Abstract

The paper analyzes the economic condition of dairy cattle breeding in Russia, taking into account regional characteristics and specifics of certain categories of producers functioning. It has been established that in recent years, an increase in milk production has been observed in Russia along with reduction in the number of cows. A tendency for the gradual withdrawal of the household sector from dairy production is emerging, and now there is a trend of outpacing growth in the production of raw milk in agricultural organizations, compensating for the drop in this indicator in private households. The rating of the largest raw milk producers in Russia is analyzed. The current trends and promising directions for the development of the dairy-food subcomplex of the country in terms of agro-industrial integration are identified. The necessity of creating and developing clusters for the milk production and processing based on the integration of agricultural producers in the regions is justified. A generic cluster model is proposed based on the integration of agricultural producers of raw milk. The development of integration interaction between subjects of cluster formations participating in the value-added chain from production to processing and sale of the finished product will significantly improve the efficiency of their functioning and ensure the innovative development of the dairy product subcomplex. A survey of managers and specialists of the agro-industrial sector on the need for the integration of agricultural producers and the need to create a regional cluster for the milk production and processing was conducted.

Keywords: Dairy farming economydairy product subcomplexmilk producers ratingagro-industrial integrationmilk production and processing cluster

Introduction

The world raw milk production is constantly growing, in many respects it is a reaction to the increasing demand for dairy products. In the global market, Russia has become a significant producer of milk and dairy products, in the world raw milk production it accounts for about 6%. Russia ranks fifth after India, the USA, China and Brazil, in the ranking of the world's largest milk producer. At the same time, consumption of dairy products and milk production per capita is much lower than in developed countries.

Dairy farming is of strategic importance for the Russian economy and the country's population. Milk and dairy products are included in the list of products that fall under the National Food Safety Doctrine. It is of primary importance in the diet of the population. More than 21 thousand organizations and individual entrepreneurs function in the dairy-food subcomplex of Russia, with 1.2 million people involved in the labor activity. Milk accounts for 40% of the gross livestock production value, and dairy products account for about 15% in the turnover structure of retail chains (Chekaldin, 2017).

Problem Statement

In modern conditions, most agricultural producers sell cattle milk in the form of raw materials for further processing by dairy industry enterprise, and only a few master the technologies of processing products based on livestock farms on their own or as part of integration industry associations.

Raw milk processing technologies are often capital-intensive and require serious investments, which is not always within the power of one farm, especially if it is a small one. However, agricultural products sold in a processed form can provide a producer with a higher added value, form a more competitive price, and shorten the process of distribution from farm to consumer. In this regard, it is necessary to consolidate the financial and production capacity of commodity raw milk producers on the ground of agro-industrial integration. This will allow the subjects of integration formations that participate in the value added chain from production to processing and marketing of the finished product to significantly increase their efficiency and to ensure the innovative development of the dairy product subcomplex.

Research Questions

In recent years, an increase in milk production has been observed in Russia along with a reduction in the number of cows, which indicates an intensive development of dairy farming (Table

The number of cattle in 2017 amounted to 18.7 million heads, including 8.3 million cows. However, the number of dairy cows is 435 thousand heads less than the level of 2013. In 2017, the gross milk production reached 31,184 thousand tons, which is 655 thousand tons or 2.1% higher than the 2013 level.

As a positive factor in the development of dairy farming, it is necessary to consider the continued growth in milk production in agricultural organizations (AO), where milk production increased by 1,627.1. tons, or 11.6% (table

In households, gross milk yield has decreased by 1,559.6 thousand tons, or 10.6%. In peasant (farmer) farms and individual entrepreneurs (PH and IE) the growth of milk production amounted to 587.1 thousand tons, or 32.5%. The tendency of gradual retirement of the households sector from dairy production is forming. Currently, there is a trend of outpacing growth in the raw milk production in agricultural organizations, compensating for the drop in this indicator in private households. This allows us to state that the Russian dairy products subcomplex is emerging from a state of stagnation (Amerkhanov, 2017).

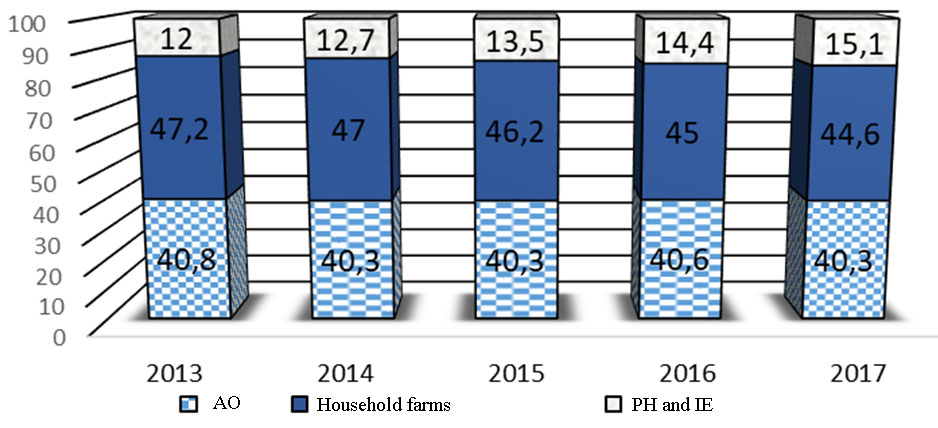

In the structural distribution of the cows livestock by farms categories, the share of household farms prevails, which in 2017 accounted for 44.6%, agricultural organizations - 40.3%, and private farms - 15.1% (Figure

The role of household farms is reducing due to the population refusing to have cows. In agricultural organizations, livestock slaughter was very active, so the heads number decreased by 6.1%. A positive trend appears in the dynamics of the cow livestock in private farms, where growth over three years amounted to almost 200 thousand heads or 19.2%. It has become possible due to the implementation of the sectoral grant programs “Support for beginning farmers”, “Development of family livestock farms based on private farms” with substantial funding from the budget (Trukhachev & Kurennaya, 2016).

More than 60 regions of the Russian Federation are engaged in the raw milk production and whole-milk products (Avzalov & Kolevid, 2017). Milk production throughout the territory of the Russian Federation is extremely unevenly dispersed, which can be explained by the difference in natural and socio-economic conditions. The absolute leader, which occupies an overwhelming market share in this segment, cannot be singled out, since the production in each of the regions does not exceed 10% of the total.

The undisputed leaders in milk production are the Volga, Central, Siberian Federal Districts. They account for more than 65% of the Russian production of whole milk (Table

A high proportion of milk production in private households is in the subjects of the Southern, North Caucasus, Far Eastern federal districts. This figure reaches 70% or more. In the Central and Northwestern Federal Districts are concentrated the largest processing enterprises of the country dairy industry, which are focused on working with modern dairy farms (Kurennaya, Kusakina, Aydinova, Kosinova, & Shevchenko, 2018).

Today, the 20 largest companies producing raw milk produce 1.8 million tons of raw materials per year - this represents 8.4% of the total production of marketable milk in Russia. Milknews, together with the consulting agency Streda, prepared a rating of the largest raw milk producers in Russia in order to find out which forces ensured Russia's place on the world market. At the end of 2017, the top 10 of the largest raw milk producers and the top 10 of the most productive dairy farms are presented in Table

(source: Information Agency «Milknews» website // www. milknews.ru)

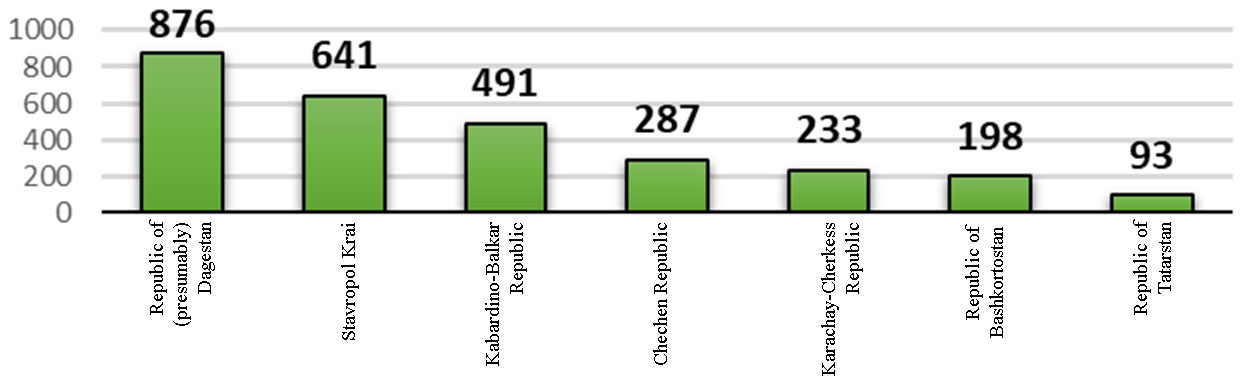

In 2017, 9% of all Russian milk was produced in the regions of the North Caucasus Federal District, which ensured it 5th place among federal districts, and the growth rate 5.3% over the past five years. The largest gross milk yield falls on milk producers in the Republic of Dagestan (Figure

It should be noted that the potential of the North Caucasus Federal District is large. In this region there are all factors for increasing production - historical and cultural traditions, developed science and education. The best livestock numbers are observed in Dagestan, Bashkortostan and Tatarstan. This is explained by the fact that in Dagestan there is a very large number of livestock in household farms, almost every house has a cow, the traditional way of life is preserved, which gives the region such indicators (Butsenko, 2007). Some experts also believe that the performance of individual areas is overstated.

Purpose of the Study

The most effective form of integration in dairy farming are clusters that allow, taking into account industry and regional characteristics, to maximize the effect of the production scale, the comparative advantages of the industry (Kosinova & Agalarova, 2017; Stankevich, 2016). The purpose of forming agri-food clusters for the milk production and processing is to create an effective integration system for the interaction of agricultural producers, processing enterprises and the scientific and educational sector to improve the provision of the population with high-quality domestic dairy products and increase the industry’ competitiveness.

Research Methods

The agro-industrial cluster is a system of geographically neighboring agricultural producers, its processors operating on the basis of cooperation among themselves and supporting the innovative development of all organizations in the cluster (Bannikova, Onezhkina, Agalarova, & Tenishchev, 2018; Karpenko, 2016). On the one hand, it is a rational way of structural construction of the region’s agrarian sector. On the other hand, it is a scientifically based approach to locate and optimally combine activities in order to obtain a synergistic effect based on a combination of production and marketing processes, rational use of natural and economic potential, minimizing costs and maximizing revenue, growing of final product competitive advantages (Vorontsova, Dedyukhina, Kosinova, Momotova, & Yakovenko, 2019).

The methodology for the formation of agro-industrial clusters in dairy farming requires adherence to a specific sequence of participants’ integration interaction. At the preparatory stage, the system of external and internal conditions affecting the efficiency of the partner enterprises functioning is studied, the results of their economic activity are evaluated according to indicators determining their potential financial stability, solvency and reliability as a business partner. Estimated volumes of production and processing of milk and estimated possible markets for its sales of dairy products are also calculated. The risks analysis, finding possible advantages and disadvantages of an integration association is the first priority when deciding on the entry of economic entities into the agrifood cluster. The initiator of the creation of such a cluster may be government bodies, dairy processing enterprises or raw milk agricultural producers.

The next stage is the development of the cluster’s organizational and management structure, with the distribution of management functions between the founders of the agro-industrial cluster and their subordinates. The implementation of the project, registration of the cluster and the gradual activation of its activities begins. At this stage, participating enterprises adjust their activity.

Evaluation of the cluster development strategy and its effectiveness occurs at the final stage. It analyzes the performance of the integrated formation itself, as well as individual participating companies before and after their entry into the cluster, evaluates the effectiveness of creating the final cost of the product with the maximum effect at all stages of production: “from farm to counter”. The result is a system with stable organizational and economic relations between milk producers, milk processing organizations, logistics and sales entities, representatives of the scientific and educational sphere.

A generic cluster model for the milk production and processing is based on the integration of agricultural producers and involves the interaction of the internal and external environment. The internal environment of the cluster is represented by raw milk producers and processing enterprises. The main integrators of this sector are agricultural producers, including their associations, as a source raw material base for the enterprises of the processing industry. The vector of cluster’s core development should be directed towards increasing the number of agricultural producers who are mastering the possibilities of processing milk on the basis of their own production. Such interaction is especially important in the context of the need to create an innovation system and infrastructure for the production of competitive domestic products and on this basis increase the profitability of agricultural producers (Kiseleva, 2011).

The external environment of the integration cluster includes organizations that supply specialized equipment for the production, processing and storage of milk and dairy products, breeding and genetic centers, feed suppliers, machinery, specialized equipment, packaging material, etc. At the same time, the key link in the milk production and processing cluster are government agencies, industry associations. Sales markets (consumers) - logistics and marketing companies, wholesale and retail businesses, catering companies, food and pharmaceutical industry organizations, world markets (Belikova, Zaporozhets, Tenischev, Zvyagintseva, & Isaenko, 2018; Safronova, 2014).

The combination and cooperation within the cluster helps to share high costs and risks in the development of innovations, the management of which is not possible in individual agricultural organizations (Kotarev, Kotareva, & Lesnikov, 2018). Therefore, from the standpoint of considering the advantages of the economy of individual regions, the dairy cluster can be viewed as a point of growth in the domestic market.

Findings

The need for integration of agricultural producers and the need to create a regional cluster for the milk production and processing in the Stavropol Territory were studied using the questionnaire. It was carried out as a survey, in which 50 respondents took part. Almost half of the respondents are employees of agricultural organizations and enterprises, one third is chiefs of private farms, the rest are employees of agricultural holdings and small agribusiness entities.

88% of the respondents noted that in modern conditions there is a need for the integration of agricultural producers, while 12% doubt the need to participate in integration units. Of the proposed areas of integration interactions, the most important for respondents were three types of integration: production (72%), marketing and sales (60%), investment (36%).

60% of respondents expressed a desire to join the integration association (cluster) for the milk production and processing; 16% of respondents indicated that their farms have their own facilities for processing agricultural products; 24% said they did not think about integration, because they are not familiar with its advantages.

Conclusion

Thus, the need to develop dairy farming through the creation of regional clusters for the agricultural products production and processing based on the agro-industrial integration of commodity producers is not in doubt. At the same time, it is necessary to resolve issues of organizational and legal, financial and economic nature, which form the mechanism of interaction between the subjects of agro-industrial integration.

References

- Amerkhanov, Kh. A. (2017). The state and development of the dairy cattle industry in Russia. Dairy and meat cattle industry, 1, 2–5.

- Avzalov, M. R., & Kolevid, G. R. (2017). The state and main directions of development of the dairy cattle industry in Russia. Russian electronic scientific magazine, 4(26), 110–121.

- Bannikova, N. V., Onezhkina, O. N., Agalarova, E. G., & Tenishchev, A.V. (2018). Forecasting the tendencies of the Russian vegetables market development. Journal of Business and Retail Management Research, 13(1), 148–155.

- Belikova, I. P., Zaporozhets, D. V., Tenischev, A.V., Zvyagintseva, O. S., Isaenko, A. P. (2018). Innovative Development Of The Agricultural Sector: Problems And Prospects. Research journal of pharmaceutical biological and chemical sciences, 9(6), 1860–1865.

- Butsenko, L. S. (2007). Improving the efficiency of the milk and dairy production in a restructured economy. Stavropol, GOUVPO (State educational institution of higher vocational education) « North-Caucasus State Technical University».

- Chekaldin, A. M. (2017). On the state of the dairy cattle industry in Russia. Innovative development, 7(12), 37–38.

- Karpenko, G. G. (2016). Ensuring food import substitution through cooperation and agro-industrial integration. Regional economics and management: electronic scientific journal, 4(48), 379–389.

- Kiseleva, N. N. (2011). Designing the forms of spatial organization of agro-industrial production in the Stavropol Krai. Management of Economic Systems: electronic scientific journal, 9(33), 17–22.

- Kosinova, E. A., & Agalarova, E. G. (2017). Prospects for the formation of a vegetable processing cluster in the Stavropol Krai. Economics: yesterday, today, tomorrow, 7(12A), 94–101.

- Kotarev, A. V., Kotareva, A. O., & Lesnikov, I. V. (2018). Dairy cluster functioning in the Voronezh region in terms of compliance with the economic efficiency criteria. Proceedings of the Voronezh State University of Engineering Technologies, 80, 1(75), 427–431.

- Kurennaya, V. V., Kusakina, O. N., Aydinova, A. T., Kosinova, E. A., & Shevchenko, E. A. (2018). State And Development Trends Of The Agri-Food Market In The Region. Research journal of pharmaceutical biological and chemical sciences, 9(6), 1537.

- Safronova, Y. (2014). Dairy cluster as an innovative tool to economic development of the region. International Agricultural Journal, 6, 63–65.

- Stankevich, I. I. (2016). On formation of dairy cluster management tools. Economics and Management, 2(46), 32–38.

- Trukhachev, V. I., & Kurennaya, V. V. (2016). Methodological aspects of system and hierarchal analysis of the oilseeds sub-complex of the regional agro-industrial complex: Risks and production and technological specificity. International Journal of Applied Business and Economic Research, 2(14), 767–784.

- Vorontsova, G. V., Dedyukhina, I. F., Kosinova, E. A., Momotova, O. N., & Yakovenko, N. N. (2019). Perspectives of development of managerial science in the conditions of information society. Advances in Intelligent Systems and Computing, 726, 980–988.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Kosinova, E., Tokareva, G., Ermakova, A., & Bezgina*, Y. (2019). Economic Condition And Development Of Dairy Farming In Agro-Industrial Integration. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 422-429). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.58