Inflation is a condition where prices of goods and services also experience price increases that last for quite a long time and the increase occurs evenly. High inflation in a country it will have a negative impact on existing consumption, because of the prices of goods and services on the market are very high. The tendency of people to consume goods and services will decrease. Rising prices - prices that exist in the market are not accompanied by increases in salary or income the community so that it makes public consumption down. If inflation increases, the price of domestic goods increases. The increase in the price of goods is equal to the decline in the value of the currency. 2018, Indosat experienced a decline in revenue and a decrease in customers, while the revenue earned was Rp. 11.06 trillion, down 26.8% compared to the same period last year of Rp. 15.11 trillion. Telkomsel's revenue in 2018 has decreased to 4.3 percent compared to the previous year. The achievement of Telkomsel is in line with the world situation in the telecommunications industry, whose revenues dropped 7.3 percent (Antara News, 2018). The decline in Telkomsel's revenue was considered as a lesson to improve itself so as not to experience a similar event this year and in the future.

Table

Research Questions

Based on the table from the above research and based on economic problems related to technology and telecommunications, the writer wants to make questions related to this research

Does the number of the customers affect in inflation and the exchange rate directly or indirect?

Here I want to know how the customer relationship to the exchange rate directly or indirectly, namely with inflation does it affect the addition of the number of customers.

Whether investment in additional networks affects the exchange rate through inflation.

The addition of the network is a manifestation of the seriousness of the telecommunications company in providing servants in the context of increasing the number of customers oriented in increasing the company's revenue. through this paper the author wants to find out how much influence the decline in the value of the currency on the addition of the network.

Purpose of the Study

This paper aims to determine the effect of rising exchange rates on the development of telecommunications companies and how these companies overcome this, also becomes a policy for the government in dealing with rising exchange rates on the economy, especially in telecommunications companies.

Research hypothesis

This hypothesis is used for the interim answer in the study. From the formulation of the problem above, the writer gives the following hypothesis:

The number of customers has a positive effect on investment in directly

The number of customers has a negative effect on inflation in directly

Investment has a negative effect on inflation in directly

The number of customers has a negative effect on the exchange rate in directly

The investment has a positive effect on the exchange rate

Inflation has a positive effect on exchange rates.

Definition of variables

Inflation

Inflation is the tendency for prices to rise continuously. An increase in the price of one or two items is not called inflation, unless the increase is widespread or results in a majority increase

Customers

Consumers are all individuals and households who buy or obtaingoods or services for personal consumption. The customer is the most influential of anorganization in carrying out its business. (Carbone, 2004).

Investment

Investment is one or more assets that are owned and usually long-term in the hope of obtaining profits in the future. Investment includes the addition of capital stocks or goods in a country, such as building production equipment, and inventory items within one year (Samuelson & William,2004).

Exchange Rate

According to Obstfeld and Krugman (2003), the notion of exchange rate is the price of a currency of one country that is measured or stated in another country's currency. in this case the rupiah against the US dollar

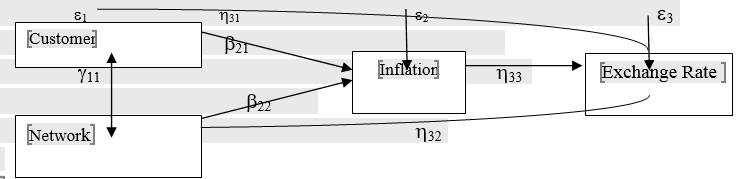

Schematically analysis

Schematically Analysis of the influence of consumption / customer, network investment on inflation in Indonesia can be described in Figure

Research Methods

This research uses a quantitative approach, where the approach has been predetermined using secondary data and numerical data. Linking variables in problems and hypotheses. Quantitative data, namely data in the form of numbers or qualitative data that is predicted (Sugiyono, 2008). With time in the period 2003 - 2018. Secondary data collection methods obtained from the Central Bureau of Statistics and library engineering is to collect data from books, journals, and research results. Based on the theories and research hypotheses, the dependent variables determined are inflation and exchange rates. Inflation is obtained from all sectors in the six-month period in the form of percent and Exchange Rate is the exchange rate of the rupiah against the US dollar. The independent variable is the number of customers and the number of BTS / network. The telecommunications industry company in this case is the amount of network infrastructure built by the telecommunications industry in six months and in units. Customers are total customers who use postpaid cellular products as well as six-month prepaid periods in millions.

Data analysis techniques

Path Analysis is an extension of multiple linear analysis or path analysis is the use of regression analysis to estimate causality relationships between variables (causal models) that have been predetermined based on theory. Path analysis alone does not determine causal relationships and also cannot be used as a substitute for researchers to see causality between variables. Inter-variable causality relationships have been formed with models based on theoretical foundations. What is done by path analysis is determining the pattern of relationships between three or more variables and cannot be used to confirm or reject the hypothesis of imaginary causality. Path diagrams and structural equations in path analysis before the researcher analyzes a study, the researcher first creates a path diagram that is used to present the problem in the form of images and determine structural equations that state the relationship between variables in the path diagram.

Noor (2011) states that path diagrams can be used to calculate the direct and indirect effects of the dependent variable on an independent variable. These influences are reflected in what is called the path coefficient, where mathematically path analysis follows structural modes. The first step in pathway analysis is to design path diagrams in accordance with the hypotheses developed.

The explanation will be divided into 4 (four) stages, namely:Data Preparation (Data Tabulation); Estimation of Linear Regression Model (Multiple); testing of Classical Assumptions; model Feasibility Test (Goodness of Fit Model) and interpretation of Linear Regression Models (Multiple)

Data preparation is intended to input data into SPSS software. After the data is input into the software, then the next step is to estimate (estimate) the model (equation) linear regression, new followed by testing classical assumptions. Classical assumption testing is done after the regression model is estimated, not before the model is estimated.

Testing of classical assumptions that include normality, heteroscedasticity and autocorrelation requires residual model data obtained after the model is formed. This analysis aims to determine the effect of independent variables on the dependent variable. To test the hypotheses in this study, the regression equation will be used as follows:

Regression Equation

X1 = + 11LogX2 + 1

Y1 = + 11 LogX1 +12 LogX2 + 2

Y2 = + 31 LogX1 + 32 LogX2 +33LogY1 + 3

Y1 = Inflation

Y2 = Exchange Rate

X1 = Customer / Consumption

X2 = Investment / Network

1,2,3=.Error Term

The regression coefficient is very decisive as the basis of analysis. This means that if the coefficient is negative (+) then it can be said that there is a direct influence between the independent variable and the dependent variable. Whereas if the coefficient of the value of is negative (-) this indicates a negative influence where the increase in the value of the independent variable will result in a decrease in the value of the dependent variable.

According to Ghozali (2011), the accuracy of the sample regression function in estimating the actual value can be measured from its goodness of fit. Statistically measured from the value of the coefficient of determination (R2), the statistical value F (the feasibility test model) and the statistical value t (test the significance of individual parameters).

Findings

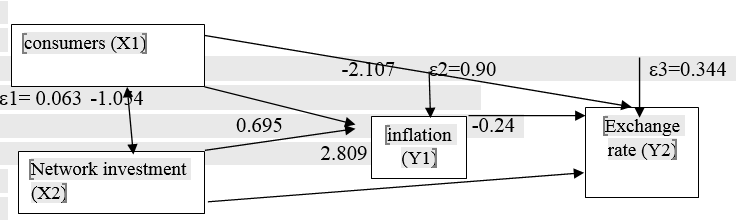

Path analysis is presented in Figure

1 =

3

Direct Effect

X1 = 11LogX2 + 1

Y1 = 21 LogX1 +22 LogX2 + 2

Y2 = 31 LogX1 + 32 LogX2 + 33 Y1 + 3

X2 against X1 (Network Infrastructure Against Number of Customers) = 0,000 directly influences

Network infrastructure has a positive effect on the number of customers. meaning that if the network increases by 1, the number of subscribers will increase by 968 subscribers. According to the Indonesian Cellular Telephone Association (ATSI) to build a certain network infrastructure reached Rp15 trillion, which aims to strengthen services to consumers. With such investment, the growth rate in the telecommunications sector is expected to increase by 40%. The telecommunications industry will experience significant growth, therefore investment in the cellular sector will remain large and remain a locomotive of the telecommunications industry that has a significant influence on customers. This means that network infrastructure is the most important facility provided by telecommunications companies to increase the number of customers which will also increase the financial performance of telecommunications companies.

X1 against Y1 = 0.115 directly has no effect

X2 against Y1 = 0.293 directly has no effect

X1 against Y2 = 0,000 directly influences

The number of customers directly has a negative effect on the exchange rate. meaning that if the rupiah exchange rate against the dollar rises by 1 rupiah, the number of customers will decrease by 2,107,000. If the exchange rate rises, import costs will rise and consequently prices will rise, if prices will rise then (consumer) demand will decrease. Other impacts of the weakening of the rupiah against the dollar include the following: The negative impact of a fall in the exchange rate is that it will effectively reduce the purchasing power (demand) of consumers, especially middle and low income (poor) people. The impact of this decline in demand will reduce the production of goods.

X2 against Y2 = 0,000 directly influences

Network infrastructure directly influences exchange rates and shows positive effects. This means that if the exchange rate rises, the company will add to the network but not significantly or not too influential. The weakening of the rupiah against the US dollar has an impact on economic stability in the country, including the telecommunications industry. however the purchasing power of the people towards access to communication communication technology is still relatively high.

Based on data from the Coordinating Ministry for Economic Affairs in Indonesia, the telecommunications sector accounts for 7% of Indonesia's total imports. The data show that 2% is in the form of infrastructure and 5% of mobile devices. The information and communication technology industry contributes the second largest to Non-Tax State Revenues (US $ 14 trillion), but the amount that returns is only US $ 2 trillion until now operational costs the biggest for operators is the provision of infrastructure such as building telecommunications towers, given Indonesia's geographical conditions which are a challenge. Moreover, this year the operator is supporting a government program to expand broadband coverage. The government's target this year is the provision of national broadband, of course this will cost not a little. To work around this, operators are looking for ways to share infrastructure to reduce costs. The operators have carried out various ways to support the continuity of communication access, one of which is through passive sharing infrastructure which in the future can become an active sharing that can reduce operational costs per kilobytes.

Y1 against Y2 = 0.729 directly has no effect

Indirect Effect

= -1.054 x -0.24

= 0.253 (because it is bigger than sig 0.05) meaning that it has no effect

Indirectly the relationship between the number of customers and the exchange rate of the rupiah against the dollar through inflation is not related.

= 0.695x-0.24

= -0.17 (greater than sig 0.05) means that it has no effect

Indirectly the relationship of network infrastructure to the rupiah exchange rate through inflation has no effect

Total Effect

= 0.253 + -0.17

= -0.083 (greater than sig 0.05)

the overall rupiah exchange rate through inflation does not affect the number of customers and network infrastructure

Conclusion

This research is to find out how the effect of rising exchange rates in this case is the rupiah against the US dollar to increase the number of customers and network infrastructure through inflation. The findings in this study indicate that Total network infrastructure (X2) has a positive effect on the number of customers (X1). This means that network infrastructure is the most important facility provided by telecommunications companies to increase the number of customers. The study also found that the number of customers directly affected the exchange rate and negatively affected it. With regard to the influence of network infrastructure on exchange rates shows a positive and significant relationship. Finally, this study shows that the overall rupiah exchange rate through inflation does not affect the number of customers and network infrastructure. it can be concluded the findings of this study state that even though prices do not affect customers in using communication technology, because it is considered a very important requirement. this is a gap or opportunity for companies and governments in promoting economic growth.

References

- Antara News (2018). Industri Telekomunikasi Tetap Jadi Andalan. Antara News.

- Carbone, L. P. (2004). Managing Service Experience Clues Academy of Management Perspective. W Harton.

- Ghozali, I. (2011). Application of multivariate analysis with SPSS program. Semarang: Diponegoro University Publishing Agency.

- INDEF (2018). The Impact of the Continued Weakening of Rupiah Exchange Rate by INDEF", https://tirto.id/dampak-terus-melemahnya-nilai-tukar-rupiah-menurut-indef-cFxz.

- Noor, J. (2011). Metodologi penelitian: skripsi (Doctoral dissertation). Jakarta.

- Obstfeld, M., & Krugman, P. R. (2003). International Economics: Theory and Policy. Pearson Education, Inc.

- Ragandhi, A. (2011). Pengaruh pendapatan nasional, inflasi dan suku bunga deposito terhadap konsumsi masyarakat di Indonesia (Doctoral dissertation). UNS Sebelas Maret University.

- Samuelson, P. A., & William, D. N. (2004). Ilmu Ekonomi Makro Edisi Ke-17. Jakarta: PT Media Global Edukasi.

- Sugiyono, J. (2008). Statistics for research. Bandung, Indonesia: Alfabeta Press.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

30 March 2020

Article Doi

eBook ISBN

978-1-80296-080-8

Publisher

European Publisher

Volume

81

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-839

Subjects

Business, innovation, sustainability, development studies

Cite this article as:

Naeruz, M. (2020). Customer Influence, Network Infrastructure To Exchange Rate Through Inflation In Indonesia. In N. Baba Rahim (Ed.), Multidisciplinary Research as Agent of Change for Industrial Revolution 4.0, vol 81. European Proceedings of Social and Behavioural Sciences (pp. 320-328). European Publisher. https://doi.org/10.15405/epsbs.2020.03.03.39