Abstract

Improving agriculture competitiveness in the country is the problem solution of its further development. Thus, the increased need for food production in the required volume, proper quality and assortment meeting the accepted standards and norms in the Chechen Republic is due to the growing demographic situation in the region, North Caucasus Federal District, ensuring food security due to accelerated import substitution. To expand economic access to food, it is advisable to continue agriculture modernization, ensure its competitiveness, lift the embargo and not tie food support programs only to Russian products. One of the conditions to support agriculture is its financial support. An important instrument of such support is financial and credit infrastructure with specific peculiarities of agricultural production. The article is devoted to the study of the role of financial and credit infrastructure in agricultural development in the Chechen Republic within global transformations. Financial and credit infrastructure of agriculture is represented by two components, each of which is focused on certain functions. It was concluded that there is a reduction in the provision of subsidies for agricultural development, a change in the structure of subsidies provided, and the need to support rural population to increase the scale of productivity indicators in the industry. The possible development directions for methods and tools of financial and credit infrastructure are considered. Priority is given to agricultural insurance and taxation, since such methods to support agriculture are not subject to reduction within the framework of the World Trade Organization.

Keywords: Regionagriculturefinancialcredit infrastructure

Introduction

The 2002 Summit of Food and Agriculture Organization of the United Nations (FAO) recognized the global nature of the food problem. Thus, the “Doctrine of Food Security of the Russian Federation” was adopted in Russia. Some items of the Doctrine focus on improving the efficiency of state financial regulation and supporting agricultural producers, creating conditions for maintaining their financial stability and solvency. The formation of a modern agricultural complex that meets the needs of the republic’s population in food products and has a high export potential is determined by the objective of the Strategy for the Social and Economic Development of the Chechen Republic until 2025. However, a special role of agriculture to ensure food security of the regions and increase their competitiveness requires financial support corresponding to the global challenges. The specific peculiarities of agricultural production determine the special significance of financial and credit infrastructure of agriculture, which is a conductor of financial and credit resources for agricultural organizations. Global aspects of food security are presented by Shagaida and Uzun (2015), Usenko (2017), Ushachev (2013). The methodological basis for the study of infrastructure is represented by Inshakov (1995), Russkova (2006), Stukach and Fleikler (2007), Timofeeva (2005). Russian economic science does not include publications devoted to a comprehensive study of the role of the financial and credit infrastructure in agricultural development in the Chechen Republic. The work of these scientists became the impetus and basis for further research in the field of financial and credit infrastructure of agriculture and the development of its elements at the present stage of agricultural reform.

Problem Statement

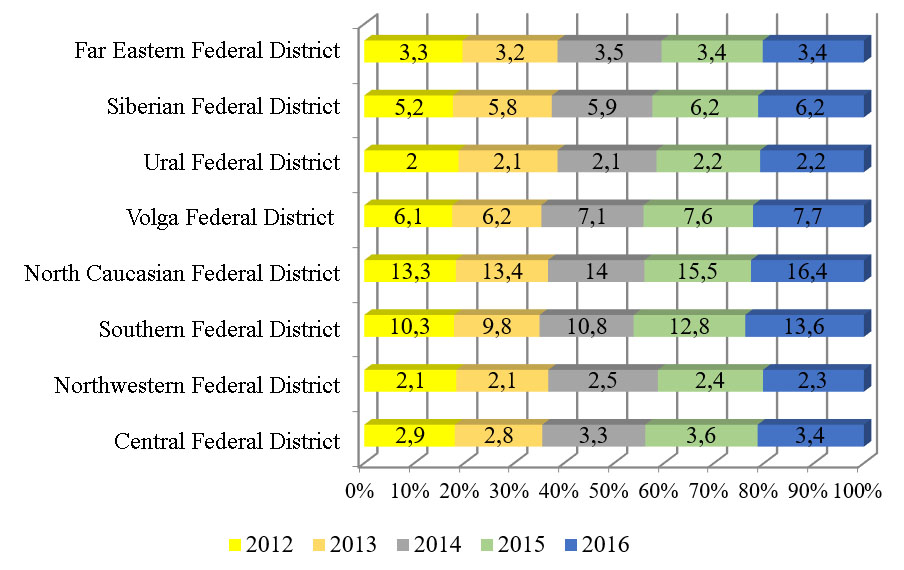

For five years, there is a steady increase in agricultural production, crop yields and livestock productivity, and labor productivity. The growth of production volumes and production efficiency helped to reduce the level of import dependence of the country, increase exports of agricultural products and food. The available data allowed us systematize the indicators of agricultural development in the Russian Federation (Figure

However, in terms of districts’ subjects, the Chechen Republic is distinguished by the lowest indicators of agricultural development (Table

An important argument is the residence of more than 60% of the population in rural areas, and a predominance of unemployment (rural unemployment rate in 2017 was 12.6%). Therefore, support for rural as well as mountain areas will contribute to agricultural development as a whole and increase the level of employment of the population. Note that even economically favorable conditions, the development of agriculture is impossible without government regulation and support (Gorshkova, Grigoryeva, Perekhodov, Shkarupa, & Arkannikov, 2017). Financial and credit infrastructure is of particular importance in the development of agriculture, since the recipients of financial and credit resources are not only agricultural production itself, but also other types of agricultural infrastructure: production, social, commercial, information, innovation.

Research Questions

The consideration of financial and credit infrastructure of agriculture in the Chechen Republic not only expands and develops the scientific understanding of the essence and role in the development of the region. It also helps to substantiate theoretically the directions to improve its methods and tools.

Purpose of the Study

The purpose of the article is to study the role of financial, credit infrastructure of the Chechen Republic in the formation of modern agricultural complex and strengthen national food security.

Research Methods

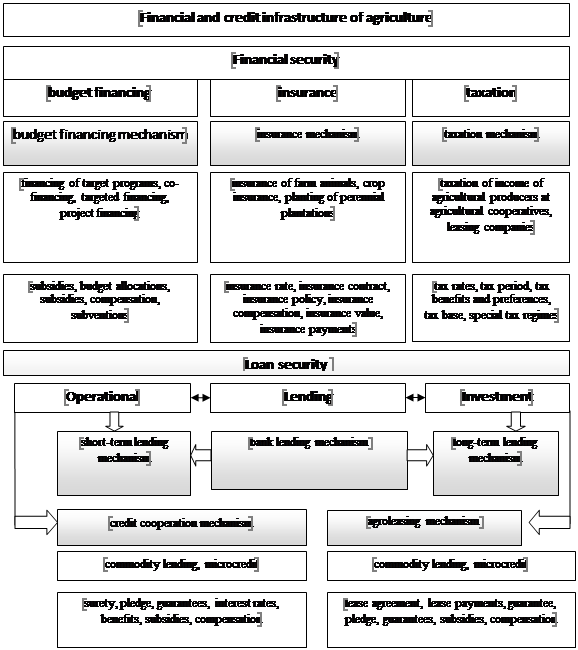

This study is based on the study and synthesis of theoretical and factual materials on the development of financial and credit infrastructure of agriculture with various methods: systemic, comparative, tabular and graphical methods to process and present data (fig.

Findings

Under financial and credit infrastructure of agriculture, we will understand “a set of interrelated financial and credit organizations, their functions, financial and credit mechanisms mediating financial and credit relations about the movement of incoming and outgoing cash flows in the process of circulation of capital of agricultural organizations” (Shkarupa, 2017, p. 12).

The presented elements of the subsystems of financial and credit infrastructure of agriculture are implemented in the Chechen Republic within the program-target method (the state program “Development of agriculture and regulation of the markets of agricultural products, raw materials and food in the Chechen Republic for 2014-2020”). Consider some of them (Figures

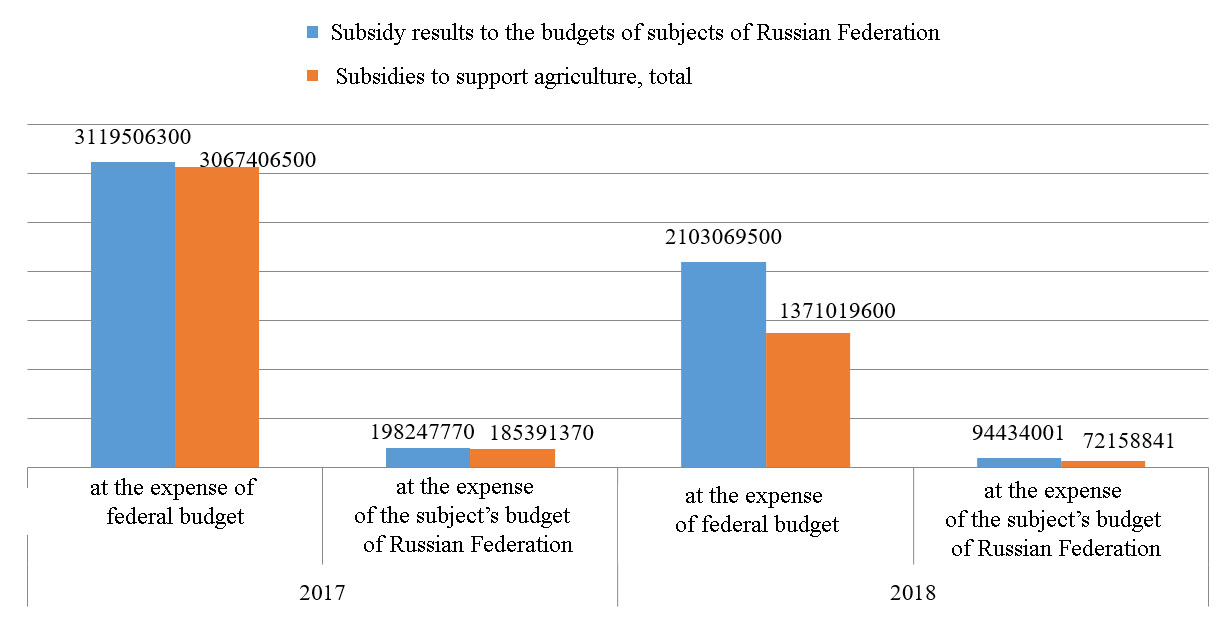

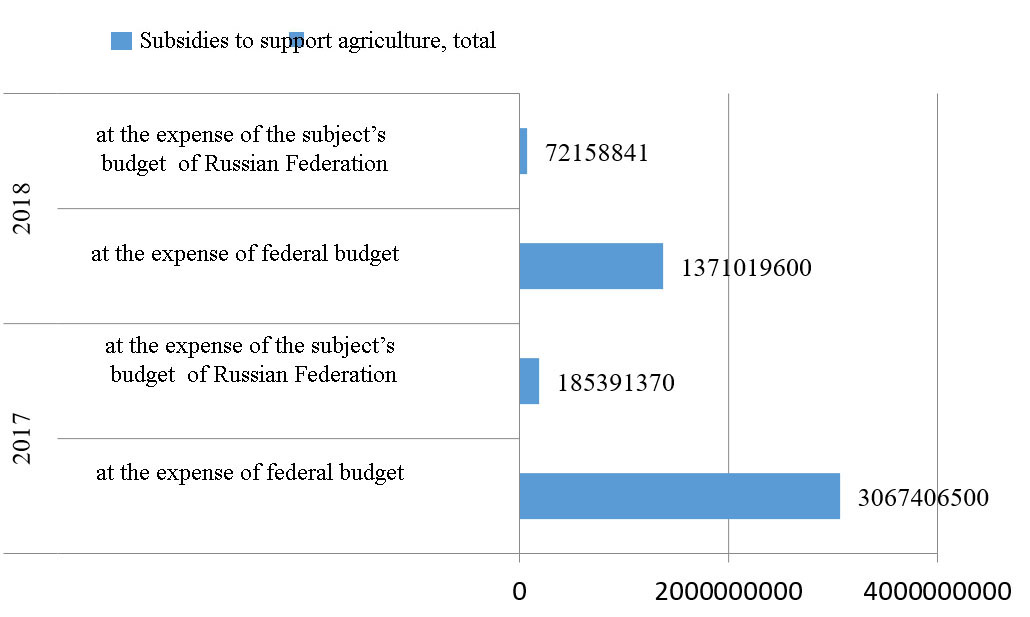

The analysis of budget financing showed a decrease in allocated subsidies from both the federal budget and budget of the constituent entity of the Russian Federation budget (Figure

The analysis of funds’ use from the federal and regional budgets started from 2014, showed that the composition of the subsidies provided to support agriculture has been changed. The current lack of “subsidies to provide housing for citizens living and working in rural areas and housing for young families and young professionals living and working in rural areas” is a disincentive factor in rural development. The influence on agricultural development in whole Subsidies to reimburse part of the costs of agricultural producers to pay insurance premiums accrued under the agricultural livestock insurance contract as a separate subsidy ceased to exist due to the introduction of a single subsidy that integrated separate subsidies, including financial support for insurance in agricultural complex (Shkarupa, Perehodov, & Ulanova, 2018). Thus, the “single subsidy” impedes the process of planning agricultural insurance, contributes to the risk of shortfall in insurance premiums, an increase in the receivables of insurers, which ultimately affects the amount of state support provided.

Conclusion

According to the study results, we will offer the following directions for the development of methods, tools for financial, and credit infrastructure of agriculture. Agricultural insurance carried out with state support, is one of the vectors of financial policy in agricultural development that does not contradict the requirements of the World Trade Organization. Therefore, the development of agricultural insurance is reasonable due to the relevance and necessity in connection with such innovations in agricultural insurance as a “single subsidy”. Unfortunately, many key agricultural regions reject insurance protection in favor of a loan reimbursement subsidy. It is necessary to increase the transparency of this type of subsidy as “other interbudgetary transfers to compensate agricultural producers the damage caused as a result of natural emergencies in the territories of the constituent entities of the Russian Federation” allocating a subsidy “for reimbursing part of the costs of agricultural producers for paying insurance premiums under the agricultural insurance agreement in the field of crop and livestock” in a separate direction. It is possible to adjust and refine regulatory documents that ensure the obligatory and timely receipt of subsidies in the event of an insured event. Considering the uniqueness of the natural and climatic potential of the region under consideration, which influence the creation of conditions for the development of modern innovative agriculture, the basis of which are intensive technologies for agricultural production, strengthening the tax incentive mechanisms (delaying tax payments, applying a tax credit, transferring losses for future tax periods) becomes important. The expansion of tax investment benefits for the production of competitive analogues imports of agricultural machinery). The development potential of financial and credit infrastructure of agriculture is not limited solely to the proposed areas. The results obtained do not claim to disclose all aspects of agricultural problems in the Chechen Republic from the standpoint of financial and credit infrastructure.

References

- Gorshkova, N., Grigoryeva, L., Perekhodov, P., Shkarupa, E., & Arkannikov, A. (2017). Informational and analytical support for integration of agro-industrial enterprises in Russia. Russia and the European Union. Development and Perspectives Ser. Contributions to Economics. Switzerland: Cham, Springer International Publishing AG.

- Inshakov, О.V. (1995). The mechanism of social market transformation and sustainable development of agricultural complex in Russia. Volgograd: Volgograd State University Publishing House.

- Ministry of Agriculture of the Chechen Republic (2018). Retrieved from: http://www.mcx-chr.ru/mainpage.php?page=1

- Russkova, Е. G. (2006). Market economy infrastructure. Volgograd: Volgograd Scientific Publishing House.

- Shagaida, N. I., & Uzun, V. Ya. (2015). Food security in Russia: monitoring, trends and threats. Moscow: Publishing House "Delo" RANEPA.

- Shkarupa, E. A. (2017). Financial and credit infrastructure of agriculture as an element of state financial and credit systems. Economy: yesterday, today, tomorrow, 7(1B), 5–16

- Shkarupa, E. A., Perehodov, Pa. P., & Ulanova, I. A. (2018). Regional State-Supported Agricultural Insurance Development in Context of Global Transformations. In Advances in Economics, Business and Management Research (AEBMR), vol. 39. Competitive, Sustainable and Secure Development of the Regional Economy: "Response to Global Challenges" (CSSDRE 2018).

- Stukach, V. F., & Fleiker, I. А. (2007). Financial and credit infrastructure of regional agricultural complex. Omsk: Publishing house FGOU VPO.

- Timofeeva, G. V. (2005). Development of integrated infrastructure of Russian agricultural complex: trends and mechanisms. Volgograd: Publishing House, Volgograd State University.

- Usenko, L. N. (2017). The role of state support in realizing the potential of Russian agricultural complex and ensuring food security. Scientific works of the Free Economic Society of Russia, 203.

- Ushachev, I. G. (2013). Food security of Russia within global partnership. Moscow: GNU VNIIESH.

Copyright information

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

About this article

Publication Date

28 December 2019

Article Doi

eBook ISBN

978-1-80296-075-4

Publisher

Future Academy

Volume

76

Print ISBN (optional)

-

Edition Number

1st Edition

Pages

1-3763

Subjects

Sociolinguistics, linguistics, semantics, discourse analysis, science, technology, society

Cite this article as:

Yalmaev*, R., Shkarupa, Е., & Kalianova, Е. (2019). Role Of Financial And Credit Infrastructure In Agricultural Development In Chechen Republic. In D. Karim-Sultanovich Bataev, S. Aidievich Gapurov, A. Dogievich Osmaev, V. Khumaidovich Akaev, L. Musaevna Idigova, M. Rukmanovich Ovhadov, A. Ruslanovich Salgiriev, & M. Muslamovna Betilmerzaeva (Eds.), Social and Cultural Transformations in the Context of Modern Globalism, vol 76. European Proceedings of Social and Behavioural Sciences (pp. 3397-3404). Future Academy. https://doi.org/10.15405/epsbs.2019.12.04.456